Global Application Centric Infrastructure Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs), By End-Use Industry (IT & Telecom, BFSI, Healthcare & Lifesciences, Retail & eCommerce, Government & Defense, Manufacturing, Energy & Utilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163018

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- Key Aspects of the ACI Market

- Key Statistics of ACI Infrastructure

- Key Statistics by Category

- U.S. Market Size

- Component Analysis

- Organization Size Analysis

- End-Use Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

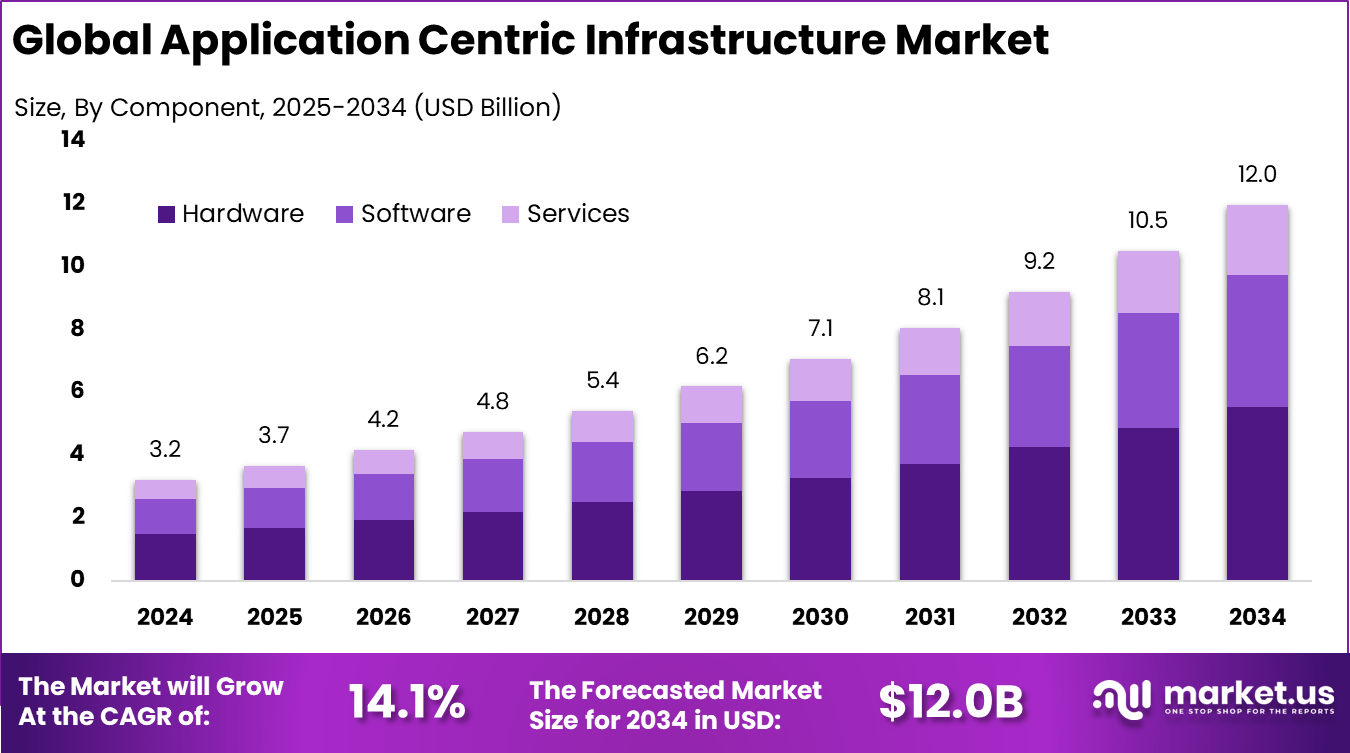

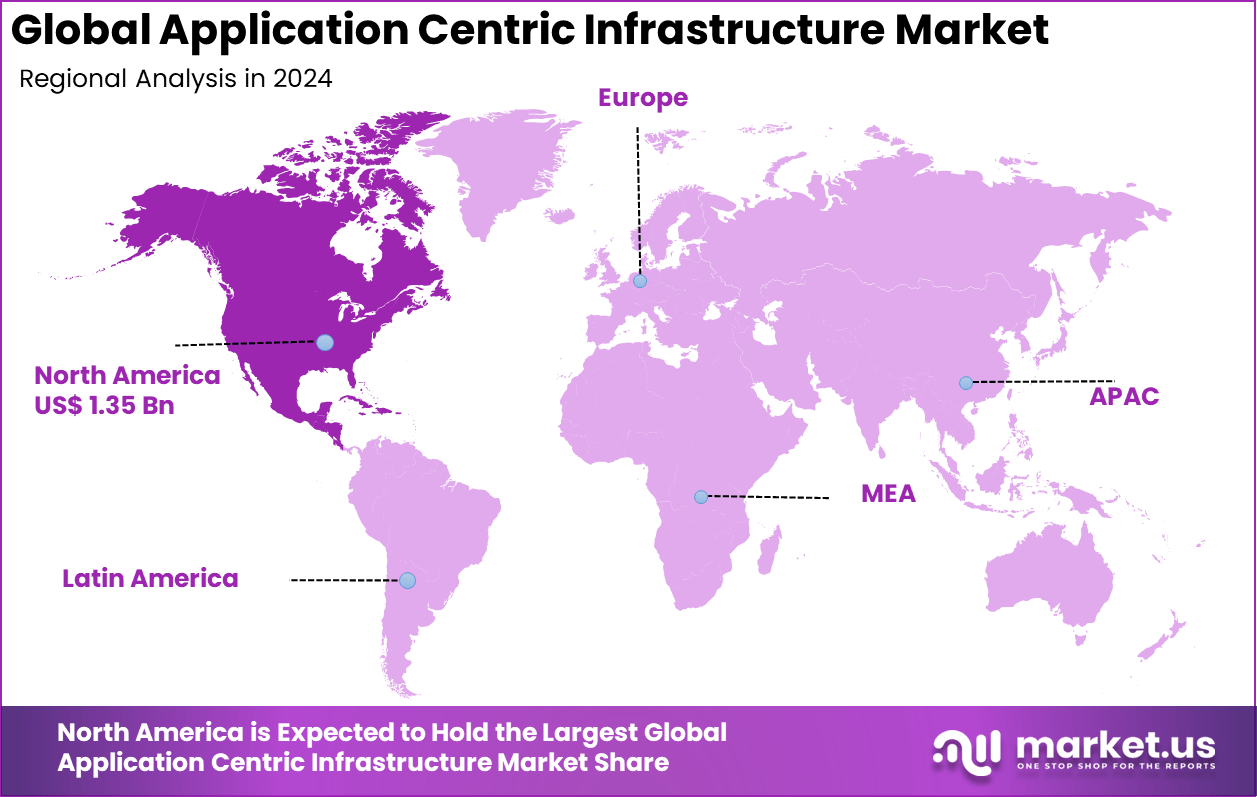

The Global Application Centric Infrastructure Market size is expected to be worth around USD 12.0 billion by 2034, from USD 3.2 billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.3% share, holding USD 1.35 billion in revenue.

The Application Centric Infrastructure (ACI) market represents a modern approach to IT networking that focuses on applications as the core element for infrastructure management. ACI integrates software and hardware to automate and centrally manage network resources aligned with application requirements. This infrastructure model promotes agility, scalability, and security by enabling policies and configurations specific to each application, reducing manual effort and accelerating deployment times.

Top driving factors for the ACI market include the rapid rise of cloud computing and virtualization, pushing enterprises toward more agile network management. The need for centralized visibility and automated enforcement of security policies plays a critical role amid growing cybersecurity threats and regulatory pressures.

The market for Application Centric Infrastructure is driven by the growing adoption of cloud computing and automation across industries. Businesses seek scalable and flexible infrastructure to support dynamic workloads, and ACI offers automated network management that speeds application deployment and reduces operational complexity.

For instance, in July 2025, Hewlett Packard Enterprise (HPE) completed the acquisition of Juniper Networks and unveiled its agentic infrastructure strategy at HPE Discover 2025. HPE launched AI-focused innovations, including GreenLake Intelligence and AI Factories, aiming to lead enterprise AI adoption with hybrid cloud and intelligent networking solutions.

Key Takeaway

- The Hardware segment led the market with 46.3%, driven by growing demand for programmable network switches and routers that support dynamic application environments.

- Large Enterprises dominated with 87.9%, reflecting their higher capacity to adopt ACI frameworks for optimizing complex data center operations.

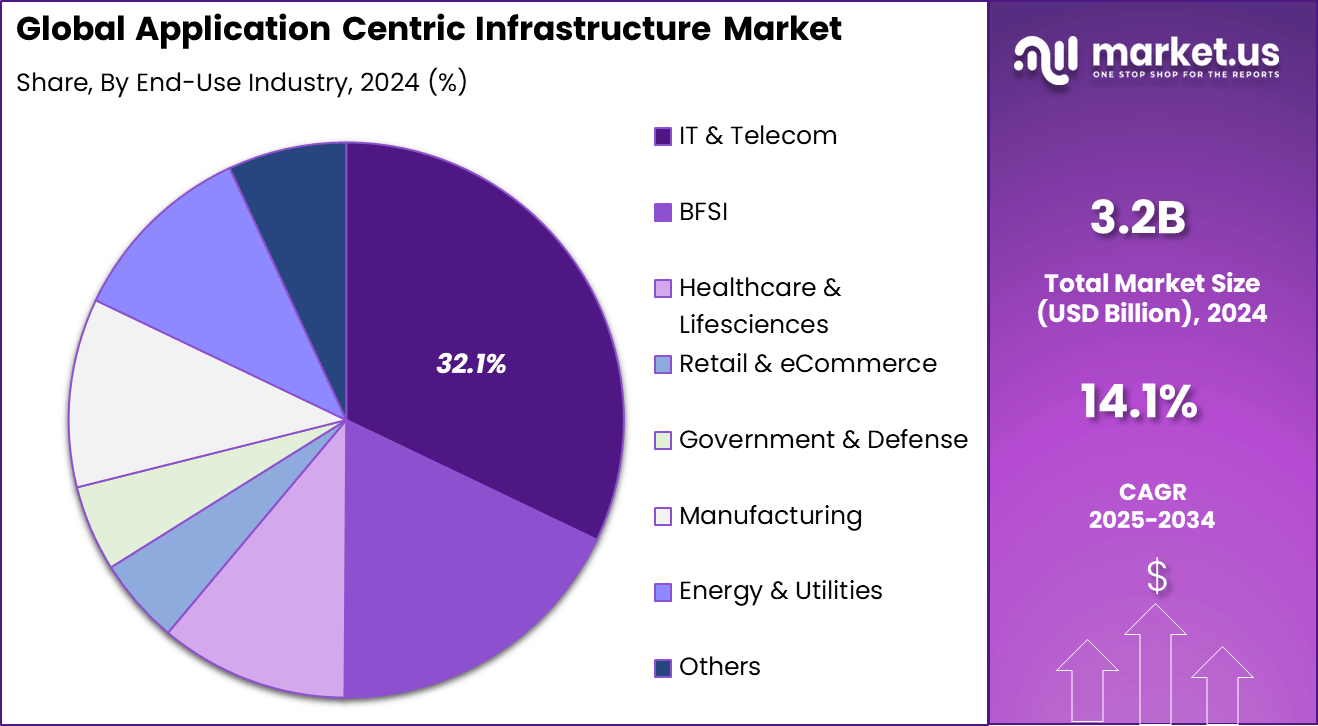

- The IT & Telecom sector accounted for 32.1%, supported by increasing adoption of cloud-native and virtualized network infrastructures.

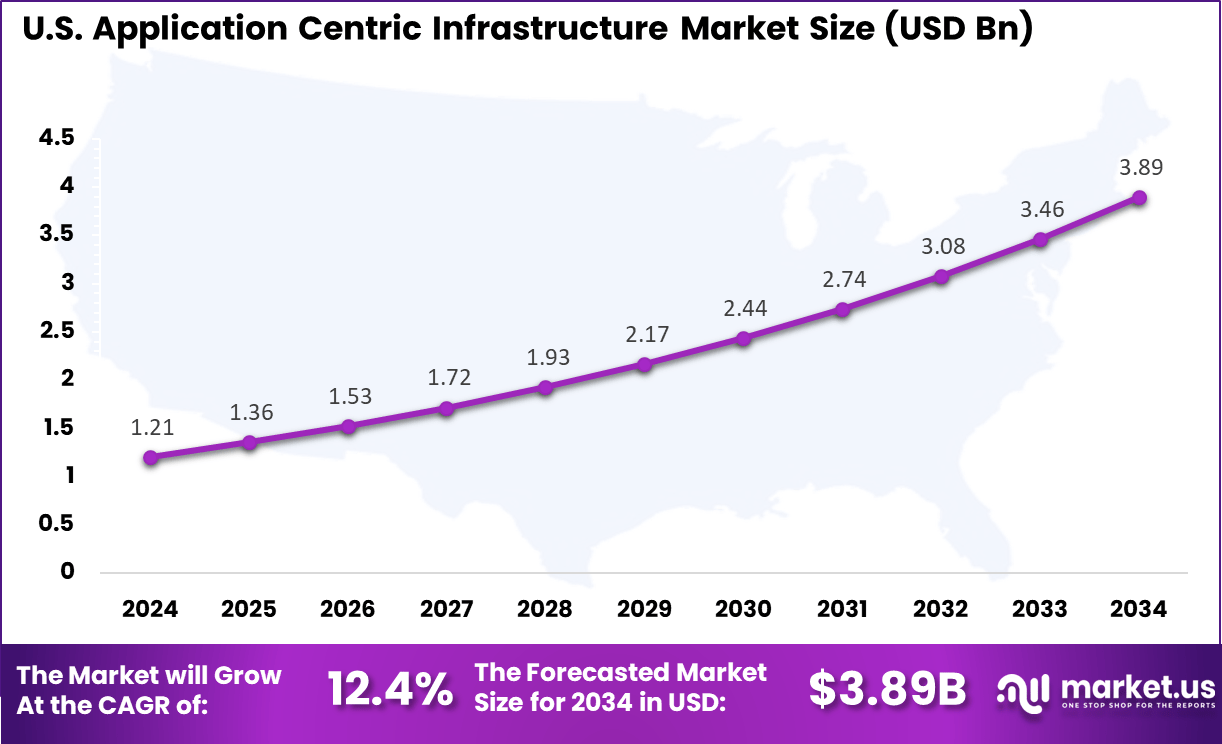

- The US market reached USD 1.21 Billion in 2024, recording a strong 12.4% CAGR, fueled by rapid digital transformation and the shift toward software-defined networking.

- North America maintained a leading 42.3% share of the global market, supported by early technology adoption, strong enterprise IT investments, and widespread use of automation-driven infrastructure solutions.

Role of Generative AI

Generative AI plays an important role in enhancing application centric infrastructure by automating critical network management tasks and improving predictive analytics. For example, 85% of business leaders expect to use generative AI for routine, low-value tasks by the end of 2025. This AI-powered automation increases operational efficiency by enabling real-time adjustments to network traffic and resource allocation based on application demands.

The technology allows networks to dynamically adapt, minimizing downtime and ensuring seamless application performance. Moreover, generative AI supports improved decision-making by analyzing vast datasets, contributing to more accurate predictive maintenance and security monitoring within application-centric environments. This integration of generative AI helps organizations manage increasingly complex IT infrastructures by reducing manual intervention and speeding up troubleshooting processes.

As 77% of businesses plan to apply generative AI in customer service, similar principles apply within infrastructure management to enhance responsiveness and reliability. It also facilitates hyper-personalized network policies tailored to specific application needs, thereby improving security posture and compliance without compromising agility. Overall, the application of generative AI is transforming infrastructure management toward a more proactive, automated, and intelligent framework.

Investment and Business Benefits

Investment in ACI centers on strategic digital transformation and infrastructure modernization. There is increasing funding for hybrid cloud deployments, edge computing, and upgrades focused on security and automation. Investors are attracted to ACI’s potential to lower long-term IT costs and reduce downtime, with firms noting operational efficiency gains exceeding 20%.

Focus areas include energy-efficient data centers and scalable updates for evolving cloud and multi-tenant environments. Additionally, as regulations tighten, infrastructure investments prioritizing compliance capabilities provide attractive growth potential. The continual rise of AI-integrated network management also opens new avenues for investment in advanced analytics platforms.

Businesses gain measurable benefits from ACI, including reduced downtime, faster deployment speeds, and lower operational complexity. IT teams experience up to an 85% reduction in manual tasks related to network management. Cost savings arise from streamlined hardware use and fewer configuration errors, often exceeding 20%.

End-to-end visibility and automated troubleshooting accelerate issue resolution, improving application uptime and service reliability. ACI’s unified framework simplifies multi-location network control, allowing organizations to expand or adapt infrastructure with minimal disruption. These benefits translate into a competitive advantage through improved user experience and operational resilience.

Key Aspects of the ACI Market

- Centralized management: Application Centric Infrastructure (ACI) is built around centralized controllers such as the Application Policy Infrastructure Controller (APIC). This architecture simplifies network deployment and monitoring by automating configurations and ensuring consistent resource management across environments.

- Policy-based automation: ACI abstracts the physical infrastructure and applies policy-driven rules to manage application communication and security. This approach reduces the complexity of manual configurations, accelerates changes, and ensures uniform enforcement of network policies.

- Application-focused approach: Unlike traditional networking models, ACI prioritizes application requirements when defining network behavior. This enables smoother deployment lifecycles and aligns with DevOps practices, making it easier to adapt networks to evolving workloads.

- Hybrid and multicloud support: ACI is designed to extend seamlessly across on-premises data centers and cloud environments, supporting hybrid and multicloud strategies. This flexibility ensures secure and consistent connectivity for enterprises adopting distributed IT models.

- Open ecosystem: The ACI ecosystem supports integration with third-party vendors, allowing users to customize solutions and build interoperable data center infrastructures. This open model provides choice and adaptability for diverse enterprise needs.

- Security: Security capabilities are embedded within ACI solutions. These include automated policy enforcement, support for zero-trust security models, and integration with external security services through mechanisms like service chaining, ensuring both scalability and protection.

Key Statistics of ACI Infrastructure

- High-speed switching: The Cisco Nexus 9500 and 9300 series switches support port speeds of up to 400 Gbps, ensuring the performance required for modern data center environments.

- Throughput capacity: On the Nexus 9500 series, each line card can deliver throughput of up to 12.8 Tbps, enabling high-density and bandwidth-intensive applications without performance bottlenecks.

- High-scale forwarding profiles: ACI supports advanced forwarding capabilities. The High Policy profile allows for up to 256,000 policies on compatible switches, ensuring scalability for complex enterprise deployments.

- Dual-stack support: The High Dual Stack profile provides capacity for 64,000 endpoint MAC addresses and 64,000 endpoint IPv4 addresses, supporting large-scale, dual-stack network environments with both IPv4 and MAC-based traffic.

Key Statistics by Category

Switch Performance

- Switch models: Cisco ACI is compatible with Nexus 9300 and 9500 series switches, forming the hardware backbone of the platform.

- Port speeds: Ports support speeds of up to 400 Gbps, meeting the requirements of modern, high-performance data centers.

- Throughput: The Nexus 9500 series delivers up to 12.8 Tbps per line card, ensuring scalability for bandwidth-intensive applications.

Policy and Scale

- Policy scale: The High Policy profile supports up to 256,000 policies on compatible switches, enabling complex enterprise configurations.

- EP MAC and IPv4 scale: The High Dual Stack profile accommodates up to 64,000 endpoint MAC addresses and 64,000 IPv4 addresses, supporting large-scale deployments.

- High LPM profile: Provides support for 128,000 IPv4 and 64,000 IPv6 Layer 3 Prefix Limit (LPM) entries, expanding routing capabilities.

Deployment and Management

- Topology: ACI uses a two-tier leaf-and-spine architecture, simplifying scalability and traffic distribution.

- Centralized control: The Application Policy Infrastructure Controller (APIC) acts as the central management point for automation, monitoring, and policy enforcement.

- Stateless switches: Switches operate in a stateless mode, with policies automatically pushed from the APIC, eliminating the need for manual configuration at the switch level.

Ecosystem and Security

- Third-party integration: ACI offers open APIs for integration with diverse third-party solutions, enabling flexible ecosystem partnerships.

- Service chaining: Supports multivendor service graphs for deploying functions such as firewalls, intrusion prevention, and load balancing directly into the traffic path.

- Zero trust model: Applications are grouped into Endpoint Groups (EPGs), with traffic explicitly permitted through contracts, ensuring strong segmentation.

- Security features: ACI provides built-in security controls with granular visibility into application-level traffic, enhancing compliance and risk management.

U.S. Market Size

The market for Application Centric Infrastructure within the U.S. is growing tremendously and is currently valued at USD 1.21 billion, the market has a projected CAGR of 12.4%. The market is growing rapidly, driven by increasing adoption of cloud computing, AI, and software-defined networking. Enterprises are seeking flexible, secure, and automated infrastructure to support digital transformation and hybrid cloud strategies, enabling better application delivery and operational efficiency.

Additionally, strong investments by large enterprises and the public sector in scalable infrastructure, combined with a mature technology ecosystem and government policies favoring cybersecurity, are further accelerating market growth. This dynamic landscape is boosting demand for ACI solutions that improve network agility and security.

For instance, in June 2025, Cisco unveiled a new secure network architecture designed to power future campus, branch, and industrial networks with AI workloads in mind. The architecture offers unified management, next-generation high-capacity switches (up to 51.2Tbps throughput), advanced security with quantum-resistant protection, and AI-driven operational automation called AgenticOps, simplifying complex IT and OT operations while enhancing network security and reliability.

In 2024, North America held a dominant market position in the Global Application Centric Infrastructure Market, capturing more than a 42.3% share, holding USD 1.35 billion in revenue. This dominance is driven by strong technological innovation, substantial investments in digital transformation, and the rapid adoption of cloud-based solutions across industries such as finance, healthcare, and technology.

The region benefits from a robust ecosystem of technology providers and major cloud service platforms like AWS, Microsoft, and Google. Businesses in North America prioritize flexible, secure, and efficient application infrastructure to stay competitive, supported by favorable government policies and a mature technology landscape. This combination sustains North America’s leadership position in ACI market growth.

For instance, in September 2025, VMware announced VMware Cloud Foundation 9.0, the industry’s first unified private cloud platform. It integrates enhanced AI-ready data platforms and Private AI Services, enabling secure, scalable AI-native cloud infrastructure. Key partnerships with Broadcom, Canonical, and NVIDIA were highlighted to accelerate AI innovation, cloud-native app delivery, and cybersecurity, with major enterprise adoption including Walmart.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 46.3% share of the Global Application Centric Infrastructure Market. This reflects the continued importance of physical networking devices such as switches, routers, and servers that form the foundation of ACI systems.

Hardware provides the essential connectivity and processing capabilities needed for seamless application delivery and network performance. As organizations face increasing demands for faster and more reliable networks, investing in advanced hardware remains a priority to support efficient IT infrastructure.

Hardware’s role extends beyond simply connecting systems. It supports emerging technologies like artificial intelligence and cloud computing by delivering the necessary speed and stability. This continued investment in hardware innovation ensures that enterprises can meet evolving business needs while maintaining network security and agility.

For Instance, in June 2025, Cisco Systems introduced updates to its Application Centric Infrastructure hardware, focusing on enhancing the Cisco Nexus 9000 series spine and leaf switches. These improvements aimed to simplify network automation and boost performance for data centers, reinforcing Cisco’s leadership in network hardware for ACI solutions.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 87.9% share of the Global Application Centric Infrastructure Market. These organizations typically have complex IT environments that require scalable, secure, and highly automated infrastructures to support global operations.

ACI solutions help large enterprises optimize network management, improve application performance, and enhance security across vast networks. The scale and criticality of applications in large enterprises drive their need for advanced IT solutions like ACI. With digital transformation initiatives and cloud migrations well underway, these organizations benefit from ACI’s centralized management and policy automation.

For instance, in August 2025, VMware unveiled several new software and AI-driven infrastructure tools at its VMware Explore event, focusing on real-time application monitoring and full-stack infrastructure management. These innovations cater primarily to large enterprise clients, allowing them to automate compliance and operational tasks across complex IT environments, reducing downtime and improving service delivery.

End-Use Industry Analysis

In 2024, The IT & Telecom segment held a dominant market position, capturing a 32.1% share of the Global Application Centric Infrastructure Market. This sector demands highly reliable and flexible network infrastructure to manage massive data flows, cloud services, and next-generation technologies like 5G. ACI enables telecom and IT providers to automate network configurations, enhance security protocols, and streamline service delivery.

As the IT and Telecom industries continue to evolve rapidly, they require infrastructure that can adapt quickly to changing workloads and technological advancements. Application-centric approaches help these organizations reduce latency, improve network visibility, and maintain high service quality. This makes the sector a key driver of demand for ACI solutions worldwide.

For Instance, in February 2025, Dell Technologies announced its Open Telecom Transformation Program aimed at accelerating digital transformation for telecommunications providers. This initiative includes AI solutions and cloud infrastructure partnerships with major telecom vendors like Nokia to enhance network agility, scalability, and efficiency. Dell’s efforts help telecom operators modernize legacy systems and adopt cloud-native architectures in an increasingly competitive market.

Emerging Trends

One of the strongest trends shaping this market is the shift toward cloud-native architectures and edge computing adoption. Research reports indicate that by the end of 2025, 90% of applications will be cloud-native, driving demand for infrastructures that can support microservices, serverless platforms, and multi-cloud environments.

Edge computing is also rapidly expanding, enabling data processing closer to the source, which is critical for latency-sensitive applications. This trend toward decentralized infrastructure helps industries handle large data volumes more efficiently while maintaining the agility of application delivery. Another critical trend involves heavy investment in automation and AI integration, which is becoming standard across application infrastructure solutions.

Automation minimizes operational complexity and accelerates deployment cycles, while AI enhances performance optimization and security through continuous monitoring and anomaly detection. There is also a growing embrace of open-source technologies and modular architectures that provide flexibility and faster innovation cycles. These trends reflect an ongoing transformation toward more scalable, secure, and agile infrastructure ecosystems rooted in intelligent software-defined networking principles.

Growth Factors

Cloud adoption remains the primary growth driver, as organizations increasingly migrate workloads to cloud environments seeking scalability and cost efficiency. Robust demand for data center modernization and digital transformation initiatives also propels growth by encouraging adoption of automated and policy-driven network architectures.

AI-driven networking solutions contribute as well, enabling real-time resource allocation and predictive maintenance, which optimize performance while reducing downtime and costs. Reports show adoption of AI-based networking is rising steadily due to these operational advantages. Increased network complexity, fueled by IoT, AI/ML workloads, and the expansion of digital services, further drives demand for application centric infrastructure.

Businesses need agile networks capable of handling diverse application requirements securely and consistently. The rising importance of hybrid cloud models also spurs growth as companies seek seamless workload mobility across on-premises and cloud environments. Together, these factors create a compelling need for solutions that blend hardware and software into intelligent, policy-driven infrastructure capable of accelerating time to market and improving resource utilization.

Key Market Segments

By Component

- Hardware

- Switches

- Controllers

- Others

- Software

- On-Premises

- Cloud-based

- Services

- Professional Services

- Support & Maintenance

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By End-Use Industry

- IT & Telecom

- BFSI

- Healthcare & Lifesciences

- Retail & eCommerce

- Government & Defense

- Manufacturing

- Energy & Utilities

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Adoption of Cloud Computing and Automation

The growing use of cloud computing and hybrid IT environments is a key factor driving the Application Centric Infrastructure market. Organizations are increasingly adopting cloud models to gain scalability and operational flexibility. It helps automate the management of complex IT environments, speeding up application deployment and simplifying network operations. This capability supports businesses in adapting quickly to changing needs and enhances overall productivity.

Additionally, the integration of AI with ACI solutions enables real-time monitoring and resource optimization. This technology allows companies to predict potential failures and automatically adjust resources, minimizing downtime and improving efficiency. Together, cloud adoption and automation are fueling a strong demand for ACI systems in modern data centers and cloud platforms.

For instance, in June 2025, Hewlett Packard Enterprise expanded its networking automation capabilities through acquisitions and new AI-driven observability tools. HPE introduced a private 5G competency program to facilitate cellular connectivity in enterprise environments, focusing on business automation and operational efficiency. This move targets the growing demand for automated infrastructure in hybrid cloud environments.

Restraint

Complexity in Legacy System Integration

A significant barrier hampering the growth of the market is the challenge of integrating these modern solutions with existing legacy IT infrastructures. Many enterprises have older hardware and software that do not easily align with the policy-driven, automated nature. This results in complex, time-consuming, and costly migration processes that require specialized expertise.

The incompatibility between legacy systems and new ACI technologies limits the ability to fully automate network management and policy enforcement. This gap often results in slower adoption rates as organizations weigh the cost and risk of integration against the potential benefits.

For instance, in August 2025, VMware continued working on integrations between Cisco ACI and its vSphere virtualized environments to bridge physical and virtual network management. While enhancements improve automation and visibility, the ongoing need to support legacy virtualization platforms highlights integration complexity. Enterprises face challenges balancing older systems with new ACI-driven network policies, reflecting broader market restraint due to legacy system dependencies.

Opportunities

Edge Computing and IoT Expansion

The increase in edge computing and IoT device deployments provides new avenues for growth in the market. As data is increasingly generated at the network edge, there is a need for scalable, secure infrastructure close to these data sources. They offer automation and centralized policy management that suit the distributed nature of edge environments.

This trend is particularly salient in industries dependent on real-time data analysis and security, where IoT devices must reliably connect and communicate. Telecom and network providers are collaborating to build edge data centers and micro-networks, making ACI solutions critical to supporting these emerging infrastructures.

For instance, in October 2025, Nokia announced expanded AI-driven capabilities in its MantaRay automation platform by licensing software from HPE. This collaboration aims to boost autonomous infrastructure management for mobile networks and edge computing deployments, addressing the need for reliable, scalable infrastructure closer to data sources driven by IoT growth and 5G transition preparation.

Challenges

Need for Skilled Workforce

The shortage of skilled professionals familiar with ACI technology represents a major challenge for its widespread adoption. Managing ACI requires advanced knowledge in network automation, cloud integration, and policy-driven management, areas where many organizations lack in-house expertise.

This talent gap forces companies to invest heavily in training or rely on external consultants, increasing implementation costs and complexity. Without sufficient skill availability, companies may delay or limit their adoption of ACI solutions, restraining overall market growth.

For instance, in June 2025, reports on Juniper Networks highlighted its efforts to enable partner growth through enhanced programs and resources aimed at building expertise in AI-native networking solutions. Despite strong product innovation, expanding training and partner enablement remain critical to compensate for the industry’s ongoing shortage of skilled professionals capable of managing complex ACI deployments.

Key Players Analysis

The Application Centric Infrastructure Market is led by networking and IT infrastructure giants such as Cisco Systems, Inc., VMware, Inc., Juniper Networks, Inc., and Arista Networks, Inc. These companies dominate with advanced software-defined networking (SDN) platforms that integrate automation, policy-driven management, and analytics.

Prominent technology providers including Hewlett Packard Enterprise (HPE), Dell Technologies, Inc., Huawei Technologies Co., Ltd., Nokia Networks, and IBM Corporation contribute by offering end-to-end network orchestration, virtualization, and workload optimization. Their systems support large-scale data centers and enterprise IT environments, facilitating secure and adaptive application delivery aligned with evolving digital transformation goals.

Additional participants such as Fujitsu Ltd., Extreme Networks, Ciena Corporation, Broadcom Inc., F5 Networks, Inc., Citrix Systems, Inc., NEC Corporation, Check Point Software Technologies, Fortinet, Inc., Palo Alto Networks, Inc., and NetApp, Inc., along with other key players, focus on enhancing network visibility, security, and application control.

Top Key Players in the Market

- Cisco Systems, Inc.

- VMware, Inc.

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Hewlett Packard Enterprise (HPE)

- Dell Technologies, Inc

- Huawei Technologies Co., Ltd.

- Nokia Networks

- IBM Corporation

- Fujitsu Ltd.

- Extreme Networks

- Ciena Corporation

- Broadcom Inc.

- F5 Networks, Inc.

- Citrix Systems, Inc.

- NEC Corporation

- Check Point Software Technologies

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- NetApp, Inc.

- Others

Recent Developments

- In June 2025, Cisco Systems launched a new generation of AI-powered networking hardware, including the Cisco C9350 and C9610 Smart Switches, delivering up to 51.2Tbps throughput with ultra-low latency and enhanced security for AI workloads. They also expanded the wireless portfolio with new Wi-Fi 7 access points and introduced ruggedized industrial switches for AI-driven applications.

- In July 2025, Hewlett Packard Enterprise (HPE) completed the acquisition of Juniper Networks after resolving regulatory challenges. This acquisition doubles HPE’s networking business size, creating a leading portfolio for AI-native networking and integrated cybersecurity. Juniper’s former CEO, Rami Rahim, now leads the combined HPE Networking business.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 12 Bn CAGR(2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs), By End-Use Industry (IT & Telecom, BFSI, Healthcare & Lifesciences, Retail & eCommerce, Government & Defense, Manufacturing, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., VMware, Inc., Juniper Networks, Inc., Arista Networks, Inc., Hewlett Packard Enterprise (HPE), Dell Technologies, Inc., Huawei Technologies Co., Ltd., Nokia Networks, IBM Corporation, Fujitsu Ltd., Extreme Networks, Ciena Corporation, Broadcom Inc., F5 Networks, Inc., Citrix Systems, Inc., NEC Corporation, Check Point Software Technologies, Fortinet, Inc., Palo Alto Networks, Inc., NetApp, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Application Centric Infrastructure MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Application Centric Infrastructure MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- VMware, Inc.

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Hewlett Packard Enterprise (HPE)

- Dell Technologies, Inc

- Huawei Technologies Co., Ltd.

- Nokia Networks

- IBM Corporation

- Fujitsu Ltd.

- Extreme Networks

- Ciena Corporation

- Broadcom Inc.

- F5 Networks, Inc.

- Citrix Systems, Inc.

- NEC Corporation

- Check Point Software Technologies

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- NetApp, Inc.

- Others