Global Audit and Data Controls Market Size, Share, Growth Analysis By Deployment Mode (Cloud-based, On-premises), By Application (Audit Management, Internal Controls Management, Compliance Auditing, IT Audit and Data Integrity, Continuous Controls Monitoring, Risk-Based Auditing, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, Government and Public Sector, IT and Telecommunications, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2035

- Published date: Feb 2026

- Report ID: 178607

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

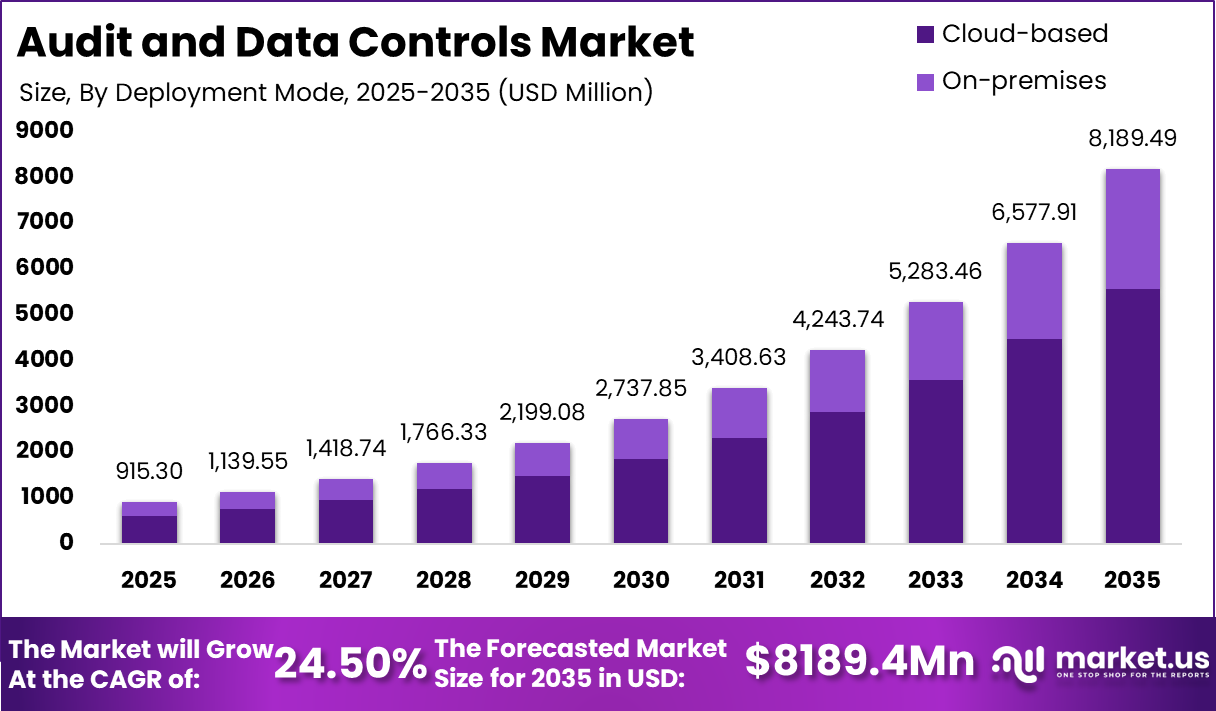

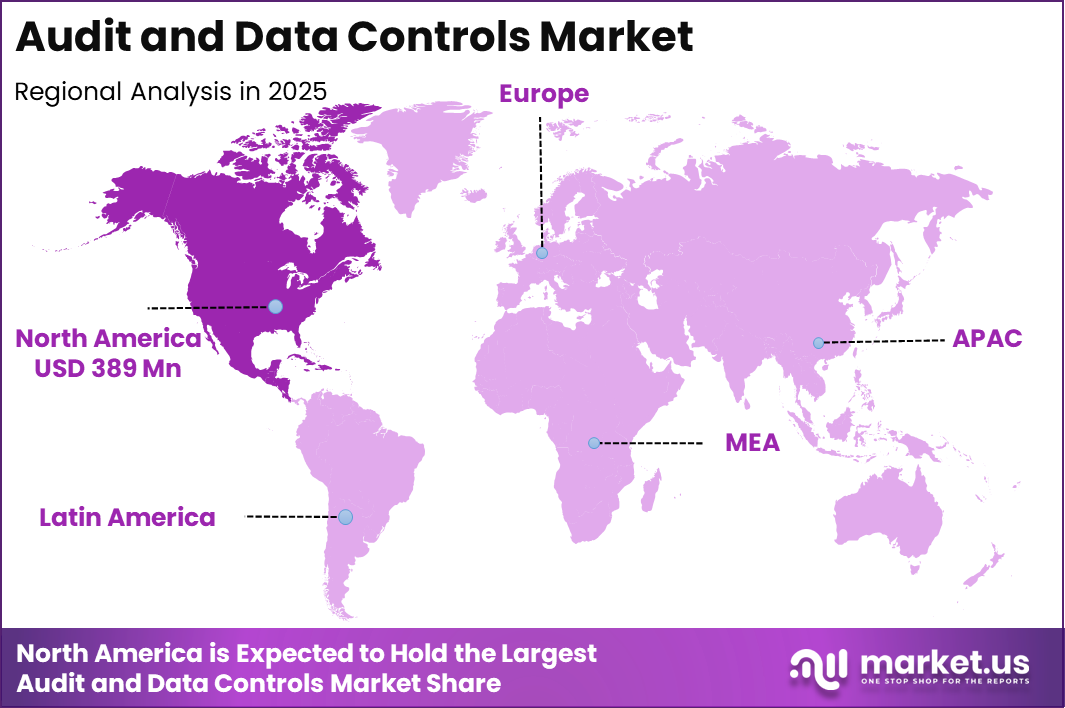

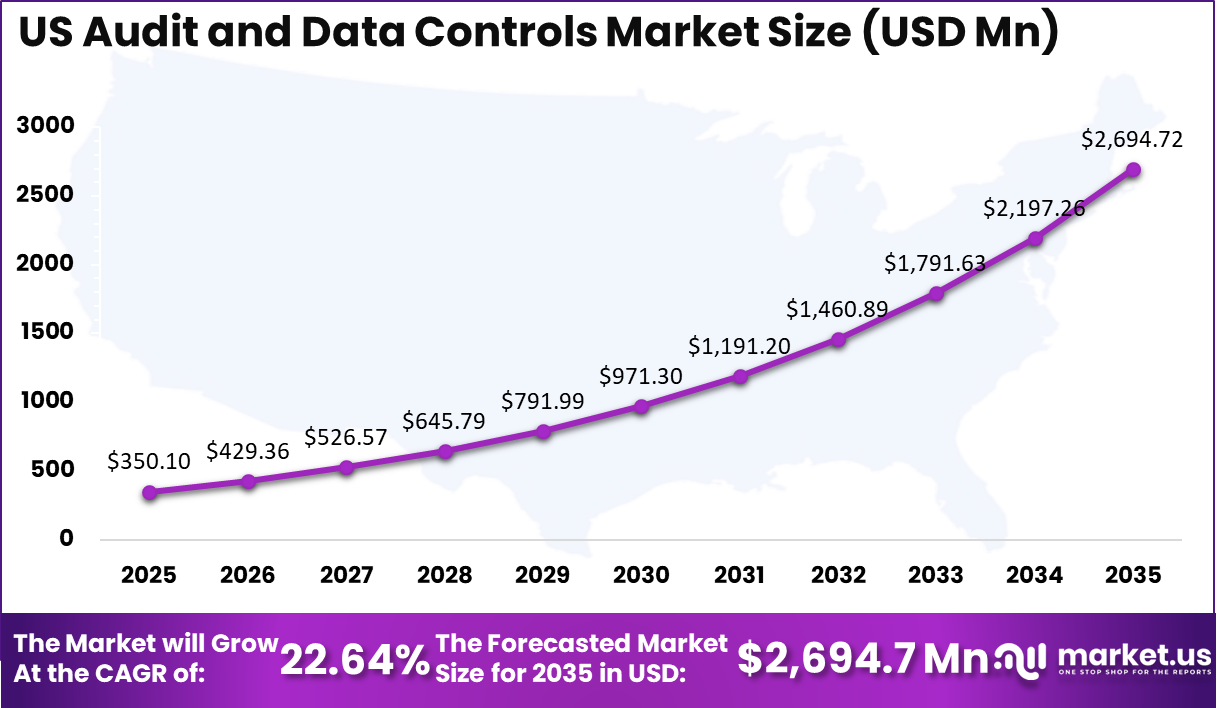

The Audit and Data Controls Market is valued at USD 915.3 million in 2025 and is projected to reach USD 8,189.4 million by 2035, expanding at a 24.50% CAGR. North America accounts for 42.5% share, with a 2025 size of USD 389 million. The US market is valued at USD 350.1 million in 2025 and is projected to reach USD 2,694.7 million by 2035, growing at a 22.64% CAGR.

Audit and data controls are becoming a board-level priority as organizations face tighter expectations for accurate reporting, stronger internal controls, and defensible evidence during audits. Enterprises are moving away from manual, spreadsheet-driven control testing toward systems that can standardize control libraries, automate evidence collection, and maintain clear traceability across processes, users, and datasets.

Demand is being reinforced by increasing reliance on cloud platforms and third-party applications, where access governance, change tracking, and continuous monitoring are essential to reduce audit findings and control failures. Buyers are prioritizing tools that shorten audit cycles, improve the quality of control documentation, and support faster remediation when exceptions are identified.

North America leads adoption due to mature compliance programs and higher audit intensity across regulated industries, while US growth is supported by ongoing investments in governance automation, stronger accountability across business units, and the need to demonstrate reliable controls across complex data environments.

Effective Takeaways

- The audit and data controls market is valued at USD 915.3 million in 2025, indicating an early stage but rapidly scaling space.

- A 24.50% CAGR highlights strong demand for automation in audit readiness and control monitoring.

- The market is projected to reach USD 8,189.4 million by 2035, reflecting broad enterprise adoption over time.

- North America leads with a 42.5% share, supported by mature compliance programs and high audit intensity.

- North America reaches USD 389 million in 2025, showing strong regional spending concentration.

- The US accounts for USD 350.1 million in 2025, making it the core revenue contributor within North America.

- US demand is projected to scale to USD 2,694.7 million by 2035 as continuous controls and evidence automation expand.

- A 22.64% CAGR positions the US as a high-growth market driven by governance modernization and audit efficiency goals.

Industry Adoption

Audit and data controls adoption is accelerating as organizations move toward continuous assurance and tighter accountability for how data is created, changed, accessed, and reported. Enterprises in regulated sectors are prioritizing automated control frameworks that standardize policies, map controls to processes, and maintain evidence trails that can be produced quickly during audits.

Adoption is strongest where reporting cycles are frequent and audit scrutiny is high, such as in financial services, healthcare, life sciences, and large digital platforms managing sensitive customer data. These buyers focus on tools that reduce manual sampling, improve the consistency of control testing, and shorten audit timelines through automated evidence collection and exception management.

IT and security teams are also driving adoption as cloud use expands and third-party applications multiply. Modern control environments increasingly require continuous monitoring of privileged access, configuration changes, and data movement across hybrid infrastructures. This has raised demand for integrated workflows that connect identity governance, logging, and change management data to audit-ready reports.

Organizations are also adopting audit and data controls to improve internal governance, not only to satisfy external auditors. Common use cases include enforcing segregation of duties, tracking policy compliance, maintaining data lineage for key reports, and accelerating remediation when control gaps are found. Overall, adoption is shifting from periodic compliance projects to embedded controls that run as part of daily operations.

By Deployment Mode

Cloud-based deployments account for 68% share of the audit and data controls market, while on-premises models represent the remaining 32%. Cloud-based audit and data controls lead adoption because they support faster rollout of standardized controls across multiple business units, locations, and applications. Enterprises increasingly run critical workloads in cloud platforms and SaaS tools, so control evidence such as access logs, configuration changes, approvals, and transaction histories is already generated digitally and can be captured centrally when controls are deployed in the cloud.

Cloud delivery also simplifies updates to control libraries and testing workflows, which is important as audit requirements change and organizations need consistent governance without long upgrade cycles. For distributed teams, cloud platforms improve collaboration between internal audit, compliance, IT, and business owners by enabling role-based access, shared evidence repositories, and real-time visibility into exceptions and remediation status. This directly supports shorter audit cycles and stronger readiness.

On-premises deployments remain important in environments with strict data residency policies, legacy system dependencies, or internal security requirements that favor direct infrastructure control. Organizations with highly customized ERP and financial systems may also keep control tooling on premises to reduce integration risk and align with existing governance architectures. Even so, cloud-based models hold the larger share because they align better with modern application stacks and continuous controls monitoring.

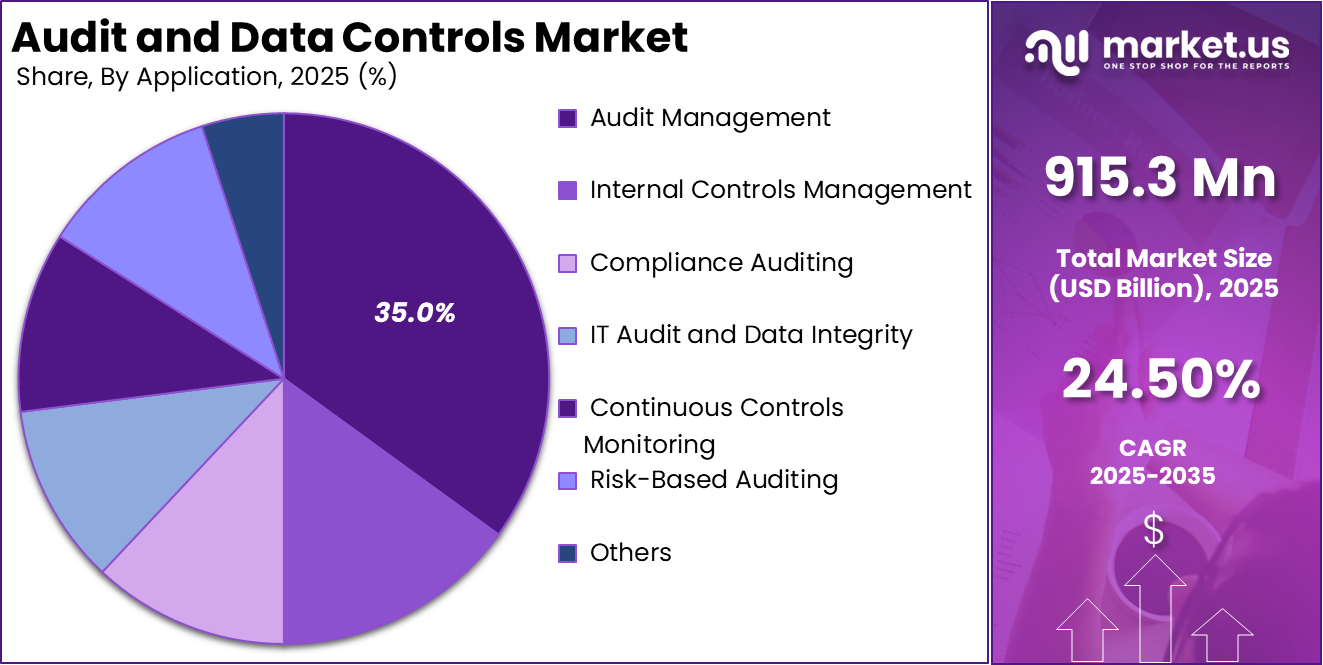

By Application

Audit management accounts for 35% share of the audit and data controls market, while the remaining 65% is distributed across internal controls management, compliance auditing, IT audit and data integrity, continuous controls monitoring, risk-based auditing, and other use cases. Audit management leads because it is the operational hub where audit plans, workpapers, evidence requests, findings, and remediation activities are coordinated.

Organizations prioritize this layer first since it directly reduces audit cycle time and improves consistency across teams, especially when audits span multiple business units and systems. A structured audit management workflow helps standardize scoping, sampling, documentation, and sign-offs, while creating a clear record of who reviewed what and when.

This improves accountability and reduces the back and forth that often delays audits when evidence is incomplete or stored across multiple tools. It also supports stronger coordination with process owners by automating request tracking, reminders, and escalation when deliverables are late.

The other application areas grow alongside audit management as firms push toward stronger control maturity. Internal controls management expands as organizations formalize control libraries and testing, compliance auditing rises with regulatory pressure, IT audit and data integrity grow with cloud adoption, and continuous controls monitoring gains traction as enterprises move from periodic testing to ongoing assurance. Even so, audit management remains the largest share because it orchestrates end-to-end audit execution and ties together controls, evidence, and remediation in one place.

By End-User Industry

Banking, financial services, and insurance account for 34% share of the audit and data controls market, while the remaining 66% is distributed across healthcare and life sciences, government and public sector, IT and telecommunications, retail and consumer goods, manufacturing, energy and utilities, and other industries.

BFSI leads adoption because audit and control requirements are continuous and closely tied to financial reporting integrity, customer data protection, and operational resilience. Banks and insurers operate complex product portfolios and high-volume transaction environments, which increase exposure to control failures such as improper access, segregation of duties conflicts, reporting inconsistencies, and weak change management.

As a result, BFSI organizations prioritize platforms that standardize audit workflows, automate control testing, and maintain traceable evidence across systems, users, and processes. These capabilities help reduce repeat findings, improve response speed during supervisory reviews, and strengthen confidence in internal reporting and risk governance.

Other sectors are accelerating adoption as regulatory pressure expands and digital operations become more data-intensive. Healthcare and life sciences require strong documentation and data integrity controls, government agencies need transparent oversight and accountability, and IT and telecom firms focus on access governance and security auditing across cloud environments.

Retail, manufacturing, and energy utilities are also investing as supply chains digitize and critical infrastructure requirements tighten. Even so, BFSI retains the largest share because audit intensity is higher, reporting cycles are frequent, and the cost of non-compliance and remediation is substantial.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Application

- Audit Management

- Internal Controls Management

- Compliance Auditing

- IT Audit and Data Integrity

- Continuous Controls Monitoring

- Risk-Based Auditing

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare and Life Sciences

- Government and Public Sector

- IT and Telecommunications

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Others

Regional Analysis

North America holds 42.5% share of the audit and data controls market and is valued at USD 389 million in 2025. North America remains the leading region for audit and data controls adoption because organizations in the region operate under mature governance expectations and high audit intensity across both regulated and large enterprise environments.

Companies are placing stronger emphasis on audit readiness, control documentation quality, and defensible evidence trails that can be produced quickly during internal and external reviews. Adoption is being reinforced by the growing complexity of enterprise data environments, where key records and approvals are spread across ERP systems, cloud applications, and third-party platforms.

This has increased the need for standardized control frameworks that can improve visibility into who accessed data, what changed, and whether approvals and policies were followed consistently. North American buyers also tend to prioritize audit efficiency, focusing on tools that reduce manual workpaper preparation, streamline evidence requests, and accelerate remediation workflows when exceptions are identified.

As organizations expand digital operations and rely more on automated processes, audit and data controls are increasingly treated as an operational requirement rather than a periodic compliance exercise. This combination of strong governance culture, complex data estates, and a continuous focus on audit efficiency explains why North America commands the largest share and a sizeable 2025 market base.

US Market Size

The US audit and data controls market is valued at USD 350.1 million in 2025 and is projected to reach USD 2,694.7 million by 2035, expanding at a 22.64% CAGR. The US is a high adoption market for audit and data controls because organizations face strong expectations for audit readiness, accurate financial reporting, and defensible evidence across business processes and IT systems.

Enterprises are investing in platforms that standardize audit workflows, strengthen internal control documentation, and improve the speed and quality of evidence collection during internal and external audits. Adoption is also being reinforced by the complexity of modern data environments where critical records sit across ERP platforms, cloud applications, and third-party systems, making it harder to maintain consistent approvals, access governance, and change tracking.

US buyers tend to prioritize solutions that shorten audit cycles, reduce manual testing effort, and provide clear accountability for remediation when control gaps are identified. Continuous monitoring is becoming more important as companies aim to detect exceptions earlier, reduce repeat findings, and support year-round assurance rather than periodic compliance preparation.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Audit and data controls adoption is being driven by heavier scrutiny on reporting quality and the cost of weak governance. Regulators continue to pursue disclosure, reporting, and control related misconduct, and the SEC reported 583 total enforcement actions in fiscal year 2024 with USD 8.2 billion in financial remedies, which reinforces the need for stronger evidence trails, faster audit response, and more defensible control testing.

At the same time, internal control programs are becoming more resource-intensive, pushing organizations to automate. KPMG’s 2025 SOX survey reported an average SOX program budget of USD 2.3 million and an average time effort of 15,580 hours, with both cost and hours rising substantially over the prior two years, which increases pressure to reduce manual testing and improve workflow efficiency through software.

Audit quality oversight is also acting as a catalyst, since inspection bodies keep highlighting deficiencies that require firms and issuers to strengthen documentation, management review controls, and data integrity practices across systems. These forces are accelerating investment in platforms that centralize audit workpapers, standardize control libraries, automate evidence collection, and track remediation in real time, so organizations can reduce repeat findings and sustain year-round readiness rather than preparing only around audit season.

Restraint factors

A major restraint in audit and data controls market adoption is the capability gap within internal audit and compliance teams. Many organizations are expanding expectations for continuous monitoring, data integrity checks, and technology-enabled assurance, but resourcing and skills are not keeping pace. One indicator is that 66% of internal audit teams say their capabilities do not fully align with their organization’s priorities, which slows tool selection, limits automation ambition, and increases dependence on manual workarounds even after software is deployed.

Another restraint is the integration burden created by fragmented data estates. Audit evidence often sits across ERP platforms, identity systems, ticketing tools, cloud logs, spreadsheets, and vendor portals, so consolidating it into a single control narrative requires data mapping, workflow redesign, and sustained ownership from process teams.

This challenge is compounded by the broader enterprise problem of disconnected datasets and duplication, where siloed data makes it harder to maintain consistent, auditable definitions and to reproduce results when auditors reperform testing. As a result, implementation timelines extend, stakeholder fatigue rises, and some projects get limited to narrow use cases rather than scaling across the enterprise.

Growth Opportunities

A major opportunity is the shift from periodic audits to continuous controls monitoring, where exceptions are detected earlier, and remediation is tracked in near real time. Audit oversight trends are reinforcing this direction. In the US, PCAOB inspection results reported audit deficiencies in 39% of inspections in 2024, down from 46% in 2023, showing both pressure and momentum for better quality and more consistent evidence.

As boards and audit committees demand stronger assurance, enterprises are investing in platforms that connect process controls, IT change logs, access reviews, and issue management into a single evidence trail that can stand up to re-performance and regulator scrutiny. Another opportunity is AI-enabled audit analytics that reduces manual sampling and expands coverage across large datasets.

A Wolters Kluwer survey found 39% of internal auditors already use AI, and another 41% intend to adopt it within 12 months, implying a fast scaling market for tools that automate testing, highlight anomalies, and accelerate workpaper completion.

At the same time, readiness gaps create demand for packaged capabilities and managed services to operationalize AI safely. For example, one industry report noted only 28% of internal audit leaders feel confident about their teams’ ability to audit AI risks, which opens space for governance templates, control libraries, and assurance frameworks focused on AI systems.

Trending factors

Audit and data controls are trending toward technology-assisted assurance, where audit teams rely more on data analytics, automated testing, and digital evidence trails instead of manual sampling. The direction is clear in internal audit skill priorities, as 92% of CAEs say data analytics is the most important technology skill for the future, which is accelerating investments in controls that can continuously capture logs, approvals, and exceptions in a structured and reusable way.

Another trend is early but growing use of generative AI in internal audit, with 41% of teams reporting some GenAI use, while frequent or extensive use remains limited, showing the market is moving from experimentation to governance-focused adoption. This is also shaping demand for stronger auditability of AI outputs, model change tracking, and documentation standards.

A third trend is the rising focus on technology-assisted analysis in external audits, reinforced by PCAOB amendments that clarify auditor responsibilities when using technology-based tools, effective for fiscal years beginning on or after December 15, 2025.

Together, these trends are pushing buyers toward platforms that unify audit management, control testing, and continuous monitoring, with clearer traceability across data sources and faster evidence production during audits and regulatory reviews.

Competitive Analysis

Competition in audit and data controls is split between platform vendors that deliver repeatable workflows and suites that embed controls into enterprise systems. IBM positions OpenPages as an integrated GRC platform with dedicated internal audit management to plan, execute, and report audits within a broader risk and compliance view.

Oracle competes by tying audit and compliance directly to ERP controls, emphasizing user access control, activity monitoring, and automated compliance workflows for Oracle Cloud ERP environments. SAP follows a similar control-first approach, with access control capabilities focused on detecting access risks, embedding compliance checks into processes, and supporting workflow-driven access requests and approvals.

A second lane is cloud native workflow and content-led compliance. Microsoft competes through Microsoft Purview Compliance Manager, focused on assessing and managing compliance across multicloud environments with control management and auditor reporting support. ServiceNow competes by operationalizing GRC in daily work, including policy and compliance workflows that map procedures to external regulations and support continuous monitoring.

MetricStream and NAVEX compete through integrated risk and compliance platforms that centralize regulations, risks, controls, audits, and reporting, while Diligent and Wolters Kluwer compete strongly with unified governance and audit execution platforms such as Diligent One and TeamMate+ for end-to-end audit workflow.

Thomson Reuters supports this ecosystem with Regulatory Intelligence content coverage across 1,200-plus regulatory bodies and 2,500-plus collections, often feeding regulatory change processes used by platforms and advisory teams. Big Four firms, including Deloitte, PwC, EY, and KPMG, compete by implementing and operating controls programs through controls assurance, managed services, and SOX support.

Top Key Players in the Market

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- Thomson Reuters Corporation

- Wolters Kluwer N.V.

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers LLP

- Ernst & Young Global Limited

- KPMG International Cooperative

- ServiceNow, Inc.

- MetricStream Inc.

- NAVEX Global Inc.

- Diligent Corporation

- Others

Future Predictions

Over the next few years, audit and data controls are expected to move from annual, checklist-driven programs to continuous assurance that runs alongside day-to-day operations. SOX programs are already consuming heavy resources, with an average budget of USD 2.3 million and 15,580 hours of effort reported in KPMG’s 2025 SOX survey, so buyers are anticipated to accelerate automation to reduce manual testing and evidence chasing.

Internal audit teams are also expected to scale AI-assisted procedures quickly, as Wolters Kluwer reported AI adoption is projected to double to 80% in 2026, driven by productivity and faster anomaly detection. External audit practices are likely to reinforce this shift, since PCAOB amendments related to technology-assisted analysis become effective for audits of fiscal years beginning on or after December 15, 2025, pushing stronger use of advanced analytics and more consistent electronic evidence expectations.

Recent Developments

- In 2025, IBM made OpenPages 9.1.3 available on December 12, 2025, extending its GRC stack with extensible AI and usability upgrades aimed at faster risk and audit operations.

- In 2025, NAVEX finalized a majority stake transaction led by Goldman Sachs Alternatives and including Blackstone on October 14, 2025, signaling fresh capital to expand its ethics, risk, and compliance software footprint.

- In 2025, ServiceNow’s GRC Audit Management app posted an update on December 4, 2025, reflecting continued feature and security enhancements for internal audit workflow automation.

Report Scope

Report Features Description Market Value (2025) USD 915.3 Million Forecast Revenue (2035) USD 8189.4 Million CAGR(2025-2035) 24.50% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Application (Audit Management, Internal Controls Management, Compliance Auditing, IT Audit and Data Integrity, Continuous Controls Monitoring, Risk-Based Auditing, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, Government and Public Sector, IT and Telecommunications, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, SAS Institute Inc., Thomson Reuters Corporation, Wolters Kluwer N.V., Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, KPMG International Cooperative, ServiceNow, Inc., MetricStream Inc., NAVEX Global Inc., Diligent Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Audit and Data Controls MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Audit and Data Controls MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- Thomson Reuters Corporation

- Wolters Kluwer N.V.

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers LLP

- Ernst & Young Global Limited

- KPMG International Cooperative

- ServiceNow, Inc.

- MetricStream Inc.

- NAVEX Global Inc.

- Diligent Corporation

- Others