Global Antisense Oligonucleotides Market By Product Type (Pegaptanib, Mipomersen, Eteplirsen, Approved Drugs and Pipeline Analysis), By Indication (Ocular Diseases, Spinal Muscular Atrophy, Diabetes, Cancer and Others), By Application (Basic Research, Target Validation, Genomics and Drug Discovery), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178217

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

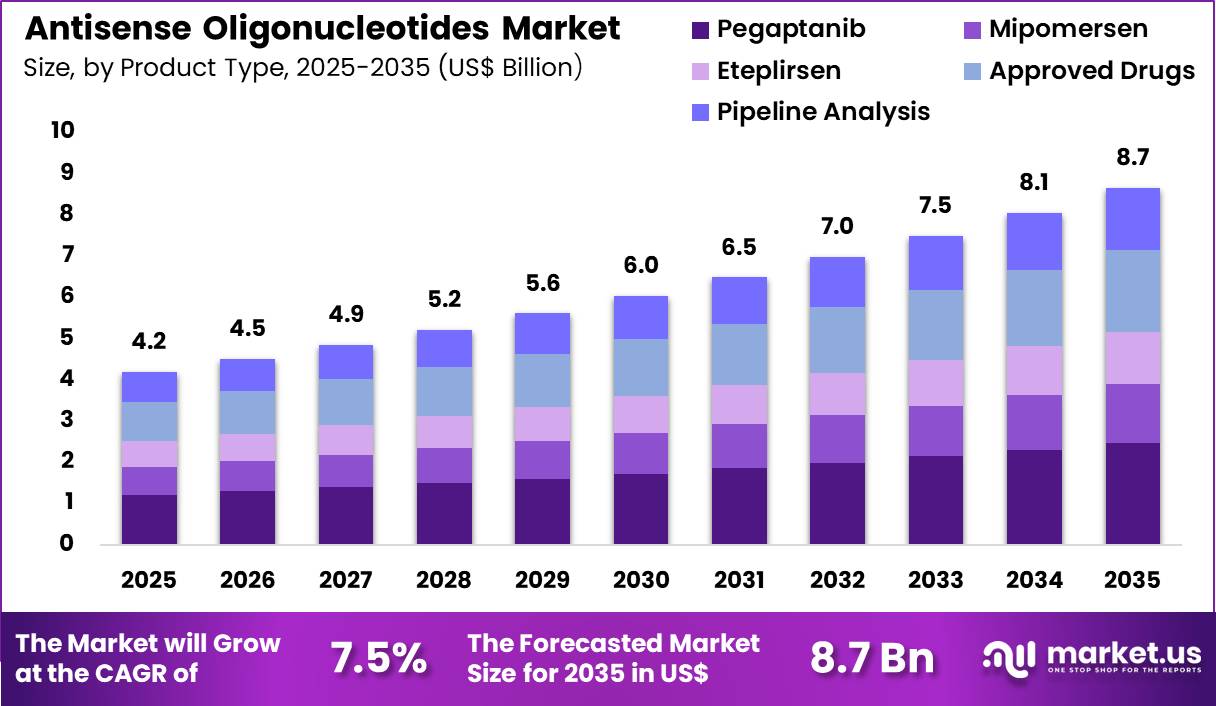

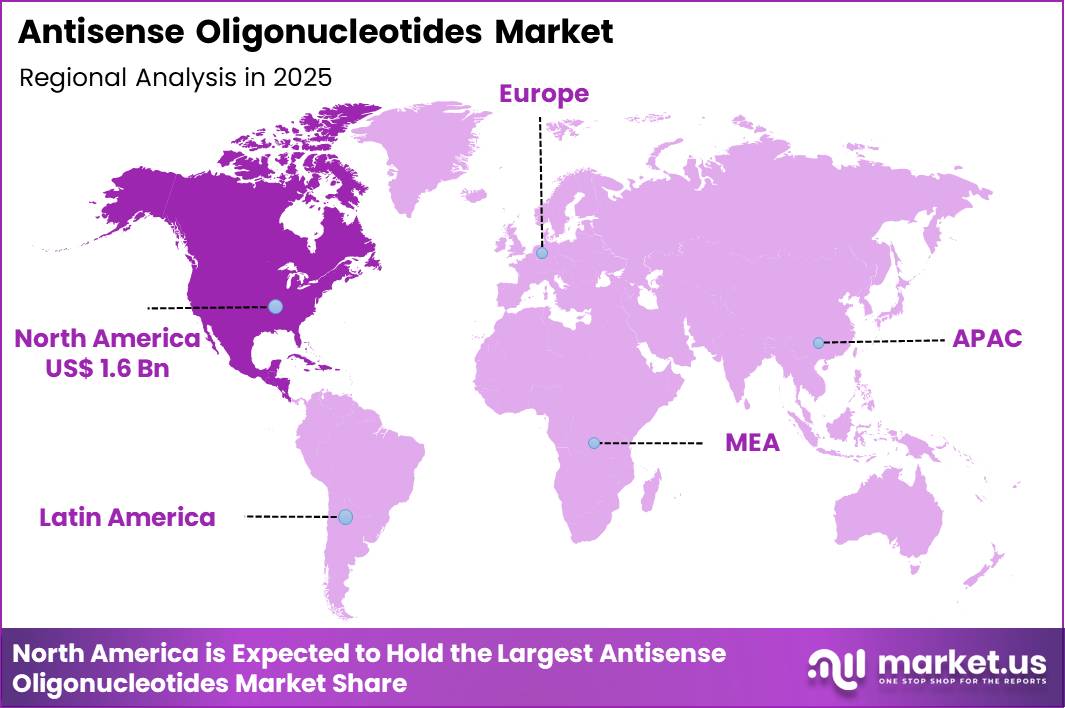

The Global Antisense Oligonucleotides Market size is expected to be worth around US$ 8.7 Billion by 2035 from US$ 4.2 Billion in 2025, growing at a CAGR of 7.5% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 38.8% share with a revenue of US$ 1.6 Billion.

Increasing prevalence of genetic disorders and the push for targeted therapies drive the antisense oligonucleotides market as pharmaceutical companies prioritize RNA-modulating agents that selectively inhibit disease-causing proteins. Clinicians increasingly administer antisense oligonucleotides for spinal muscular atrophy, where these molecules bind to pre-mRNA to promote exon inclusion and restore functional protein production, improving motor function in pediatric patients.

These therapies support applications in Duchenne muscular dystrophy by skipping defective exons in dystrophin mRNA, enhancing muscle strength and delaying disease progression in ambulatory boys. Researchers apply antisense oligonucleotides in transthyretin amyloidosis, reducing amyloid deposition in peripheral nerves and cardiac tissue to alleviate neuropathy and cardiomyopathy symptoms.

Oncologists utilize these agents to silence oncogenes in solid tumors, disrupting cell proliferation pathways and complementing chemotherapy regimens. Neurologists explore their role in Huntington’s disease, targeting mutant huntingtin mRNA to mitigate neurotoxicity and slow cognitive decline.

Pharmaceutical developers pursue opportunities to engineer chemically modified antisense oligonucleotides with enhanced stability and cellular uptake, expanding applications in central nervous system disorders through intrathecal delivery. Companies advance lipid nanoparticle formulations that improve bioavailability, broadening utility in liver-targeted therapies for metabolic diseases like familial chylomicronemia syndrome.

These innovations facilitate combination approaches with CRISPR editing, optimizing gene silencing in rare genetic conditions. Opportunities emerge in prophylactic uses for at-risk populations, where early antisense intervention prevents symptom onset. Recent trends emphasize multi-target antisense designs and AI-optimized sequences, positioning the market for growth in personalized medicine and broader therapeutic indications.

Key Takeaways

- In 2025, the market generated a revenue of US$ 4.2 Billion, with a CAGR of 7.5%, and is expected to reach US$ 8.7 Billion by the year 2035.

- The product type segment is divided into pegaptanib, mipomersen, eteplirsen, approved drugs and pipeline analysis, with pegaptanib taking the lead with a market share of 28.6%.

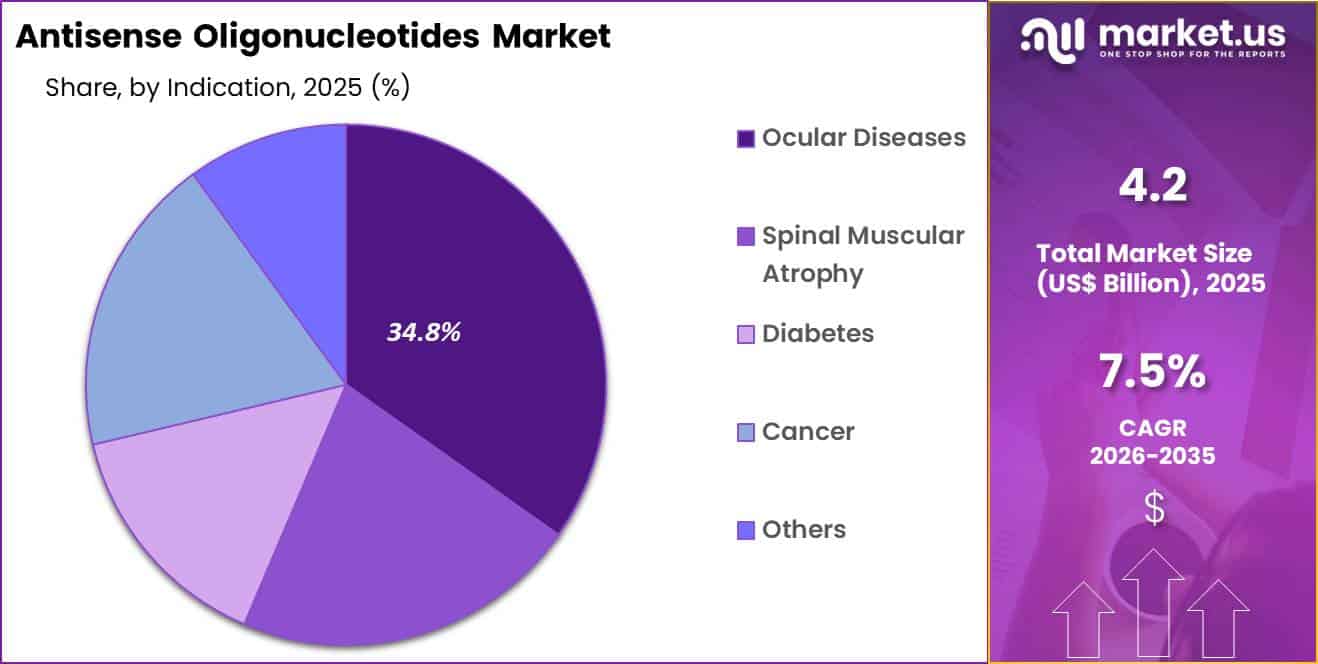

- Considering indication, the market is divided into ocular diseases, spinal muscular atrophy, diabetes, cancer and others. Among these, ocular diseases held a significant share of 34.8%.

- Furthermore, concerning the application segment, the market is segregated into basic research, target validation, genomics and drug discovery. The basic research sector stands out as the dominant player, holding the largest revenue share of 39.5% in the market.

- North America led the market by securing a market share of 38.8%.

Product Type Analysis

Pegaptanib contributed 28.6% of growth within product type and led the antisense oligonucleotides market due to its established role in targeting vascular endothelial growth factor pathways in ocular conditions. Clinicians and researchers recognize pegaptanib as one of the early successful antisense-based therapies, which reinforces confidence in oligonucleotide platforms.

Its targeted mechanism supports selective inhibition, which aligns with precision treatment strategies in ophthalmology. Continued clinical familiarity and historical data sustain its market relevance. Growth strengthens as ongoing research into RNA-targeted therapeutics builds on early antisense successes. Advances in delivery systems and molecular stability enhance therapeutic performance.

Regulatory experience with earlier antisense agents supports smoother evaluation pathways for related products. Expanding patient awareness of targeted therapies increases treatment acceptance. The segment is expected to maintain leadership as legacy products continue to anchor clinical and research momentum in antisense technology.

Indication Analysis

Ocular diseases generated 34.8% of growth within indication and emerged as the leading segment due to high prevalence of retinal and macular disorders. Antisense oligonucleotides offer targeted gene expression modulation that supports precision treatment in ophthalmology. Clinicians favor localized delivery in ocular conditions, which improves safety and reduces systemic exposure. Rising incidence of age-related vision impairment increases therapeutic demand.

Growth accelerates as early diagnosis programs expand access to ophthalmic care. Innovation in intravitreal administration techniques strengthens therapeutic adoption. Research interest in gene-silencing strategies for retinal diseases further drives development.

Aging populations elevate long-term treatment needs. The segment is anticipated to sustain leadership as ocular disorders continue to represent a significant share of RNA-targeted therapeutic applications.

Application Analysis

Basic research accounted for 39.5% of growth within application and dominated the antisense oligonucleotides market due to strong academic and preclinical exploration of gene regulation mechanisms. Research laboratories use antisense molecules to investigate gene function and pathway modulation. Funding for molecular biology and genomics supports steady procurement of custom oligonucleotides. Universities and research institutes rely on antisense tools to validate experimental hypotheses and disease models.

Growth continues as RNA biology research expands across multiple therapeutic areas. Integration of antisense approaches into functional genomics studies increases utilization. Training programs emphasize gene-silencing techniques, reinforcing adoption among new researchers.

Collaboration between academia and industry further strengthens demand. The segment is projected to remain dominant as foundational research continues to drive innovation in RNA-targeted therapies.

Key Market Segments

By Product Type

- Pegaptanib

- Mipomersen

- Eteplirsen

- Approved Drugs

- Pipeline Analysis

By Indication

- Ocular Diseases

- Spinal Muscular Atrophy

- Diabetes

- Cancer

- Others

By Application

- Basic Research

- Target Validation

- Genomics

- Drug Discovery

Drivers

Increasing number of approvals for antisense oligonucleotide drugs is driving the market.

The rising number of regulatory approvals for antisense oligonucleotide drugs has significantly propelled the market by expanding treatment options for rare genetic and neurological disorders. Enhanced clinical trial designs and biomarker-based endpoints have accelerated the approval process for these targeted therapies.

Healthcare regulators are prioritizing orphan designations to facilitate faster access to innovative ASO treatments for unmet medical needs. The correlation between advanced delivery systems and improved efficacy has encouraged more submissions for ASO candidates in diverse indications. Government agencies are supporting expedited reviews to address the burden of chronic diseases through precision medicine.

The association between ASO mechanisms and gene silencing has underscored their role in managing conditions like amyotrophic lateral sclerosis and polyneuropathy. National health authorities report a steady increase in ASO approvals, prompting greater investment in pipeline development. Key developers are leveraging these approvals to strengthen their portfolios in competitive therapeutic areas.

The U.S. Food and Drug Administration approved Vutrisiran in 2022 for hereditary ATTR amyloidosis with polyneuropathy. In 2023, the FDA approved tofersen for SOD1-ALS and eplontersen for ATTRv-PN, while in 2024, imetelstat for myelodysplastic syndromes and olezarsen for familial chylomicronemia syndrome received approvals.

Restraints

High research and development costs are restraining the market.

The substantial investments required for antisense oligonucleotide research and development pose a significant barrier to market growth, as preclinical and clinical trials demand extensive funding for chemistry optimization and delivery systems. Complex manufacturing processes for ASO drugs contribute to elevated expenses, limiting scalability for smaller biotechnology firms.

Healthcare payers scrutinize cost-effectiveness, often restricting reimbursement for high-priced ASO therapies in budget-constrained systems. Regulatory demands for long-term safety data add layers of financial burden during development phases. In competitive landscapes, these costs deter entry for new players, consolidating market share among established entities.

Providers must balance innovation with economic viability when advancing ASO candidates through pipelines. This restraint affects the pace of bringing new therapies to market in resource-limited regions. Collaborative funding models aim to mitigate these challenges, though effectiveness varies.

Despite therapeutic potential, fiscal hurdles impede rapid expansion in diverse indications. Biogen invested $2.5 billion in research and development in 2022, highlighting the scale of expenses in ASO-related projects.

Opportunities

Strong revenue growth from key ASO products is creating growth opportunities.

The robust sales performance of established antisense oligonucleotide products opens avenues for expanded indications and geographic reach in the RNA therapeutics landscape. Increased adoption in neurological disorders supports investments in combination therapies for comprehensive disease management. Healthcare collaborations facilitate access programs, enhancing patient uptake in underserved populations.

Strategic partnerships with distributors enable compliance and entry into new markets for ASO drugs. The substantial revenue base amplifies R&D funding for next-generation formulations. Policy advancements in orphan drug reimbursements bolster infrastructure for broader distribution. Ionis Pharmaceuticals reported revenues of $587 million in 2022, $788 million in 2023, and $705 million in 2024.

Biogen’s Spinraza, an ASO for spinal muscular atrophy, generated $1,794 million in 2022, $1,723 million in 2023, and $1,655 million in 2024. This opportunity corresponds with initiatives to elevate standards in rare disease care. Primary corporations initiate expansions to capitalize on economic recoveries in biopharma.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the antisense oligonucleotides market through biotech funding cycles, payer budgets, and long term R&D commitments. Inflation and higher interest rates tighten access to capital, which slows clinical program expansion and manufacturing scale up plans.

Geopolitical tensions disrupt global supply chains for nucleotides, specialty reagents, lipid carriers, and high precision synthesis equipment, increasing operational complexity. Current US tariffs on imported raw materials, laboratory systems, and production components raise manufacturing costs, which compresses margins and intensifies pricing discussions with healthcare systems.

These pressures can delay commercialization timelines and affect smaller developers more directly. On the positive side, trade exposure encourages domestic synthesis capacity, multi sourcing strategies, and stronger quality oversight.

Strong clinical interest in targeted RNA therapies for rare and genetic disorders sustains investment momentum. With strategic partnerships, disciplined cost management, and continued scientific progress, the market remains positioned for steady and resilient growth.

Latest Trends

FDA approvals for new ASO indications is a recent trend in the market.

In 2024, the U.S. Food and Drug Administration granted approvals for antisense oligonucleotides in novel indications, reflecting a shift toward broader therapeutic applications beyond rare neurological disorders. These approvals leverage advanced clinical data demonstrating efficacy in hematological and metabolic conditions.

Manufacturers are prioritizing regulatory pathways to expedite reviews for expanded labels in oncology and cardiovascular diseases. Clinical analyses emphasized improved patient outcomes with targeted gene silencing mechanisms.

The FDA approved imetelstat in June 2024 for myelodysplastic syndromes and olezarsen in December 2024 for familial chylomicronemia syndrome. This progress addresses unmet needs in transfusion-dependent anemias and severe hypertriglyceridemia. Industry focus on parallel submissions in Europe and Asia accelerates global availability.

The trend incorporates real-world evidence to support safety in diverse patient cohorts. Sector synergies refine delivery platforms for enhanced bioavailability. These evolutions position ASO therapies as pivotal in precision medicine strategies for 2025.

Regional Analysis

North America is leading the Antisense Oligonucleotides Market

North America held a 38.8% share of the Antisense Oligonucleotides market in 2024, reflecting strong momentum in RNA targeted therapeutics across rare and neurological disorders. Biopharmaceutical companies advanced late stage pipelines and expanded commercial outreach for approved splice modulating and gene silencing treatments.

Academic centers collaborated closely with industry to translate genomic discoveries into targeted RNA based interventions. A supportive regulatory framework and orphan drug incentives accelerated development timelines and improved patient access. Specialized neuromuscular and genetic disease clinics strengthened treatment adoption through early diagnosis programs.

Investment in oligonucleotide manufacturing capacity also increased regional supply reliability. A relevant supporting indicator comes from the US Food and Drug Administration, which approved 55 novel drugs through its CDER program in 2023, underscoring continued advancement of innovative molecular therapies within the US ecosystem.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Antisense Oligonucleotides market in Asia Pacific is expected to expand steadily during the forecast period as governments strengthen rare disease policies and genomic medicine initiatives. Regional regulators accelerate review pathways for advanced therapies to address unmet clinical needs.

Biotechnology firms in Japan, South Korea, China, and Australia increase collaboration with global developers to localize clinical trials and commercialization. Growing genetic testing infrastructure supports earlier identification of target patient populations. Public funding for precision medicine research improves translational capabilities across academic hospitals.

Manufacturing investments enhance regional production of complex nucleic acid therapeutics. A verifiable signal of research commitment appears in 2023 data from Japan’s Ministry of Health, Labour and Welfare, which continues to implement its national rare disease support framework, reinforcing structured expansion of advanced RNA based treatments across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the antisense oligonucleotides market grow by broadening therapeutic pipelines with optimized chemistries and delivery platforms that improve target specificity and reduce off-target effects in debilitating genetic and metabolic conditions. They also strengthen performance by investing in robust clinical programs and expanding regulatory engagements to secure approvals across major markets, which supports label expansion and clinician confidence.

Strategic collaborations with biotechnology innovators and academic research centers accelerate discovery and share development risk for complex, rare disease targets. Firms deepen payer and provider engagement through health-economics evidence and patient support programs that improve access and long-term adherence.

Ionis Pharmaceuticals exemplifies a specialized RNA-targeted drug developer with a deep antisense technology foundation, a diversified portfolio of marketed and late-stage candidates, and a coordinated commercial model that pairs scientific expertise with strategic partnerships.

The company advances its growth agenda through disciplined R&D funding, targeted alliance building with global biopharma partners, and a customer-centric approach that aligns innovation with unmet clinical needs.

Top Key Players

- Ionis Pharmaceuticals

- Biogen

- Alnylam Pharmaceuticals

- Roche

- Novartis

- Pfizer

- Takeda Pharmaceutical

- Sanofi

- Eli Lilly

- AstraZeneca

Recent Developments

- In December 2025, Protalix BioTherapeutics entered into a discovery-stage collaboration with Secarna Pharmaceuticals focused on developing treatments for rare renal disorders. The partnership aims to combine platform technologies to advance novel therapeutic candidates in kidney disease indications.

- Also in December 2025, Stoke Therapeutics and Biogen shared clinical findings on zorevunersen that support its potential disease-modifying effect in Dravet syndrome, reinforcing progress within their RNA-targeted therapy collaboration.

- In September 2025, Ionis Pharmaceuticals announced positive pivotal trial results for zilganersen in patients with Alexander disease. The company indicated that the data support preparation for regulatory submission to the FDA.

Report Scope

Report Features Description Market Value (2025) US$ 4.2 Billion Forecast Revenue (2035) US$ 8.7 Billion CAGR (2026-2035) 7.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pegaptanib, Mipomersen, Eteplirsen, Approved Drugs and Pipeline Analysis), By Indication (Ocular Diseases, Spinal Muscular Atrophy, Diabetes, Cancer and Others), By Application (Basic Research, Target Validation, Genomics and Drug Discovery) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ionis Pharmaceuticals, Biogen, Alnylam Pharmaceuticals, Roche, Novartis, Pfizer, Takeda Pharmaceutical, Sanofi, Eli Lilly, AstraZeneca Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antisense Oligonucleotides MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Antisense Oligonucleotides MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ionis Pharmaceuticals

- Biogen

- Alnylam Pharmaceuticals

- Roche

- Novartis

- Pfizer

- Takeda Pharmaceutical

- Sanofi

- Eli Lilly

- AstraZeneca