Global Architectural Coatings Market By Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Urethane, Others (PTFE & PVDF)), By Coating Type(Interior, Exterior), By Function(Ceramics, Inks, Lacquers, Paints, Powder Coatings, Primers, Sealers, Stains, Varnishes), By Technology(Solvent Borne, Water Borne, Other), By End-Use(Residential, Commercial, Industrial), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast to 2023-2033

- Published date: Nov 2023

- Report ID: 23444

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

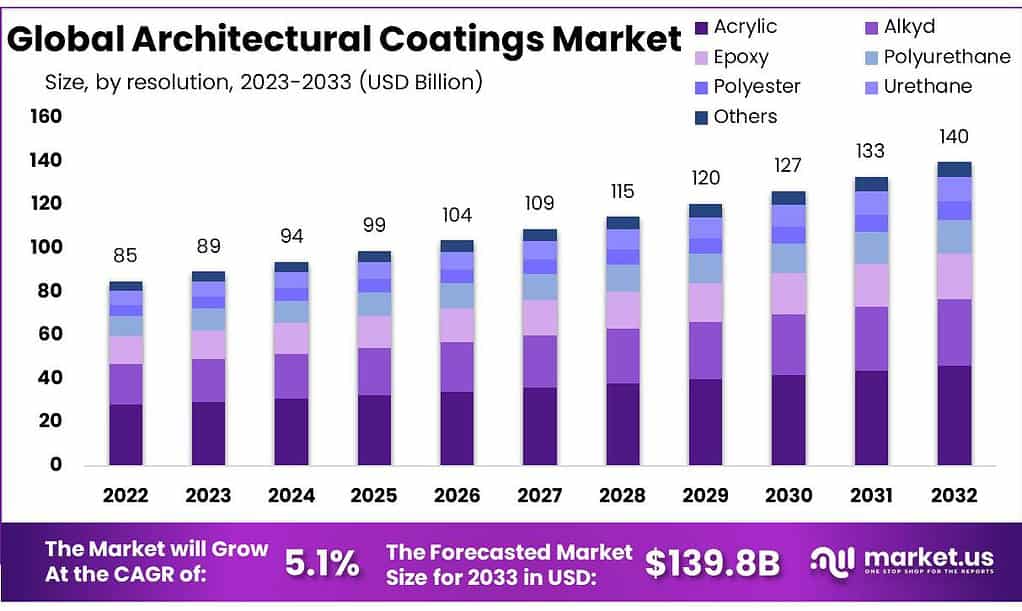

The global Architectural Coatings market size is expected to be worth around USD 139.8 billion by 2033, from USD 85 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The architectural coatings market involves the production and sale of coatings used for both decorative and protective purposes in buildings and structures. These coatings are applied to surfaces such as walls, roofs, floors, and ceilings, primarily to enhance aesthetics, durability, and weather resistance. The market encompasses various types of coatings, including paints, primers, varnishes, stains, and sealers.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The global market for architectural coatings is anticipated to surge to approximately USD 139.8 billion by 2033, showcasing a notable growth rate with a CAGR of 5.1% from 2023.

- Resin Dominance: Acrylic coatings currently lead the market, capturing over 33% due to their durability and versatility. Alkyd coatings follow closely due to their exceptional adhesion and resistance in harsh environments.

- Coating Types: Interior coatings are tailored for indoor spaces, focusing on aesthetics, durability, and eco-friendliness, whereas exterior coatings prioritize weather resistance and durability against elements like rain, sun, and dirt.

- Functionalities: Various functionalities, from ceramics offering robust protection against heat and rust to varnishes adding gloss and protection, cater to specific needs like protection, aesthetics, and durability.

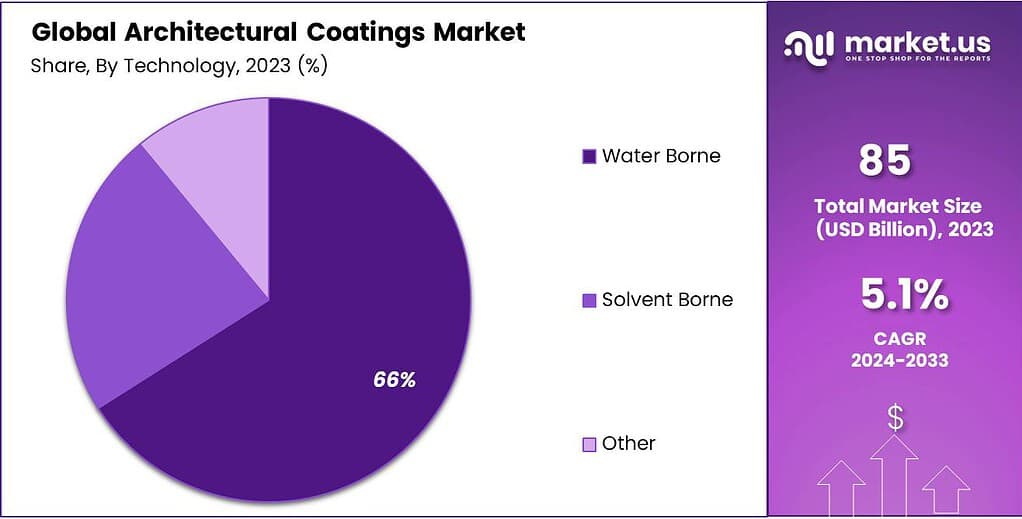

- Technology Trends: Water-borne coatings hold a significant market share (over 66%) due to their safety, quick drying, and eco-friendly nature. Solvent-borne coatings, though less in demand, are known for their durability.

- End-Use Segmentation: Residential, commercial, and industrial sectors exhibit distinct demands. Residential spaces seek paints that last longer and require minimal upkeep, while industrial coatings are crucial for protecting equipment against harsh conditions.

- Drivers & Restraints: Regulatory shifts towards eco-friendly products drive innovation but also pose challenges in adapting to new standards. Emerging markets like Asia Pacific offer growth opportunities due to fewer regulations.

- Challenges: Fluctuations in the price of key ingredients like Titanium Dioxide impact market stability and affect customer profitability, especially in planning spending for architectural coatings.

- Regional Dynamics: Asia Pacific dominates the market, driven by factors like solar energy initiatives and the region’s economic growth. The U.S. exhibits substantial demand owing to its market size, production capabilities, and affluent consumer base.

- Key Market Players: PPG Industries, Asian Paints, Nippon Paints, and Sherwin-Williams are among the prominent companies shaping the market. Recent developments like AkzoNobel’s R&D Center and Hempel’s acquisitions signal industry innovation and expansion efforts.

By Resin Type

In 2023, acrylic coatings were at the forefront, commanding a significant market share of over 33%. Acrylic paints led the market, owning over a third of the industry due to their durability and versatility in various applications. Alkyd coatings maintained a solid position owing to their excellent adhesion and resistance, especially in harsh environments.

Epoxy coatings showed steady growth, prized for their high-performance features like chemical resistance and durability. Polyurethane coatings gained ground, valued for their superior protection against weathering and abrasion.

Polyester coatings carved a niche due to their affordability and good weathering properties in certain applications. Urethane coatings witnessed gradual uptake due to their excellent flexibility and impact resistance. (PTFE & PVDF) Specialized coatings like PTFE and PVDF offered unique properties such as non-stick surfaces and exceptional chemical resistance, finding specific uses in specialized applications.

By Coating Type

Interior Coatings Think about the paints and coatings used indoors, on walls, ceilings, and floors. These are specially made for inside spaces and aim for things like making your walls look good, protecting them from stains, and staying durable.

People often look for paints that are easy to apply, don’t smell too strong, and last a long time. There’s a push for eco-friendly options too, like paints with fewer chemicals, as folks care more about their indoor air quality and the environment.

Exterior Coatings Now, imagine the coatings that go on the outside of buildings—like on walls or roofs—to shield them from weather and other outside stuff. These coatings have to look good, sure, but they also need to fight against things like rain, sun, and dirt.

The main deal here is durability against weather and UV rays. Innovations focus on making paints that stay vibrant for longer, resist cracking, and even clean themselves sometimes! Cool roof coatings are one cool example—they reflect sunlight, helping buildings stay cooler inside and save on energy.

By Function

Ceramic coatings are like strong armor, protecting against heat, rust, and wearing out. They’re often used on tiles, pottery, and building stuff to make them tougher and last longer. Inks are coatings used for printing and coloring various surfaces.

In the architectural world, they’re often employed for decorative purposes or for adding designs and patterns on walls, furniture, or other indoor structures.

Lacquers are glossy coatings that bring out a shiny finish on surfaces. They’re great for adding that polished look to wood or metal surfaces, protecting them from scratches and giving them a nice shine. Paints are the most common coatings we use to add color and protection to surfaces.

Whether it’s on walls, ceilings, or exterior structures, paints come in various types and finishes to meet different needs, from making things look pretty to shielding them from weather damage.

Powder coatings are like magic dust that’s sprayed onto surfaces and then heated to form a protective layer. They’re super durable, resistant to scratches, and are often used on metal surfaces like fences, railings, or even appliances. Primers are like the base layer before painting. They help paint stick better, cover stains or imperfections, and make sure the final paint job looks smooth and lasts longer.

Sealers are used to lock in or protect surfaces from moisture, stains, or damage. They’re often applied on concrete, wood, or masonry to keep them in good shape for a longer time. Stains can enhance the natural look of wood surfaces while providing protection.

They add color while still allowing its grain pattern to shine through. Varnishes are protective coatings applied over wood or other materials to shield them from scratches, moisture and UV rays and maintain their look for longer. With its glossy finish and protecting properties, varnishes add a glossy layer that keeps surfaces looking new for longer.

By Technology

In 2023, Water Borne paints were leading the pack, grabbing over 66% of the market. These paints are made using water as a base instead of strong chemicals. They’re popular because they’re safer to use and have fewer fumes. Plus, they dry quicker and are better for the environment.

Solvent-borne coatings held a smaller share. These coatings use strong chemicals as their base. They take longer to dry and can have a stronger smell, but they’re known for their durability in harsh conditions.

The ‘Other’ category includes some newer, innovative technologies that are gaining attention. These might have unique properties like being eco-friendly or offering specialized features for specific needs

By End Use

paints and coatings used in homes. From the colorful walls inside to the protective coatings on the outside, these are all part of the residential segment. People want paints that look good, last long, and don’t need a ton of effort to keep them looking nice.

Industrial spaces, like factories and warehouses, use coatings to protect machines, equipment, and buildings. These coatings have a heavy-duty job—they fight against things like rust, chemicals, extreme temperatures, and rough handling. They’re crucial for keeping everything running smoothly and lasting a long time.

Each of these areas has its own unique needs, and companies are always working on new coatings to meet those demands—whether it’s about making homes look great, keeping commercial spaces clean, or ensuring that industrial equipment stays in top shape.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Resin Type

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

- Urethane

- Others (PTFE & PVDF)

By Coating Type

- Interior

- Exterior

By Function

- Ceramics

- Inks

- Lacquers

- Paints

- Powder Coatings

- Primers

- Sealers

- Stains

- Varnishes

By Technology

- Solvent Borne

- Water Borne

- Other

By End-Use

- Residential

- Commercial

- Industrial

Drivers

Change in Coatings: Over the past decade, the coatings industry has seen a big shift towards eco-friendly products. This change was largely influenced by stringent EU regulations aimed at reducing harmful emissions in coatings. As a result, there’s been a move away from solvent-based coatings to safer options like water-based and powder coatings.

Regulatory Drivers: Government regulations played a major role. The European Commission introduced initiatives like the Eco-product Certification Scheme, promoting greener coatings by setting limits on harmful emissions. Similarly, in India, regulations were put in place to control lead content in household paints, urging companies to use more natural materials in coatings.

Future Outlook: Expect more changes driven by regulations. Laws against air pollution, particularly in the US and Western Europe, will likely push companies to innovate and develop even cleaner coating technologies. In essence, the coatings industry is adapting to stricter rules worldwide, steering towards more environmentally friendly options.

Restraints

Regulations Impacting Coatings: The paints and coatings industry faces a big challenge due to regulations. Changes in rules can create uncertainty across the whole production chain. When manufacturers need time to adjust to new rules and technology, it causes uncertainty. These regulatory changes affect everyone involved, from raw material producers to end users. For instance, stricter rules in different regions put pressure on architectural coatings makers to upgrade their methods to cut down on harmful emissions.

Adapting to Regulations: In the UK and the US, regulations like the Varnishes and Vehicle Refinishing Products Regulations 2005 and the EPA’s Clean Air Act revisions demand lower VOC emissions. Products that don’t meet these standards can’t be sold in Western Europe.

In short, the coatings industry faces challenges with regulations. Adjusting to new rules takes time, impacting everyone in the production chain. Governments’ stricter standards push coatings makers to upgrade their processes to reduce harmful emissions.

Opportunity

Opportunity in Emerging Markets: While big architectural coating companies in North America and Europe deal with strict government rules, emerging regions like Asia Pacific have fewer or sometimes no rules for this sector. That’s why the market for these coatings is booming in places like Asia Pacific and other growing economies.

Growth in Emerging Economies: Over the past 15 years, these emerging economies have been a driving force in global economic growth, accounting for a big chunk of the world’s economic progress and spending. But, there’s a difference in how successful these countries are economically. The ones that have seen rapid growth, especially through industrialization, have significantly boosted productivity by around 4.1% each year, creating more wealth, jobs, and demand.

In short, the lack of strict rules in emerging markets like Asia Pacific is creating a big opportunity for architectural coating companies. These growing economies are playing a massive role in global economic growth, especially those focused on industrialization, boosting productivity, and creating more jobs.

Challenges

Challenge with Titanium Dioxide (TiO2) TiO2 is a crucial ingredient in making architectural coatings, making up a big chunk, around 20-30%, of the total raw material cost. The catch is, that there’s no alternative available for this ingredient, and it’s traded globally.

But, the price of TiO2 has been going up and down a lot in the last decade, causing trouble for customers who find it hard to plan their spending. This rollercoaster of prices affects their profits.

Price Fluctuations In the US market, the TiO2 price has been pretty unpredictable. It dropped in October 2022 due to lower demand, went up a bit in November, then fell again towards the end of the year.

This price dance happened because the construction sector wasn’t doing much, leading to no significant change in TiO2 demand. On top of that, high-interest rates and inflation made manufacturing slow down. Low market activity and fewer shipments also played a role. By the end of the fourth quarter, TiO2 prices were around USD 3118 per ton.

In essence, the unpredictable prices of TiO2, a crucial ingredient in architectural coatings, make it hard for customers to plan their spending, affecting their profits. The market has been fluctuating due to low demand in the construction sector and economic pressures like high-interest rates and inflation.

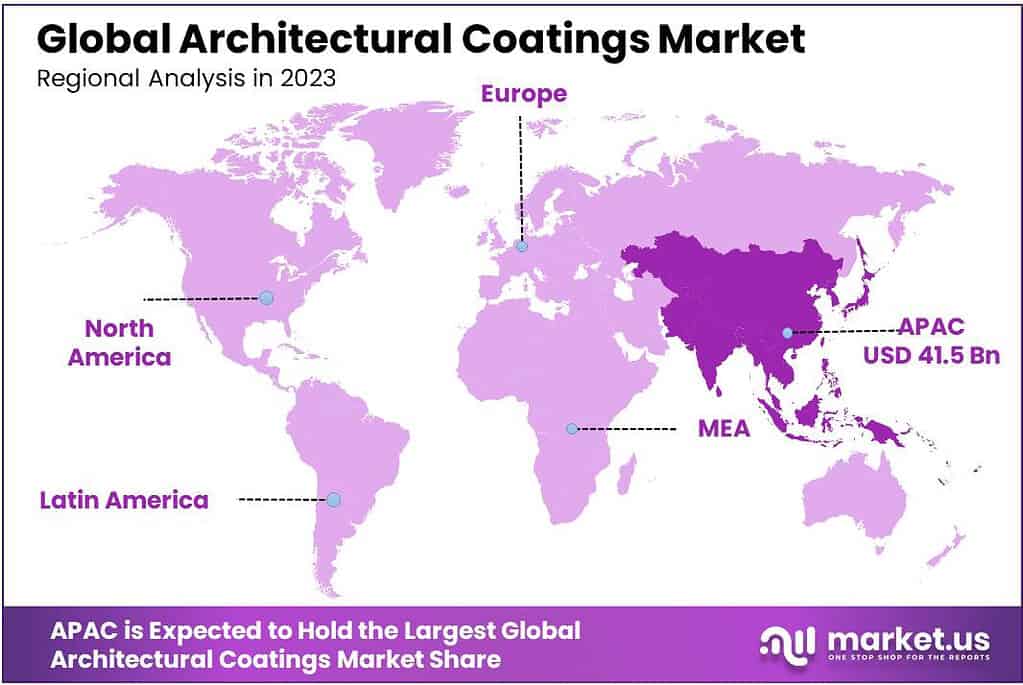

Regional Analysis

In 2023, the Asia Pacific region emerged as the dominant force in the global architectural coatings market, representing 48.9% of the total market revenues. Notably, China and India stood out as the largest markets for architectural coatings.

These nations have witnessed substantial investments directed towards establishing solar photovoltaics, aiming to generate significant amounts of solar energy. This strategic move holds the potential for displacing non-renewable energy sources.

Macro factors in the Asia Pacific region, including the burgeoning middle class, rising disposable incomes, increasing emphasis on education, and shifting demographics, have contributed to the expanding demand for architectural coatings.

Moreover, the region’s high requirement for these coatings in electronics further fuels market growth. The presence of key industry players in the Asia Pacific region acts as a catalyst for market expansion.

In the United States, ranked second in global automobile production, there’s a substantial demand for architectural coatings.

This demand surge is attributed to the country’s sizable market, robust mass-production capabilities, diverse product offerings, and affluent disposable incomes. The presence of global corporations and their manufacturing hubs has significantly bolstered the architectural coatings market in the U.S.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The architectural coatings market exhibits a competitive landscape characterized by numerous buyers and suppliers. The industry demands substantial initial investments in equipment like screeners, driers, and recycle-slurry mixers. These investments, coupled with narrow profit margins, are anticipated to mitigate industry rivalry over the forecast period.

In India, the landscape of ammonium nitrate distributors and manufacturers has experienced a decline in recent years. Stringent regulations and reduced profit margins have contributed to this downturn. Notably, Gujrat Hari Narmada Valley Fertilizers stands out as the primary manufacturer of this product within India. This dominance has resulted in a contracted market scenario, consolidating the market under their influence.

Мarkеt Кеу Рlауеrѕ

- PPG Industries

- Asian Paints

- Nippon Paints

- The Sherwin-Williams Company

- Axalta Coatings

- RPM International Inc.

- The Valspar Corporation

- Midwest Industrial Coatings Inc.

- Sumter Coatings

- BASF SE

Recent Development

AkzoNobel’s R&D Center: On March 11, 2022, AkzoNobel opened a global research and development center in the UK. This move aims to boost their innovation capabilities, especially in decorative paints.

Hempel’s Acquisition: On February 10, 2022, Hempel acquired KHIMJI PAINTS LLC, strengthening its presence in the Middle East. This acquisition helps Hempel expand its operations in that region.

Report Scope

Report Features Description Market Value (2023) USD 85 Billion Forecast Revenue (2033) USD 139.8 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Urethane, Others (PTFE & PVDF)), By Coating Type(Interior, Exterior), By Function(Ceramics, Inks, Lacquers, Paints, Powder Coatings, Primers, Sealers, Stains, Varnishes), By Technology(Solvent Borne, Water Borne, Other), By End-Use(Residential, Commercial, Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PPG Industries, Asian Paints, Nippon Paints, The Sherwin-Williams Company, Axalta Coatings, RPM International Inc., The Valspar Corporation, Midwest Industrial Coatings Inc., Sumter Coatings, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are architectural coatings?Architectural coatings are surface finishes applied to buildings and structures for decorative and protective purposes. These coatings include paints, primers, stains, varnishes, and sealers used on interior and exterior surfaces of residential, commercial, and industrial buildings.

What are the key types of architectural coatings?There are various types, such as acrylic, alkyd, epoxy, polyurethane, and others. Each type offers specific properties like durability, color retention, weather resistance, and application ease.

What innovations are shaping the market?Innovations include self-cleaning coatings, nanotechnology for enhanced durability and performance, smart coatings with functionalities like temperature regulation, and coatings designed for specific environmental conditions.

What are the key types of architectural coatings?There are various types, such as acrylic, alkyd, epoxy, polyurethane, and others. Each type offers specific properties like durability, color retention, weather resistance, and application ease.

Architectural Coatings MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Architectural Coatings MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- PPG Industries

- Asian Paints

- Nippon Paints

- The Sherwin-Williams Company

- Axalta Coatings

- RPM International Inc.

- The Valspar Corporation

- Midwest Industrial Coatings Inc.

- Sumter Coatings

- BASF SE