Asia-Pacific Active Pharmaceutical Ingredient Market Analysis By Type (Generic, Innovative), By Manufacturers (Captive, Merchant), By Synthesis (Biotech, Synthetic), By Usage (Clinical, Research), By Application (Cardiology, Oncology, Neurology, Orthopedics, Endocrinology, Pulmonology, Nephrology, Ophthalmology, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 74488

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

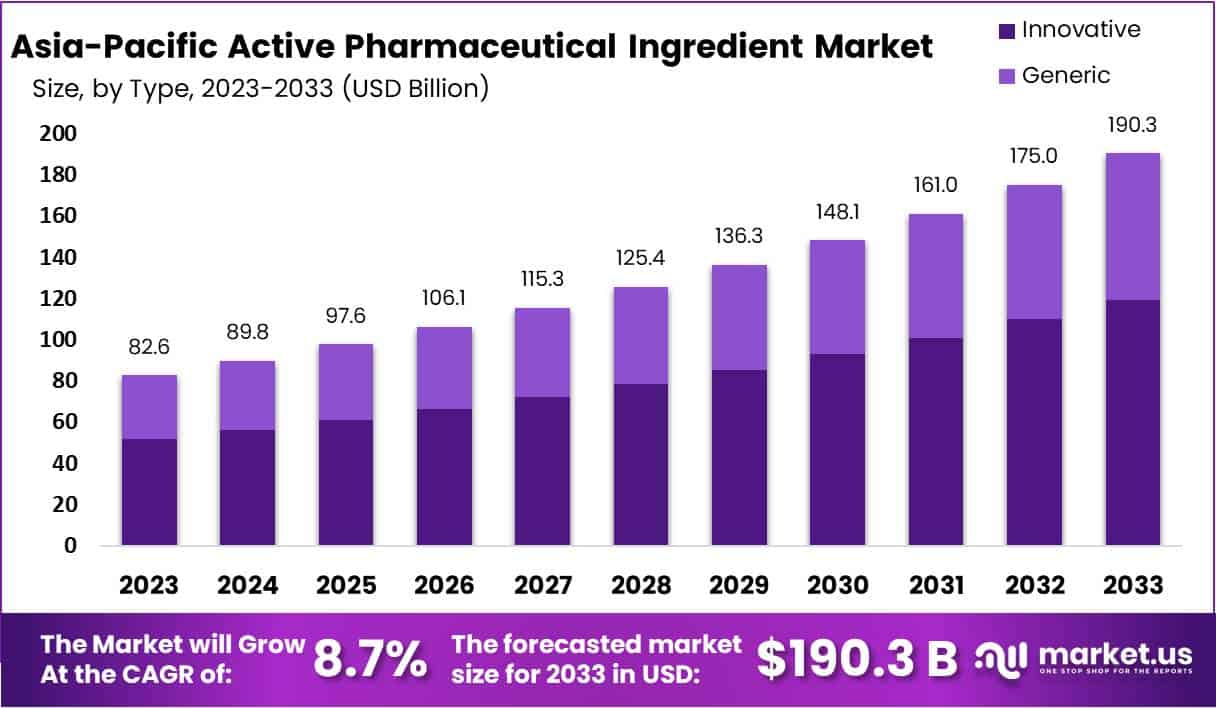

The Asia-Pacific Active Pharmaceutical Ingredient Market size is expected to be worth around USD 190.3 Billion by 2033, from USD 82.6 Billion in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

The Asia-Pacific region is witnessing a notable expansion in the Active Pharmaceutical Ingredients (API) market, a trend anticipated to persist in the coming years. This growth can be attributed to several key factors: the increasing prevalence of chronic diseases, an aging population, the trend towards outsourcing API production, the integration of biologics in disease management, and a rise in regulatory approvals coupled with the expiration of patents for significant drugs.

Active Pharmaceutical Ingredients play an essential role across various sectors, with pharmaceutical manufacturing leading the demand. This importance is further underscored by the support from the nutraceutical, cosmetics, and veterinary medicine industries. A report from the Global Health Institute indicates that pharmaceuticals are responsible for over 60% of the API market’s consumption, emphasizing the crucial role of APIs in promoting health and wellness across diverse areas.

The regulatory environment for APIs in the Asia-Pacific region varies significantly across countries, yet efforts by the International Council for Harmonisation (ICH) to standardize regulations globally are notable. Agencies like Singapore’s Health Sciences Authority (HSA) and India’s Central Drugs Standard Control Organization (CDSCO) enforce rigorous standards to ensure the quality, safety, and efficacy of APIs. With over 80 countries aligning with ICH guidelines, as reported by the World Health Organization, the importance of harmonization in maintaining global healthcare standards is evident.

China holds a dominant position in the Asia-Pacific API market, accounting for approximately 50% of the market share. On the other hand, the Indian API sector is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 8.1% from 2023 to 2033. This growth is bolstered by cost advantages and strategic government support, as highlighted by industry insights.

Government policies are significantly propelling the API industry forward, with financial incentives encouraging manufacturing and R&D efforts. According to the Pharmaceutical Research and Manufacturers Association, investments in the API sector, especially in China and India, have surged, with funding from the government and private sectors exceeding $5 billion in the past year. These investments are aimed at increasing production capacities by 20%, modernizing facilities, and fostering innovation.

Furthermore, the API market is experiencing a surge in strategic collaborations, including mergers, acquisitions, and partnerships. A 2023 report by the Global Health Institute notes a 25% year-over-year increase in strategic partnerships within the API sector, highlighting the industry’s dedication to pharmaceutical innovation and meeting the evolving demands of healthcare.

Key Takeaways

- Asia-Pacific API market to reach USD 190.3 Billion by 2033, growing at 8.7% CAGR from 2024.

- Innovative segment leads with 62.7% market share, driven by R&D investments and supportive policies.

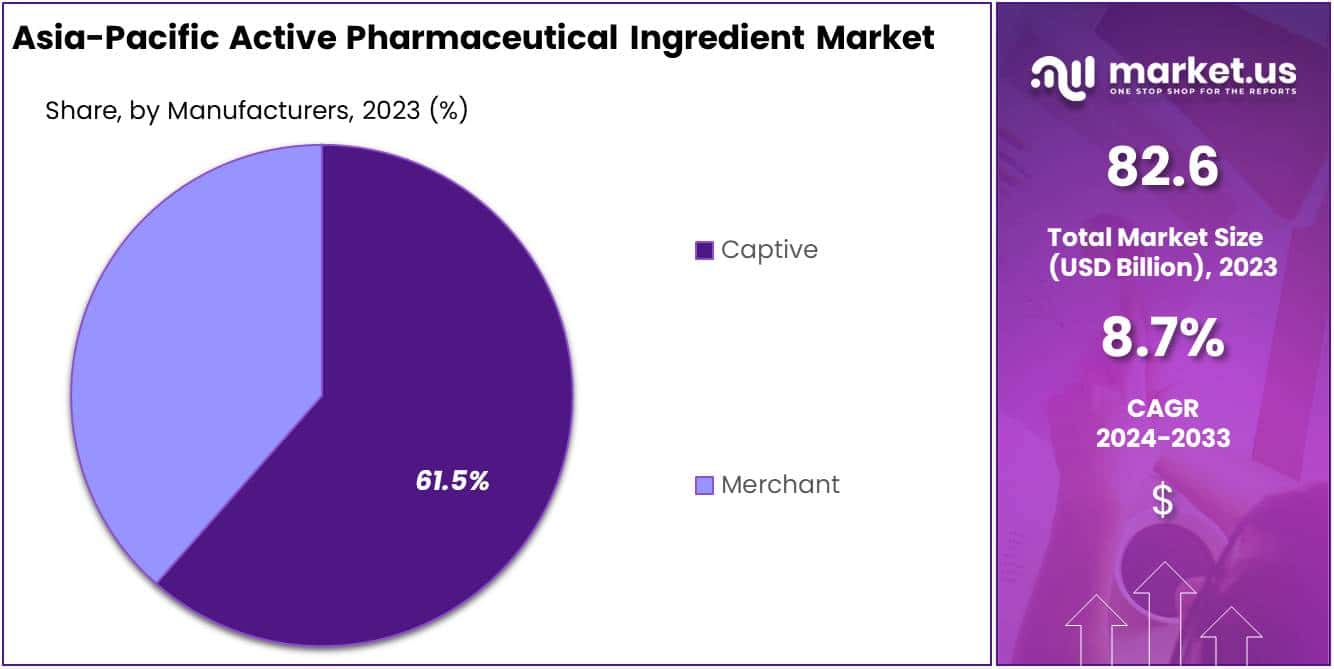

- Captive segment dominates with 61.5% market share, ensuring quality control through in-house production.

- Synthetic APIs hold over 76.2% market share, favored for accessibility and cost-effectiveness.

- Clinical applications account for 71.3% market share, driven by demand for effective pharmaceuticals.

- Cardiology segment leads with 21.4% market share, fueled by rising prevalence of cardiovascular diseases.

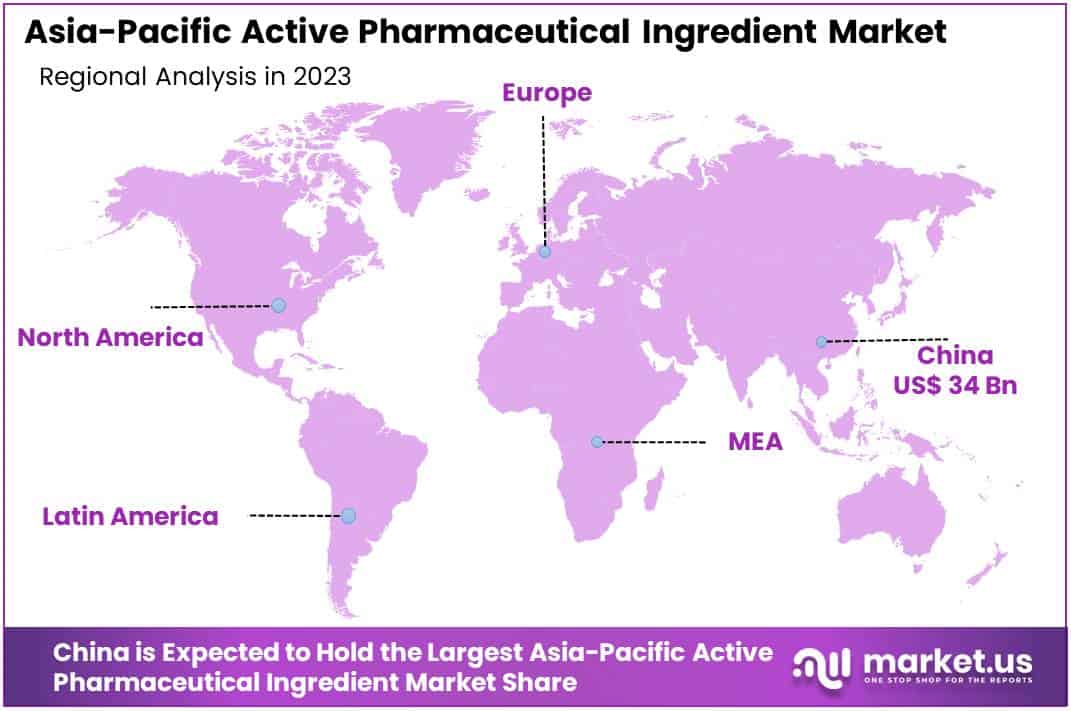

- China commands 41.2% market share, valued at USD 34 billion in 2023, with robust production capabilities.

- India poised for growth with efficient manufacturing processes and a strong generic drugs sector.

- Outsourcing of API manufacturing presents growth opportunities, leveraging cost efficiencies and specialized capabilities.

Type Analysis

In 2023, the Innovative segment secured a leading position within the Asia-Pacific Active Pharmaceutical Ingredient (API) Market, boasting over a 62.7% share. This dominance is largely due to substantial investment in research and development by regional pharmaceutical firms, aimed at launching new drug solutions. Such efforts are in response to the rising incidence of chronic and lifestyle-induced conditions across Asia-Pacific. The region’s focus on developing cutting-edge therapeutic options has significantly propelled the demand for innovative APIs. Supportive government policies promoting pharmaceutical innovation have further fueled this segment’s growth, highlighting tax benefits, funding opportunities, and simplified drug approval processes.

Meanwhile, the Generic segment, despite holding a lesser market share, has seen notable expansion. This growth is attributed to the expiration of patents for numerous leading drugs, sparking an increased demand for generic medications. The affordability of generics, coupled with governmental drives to encourage their use for healthcare cost reduction, has bolstered this sector’s development. Additionally, Asia-Pacific’s emergence as a key player in API production and exportation, thanks to its cost-efficient manufacturing landscape and skilled labor force, supports both local and international demands, reinforcing the region’s stature in the global API arena.

Looking ahead, the Asia-Pacific API market is poised for sustained growth, driven by continuous advancements in pharmaceutical research, an aging demographic, and escalating chronic disease rates. Nevertheless, the market is navigating through challenges such as regulatory complexities, pricing pressures, and the imperative for ongoing innovation to address changing healthcare needs. Stakeholders are advised to pursue strategic partnerships, boost research and development capabilities, and invest in novel technologies like biologics and personalized medicine. These strategies are essential for maintaining a competitive advantage and significantly contributing to the pharmaceutical industry’s global expansion.

Manufacturers Analysis

In 2023, the Captive segment significantly dominated the Manufacturers Segment of the Asia-Pacific Active Pharmaceutical Ingredient (API) Market, securing over 61.5% of the market share. This segment’s leadership is largely due to its pivotal role in maintaining a steady supply of high-quality APIs, crucial for the production of efficacious pharmaceuticals. By producing APIs in-house, pharmaceutical firms gain direct control over quality, supply chain robustness, and cost-effectiveness. This approach is particularly advantageous in the Asia-Pacific region, known for its stringent regulatory standards, including adherence to Good Manufacturing Practices (GMP).

The dominance of the Captive segment also reflects a strategic emphasis on research and development (R&D) activities. These efforts are central to fostering innovation within the API market, through both the development of new APIs and the enhancement of existing ones. Such innovations are key to introducing new therapeutic options and improving the safety and efficacy profiles of current treatments. Moreover, this segment’s substantial market share underscores the importance of mitigating supply chain and quality control risks, which are crucial in the highly competitive pharmaceutical landscape.

Conversely, the Merchant segment, characterized by the procurement of APIs from external manufacturers, is also gaining traction. This shift is driven by pharmaceutical companies’ increasing inclination towards outsourcing API production, aiming to capitalize on cost efficiencies and concentrate on their core competencies, such as drug development and marketing. The growth of the Merchant segment is further bolstered by the rising capabilities of contract manufacturing organizations (CMOs) in the region, capable of meeting the stringent quality standards of the pharmaceutical industry. This evolving dynamic between the Captive and Merchant segments illustrates the strategic balance companies are navigating between control versus cost, and quality versus flexibility.

Synthesis Analysis

In 2023, the synthetic segment emerged as the predominant force within the Synthesis Segment of the Asia-Pacific Active Pharmaceutical Ingredient (API) Market, securing an impressive share exceeding 76.2%. This leadership stance is largely due to the segment’s comprehensive accessibility to synthetic APIs, along with substantial advancements in synthetic chemistry techniques. Moreover, the capability of this segment to deliver a consistent and scalable supply of APIs plays a crucial role in satisfying the escalating demands of the pharmaceutical sector across this region. The cost-effectiveness of synthetic APIs, crucial for the price-sensitive markets in Asia-Pacific, also contributes to their widespread adoption.

The synthetic API segment benefits significantly from ongoing investments in research and development, particularly in enhancing synthetic methodologies through green chemistry. Such improvements not only bolster the segment’s sustainability but also ensure compliance with global environmental standards, thereby broadening its appeal. Additionally, the regulatory environment in Asia-Pacific, characterized by streamlined approval processes for synthetic APIs, accelerates the introduction of pharmaceutical products to the market. This is particularly evident in the flourishing generic drug sectors of India and China, which intensifies the demand for synthetic APIs.

However, the landscape is evolving with the rising interest in biologics and precision medicine, hinting at a gradual shift towards more personalized treatment options. This trend poses potential challenges to the demand for synthetic APIs in the long run. Moreover, the global drive towards sustainable manufacturing and reduced carbon footprints necessitates ongoing innovation within the synthetic API segment. To maintain their market dominance, stakeholders must stay attuned to these changes, adapting their strategies to leverage emerging opportunities and navigate the complexities of the evolving pharmaceutical landscape in the Asia-Pacific region.

Usage Analysis

In 2023, the clinical segment emerged as the predominant force within the Usage Segment of the Asia-Pacific Active Pharmaceutical Ingredient (API) Market, securing over a 71.3% share. This significant market dominance underscores the critical role of APIs in the development and manufacturing of pharmaceutical formulations that are essential for clinical applications. The robust growth in this segment can be attributed to the increasing demand for effective pharmaceuticals in response to the region’s growing healthcare needs, coupled with substantial investments in research and development by leading pharmaceutical companies aiming to expand their product portfolios.

The expansion of the clinical segment is further supported by the Asia-Pacific region’s rapid advancements in biotechnology and pharmaceutical sciences. These advancements have led to the introduction of innovative APIs that offer enhanced efficacy, safety, and patient outcomes, thereby driving the segment’s growth. Additionally, government initiatives across various countries in the region to promote the pharmaceutical sector, including regulatory support and funding for drug development projects, have played a pivotal role in bolstering the clinical segment’s market share.

Looking ahead, the clinical segment of the Asia-Pacific API market is poised for sustained growth, driven by ongoing innovations in drug development, an increasing focus on personalized medicine, and the rising prevalence of chronic diseases. Moreover, the region’s aging population and improving healthcare infrastructure are expected to further stimulate demand for clinically effective pharmaceuticals, ensuring the clinical segment’s continued market dominance. Strategic collaborations and partnerships between pharmaceutical companies and research institutions are likely to enhance the development of novel APIs, cementing the Asia-Pacific region’s status as a key player in the global pharmaceutical industry.

Application Analysis

In 2023, the Cardiology segment emerged as a frontrunner in the Application Segment of the Asia-Pacific Active Pharmaceutical Ingredient (API) Market, securing over a 21.4% share. This prominence is largely due to the escalating prevalence of cardiovascular diseases (CVDs) across Asia-Pacific, propelled by aging demographics, increasing obesity rates, and lifestyle-induced risk factors. The region’s burgeoning demand for cardiology-related APIs underscores the critical need for effective management and treatment of CVDs.

Enhancements in pharmaceutical R&D have led to the innovation of novel APIs that offer improved efficacy with fewer side effects, further fueling market growth. Government efforts to enhance healthcare infrastructure and accessibility have significantly contributed to the segment’s expansion, alongside policies favoring pharmaceutical manufacturing, particularly in India and China.

The surge in healthcare investments by both governmental and private sectors, combined with heightened awareness about CVD prevention, is anticipated to sustain the demand for cardiology APIs in Asia-Pacific. The market’s momentum is also driven by the generic drug sector, which benefits from cost efficiency and the expiry of patents on several leading drugs. The trend towards more targeted and specialized APIs indicates a shift towards personalized medicine, promising more advanced treatment options within cardiology.

This shift not only highlights the industry’s evolution towards patient-specific solutions but also points to potential growth opportunities for the Cardiology segment. The continuous focus on innovation, coupled with the demand for affordable, quality healthcare solutions, positions the Cardiology segment for further expansion, thereby playing a pivotal role in the development of the Asia-Pacific API market.

Key Market Segments

Type

- Generic

- Innovative

Manufacturers

- Captive

- Merchant

Synthesis

- Biotech

- Synthetic

Usage

- Clinical

- Research

Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Endocrinology

- Pulmonology

- Nephrology

- Ophthalmology

- Others

Drivers

Increasing Prevalence of Chronic Diseases

The escalation in the incidence of chronic diseases within the Asia-Pacific region, notably diabetes, cardiovascular diseases, and cancer, serves as a pivotal driver for the expansion of the Active Pharmaceutical Ingredient (API) market. According to data from the World Health Organization, the Western Pacific region, encompassing a significant portion of Asia-Pacific, has witnessed a marked increase in non-communicable diseases, with over 425 million individuals currently living with diabetes, and this number is projected to rise.

Additionally, cardiovascular diseases account for 37% of all deaths in the region, while cancer incidence rates are expected to increase by over 60% in the next two decades. This growing burden of chronic conditions necessitates advanced and efficacious treatment modalities, propelling demand for innovative APIs. Consequently, the imperative for a consistent pharmaceutical supply to address the expanding patient demographic is catalyzing production enhancements and innovation within the API sector, underpinning the market’s growth trajectory.

Restraints

Stringent Regulatory Policies

The implementation of stringent regulatory policies and standards in the Asia-Pacific region, focused on assuring the safety, efficacy, and quality of Active Pharmaceutical Ingredients (APIs), significantly constrains market growth. These regulations mandate exhaustive testing, comprehensive documentation, and strict adherence to quality controls, leading to escalated production costs and elongated timelines for product launches.

According to a report by the Pharmaceutical Research and Manufacturers of America (PhRMA), regulatory compliance costs can amplify API manufacturing expenses by approximately 20-30%. Additionally, the Asia-Pacific Economic Cooperation (APEC) highlights that the regulatory approval process for new pharmaceuticals can extend product development cycles by an average of 2-3 years, delaying market entry. While these regulatory frameworks are indispensable for maintaining high public health standards, they inadvertently pose considerable challenges to manufacturers, decelerating the pace of innovation and market expansion in the Asia-Pacific API sector.

Opportunities

Outsourcing of API Manufacturing

The outsourcing of Active Pharmaceutical Ingredient (API) manufacturing to the Asia-Pacific region represents a pivotal growth opportunity for its market. Countries like India and China have emerged as global epicenters for the production of APIs, attributed to their capacity to provide high-quality and cost-effective solutions. This transition towards outsourcing is primarily motivated by the industry’s aim to diminish manufacturing expenses, harness specialized production capabilities, and enhance supply chain efficiencies.

According to a report by the International Trade Administration, the pharmaceutical sector in Asia-Pacific is expected to witness a compound annual growth rate (CAGR) of approximately 8.34% between 2021 and 2026, significantly propelled by the API manufacturing sector. This burgeoning trend not only promises substantial growth prospects for local manufacturers but also positions the region as a formidable force in the global API market landscape. Consequently, the Asia-Pacific region’s strategic emphasis on API outsourcing is set to fortify its global market standing, offering a competitive edge in meeting the escalating global demand for pharmaceuticals.

Trends

Increasing Investment in Biotechnology

The Asia-Pacific Active Pharmaceutical Ingredient (API) market is undergoing a significant shift, with a marked increase in investments in biotechnology, signaling a pivotal change towards the production of biopharmaceuticals. This movement is propelled by a concentrated effort on the research and development of biologic APIs, which are derived from living organisms and are crucial for creating highly specific and effective treatments for a wide range of diseases. The rapid growth of the biopharmaceutical sector in this region is supported by significant advancements in biotechnology, alongside favorable government policies and a notable rise in healthcare expenditures.

According to a study by the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), the Asia-Pacific region has seen a compound annual growth rate (CAGR) of 8.1% in biopharmaceutical investments over the past five years. This trend is indicative of the region’s evolving pharmaceutical landscape, which is increasingly focusing on developing sophisticated biologic treatments, thereby enhancing the Asia-Pacific’s stature as an emerging leader in innovative healthcare solutions on the global stage.

Regional Analysis

In 2023, the Asia-Pacific Active Pharmaceutical Ingredient (API) Market was significantly influenced by China’s commanding presence, which secured over 41.2% of the market share, equivalent to a USD 34 billion market valuation. This dominance is largely due to China’s extensive production capabilities, substantial R&D investments, and favorable government policies towards the pharmaceutical industry.

The country’s leading position is further bolstered by the proliferation of large-scale API manufacturers and a concerted effort towards enhancing pharmaceutical product quality and innovation. Additionally, the region’s overall growth is propelled by an escalating demand for generic medications, increased healthcare spending, and a higher incidence of chronic diseases.

India, alongside China, emerges as a critical force in the Asia-Pacific API market, thanks to its efficient manufacturing processes, skilled labor force, and robust generic drugs sector. The Indian market is poised for significant growth, driven by government initiatives aimed at bolstering domestic production and reducing import dependence.

Other regions include Japan, South Korea, and Australia, each contributing uniquely to the market’s expansion through technological advancements, regulatory reforms, and investment in pharmaceutical research. The region’s market dynamics present a mix of challenges and opportunities, with regulatory complexities and environmental concerns on one side, and a burgeoning demand for pharmaceuticals on the other, signaling a bright future for the Asia-Pacific API market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Asia-Pacific Active Pharmaceutical Ingredient (API) market is a vibrant sector with key players shaping its dynamics. Among these, Sun Pharmaceuticals stands out for its broad product range and strong research and development. The company’s focus on generic drugs and efficient manufacturing enhances its global presence, making it a leader in the market.

Dr. Reddy’s Laboratories is another major player, known for its innovative API solutions. The emphasis on quality and compliance has bolstered its reputation, with investments in technology boosting production capabilities. This positions Dr. Reddy’s Laboratories prominently within the Asia-Pacific and beyond.

Aurobindo Pharma distinguishes itself through cost-effective manufacturing and a diverse API portfolio. Its efforts to improve operational efficiency and expand production capacity are crucial for meeting the increasing demand. The company’s extensive distribution network supports its reach in emerging markets across the region.

Syn-Tech Chem & Pharm Co. Ltd., though smaller, specializes in niche segments with its custom synthesis and development focus. Its unique position in the market is due to its agile and customer-focused approach, contributing significantly to the sector.

Other important market participants also play vital roles, enhancing the competitive landscape with their varied strategies and offerings. Collectively, these players drive innovation and market growth, meeting the pharmaceutical industry’s evolving needs. The collaborative impact of these companies underscores the Asia-Pacific region’s importance in the global API industry.

Market Key Players

- Sun Pharmaceuticals

- Dr. Reddy’s Laboratories

- Aurobindo Pharma

- Syn-Tech Chem & Pharm Co. Ltd.

- Everlight Chemical Industrial Corporation

- Yung Shin Pharma Ind.Co. Ltd

- Meiji

- API Corporation

- SK Bioland

- Anzchem

- Auspep

Recent Developments

- In December 2023, Sun Pharmaceuticals made a significant move by acquiring a controlling stake in Brazil’s Pharmatec for $420 million. This acquisition demonstrates Sun Pharma’s expanding influence in the Latin American pharmaceutical market, showcasing their commitment to global growth, particularly in the API sector.

- In August 2023, Dr. Reddy’s Laboratories made headlines with the inauguration of their new API manufacturing facility in Visakhapatnam, India. This strategic expansion is aimed at bolstering their production capabilities for complex generic APIs, aligning with the rising demand in the region.

- In October 2023, SK Bioland entered into a noteworthy partnership with Merck, focusing on the co-development and manufacturing of innovative antibody-drug conjugates (ADCs) for treating various cancers. Leveraging SK Bioland’s API expertise, this collaboration aims to introduce novel cancer therapies to the Asia-Pacific market, showcasing their dedication to advancing healthcare solutions in the region.

Report Scope

Report Features Description Market Value (2023) USD 82.6 Bn Forecast Revenue (2033) USD 190.3 Bn CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Generic, Innovative), By Manufacturers (Captive, Merchant), By Synthesis (Biotech, Synthetic), By Usage (Clinical, Research), By Application (Cardiology, Oncology, Neurology, Orthopedics, Endocrinology, Pulmonology, Nephrology, Ophthalmology, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sun Pharmaceuticals, Dr. Reddy’s Laboratories, Aurobindo Pharma, Syn-Tech Chem & Pharm Co. Ltd., Everlight Chemical Industrial Corporation, Yung Shin Pharma Ind.Co. Ltd, Meiji, API Corporation, SK Bioland, Anzchem, Auspep Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Asia-Pacific Active Pharmaceutical Ingredient market in 2023?The Asia-Pacific Active Pharmaceutical Ingredient market size is USD 82.6 billion in 2023.

What is the projected CAGR at which the Asia-Pacific Active Pharmaceutical Ingredient market is expected to grow at?The Asia-Pacific Active Pharmaceutical Ingredient market is expected to grow at a CAGR of 8.7% (2024-2033).

List the segments encompassed in this report on the Asia-Pacific Active Pharmaceutical Ingredient market?Market.US has segmented the Asia-Pacific Active Pharmaceutical Ingredient market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Generic, Innovative), By Manufacturers (Captive, Merchant), By Synthesis (Biotech, Synthetic), By Usage (Clinical, Research), By Application (Cardiology, Oncology, Neurology, Orthopedics, Endocrinology, Pulmonology, Nephrology, Ophthalmology, Others).

List the key industry players of the Asia-Pacific Active Pharmaceutical Ingredient market?Sun Pharmaceuticals, Dr. Reddy’s Laboratories, Aurobindo Pharma, Syn-Tech Chem & Pharm Co. Ltd., Everlight Chemical Industrial Corporation, Yung Shin Pharma Ind.Co. Ltd, Meiji, API Corporation, SK Bioland, Anzchem, Auspep

Which region is more appealing for vendors employed in the Asia-Pacific Active Pharmaceutical Ingredient market?China is expected to account for the highest revenue share of 41.2% and boasting an impressive market value of USD 34 billion. Therefore, the Asia-Pacific Active Pharmaceutical Ingredient industry in North America is expected to garner significant business opportunities over the forecast period.

Asia-Pacific Active Pharmaceutical Ingredient MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Asia-Pacific Active Pharmaceutical Ingredient MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sun Pharmaceuticals

- Dr. Reddy’s Laboratories

- Aurobindo Pharma

- Syn-Tech Chem & Pharm Co. Ltd.

- Everlight Chemical Industrial Corporation

- Yung Shin Pharma Ind.Co. Ltd

- Meiji

- API Corporation

- SK Bioland

- Anzchem

- Auspep