Global Athletic Footwear Market By Product Type (Running Shoes, Sports Shoes, Trekking and Hiking Shoes, Walking Shoes, Aerobic Shoes), By End-User (Men, Women, Children), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 19833

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Athletic Footwear Market is expected to be worth around USD 229.6 Billion by 2033, up from USD 138.3 Billion by 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Athletic footwear encompasses shoes designed specifically for sports and other forms of physical exercise, but they are also commonly used for casual wear. Such footwear is engineered to enhance comfort, provide stability, and prevent injuries during various activities including running, basketball, tennis, and training exercises.

The athletic footwear market is a dynamic sector that includes the sale and production of sports-specific and leisure-use shoes. This market benefits from increasing health awareness, growing global interest in sports, and a rising emphasis on fitness across all age groups which drives consumer demand for specialized footwear.

The growth of the athletic footwear market can be attributed to technological advancements in footwear materials and design, promoting superior performance characteristics. Increased participation in sports activities worldwide also significantly contributes to market expansion.

Demand in the athletic footwear market is driven by a surge in health consciousness and a global trend toward casual and comfortable fashion. The demographic expansion of active individuals and sports enthusiasts continually fuels the need for innovative athletic shoes.

The market presents opportunities for the expansion of eco-friendly and sustainable footwear as consumers increasingly prefer products with minimal environmental impact. Additionally, the integration of smart technology in athletic smart shoes for performance tracking and fitness monitoring opens new avenues for growth.

The athletic footwear market is currently experiencing a significant evolution driven by multiple factors including technological innovation, sustainability initiatives, and substantial financial investments in new ventures. Notably, the market has seen substantial investments aimed at developing consumer-centric brands and technologies.

For instance, Agilitas Sports, co-founded by industry veterans from Puma, has secured a total funding of INR 537 crore, with a recent investment of ₹100 crore from Nexus Venture Partners. This funding is targeted toward building a comprehensive value chain spanning from smart manufacturing to retail specifically for sports footwear and apparel.

Further emphasizing the sustainability trend within the sector, the new startup Hylo has been notable for integrating advanced materials science to produce athletic footwear with lower environmental impacts.

The company raised approximately €2.9 million, supported by Eka Ventures and other participants, including notable sports personalities.

Hylo’s launch product—a vegan, recyclable running shoe—demonstrates a 52% reduction in carbon footprint compared to traditional running shoes, underscoring the market’s shift towards eco-friendly products.

Additionally, the athletic footwear market is also witnessing emerging players like Comet, which recently raised $5 million from Elevation Capital and Nexus Ventures.

This investment highlights the growing appeal of innovative startups in the athletic footwear space that are ready to disrupt traditional market dynamics with new business models and product offerings.

Together, these developments represent a market ripe with opportunities for both growth and transformation, catering to a more environmentally conscious and health-oriented global consumer base.

Key Takeaways

- The Global Athletic Footwear Market is expected to be worth around USD 229.6 Billion by 2033, up from USD 138.3 Billion by 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

- In 2023, Running Shoes held a dominant market position in the By Product Type segment of the Athletic Footwear Market, with a 38.1% share.

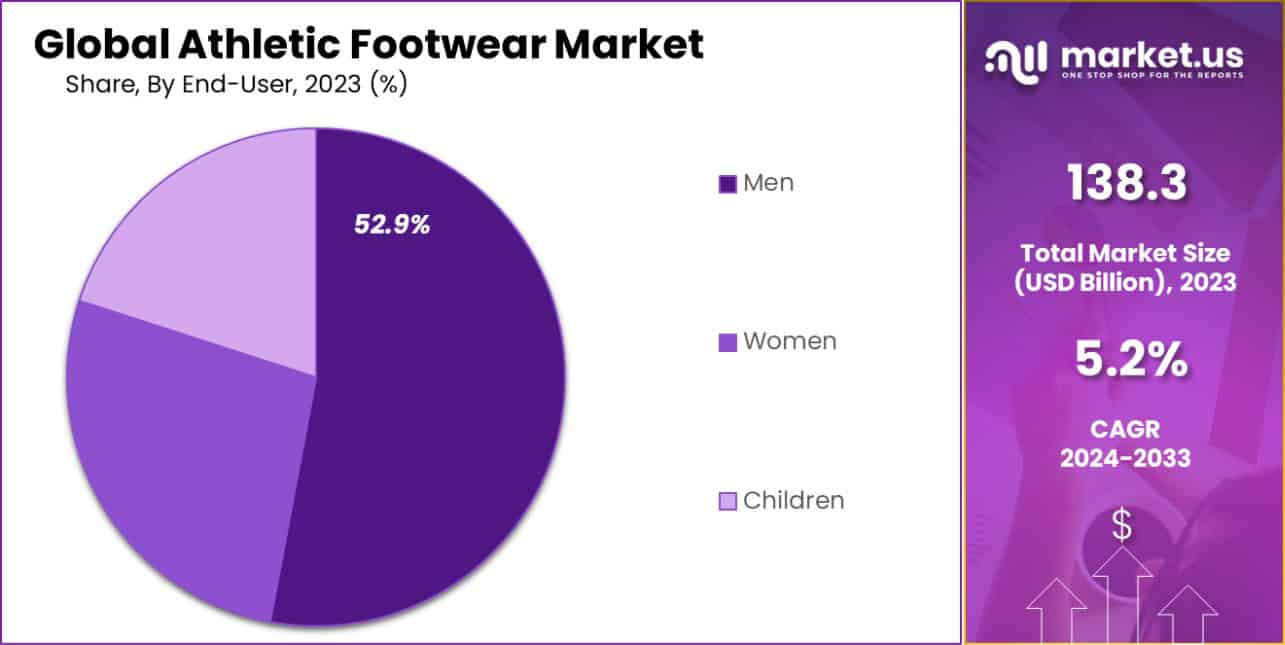

- In 2023, Men held a dominant market position in the end-user segment of the Athletic Footwear Market, with a 52.9% share.

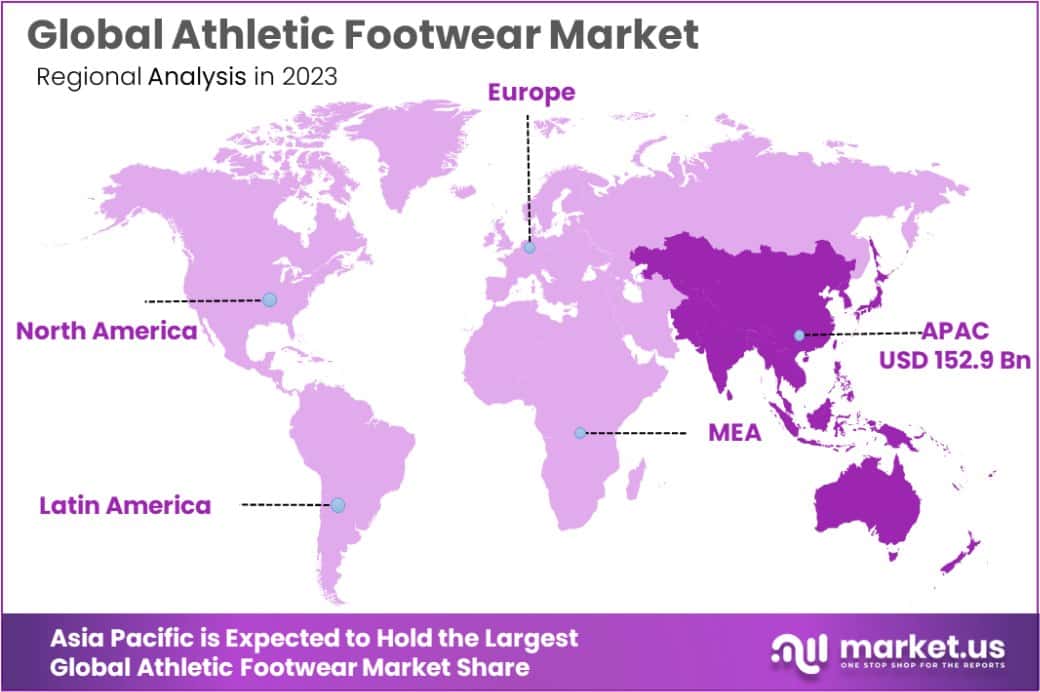

- Asia Pacific dominated a 38.3% market share in 2023 and held USD 52.9 Billion in revenue from the Athletic Footwear Market.

By Product Type Analysis

In 2023, Running Shoes held a dominant market position in the By Product Type segment of the Athletic Footwear Market, capturing a 38.1% share. This segment benefits significantly from the global trend towards fitness and wellness, with consumers increasingly participating in running as a form of exercise that requires minimal equipment and can be practiced almost anywhere.

The demand for running shoes is further bolstered by continuous innovations in shoe technology, such as enhanced cushioning and lightweight materials, which aim to improve performance and reduce injury risk.

Sports Shoes followed, accounting for a significant portion of the market with a focus on specialized footwear designed for various sports activities including basketball, soccer, and tennis. These shoes are tailored to offer the necessary support, flexibility, and durability required by specific sports, influencing their demand pattern.

Trekking and Hiking Shoes also captured a notable market share, driven by an increasing interest in outdoor activities among all age groups. These shoes are designed to provide enhanced grip and support in rugged terrains, appealing to adventure enthusiasts.

Walking Shoes and Aerobic Shoes, while holding smaller shares, are integral to the market. Walking shoes are favored for their comfort and versatility, while aerobic shoes are designed to facilitate intense workouts, meeting the needs of a niche but loyal fitness demographic. Together, these segments underscore the diverse consumer demand shaping the athletic footwear market.

By End-User Analysis

In 2023, Men held a dominant market position in the By End-User segment of the Athletic Footwear Market, with a 52.9% share. This majority is attributed to the increased participation of men in sporting activities and a growing trend towards health and fitness, which boosts the demand for athletic footwear designed for performance.

Women constituted 31.8% of the market, driven by rising involvement in sports and an expanding range of female-specific athletic footwear that combines style with functionality. Children accounted for 15.3% of the market segment, supported by the growing interest in youth sports and parental focus on equipping children with proper footwear for athletic activities.

The data reflects a robust demand across all demographics, with men leading, as sports participation continues to rise globally, influencing footwear preferences and contributing significantly to market dynamics.

Key Market Segments

By Product Type

- Running Shoes

- Sports Shoes

- Trekking and Hiking Shoes

- Walking Shoes

- Aerobic Shoes

By End-User

- Men

- Women

- Children

Drivers

Athletic Footwear Market Growth Factors

The Athletic Footwear Market is experiencing significant growth driven primarily by the global increase in health consciousness. More people are participating in sportswear and fitness activities, which directly boosts the demand for athletic shoes designed for specific sports and workouts.

Additionally, technological advancements in footwear, such as improved comfort and performance features, attract consumers seeking to enhance their athletic performance. The market also benefits from the rising trend of using athletic shoes as casual wear, known as the athleisure trend, expanding the consumer base beyond active athletes to include daily wear in urban fashion.

This blend of functionality, style, and increasing health trends firmly positions athletic footwear for continued market expansion.

Restraint

Challenges in Athletic Footwear Market

The Athletic Footwear Market faces a significant challenge from the high cost of premium sports shoes, which can deter budget-conscious consumers. Innovations and advanced technologies integrated into athletic footwear, while enhancing performance and comfort, also raise production costs, resulting in higher retail prices.

This pricing issue is particularly impactful in less affluent regions where spending power is limited. Moreover, the market is subject to intense competition among numerous brands, which can lead to price wars and affect profitability.

Additionally, the volatility in raw material prices, such as rubber and synthetic fabrics, further complicates pricing strategies, posing a persistent restraint on the market’s growth potential.

Opportunities

Expanding Opportunities in Athletic Footwear

The Athletic Footwear Market presents vast opportunities, particularly through the rising trend of customization and personalization. Consumers increasingly seek products that reflect their style and specific athletic needs, pushing companies to innovate with customizable options.

This trend is coupled with growing markets in emerging economies, where increasing income levels and health awareness are boosting demand for athletic footwear. Additionally, the integration of sustainable practices and eco-friendly materials is opening new avenues for growth.

As environmental concerns become more pronounced, consumers are showing a preference for brands that prioritize sustainability in their products. These factors combined create a dynamic environment for expansion and innovation within the athletic footwear industry, catering to a broader and more environmentally conscious customer base.

Challenges

Challenges Facing Athletic Footwear Market

One of the key challenges in the Athletic Footwear Market is the constant need for innovation amid fierce competition. Brands must continually develop new technologies and designs to stay relevant, which demands substantial investment in research and development.

This intense competition not only pushes production costs higher but also shortens the product lifecycle, requiring quicker turnover of stock. Furthermore, the global nature of the market introduces complexities in supply chain management, affected by fluctuating import/export regulations and tariffs.

The market also faces challenges from counterfeit products, which undermine brand reputation and revenue. These factors collectively pose significant hurdles to maintaining market share and profitability in the rapidly evolving athletic footwear landscape.

Growth Factors

Key Growth Drivers for Athletic Footwear

The Athletic Footwear Market is propelled by several growth factors, notably the increasing global interest in sports and physical fitness. As more people engage in regular exercise and participate in sports activities, the demand for specialized athletic shoes intensifies.

This trend is supported by government initiatives in many countries that promote sports and active lifestyles to combat health issues like obesity. Additionally, the growing popularity of sports apparel as fashion items, known as the athleisure trend, extends the market beyond traditional sports participants to fashion-conscious consumers.

This broader appeal helps sustain market growth. Moreover, advancements in shoe technology, offering better comfort, durability, and performance, also attract customers seeking quality products, further driving market expansion.

Emerging Trends

Emerging Trends in Athletic Footwear

Emerging trends in the Athletic Footwear Market are reshaping consumer preferences and industry standards. Notably, the digital integration into footwear, such as smart shoes equipped with sensors to track performance metrics, is gaining traction.

These technological enhancements appeal to tech-savvy consumers and those focused on optimizing their athletic performance through data. Another significant trend is the shift towards sustainable and eco-friendly materials, as environmental consciousness grows among consumers. Brands that incorporate recycled materials and promote sustainable practices are increasingly favored.

Additionally, the expansion of direct-to-consumer sales channels, facilitated by e-commerce, allows brands to engage directly with customers, offering personalized experiences and exclusivity in product offerings. These trends are setting new directions for the market, emphasizing innovation, sustainability, and consumer engagement.

Regional Analysis

The Athletic Footwear Market exhibits diverse trends across global regions, each reflecting unique consumer behaviors and economic conditions. Asia-Pacific stands as the dominant region with a 38.3% market share, valued at USD 52.9 billion, driven by expanding urban populations and increasing income levels that enhance spending on sports and fitness products.

In North America, the market is propelled by a strong culture of sports and outdoor activities, coupled with high consumer spending power, making it a significant contributor to global sales. Europe follows closely, where an emphasis on health and wellness, combined with a robust sporting infrastructure, supports sustained demand.

Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets due to rising sports participation and growing awareness about the health benefits of physical activity.

These regions are experiencing rapid growth, albeit from a smaller base, fueled by urbanization and youth demographics. Collectively, these regional dynamics illustrate a robust global market poised for ongoing growth and expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Athletic Footwear market is significantly shaped by major players: Nike, Inc., Adidas AG, and PUMA SE. Each of these entities brings distinct strengths and strategies to the forefront, reinforcing their positions and driving the industry’s dynamics.

Nike, Inc. continues to dominate the market with its innovative approaches to footwear technology and marketing. Nike’s strong brand recognition and substantial investment in research and development allow it to introduce groundbreaking products that cater to a broad consumer base, ranging from professional athletes to casual gym-goers.

The company’s adept use of digital marketing and direct-to-consumer sales channels also enhances its market presence and customer loyalty.

Adidas AG stands as a formidable competitor, primarily due to its diverse product lineup and strong global footprint. Adidas has made significant strides in sustainability, an increasingly crucial factor in consumer purchasing decisions.

The company’s commitment to using recycled materials and reducing its carbon footprint resonates well with environmentally conscious consumers, further strengthening its market share.

PUMA SE, while smaller in scale compared to Nike and Adidas, has effectively carved a niche for itself by focusing on both performance and fashion. PUMA’s collaborations with high-profile celebrities and designers have effectively amplified its visibility and appeal, particularly among younger consumers.

This strategy, combined with consistent technological advancements in its footwear, positions PUMA as a vibrant and trendy choice within the athletic footwear space.

Together, these companies not only drive competitive pressures but also push the boundaries of innovation, sustainability, and marketing in the athletic footwear market. Their collective actions and strategic directions are critical in shaping the market landscape, influencing consumer preferences, and emerging industry trends in 2023 and beyond.

Top Key Players in the Market

- Nike, Inc.

- Adidas AG

- PUMA SE

- SKECHERS USA, Inc.

- New Balance Athletics, Inc.

- ASICS Corporation

- Under Armour, Inc.

- FILA Holdings Corp.

- Mizuno Corporation

- Brooks Sports, Inc.

- Other Key Players

Recent Developments

- In October 2024, Brandman Retail partners with Wolverine Worldwide to distribute Saucony’s Autumn/Winter 2024 collection, introducing innovative running and lifestyle footwear to India’s market.

- In October 2024, Portland launched the $125-million Made in Old Town project, a collaborative hub for innovation and onshore production in the footwear industry, supported by key industry leaders and political figures.

Report Scope

Report Features Description Market Value (2023) USD 138.3 Billion Forecast Revenue (2033) USD 229.6 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Running Shoes, Sports Shoes, Trekking and Hiking Shoes, Walking Shoes, Aerobic Shoes), By End-User (Men, Women, Children) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nike, Inc., Adidas AG, PUMA SE, SKECHERS USA, Inc., New Balance Athletics, Inc., ASICS Corporation, Under Armour, Inc., FILA Holdings Corp., Mizuno Corporation, Brooks Sports, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Athletic Footwear MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Athletic Footwear MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Nike, Inc.

- Adidas AG

- PUMA SE

- SKECHERS USA, Inc.

- New Balance Athletics, Inc.

- ASICS Corporation

- Under Armour, Inc.

- FILA Holdings Corp.

- Mizuno Corporation

- Brooks Sports, Inc.

- Other Key Players