Global Auto-boxing Technology Market By Component (Solution, Services), By End-use (Food, Beverages, Pharmaceuticals, Retail & E-commerce, Manufacturing), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 120817

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

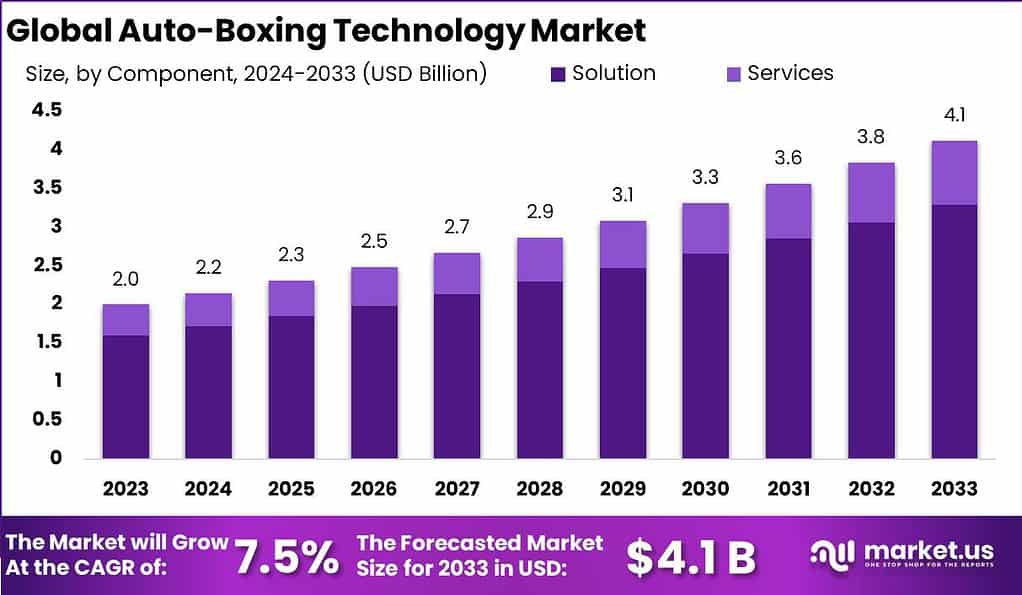

The Global Auto-boxing Technology Market size is expected to be worth around USD 4.1 Billion By 2033, from USD 2.0 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Auto-boxing technology automates the packaging process by employing sophisticated systems that can adapt to various product sizes and shapes with minimal human input. These systems utilize sensors and adjustable components to measure and configure the right box size for each item, ensuring a snug fit that protects the contents during shipping. This technology dramatically speeds up the packaging process, reduces material waste, and improves overall efficiency in the packing line.

The market for auto-boxing technology is expanding rapidly, propelled by the increasing demands of the e-commerce sector. As online shopping grows, so does the need for quick, efficient packaging solutions that can keep up with high volume orders and diverse product types. This market is also driven by the ongoing push to cut labor costs and streamline supply chain operations.

Innovations in auto-boxing technology are continually advancing, focusing on enhancing the speed and accuracy of the packaging process while also increasing the systems’ adaptability to handle a wider variety of products. Furthermore, auto-boxing technology offers flexibility and adaptability in packaging operations.

The systems can be programmed to accommodate various product sizes, shapes, and packaging requirements, allowing businesses to cater to a wide range of products without the need for manual adjustments or reconfigurations. This versatility is particularly beneficial for industries with diverse product portfolios or those experiencing frequent changes in packaging specifications.

In terms of sustainability, auto-boxing technology can contribute to reducing waste and optimizing the use of resources. These systems can optimize the box size based on the dimensions of the product being packaged, minimizing excess packaging material and reducing the carbon footprint associated with transportation. By implementing auto-boxing technology, companies can align their packaging processes with sustainability goals, enhancing their reputation as environmentally responsible organizations.

Key Takeaways

- The global auto-boxing technology market is projected to expand significantly, with its value anticipated to grow from USD 2.0 billion in 2023 to around USD 4.1 billion by 2033. This growth, occurring at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2033.

- The Solution segment of the auto-boxing technology market held a dominant position, capturing more than an 80% share of the market in 2023.

- In 2023, the Food segment of the auto-boxing technology market held a dominant position, capturing more than a 26.5% share.

- In 2023, APAC held a dominant market position in the auto-boxing technology market, capturing more than a 36.5% share.

By Component Analysis

In 2023, the Solution segment of the auto-boxing technology market held a dominant position, capturing more than an 80% share of the market. This segment includes the hardware and software that constitute the core of auto-boxing systems.

The prominence of the Solution segment is primarily due to the critical need for advanced, automated packaging systems in industries such as e-commerce, where speed, efficiency, and precision are paramount. As online retail continues to grow, the demand for reliable and fast packaging solutions that can handle a wide range of product sizes and specifications has surged.

The leading position of the Solution segment is further bolstered by continual technological advancements. Innovations in machine learning, artificial intelligence, and robotics have significantly enhanced the capabilities of auto-boxing systems, making them more adaptable and efficient. These improvements help in minimizing packaging waste by precisely determining the most appropriate box size for each item, which not only reduces material costs but also aligns with environmental sustainability efforts.

Moreover, the integration of IoT (Internet of Things) technologies allows for real-time monitoring and optimization of the packaging process, enhancing the operational efficiency of these solutions. The ongoing investment in developing smarter, more integrated auto-boxing solutions is expected to keep this segment in the lead, catering to the ever-evolving needs of fast-paced industrial environments where both speed and accuracy are crucial.

By End-use Analysis

In 2023, the Food segment of the auto-boxing technology market held a dominant position, capturing more than a 26.0% share. This leading status stems from the critical need within the food industry for efficient and hygienic packaging solutions that meet stringent regulatory standards. Auto-boxing technologies cater effectively to these requirements by ensuring precise, consistent packaging that maintains the integrity and safety of food products during transport and storage.

The importance of the Food segment is also driven by the growing consumer demand for packaged food products, influenced by changing lifestyles and the convenience of ready-to-eat and ready-to-cook food items. As food manufacturers strive to increase production outputs while maintaining quality, the adoption of auto-boxing systems has become a viable solution to enhance packaging lines and reduce the potential for human error, which is particularly crucial in maintaining food safety standards.

Furthermore, innovations in auto-boxing technology that allow for customization and flexibility in packaging different types of food products – from perishables to dry goods – have made these solutions even more attractive to food manufacturers. The ability to adjust to various packaging sizes and materials on the fly, without compromising speed or quality, supports the dynamic needs of the food sector. This adaptability, combined with ongoing advancements in automation and data analytics, continues to propel the Food segment’s dominance in the auto-boxing technology market.

Key Market Segments

By Component

- Solution

- Services

By End-use

- Food

- Beverages

- Pharmaceuticals

- Retail & E-commerce

- Manufacturing

Driver

Growth in E-commerce and Labor Efficiency

The auto-boxing technology market is being driven primarily by the rapid expansion of the e-commerce sector, which demands fast and efficient packaging solutions. As online shopping continues to grow, there’s a heightened need for packaging systems that can keep pace with high-volume orders and varied packaging sizes.

Auto-boxing technology enhances packaging speed and consistency, addressing this need effectively. Additionally, auto-boxing systems significantly reduce the reliance on labor by automating critical steps in the packaging process, which is particularly advantageous given the current challenges related to labor shortages in many industries.

Restraint

High Initial Investment Costs

A major restraint for the auto-boxing technology market is the significant initial investment required for implementation. The costs associated with purchasing and installing these automated systems can be prohibitive for small to medium-sized enterprises (SMEs).

While the long-term benefits – such as labor cost savings and increased efficiency – are substantial, the upfront financial burden can deter businesses from adopting these advanced technologies. This financial barrier can slow down the market penetration rate of auto-boxing solutions, especially in regions with a prevalence of smaller businesses.

Opportunity

Environmental Sustainability

Auto-boxing technology presents significant opportunities in terms of environmental sustainability. These systems are designed to optimize packaging material use, significantly reducing waste. By precisely sizing boxes to fit the product, auto-boxing machines minimize the need for additional packing materials, such as fillers, thus not only cutting down material costs but also reducing the environmental footprint of packaging. This aspect is increasingly appealing as businesses and consumers alike grow more conscious of sustainability. The ability of auto-boxing technology to align with eco-friendly practices offers a substantial growth opportunity for the market.

Challenge

Adapting to Diverse Product Requirements

One of the main challenges facing the auto-boxing technology market is the need to accommodate a wide range of product sizes and shapes, which varies significantly across different industries. Developing technology that can dynamically adapt to such diversity is complex and requires continuous innovation.

This challenge is compounded in sectors with highly variable product dimensions or packaging standards, such as consumer electronics or bespoke manufacturing. The ability of companies to innovate and provide flexible, adaptable solutions will be crucial in overcoming this hurdle and fully tapping into the potential of the auto-boxing technology market.

Growth Factors

- E-commerce Expansion: The rapid growth of the e-commerce sector significantly drives the demand for efficient packaging solutions. Auto-boxing technologies offer fast and reliable packaging, essential for handling the high volume of orders typical in e-commerce.

- Labor Efficiency: Auto-boxing technology reduces dependency on manual labor, which is a critical factor in its adoption, especially in regions with high labor costs. Automation helps streamline operations and cut costs.

- Technological Advancements: Innovations in auto-boxing systems, such as integration with artificial intelligence and machine learning for better box size optimization and material savings, spur market growth.

- Sustainability Concerns: There’s a growing emphasis on reducing packaging waste, which aligns with the environmental sustainability efforts of companies. Auto-boxing technology supports this by minimizing material usage and waste.

- Government Support for Automation: Various government initiatives promoting automation and technological advancement in industries also support the growth of the auto-boxing technology market.

Emerging Trends

- Customization and Flexibility: Increasing demand for packaging solutions that can handle a wide variety of product sizes and shapes without sacrificing speed or efficiency.

- Integration with IoT: The integration of auto-boxing systems with the Internet of Things (IoT) for enhanced monitoring and optimization of the packaging process is a notable trend.

- Increased Focus on Operational Efficiency: There’s a continuous push to improve the operational efficiency of packaging lines, with auto-boxing technologies at the forefront of these efforts, offering faster turnaround times and reduced downtime.

- Growth in Service Offerings: Alongside hardware, the services segment, including maintenance, training, and support, is expected to grow rapidly. These services are crucial for ensuring the smooth operation and longevity of auto-boxing systems.

- Adoption Across Diverse Industries: While initially popular primarily in e-commerce and retail, auto-boxing technology is seeing increased adoption across various other sectors, including food and pharmaceuticals, driven by the need for efficient, compliant, and hygienic packaging.

Regional Analysis

In 2023, APAC held a dominant market position in the auto-boxing technology market, capturing more than a 36.5% share. This substantial market share can be attributed to several key factors that underscore the region’s robust industrial expansion and technological adoption. Predominantly, the surge in e-commerce and manufacturing sectors across major economies such as China, India, and Japan has fueled the demand for automated packaging solutions.

These technologies streamline operations, reduce labor costs, and enhance efficiency, making them highly desirable in high-volume packaging environments. Furthermore, government initiatives aimed at digital transformation and the automation of industrial processes have supported the proliferation of auto-boxing technologies in the region. For instance, China’s Made in China 2025 plan, which emphasizes upgrading manufacturing capabilities, directly boosts the adoption of automated systems, including auto-boxing solutions.

Additionally, the rising labor costs in these economies incentivize companies to adopt automation to maintain profitability. Technological advancements and local manufacturing of auto-boxing systems also contribute to reducing costs and enhancing accessibility, thereby driving market growth. In contrast, North America also shows significant activity in the auto-boxing technology market, primarily driven by the region’s mature e-commerce sector and the high adoption rate of new technologies.

Europe follows closely, with stringent regulations on packaging and sustainability pushing companies towards efficient, automated boxing solutions. Latin America, while still emerging in this field, shows promise due to increasing industrialization and foreign investments in automation technologies. The Middle East and Africa are gradually adopting these technologies, with growth influenced by evolving retail sectors and economic diversification efforts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The auto-boxing technology market is characterized by intense competition and innovation among several key players, each contributing to the advancement and proliferation of these systems globally. CMC Packaging Automation, a leader in the field, is known for its dynamic solutions that cater to diverse packaging needs, often driving market trends through continuous technological enhancements.

Bell and Howell LLC and Packsize International Inc. are other major entities that significantly influence market dynamics through strategic innovations and adaptive technologies that address both high-speed industrial needs and sustainability concerns. For instance, the market has seen innovative product launches aimed at enhancing operational efficiencies and adapting to the growing e-commerce demands. Companies like Packsize International Inc. and WestRock Company have been at the forefront, continuously evolving their product lines to meet the complex requirements of high-speed packaging environments

Top Key Players in the Market

- CMC Packaging Automation

- Bell and Howell LLC

- Packsize International Inc.

- WestRock Company

- T-Roc Equipment

- Aopack

- Kolbus Autobox (KOLBUS GmbH & Co. KG)

- Ranpak

- Panotec Srl Unipersonale

- EMBA Machinery AB

- Zemat Technology Group

- Pattyn

- Sparck Technologies

Recent Developments

- In March 2024, CMC Packaging Automation North America, a subsidiary of CMC Packaging Automation, inaugurated its 30,000-square-foot Tech Center in Georgia, U.S. The center aims to foster experimentation, innovation, and collaboration. This positions CMC Packaging Automation as a leader in developing innovative solutions and sustainable materials to address evolving needs.

- In March 2023, Packsize unveiled the Ultra5, an advanced on-demand box machine developed in collaboration with Walmart. This machine, designed to produce right-sized boxes efficiently, was part of Walmart’s initiative to enhance e-commerce fulfillment by reducing waste and improving shipping logistics.

- In June 2023, WestRock Company – Introduced a new line of sustainable packaging solutions, focusing on reducing environmental impact and increasing recyclability.

Report Scope

Report Features Description Market Value (2023) USD 2.0 Bn Forecast Revenue (2033) USD 4.1 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By End-use (Food, Beverages, Pharmaceuticals, Retail & E-commerce, Manufacturing) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape CMC Packaging Automation, Bell and Howell LLC, Packsize International Inc., WestRock Company, T-Roc Equipment, Aopack, Kolbus Autobox (KOLBUS GmbH & Co. KG), Ranpak, Panotec Srl Unipersonale, EMBA Machinery AB, Zemat Technology Group, Pattyn, Sparck Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Auto-boxing Technology?Auto-boxing technology refers to systems and machines designed to automate the process of packing items into boxes. This technology is commonly used in manufacturing, logistics, and e-commerce industries to enhance packaging efficiency, reduce labor costs, and improve packaging consistency.

How big is Auto-boxing Technology Market?The Global Auto-boxing Technology Market size is expected to be worth around USD 4.1 Billion By 2033, from USD 2.0 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Which segment accounted for the largest auto-boxing technology market share?In 2023, the Solution segment of the auto-boxing technology market held a dominant position, capturing more than an 80% share of the market.

Who are the key players in the auto-boxing technology market?Key players include CMC Packaging Automation, Bell and Howell LLC, Packsize International Inc., WestRock Company, T-Roc Equipment, Aopack, Kolbus Autobox (KOLBUS GmbH & Co. KG), Ranpak, Panotec Srl Unipersonale, EMBA Machinery AB, Zemat Technology Group, Pattyn, Sparck Technologies

What are the factors driving the auto-boxing technology market?Factors driving the market include increasing demand for automation, cost reduction in labor, and growth in e-commerce.

Auto-boxing Technology MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Auto-boxing Technology MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- CMC Packaging Automation

- Bell and Howell LLC

- Packsize International Inc.

- WestRock Company

- T-Roc Equipment

- Aopack

- Kolbus Autobox (KOLBUS GmbH & Co. KG)

- Ranpak

- Panotec Srl Unipersonale

- EMBA Machinery AB

- Zemat Technology Group

- Pattyn

- Sparck Technologies