Global Apiculture Market Size, Share, And Business Benefits By Type (Honey, Beeswax, Propolis, Others), By Methods (Traditional Beekeeping, Modern Beekeeping), By End Use (Food and Beverages, Medical, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155121

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

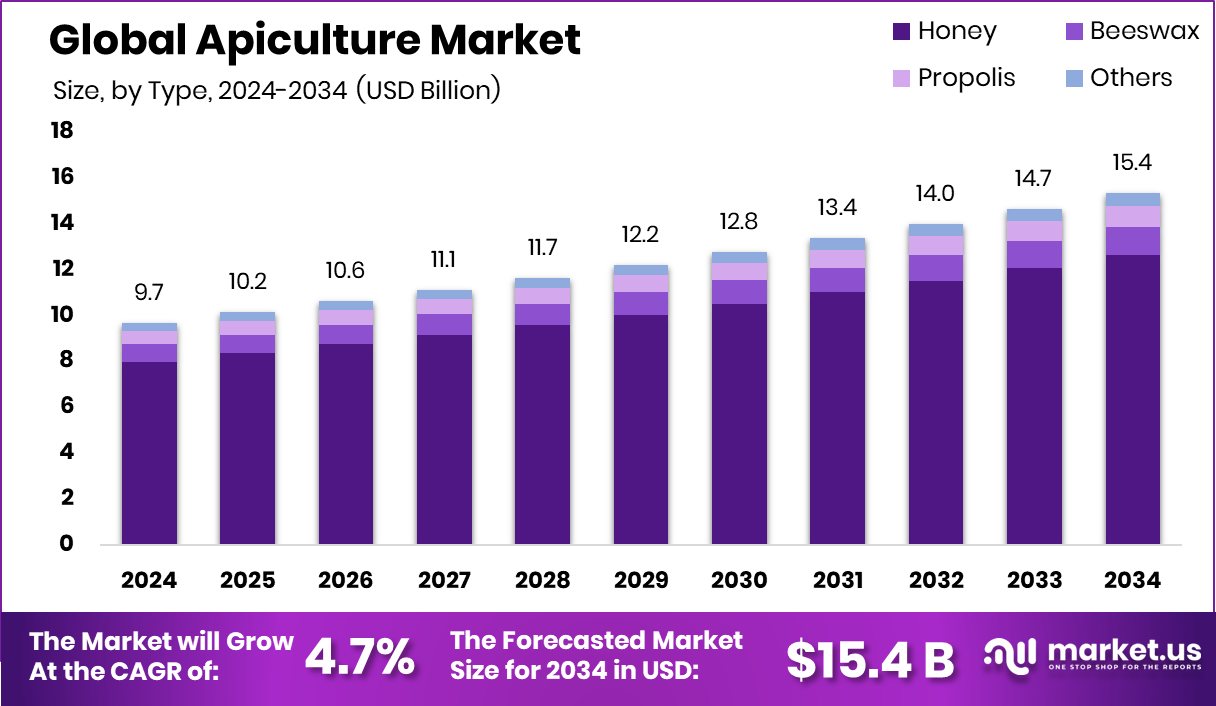

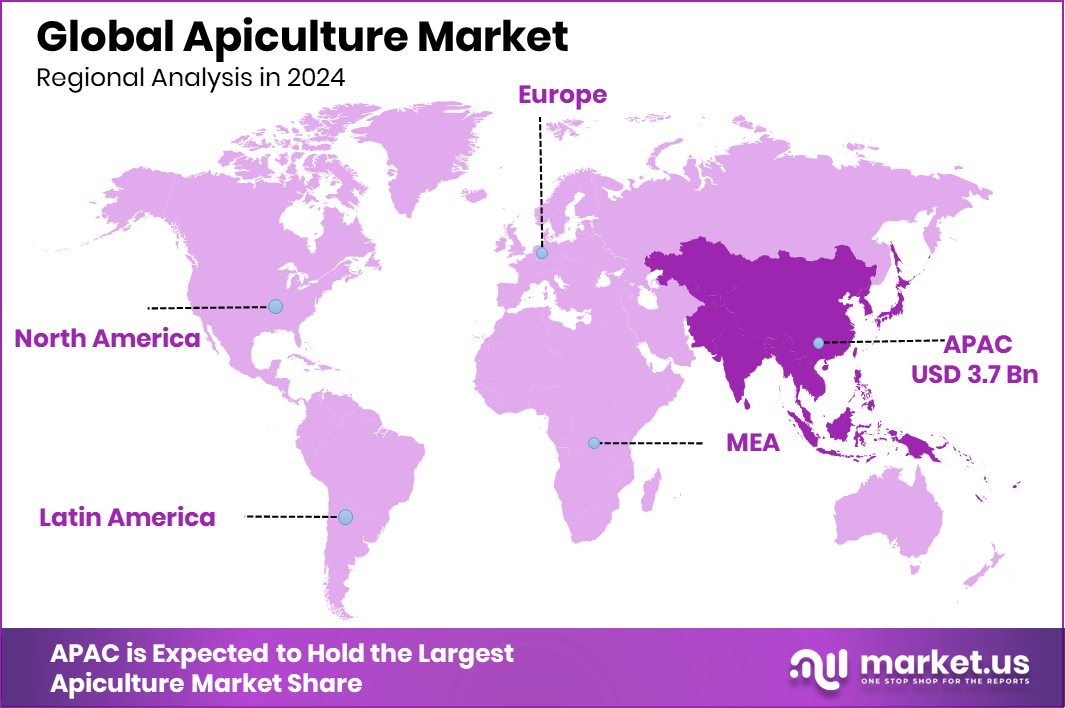

The Global Apiculture Market is expected to be worth around USD 15.4 billion by 2034, up from USD 9.7 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. Asia-Pacific’s USD 3.7 Bn market benefits from growing beekeeping.

Apiculture, also known as beekeeping, is the practice of maintaining bee colonies to produce honey, beeswax, royal jelly, and other bee-related products. It also plays a vital role in pollination, which supports agricultural productivity and biodiversity. Beekeeping can be done on a small or large scale, and it has significant environmental benefits by supporting healthy ecosystems and boosting crop yields.

The apiculture market refers to the industry that revolves around the production, processing, and distribution of honey, bee-derived products, and pollination services. It includes both small-scale beekeepers and large commercial operations catering to local and global demand. This market is also influenced by environmental factors, consumer trends toward natural products, and the increasing importance of pollination in sustainable agriculture.

One of the key growth factors for apiculture is the rising awareness about the health benefits of honey and other natural bee products. With consumers shifting toward organic and chemical-free food items, demand for high-quality, raw honey is expanding steadily. Additionally, the use of bees in pollinating crops is boosting agricultural yields, further driving the sector’s value. According to an industry report, Beekeepers seek training as the government assigns ₹500 crore for apiculture

The demand for apiculture products is also supported by the growing popularity of wellness and herbal remedies. Honey, propolis, and royal jelly are being increasingly used in food, skincare, and medicinal applications, widening their market reach. This trend is further supported by the shift toward sustainable and eco-friendly products. According to an industry report, $5 million has been set aside to support beekeepers.

Key Takeaways

- The Global Apiculture Market is expected to be worth around USD 15.4 billion by 2034, up from USD 9.7 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Honey dominates the apiculture market with an 82.3% share, driven by rising demand for natural sweeteners.

- Traditional beekeeping holds 67.7% of the market share, reflecting its widespread adoption among small- and medium-scale beekeepers.

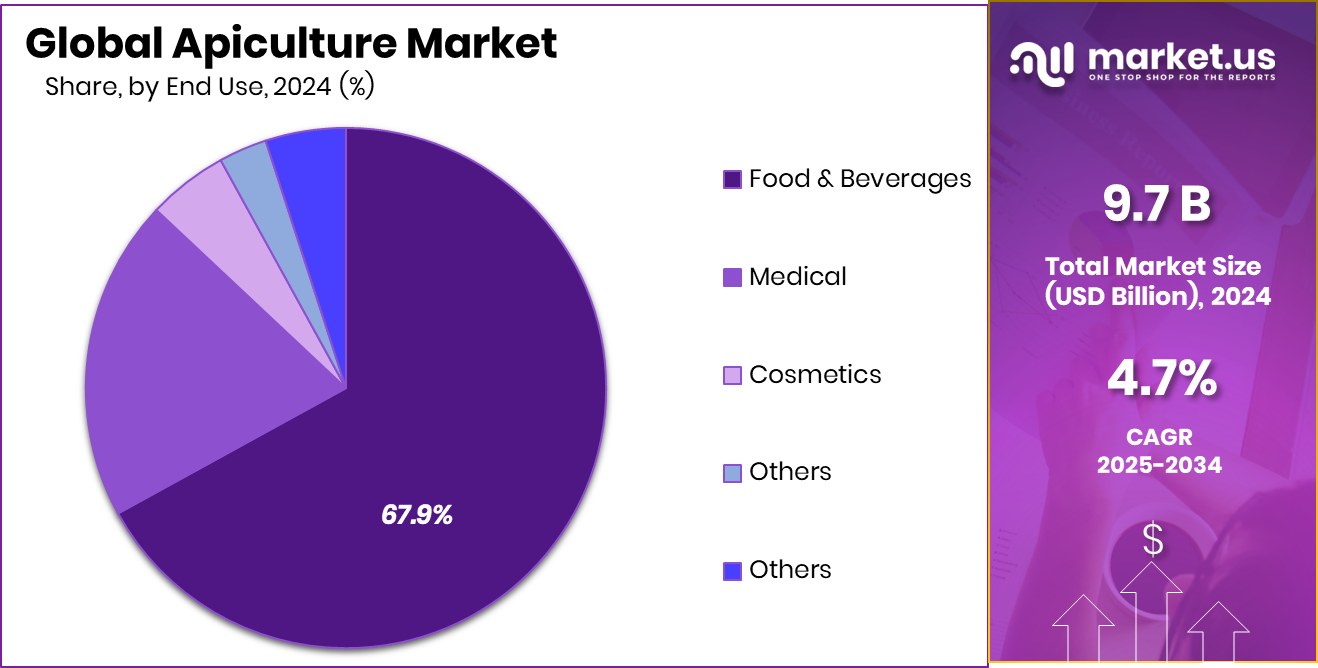

- The food and beverages sector accounts for a 67.9% share of the apiculture market demand.

- Strong honey consumption drives the Asia-Pacific’s 38.20% market share.

By Type Analysis

Honey dominates the apiculture market with 82.3% of the global share.

In 2024, Honey held a dominant market position in the By Type segment of the Apiculture Market, with an 82.3% share. This strong lead is driven by honey’s wide acceptance as a natural sweetener and its diverse applications across food, beverage, pharmaceutical, and personal care industries. Consumers are increasingly turning to honey for its nutritional profile, antioxidant properties, and medicinal benefits, making it a staple in both household consumption and industrial formulations.

The market’s growth for honey is also supported by the increasing adoption of functional foods and traditional remedies. Honey is extensively used in wellness products, herbal medicines, and as a natural preservative, which adds to its versatility and demand. Seasonal and specialty honeys, such as monofloral varieties, are also gaining traction among premium consumers, boosting value sales.

Export opportunities remain a significant driver, with international markets showing a strong appetite for high-quality, sustainably produced honey. Combined with rising domestic consumption, these factors are expected to maintain honey’s leading position in the apiculture market. Its dominance reflects both its cultural relevance and its expanding role in modern health and nutrition trends.

By Methods Analysis

Traditional beekeeping leads with 67.7% market share globally.

In 2024, traditional beekeeping held a dominant market position in the by-methods segment of the apiculture market, with a 67.7% share. This method’s leadership is largely attributed to its simplicity, low initial investment, and suitability for both rural and small-scale operations. Traditional beekeeping relies on time-tested practices that are easy to adopt without the need for advanced equipment, making it accessible to a broad base of beekeepers, especially in developing and semi-urban regions.

The popularity of traditional beekeeping is further driven by its alignment with natural and sustainable farming practices. Many consumers associate honey and other bee products from traditional methods with being more authentic, chemical-free, and eco-friendly, enhancing their market appeal. Additionally, this method often supports biodiversity by allowing bees to thrive in natural habitats, contributing positively to local ecosystems.

In many regions, traditional beekeeping also holds cultural and historical value, with practices passed down through generations. This heritage factor not only sustains the method but also promotes its products as premium, artisanal offerings in niche markets. With growing consumer interest in sustainable and traceable sourcing, traditional beekeeping is expected to maintain its strong position, backed by both its economic viability and environmental benefits.

By End Use Analysis

Food and beverages account for 67.9% of apiculture product usage.

In 2024, Food and Beverages held a dominant market position in the end-use segment of the Apiculture Market, with a 67.9% share. This dominance is driven by the extensive use of honey and other bee-derived products as natural sweeteners, flavor enhancers, and nutritional additives in a wide range of food and drink products. Honey’s appeal as a healthier alternative to refined sugar has significantly boosted its incorporation into bakery goods, confectionery, dairy products, beverages, and functional foods.

The growing global shift toward clean-label and natural ingredients has further supported demand in the food and beverage sector. Consumers are increasingly seeking products that are free from artificial additives, and honey’s natural composition aligns perfectly with this trend. Beyond sweetness, honey offers antioxidant, antimicrobial, and preservative properties, adding both health and shelf-life benefits to food products.

Additionally, the rising popularity of specialty and artisanal food products has fueled interest in premium honey varieties, such as organic and monofloral honeys, which are valued for their unique flavors and origins. With the expanding functional food market and the trend toward healthier lifestyles, the food and beverage sector is expected to sustain its strong position, continuing to be the primary driver of apiculture product consumption.

Key Market Segments

By Type

- Honey

- Beeswax

- Propolis

- Others

By Methods

- Traditional Beekeeping

- Modern Beekeeping

By End Use

- Food and Beverages

- Medical

- Cosmetics

- Others

Driving Factors

Rising Demand for Natural and Healthy Sweeteners

One of the biggest driving factors for the apiculture market is the increasing demand for natural and healthy sweeteners like honey. People are becoming more aware of the harmful effects of refined sugar and artificial sweeteners, leading them to choose honey as a safer, healthier option. Honey not only adds sweetness but also offers vitamins, minerals, antioxidants, and antibacterial benefits.

It is widely used in everyday diets, health drinks, bakery products, and even in traditional remedies. The growing trend of healthy living, coupled with the shift toward organic and clean-label foods, has further boosted honey consumption worldwide. This changing consumer preference is pushing beekeeping and honey production forward, making it a major growth driver for the apiculture market.

Restraining Factors

Declining Bee Populations Threaten Market Stability

A major restraining factor for the apiculture market is the steady decline in global bee populations. Issues like habitat loss, excessive pesticide use, climate change, and diseases such as colony collapse disorder are reducing the number of healthy bee colonies. Since bees are the primary source of honey and other bee-related products, their decline directly impacts production capacity.

Lower bee populations also affect pollination, which in turn can reduce crop yields in agriculture. For beekeepers, this means higher costs for colony maintenance and replacement, as well as lower overall productivity. If these environmental and health challenges are not addressed, they could significantly slow the growth of the apiculture market in the coming years.

Growth Opportunity

Expanding Market for Organic and Specialty Honey

A key growth opportunity in the apiculture market lies in the rising demand for organic and specialty honey varieties. Consumers are increasingly seeking products that are free from chemicals, pesticides, and artificial additives, creating a strong market for honey produced through sustainable and organic beekeeping practices. Specialty honeys, such as monofloral types like manuka, acacia, or lavender honey, are gaining popularity for their unique flavors, nutritional value, and potential medicinal properties.

These premium products often command higher prices, making them profitable for producers. Additionally, growing export demand for high-quality, traceable honey in health-conscious markets worldwide is opening new revenue streams. By focusing on organic certification and niche honey varieties, beekeepers can tap into a rapidly expanding consumer base.

Latest Trends

Integration of Technology in Modern Beekeeping Practices

One of the latest trends in the apiculture market is the growing use of technology to improve beekeeping efficiency and productivity. Beekeepers are adopting tools like smart hives, remote monitoring systems, and data analytics to track hive health, bee activity, and honey production in real time. These innovations help detect problems early, such as disease outbreaks or queen loss, allowing for timely action.

GPS tracking and automated feeders are also being used to reduce manual labor and optimize bee management. Technology not only increases yield but also supports sustainable practices by minimizing stress on bee colonies. This tech-driven approach is attracting younger generations to beekeeping, modernizing the industry while ensuring long-term stability and growth.

Regional Analysis

Asia-Pacific holds a 38.20% share, valued at USD 3.7 Bn.

In 2024, Asia-Pacific emerged as the leading region in the global apiculture market, capturing a dominant 38.20% share, valued at USD 3.7 billion. This strong position is fueled by the region’s high honey consumption, extensive beekeeping practices, and favorable climatic conditions for large-scale apiary operations. Countries such as China, India, and New Zealand play a significant role in production, with China being one of the largest global exporters of honey.

Rising consumer preference for natural sweeteners and traditional remedies, combined with the growing popularity of organic and specialty honey varieties, has further boosted market demand. North America and Europe follow closely, driven by strong consumer awareness and the integration of honey into functional foods and beverages. Meanwhile, the Middle East & Africa and Latin America are witnessing steady growth, supported by expanding agricultural pollination services and increased focus on sustainable farming practices.

Across all regions, the shift toward clean-label, eco-friendly products is influencing purchasing trends, but Asia-Pacific’s well-established production capabilities and export strength position it firmly at the forefront of the market. With rising global demand and government initiatives promoting apiculture, the region is expected to maintain its lead over the forecast period, strengthening its role in the global honey supply.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Capilano Honey Ltd., known for its strong brand presence and commitment to quality, has leveraged its expertise in sourcing and processing premium honey to cater to both domestic and international markets. The company’s focus on sustainability and traceability has strengthened consumer trust, particularly in export-driven segments.

Organic Bee Farms has carved out a niche by specializing in certified organic honey and bee products. Its dedication to chemical-free, eco-friendly production methods aligns well with the growing global demand for organic and clean-label products, positioning it strongly in health-conscious consumer markets.

Dabur Ltd., with its diverse product portfolio, integrates honey into both food and healthcare segments. Its strong distribution network and brand heritage have helped expand honey’s reach across urban and rural markets, while also promoting its medicinal and wellness benefits.

NOW Foods, recognized for its health and wellness products, has successfully incorporated honey and bee-derived ingredients into dietary supplements and functional foods. The company’s emphasis on quality control and natural sourcing has helped attract a loyal consumer base.

Top Key Players in the Market

- Capilano Honey Ltd.

- Organic Bee Farms

- Dabur Ltd.

- NOW Foods

- Koster Keunen LLC

- Barkman Honey

- Heavenly Organics

- Strahl & Pitsch Inc.,

- Miller’s Honey

- Durham’s Bee Farm

Recent Developments

- In September 2024, Dabur partnered with Agri-tech firm Farmonaut (around late 2024) to strengthen honey traceability using blockchain and satellite monitoring. Through this, consumers can scan product codes to learn about the journey of their honey—from hive to table—adding a boost to quality and transparency.

- In June 2025, Capilano’s parent group, Hive & Wellness, acquired Byron Bay Honey. The Byron Bay Honey brand now shares the same Brisbane address as Capilano, indicating a consolidation under one roof. This expansion strengthens Capilano’s retail presence across major Australian supermarkets.

Report Scope

Report Features Description Market Value (2024) USD 9.7 Billion Forecast Revenue (2034) USD 15.4 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Honey, Beeswax, Propolis, Others), By Methods (Traditional Beekeeping, Modern Beekeeping), By End Use (Food and Beverages, Medical, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Capilano Honey Ltd., Organic Bee Farms, Dabur Ltd., NOW Foods, Koster Keunen LLC, Barkman Honey, Heavenly Organics, Strahl & Pitsch Inc.,, Miller’s Honey, Durham’s Bee Farm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Capilano Honey Ltd.

- Organic Bee Farms

- Dabur Ltd.

- NOW Foods

- Koster Keunen LLC

- Barkman Honey

- Heavenly Organics

- Strahl & Pitsch Inc.,

- Miller's Honey

- Durham's Bee Farm