Global Aquaculture Prebiotics Market By Source (Plant-derived, Yeast And Fungal-derived, Algal And Marine-derived, Synthetic/Fermentation-derived), By Prebiotic Type ( Mannan-oligosaccharides (MOS), Fructo-oligosaccharides (FOS), Galacto-oligosaccharides (GOS), Inulin, Beta-glucans, Resistant Starch And Fibers, Novel Prebiotics), By Form (Powder / Dry Blends, Liquid Additives, Encapsulated / Coated Forms, Prebiotic-rich Functional Feed), By Functionality (Gut Health And Microbiome Balance, Growth Performance And Feed Conversion, Immunity Enhancement And Disease Resistance, Stress Tolerance), By Application (Shrimp, Freshwater Fish, Marine Fish, Mollusks, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172231

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

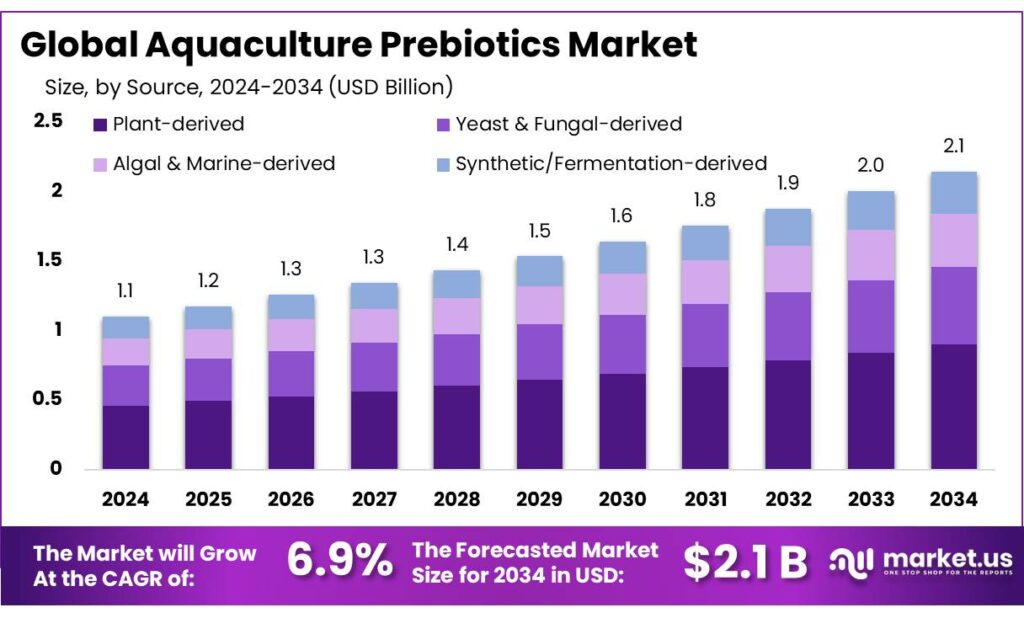

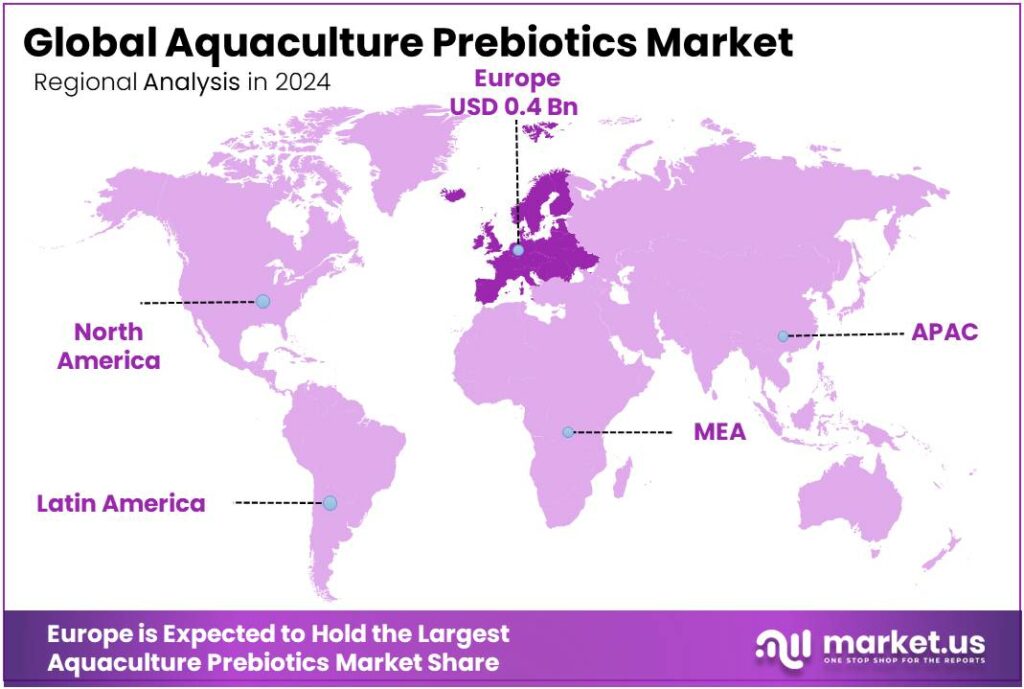

The Global Aquaculture Prebiotics Market size is expected to be worth around USD 2.1 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 43.9% share, holding USD 0.4 Billion in revenue.

Aquaculture prebiotics have emerged as a critical subset of functional feed additives designed to improve gut health, immunity, nutrient absorption, and overall performance of aquatic species such as fish, shrimp, and mollusks. Unlike conventional feed ingredients focused solely on basic nutrition, prebiotics represent non‑digestible compounds that selectively stimulate beneficial microbiota in the gastrointestinal tract, addressing both health and sustainability concerns in intensive aquaculture systems. Functional feed additives, including prebiotics, are increasingly recognized for their role in enhancing feed conversion ratios, reducing disease incidence, and minimizing reliance on antibiotics, thereby supporting sustainable aquaculture growth globally.

Several key driving factors underpin this growth. First, the rising global demand for seafood, coupled with aquaculture’s role in supplying a significant proportion of human dietary protein, fuels investment in technologies that improve animal health and feed efficiency. The FAO state of world fisheries reports aquaculture’s fast‑paced contribution to food security and nutrition, reinforcing the need for better health management tools like prebiotics.

In India, the Pradhan Mantri Matsya Sampada Yojana allocates significant funding to bolster aquaculture productivity and scientific farming practices that include enhanced feed technologies and disease management, indirectly benefiting prebiotic usage. In the United States, the National Aquaculture Development Plan, rooted in the National Aquaculture Act of 1980 and recently updated in 2024, creates a policy framework to support sustainable aquaculture, innovation, and enhanced feed efficiency through coordinated federal efforts.

In terms of government and institutional support, broader aquaculture development initiatives indirectly reinforce the prebiotics sector by expanding production capacity and emphasizing sustainability. For example, India’s Blue Revolution programme has mobilized over USD 5.31 billion in sector investment since 2015, focusing on infrastructure, biosecurity, and health management within aquaculture—a context that naturally increases uptake of functional feed additives including prebiotics. Globally, FAO and national plans promote sustainable aquaculture growth, food security, and innovation in nutrition and health practices, thereby creating a policy environment conducive to prebiotic adoption.

Key Takeaways

- Aquaculture Prebiotics Market size is expected to be worth around USD 2.1 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 6.9%.

- Plant-derived held a dominant market position, capturing more than a 42.7% share in the aquaculture prebiotics market.

- Mannan-oligosaccharides (MOS) held a dominant market position, capturing more than a 31.5% share in the aquaculture prebiotics market.

- Powder / Dry Blends held a dominant market position, capturing more than a 49.9% share in the aquaculture prebiotics market.

- Gut Health & Microbiome Balance held a dominant market position, capturing more than a 39.2% share in the aquaculture prebiotics market.

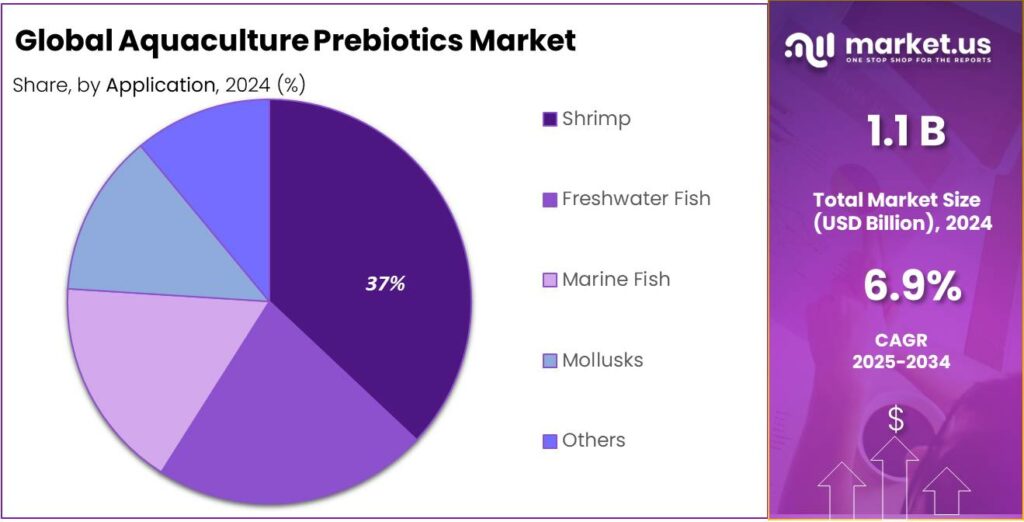

- Shrimp held a dominant market position, capturing more than a 37.8% share in the aquaculture prebiotics market.

- Europe emerged as the dominant region in the aquaculture prebiotics market, capturing more than 43.9% share and generating approximately USD 0.4 billion.

By Source Analysis

Plant-derived sources lead aquaculture prebiotics with a 42.7% share due to natural efficacy and sustainable sourcing

In 2024, Plant-derived held a dominant market position, capturing more than a 42.7% share in the aquaculture prebiotics market. This strong performance is mainly linked to the growing preference for natural feed additives that support gut health, immunity, and growth performance in farmed fish and shrimp. Plant-based prebiotics sourced from ingredients such as chicory, seaweed, cereals, and legumes are widely adopted because they are safe, easily digestible, and well accepted across different aquaculture species.

By Prebiotic Type Analysis

Mannan-oligosaccharides (MOS) dominate with a 31.5% share due to proven gut health benefits

In 2024, Mannan-oligosaccharides (MOS) held a dominant market position, capturing more than a 31.5% share in the aquaculture prebiotics market. This strong presence is mainly driven by the proven effectiveness of MOS in improving gut health, strengthening immune response, and reducing the risk of pathogenic infections in fish and shrimp. Derived mainly from yeast cell walls, MOS is widely used across commercial aquaculture systems due to its stable performance under varying water and feed conditions.

By Form Analysis

Powder / Dry Blends lead with a 49.9% share due to ease of handling and feed compatibility

In 2024, Powder / Dry Blends held a dominant market position, capturing more than a 49.9% share in the aquaculture prebiotics market. This strong share is mainly due to the convenience these forms offer in feed manufacturing and on-farm usage. Powdered prebiotics blend easily with standard aquafeed formulations, ensuring uniform distribution and consistent intake across fish and shrimp populations. Their dry nature also supports longer shelf life and easier storage, which is important for large-scale aquaculture operations.

By Functionality Analysis

Gut Health & Microbiome Balance leads with a 39.2% share driven by disease prevention focus

In 2024, Gut Health & Microbiome Balance held a dominant market position, capturing more than a 39.2% share in the aquaculture prebiotics market. This leadership is mainly linked to the growing emphasis on maintaining a healthy digestive system in farmed fish and shrimp, especially under intensive farming conditions. Prebiotics that support beneficial gut bacteria help improve nutrient absorption, strengthen natural immunity, and reduce the risk of disease outbreaks.

By Application Analysis

Shrimp farming leads with a 37.8% share due to high disease sensitivity and intensive production

In 2024, Shrimp held a dominant market position, capturing more than a 37.8% share in the aquaculture prebiotics market. This dominance is mainly driven by the high sensitivity of shrimp to gut-related diseases and environmental stress, which makes functional feed additives an essential part of shrimp nutrition. Prebiotics are widely used in shrimp feed to support digestive health, improve immunity, and enhance resistance to common bacterial infections, especially in intensive farming systems.

Key Market Segments

By Source

- Plant-derived

- Yeast & Fungal-derived

- Algal & Marine-derived

- Synthetic/Fermentation-derived

By Prebiotic Type

- Mannan-oligosaccharides (MOS)

- Fructo-oligosaccharides (FOS)

- Galacto-oligosaccharides (GOS)

- Inulin

- Beta-glucans

- Resistant Starch & Fibers

- Novel Prebiotics

By Form

- Powder / Dry Blends

- Liquid Additives

- Encapsulated / Coated Forms

- Prebiotic-rich Functional Feed

By Functionality

- Gut Health & Microbiome Balance

- Growth Performance & Feed Conversion

- Immunity Enhancement & Disease Resistance

- Stress Tolerance

By Application

- Shrimp

- Freshwater Fish

- Marine Fish

- Mollusks

- Others

Emerging Trends

Integration of Prebiotics with Precision and Sustainable Aquaculture Practices

In the past few years, the aquaculture industry has been shifting in a way that feels as much human as it is technical: farmers, scientists, and policy makers are all searching for ways to grow more seafood without harming people, animals, or the environment. One of the most important emerging trends in this space is how prebiotics are being woven into smarter, eco‑friendly aquaculture systems — not just as standalone additives, but as part of a broader movement towards precision, sustainability, and animal welfare.

The Food and Agriculture Organization of the United Nations (FAO) reports that global aquaculture production is continuing its long‑term rise, reaching around 197 million tonnes in 2025, with aquaculture growing by about 2.7 % compared with 2024 and accounting for most of that increase. This isn’t just a dry statistic: it represents millions of smallholders, farm workers, and companies around the world working to help feed consumers as global demand for seafood grows. The FAO also notes that aquaculture’s continued expansion is essential for food security and nutrition, especially in regions where protein sources are limited.

As aquaculture continues to supply increasing amounts of the world’s seafood — helping 3.2 billion people get vital nutrients like high‑quality protein and omega‑3 fatty acids — improvements in feed formulations and health management aren’t abstract; they help reduce disease outbreaks, lower environmental impacts, and improve livelihoods for farmers in developing and developed countries alike. This makes the industry’s movement toward prebiotics and sustainable practices not just a technical trend, but a people‑centred evolution in how food is grown, shared, and enjoyed.

Drivers

Reducing Antibiotic Use and Antimicrobial Resistance in Aquaculture

For many years, farmers used antibiotics not just to treat diseases in aquaculture animals, but also to prevent illness and, in some places, to promote growth. This practice has helped keep farms productive, but it has come at a cost. According to the Food and Agriculture Organization (FAO), the use of antimicrobial medicines in aquaculture is widespread around the world and contributes to the development and spread of antimicrobial resistance (AMR) — a serious problem where bacteria evolve to resist the very drugs we rely on to treat infections in humans and animals.

One often‑quoted estimate based on scientific modelling suggests that global antimicrobial use in aquaculture was around 10,259 tons in 2017 and could increase to about 13,600 tons by 2030, highlighting that this is not a small, isolated concern but a growing global one. While this figure encompasses all antimicrobial agents (and not antibiotics alone), it shows the scale of medicines involved in aquatic animal production — medicines which, if misused, contribute to resistant pathogens.

Governments and international bodies are responding too. The FAO’s Action Plan on Antimicrobial Resistance (2021–2025) explicitly promotes alternatives to antimicrobial use in food‑producing animals, including aquaculture, as part of a broader strategy to reduce reliance on antibiotics and protect public health. This reflects a growing global consensus that sustainable aquaculture must embrace nutritional strategies like prebiotics, alongside vaccines, biosecurity, and better management practices, to reduce the need for antibiotics in the first place.

Restraints

High Cost and Economic Barriers to Prebiotic Adoption in Aquaculture

Aquaculture feed costs are a huge part of overall production expenses. According to the Food and Agriculture Organization (FAO), feed can make up 40 %–60 % of total production costs for many fish and shrimp farming operations, especially in semi‑intensive and intensive systems where formulated feed is used instead of natural pond foods. These amounts of money are significant, especially for small‑holder farmers who often operate on tight margins and depend on every rupee earned from their stock.

Prebiotics, although beneficial for fish health and immune function, sit on the premium end of aquaculture feed additives. They are specialized ingredients like inulin, mannan‑oligosaccharides (MOS), or fructo‑oligosaccharides (FOS) that are processed to survive the gut and nourish desirable gut bacteria. Many small and medium producers feel this cost most acutely because they already struggle with the price of conventional feed — which itself has seen sharp increases, with some core ingredients such as fish oil rising by up to 250 % in recent years, pushing feed prices higher overall.

Governments and development agencies recognize this too. Technical papers produced by the FAO emphasize the need to strengthen feed policy, improve information and training, and develop supportive regulatory frameworks so that small‑scale farmers can safely access improved feeds and technologies. These include best practices for including additives like prebiotics in diets, monitoring outcomes, and justifying investments based on improved animal health.

These economic and regulatory barriers don’t mean prebiotics are without value. On the contrary, scientists and experts recognize their benefits for animal welfare and reduced reliance on antibiotics. But farmers operate in a world of cash flow and survival, and if a product is too expensive or its benefits are not well quantified for each species and farming condition, many simply cannot or will not switch to it. It’s not because they are resistant to innovation — it’s because their livelihoods depend on keeping costs under control.

Opportunity

Rising Global Seafood Demand and Expanding Aquaculture Production

Every year, more people depend on seafood as a primary protein source. According to the Food and Agriculture Organization of the United Nations (FAO), global seafood production is set to grow to around 197 million tonnes in 2025, driven significantly by aquaculture, which is forecast to produce around 104.1 million tonnes — nearly 53 % of total seafood output that year. Wild‑capture fisheries are expected to remain stable around 92.9 million tonnes, but they are no longer the fastest‑growing source of seafood. That role now belongs to aquaculture.

Prebiotics are a part of this opportunity because they support the very qualities that farmers need to meet demand: better fish health, improved feed utilization, and lower disease risks. When aquaculture expands rapidly — as it is doing — disease pressure also grows. Healthy gut flora and immune resilience become central to productive farms, especially in warm‑water species like tilapia, carp, shrimp and catfish that supply millions of small‑scale farmers and processors globally.

The FAO’s outlook highlights that aquaculture is the engine of growth for seafood production, with annual increases driven by global consumption and export value, which is also expected to rise substantially (global seafood export value projected at USD 193.3 billion in 2025). This value is not just currency — it represents jobs, livelihoods, and food on dinner tables in countries far from the coast as well as those on the shoreline.

Governments and institutions are taking note. The FAO’s Blue Transformation initiative aims to boost aquaculture to meet nutrition needs and fight hunger worldwide, targeting roughly 35 % growth in aquaculture production by 2030 to improve food availability and bolster coastal economies. Policies under this framework encourage investment in sustainable practices, training for farmers, and innovation in feed and health management — areas where prebiotics can play a vital role.

Regional Insights

Europe leads aquaculture prebiotics with 43.9% share and USD 0.4 billion value in 2024

In 2024, Europe emerged as the dominant region in the aquaculture prebiotics market, capturing more than 43.9% share and generating approximately USD 0.4 billion in revenue. This leading position reflects the region’s advanced aquaculture infrastructure, strict regulatory environment that prioritises reduced antibiotic use, and widespread adoption of functional feed additives that support animal health and sustainable practices. European producers have increasingly integrated prebiotics into feed formulations to enhance gut health, boost immunity, and improve growth performance among farmed species such as salmon, trout, sea bass and shrimp, aligning with consumer demand for high-quality, traceable seafood.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill Aqua Nutrition supplies a broad range of aquafeed products with prebiotic components aimed at improving gut health and nutrient absorption in farmed species. The division delivers around 1.8 million t of premium aquaculture feeds annually and focuses on sustainable formulations that support immunity and feed conversion in salmon and shrimp in 2024–2025, backed by global R&D networks.

IFF/DuPont operates through Danisco Animal Nutrition, applying fermentation technology and advanced encapsulation techniques to deliver prebiotic and supportive feed solutions that enhance microbial balance and nutrient uptake in aquaculture species. In 2024–2025, the company integrates these technologies into feed programs across multiple global markets to meet rising demand for natural gut health additives.

Top Key Players Outlook

- Nutreco N.V.

- Cargill Aqua Nutrition

- ADM

- Evonik Industries AG

- IFF/DuPont

- Alltech Inc.

- DSM-Firmenich

- Ridley Aqua Feed

- BioMar Group

- Kemin Industries

Recent Industry Developments

In 2024, Evonik took a significant step by launching Evonik Vland Biotech, a joint venture with Shandong Vland Biotech that started operations on January 1, 2024, with Evonik holding 55 % of the shares, aimed at expanding gut‑health solutions such as probiotics into the Greater China region and beyond, which indirectly supports aquaculture nutrition and health outcomes across species including fish and shrimp.

In 2025, ADM continued to emphasise research and science‑based nutrition with a clear human‑centred perspective: on June 19, 2025, the company officially opened a 1,600 m² R&D centre in Lausanne, Switzerland, specifically dedicated to advanced microbiome research for farm and companion animals, including work on pre‑clinical biotics and fermentation‑derived ingredients that help animals’ digestive and immune systems stay healthy.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 2.1 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-derived, Yeast And Fungal-derived, Algal And Marine-derived, Synthetic/Fermentation-derived), By Prebiotic Type ( Mannan-oligosaccharides (MOS), Fructo-oligosaccharides (FOS), Galacto-oligosaccharides (GOS), Inulin, Beta-glucans, Resistant Starch And Fibers, Novel Prebiotics), By Form (Powder / Dry Blends, Liquid Additives, Encapsulated / Coated Forms, Prebiotic-rich Functional Feed), By Functionality (Gut Health And Microbiome Balance, Growth Performance And Feed Conversion, Immunity Enhancement And Disease Resistance, Stress Tolerance), By Application (Shrimp, Freshwater Fish, Marine Fish, Mollusks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nutreco N.V., Cargill Aqua Nutrition, ADM, Evonik Industries AG, IFF/DuPont, Alltech Inc., DSM-Firmenich, Ridley Aqua Feed, BioMar Group, Kemin Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aquaculture Prebiotics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Aquaculture Prebiotics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nutreco N.V.

- Cargill Aqua Nutrition

- ADM

- Evonik Industries AG

- IFF/DuPont

- Alltech Inc.

- DSM-Firmenich

- Ridley Aqua Feed

- BioMar Group

- Kemin Industries