Global Application Delivery Network Market Size, Share, Statistics Analysis Report By Deployment (On-Premise, Cloud), By Enterprise Size (SMEs, Large Enterprises), By End-user Vertical (BFSI, IT and Telecom, Healthcare, Government, Media & Entertainment, Other End-user Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135879

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

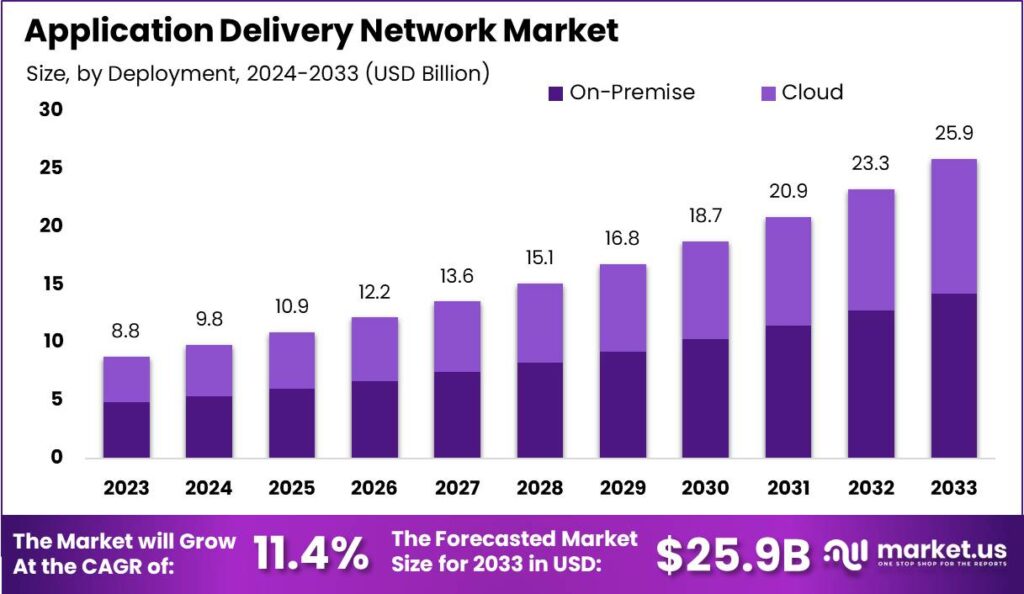

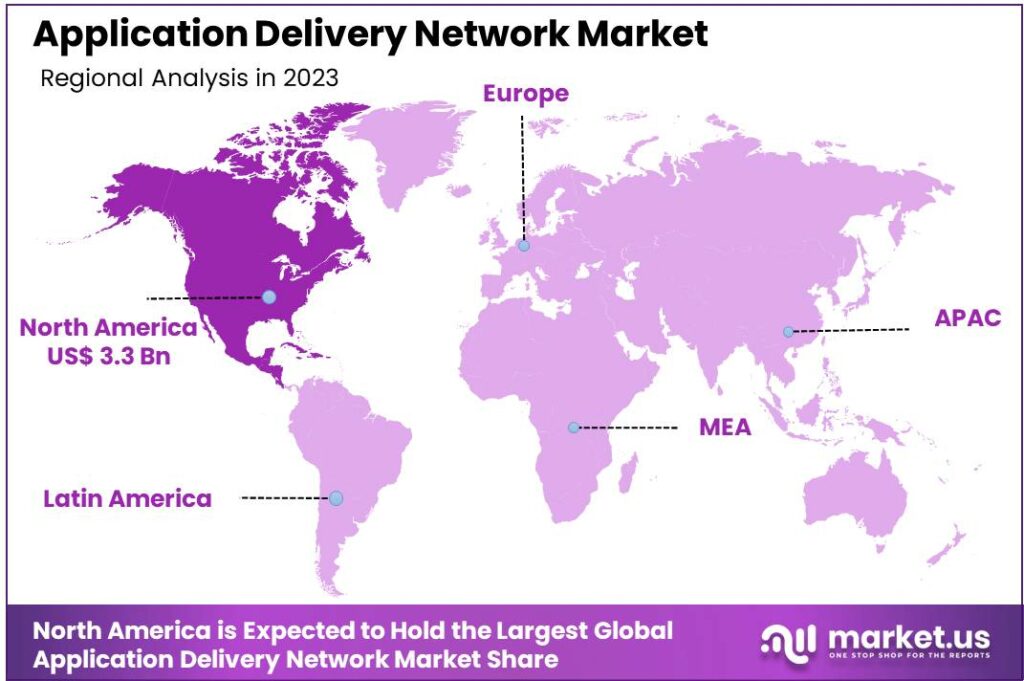

The Global Application Delivery Network Market size is expected to be worth around USD 25.9 Billion By 2033, from USD 8.82 Billion in 2023, growing at a CAGR of 11.40% during the forecast period from 2024 to 2033. In 2023, North America dominated the Application Delivery Network (ADN) market, capturing over 38% share, which equates to USD 3.3 billion in revenue.

An Application Delivery Network (ADN) is a suite of technologies designed to ensure the efficient and secure delivery of applications across a network. ADNs are primarily used to enhance the availability, speed, and security of applications. They achieve this by distributing application services between data centers and cloud environments, thereby optimizing resource use and reducing load times.

Key Takeaways

- The Global Application Delivery Network Market size is projected to reach USD 25.9 Billion by 2033, growing from USD 8.82 Billion in 2023, at a CAGR of 11.40% during the forecast period from 2024 to 2033.

- In 2023, the On-Premise segment of the Application Delivery Network (ADN) market dominated, holding more than a 55% share.

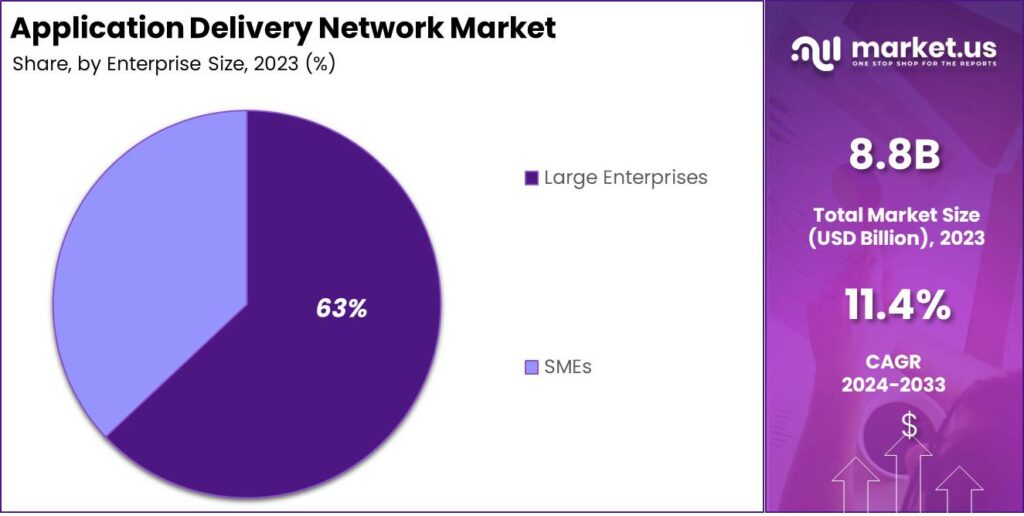

- The Large Enterprises segment held a dominant position in 2023, accounting for more than a 63% share of the Application Delivery Network (ADN) market.

- Within the ADN market, the IT and Telecom segment captured over 27% share in 2023, establishing its dominance.

- North America led the Application Delivery Network (ADN) market in 2023, commanding more than a 38% share, which translates to approximately USD 3.3 billion in revenue.

Deployment Analysis

In 2023, the On-Premise segment of the Application Delivery Network (ADN) market held a dominant position, capturing more than a 55% share. This segment benefits from its ability to offer enhanced security and control, which is crucial for organizations handling sensitive data or requiring stringent compliance with data protection regulations.

The preference for on-premise deployment can also be attributed to its reliability and performance advantages. On-premise ADNs provide organizations with the ability to manage and optimize their network resources without depending on external service providers.

Moreover, organizations opting for on-premise ADNs avoid recurring subscription costs associated with cloud services, which can be economically advantageous in the long term. While initial investments and maintenance costs are higher, many large enterprises find that on-premise solutions offer a better return on investment due to the total control over the entire infrastructure, leading to cost savings on a larger scale.

The leading position of the on-premise segment is reinforced by the slow but persistent skepticism about cloud security and data sovereignty, particularly among organizations in regions with strict data residency laws. A significant portion of the market continues to lean towards on-premise deployments to keep critical data within their physical premises, aligning with corporate governance and compliance mandates.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position, capturing more than a 63% share of the Application Delivery Network (ADN) market. This substantial market share can be attributed to the high demand for advanced network infrastructure solutions among large enterprises.

Typically, these organizations manage extensive data traffic and require robust systems to ensure secure and efficient application delivery across global networks. The complexity and scale of their operations necessitate a greater reliance on ADNs to maintain operational continuity and protect against cybersecurity threats.

The leadership of the Large Enterprises segment in the ADN market is further reinforced by their capacity to invest in cutting-edge technology. Large enterprises often have the financial flexibility to implement sophisticated ADN solutions that are integral to supporting their extensive digital ecosystems.

This investment is driven by the need to enhance performance and minimize downtime, which can have significant financial implications at this scale. Moreover, the ability to deploy comprehensive ADN solutions enables these organizations to optimize their network capabilities, thus improving overall business efficiency and user satisfaction.

End-user Vertical Analysis

In 2023, the IT and Telecom segment held a dominant market position within the Application Delivery Network (ADN) market, capturing more than a 27% share. This leadership can primarily be attributed to the exponential growth in data traffic and the escalating need for advanced network management solutions.

As digital transformation initiatives have become central to enterprise strategies, there has been a significant increase in the deployment of cloud-based solutions and services across the IT and telecom sector. These factors collectively drive the demand for robust application delivery networks that can ensure high-quality service delivery and network efficiency.

The prominence of the IT and Telecom segment also stems from the rising need for cybersecurity measures. With cyber threats becoming more sophisticated, ensuring the security and integrity of data transmitted across networks has become paramount.

Application delivery networks enhance the security posture of IT and telecom services by providing features like load balancing, web application firewalls, and secure sockets layer (SSL) offloading. These features help mitigate the risk of Distributed Denial of Service (DDoS) attacks and data breaches, further cementing the segment’s lead in the ADN market.

Key Market Segments

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- SMEs

- Large Enterprises

By End-user Vertical

- BFSI

- IT and Telecom

- Healthcare

- Government

- Media & Entertainment

- Other End-user Verticals

Driver

Surge in Global Data Traffic

The Application Delivery Network (ADN) market is primarily driven by the exponential increase in global data traffic. As digital platforms become more pervasive in both personal and professional realms, the volume of data traversing networks has surged dramatically.

The increase in data exchange demands efficient management for smooth application performance. ADNs are essential for optimizing and accelerating application delivery, improving user experiences. The surge in mobile data traffic, driven by smartphone use and the BYOD trend, emphasizes the need for ADNs.

Restraint

High Implementation Costs

The adoption of ADNs, while beneficial, is often curtailed by high initial and operational costs. Setting up an ADN requires substantial investments in sophisticated hardware and software and their integration into existing network frameworks.Ongoing maintenance and upgrades of these systems further necessitate specialized skills, adding to the operational overhead.

For small and medium-sized enterprises (SMEs), these extensive costs can be daunting, limiting their ability to implement these advanced network solutions. Moreover, integrating ADNs with outdated legacy systems can introduce complications, potentially leading to increased downtime and hampering productivity during the transition.

Opportunity

AI and Machine Learning Integration

Incorporating artificial intelligence (AI) and machine learning (ML) into ADNs represents a significant growth opportunity within the market. AI and ML can dramatically refine ADN functionalities, such as traffic management, security threat detection, and network optimization.

AI and ML technologies enable real-time data analysis, predictive maintenance, and automated decision-making, improving network efficiency and user experience. AI-driven ADNs can manage traffic and prevent congestion, while ML detects security anomalies, enhancing cyber defense. This shift towards intelligent, automated networks fosters innovation and market growth in ADNs.

Challenge

Integration with Existing Systems

Integrating ADNs into established IT infrastructures presents notable challenges. Often, legacy systems are not equipped to seamlessly accommodate modern ADN solutions, which can lead to operational disruptions during integration.

This complex process demands meticulous planning and skilled execution to ensure that existing application performances are not detrimentally impacted. The need for specialized expertise for integration often means additional training for staff or the hiring of external consultants, increasing both costs and project timelines.

Emerging Trends

Application Delivery Networks (ADNs) are evolving to meet the growing demand for efficient, secure, and high-performing application delivery. A significant trend is the integration of cloud-based solutions, enabling businesses to scale services and optimize application delivery across diverse environments.

The rise of 5G technology is another pivotal development, offering faster and more reliable connectivity. This advancement enhances the performance of ADNs, particularly in delivering real-time applications that require low latency.

The adoption of hybrid application delivery solutions is also on the rise, combining on-premises and cloud-based environments to meet specific business needs. This approach allows for dynamic traffic routing based on application requirements and current network conditions, enhancing flexibility and performance.

Business Benefits

Implementing an Application Delivery Network (ADN) offers several advantages for businesses. ADNs enhance application performance by optimizing traffic management and reducing latency, leading to improved user satisfaction and productivity.

ADNs provide scalability, allowing businesses to efficiently manage increased traffic and user demands without compromising performance. This scalability is crucial for supporting business growth and adapting to changing market conditions.

Cost efficiency is also achieved through ADNs by reducing the need for extensive hardware investments and lowering operational costs. By optimizing resource utilization and enabling efficient traffic management, businesses can achieve better performance with fewer resources.

Furthermore, ADNs offer improved reliability and availability of applications. Through load balancing and failover mechanisms, ADNs ensure continuous application availability, minimizing downtime and maintaining business continuity.

Regional Analysis

In 2023, North America held a dominant market position in the Application Delivery Network (ADN) market, capturing more than a 38% share, equivalent to USD 3.3 billion in revenue. This substantial market share can be attributed to several key factors that are unique to the region.

The presence of a robust technological infrastructure and the early adoption of cloud-based solutions have significantly contributed to the growth of the ADN market. North American enterprises have consistently prioritized enhancing their network capabilities to support high volumes of data and ensure efficient content delivery across platforms.

Moreover, the region hosts some of the world’s leading technology and telecommunications companies, which not only serve as primary users of ADN technologies but also drive innovation in this field. The strategic focus on cybersecurity measures and the need for high-speed and reliable network performance are pivotal in driving the adoption of ADN solutions.

Another contributing factor to North America’s leadership in the ADN market is its strong regulatory environment, which promotes data protection and privacy. This regulatory framework compels businesses to adopt secure and efficient networking technologies, further boosting the ADN market growth. Additionally, the increasing demand for mobile Internet applications and the expansion of e-commerce have led to a surge in content delivery requirements, thereby fueling the need for sophisticated ADN solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Companies operating in Application Delivery Network (ADN) market focus on providing tools and technologies that optimize the delivery of applications while ensuring data security and seamless user experiences.

Array Networks has positioned itself as a leader in delivering application networking and security solutions. The company offers advanced load balancing, application delivery controllers, and secure access solutions tailored to meet the demands of modern enterprises. Its focus on high-performance technology with simplified deployment makes it a preferred choice for businesses seeking reliable application delivery systems.

A10 Networks, Inc. specializes in multi-cloud and edge computing solutions, enabling organizations to secure and optimize application delivery in complex environments. Their Thunder ADC (Application Delivery Controller) stands out for its scalability, ensuring smooth traffic management for both small and large enterprises.

Broadcom Inc., through its Symantec division, plays a significant role in the ADN market by offering a comprehensive suite of application delivery and cybersecurity solutions. Leveraging its expertise in network performance optimization and threat protection, Broadcom provides robust tools that cater to diverse industries.

Top Key Players in the Market

- Array Networks

- A10 Networks, Inc.

- Broadcom Inc. (Symantec Corporation)

- Cisco Systems Inc.

- Citrix Systems Inc.

- F5 Networks Inc.

- Kemp Technologies

- Avi Networks (Vmware)

- Radware Corporation

- Akamai Technologies

- Barracuda Networks Inc.

- Other Key Players

Top Opportunities Awaiting for Players

The Application Delivery Network (ADN) market is poised for significant growth and offers numerous opportunities for market players.

- Expansion in Cloud-Based Applications: The rapid increase in cloud-based applications offers a substantial opportunity for ADN providers. As organizations continue to migrate their applications to the cloud, they require robust ADN solutions that ensure efficient and secure application delivery across diverse environments.

- Cybersecurity Solutions Integration: With cyber threats on the rise, integrating advanced cybersecurity features into ADN solutions can provide a competitive edge. This includes services like DDoS protection, SSL interception, and other security measures that are becoming essential as businesses seek to safeguard their digital assets.

- Support for Emerging Technologies: As technologies like IoT, 5G, and AI continue to evolve, there is a growing need for ADNs that can support these technologies’ bandwidth and latency requirements. ADN providers that innovate to support these technologies can capture new markets and deliver added value to their clients.

- Enhanced Performance Monitoring and Analytics: Implementing sophisticated analytics and performance monitoring tools within ADN solutions can attract enterprises looking to optimize application performance and user experience in real-time. This also includes the adoption of artificial intelligence and machine learning for predictive analysis and better decision-making.

- Geographic Expansion: There is a significant opportunity for ADN providers to expand into new geographical markets, especially in regions like Asia-Pacific, which is expected to witness the fastest growth. This expansion can be driven by increasing digital transformation initiatives in these regions, where businesses are increasingly dependent on robust digital infrastructure to support their growth and operational needs.

Recent Developments

- In June 2023, Cloudflare, the leader in security, performance, and reliability, has teamed up with Databricks, the data and AI powerhouse, to simplify and secure live data sharing and collaboration. This partnership enables organizations to overcome the challenges and costs of multi-cloud analytics and AI, unlocking their full potential.

- In July 2023, F5 acquired Suborbital, a technology startup focused on cloud-native platforms using WebAssembly, to enhance its application delivery solutions.

Report Scope

Report Features Description Market Value (2023) USD 8.82 Bn Forecast Revenue (2033) USD 25.9 Bn CAGR (2024-2033) 11.40% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (On-Premise, Cloud), By Enterprise Size (SMEs, Large Enterprises), By End-user Vertical (BFSI, IT and Telecom, Healthcare, Government, Media & Entertainment, Other End-user Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Array Networks, A10 Networks, Inc., Broadcom Inc. (Symantec Corporation), Cisco Systems Inc., Citrix Systems Inc., F5 Networks Inc., Kemp Technologies, Avi Networks (Vmware), Radware Corporation, Akamai Technologies, Barracuda Networks Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Application Delivery Network MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Application Delivery Network MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Array Networks

- A10 Networks, Inc.

- Broadcom Inc. (Symantec Corporation)

- Cisco Systems Inc.

- Citrix Systems Inc.

- F5 Networks Inc.

- Kemp Technologies

- Avi Networks (Vmware)

- Radware Corporation

- Akamai Technologies

- Barracuda Networks Inc.

- Other Key Players