Global Appetite Suppressants Market Analysis By Product Type (Prescription appetite suppressants (Liraglutide, Semaglutide, Tirzepatide, Naltrexone-bupropion, Phentermine-topiramate, Benzphetamine, Diethylpropion, Phendimetrazine, Phentermine), Non-prescription appetite suppressants (Caffeine-based supplements, Green tea extract, Glucomannan, Conjugated Linoleic Acid (CLA), Bitter Orange (Synephrine), Garcinia Cambogia, Others)), By Form (Tablets & capsules, Liquids, Powder, Others), By Route of Administration (Oral, Injectables, Transdermal patches), By Application (Obesity Management, Metabolic Health Support, Sports & Fitness Support, Bariatric Care Support), By Age Group (13-17 years, 18-30 years, 31-50 years, 50 years & above), By Gender (Female, Male), By Distribution Channel (Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Specialty Nutrition & Wellness Stores, Online/e-commerce platforms, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167962

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

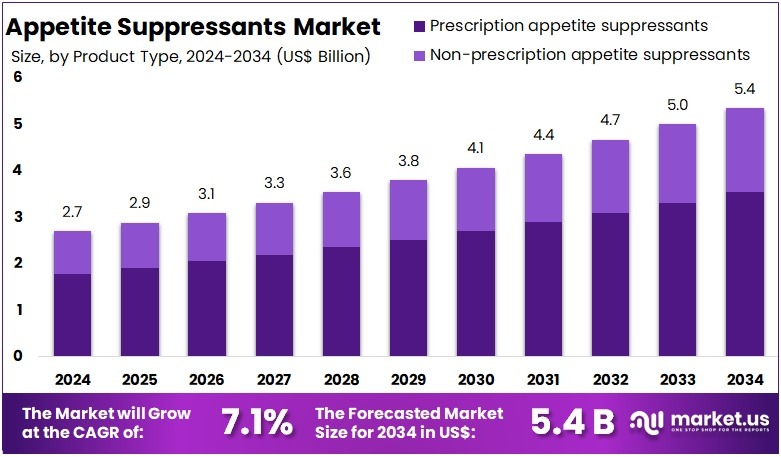

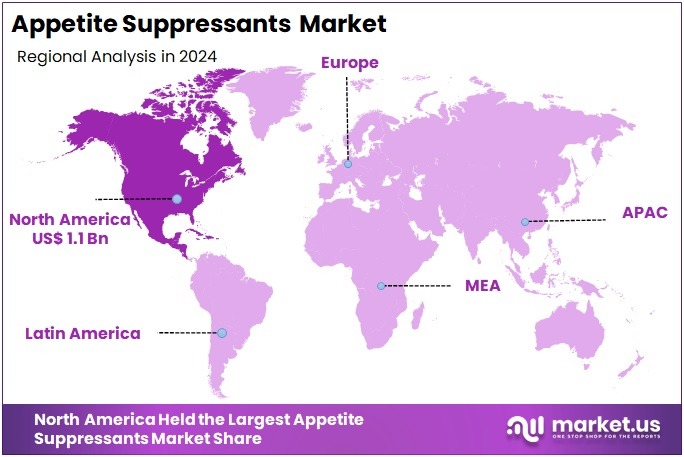

The Global Appetite Suppressants Market size is expected to be worth around US$ 5.4 Billion by 2034, from US$ 2.7 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.3% share and holds US$ 1.1 Billion market value for the year.

Appetite suppressants form a core component of structured weight-management programs, as these products help reduce hunger signals and improve satiety. Their relevance has increased because obesity is now recognized as a chronic health condition rather than a behavioral issue. According to public health authorities, long-term weight control often requires pharmacologic support when lifestyle measures alone do not achieve adequate results.

The sector is expanding because global weight-related challenges continue to intensify across regions. Multiple health bodies report that the rising prevalence of excess weight is creating consistent demand for therapeutic appetite control. According to global assessments for 2022, more than 1 billion people were living with obesity, and around 43% of adults were overweight. These proportions show that one in eight people already live with obesity, widening the patient base for long-term appetite regulation products.

The financial burden associated with obesity is another central factor supporting growth. Health systems worldwide are facing rising treatment costs for diabetes, cardiovascular disease, and other obesity-related complications. According to a study by the World Obesity Federation, overweight and obesity could reduce global GDP by 2.9% by 2035. Economic losses may exceed USD 4 trillion per year if current conditions persist, encouraging investment in preventive and therapeutic appetite suppressants.

Long-term projections confirm that obesity is expected to remain a major global health challenge. Analysts emphasize that rising rates among adults and children make obesity a persistent structural issue rather than a temporary trend. For example, the World Obesity Atlas 2024 suggests that the number of adults with obesity may rise from 0.81 billion in 2020 to about 1.5 billion by 2035. WHO further notes that adult obesity has more than doubled since 1990, while childhood and adolescent obesity has increased four-fold, reinforcing sustained demand for appetite control solutions.

Regulatory Momentum, Therapeutic Innovation, and Market Expansion

Regulatory clarity is supporting innovation in obesity and appetite suppressant therapies. Authorities are now emphasizing long-term weight maintenance and improvements in obesity-related outcomes. According to updated FDA draft guidance, drug developers must demonstrate durable fat reduction and clinically meaningful benefits. This structured framework lowers development uncertainty and encourages investment in chronic-use appetite suppressants.

A wave of therapeutic advancements has strengthened confidence in pharmacologic appetite control. Clinical outcomes have shown that modern agents can deliver sustained weight loss and reliable appetite reduction. For example, FDA approvals include orlistat, phentermine-topiramate, naltrexone-bupropion, liraglutide, semaglutide, and tirzepatide for long-term weight management. In Europe, the EMA has authorized GLP-1 receptor agonists such as liraglutide and semaglutide for eligible patients, demonstrating broad regulatory acceptance.

Growing recognition of obesity as a disease has also influenced prescribing patterns. Medical organizations emphasize that obesity involves genetic, environmental, and metabolic factors that require structured medical intervention. According to WHO expert reviews, GLP-1 therapies are now used across North America, Europe, Asia, and Australia, and they offer substantial weight reduction in people with comorbidities. This clinical repositioning supports broader reimbursement and strengthens market growth.

Supply-side developments further shape sector performance. Manufacturers are working to increase output as demand continues to outpace available supply in many regions. For instance, EMA reports have highlighted significant demand surges for GLP-1 receptor agonists and noted temporary shortages. These conditions reflect the scale of global adoption, and as capacity expands and more competitors enter the market, overall access and market volumes are expected to rise steadily.

Key Takeaways

- The Global Appetite Suppressants Market is projected to reach US$ 5.4 Billion by 2034 from US$ 2.7 Billion in 2024, driven by a 7.1% CAGR.

- Prescription appetite suppressants were described as the leading product type in 2024, accounting for over 66.3% of total market share.

- Tablets and capsules were noted as the dominant formulation category in 2024, capturing more than 72.5% of the overall market demand.

- The oral route of administration was identified as holding a strong lead in 2024, representing over 69.6% of total usage.

- Obesity management was highlighted as the primary application area in 2024, contributing more than 60.1% of the segment share.

- Consumers aged 31–50 years were recognized as the largest age-based user group in 2024, accounting for more than 42.0% of demand.

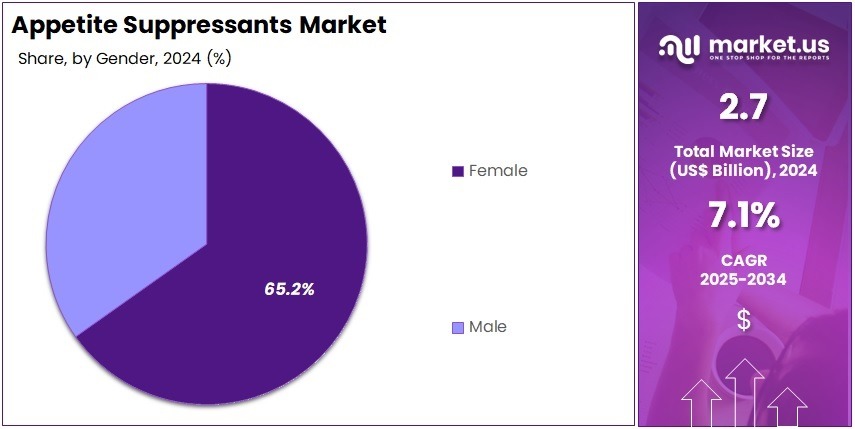

- Female consumers were observed as the leading demographic segment in 2024, representing over 65.2% of the total market share.

- Pharmacies and drug stores were reported as the principal distribution channel in 2024, securing more than 45.6% of overall sales.

- North America was identified as the dominant regional market in 2024, holding a 42.3% share valued at approximately US$ 1.1 Billion.

Product Type Analysis

In 2024, the ‘Prescription appetite suppressants’ held a dominant market position in the Product Type Segment of Appetite Suppressants Market, and captured more than a 66.3% share. This leadership was driven by the rising incidence of obesity and the strong clinical performance of prescription therapies. Demand grew as physicians endorsed regulated products with proven outcomes. Patients showed higher adherence due to reliable weight-control benefits. Expanded insurance support also strengthened uptake and improved access across major regional markets.

Prescription products such as liraglutide, semaglutide, and tirzepatide recorded strong adoption. Their effectiveness in appetite regulation and weight reduction supported consistent demand. Safety profiles improved through continuous clinical evaluation. Medical supervision further enhanced consumer trust. The availability of combination therapies also increased usage. Structured treatment plans encouraged better long-term compliance. These factors collectively reinforced the dominance of prescription options and sustained their competitive advantage throughout the assessment period across both developed and emerging regions.

Non-prescription appetite suppressants experienced steady but limited growth. This segment included caffeine-based supplements, green tea extract, glucomannan, CLA, bitter orange, garcinia cambogia, and other natural products. Consumer interest was supported by easy access, lower cost, and rising preference for plant-based solutions. However, the overall impact remained modest due to variable efficacy. Lack of consistent clinical validation also reduced adoption. Regulatory differences across markets created uncertainty. These challenges restricted the segment’s ability to compete with prescription products.

A clear performance gap remained between prescription and non-prescription categories. Clinical strength drove the premium positioning of prescription drugs, while natural supplements attracted cost-sensitive consumers seeking convenient options. Market dynamics reflected a shift toward evidence-based weight-management solutions. Healthcare providers influenced decision-making by promoting therapies with measurable outcomes. Ongoing innovation in metabolic treatments is expected to expand the prescription segment further. Meanwhile, the non-prescription segment will grow slowly as demand remains centered on wellness-oriented users.

Form Analysis

In 2024, the ‘Tablets & capsules’ held a dominant market position in the Form Segment of the Appetite Suppressants Market and captured more than a 72.5% share. The segment maintained strong demand due to its ease of use. It offers accurate dosing and longer shelf stability. These advantages improved acceptance among consumers. Rising use in weight-management routines further supported growth. The format is expected to remain prevalent.

The liquid form recorded steady progress in the market. It gained traction due to faster absorption and suitability for consumers with swallowing difficulties. However, its overall use remains lower because of shorter shelf stability and higher transport costs. Powder formats showed moderate adoption. These products offer flexible consumption options and align with personalized nutrition trends. Their growth is supported by rising interest in meal-replacement blends across online channels. This trend is expected to continue.

Other formats, including gummies, sprays, and patches, experienced gradual acceptance in the market. These products appeal to consumers seeking novel and convenient delivery options. Functional gummies, in particular, are gaining visibility due to improved taste and portability. However, adoption remains limited because of higher production complexity and lower availability. Ongoing innovation is expected to expand this category. The segment will grow as manufacturers introduce diverse formulations that support user compliance and enhance overall product appeal.

Route of Administration Analysis

In 2024, the ‘Oral’ route held a dominant market position in the Route of Administration segment of the Appetite Suppressants Market, and captured more than a 69.6% share. Strong patient acceptance supported this leadership. Easy dosing improved adherence. Wide product availability strengthened uptake across regions. Low administration barriers encouraged frequent use. Oral formats also fitted well within routine weight-management plans. The segment benefited from broad access through retail and online channels, which increased consistent consumption.

The injectable route held a smaller share but showed steady improvement. Rising use of advanced weight-management therapies supported this trend. Higher bioavailability offered clinical benefits. The segment gained attention due to medical supervision requirements that ensured safe dosing. However, cost and the need for trained professionals limited rapid expansion. Increasing adoption of novel formulations is expected to support future growth. Injectables remained important for patients requiring targeted delivery and stronger therapeutic responses.

Transdermal patches represented a niche segment with gradual progress. Their non-invasive nature improved comfort for specific patient groups. Controlled drug release enhanced adherence. Limited product variety restrained widespread adoption. Higher production complexity also restricted faster growth. Ongoing development in patch-based delivery technologies is expected to support long-term opportunities. Demand for alternative administration routes encouraged innovation. The segment continued to attract attention from manufacturers exploring differentiated solutions for appetite control and sustained therapeutic outcomes.

Application Analysis

In 2024, the ‘Obesity Management’ held a dominant market position in the Application Segment of Appetite Suppressants Market, and captured more than a 60.1% share. The segment advanced due to rising obesity cases. High awareness of weight-related risks encouraged product adoption. Demand grew as structured weight control programs expanded. Clinical guidance supported wider use. The focus on safe appetite control strengthened market uptake. Preventive health priorities also contributed to segment resilience across key regions.

The Metabolic Health Support segment reported steady progress. Growth was driven by rising metabolic disorders. Conditions such as diabetes and insulin resistance increased product need. Consumers sought solutions that helped maintain glucose balance. Preventive care trends supported consistent demand. The Sports and Fitness Support segment added further momentum. Interest in active lifestyles sustained product uptake. Athletes used appetite control aids to support training goals. Broader fitness participation reinforced market expansion.

The Bariatric Care Support segment showed gradual expansion. Growth was influenced by an increasing volume of bariatric procedures. Post-surgical patients used appetite management products to support recovery. Clinical protocols encouraged controlled intake. Structured nutrition plans improved adherence. The segment benefited from rising demand for guided weight-maintenance solutions. Healthcare providers promoted monitored supplementation. Wider acceptance of medical weight-loss pathways supported ongoing uptake. The combined effect strengthened the long-term outlook for appetite suppressant applications.

Age Group Analysis

In 2024, the ‘31-50 years‘ segment held a dominant market position in the Age Group Segment of the Appetite Suppressants Market and captured more than a 42.0% share. This dominance was driven by higher obesity levels in adults. Busy routines and limited physical activity increased reliance on suppressants. Strong awareness of weight-management solutions also supported demand. Consumers in this group showed higher spending power. Premium and natural formulations gained traction. The segment is expected to remain the key demand driver.

The 18-30 years segment represented a notable share. Interest in fitness trends supported wider product use. Young adults responded strongly to digital wellness campaigns. Social media also influenced their product choices. Natural suppressants gained popularity in this group. The 50 years and above category showed steady growth. Rising metabolic health issues supported usage in older adults. Mild and clinically guided formulations were preferred. Safety awareness played a vital role in shaping their buying behavior and overall market acceptance.

The 13-17 years segment held a limited share due to strict regulations. Usage remained closely supervised by healthcare providers. Parents preferred nutritional counseling over appetite suppressants. Growth in this group is expected to stay slow. Across all age groups, shifting lifestyle patterns influenced consumption trends. Adults drove the highest adoption levels. Younger adults showed strong interest in wellness-driven products. Older adults relied on physician-recommended solutions. These patterns shaped the overall age-based structure of the appetite suppressants market.

Gender Analysis

In 2024, the ‘Female’ segment held a dominant market position in the Gender Segment of the Appetite Suppressants Market, and captured more than a 65.2% share. This leadership was driven by rising health awareness among women. Demand increased due to concerns related to weight control. Adoption of natural formulations also grew. Urban consumers showed strong interest. Digital wellness platforms supported product visibility. Preventive health habits improved usage rates. These factors strengthened the segment and drove consistent growth.

The female segment also benefited from higher engagement with structured diet programs. Many users preferred suppressants for appetite control. Online retail channels expanded access. Social media trends influenced buying decisions. Increased focus on hormonal balance supported category adoption. Product availability improved across regions. Emerging markets demonstrated rising acceptance. These developments reinforced the long-term potential of the segment. Continuous interest in wellness solutions is expected to sustain growth over the forecast period.

The male segment accounted for the remaining share of the market in 2024. Growth in this group remained steady. Fitness participation increased. Interest in fat-loss products rose gradually. Many users preferred stimulant-based formulas. Awareness of metabolic health improved adoption. However, usage levels remained lower than those of females. Product uptake was higher in sports-focused consumers. Broader acceptance is anticipated as more men adopt structured weight-management routines. These trends indicate balanced growth prospects for both gender segments.

Distribution Channel Analysis

In 2024, the ‘Pharmacies & Drug Stores’ held a dominant market position in the Distribution Channel Segment of the Appetite Suppressants Market, and captured more than a 45.6% share. This leadership was driven by strong consumer trust and direct access to licensed pharmacists. The availability of prescription and over-the-counter products supported steady demand. Regulated dispensing improved safety and confidence. Clear product labeling and medical guidance further increased adoption. These factors strengthened the overall influence of this channel.

Supermarkets and hypermarkets showed consistent growth during the year. High product visibility and competitive prices supported wider adoption. Large retail chains expanded weight-management assortments to meet rising demand. Specialty nutrition and wellness stores also performed well. These outlets attracted consumers seeking natural solutions and expert advice. Trained staff and curated product lines increased buyer confidence. Their emphasis on holistic health supported ongoing interest in plant-based and clean-label appetite suppressants across developed urban markets.

Online and e-commerce platforms recorded rapid expansion. Easy access, product comparison, and discreet purchasing improved digital adoption. Subscription programs supported repeat buying. Promotional discounts and targeted advertising increased traffic. Other channels, including convenience stores, fitness centers, and direct-to-consumer models, added incremental value. Their reach remained smaller but continued to rise. Urban lifestyles and on-the-go consumption patterns supported this trend. Overall, the distribution landscape became more diverse while maintaining strong reliance on pharmacy-based purchases.

Key Market Segments

By Product Type

- Prescription appetite suppressants

- Liraglutide

- Semaglutide

- Tirzepatide

- Naltrexone-bupropion

- Phentermine-topiramate

- Benzphetamine

- Diethylpropion

- Phendimetrazine

- Phentermine

- Non-prescription appetite suppressants

- Caffeine-based supplements

- Green tea extract

- Glucomannan

- Conjugated Linoleic Acid (CLA)

- Bitter Orange (Synephrine)

- Garcinia Cambogia

- Others

By Form

- Tablets & capsules

- Liquids

- Powder

- Others

By Route of Administration

- Oral

- Injectables

- Transdermal patches

By Application

- Obesity Management

- Metabolic Health Support

- Sports & Fitness Support

- Bariatric Care Support

By Age Group

- 13-17 years

- 18-30 years

- 31-50 years

- 50 years & above

By Gender

- Female

- Male

By Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Specialty Nutrition & Wellness Stores

- Online/e-commerce platforms

- Others

Drivers

Escalating Obesity Burden Driving Demand for Appetite Suppressants

The rising global burden of obesity has emerged as a major factor driving the adoption of appetite suppressants. The growth of this segment can be attributed to rapid lifestyle changes, high-calorie dietary patterns, and reduced physical activity, which have contributed to widespread weight gain. Increasing awareness of obesity-related health complications has strengthened the need for effective weight-management solutions. As a result, the market has been witnessing greater interest in products that support appetite control, improve satiety, and reduce excessive caloric intake.

Growing health risks associated with obesity have intensified the demand for therapeutic interventions that help regulate eating behavior. The prevalence of metabolic disorders, diabetes, and cardiovascular diseases has reinforced the importance of appetite-modulating products as part of comprehensive treatment plans. This trend has supported the shift toward clinical and consumer adoption of pharmacologic agents that manage hunger and prevent overeating. The expansion of the overweight population has therefore created sustained momentum for appetite suppression therapies.

According to the World Health Organization, an estimated 2.5 billion adults were overweight in 2022. Within this group, about 890 million people were living with obesity, representing 43% of adults being overweight and 16% classified as obese. It was also reported that one in eight individuals globally was affected by obesity. These figures illustrate the scale of the problem and highlight the increasing dependence on structured interventions. For instance, appetite suppressants are being considered essential tools to support regulated energy intake.

Further evidence reinforces the critical need for these solutions. A study by ScienceDirect estimated that more than 1 billion people worldwide were obese in 2022, accounting for nearly 13% of the global population. This finding confirmed that obesity has reached epidemic proportions. The rising disease burden has accelerated clinical interest in pharmacologic appetite suppression. For example, satiety-enhancing agents are being integrated into broader obesity management programs to reduce food cravings and improve long-term weight outcomes.

Restraints

Safety Concerns and Regulatory Scrutiny in the Appetite Suppressants Market

Market expansion has been restricted by rising safety concerns and tighter regulatory scrutiny surrounding appetite suppressants. The restraint has emerged because product evaluations now emphasize long-term safety, adverse effects, and clinical risk–benefit balance. The growth of the market has been affected as several chemical-based products have faced questions regarding toxicity and systemic effects. This situation has led to lower consumer confidence. It has also created a challenging approval pathway for manufacturers seeking rapid commercialization of new centrally acting appetite control formulations.

Stringent reviews have increased the regulatory burden and delayed the introduction of new pharmacologic options. Approval processes now require extensive data on sustained efficacy, tolerability, and post-marketing safety. For instance, regulatory bodies have implemented stronger monitoring frameworks after repeated concerns related to cardiovascular and metabolic risks. These measures have contributed to limited product visibility and slower innovation cycles. As a result, overall market penetration has been influenced by prolonged evaluations and a more conservative environment for appetite suppressant development.

According to a study by NCBI, the U.S. FDA requested the withdrawal of lorcaserin in 2020 after a large safety trial of nearly 12,000 patients reported a higher cancer incidence compared with placebo. For example, increased cases of pancreatic, colorectal, and lung cancers were observed in treated groups. This regulatory action strengthened caution regarding serotonin-modulating agents. It also reinforced the need for continuous oncologic monitoring. The incident prompted clinicians to adopt a more risk-averse approach toward prescribing centrally acting suppressants.

A study published in The Lancet in 2025 emphasized that such events have encouraged regulators to apply more rigorous benefit–risk assessments to weight-loss medications. For example, long-term evaluation of cardiovascular, psychiatric, and oncologic outcomes is now required before broad market adoption. These heightened requirements have slowed product pipelines and reshaped investment priorities. According to this review, the industry continues to face challenges due to increased evidence-based scrutiny, which has constrained market expansion and reinforced safety as a key restraining factor for appetite suppressants.

Opportunities

Growing Demand For Natural And Plant-Based Formulations

A substantial opportunity has emerged in the appetite suppressants category due to rising consumer demand for natural, clean-label, and plant-based solutions. The shift toward botanical ingredients has strengthened market acceptance for supplements that support satiety and calorie control. The growth of the market can be attributed to the increasing preference for green tea extract, garcinia cambogia, glucomannan, and dietary fibers. These products are perceived as safe and familiar, which encourages wider use. New product development and premium positioning are being enabled by this trend.

A parallel opportunity is being created by advancements in high-efficacy hormonal satiety agents. Appetite suppressants are benefiting from innovations that target hormonal pathways related to fullness and metabolic regulation. Growing interest in GLP-1 receptor agonists, dual GIP/GLP-1 agonists, and GLP-1–amylin combinations has expanded the commercial potential for appetite-focused products. The demand is rising because these agents produce significant weight-management outcomes. As awareness increases, the appetite suppressant segment is expected to integrate more clinically validated mechanisms that raise consumer trust and support premium pricing.

The rise in efficacy is supported by several clinical findings. According to a review published on ScienceDirect in 2024, semaglutide delivered around 12% placebo-corrected weight loss, indicating stronger appetite-reducing performance than older agents. Study by Nature reported that this reduction could be sustained for four years. For example, improvements in anthropometric measures were observed consistently versus placebo. Such long-term outcomes strengthen confidence in hormonal satiety mechanisms. These findings reinforce the potential for innovations that enhance appetite suppression through pharmacological pathways.

Recent clinical trials further highlight the competitive advantage for advanced appetite suppressants. According to the New England Journal of Medicine in 2025, tirzepatide achieved 20.2% mean weight reduction at 72 weeks, exceeding semaglutide under similar study conditions. Study by JAMA Network also confirmed higher average weight loss in real-world comparisons. For instance, a Reuters update in 2025 stated that amycretin reached up to 24% weight loss in non-diabetic individuals. These findings demonstrate significant market potential as payers increasingly recognize obesity as a chronic disease requiring targeted satiety therapies.

Trend

Shift Toward Multifunctional Weight-Management Products

A major trend in the appetite suppressants market has been the transition toward multifunctional solutions that deliver broader wellness benefits. The growth of the market can be attributed to rising consumer demand for products that support appetite control alongside metabolism improvement, energy enhancement, and gut-health balance. This shift has strengthened product differentiation across supplements, functional foods, and beverages. The preference for holistic outcomes has increased adoption, as consumers seek products that offer both weight-management effects and additional health value in a single formulation.

The market has also been shaped by a clear movement away from traditional over-the-counter diet pills toward clinically validated and regulated pharmacotherapies. This shift has been driven by the need for sustained weight-loss outcomes and stronger scientific evidence. Study findings highlight that consumers increasingly favor therapies backed by clinical trials and guideline recommendations. As a result, appetite-suppressant products are moving from short-term solutions toward long-term chronic treatment frameworks supported by healthcare providers.

According to the U.S. NIH Office of Dietary Supplements, about 15% of adults in the United States have used weight-loss dietary supplements. For instance, usage is higher in women at 21% compared with 10% in men, and spending on pill-based weight-loss products is estimated at nearly USD 2.1 billion per year. However, the same source notes that evidence for meaningful and sustained weight loss remains limited for most OTC supplements, despite their claims of appetite reduction or metabolic support.

Clinical guidelines further reinforce the shift toward evidence-based pharmacotherapy. According to Gastro Journal, recommendations now support initiating medication at BMI thresholds of ≥30 kg/m², or ≥27 kg/m² with comorbidities, and endorse agents such as semaglutide 2.4 mg. Study by The Lancet indicates that research is progressing beyond older stimulatory suppressants toward hormone-based and combination therapies. For example, findings reported by The Guardian show significant weight regain after stopping advanced agents like tirzepatide, emphasizing their role as chronic treatments.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.3% share and holding a US$ 1.1 billion market value for the year. The region showed strong demand for appetite suppressants due to rising obesity rates and growing interest in weight-management solutions. Consumers remained highly aware of health risks linked to excess weight. This awareness increased the use of products that support appetite control. Consistent adoption across different age groups reinforced market expansion.

Growth in the region was supported by advanced healthcare systems and high spending on wellness products. Preventive health practices were widely encouraged. This helped consumers adopt appetite suppressants as part of daily routines. Information about supplement use was easily accessible. Healthcare professionals also guided consumers toward safe options. These factors strengthened the regional market. Rising concerns about lifestyle-related conditions further elevated demand for solutions that help manage appetite and support healthier eating habits.

North America also benefited from strong retail and online distribution channels. Pharmacies and large retail chains provided easy access to products. E-commerce platforms expanded reach and improved product availability. Subscription models encouraged regular purchases and stable demand. Clear labeling supported quick decision-making. Frequent promotions helped increase visibility. Digital platforms made information simple to understand. These distribution strengths ensured consistent product exposure and reinforced the region’s leadership in appetite suppressant adoption.

Regulatory oversight contributed to consumer trust and strengthened product credibility. Strict quality standards ensured safety. This compliance encouraged responsible development of appetite suppressants. Natural and clean-label formulations gained popularity. Consumers preferred plant-based options with transparent ingredient lists. This shift aligned with broader wellness habits in the region. Steady interest in science-backed products supported long-term market growth. As a result, North America is expected to maintain its leading position in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The appetite suppressants market includes several strong prescription and consumer-health players. Companies such as Novo Nordisk and Eli Lilly are shaping clinical practice with advanced weight-management drugs. Their products deliver high efficacy and strong safety profiles. These firms also invest heavily in R&D. This strengthens their long-term position. Their commercial scale, global presence, and payer engagement allow them to lead prescription demand. As a result, they continue to influence innovation cycles and treatment guidelines.

A second group includes companies linked to established prescription options. Firms such as Takeda and Orexigen Therapeutics support non-GLP therapies that remain relevant for selected patient groups. These products offer moderate efficacy but stable adoption. Their market strength comes from clinical familiarity and cost advantages. Companies in this segment focus on lifecycle management and targeted commercialization. They also rely on partnerships in key regions. This helps them maintain demand in a competitive market where newer drugs dominate.

Another part of the market features differentiated technologies. Gelesis Holdings, for example, offers a nonsystemic oral hydrogel that supports fullness without systemic exposure. This creates a unique positioning compared with drug-based therapies. Companies like Teva Pharmaceutical strengthen access through generics and broad manufacturing scale. Their presence enhances affordability and availability. These players focus on volume growth and supply reliability. Their contribution helps diversify treatment choices for consumers and expands options beyond high-cost prescription drugs.

The broader ecosystem includes consumer-health and nutrition companies. Firms such as Nestlé, Unilever, GNC, Nature’s Bounty, Haleon, and NOW Foods supply supplements and functional products for appetite control. Their strength lies in branding, retail penetration, and price flexibility. Companies like Procter & Gamble, Bayer AG, Sun Pharma, and Currax Pharmaceuticals add scale through regional and global channels. These players target wellness-driven users. Their strategies focus on portfolio diversity, marketing, and rapid product launches to capture growing lifestyle-weight-management demand.

Market Key Players

- Novo Nordisk A/S

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Orexigen Therapeutics Inc.

- Teva Pharmaceuticals USA

- Taj Pharma

- Sinew Nutrition

- Gelesis Holdings Inc.

- Sun Pharmaceutical Industries Ltd.

- Innovent Biologics Inc.

- Currax Pharmaceuticals

- Haleon group

- GNC Holdings LLC

- NOW Foods

- Procter & Gamble

- Nestlé

- Nature’s Bounty

- Unilever

- Bayer AG

Recent Developments

- In December 2024: Lilly announced that the FDA approved Zepbound for treatment of moderate-to-severe obstructive sleep apnea (OSA) in adults with obesity, to be used alongside diet and physical activity. This label expansion further embedded tirzepatide as a key obesity-related therapy, recognizing weight reduction via appetite and metabolic effects as central to OSA management in these patients.

- In June 2024: The FDA listed the first-time generic approval for Qsymia, an oral chronic weight-management drug combining phentermine (a sympathomimetic appetite suppressant) and topiramate extended-release. The approval, under ANDA 204982, went to Actavis Laboratories FL, Inc., which is a subsidiary of Teva. This was a major generic entry into the prescription appetite-suppressant pill market.

- In March 2024: The U.S. FDA approved a new indication for Wegovy (semaglutide 2.4 mg), making it the first weight-loss medicine also approved to reduce the risk of cardiovascular death, heart attack, and stroke in adults with established cardiovascular disease who are overweight or obese. This reinforced Wegovy’s positioning not only as an appetite-suppressing GLP-1 therapy but also as a cardiometabolic risk-reduction drug.

Report Scope

Report Features Description Market Value (2024) US$ 2.7 Billion Forecast Revenue (2034) US$ 5.4 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Prescription appetite suppressants (Liraglutide, Semaglutide, Tirzepatide, Naltrexone-bupropion, Phentermine-topiramate, Benzphetamine, Diethylpropion, Phendimetrazine, Phentermine), Non-prescription appetite suppressants (Caffeine-based supplements, Green tea extract, Glucomannan, Conjugated Linoleic Acid (CLA), Bitter Orange (Synephrine), Garcinia Cambogia, Others)), By Form (Tablets & capsules, Liquids, Powder, Others), By Route of Administration (Oral, Injectables, Transdermal patches), By Application (Obesity Management, Metabolic Health Support, Sports & Fitness Support, Bariatric Care Support), By Age Group (13-17 years, 18-30 years, 31-50 years, 50 years & above), By Gender (Female, Male), By Distribution Channel (Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Specialty Nutrition & Wellness Stores, Online/e-commerce platforms, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novo Nordisk A/S, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Orexigen Therapeutics Inc., Teva Pharmaceuticals USA, Taj Pharma, Sinew Nutrition, Gelesis Holdings Inc., Sun Pharmaceutical Industries Ltd., Innovent Biologics Inc., Currax Pharmaceuticals, Haleon group, GNC Holdings LLC, NOW Foods, Procter & Gamble, Nestlé, Nature’s Bounty, Unilever, Bayer AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Appetite Suppressants MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Appetite Suppressants MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novo Nordisk A/S

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Orexigen Therapeutics Inc.

- Teva Pharmaceuticals USA

- Taj Pharma

- Sinew Nutrition

- Gelesis Holdings Inc.

- Sun Pharmaceutical Industries Ltd.

- Innovent Biologics Inc.

- Currax Pharmaceuticals

- Haleon group

- GNC Holdings LLC

- NOW Foods

- Procter & Gamble

- Nestlé

- Nature's Bounty

- Unilever

- Bayer AG