Global Application Server Market By Type (JAVA, Microsoft Windows, and Other Types), By Deploymenmt Mode (Cloud and On-Premise), By End-Use (BFSI, Government, Healthcare, IT & Telecom, and Other End-Use), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 13649

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

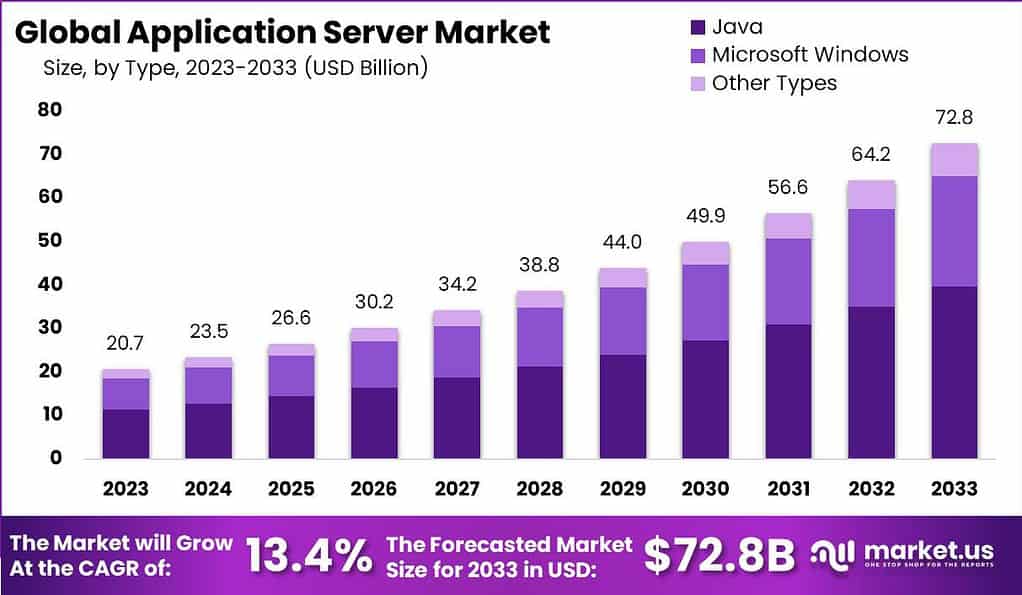

The global Application Server Market is likely to secure a valuation of USD 23.5 Billion in 2024, with a CAGR of 13.4% during the forecast period. The worldwide market is anticipated to capture a valuation of USD 72.8 Billion by 2033.

An application server serves as a software framework essential for hosting and executing applications, functioning as a mediator between client-side applications and server-side resources. It manages the execution and delivery of applications across a network, handling tasks such as data access, security, session management, and scalability. This allows developers to concentrate on constructing the application logic.

Application servers facilitate the deployment of web applications, enterprise software, and other distributed systems, ensuring efficient communication between various components and reliable performance. The application server market denotes the industry segment dedicated to the development, sale, and deployment of application server software and associated services. This market encompasses diverse vendors and providers offering application server solutions to organizations in various sectors.

Note: Actual Numbers Might Vary In The Final Report

Commercial and open-source application server offerings are part of the market, meeting the varied needs and preferences of businesses and developers. The demand for resilient and scalable software infrastructure to support contemporary application development and deployment propels the application server market. As applications become more complex and seamless integration becomes imperative, organizations seek dependable and effective application server solutions for optimal performance and user experience.

The market is marked by continual innovation, with vendors striving to enrich their offerings by incorporating features such as cloud compatibility, containerization, and support for emerging technologies like microservices and serverless computing. As an example, AGNITY provides Intelligent Business Communication through its Communication Application Server (CAS), a virtualized service delivery platform tailored for service providers to address high capacity and throughput requirements. The platform features a layered and modular architecture, enabling seamless expansion when additional network connectivity is needed for new applications.

Key Takeaways

- Market Size and Growth: The Application Server market is anticipated to reach USD 72.8 billion by 2033. It is estimated to record a steady CAGR of 13.4% during the forecast period.

- Type Analysis: In 2023, the Java segment held the dominant market position with over 54.6% share.

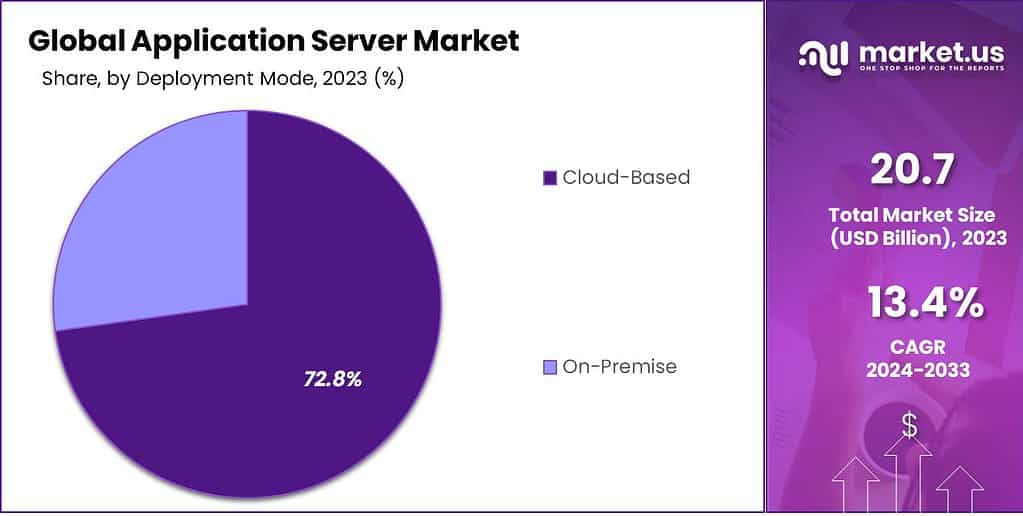

- Deployment Mode Analysis: In 2023, the cloud-based segment held a dominant position with more than 72.8% share.

- End-use Analysis: In 2023, the manufacturing industry held a leading position with over 28.3% share.

- Driving Factors: Increasing demand for web-based applications and services.

- Restraining Factors: Security concerns related to application server usage.

- Growth Opportunities: Surge in e-commerce and mobile app usage.

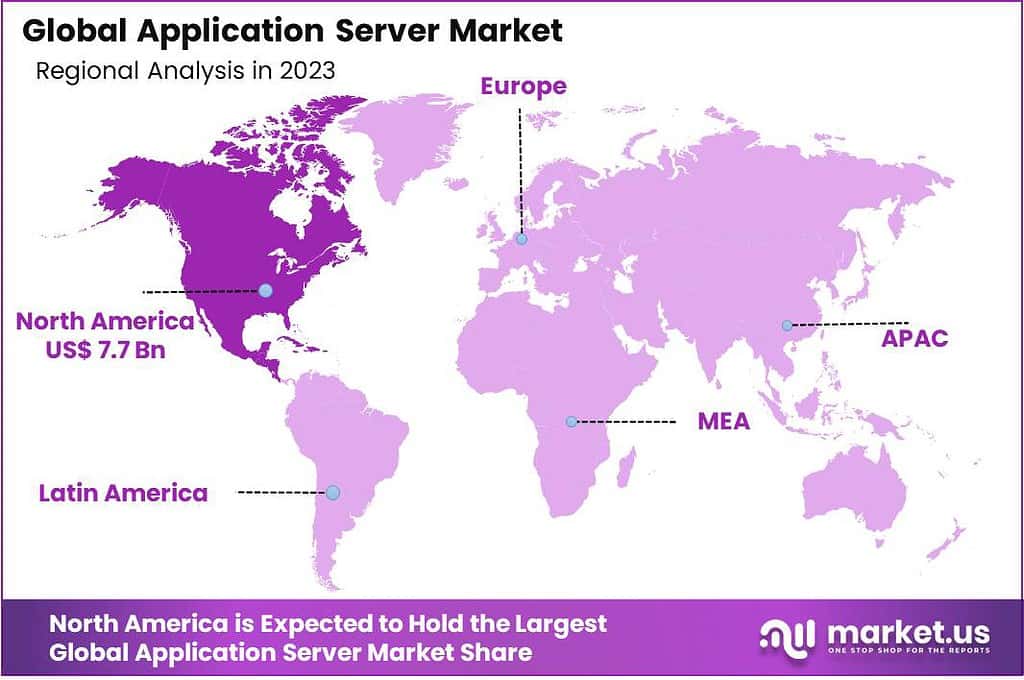

- Key Regions: In 2023, North America held a dominant position with more than 37.6% share.

- Key Players: Key players in the Application Server market include Microsoft Corporation, IBM Corporation, Oracle Corporation, and more.

Type Analysis

In 2023, the Java segment held a dominant market position in the application server market, capturing more than a 54.6% share. This significant presence is primarily due to Java’s versatility, security features, and its widespread adoption among developers for building robust, enterprise-scale applications. Java servers are known for their efficiency in handling complex transactions and applications, making them a preferred choice for businesses looking to scale and secure their operations.

On the other hand, the Microsoft Windows segment also plays a crucial role in the application server market. Known for its user-friendly interface and compatibility with a wide range of applications, Windows servers are a go-to for many businesses, especially those integrated deeply with other Microsoft products and services. The ease of use and the comprehensive support provided by Microsoft contribute to the popularity and steady growth of this segment.

Other types of application servers, including those based on open-source platforms and proprietary systems, account for the remaining market share. These servers offer varied functionalities and benefits, such as cost-effectiveness, flexibility, and specialized features tailored to specific business needs. As companies continue to seek customized and adaptable solutions, these alternative types are gaining traction, reflecting the diverse and evolving needs of the application server market.

Deployment Mode Analysis

In 2023, the cloud-based segment held a dominant position in the application server market, capturing more than a 72.8% share. This growth has been driven by the accelerating pace of cloud adoption, as organizations seek more agile and scalable infrastructure. Cloud-based application servers enable easier deployment, automatic updates, and usage-based billing models. Leading vendors have invested heavily in cloud-native application servers tailored for public and private cloud environments.

Meanwhile, On-premise application servers allow for greater customization and control for organizations with complex infrastructure needs or regulatory requirements. Vendors are adding capabilities like Kubernetes support and advanced developer tools to modernize their on-premise offerings. The on-premise segment will continue playing an important role, especially among large enterprises. However, cloud is expected to see faster growth over the next few years as more mission-critical workloads move to the cloud.

Note: Actual Numbers Might Vary In The Final Report

End-use Analysis

In 2023, the manufacturing industry held a leading position in the application server market, capturing more than a 28.3% share. This sector relies heavily on application servers to run critical production, inventory, and supply chain applications. Manufacturers are modernizing their IT infrastructure and migrating more workloads to the cloud, driving adoption of cloud-based application servers. Key vendors like IBM and Red Hat are tailoring offerings for the complex requirements of industrial environments.

The IT and telecom sector accounted for a significant share of the application server market. Telecom providers leverage application servers to deliver next-gen 5G services and optimize their networks. IT service providers use application servers to develop and host SaaS applications. As 5G rollouts accelerate globally, robust application infrastructure is needed to support advanced capabilities. Cloud-native application servers enable the agility and scalability required for modern telecom workloads.

Financial services represented a major share of the market in 2023. Banks and insurers rely on application servers to run core banking, trading, risk analysis and other fintech applications. Security and regulatory compliance are top priorities in this sector. On-premise application servers still play a significant role, but momentum is building to utilize cloud and container-based application infrastructure. The finance industry is also exploring ways to modernize legacy systems with microservices architectures.

The government sector captured a substantial share. Government agencies are modernizing their systems and migrating more applications to secure cloud environments. Red Hat recently announced a new application platform tailored for government clients and their unique compliance needs. Microsoft Azure and AWS also offer cloud-based application servers designed for public sector workloads.

Finally, healthcare accounted for an important share of the market. Healthcare providers leverage application servers to underpin electronic health records (EHRs), medical imaging, patient portals, and other critical systems. HIPAA compliance is an important consideration when choosing application infrastructure. Hybrid cloud models are popular in healthcare, allowing sensitive data to remain on-premise while other workloads move to the cloud.

Across major sectors, application servers provide the foundation for running mission-critical business applications. As these workloads become more complex and distributed, purpose-built application servers offer scalability, security, and next-gen capabilities like containers and microservices. The market is expected to grow at a healthy rate as companies modernize their application infrastructure both on-premise and in the cloud.

Driving Factors

- Increasing demand for web-based applications and services: Web-based applications like e-commerce, webmail, social media etc. are driving the need for robust application servers to handle user traffic and demands.

- Growing adoption of cloud computing and virtualization technologies: Cloud computing allows organizations to migrate applications to scalable cloud environments. Virtualization provides the ability to optimize hardware usage. Both trends rely on advanced application servers.

- Rising need for scalable and flexible application infrastructure: Modern apps need to handle unpredictable workloads and scale rapidly. Application servers provide the flexible infrastructure to add/reduce resources on-demand.

- Expansion of e-commerce and mobile app development: Growth in online shopping, banking, entertainment apps etc. requires backend application servers to support performance and reliability.

Restraining Factors

- Security concerns related to application server usage: Running critical business apps on shared application servers raises security concerns like data breaches, DDoS attacks etc.

- High initial investment and maintenance costs: Costs related to licensing, hardware, migration, maintenance, tuning etc. are still barriers for adopting application servers for some organizations.

- Compatibility issues with legacy systems: Integrating legacy systems with modern application servers can be technically challenging.

- Limited awareness and expertise in emerging markets: Lack of technical skills and knowledge around optimizing application servers is still an issue in developing regions.

Growth Opportunities

- Surge in e-commerce and mobile app usage: Booming e-commerce and shift to mobile apps provides huge scope for scaling out application infrastructure.

- Growing adoption of microservices architecture: Microservices architecture enables breaking monoliths into independently deployable services – well suited for application servers.

- Increasing demand for scalable and agile application deployment: Agile and scalable deployment meets needs of businesses rapidly rolling out new applications/features.

- Rise in the adoption of application servers in the healthcare and education sectors: Application servers not as widely adopted in healthcare and education earlier, offering room for growth.

Challenges

- Ensuring robust security measures against cyber threats: Servers must be hardened to prevent attacks, unauthorized access, data loss etc. Updates and patching requires diligence.

- Integration complexities with diverse IT environments: Each environment (cloud, on-premise, hybrid) presents integration and management challenges for application servers.

- High competition among key players leading to pricing pressures: Leading vendors compete aggressively on pricing, features, performance benchmarks etc. which impacts provider margins.

- Adapting to rapidly evolving technology and market trends: Innovations like serverless, edge computing etc. demand rapid evolution of application server capabilities.

Key Market Trends

- Shift towards containerization and Kubernetes for application deployment: Containers and orchestration (Kubernetes) help application portability across environments.

- Rising adoption of serverless computing and Function as a Service (FaaS): Serverless computing reduces operational overheads for organizations by providing automated backend.

- Increasing focus on energy efficiency and green data center initiatives: Energy efficiency is important for data centers running thousands of application servers.

- Growing prominence of open-source application server solutions: Open source application servers are gaining popularity by offering reduced costs and greater customization.

Key Market Players

By Type

- Java

- J Boss

- Jetty

- Tomcat

- Others

- Microsoft Windows

- Other Types

By Deployment Mode

- Cloud

- On-premise

By End-use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Other End-Use

Regional Analysis

In 2023, North America held a dominant position in the application server market, capturing more than a 37.6% share. The region has seen rapid adoption of cloud computing and advanced technologies that rely on robust application infrastructure. The demand for Application Server in North America was valued at US$ 7.7 billion in 2023 and is anticipated to grow significantly in the forecast period.

Large enterprises across sectors like financial services, healthcare and manufacturing are modernizing their application landscapes and migrating workloads to the cloud at scale in the region. Europe represents the second largest regional market, driven by advanced economies like Germany, France, UK and others that are investing heavily in digital transformation.

The Asia Pacific region is witnessing robust growth, fueled by rapid development of enterprise IT infrastructure and surging demand for modern applications in countries like China, India, Japan and Australia.

Latin America and MEA currently have lower market shares compared to other regions, but are projected to exhibit strong growth as investments in IT modernization and cloud infrastructure ramp up across key countries. As application workloads become more distributed and complex globally, regional application server markets are forecast to grow steadily, complemented by maturation of 5G networks and edge computing capabilities.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The application server market is highly competitive, with several key players offering comprehensive solutions and services. Microsoft Corporation, International Business Machines Corp., Oracle Corporation, Red Hat, Inc., and TIBCO Software Inc. are the key players in this market. To improve and expand their product and service offerings, they are actively involved in product development.

To drive organic growth and strengthen their market position, all market participants are investing heavily in R&D. They also place a lot of emphasis on strategic partnerships and mergers and acquisitions to create technologically advanced products and be competitive in the market.

Top Players in the Application Server Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- The Apache Software Foundation

- SAP SE

- VMware LLC

- NEC Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Co.

- TIBCO Software Inc.

- Other Key Players

Recent Developments

Acquisitions

- Oracle acquires OutSystems: Oracle is improving its cloud app-building platform (PaaS), and this might give a strong challenge to big players like Salesforce and Microsoft.

- Red Hat strengthens Java EE expertise with JBoss acquisition: Red Hat is now a major player in the open-source app server market, and it can reach more businesses.

- VMware’s Tanzu acquisition: VMware is now stronger in making cloud apps, and it can use containers. This might change how people use app servers in places with mixed clouds.

Company News

- In October 2023: IBM announces WebSphere Liberty 23 with enhanced support for microservices and cloud deployments.

- July 2023, Microsoft updates Azure App Service with significant performance and scalability improvements.

- In April 2023: NGINX, Inc. acquires UShareSoft, a provider of high-performance Java application servers, expanding its portfolio.

- In January 2023, AWS launches Amazon Web Services App Server, a fully managed Java-based application server on the cloud.

Report Scope

Report Features Description Market Value (2023) US$ 20.7 Bn Forecast Revenue (2033) US$ 72.8 Bn CAGR (2024-2033) 13.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (JAVA, Microsoft Windows, and Other Types), By Deploymenmt Mode (Cloud and On-Premise), By End-Use (BFSI, Government, Healthcare, IT & Telecom, and Other End-Use) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Oracle Corporation, The Apache Software Foundation, SAP SE, VMware LLC, NEC Corporation, Cisco Systems, Inc., Fujitsu Limited, Hewlett Packard Enterprise Co., TIBCO Software Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an application server?An application server is a software framework that provides an environment for applications to run, manage, and communicate with each other in a networked environment.

What are the key trends shaping the application server market?Trends include the rise of containerization and microservices, a shift towards cloud-native application development, and increased adoption of open-source application servers.

Who are the key players in the Application Server market?Key players in the Application Server market may include IBM Corporation, Microsoft Corporation, Oracle Corporation, The Apache Software Foundation, SAP SE, VMware LLC, NEC Corporation, Cisco Systems, Inc., Fujitsu Limited, Hewlett Packard Enterprise Co., TIBCO Software Inc., Other Key Players

What is the Application Server market report scope?The scope of an Application Server market report typically outlines the areas covered, such as market size, key players, growth factors, challenges, and trends. This information is usually available in the introduction or executive summary of the report.

-

-

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- The Apache Software Foundation

- SAP SE

- VMware LLC

- NEC Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Co.

- TIBCO Software Inc.

- Other Key Players