Global Augmented Reality Market By Component (Hardware, Software), By Device type (Head-Mounted Display, Smart Glass (Cinema Display Glasses, XR Glasses), Head-Up Display, Handheld Devices), By Industry Vertical (Aerospace & Defense, Automotive, Education, E-commerce & Retail, Gaming & Entertainment, Healthcare, Industrial & Manufacturing, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 109899

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

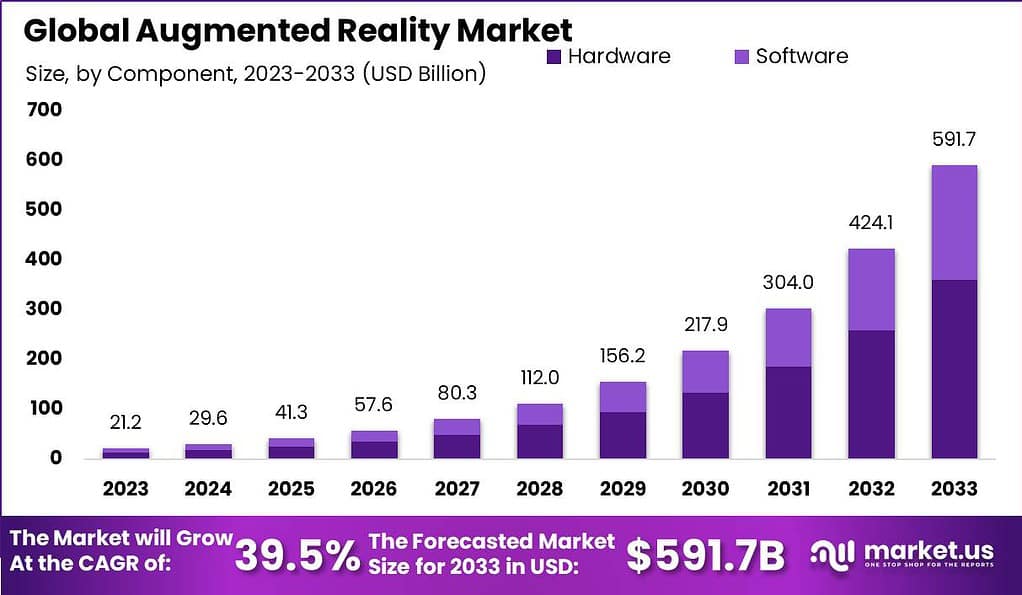

The global Augmented Reality Market is anticipated to be USD 591.7 billion by 2033. It is estimated to record a steady CAGR of 39.5% in the Forecast period 2024 to 2033. It is likely to total USD 29.6 billion in 2024.

Augmented Reality (AR) represents a progressive technology that overlays digital information onto the physical world, enhancing the user’s perception and interaction with their environment. This technology integrates computer-generated enhancements, such as graphics, sounds, or GPS data, to augment the user’s real-world experience. It differs fundamentally from Virtual Reality (VR), which creates an entirely artificial environment

The augmented reality (AR) market is experiencing significant growth, driven by advancements in technology and increasing consumer demand for immersive experiences. The growth of the market can be attributed to several factors, including the proliferation of smartphones and internet connectivity, which have made AR more accessible to a wider audience.

However, the market faces challenges such as privacy concerns and the high cost of AR devices, which can limit adoption rates. Despite these challenges, opportunities abound, particularly in enhancing user engagement across various industries, from retail to education, offering a more interactive and personalized experience.

Key Takeaways

- The global Augmented Reality Market is anticipated to reach USD 591.7 billion by 2033. It is estimated to record a steady Compound Annual Growth Rate (CAGR) of 39.5% from 2024 to 2033.

- In 2023, the Augmented Reality (AR) market was distinctly segmented into hardware and software components, with the hardware segment holding a dominant market position, capturing more than 61% share.

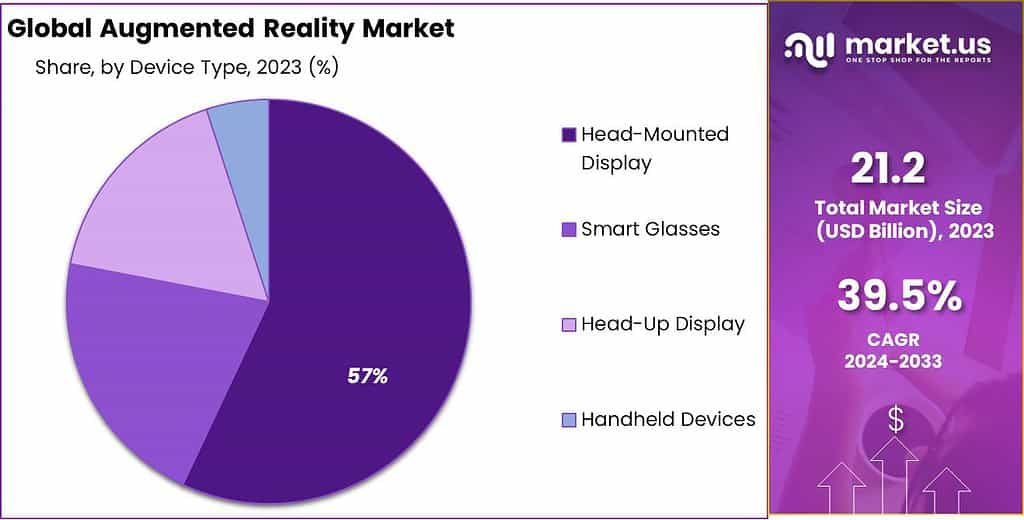

- In 2023, the Head-Mounted Display (HMD) segment held a dominant market position in the Augmented Reality (AR) market, capturing more than 57% share.

- In 2023, the Industrial & Manufacturing segment held a dominant position in the Augmented Reality (AR) market, capturing more than 25% share.

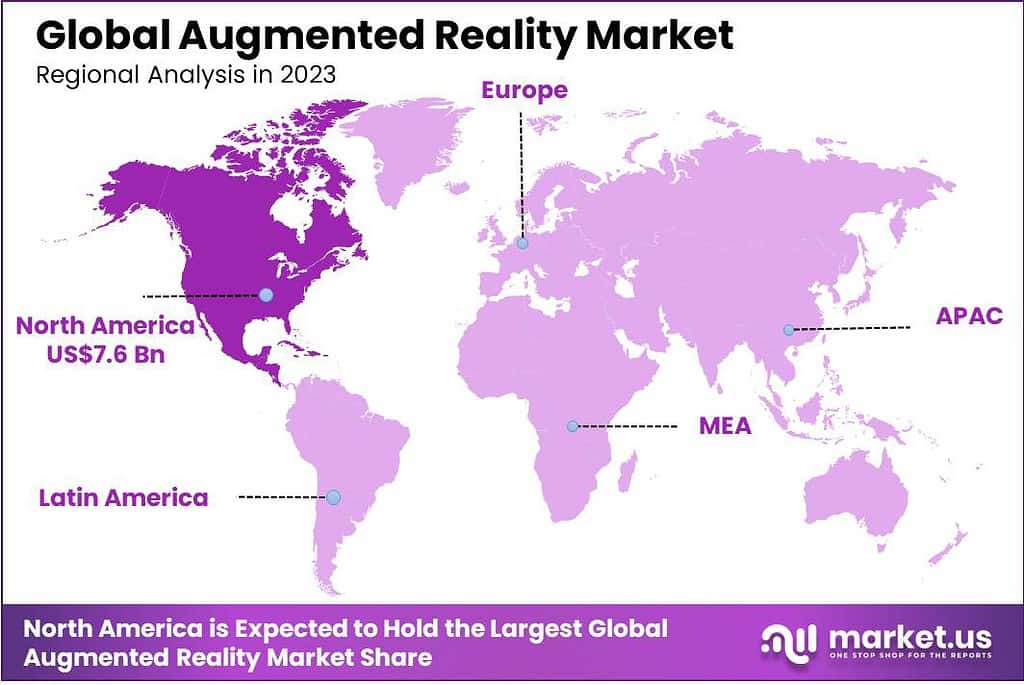

- North America held a dominant market position in 2023, capturing more than a 36% share.

- There will be 1.73 billion augmented reality users on mobile by 2024.

- 64% of consumers believe AR can benefit them in their shopping experience.

- Revenue for AR will hit ~$340 billion by 2028.

- In digital marketing campaigns, 67% of media planners and buyers want AR/VR ads.

- Augmented reality users mainly fall into the 16-34 age group.

- The AR market will be worth over ~$29.6 billion in 2024.

- 86% of people first experienced augmented reality using their smartphone.

- Augmented Reality will be worth ~$21.2 billion in 2023.

- The UK holds a 9% share of the immersive reality global market.

- By the end of 2023, there should be around ~1.4 billion AR users.

- Almost 50% of Americans use augmented reality without realizing it.

- 70% of consumers believe AR can help them learn new personal and professional skills.

- Around 1 in 3 (32%) of Americans are interested in playing augmented reality video games.

- 56% of 45 to 54-year-olds are aware of AR. And just 44% of 55 to 64-year-olds know about AR technology.

- Over 90% of Gen Zs are interested in AR shopping experiences.

- North America (~$220,000) and Europe (~$190,000) are the two largest contributors to this figure.

- As of 2025, the estimated economic value of AR in the vehicle space will be ~$2 billion to ~$3 billion.

- In a survey, 49% of respondents cited consumer privacy and data security concerns as a top legal risk in working with AR/VR technologies.

- 61% of consumers prefer retailers offering AR experiences.

- Most Japanese consumers (66%) want offline stores to provide AR experiences.

Component Analysis

In 2023, the Augmented Reality (AR) market was distinctly segmented into hardware and software components, with the hardware segment holding a dominant market position, capturing more than a 61% share. This significant share can be attributed to the critical role of advanced hardware in facilitating AR experiences.

The hardware components, encompassing AR headsets, glasses and sensors, are integral in delivering immersive and interactive user experiences. These devices have seen substantial advancements in terms of miniaturization, power efficiency, and display technologies, leading to wider adoption. In January 2022, Qualcomm Technologies, Inc. entered a partnership with Microsoft Corporation to create specialized chips for AR glasses, designed to seamlessly integrate with metaverse applications.

The software segment, while smaller in comparison, is experiencing rapid growth. Software for AR includes application development platforms, interface software, and management solutions, all crucial for creating and deploying AR experiences. The increasing demand for AR applications in various industries, such as gaming, retail, and healthcare, is driving the growth of this segment. The software segment is also benefiting from the continuous improvements in AR platforms, which are becoming more user-friendly and capable of supporting complex applications.

Device Type Analysis

In 2023, the Head-Mounted Display (HMD) segment held a dominant market position in the Augmented Reality (AR) market, capturing more than a 57% share. This substantial market share is attributed to the widespread adoption of HMDs in gaming, military training, and healthcare sectors for immersive experiences and precise training simulations. HMDs offer a hands-free AR experience, making them highly desirable in professional and entertainment applications.

Smart Glasses, encompassing Cinema Display Glasses and XR Glasses, also represent a significant portion of the market. These devices are increasingly popular for their portability and convenience, allowing users to access AR technology in everyday settings. The growing interest in enhancing consumer experiences, particularly in entertainment and retail, drives demand for these devices. For instance, Early in 2022, Snapchat introduced augmented reality shopping enhancements, such as the Dress Up tool. The latest technology from Snapchat empowers brand outlets to design AR Lenses, offering customers the opportunity to virtually try on shoes or apparel within the augmented reality realm.

The Head-Up Display (HUD) segment, predominantly used in automotive and aviation industries, is gaining traction. HUDs project information onto transparent displays, enabling drivers and pilots to access data without diverting their attention. This technology’s potential to enhance safety and efficiency in transportation is a key factor in its market growth.

Handheld Devices, such as smartphones and tablets equipped with AR capabilities, are widely accessible and have a substantial user base. Their versatility and ease of use make them a popular choice for casual AR experiences. However, the handheld segment faces competition from more immersive AR technologies like HMDs and Smart Glasses.

Industry Vertical

In 2023, the Industrial & Manufacturing segment held a dominant position in the Augmented Reality (AR) market, capturing more than a 25% share. This prominence is largely due to AR’s ability to enhance efficiency and precision in manufacturing processes, such as assembly, maintenance, and quality control. AR technology provides real-time data and visual guidance, which significantly improves operational productivity and reduces errors.

The Aerospace & Defense sector also leverages AR for training, maintenance, and battlefield simulations, offering realistic and cost-effective training solutions. This technology’s capacity for detailed visual instructions and data overlay makes it invaluable in these high-stakes environments.

In the Automotive industry, AR is transforming design, manufacturing, and marketing. From virtual prototyping to augmented showrooms, it offers immersive experiences and streamlined processes, contributing to this sector’s growing market share.

The Education sector is increasingly adopting AR to create interactive and engaging learning experiences. It’s particularly effective in subjects requiring visual representation, like science and history, making complex concepts easier to understand.

E-commerce & Retail industries are utilizing AR to enhance customer experience. Virtual try-ons and in-room product visualizations are revolutionizing the way consumers shop, leading to increased market engagement.

Gaming & Entertainment remains a significant segment, with AR games providing immersive experiences. This sector continues to attract a wide user base, driven by innovative gaming formats and interactive content.

Healthcare is another key sector for AR, used for surgical simulations, patient education, and treatment visualization. Its application in patient care and medical training is expanding rapidly, indicating substantial growth potential. In January 2022, AMA Corporation Plc enhanced its collaboration with Vuzix Corporation, a prominent provider of smart glasses and AR technology, with expectations of expediting the digital transformation within their shared customer base in healthcare and industrial sectors.

Key Market Segments

By Component

- Hardware

- Software

By Device type

- Head-Mounted Display

- Smart Glass

- Cinema Display Glasses

- XR Glasses

- Head-Up Display

- Handheld Devices

By Industry Vertical

- Aerospace & Defense

- Automotive

- Education

- E-commerce & Retail

- Gaming & Entertainment

- Healthcare

- Industrial & Manufacturing

- Others

Drivers

- Rising investments in the AR market: The augmented reality market has witnessed significant investments from various sectors. Venture capitalists, technology companies, and major corporations are investing in AR development, research, and acquisitions. These investments fuel innovation, drive technological advancements, and contribute to the growth of the AR market.

- Rising adoption of AR technology in the healthcare sector: The healthcare sector is increasingly embracing augmented reality technology. AR applications are used for surgical planning, medical training, patient education, and rehabilitation. AR enhances visualization, improves accuracy, and enhances patient outcomes in various medical procedures. The growing adoption of AR in healthcare drives the demand for AR solutions and supports market growth.

- Government regulations in the AR market: They are primarily focus on privacy, data security, and user safety. As AR technologies often involve the collection and processing of large amounts of data, including personal information, governments worldwide are implementing regulations to ensure data protection and user privacy

- Government Initiatives: Various government initiatives are supporting the growth and development of the AR market. These initiatives often take the form of funding for research and development, grants for startups in the AR space, and collaborations with academic institutions. Governments recognize the potential of AR in enhancing public services, education, healthcare, and defense, and are therefore keen to foster innovation in this field.

Restraints

- Lack of standards: The lack of standardized frameworks and protocols poses a restraint to the AR market. Inconsistencies in hardware, software, and content formats make it challenging for developers to create interoperable AR applications. The absence of industry-wide standards hinders seamless integration, compatibility, and collaborative development in the AR ecosystem.

- Health issues associated with excessive usage of AR: Prolonged usage of AR devices can lead to various health issues, including eye strain, headaches, and motion sickness. Extended exposure to virtual content can also cause cognitive and psychological effects. Ensuring user safety and addressing these health concerns is important for the widespread adoption of AR technology.

Opportunities

- Implementation of augmented reality in manufacturing: Augmented reality offers significant opportunities for the manufacturing industry. It can be used for assembly line guidance, maintenance and repair, training simulations, and quality control. By overlaying digital information onto physical objects, AR enhances productivity, reduces errors, and improves operational efficiency in manufacturing processes.

- High growth of the travel and tourism industry: The travel and tourism industry presents a promising opportunity for augmented reality. AR can enhance the tourist experience by providing interactive and immersive content, virtual tours, and location-based information. AR applications can guide tourists, offer historical and cultural insights, and create engaging experiences at attractions and landmarks. The growing demand for unique and personalized travel experiences fuels the adoption of AR technology in the travel and tourism sector.

Challenges

- Reconfiguration of applications for different platforms: Developing AR applications that are compatible with various platforms, such as smartphones, tablets, smart glasses, and headsets, can be a challenge. Each platform may have different technical specifications and capabilities, requiring developers to adapt and optimize their applications accordingly. Ensuring a seamless user experience across different platforms poses a challenge for the AR market.

- Adaptation to Diverse Hardware and Software Platforms: A pivotal challenge in the augmented reality (AR) market is the adaptation of applications to a wide array of hardware and software platforms. This diversity necessitates the reconfiguration of AR applications to suit various operating systems, device specifications, and user interfaces, presenting a multifaceted technical and logistical obstacle.

Regional Analysis

In 2023, North America held a dominant market position in the augmented reality (AR) market, capturing more than a 36% share. This region’s strong performance can be attributed to its advanced technological infrastructure, significant investments in AR technologies. The demand for Augmented Reality in North America reached US$ 7.6 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

Europe region exhibited substantial growth in the AR market, driven by increasing demand for AR applications in education, marketing, and tourism. European governments’ supportive policies for technology innovation and the growing integration of AR in cultural and historical experiences have been pivotal in this expansion. The market size in Europe, while smaller than North America, has shown consistent growth, particularly in Western European countries.

The Asia-Pacific (APAC) region is emerging as a rapidly growing market for AR technologies. This growth is fueled by the rising adoption of AR in countries like China, Japan, and South Korea, known for their technological prowess. The increasing use of AR in mobile applications, gaming, and educational sectors, along with substantial investments from regional tech giants, has been instrumental in this growth. The APAC market is characterized by a high potential for innovation and an expanding consumer base eager to adopt new technologies.

In Latin America, the AR market is in a nascent stage but showing promising growth. Factors contributing to this include the growing smartphone penetration and the gradual increase in technology adoption across various sectors. Brazil and Mexico are leading this growth, with applications in tourism and education showing significant potential.

Lastly, the Middle East and Africa (MEA) region, while currently holding a smaller share of the global AR market, is witnessing rapid growth. The adoption of AR in retail and marketing, along with increasing investments in smart city projects and technology infrastructure, particularly in countries like the UAE and Saudi Arabia, are key drivers for this region. The MEA market is expected to grow significantly in the coming years, driven by both technological advancements and increasing awareness of AR applications.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Augmented Reality (AR) market is rapidly growing and comprises several key players that are driving innovation and adoption of AR technologies. These players offer hardware, software, and solutions that enable users to experience augmented reality, blending digital content with the real world.

List of the prominent players in the global Augmented Reality (AR) market:

- Apple, Inc.

- Blippar Limited

- Google LLC

- Lenovo Group

- Magic Leap, Incorporated

- Meta

- Microsoft Corporation

- PTC Inc.

- Snap, Inc.

- Sony Corporation

- TeamViewer AG

- Vuzix Corporation

- Wikitude GmbH

- Xiaomi Corporation

- Zappar Limited

Recent Developments

- In July 2023, Apple released the Deep Field AR app, designed specifically for students. Utilizing the Apple Pencil, the iPad app provides students with an immersive experience, allowing them to experiment with vibrant colors, textures, and shapes as they draw their own flora and fauna.

- In June 2023, Apple Inc. released Apple Vision Pro, which incorporates visionOS, the globe’s primary spatial operating system. This revolutionary system empowers users to interact with digital content using an ultra-high-resolution display.

- In January 2022, Qualcomm and Microsoft announced a partnership aimed at advancing and accelerating augmented reality, creating new pathways to the metaverse. The collaboration involves the joint design of unique augmented reality chips and the integration of software platforms.

- In September 2022, Blippar, a leading augmented reality (AR) technology and content platform, integrated its WebAR Software Development Kit (SDK) into Unity. This integration enables Unity developers to easily create simple AR experiences that can be swiftly distributed to any web browser. With the Blippar SDK Beta plug-in, Unity developers can seamlessly develop and distribute WebAR experiences without the need to switch between different platforms.

Report Scope

Report Features Description Market Value (2023) US$ 21.2 Bn Forecast Revenue (2033) US$ 591.7 Bn CAGR (2024-2033) 39.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software), By Device type (Head-Mounted Display, Smart Glass (Cinema Display Glasses, XR Glasses), Head-Up Display, Handheld Devices), By Industry Vertical (Aerospace & Defense, Automotive, Education, E-commerce & Retail, Gaming & Entertainment, Healthcare, Industrial & Manufacturing, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Apple, Inc., Blippar Limited, Google LLC, Lenovo Group, Magic Leap, Incorporated, Meta, Microsoft Corporation, PTC Inc., Snap, Inc., Sony Corporation, TeamViewer AG, Vuzix Corporation, Wikitude GmbH, Xiaomi Corporation, Zappar Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Augmented Reality (AR)?Augmented Reality is a technology that overlays digital information, such as images, text, or 3D models, onto the real-world environment using devices like smartphones, smart glasses, or AR headsets.

How big is Augmented Reality Market?The global Augmented Reality Market is anticipated to be USD 591.7 billion by 2033. It is estimated to record a steady CAGR of 39.5% in the Forecast period 2024 to 2033. It is likely to total USD 29.6 billion in 2024.

How does Augmented Reality work?AR works by using sensors and cameras to capture the real-world environment. The captured information is then processed and overlaid with digital content, which is displayed on the user's device.

Who is the target market for augmented reality?The target market for augmented reality is diverse and includes various industries and consumer segments. Businesses in sectors such as gaming, healthcare, education, retail, manufacturing, and navigation are adopting AR technologies. Additionally, consumers who seek enhanced experiences in areas like gaming, entertainment, and shopping are part of the target market.

What is an example of AR?An example of AR is the use of smartphone applications that overlay digital information on the real world. For instance, mobile games like Pokémon GO use AR to superimpose virtual creatures onto the physical environment as seen through the device's camera.

How is AR used in shopping?AR is used in shopping to enhance the customer experience. Retailers may use AR applications to allow customers to virtually try on clothing or accessories, visualize furniture in their homes before purchase, or access additional product information by scanning items with a mobile device. AR enhances product engagement and provides a more interactive and immersive shopping experience.

What are the key applications of Augmented Reality?AR has diverse applications, including gaming, education, healthcare, retail, manufacturing, and navigation. It is used for enhancing user experiences and providing additional information in real-time.

-

-

- Apple, Inc.

- Blippar Limited

- Google LLC

- Lenovo Group

- Magic Leap, Incorporated

- Meta

- Microsoft Corporation

- PTC Inc.

- Snap, Inc.

- Sony Corporation

- TeamViewer AG

- Vuzix Corporation

- Wikitude GmbH

- Xiaomi Corporation

- Zappar Limited