Global ATM Managed Services Market Size, Share, Statistics Analysis Report By Service Type (ATM Replenishment and Currency Management, Incident Management, Network Management, Security Management, Other Service Types), By ATM Location (Onsite ATMs, Offsite ATMs, Mobile ATMs, Worksite ATMs), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135572

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

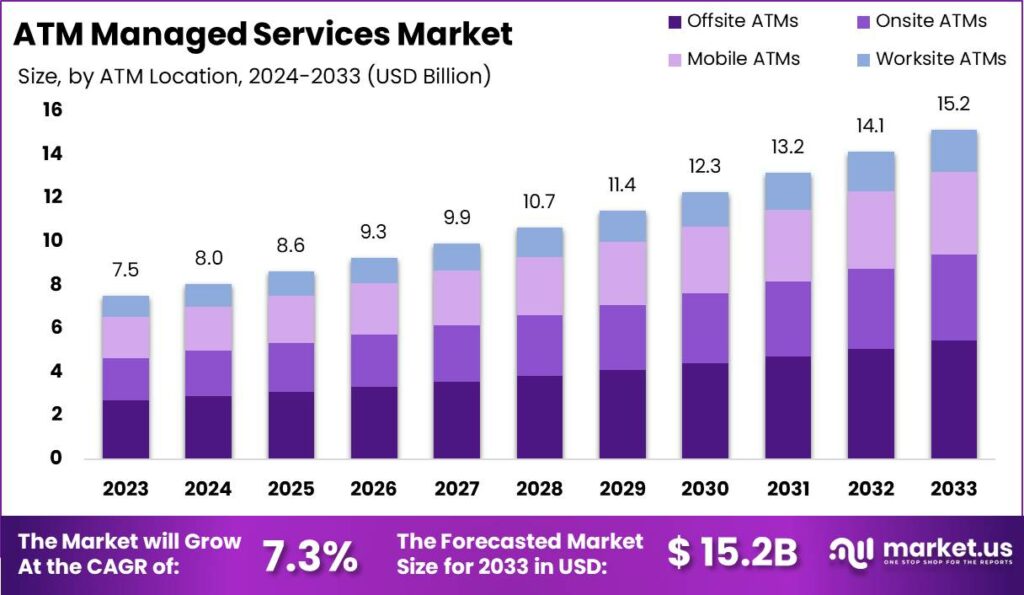

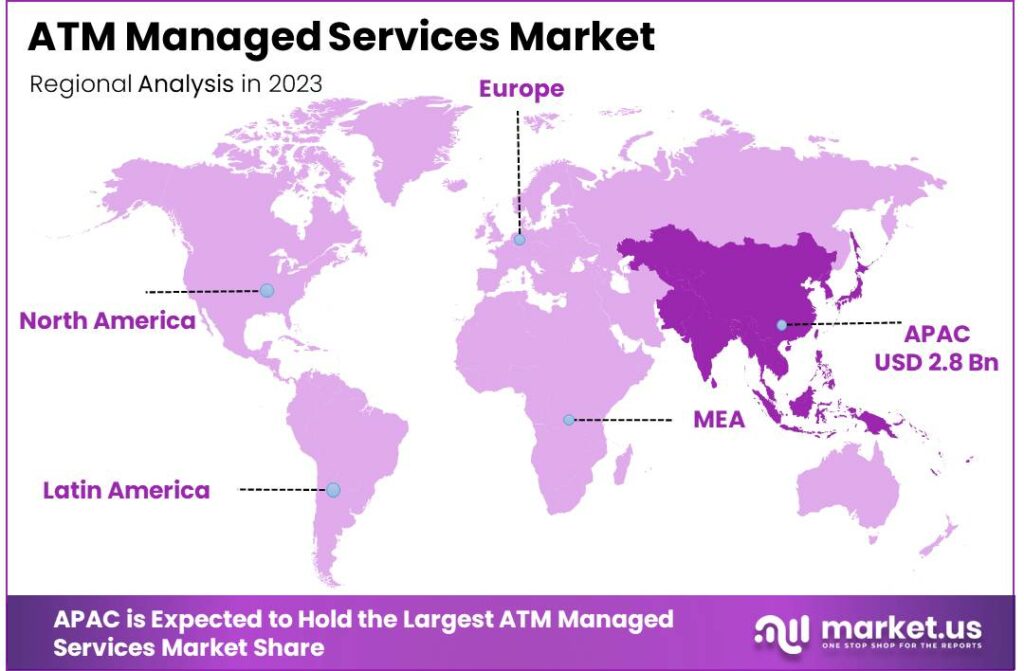

The Global ATM Managed Services Market size is expected to be worth around USD 15.2 Billion By 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 7.30% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific (APAC) region held a dominant position in the ATM Managed Services sector, accounting for over 38.5% of the market share, which translated to USD 2.8 billion in revenue.

ATM managed services involve the comprehensive management of ATM networks by third-party companies specializing in optimizing the performance, security, and efficiency of these machines. These services can include ATM deployment, transaction processing, maintenance, and software updates. The primary goal is to ensure that ATMs are operating smoothly, securely, and are compliant with current regulations.

The ATM managed services market is experiencing significant growth due to the increasing number of ATMs worldwide and the rising demand for efficient and secure transaction processes. Financial institutions are keen on outsourcing ATM management to reduce operational costs and enhance customer service. The market includes a range of services from basic maintenance to full-fledged outsourcing, where all aspects of ATM operation, including software, hardware, and cash management, are handled by service providers.

The primary driving factors for the growth of the ATM managed services market include the increasing complexity of ATM operations and the need for compliance with regulatory standards. Financial institutions are also motivated by the need to reduce operational costs and enhance customer experience, which can be achieved by leveraging the expertise of managed service providers who bring efficiency and technological advancements to ATM operations.

Market demand for ATM managed services is fueled by the growing dependency on ATMs for a range of banking operations beyond cash withdrawals, such as deposits, fund transfers, and bill payments. This has led to a higher expectation for uptime and security from customers. The market is ripe with opportunities, particularly in developing regions where the expansion of banking services is creating a surge in ATM deployments.

Technological innovations play a crucial role in shaping the ATM managed services landscape. Advanced analytics, IoT, and improved cash management algorithms help optimize operations and anticipate maintenance needs before outages occur. These technologies not only enhance the efficiency of ATMs but also ensure a higher standard of security and compliance, critical for maintaining customer trust and meeting regulatory requirements.

Key Takeaways

- The ATM Managed Services Market size is expected to reach USD 15.2 Billion by 2033, up from USD 7.5 Billion in 2023, growing at a CAGR of 7.30% during the forecast period from 2024 to 2033.

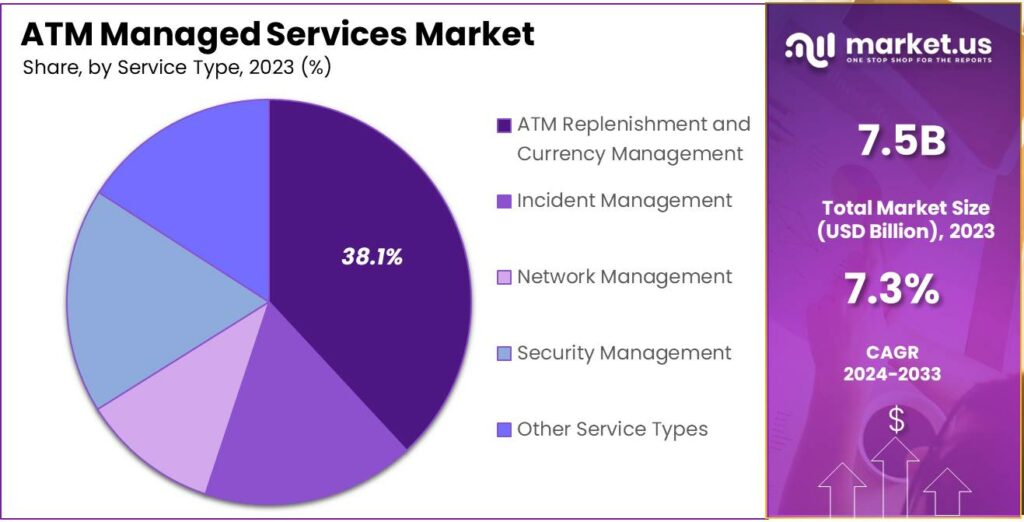

- In 2023, the ATM Replenishment and Currency Management segment held a dominant position, capturing more than 38.1% of the overall ATM Managed Services market.

- The Offsite ATMs segment also held a strong market position in 2023, capturing more than 35.9% of the global ATM Managed Services market. This leadership is primarily driven by the increasing deployment of ATMs in non-branch locations, such as shopping malls, convenience stores, and remote areas.

- In 2023, the Asia-Pacific (APAC) region dominated the ATM Managed Services sector, accounting for more than 38.5% of the market share, which equated to USD 2.8 billion in revenue.

Service Type Analysis

In 2023, the ATM Replenishment and Currency Management segment held a dominant market position, capturing more than a 38.1% share of the overall ATM Managed Services market. This segment is the largest due to the essential role it plays in ensuring that ATMs are adequately stocked with cash, a critical aspect of maintaining ATM functionality.

Financial institutions and retailers rely on efficient replenishment services to minimize downtime and enhance the customer experience, making this segment integral to the operation of ATMs. ATM Replenishment and Currency Management services are responsible for the timely and accurate refilling of cash, reducing the risk of cash shortages that could lead to customer dissatisfaction and loss of business.

The dominance of the ATM Replenishment and Currency Management segment can also be attributed to the significant logistical challenges involved in maintaining a constant flow of cash to ATMs. These services require a high level of coordination between service providers, financial institutions, and regulatory authorities, particularly in regions with high transaction volumes or remote locations.

The prominence of this segment is in the increasing complexity of cash management systems. The introduction of advanced technology in ATM networks, such as smart cash management systems and real-time monitoring, has made it easier for operators to optimize cash utilization and reduce the costs associated with excess or insufficient cash.

ATM Location Analysis

In 2023, the Offsite ATMs segment held a dominant market position, capturing more than a 35.9% share of the global ATM Managed Services market. This segment’s leadership can be attributed to several key factors, primarily driven by the increasing deployment of ATMs in non-branch locations, such as shopping malls, convenience stores, and remote areas.

Offsite ATMs are particularly valued for their convenience and accessibility, providing consumers with easy access to cash in locations outside traditional bank branches. As urbanization increases and consumer demand for 24/7 banking services grows, the need for offsite ATMs has naturally surged, resulting in a higher share of the managed services market.

The offsite ATMs segment continues to lead primarily because of the lower overhead costs and greater scalability they offer to financial institutions. These ATMs can be strategically placed in high-traffic locations with minimal infrastructure requirements, which is appealing for independent ATM operators looking to maximize their reach while controlling costs.

Another key driver for the dominance of the offsite ATMs segment is the growing reliance on these machines for cash withdrawal and other services such as bill payments, mobile top-ups, and ticketing. These multifunctional capabilities, combined with enhanced security features and remote monitoring, have increased the popularity of offsite ATMs.

Key Market Segments

By Service Type

- ATM Replenishment and Currency Management

- Incident Management

- Network Management

- Security Management

- Other Service Types

By ATM Location

- Onsite ATMs

- Offsite ATMs

- Mobile ATMs

- Worksite ATMs

Driver

Increasing Demand for ATM Uptime and Operational Efficiency

A significant driver for the growth of ATM Managed Services is the increasing demand for enhanced uptime and operational efficiency. Financial institutions and banks rely heavily on ATMs to provide 24/7 access to cash, and any downtime directly impacts customer satisfaction and operational costs.

As ATMs play a key role in customer experience, financial institutions are relying on managed services for optimal performance and cost reduction. Third-party providers offer 24/7 monitoring, timely repairs, and proactive maintenance, improving service reliability and reducing system failures.

Additionally, ATM managed services allow financial institutions to focus on their core competencies, such as financial products and services, while ensuring that their ATMs operate seamlessly.

Restraint

Security Concerns and Vulnerabilities

Despite the benefits, security concerns remain a significant restraint for ATM managed services. As ATMs are connected to financial networks, they are vulnerable to cyberattacks, fraud, and theft. Cybercriminals can target both the machines themselves and the communication channels between ATMs and bank systems.

Managed service providers must invest in robust security measures, such as encryption and multi-factor authentication, to prevent data breaches and financial losses. Furthermore, some institutions remain hesitant to outsource ATM management due to concerns about losing control over security protocols, fearing that third-party providers may not adhere to the same stringent security standards.

Opportunity

Expansion of ATM Networks in Emerging Markets

An opportunity within the ATM Managed Services market lies in the expansion of ATM networks in emerging markets, especially in regions like Asia-Pacific, Africa, and Latin America. As economic development increases and financial inclusion becomes a priority in these regions, there is a growing demand for ATMs.

Managed services can help financial institutions in these emerging markets deploy, monitor, and maintain their ATMs at a lower cost. This would allow them to provide essential banking services to underserved populations while maintaining operational efficiency. As more financial institutions look to expand their networks in these areas, the demand for managed services is expected to grow.

Challenge

Regulatory Compliance and Service Standardization

One of the primary challenges for ATM Managed Services providers is ensuring compliance with varying regulatory standards across different regions. ATM operators are required to adhere to a wide range of regulations, including security protocols, data privacy laws, and accessibility requirements.

Regulations vary widely by country, making compliance complex and costly for service providers. They must stay updated on changing laws, implement necessary system adjustments, and ensure compliance to avoid penalties, legal issues, and reputational damage. Balancing compliance with efficient service delivery is a major challenge in the ATM managed services industry.

Emerging Trends

One of the key trends is the integration of Artificial Intelligence (AI) and machine learning to improve the predictive maintenance of ATMs. By using data analytics, banks can proactively identify issues before they disrupt operations, minimizing downtime and improving customer satisfaction.

Another emerging trend is the move towards cloud-based ATM management systems. These platforms allow banks to manage and monitor their entire network of ATMs from a centralized location, providing greater flexibility and reducing the need for on-site maintenance.

Further, with the increasing push towards contactless and mobile banking, ATMs are becoming more integrated with mobile wallets and digital payment systems. Customers can now perform more complex transactions, such as cashless withdrawals or even transfers between digital wallets and bank accounts, directly through ATMs.

Business Benefits

ATM managed services offer numerous advantages for businesses, with cost-efficiency being one of the most compelling benefits. By outsourcing the management of ATMs, banks and financial institutions can reduce the costs associated with maintaining in-house teams.

Security is another significant advantage provided by ATM managed services. Service providers often implement advanced security measures, including regular software updates, encryption technologies, and fraud detection systems. This enhanced security helps protect both the financial institution and its customers from the growing threat of cybercrime and card skimming.

Further, ATM managed services enhance customer satisfaction by ensuring high availability and reliability of ATMs. Through predictive maintenance, ATM uptime is maximized, reducing the chances of a malfunction during peak times. This reliability translates into better customer experiences, with less frustration and more convenience for users.

Regional Analysis

In 2023, Asia-Pacific (APAC) held a dominant market position in the ATM Managed Services sector, capturing more than a 38.5% share, which equated to USD 2.8 billion in revenue. The region’s leadership in the market can be attributed to the rapid expansion of ATM networks across both developed and emerging economies.

As APAC continues to experience robust economic growth, there has been a significant rise in banking activities, particularly in countries like China, India, and Southeast Asia, driving the demand for reliable and efficient ATM management services. The need for cost-effective solutions to support these growing ATM networks is fueling the market’s expansion.

The growth of digital banking in APAC is driving demand for ATM Managed Services. While digital banking is on the rise, cash remains vital, particularly in rural areas with limited banking access. This creates a need for efficient currency management, replenishment, and incident management to ensure ATMs remain operational.

Another key driver for the APAC region’s dominance is the increasing adoption of advanced technologies like AI and IoT for ATM monitoring and management. The region’s strong focus on technological advancements in banking, particularly in countries such as Japan and South Korea, has made ATM Managed Services more effective and appealing to financial institutions and retailers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The ATM Managed Services market is highly competitive, with several key players providing comprehensive solutions across the globe.

NCR Atleos is one of the dominant players in the ATM Managed Services market, renowned for its innovative solutions and extensive service portfolio. The company offers a wide array of managed services, including cash management, remote monitoring, software upgrades, and troubleshooting.

Diebold Nixdorf, Inc. is another major player, known for its comprehensive suite of ATM services, which includes ATM hardware, software, and end-to-end managed services. The company’s global presence, particularly in Europe, North America, and Asia, allows it to serve a broad range of financial institutions and retail clients.

Euronet Worldwide, Inc. has established itself as a leader in the ATM Managed Services market, providing end-to-end solutions to banks and financial institutions globally. The company offers services ranging from cash replenishment to 24/7 monitoring and troubleshooting. Euronet’s strength lies in its extensive ATM network and its ability to offer customized solutions based on market-specific requirements.

Top Key Players in the Market

- NCR Atleos

- Diebold Nixdorf, Inc.

- Euronet Worldwide, Inc.

- Fiserv, Inc.

- AGS Transact Technologies Ltd.

- Brink’s Incorporated

- Hitachi, Ltd.

- Hyosung TNS Inc.

- CMS Info Systems Limited

- Other Key Players

Top Opportunities Awaiting for Players

The ATM Managed Services market is rapidly evolving, presenting significant opportunities for players in the sector.

- Expansion in Emerging Markets: With increasing financial inclusion and digital banking trends in emerging markets, especially in Asia-Pacific, Latin America, and Africa, the demand for ATMs is on the rise. Companies providing managed services can leverage this growing demand by offering tailored solutions for these markets, such as low-cost, scalable ATM services that address the unique needs of regions with large unbanked populations.

- Shift Toward Cashless Transactions and ATM Modernization: As cash usage declines globally, ATMs are evolving beyond simple cash dispensers. Players in the ATM managed services market have the opportunity to provide value-added services that support the transition from traditional ATMs to multifunctional, self-service kiosks. By investing in software, security, and hardware upgrades, companies can help financial institutions enhance the functionality of their ATM networks.

- Increased Focus on Security: With rising concerns about cyber threats, data breaches, and fraud, financial institutions are investing more in secure ATM networks. Managed services providers that offer robust security solutions, including end-to-end encryption, malware detection, and advanced fraud monitoring, will see increased demand. As security regulations become more stringent, companies offering compliant, secure ATM services will stand out in a competitive market.

- Cost-Efficiency and Outsourcing: By leveraging third-party experts for ATM monitoring, maintenance, cash replenishment, and software upgrades, banks and other financial institutions can focus on core business activities while reducing overhead costs. This trend presents an opportunity for managed services providers to offer cost-effective solutions that optimize ATM uptime and operational efficiency.

- Sustainability and Green ATMs: Sustainability is becoming a key consideration for many financial institutions, especially in Europe and North America, where environmental regulations are stricter. Managed services providers that offer energy-efficient ATMs, eco-friendly maintenance practices, and waste reduction strategies are likely to gain a competitive edge.

Recent Developments

- In January 2024, Brinks, a global leader in cash logistics and security services, merged with Cardtronics, one of the world’s largest ATM operators. The merger aims to create a comprehensive global platform for ATM managed services, combining Brinks’ expertise in cash management and security with Cardtronics’ extensive ATM network.

- In October 2024, NCR Corporation has introduced a cutting-edge facial recognition technology, enabling customers to withdraw cash from ATMs using only their face, eliminating the need for a card. This innovative system leverages a powerful combination of AI and 3D camera technology to accurately verify identities.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Bn Forecast Revenue (2033) USD 15.2 Bn CAGR (2024-2033) 7.30% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (ATM Replenishment and Currency Management, Incident Management, Network Management, Security Management, Other Service Types), By ATM Location (Onsite ATMs, Offsite ATMs, Mobile ATMs, Worksite ATMs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NCR Atleos, Diebold Nixdorf, Inc., Euronet Worldwide, Inc., Fiserv, Inc., AGS Transact Technologies Ltd., Brink’s Incorporated, Hitachi, Ltd., Hyosung TNS Inc., CMS Info Systems Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  ATM Managed Services MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

ATM Managed Services MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- NCR Atleos

- Diebold Nixdorf, Inc.

- Euronet Worldwide, Inc.

- Fiserv, Inc.

- AGS Transact Technologies Ltd.

- Brink's Incorporated

- Hitachi, Ltd.

- Hyosung TNS Inc.

- CMS Info Systems Limited

- Other Key Players