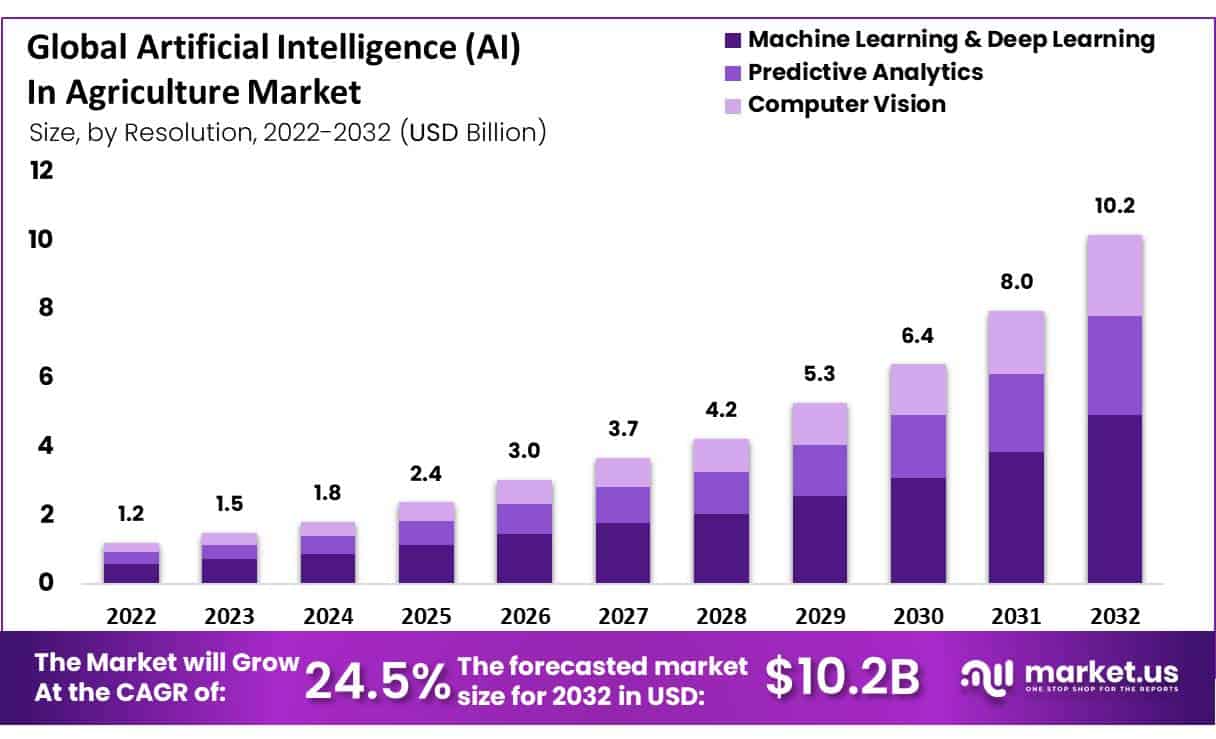

Global AI in Agriculture Market by Technology (Machine Learning & Deep Learning, Predictive Analytics, and Computer Vision), By Application (Precision Farming, Drone Analytics), By Component (Hardware, Software, Service, and AI-as-a-Service), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 12196

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global AI In Agriculture market size is expected to be worth around USD 10.2 billion by 2032 from USD 1.5 billion in 2023, growing at a CAGR of 24.5% during the forecast period from 2022 to 2032.

Artificial Intelligence (AI) in agriculture refers to the application of AI technologies in various agricultural processes to improve efficiency, productivity, and sustainability. It involves the use of advanced algorithms, machine learning, computer vision, and data analytics to analyze vast amounts of agricultural data and make informed decisions.

The AI in agriculture market is witnessing significant growth as the industry recognizes the potential of AI technologies to address challenges such as climate change, population growth, and the need for sustainable food production. AI is being utilized in various aspects of agriculture, including crop monitoring and management, precision farming, agricultural robotics, predictive analytics, and yield optimization.

According to the United Nations (UN), the global population will reach 9.8 billion by 2050. As a result, artificial intelligence must be brought into agriculture to keep up with an ever-increasing demand. With limited arable land available and increased food safety requirements driving green revolution initiatives utilizing AI technology, the Internet of Things, and big data. AI-enabled apps have already found applications within agriculture, such as predictive analysis, recommendation engines, pest identification/detection, and soil monitoring.

Artificial intelligence solutions such as drones, robots, and ground-based wireless sensors are becoming more widely utilized in the agricultural industry. For example, in November 2017, Microsoft joined forces with the International Crop Research Institute of the Semi-Arid Tropics to launch an AI Sowing App. In addition, Nature Fresh Farms is another U.S. tech company using artificial intelligence technology to analyze plant data at scale and produce accurate yield and harvest forecasts; their algorithm even predicts when blossoms will ripen.

Automation in agriculture helps allocate resources such as fertilizers and water, determine ideal dates for crop sowing, detect weeds, and drive demand for artificial intelligence solutions. It can even suggest how many seeds should be planted based on long-term weather data, production data, and commodity pricing predictions. Many tech companies and start-ups are capitalizing on the multiple advantages of AI-based applications to expand their IoT-enabled devices that could be utilized for large-scale deployments of AI applications in agriculture.

Key Takeaways

- The global Artificial Intelligence (AI) in Agriculture market size was estimated at USD 1.5 billion in 2023 and it is expected to surpass around USD 10.2 billion by 2032, growing at a CAGR of 24.5% from 2023 to 2033.

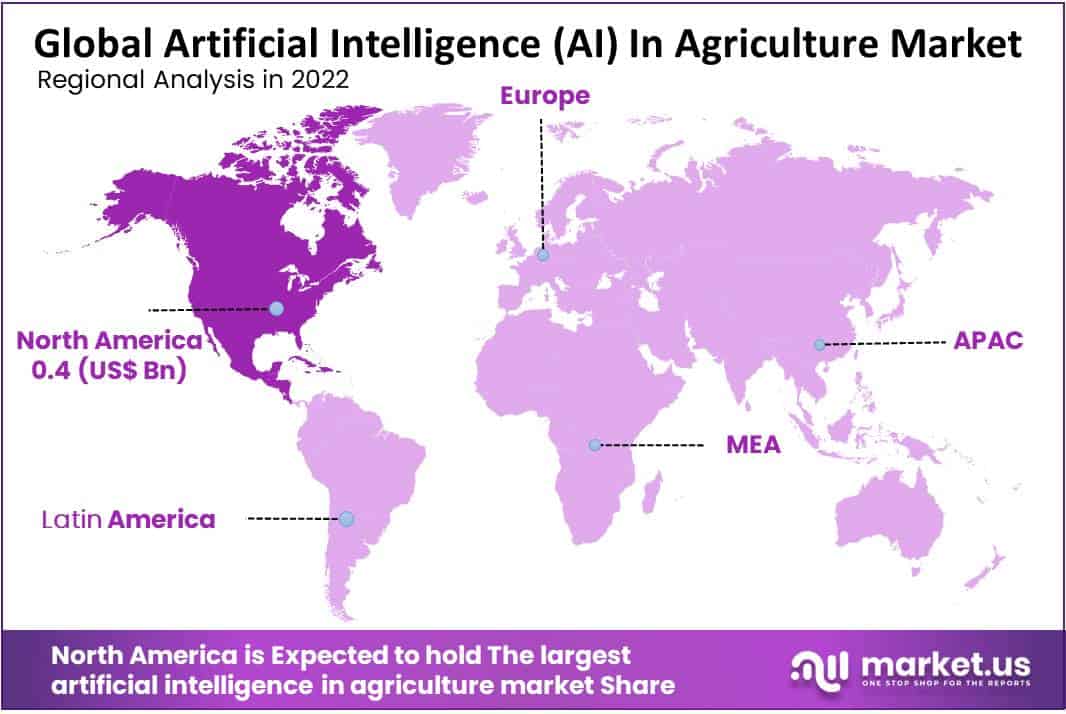

- North America leads in artificial intelligence (AI) agricultural technologies, followed by Europe and Asia Pacific.

- Asia Pacific is currently the fastest-growing market for AI in Agriculture due to the region’s rapidly increasing population and food demand.

- AI in Agriculture markets face several key obstacles, including an acute labor shortage, high costs of AI technologies and a need for more data.

- Demand: Meeting rising population growth and food demand by increasing crop yields.

- Key Trends: Farmers and agribusinesses are increasingly turning to AI technologies, and AI solutions for a range of agricultural tasks have become more widely adopted.

- Drivers: The need to improve crop yields and lower costs are two key considerations when making decisions regarding crop management practices.

- Restraints: Lack of skilled labor and need for additional data collection systems are major obstacles to growth.

- Opportunities: The growing popularity of cloud-based AI solutions

- Challenges: The high cost of AI technologies

- Most prominent Artificial Intelligence (AI) in Agriculture industry players: Raven Industries Inc., Farmers Edge Inc., Deere & Company, A.A.A Taranis Visual Ltd., Gamaya SA, AGCO Corporation, Bayer AG, IBM Corporation, Ag Leader Technology, Trimble Inc., and Other Key Players.

By Technology Analysis

The market can be segmented on technology into machine learning, deep learning, predictive analytics, and computer vision. Many agribusiness companies utilize predictive analytics to deploy artificial intelligence; AgEagle Aerial Systems Inc., Microsoft, and Granular have all developed AI-enabled platforms and solutions for agriculture and farming that utilize this predictive analytics technology. Pesticide control, crop disease infestations, weather tracking, irrigation, and drainage management are significant challenges facing agriculture today. Farmers can address these issues through predictive analysis using image processing and neural networks.

Predictive analytics has enabled drone-enabled agriculture solutions, with AgEagle Aerial Systems Inc. as one example. This company utilizes artificial intelligence to boost crop yield through drone technology. Drone analytical solutions offer drone analytical solutions for crop area identification and management.

Predictive analytics has become more efficient in agricultural applications, so this segment is expected to experience a steady CAGR during the forecast period. Machine learning is being applied to sensor data in farm management systems to transform them into real artificial intelligence systems – leading to more significant production improvements. Machine learning and deep learning segments are expected to expand concurrently.

By Application Analysis

The market can be divided into four categories based on application: precision farming, drone analytics, and agriculture robots. Over the forecast period, precision farming is expected to hold a significant market share. Precision farming is an AI-enabled application proliferating in agriculture; it helps farmers reduce costs and maximize their resources.

AI is widely used in precision farming to collect, interpret and analyze digital data. For example, GPS-equipped combine harvesters use artificial intelligence to track harvest yields for field variability analysis – including differences in soil makeup or water. This analysis and prediction allow farmers to adjust fertilizers or pesticides accordingly.

AI can even control agriculture robots through artificial intelligence combined with field sensors and data analytics. As a result, they’re effective for many applications, such as harvesting crops efficiently as they weed or hoe themselves. As more businesses adopt artificial intelligence technologies along with advances in robotics technology, the segment of agriculture robots is proliferating.

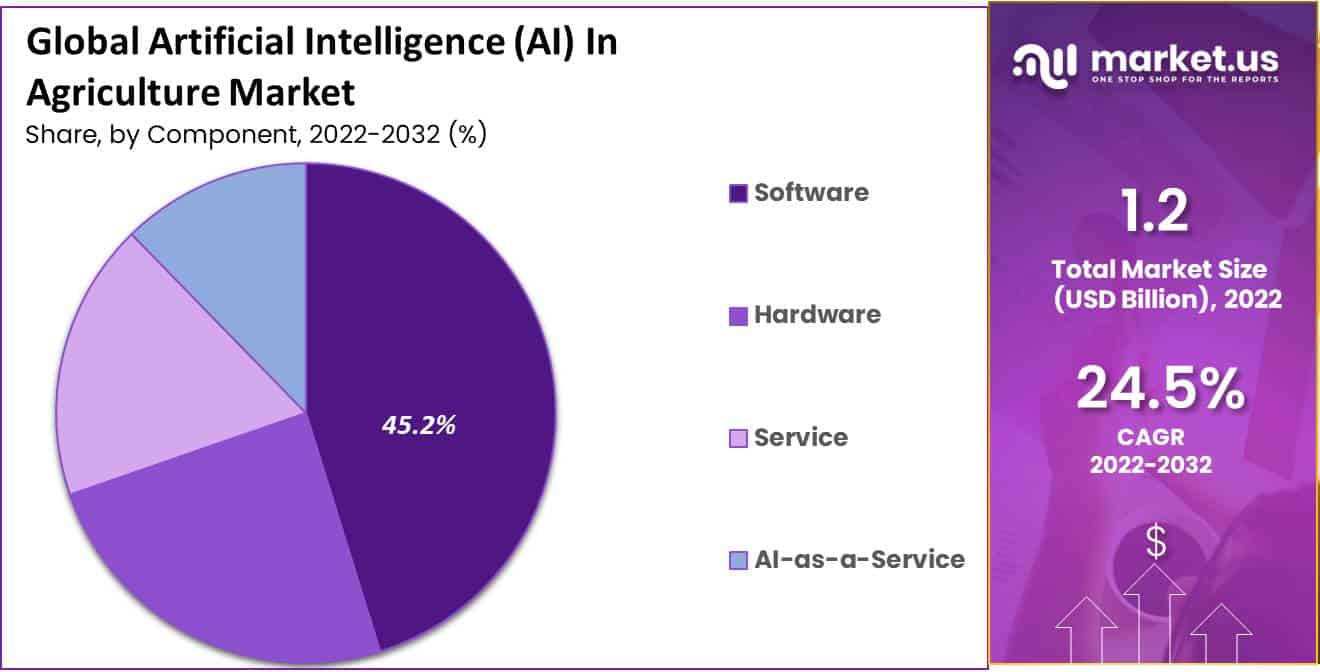

By Component Analysis

The market can be divided into service, hardware, and software segments. It is anticipated that software will hold a majority share in this space. Microsoft, IBM, Deere & Company, and Deere and Company all provide AI-based solutions to the agricultural industry. This type of software helps increase crop productivity through prediction-based analysis and computer vision tools.

The software industry is witnessing an uptick in using predictive analytics-based tools. Popular programs include the Watson Decision Platform from IBM Corporation, the AI Sowing App of Microsoft, and See and Spray pesticide and insecticide distribution systems from Deere and Company. These artificial intelligence programs assist farmers with selecting when to plant crops; spotting crop diseases; tracking yield, and calculating land, fertilizers, and water requirements. In addition, AI technology has many potential uses, such as precision farming or drone analysis – further fueling demand for software within this segment of the agricultural software market.

Key Market Segments

By Technology

- Machine Learning & Deep Learning

- Predictive Analytics

- Computer Vision

By Application

- Precision Farming

- Drone Analytics

- Agriculture Robots

- Livestock Monitoring

- Labor Management

- Agriculture Robots

- Other Applications

By Component

- Hardware

- Software

- Service

- AI-as-a-Service

Drivers

Growth Was Driven by IoT

Daily, vast amounts of data are produced in structured and unstructured formats. This includes historical weather patterns, soil reports, new research, and drone images. All this can be sensed by IOT solutions to provide strong perceptions that boost yield. Two technologies commonly used for intelligent data fusion are Remote Sensing (proximity sensing) and Remote Sensing (remote sensing), which allows soil analysis based on beneath-surface soil at a specific place. For example, Rowbot, a hardware solution that combines data collection software and robotics, has already created the ideal fertilizer for growing corn.

Image-Based Insight Generation

Today, high-altitude farming is one of the hottest topics in agriculture. Drone-based images provide invaluable field analysis, crop observation, and scanning data. Drone data, IOT, and computer vision technology can all be combined to enable farmers to act swiftly. Aerialtronics has implemented Visual Recognition APIs and the IBM Watson IoT Platform on their commercial drones so they can perform image analysis in real time. Computer vision technology is also increasingly employed for crop readiness identification, disease detection, field management, and more – helping farmers stay ahead of their operations.

Health Monitoring of Crops

Remote sensing technologies, hyperspectral imaging, and 3d laser scanning can be utilized to generate crop metrics across thousands of acres. This technology has the potential to revolutionize how farmers view farmlands. Furthermore, this monitoring can be done throughout a crop’s entire lifecycle to detect anomalies and generate reports accordingly.

Restraints

Lack of Workers

Due to a shortage of skilled workers, aging farmers, and declining interest among young people in farming as a career path, there has been an alarming decrease in global workforce numbers. As governments and private institutions strive to automate agriculture operations using artificial intelligence technology, this trend towards decreasing labor has caused alarmingly rapid increases.

Increased Adoption of Agricultural Drones

Drones equipped with thermal, multispectral, or hyperspectral sensors can identify areas that need their irrigation schedules adjusted. These sensors use the heat signature of crops to calculate the vegetation index – an AI-based indicator of health. Chemical spraying, while not widespread, is still a necessary part of industrial agriculture. But with intelligent farming drones, it has become possible to minimize their environmental impact; UAVs (Unmanned Aerial Vehicles) measure distances with great precision just like sprayers do; this results in fewer chemicals entering groundwater sources.

Challenges

Lack of Understanding with High Tech Machine Learning Solutions

AI in agriculture has many applications, yet there is a lack of awareness regarding high-tech machine-learning solutions in farms worldwide. Adjusting farming to external factors such as weather patterns, soil conditions, and pest presence requires significant financial investment. At the same time, AI systems need vast data to train machines and make accurate predictions.

Trends

A significant trend in agriculture is the increasing use of robotics. Farming practices have become more sophisticated and modernized due to technology’s adoption. A rise in agricultural robot usage is likely due to an expanding global population, a shortage of farm workers, and automation within agriculture.

Agriculture stakeholders are focusing on increasing production productivity through modern farming practices and reducing carbon footprints, which has driven the demand for robots. Robotic companies provide products that can be applied in unstructured and dynamic agricultural settings. Since their inception, robots have been used in industrial production; however, technological advances have extended their capabilities into many sectors, such as transport, healthcare, and agriculture. Furthermore, robots play an increasingly significant role in alleviating food shortages; milking farms also use robotic systems.

An EU foresight study predicts that by 2025, approximately 50% of European dairy farms will be automated. Fullwood Paco already implemented a batch milking system in May 2022 with six robots capable of simultaneously milking 150-300 cows. Fullwood Paco can easily adjust according to their cows’ changing needs and production demands.

Smart sensors are becoming increasingly commonplace in these practices, signaling a significant trend in the market. Precision agriculture practices have seen an uptick in using sensors, enabling farmers to maximize yields with minimal resources such as seeds, fertilizers, and water. Monitoring crop growth at the microscale level helps farmers conserve valuable and expensive resources while reducing environmental impact.

Regional Analysis

North America accounted for more than 39% of the global market in 2022 due to its dominant industrial automation industry and increasing adoption of artificial intelligence solutions. In addition, North America boasts a higher purchasing power, continued investments in automation, significant investments in IoT technology, and government initiatives toward in-house AI equipment manufacturing. Furthermore, many agricultural technology providers such as Deere & Company, Microsoft, Granular Inc., and The Climate Corporation are present on this front.

Over the forecast period, Asia Pacific is expected to witness the highest compound annual growth rate due to the increasing use of artificial intelligence technology in agriculture. China and India are two emerging economies that have already adopted artificial intelligence solutions such as remote monitoring technology or predictive analysis for food industry needs. In addition, Agribusiness companies are encouraged to utilize AI-enabled services and solutions due to the growing demand for smart cities.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Vendors offering artificial intelligence solutions to agriculture focus on growing their customer base to gain a competitive edge in the market. They often implement strategic initiatives like mergers and acquisitions and partnerships to do this. For example, Deere & Company recently joined Cultivating New Frontiers in Agriculture (CNFA) on May 26th to implement mechanization within their agriculture industry. Climate Corporation followed suit in October 2018 by joining forces with three agriculture tech firms: SoilOptix and AgCon Aerial Corp.; this collaboration allows farmers new capabilities while expanding Climate FieldView’s digital platform further.

With many local and regional players’ presence, the artificial intelligence (AI) market in agriculture is fragmented. As a result, market players are subject to intense competition from top players, particularly those with strong brand recognition and high distribution networks. As a result, companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market. The following are some of the major players in global artificial intelligence (AI) in the agriculture industry.

Top Market Leaders

- Raven Industries Inc.

- Farmers Edge Inc.

- Deere & Company

- A.A Taranis Visual Ltd.

- Gamaya SA

- AGCO Corporation

- Bayer AG

- IBM Corporation

- Ag Leader Technology

- Trimble Inc.

Recent Development

- June 2023, Carbon Robotics: Their LaserWeederTM was recognized as the Best AI-based Solution for Agriculture at the AI Breakthrough Awards. It’s the market’s first laser weeding robot, removing over one billion weeds. This innovation uses AI, lasers, computer vision, and robotics for precise weed management.

- November 2022, DJI Agriculture: They launched the Mavic 3 Multispectral, equipped with a multispectral imaging system. This tool captures crop growth quickly, aiming for more efficient crop production. It helps reduce costs and increase income for farmers globally by catering to precision agriculture and environmental monitoring needs.

- October 2022, Microsoft: Microsoft Research made FarmVibes.AI open-sourced. This set of technologies and machine-learning algorithms focuses on sustainable agriculture. FarmVibes.AI works by integrating various data types, including weather, satellite, and drone imagery, to enhance agricultural practices.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 Bn Forecast Revenue (2032) US$ 10.2 Bn CAGR (2023-2032) 24.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology – Machine Learning & Deep Learning, Predictive Analytics, and Computer Vision; By Application – Precision Farming, Drone Analytics, Agriculture Robots, Livestock Monitoring, Labour Management, Agriculture Robots, and Other Applications; By Component – Hardware, Software, Service, AI-as-a-Service Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Raven Industries Inc., Farmers Edge Inc., Deere & Company, A.A.A Taranis Visual Ltd., Gamaya SA, AGCO Corporation, Bayer AG, IBM Corporation, Ag Leader Technology, Trimble Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the study period of this market?The AI Market in Agriculture will be evaluated from 2018-2032.

What is the growth rate of AI Market in Agriculture?The AI Market in Agriculture is projected to experience a compound annual growth rate (CAGR) of 24.5% over the next five years.

Which region has the highest growth rate for AI Market in Agriculture?Europe is projected to experience the highest compound annual growth rate from 2022-2032.

Which region holds the largest share in AI Market for Agriculture 2022?North America is projected to hold the highest share by 2022.

-

-

- Raven Industries Inc.

- Farmers Edge Inc.

- Deere & Company

- A.A Taranis Visual Ltd.

- Gamaya SA

- AGCO Corporation

- Bayer AG

- IBM Corporation

- Ag Leader Technology

- Trimble Inc.