Global Automated Parcel Delivery Terminals Market By Deployment Mode (Indoor Terminals, Outdoor Terminals), By End-User (Retailers, Logistics Companies, E-commerce Companies, Other End-Users) By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115339

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

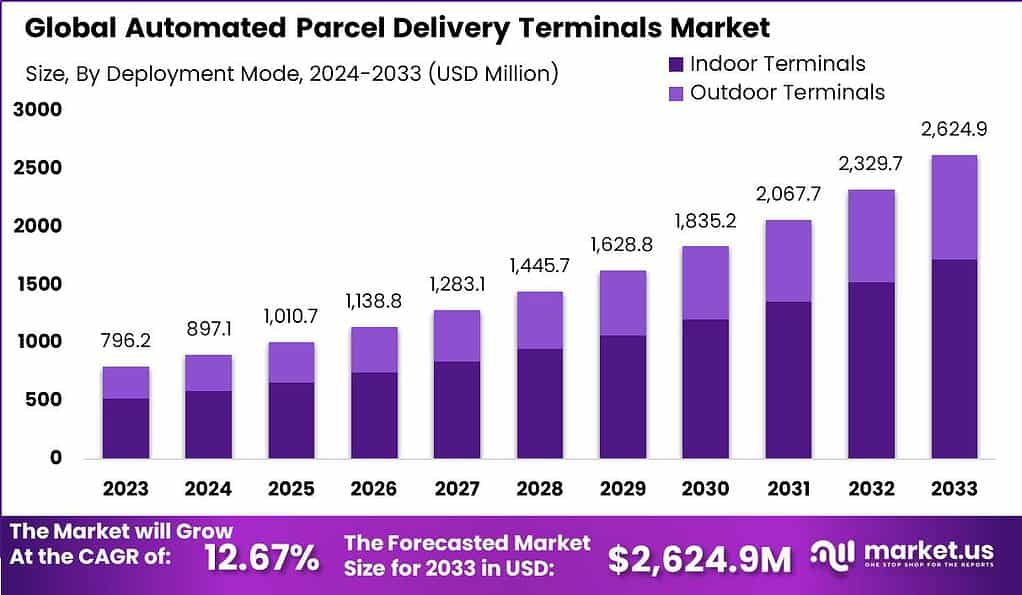

The Global Automated Parcel Delivery Terminals Market size is expected to be worth around USD 2,624.9 Million by 2033, from USD 796.2 Million in 2023, growing at a CAGR of 12.67% during the forecast period from 2024 to 2033.

Automated Parcel Delivery Terminals (APDTs) represent a cutting-edge solution designed to streamline the logistics and delivery process by providing a secure and convenient means for consumers to receive parcels without the need for direct human interaction. These terminals are typically self-service kiosks located in accessible areas, allowing customers to pick up their packages at any time, thereby significantly reducing the incidence of missed deliveries and enhancing the efficiency of last-mile delivery services.

The integration of advanced technologies such as IoT, RFID, and biometric verification in APDTs further ensures the security and traceability of parcels, making this solution increasingly attractive for both logistics companies and consumers. The growth of the APDT market is primarily driven by the surge in online shopping and the resultant increase in parcel volumes. This trend has put pressure on traditional delivery models, highlighting the need for more efficient and scalable solutions.

APDTs offer a viable answer to these challenges by reducing delivery times, minimizing the cost associated with redeliveries, and enhancing customer satisfaction through 24/7 availability. Another significant driver is the growing consumer demand for contactless deliveries, a trend accelerated by health and safety considerations in recent years.

From an analytical perspective, the Automated Parcel Delivery Terminals (APDT) market in 2023 exhibits a competitive and diverse landscape, with notable variations in company shares across different regions and terminal types. InPost, leading in Europe, holds an estimated market share of 20%, demonstrating the robust demand for APDT solutions within the continent.

Following closely are Cleveron from Estonia and TZ Limited from China, with shares of 15% and 12% respectively, highlighting the global appeal and adaptability of APDT technologies across varying markets. Smartbox in India and NeoPost in France further contribute to the market dynamics with shares of 10% and 8%, underlining the strategic importance of emerging markets and established economies in the APDT sector.

The APDT market’s vitality is further evidenced by substantial venture capital interest, with total funding surpassing USD 500 million in 2023. This investment vigor, characterized by an average deal size of USD 40-50 million, signals strong confidence among private equity firms, logistics entities, and technology venture capitalists in the growth potential of APDT solutions. Such financial backing is crucial for driving technological advancements, expanding operational capabilities, and entering new markets.

Operational statistics offer additional insights into the market’s dynamics. The average parcel delivery volume per terminal per day ranges between 20 to 30, varying significantly based on the terminal’s location and type, reflecting the operational efficiency and user adoption rates of APDTs. With over 400,000 terminals estimated globally in 2023, the infrastructure for APDTs is substantial, supporting the distribution needs of a rapidly growing e-commerce sector.

Key Takeaways

- Automated Parcel Delivery Terminals Market size is expected to be worth around USD 2,624.9 Million by 2033, with 12.67% CAGR during forecast period.

- In 2023, the Indoor Terminals segment held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 65.6% share.

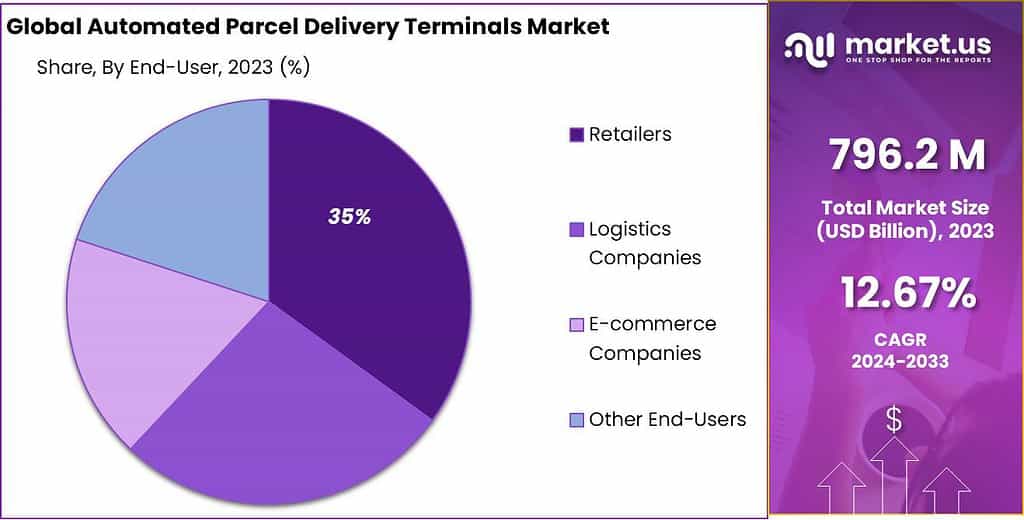

- In 2023, the Retailers segment held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 35% share.

- In 2023, Europe held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 30.7% share.

Deployment Mode

In 2023, the Indoor Terminals segment held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 65.6% share.

This segment’s leadership can be attributed to several factors that make indoor terminals a preferred choice for automated parcel delivery. Firstly, indoor terminals offer enhanced security and protection for parcels. Being located indoors, these terminals are less susceptible to theft, vandalism, and adverse weather conditions. This provides a sense of reliability and trust to both senders and recipients, ensuring the safe and secure delivery of parcels.

Moreover, indoor terminals offer convenience and accessibility to customers. They are typically placed in strategic locations such as shopping malls, residential complexes, and office buildings, making them easily accessible for pickup and drop-off. Customers can conveniently collect their parcels at their convenience, without the need for interaction with delivery personnel or waiting for home deliveries.

Indoor terminals also provide a seamless and efficient parcel management process. They are equipped with advanced technologies such as barcode scanning, automated sorting, and real-time tracking systems. These features streamline the parcel handling process, reducing operational inefficiencies and ensuring timely deliveries. Additionally, indoor terminals often offer 24/7 accessibility, allowing customers to retrieve their parcels at any time, further enhancing convenience.

Furthermore, the rise in e-commerce activities and the growing demand for last-mile delivery solutions have fueled the adoption of indoor terminals. With the increasing volume of online purchases, indoor terminals provide a cost-effective and scalable solution for handling the growing parcel volumes efficiently.

End-User Analysis

In 2023, the Retailers segment held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 35% share.

The leading position of the Retailers segment can be attributed to several key factors that make it a prominent end-user in the market. Firstly, retailers are increasingly adopting automated parcel delivery terminals as a means to enhance the customer experience. These terminals provide a convenient and self-service option for customers to collect their online purchases at their preferred time and location. By offering automated parcel delivery, retailers can provide flexibility and convenience to their customers, enabling them to retrieve their parcels without the constraints of traditional delivery methods.

Additionally, retailers benefit from the operational efficiency and cost savings offered by automated parcel delivery terminals. These terminals streamline the last-mile delivery process by reducing the need for manual interventions and minimizing the reliance on delivery personnel. Retailers can optimize their logistics operations, reduce delivery costs, and improve overall efficiency by leveraging automated parcel delivery terminals.

Furthermore, the Retailers segment benefits from the rise of e-commerce and the increasing demand for omnichannel retailing. With the growth of online shopping, retailers face the challenge of managing the growing volume of parcels and ensuring timely deliveries. Automated parcel delivery terminals provide a scalable and reliable solution for handling the surge in parcel volumes and facilitating efficient order fulfillment.

Key Market Segments

By Deployment Mode

- Indoor Terminals

- Outdoor Terminals

By End-User

- Retailers

- Logistics Companies

- E-commerce Companies

- Other End-Users

Driver

One key driver for the growth of the Automated Parcel Delivery Terminals market is the increasing demand for efficient and convenient last-mile delivery solutions. With the rise of e-commerce and online shopping, there has been a significant surge in parcel volumes, leading to challenges in traditional delivery methods. Automated parcel delivery terminals offer a viable solution by providing self-service options for customers to collect their parcels at their convenience.

These terminals enhance operational efficiency, reduce delivery costs, and improve customer satisfaction by eliminating the need for physical interaction with delivery personnel. The demand for fast and reliable parcel delivery services, combined with the need for seamless customer experiences, is driving the adoption of automated parcel delivery terminals across various industries.

Restraint

One major restraint in the Automated Parcel Delivery Terminals market is the high initial investment and infrastructure requirements. Implementing a network of automated parcel delivery terminals involves significant capital expenditure for the procurement, installation, and maintenance of the terminals. Moreover, establishing a widespread network of terminals requires securing suitable locations, obtaining necessary permits, and addressing logistical challenges.

These factors can pose barriers to entry for small and medium-sized businesses or companies with limited resources. Additionally, the ongoing operational costs, including maintenance, security, and software updates, can further strain the financial resources of businesses. The high upfront and ongoing costs associated with automated parcel delivery terminals can hinder their widespread adoption, particularly for organizations with budget constraints.

Opportunity

An opportunity in the Automated Parcel Delivery Terminals market lies in the integration of advanced technologies such as artificial intelligence (AI), machine learning, and Internet of Things (IoT). These technologies can enhance the capabilities of automated parcel delivery terminals, enabling features such as real-time tracking, predictive analytics, and smart inventory management. By leveraging AI and machine learning algorithms, terminals can optimize parcel sorting, improve operational efficiency, and enhance the overall delivery process.

IoT connectivity can enable seamless communication between terminals, delivery vehicles, and central management systems, ensuring real-time data exchange and coordination. Furthermore, the integration of AI-powered facial recognition or biometric authentication systems can enhance security and prevent unauthorized access to parcels. The convergence of these advanced technologies presents an opportunity for businesses to offer more intelligent, efficient, and secure automated parcel delivery solutions.

Challenge

One significant challenge in the Automated Parcel Delivery Terminals market is the need for standardization and interoperability. As the market continues to grow and different vendors offer their own proprietary solutions, there is a lack of uniformity and compatibility between different automated parcel delivery terminal systems. This poses challenges for logistics companies, retailers, and other end-users who may need to work with multiple terminal providers or integrate terminals into their existing operations.

Ensuring seamless compatibility and interoperability between different terminals, software platforms, and backend systems becomes crucial for efficient parcel management and coordination. Standardization efforts, industry collaborations, and the establishment of common protocols can address this challenge and facilitate the smooth integration and operation of automated parcel delivery terminals across different networks and stakeholders. Achieving interoperability will not only enhance operational efficiency but also promote a more interconnected and seamless ecosystem for automated parcel delivery.

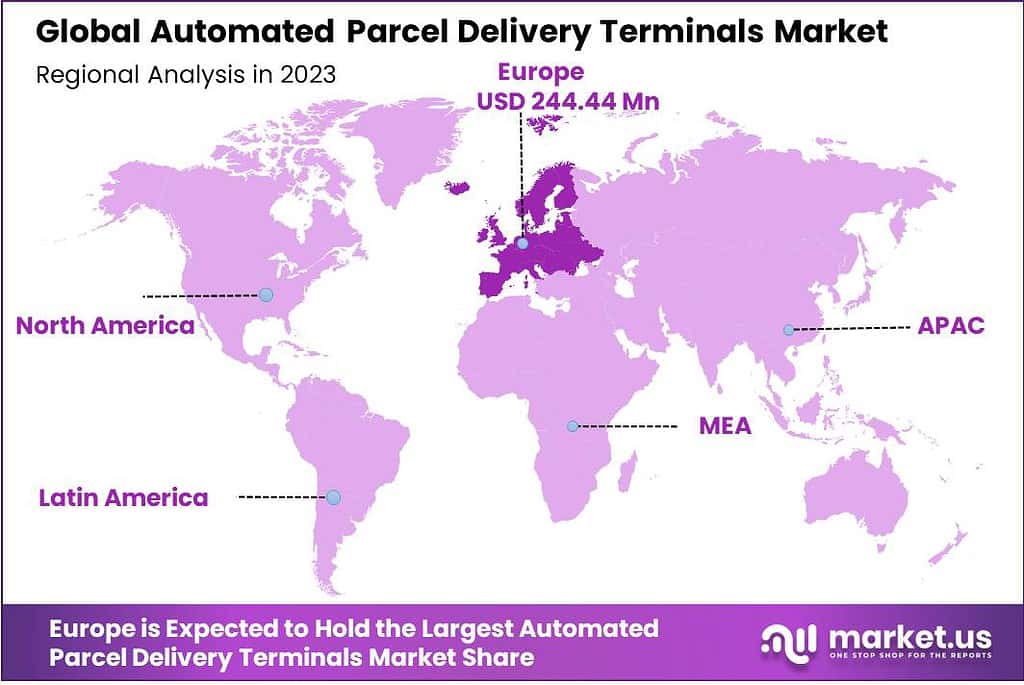

Regional Analysis

In 2023, Europe held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 30.7% share. The demand for Automated Parcel Delivery Terminals in Europe was valued at US$ 244.44 Million in 2023 and is anticipated to grow significantly in the forecast period.

This leading region has been at the forefront, driven by an accelerated adoption of e-commerce, advanced technological infrastructure, and supportive government policies aimed at enhancing last-mile delivery solutions. The proliferation of online shopping, particularly in countries such as Germany, the United Kingdom, and France, has necessitated the development of efficient and secure parcel delivery systems.

Automated Parcel Delivery Terminals have emerged as a key solution, enabling 24/7 parcel collection and drop-off, thereby significantly reducing missed deliveries and enhancing customer satisfaction. The growth of the market in Europe can be attributed to several factors, including the high density of urban populations where traditional delivery services face logistical challenges.

The integration of smart technologies such as IoT and RFID for secure and seamless operations has further propelled the adoption of these terminals. Additionally, environmental concerns and the push for sustainable delivery options have led to increased investments in automated parcel delivery systems by both private and public sectors. The European Union’s regulations favoring reduced emissions and the promotion of green logistics solutions have also played a crucial role in shaping the market dynamics.

Looking towards the Asia-Pacific (APAC) region, it is experiencing the fastest growth in the Automated Parcel Delivery Terminals market. This surge is primarily driven by the escalating e-commerce sector, rising urbanization, and the growing middle-class population with increasing disposable incomes. Countries like China, Japan, and South Korea are leading the way, with China expected to exhibit a significant CAGR due to its massive online consumer base and the government’s supportive stance towards technological advancements in logistics and supply chain management.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Automated Parcel Delivery Terminals market is characterized by a competitive landscape with several key players contributing to its growth and innovation. These entities play pivotal roles in shaping the industry through technological advancements, strategic partnerships, and expansions to meet the increasing demand for efficient and secure parcel delivery solutions. The following analysis highlights some of the major players in this market, underscoring their strategic initiatives and contributions.

Keba AG stands out as a leader in the Automated Parcel Delivery Terminals market, renowned for its cutting-edge technology solutions and extensive portfolio of delivery terminals. Keba’s terminals are distinguished by their robustness, versatility, and user-friendly interface, catering to a wide range of industries. The company has been proactive in expanding its global footprint through strategic partnerships and collaborations, aiming to enhance its service offerings and penetrate new markets.

Top Market Leaders

- Keba AG

- Cleveron Ltd.

- Neopost group

- Smartbox Ecommerce Solutions Pvt. Ltd.

- Winsen Industry Co., Ltd.

- InPost

- TZ Ltd.

- ByBox Holdings Ltd.

- ENGY Company

- Bell and Howell, LLC

- Other Key Players

Recent Developments

- InPost continued expanding its network of parcel lockers across Europe, reaching over 20,000 units by November 2023. Additionally, they launched new features for their locker system, such as extended parcel storage times and integration with additional delivery partners.

- ByBox announced a strategic partnership with DHL Parcel in July 2023 for the exclusive use of ByBox lockers in Belgium and other European markets. This significantly expands ByBox’s reach and potential customer base.

Report Scope

Report Features Description Market Value (2023) US$ 796.2 Mn Forecast Revenue (2033) US$ 2,624.9 Mn CAGR (2024-2033) 12.67% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Indoor Terminals, Outdoor Terminals), By End-User (Retailers, Logistics Companies, E-commerce Companies, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Keba AG, Cleveron Ltd., Neopost group, Smartbox Ecommerce Solutions Pvt. Ltd., Winsen Industry Co. Ltd., InPost, TZ Ltd., ByBox Holdings Ltd., ENGY Company, Bell and Howell LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Automated Parcel Delivery Terminals (APDTs)?Automated Parcel Delivery Terminals (APDTs) are self-service kiosks or lockers that enable the secure and convenient collection and delivery of parcels. They are typically located in public places such as shopping centers, train stations, and residential areas.

How big is Automated Parcel Delivery Terminals Market?The Global Automated Parcel Delivery Terminals Market size is expected to be worth around USD 2,624.9 Million by 2033, from USD 796.2 Million in 2023, growing at a CAGR of 12.67% during the forecast period from 2024 to 2033.

Who are the major vendors in the global Automated Parcel Delivery Terminals market?Some of leading players in this market include Keba AG, Cleveron Ltd., Neopost group, Smartbox Ecommerce Solutions Pvt. Ltd., Winsen Industry Co. Ltd., InPost, TZ Ltd., ByBox Holdings Ltd., ENGY Company, Bell and Howell LLC, Other Key Players

Which is the largest regional market for Automated Parcel Delivery Terminals Market?In 2023, Europe held a dominant market position in the Automated Parcel Delivery Terminals market, capturing more than a 30.7% share.

What are the opportunities prevailing in the global Automated Parcel Delivery Terminals market?The global Automated Parcel Delivery Terminals (APDT) market is ripe with opportunities, driven by the increasing demand for efficient and convenient parcel delivery solutions. As e-commerce continues to grow, there is a rising need for secure and accessible delivery options. APDTs offer a cost-effective and scalable solution for businesses and consumers alike.

What are the major drivers for the global Automated Parcel Delivery Terminals market growth?Several factors are driving the growth of the global Automated Parcel Delivery Terminals (APDT) market. Firstly, the rapid growth of e-commerce has led to an increase in parcel deliveries, driving demand for APDTs. Secondly, urbanization is leading to a rise in demand for convenient parcel delivery solutions in densely populated areas.

Automated Parcel Delivery Terminals MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Automated Parcel Delivery Terminals MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Keba AG

- Cleveron Ltd.

- Neopost group

- Smartbox Ecommerce Solutions Pvt. Ltd.

- Winsen Industry Co., Ltd.

- InPost

- TZ Ltd.

- ByBox Holdings Ltd.

- ENGY Company

- Bell and Howell, LLC

- Other Key Players