Global API Gateway Observability Market Size, Share Report By Component (Platform, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By End-User (Banking, Financial Services and Insurance (BFSI), Healthcare, Retail and E-Commerce, IT and Telecommunications, Manufacturing, Government, Other End-Users), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169065

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Segment: Platform

- Deployment Mode Segment: Cloud-Based

- Organization Size Segment: Large Enterprises

- End-User Segment: BFSI

- Regional Segment: North America

- Emerging Trends

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

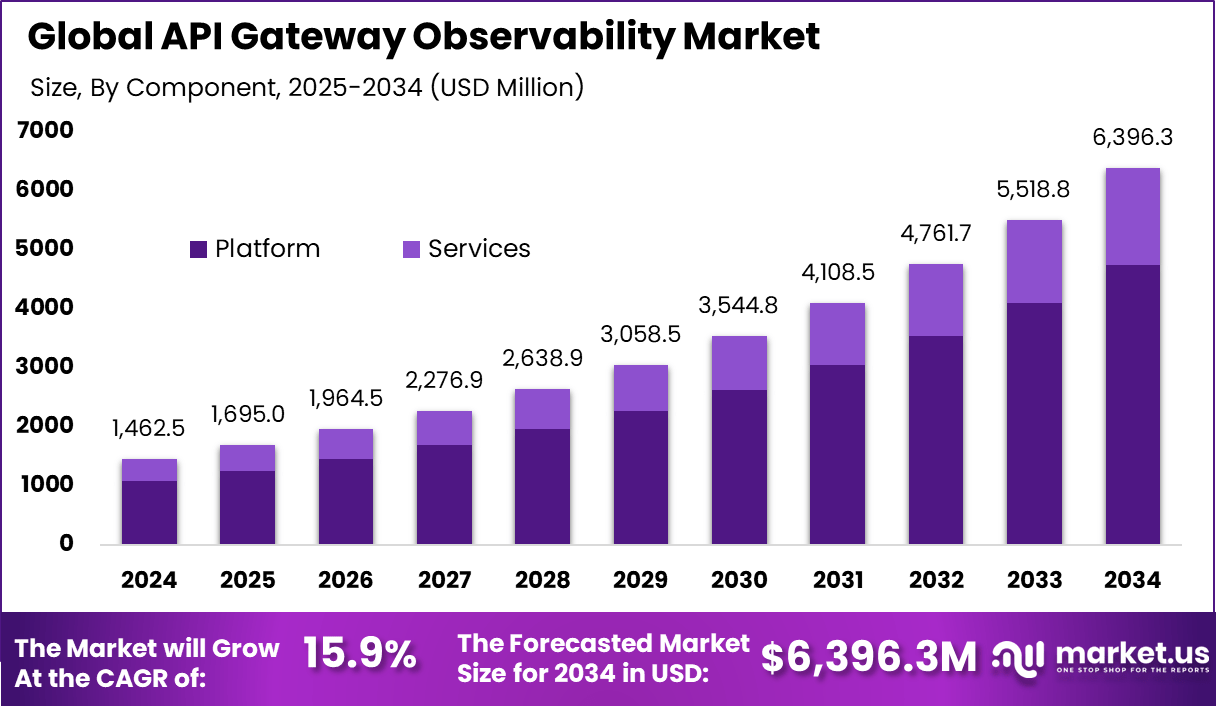

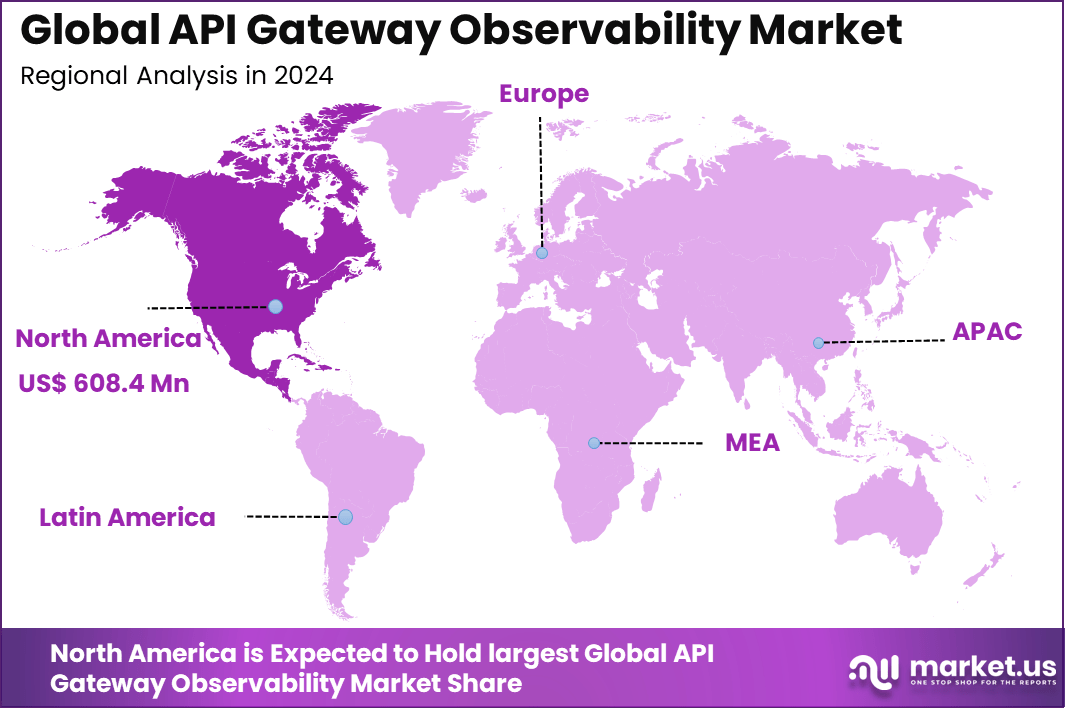

The Global API Gateway Observability Market generated USD 1462.5 Million in 2024 and is predicted to register growth from USD 1,695.0 Million in 2025 to about USD 6,396.3 Million by 2034, recording a CAGR of 15.9% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.6% share, holding USD 608.4 Million revenue.

The API gateway observability market has expanded as organisations adopt tools that monitor, measure and analyse the performance of API traffic flowing through gateway layers. Growth reflects rising dependence on API driven architectures, increasing adoption of microservices and the need for consistent visibility across distributed systems. Observability platforms now support large enterprises and digital businesses that rely heavily on real time API communication.

Demand for API gateway observability is rising due to the necessity for better API performance insights, security monitoring, and compliance assurance. Developers and IT teams adopt these tools to safeguard against failures and cyber threats while ensuring operations run smoothly. Over 70% of usage scenarios focus on anomaly detection and automated alerts that help businesses minimize downtime and improve user experience. The market is fueled by expanding digital transformation efforts, emphasizing reliability and trust in API frameworks.

Top Market Takeaways

- The platform segment captured 74.3%, showing that most users rely on integrated observability suites to monitor complex API traffic and performance.

- Cloud-based deployment accounted for 78.6%, reflecting strong preference for scalable monitoring tools that support high-volume, distributed API environments.

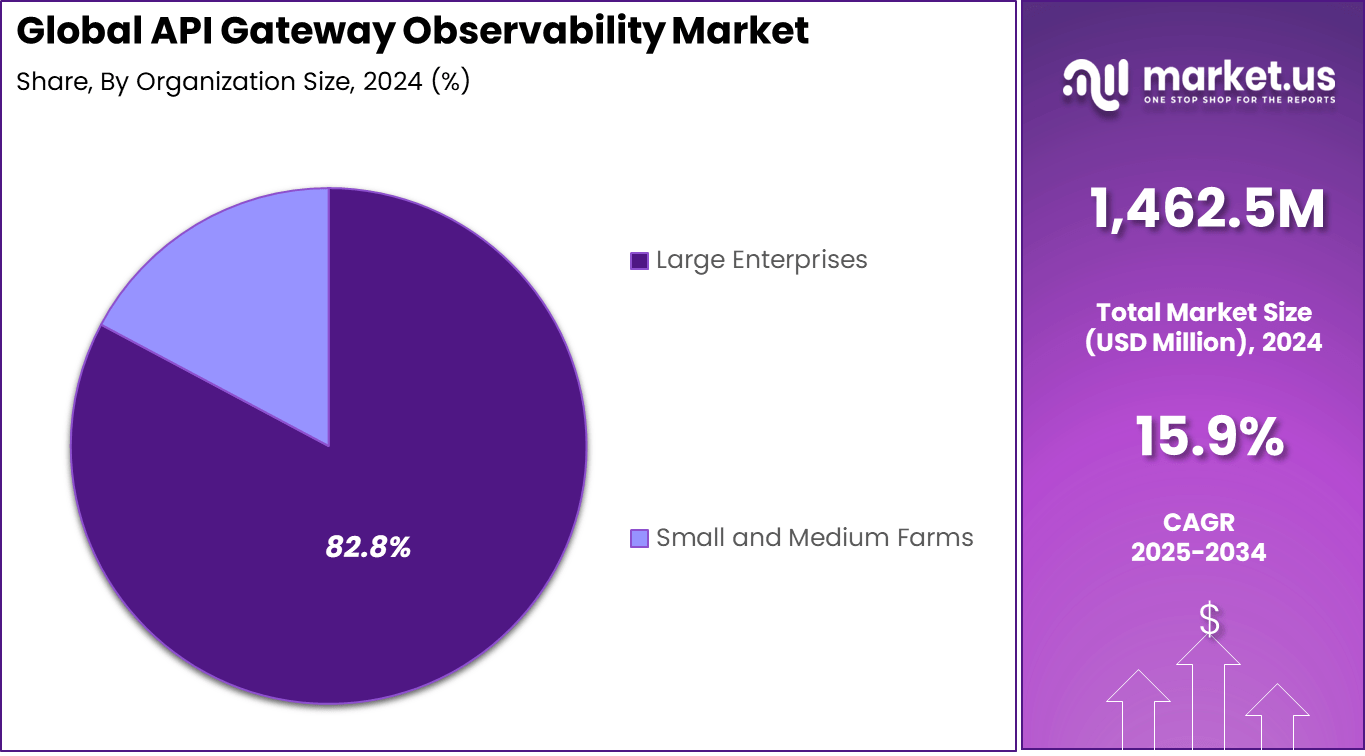

- Large enterprises represented 82.8%, indicating that organizations with extensive API ecosystems continue to drive demand for deeper visibility and reliability controls.

- The BFSI segment held 32.5%, supported by growing dependency on real-time APIs for payments, authentication, and secure data exchange.

- North America recorded 41.6%, driven by mature API adoption across digital-first enterprises and financial institutions.

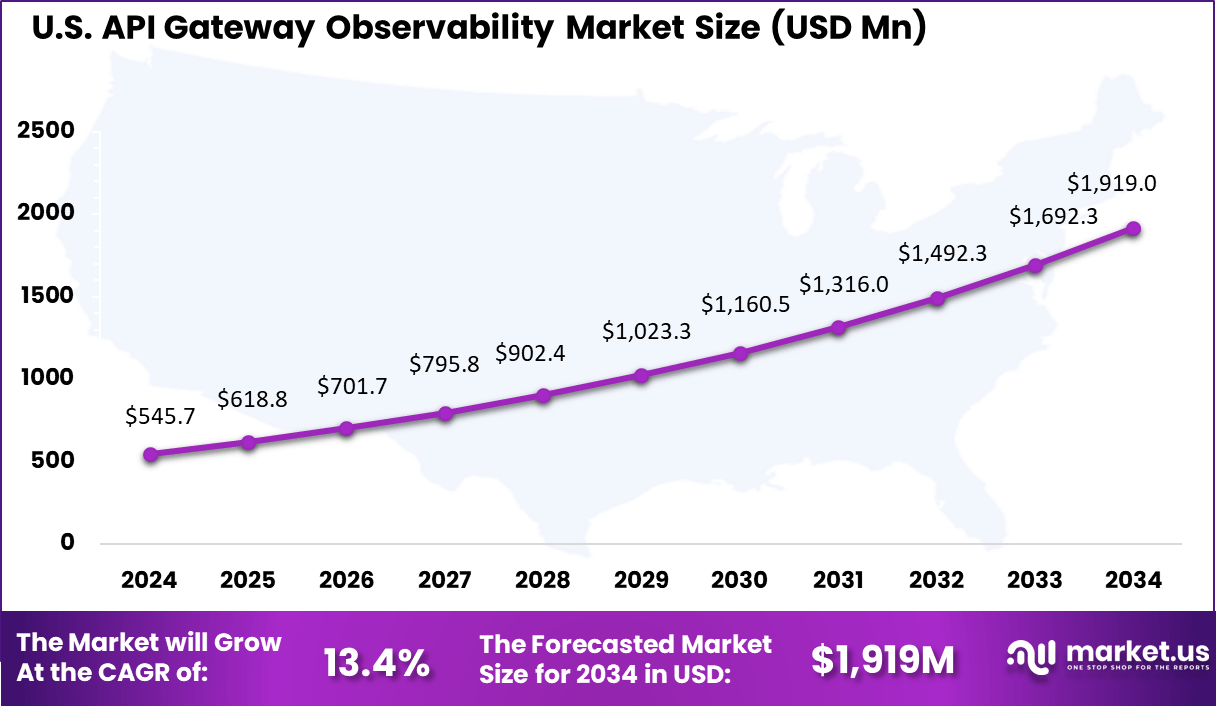

- The U.S. market reached USD 545.7 million with a 13.4% CAGR, showing solid investment in advanced observability to strengthen API resilience and uptime.

Component Segment: Platform

The platform segment dominated the API Gateway Observability market, capturing about 74.3% of the share. Platforms offer comprehensive tools that enable monitoring, tracing, and analyzing API performance across multiple environments. They provide real-time visibility that helps organizations detect and resolve issues quickly, ensuring smooth API operations.

These platforms integrate various functionalities like analytics, alerting, and reporting, making them essential for developers and operations teams managing complex API ecosystems. Their ability to support automation and continuous monitoring drives higher adoption among technology-focused companies.

Deployment Mode Segment: Cloud-Based

Cloud-based deployment accounted for approximately 78.6% of the market. The appeal of cloud solutions lies in their scalability, flexibility, and cost efficiency, which suit the dynamic needs of API observability. Cloud models allow organizations to access observability tools without the burden of managing physical infrastructure.

Cloud deployment also supports remote teams and enables seamless updates, which is critical in fast-paced technology environments. This deployment mode helps enterprises reduce downtime and improve API performance while maintaining security and compliance through managed cloud services.

Organization Size Segment: Large Enterprises

Large enterprises held a significant share of approximately 82.8% in the market. These organizations typically manage extensive API networks across various departments and require robust observability solutions to ensure operational continuity. Large enterprises prioritize comprehensive platforms that support complex environments and stringent compliance needs.

The high investment capacity and digital transformation initiatives in large firms drive the adoption of advanced API observability tools. Their focus on enhancing customer experience and operational efficiency makes observability a key part of their IT strategies.

End-User Segment: BFSI

The banking, financial services, and insurance (BFSI) sector accounted for about 32.5% of the market, reflecting the critical role of APIs in this industry. BFSI firms require real-time monitoring to safeguard data, ensure transaction integrity, and comply with regulatory mandates. API observability helps in early detection of anomalies and performance bottlenecks.

The increasing digitization of banking services and the rise of open banking APIs demand reliable observability platforms. BFSI organizations focus on API security and performance to maintain customer trust and support seamless financial operations.

Regional Segment: North America

North America commanded around 41.6% of the market share, driven by advanced infrastructure and early technology adoption. The region benefits from a strong presence of API observability vendors and substantial investment in cloud and digital transformation projects.

US Market Size

The United States leads regional growth with significant spend on observability tools aimed at enhancing system reliability and user experience. The focus on innovation in IT operations and regulatory compliance fuels steady market expansion in this technology segment.

Emerging Trends

Interest in real time and unified monitoring is increasing. Companies now prefer tools that combine tracing, logging, and metrics in one platform, reducing operational complexity. The rise of open telemetry frameworks is also improving how data is collected and compared across different systems.

Another growing trend is the use of machine learning to support anomaly detection. These systems help identify performance drops before they become visible to users. As API ecosystems grow, the need for early warning signals is becoming more important across industries.

Key Market Segments

By Component

- Platform

- Monitoring Tools

- Analytics Dashboard

- Traffic Management

- Security Management

- Performance Optimization

- Services

- Consulting Services

- Implementation Services

- Support and Maintenance

- Training and Education

- Integration Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail and E-Commerce

- IT and Telecommunications

- Manufacturing

- Government

- Other End-Users

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rise in cloud-native applications and microservices architectures

The shift by enterprises toward cloud-native applications and microservices has led to a growing demand for robust API gateway observability solutions. As systems become distributed, with many microservices communicating via APIs, the ability to monitor, trace, and analyze API traffic from a central gateway becomes critical.

The complexity of modern IT infrastructure increases the need for visibility into API performance, latency, error rates, and dependencies. This demand has significantly boosted adoption of API gateway observability tools.

Restraint

Complexity in deployment and integration overhead

Implementing API gateway observability is not straightforward in many existing environments. Observability requires integration of logging, tracing, and metrics across possibly heterogeneous backend systems – which often involves configuration overhead, agent deployment, or architectural changes. This complexity can deter organizations from adopting full-scale observability through gateways, especially when legacy systems or on-premises infrastructure are involved.

Moreover, in certain scenarios, observability tools may struggle to provide full visibility due to environment constraints or limitations in debugging capabilities. These integration and deployment challenges may reduce perceived value and delay implementation timelines, thereby restraining market penetration in segments that lack mature infrastructure or skilled resources.

Opportunity

Growing need for reliable API performance and security insights

API traffic has increased due to online banking, commerce, healthcare platforms, and digital public services. Companies now need a clear view of how their APIs behave to maintain reliable service. API gateway observability creates a single point to review performance, detect issues, and manage faults quickly. This rising need presents a strong market opportunity.

Demand is also increasing in emerging regions where digital services are expanding. As financial services, commerce platforms, and government systems shift online, organizations seek tools that simplify monitoring. This creates new space for vendors offering accessible and easy to deploy observability solutions.

Challenge

Managing cost and system load created by observability data

Observability tools collect large amounts of logs, traces, and metrics. This data can increase storage and processing costs, especially for companies handling heavy traffic. Extra load on the API gateway can also create slower responses if not managed correctly. These risks make some organizations cautious when investing.

Cost forecasting becomes difficult when traffic volumes change suddenly. Companies may see unexpected increases in data costs during seasonal spikes. This uncertainty can reduce adoption among smaller organizations or those with limited budgets.

Competitive Analysis

Google, AWS, IBM, Oracle, Broadcom, and SAP lead the API gateway observability market with platforms that provide deep visibility into API performance, traffic flows, security events, and latency patterns. Their solutions support large enterprises managing complex, distributed API environments. These companies focus on real-time monitoring, automated anomaly detection, and integrated governance.

F5, Datadog, Elastic, Alibaba Cloud, Axway, Postman, Kong, Solo.io, Gravitee, and Sensedia strengthen the competitive landscape with tools that combine metrics, logs, traces, and policy analytics. Their platforms help teams optimize API reliability, enforce security, and maintain service-level consistency. These providers emphasize flexible deployment, open-source integration, and strong developer experience.

Sematext, Dashbird, Helicone, Treblle, and other emerging participants broaden the market with lightweight observability layers designed for startups, API-first businesses, and serverless environments. Their tools offer fast setup, cost-efficient monitoring, and actionable insights that simplify troubleshooting. These companies focus on transparency, ease of use, and advanced debugging capabilities.

Top Key Players in the Market

- Google LLC

- Amazon Web Services Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Broadcom Inc.

- SAP SE

- F5 Inc.

- Datadog Inc.

- Elastic N.V.

- Alibaba Cloud Computing Ltd.

- Axway Inc.

- Postman Inc.

- Kong Inc.

- Solo.io Inc.

- Gravitee SAS

- Sensedia S.A.

- Sematext Group Inc.

- Dashbird Technologies Inc.

- Helicone Inc.

- Treblle Inc.

- Others

Recent Developments

- November 2025, Amazon Web Services Inc. (AWS): AWS launched generative AI observability features in Amazon CloudWatch. These new capabilities provide in-depth monitoring of AI workloads, including latency, token usage, errors, and performance across model invocations and agent operations. This helps DevOps teams quickly diagnose issues without custom instrumentation.

- May 2025, International Business Machines Corporation (IBM): IBM entered a collaboration with API Holdings to deploy AI-powered automated observability across healthcare digital platforms. The partnership uses IBM Instana to enhance application monitoring and incident resolution, supporting scalability and improved service delivery in healthcare.

- April 2025, Oracle Corporation: Oracle expanded its logging analytics content with new lessons for Kubernetes log solutions that monitor containerized environments. It also introduced updated application observability features to accelerate the observability journey for enterprises.

Report Scope

Report Features Description Market Value (2024) USD 1,462.5 Mn Forecast Revenue (2034) USD 6,396.3 Mn CAGR(2025-2034) 15.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platform, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By End-User (Banking, Financial Services and Insurance (BFSI), Healthcare, Retail and E-Commerce, IT and Telecommunications, Manufacturing, Government, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Amazon Web Services Inc., International Business Machines Corporation (IBM), Oracle Corporation, Broadcom Inc., SAP SE, F5 Inc., Datadog Inc., Elastic N.V., Alibaba Cloud Computing Ltd., Axway Inc., Postman Inc., Kong Inc., Solo.io Inc., Gravitee SAS, Sensedia S.A., Sematext Group Inc., Dashbird Technologies Inc., Helicone Inc., Treblle Inc., Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  API Gateway Observability MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

API Gateway Observability MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Amazon Web Services Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Broadcom Inc.

- SAP SE

- F5 Inc.

- Datadog Inc.

- Elastic N.V.

- Alibaba Cloud Computing Ltd.

- Axway Inc.

- Postman Inc.

- Kong Inc.

- Solo.io Inc.

- Gravitee SAS

- Sensedia S.A.

- Sematext Group Inc.

- Dashbird Technologies Inc.

- Helicone Inc.

- Treblle Inc.

- Others