Global Architectural Lighting Market By Light Type(Light-emitting diode (LED), High-Intensity Discharge (HID), Other Light Type), By Mounting Type(Surface-Mounted, Pendant, Wall-Mounted, Others), By Application(Indoor, Outdoor), By End-User(Residential, Commercial), By Region and Companies- Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 65190

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

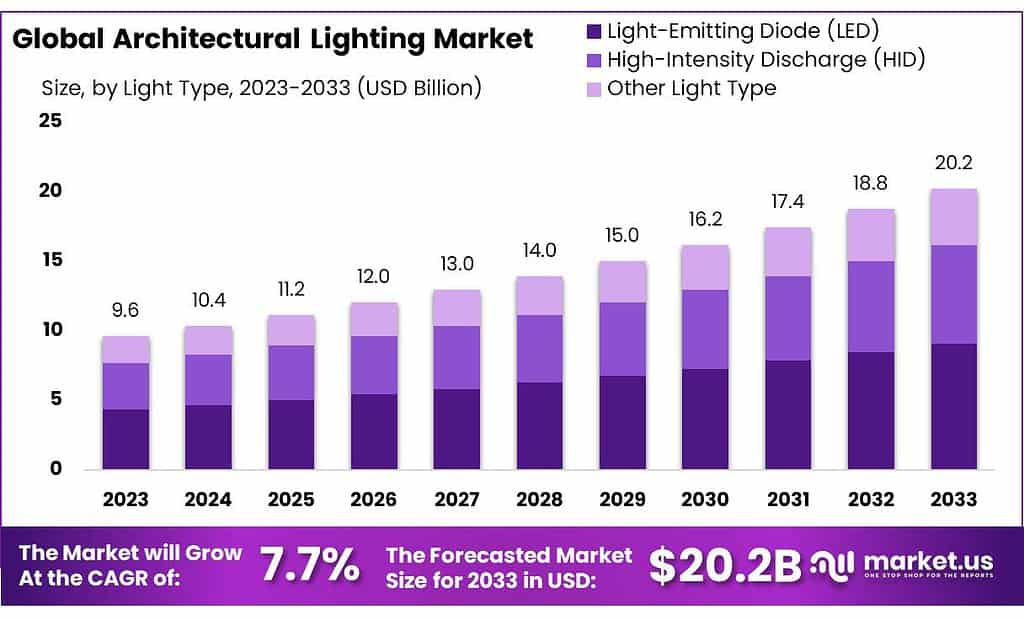

The Architectural Lighting Market size is expected to be worth around USD 20.2 billion by 2033, from USD 9.6 Bn in 2023, growing at a CAGR of 7.7% during the forecast period from 2023 to 2033.

This market will be driven by the growing demand for well-lit spaces with attractive lighting to enhance interior artifacts and corners. Architectural lighting has been favored by consumers for its cost savings, reliability, durability, adjustable illumination power, and longer life expectancy. Architectural lighting is increasingly being adopted in both residential and commercial sectors due to the need to illuminate walkways, corridors, staircases, gardens, parking lots, walkways, and other areas.

The architectural lighting market refers to the industry focused on the design, manufacture, and implementation of lighting systems that enhance the aesthetic appeal and functionality of architectural spaces. This market encompasses a wide range of products and services, including indoor and outdoor lighting fixtures, control systems, and design services, tailored to illuminate buildings and landscapes in a way that complements their design and purpose.

Architectural lighting plays a crucial role in shaping the ambiance and mood of a space, whether it’s highlighting key features of a building, providing functional illumination for workspaces, or creating an inviting atmosphere in public areas. It combines both the art and science of lighting design, taking into account aspects such as color temperature, intensity, and the interplay of light and shadow, to enhance the user experience and functionality of a space.

Key Takeaways

- Market Growth: The architectural lighting market is projected to grow from USD 9.6 billion in 2023 to USD 20.2 billion by 2033, with a CAGR of 7.7%.

- Demand Drivers: The market is fueled by the demand for well-lit spaces that enhance interiors and exteriors, with a focus on energy savings, reliability, and durability.

- Segment Popularity: LED lighting dominated the market in 2023, holding 43% of the share, due to its energy efficiency and versatility.

- Mounting Types: Wall-mounted lighting led the market with a 34.6% share in 2024, preferred for its space-saving and versatile design.

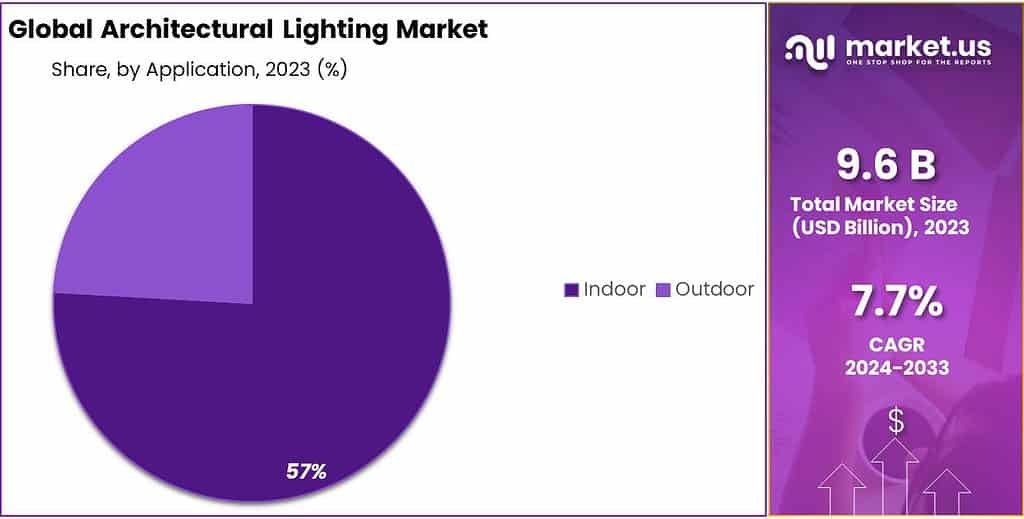

- Indoor vs Outdoor: Indoor lighting commanded a significant share of over 74% in 2023, indicating a stronger preference and demand for indoor lighting solutions.

- End-User Dominance: The Commercial sector dominated the market in 2024, with over 56.3% share, driven by the need for functional and aesthetic lighting in commercial spaces.

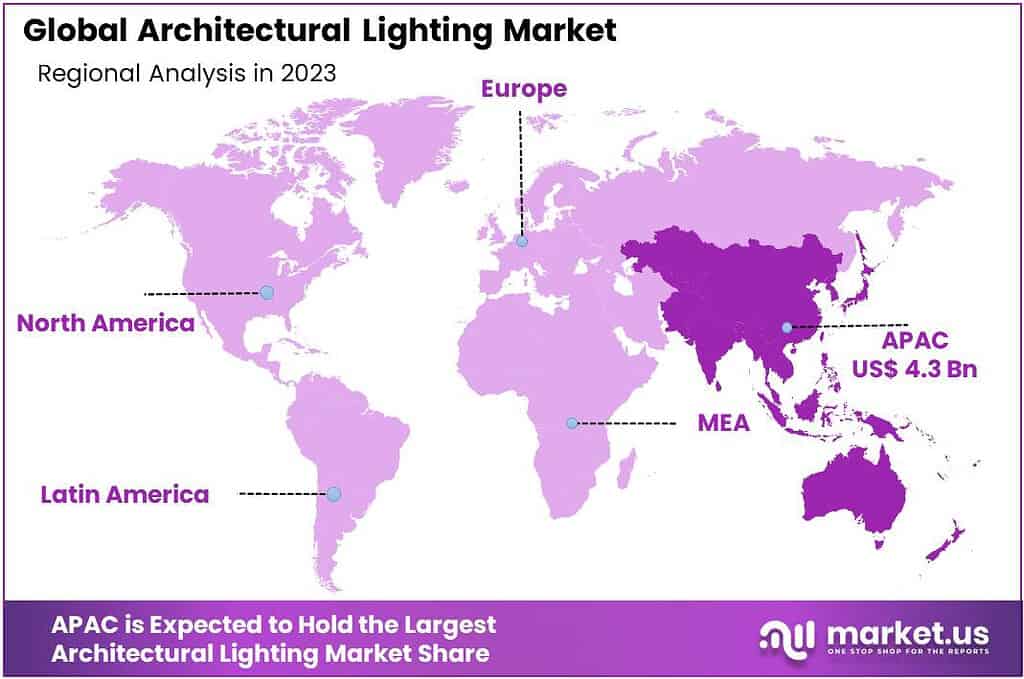

- Regional Market Leaders: The Asia Pacific region led the market with a 45% share in 2023, driven by development in residential and commercial sectors, particularly in countries like India.

Light Type Analysis

Light-emitting devices (LED) were the dominant player in architectural lighting in 2023, accounting for 43% of the market share. LEDs became the favored choice thanks to their energy efficiency, long lifespan, versatility of design applications and ability to provide bright illumination while using less energy; making them popular with both architects and lighting designers.

High-Intensity Discharge (HID) lighting held an increasingly prominent place in architectural lighting markets, second only to LEDs. While not as popular, HID lights still occupied a significant share due to their robust nature and suitability for specific architectural lighting applications like outdoor or industrial settings that required more intense illumination.

Other lighting alternatives were present on the market beyond LEDs and HIDs; however, these alternatives didn’t enjoy as great an influence as LEDs or HIDs due to factors like specific use cases or limited efficiency and design versatility. Architectural lighting applications for these other options had niche uses but did not experience widespread adoption as LEDs did.

By Mounting Type

In 2024, Wall-Mounted lighting in the architectural lighting market held a dominant position, capturing more than a 34.6% share. This segment’s strength lies in its versatility and ability to enhance both the functionality and aesthetics of a space. Wall-mounted lights are widely used in both residential and commercial settings, providing ambient, task, or accent lighting. Their popularity is also due to their space-saving design, making them ideal for areas where floor or ceiling space is limited.

Surface-Mounted lighting, another key segment, is preferred for its ease of installation and adaptability to various architectural styles. This type of lighting is commonly used in commercial and industrial settings for general lighting purposes. Its practicality and wide range of designs cater to a broad spectrum of architectural requirements, from modern to traditional.

Pendant lighting, characterized by lights that hang from the ceiling, is especially popular in residential and hospitality settings. This segment offers both functional illumination and serves as a focal point in interior design. The demand for pendant lights is driven by their ability to add a decorative element to a room, along with providing concentrated lighting over specific areas like dining tables or kitchen islands.

Application Analysis

In 2023, the architectural lighting market saw the indoor segment reign supreme, commanding more than 74% of the market share. Indoor lighting emerged as the powerhouse within architectural lighting, extensively used across residential, commercial, and institutional spaces. The widespread adoption of indoor lighting in homes, offices, retail spaces, and various indoor environments contributed significantly to its dominant market position.

Outdoor architectural lighting market shares were smaller than indoor segments. Outdoor lighting applications, which typically illuminate streets, landscapes, building exteriors, and public areas with illumination utilized less widely despite their role in improving safety, security and aesthetics in outdoor spaces. Indoor lights held more market shares.

The distinct market shares between indoor and outdoor segments illustrate a distinct preference and demand for indoor lighting solutions, due to their diverse applications and essentiality in various settings. Indoor lighting products in general were significantly dominant within the architectural lighting market landscape by 2023.

By End-User

In 2024, the Commercial segment held a dominant position in the architectural lighting market, capturing more than a 56.3% share. This dominance is largely attributed to the extensive use of architectural lighting in offices, retail spaces, hotels, and other commercial establishments.

In these settings, lighting plays a crucial role in creating an inviting and functional environment, which is essential for attracting and retaining customers and enhancing employee productivity. The commercial sector often seeks innovative lighting solutions that combine aesthetics with energy efficiency, driving the demand for advanced lighting systems.

On the other hand, the Residential segment, while smaller in comparison, plays a significant role in the architectural lighting market. Homeowners are increasingly focusing on enhancing their living spaces with lighting that is both functional and decorative.

The demand in this sector is driven by the growing trend of home renovation and interior design, where lighting is a key element in creating a desired ambiance and comfort. The residential market is witnessing a rise in the use of smart lighting solutions, which offer convenience and energy savings, further boosting its growth.

Key Market Segments

By Light Type

- Light-emitting diode (LED)

- High-Intensity Discharge (HID)

- Other Light Type

By Mounting Type

- Surface-Mounted

- Pendant

- Wall-Mounted

- Others

By Application

- Indoor

- Outdoor

By End-User

- Residential

- Commercial

Drivers

The architectural lighting market is propelled by various driving forces. Technological advancements play a prominent role in its growth; particularly advancements in lighting technologies like LED. LED innovations have revolutionized this sector with energy-efficient, versatile, and cost-effective lighting solutions; thus altering the market landscape by offering better-performing options and expanding design possibilities.

Global attention on energy efficiency and sustainability drives market expansion, driving demand for eco-friendly lighting solutions that not only consume less power but also have less of an environmental impact. LED lights play an essential part in meeting this sustainability demand by contributing to lower overall energy usage.

Smart lighting solutions represent another significant trend. By integrating with sensors and wireless controls, these intelligent solutions allow dynamic adjustments in lighting that enhance both user experience and energy efficiency. Furthermore, smart buildings and cities contribute further to this adoption trend of intelligent lighting solutions.

Urbanization and infrastructure development worldwide are also driving architectural lighting solutions globally. Construction activities increase, particularly in commercial and residential sectors, creating demand for visually pleasing designs which then further stimulates this sector of lighting solutions. This has had a direct effect on architectural lighting solutions market growth.

Lighting’s increasing emphasis on aesthetics and design plays a pivotal role in driving market expansion. No longer seen simply as functional elements, lighting now enhances spaces by becoming part of their design aesthetics. Customizable designs meet architects, designers, and consumers’ evolving preferences – further fuelling market expansion. These drivers contribute to the expansion and transformation of the architectural lighting market, leading to more cost-efficient, sustainable, and visually captivating solutions in lighting design.

Restraints

Several factors pose restraints on the architectural lighting market. Cost constraints stand out prominently, especially concerning the implementation of sophisticated lighting solutions. Initial investments required for modern systems, particularly smart or LED-based lighting, might be high, limiting widespread adoption due to affordability issues for some consumers or projects.

Stringent regulations and standards in the lighting industry present another challenge. Adhering to evolving regulations related to energy efficiency and environmental impact can be demanding and expensive for lighting manufacturers and businesses. This compliance complexity affects product development and market entry.

Despite the energy-saving benefits of advanced lighting technologies, some solutions may have a longer payback period. This extended time to recover the initial investment in energy-efficient systems could deter immediate adoption, particularly for smaller businesses or projects with financial constraints.

The complexity of new lighting technologies, especially in smart lighting systems, presents integration and compatibility challenges with existing infrastructures and control systems. These technical intricacies might hinder seamless adoption and implementation of advanced lighting solutions.

Consumer perceptions and awareness regarding modern lighting technologies may serve as another barrier. Limited knowledge or understanding about their long-term benefits such as energy savings or reduced maintenance costs may sway their decision not to invest in more innovative lighting systems.

Addressing these limitations requires taking an integrated approach that considers cost barriers, regulatory compliance requirements and consumer awareness as major obstacles to wider acceptance and adoption of advanced lighting solutions in architectural lighting markets.

Opportunities

Architectural lighting market holds tremendous promise for growth and innovation. Smart lighting solutions equipped with sensors and advanced controls offer personalized yet energy-efficient illumination experiences, offering personalized and energy-efficient experiences in homes and buildings alike. Their increased adoption represents significant opportunities for market expansion.

Focusing on energy efficiency opens a significant market niche. Eco-friendly lighting solutions that reduce energy usage are becoming increasingly in demand, such as LED technology. LEDs stand to gain tremendously from this increasing need for sustainable options in lighting design.

Infrastructure development projects, especially in urban areas, present architectural lighting firms with numerous opportunities. Large-scale construction ventures such as smart cities and commercial complexes require modern lighting solutions for efficient operation – creating demand for unique architectural lighting designs.

The evolution of lighting from mere functionality to an integral part of architectural design presents another opportunity. Creative and customizable lighting solutions cater to the evolving preferences of architects and designers, offering unique and visually captivating lighting designs that integrate seamlessly with architectural aesthetics.

The advancement of connected lighting ecosystems, integrated with IoT platforms and data-driven analytics, presents growth potential. These sophisticated lighting management systems allow for predictive maintenance and enhanced user experiences, offering expanded market offerings and driving further industry innovation.

Embracing these opportunities through smart technologies, energy-efficient solutions, innovative designs, and connected ecosystems will be pivotal for industry players to capitalize on and drive growth in the architectural lighting market.

Challenges

The architectural lighting market encounters several challenges that impact its growth and widespread adoption. Cost and affordability stand out as significant hurdles, especially concerning the implementation of advanced lighting technologies like smart or LED-based solutions. The initial investment required for these modern systems might be prohibitive for certain consumers or projects, limiting widespread adoption due to cost constraints.

Navigating stringent regulatory compliance is another notable challenge. Adhering to evolving regulations, particularly those related to energy efficiency and environmental impact, demands substantial resources and might impact the development and market entry of lighting manufacturers and businesses.

Moreover, some advanced lighting solutions, despite their energy-saving benefits, could have a longer payback period. This prolonged duration to recover the initial investment in energy-efficient systems might discourage immediate adoption, particularly for smaller businesses or projects with limited budgets.

Integrating new lighting technologies, particularly smart lighting systems, presents significant integration difficulties. Issues regarding compatibility with existing infrastructures and control systems could impede their swift adoption and implementation into everyday lighting applications.

Additionally, limited consumer understanding or knowledge about the long-term advantages associated with newer lighting technologies – such as energy savings or lower maintenance costs – may prevent their adoption. It is therefore vitally important that both consumers and professionals alike are educated about modern lighting technologies’ many advantages; though this is a complex endeavor that may prove challenging.

Responding to these obstacles requires innovative solutions, cost-efficient technologies, simplified compliance measures, and greater awareness initiatives. Overcoming such hurdles is vital to expanding the adoption of advanced lighting solutions and maintaining growth within the architectural lighting market.

Regional Analysis

The Asia Pacific dominated the architectural lighting market with a share of 45% in 2023. This region is expected to have the largest market share over the forecast period. There are more than 40 countries in the region, most of which have been identified by the United Nations as either developing or under-developed.

Innovative lighting solutions are required for infrastructure development in high-end residential and commercial buildings in Asia’s developing countries. This is driving the demand for attractive interiors & exterior lighting. India’s growing lifestyle, disposable income growth, and the availability of affordable architectural lights are all driving this market.

The market in Europe is estimated to grow at a substantial CAGR during the forecast period. This is due to the increasing adoption of energy-efficient lighting systems and advanced control systems throughout Europe. Market growth is estimated to be driven by the ever-increasing need for modern architectural lighting systems with temperature control features. This can be used in areas like homes and restaurants, theatres, museums, and hotels.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Acuity Brands Lighting Inc., Hubbell, GE Current, Siteco GmbH, Ideal Industries Inc., Technical Consumer Products Inc., Delta Light, Signify Holdings, and Zumtobel Group AG, are some of the prominent competitors in this market. These companies offer unique and affordable lighting fixtures for both indoor & outdoor applications, catering to the growing demand for architectural lighting in the residential and commercial sectors.

To strengthen their market position, vendors have chosen to use a combination of organic and inorganic growth strategies. K-LITE Industries, for instance, launched new LED architectural lighting in February 2020.

Market Key Players

- Acuity Brands Lighting Inc.

- Cree Lighting

- Delta Light

- GE Current

- GVA Lighting

- Hubbell

- OSRAM GmbH

- Panasonic Corporation

- Signify Holding

- Siteco GmbH

- Technical Consumer Products, Inc.

- Zumtobel Group AG

- Feilo Sylvania

- TCP International Holdings Ltd.

- Seoul Semiconductor Co., Ltd.

Recent Development

Jun-2022: IDEAL INDUSTRIES came into a partnership with RIVET Work, the foremost provider of workforce management software. Together, the companies aimed to supply electrical contractors transformative clarity, permit labor and supplies planning tools, and real-time leverage of business assets that helps enhance profit margins.

Jun-2022: Signify formed a partnership with EDZCOM, a group of Cellnex, and a European market head in Edge Connectivity solutions. Together, the companies aimed to create a creative and long-term personal network project with the image to make the city a better site for its residents to live and work.

Report Scope

Report Features Description Market Value (2023) USD 9.6 Bn Forecast Revenue (2033) USD 20.2 Bn CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Light Type(Light-emitting diode (LED), High-Intensity Discharge (HID), Other Light Type), By Mounting Type(Surface-Mounted, Pendant, Wall-Mounted, Others), By Application(Indoor, Outdoor), By End-User(Residential, Commercial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Acuity Brands, Inc., Cree Lighting, Delta Light, GE Current, GVA Lighting, Hubbell, OSRAM GmbH, Panasonic Corporation, Signify Holding, Siteco GmbH, Technical Consumer Products, Inc., Zumtobel Group AG, Feilo Sylvania, TCP International Holdings Ltd., Seoul Semiconductor Co., Ltd., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Architectural Lighting Market is expected to grow at?Architectural Lighting Market is growing at CAGR of 7.7% during forecast periode 2024-2033List the key industry players of the Architectural Lighting Market?Acuity Brands Lighting Inc., Cree Lighting, Delta Light, GE Current, GVA Lighting, Hubbell, OSRAM GmbH, Panasonic Corporation, Signify Holding, Siteco GmbH, Technical Consumer Products, Inc., Zumtobel Group AG, Feilo Sylvania, TCP International Holdings Ltd., Seoul Semiconductor Co., Ltd,

Architectural Lighting MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Architectural Lighting MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Acuity Brands Lighting Inc.

- Cree Lighting

- Delta Light

- GE Current

- GVA Lighting

- Hubbell

- OSRAM GmbH

- Panasonic Corporation

- Signify Holding

- Siteco GmbH

- Technical Consumer Products, Inc.

- Zumtobel Group AG

- Feilo Sylvania

- TCP International Holdings Ltd.

- Seoul Semiconductor Co., Ltd