Global Antimicrobial Packaging Market Material Type (Plastic, Biopolymer, Paperboard, Other Material Types), Antimicrobial Agents (Organic Acids, Enzymes, Essential Oils, Bacteriocins, Other Antimicrobial Agents), Packaging Type (Bags, Pouches, Cartons, Trays, Other Packaging Types), Application (Food and Beverages, Healthcare, Personal Care, Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 57178

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

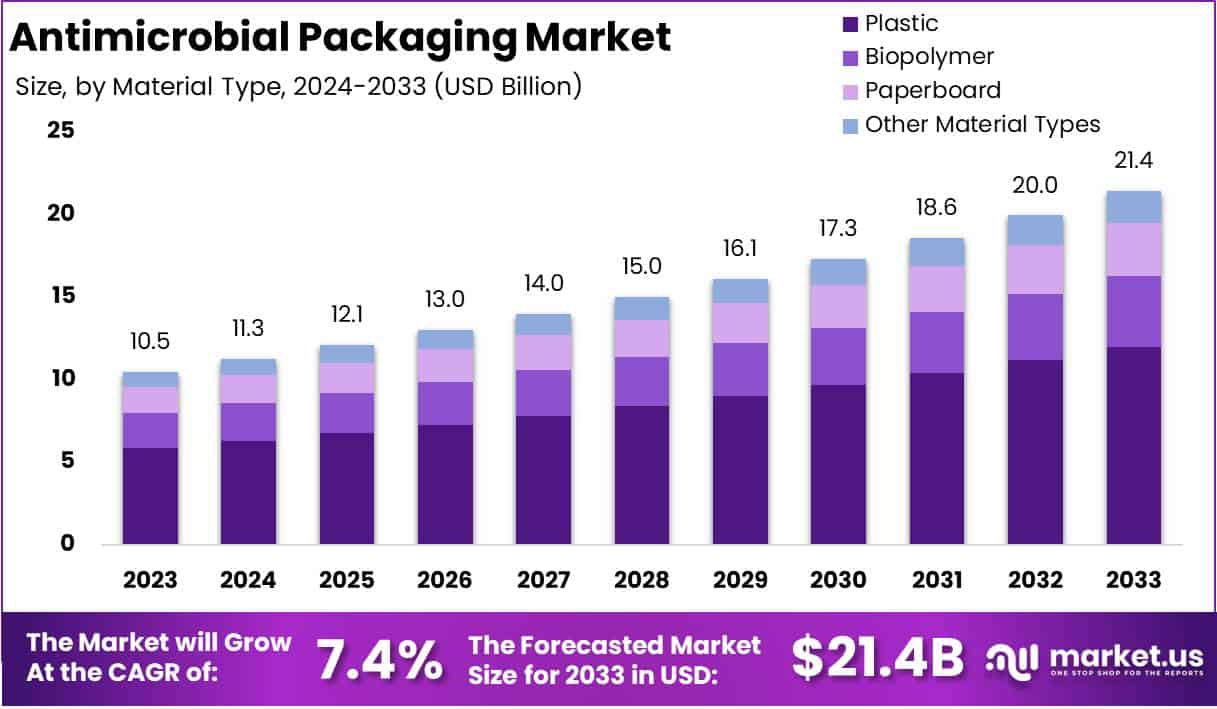

The Global Antimicrobial Packaging Market size is expected to be worth around USD 21.4 Billion by 2033, from USD 10.5 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

Antimicrobial packaging is a specialized type of packaging material designed to inhibit the growth of bacteria, fungi, and other microorganisms that can spoil products or pose health risks to consumers. This packaging incorporates antimicrobial agents, which may be natural, organic, or synthetic compounds, into the packaging materials themselves—such as plastics, paper, or coatings.

As a result, antimicrobial packaging not only extends the shelf life of perishable products like food, beverages, and pharmaceuticals but also improves safety by reducing the risk of contamination. The innovation in antimicrobial packaging reflects a significant advancement in food safety technologies, where packaging goes beyond mere containment to actively protect and preserve the quality of the product.

Driven by an increasing awareness of food safety, stringent regulations, and consumer demand for extended shelf-life products, the antimicrobial packaging market is expanding rapidly.

It involves manufacturers, material scientists, packaging solution providers, and regulatory agencies working collectively to create, test, and market antimicrobial solutions that address specific safety concerns. Additionally, this market is closely aligned with broader trends in health, sustainability, and consumer protection, making it a key area of growth and innovation within the packaging industry.

Several factors are propelling growth in the antimicrobial packaging market. Firstly, rising consumer awareness and demand for longer-lasting, safe, and uncontaminated products have fueled innovation in packaging technology.

The global increase in demand for packaged food products, coupled with the growth in the pharmaceutical industry, drives the need for advanced packaging solutions that can extend product shelf life.

Demand for antimicrobial packaging is on an upward trajectory, driven by the twin factors of consumer preference and regulatory requirements. Consumers are increasingly aware of the health risks associated with microbial contamination and have shown a preference for products that promise better safety standards.

In addition, the rising consumption of packaged foods, ready-to-eat meals, and pharmaceuticals has created a pressing need for packaging that can maintain product integrity over extended distribution networks and storage times.

Demand is particularly robust in developed regions like North America and Europe, where stringent regulations and high standards for food and pharmaceutical safety are key market drivers.

Meanwhile, emerging economies are experiencing increased demand due to the expansion of urban populations and modern retail networks, bringing antimicrobial packaging solutions to new, high-potential markets.

Opportunities in the antimicrobial packaging market are expanding, particularly in sustainable, bio-based antimicrobial solutions. With increasing regulatory scrutiny on plastic waste, there is a significant market opportunity for packaging materials that are both antimicrobial and environmentally friendly.

The demand for biodegradable or compostable packaging with antimicrobial properties is growing as manufacturers aim to balance food safety with environmental sustainability.

Additionally, advancements in nanotechnology and biotechnology offer promising pathways to develop more effective antimicrobial agents and smarter packaging materials that can adapt to different environmental conditions, further enhancing product safety and lifespan.

Collaborations between packaging companies, research institutions, and technology developers could accelerate innovation in this space, enabling firms to gain competitive advantages by meeting evolving consumer preferences and regulatory requirements.

According to Plasticstoday, SK Chemicals, a South Korean firm, has invested $98.4 million to acquire a chemical recycling facility and a PET production plant from China-based Shuye Environmental Technology. This facility, with an annual capacity of 70,000 metric tons (77,162 tons), uses advanced depolymerization to transform plastic waste into monomers, yielding recycled bis-hydroxyethyl terephthalate (BHET).

This acquisition includes a production line capable of manufacturing 50,000 metric tons (55,116 tons) of recycled PET (rPET), integrating recycled BHET into sustainable production. This development underscores the rising commitment within the antimicrobial packaging market to enhance recycling and sustainability, aligning with growing consumer demand for eco-conscious packaging solutions.

According to Woola, the antimicrobial packaging market is navigating growing demand and stringent sustainability expectations, yet faces readiness challenges. While 75% of companies have committed to sustainable packaging, fewer than 30% are prepared to meet regional standards or their own goals.

Consumer preference is clear: 64% prefer brands with sustainable packaging, with nearly half willing to pay a premium and 83% of younger consumers showing a higher willingness to invest in eco-friendly options.

However, understanding of “sustainable packaging” varies 73% equate it with recycled materials, 78% want reduced plastic, and 77% prioritize minimal packaging. Yet, 77% of consumers struggle to verify sustainability claims, emphasizing the need for clarity and credibility as brands innovate with sustainable, antimicrobial solutions.

According to WHO, foodborne illnesses affect 600 million people globally each year, with 420,000 fatalities, highlighting the critical need for antimicrobial packaging. Unsafe food results in a $110 billion annual productivity and medical cost burden in low- and middle-income countries, with children under five bearing 40% of this impact and accounting for 125,000 deaths.

Antimicrobial packaging, by reducing contamination risks, can play a crucial role in enhancing food safety, supporting global food security, and protecting vulnerable populations, particularly in resource-limited settings. This growing demand positions the antimicrobial packaging market for sustained growth.

Key Takeaways

- The global antimicrobial packaging market is projected to expand at a CAGR of 7.4% from 2024 to 2033, increasing from USD 10.5 billion in 2023 to an estimated USD 21.4 billion by 2033.

- Plastic leads the material type segment, capturing 56.1% of the antimicrobial packaging market due to its cost-effectiveness and durability in diverse applications.

- Organic acids dominate antimicrobial agents with a 32.3% market share, driven by their effectiveness in food safety applications.

- Pouches hold the largest share in packaging type, accounting for 43.5%, owing to their flexibility, cost-effectiveness, and strong barrier properties.

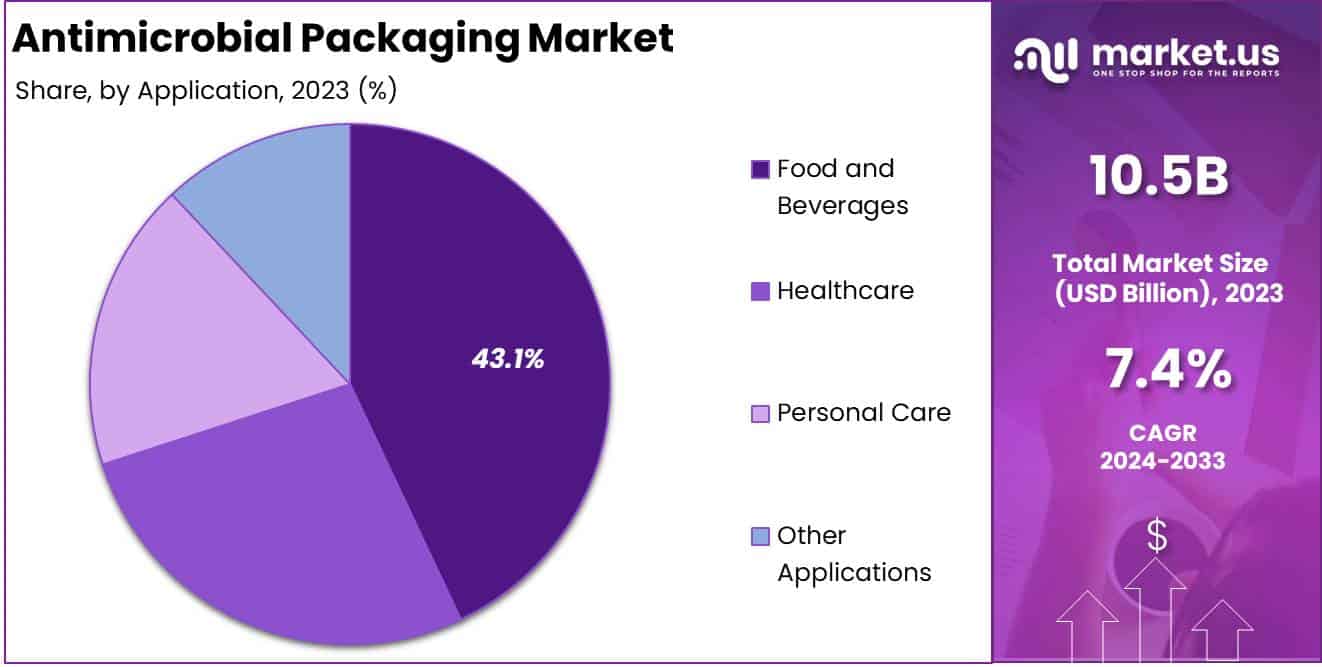

- Food and beverages command the highest application share at 43.1%, reflecting heightened demand for extended shelf-life and safety in consumable products.

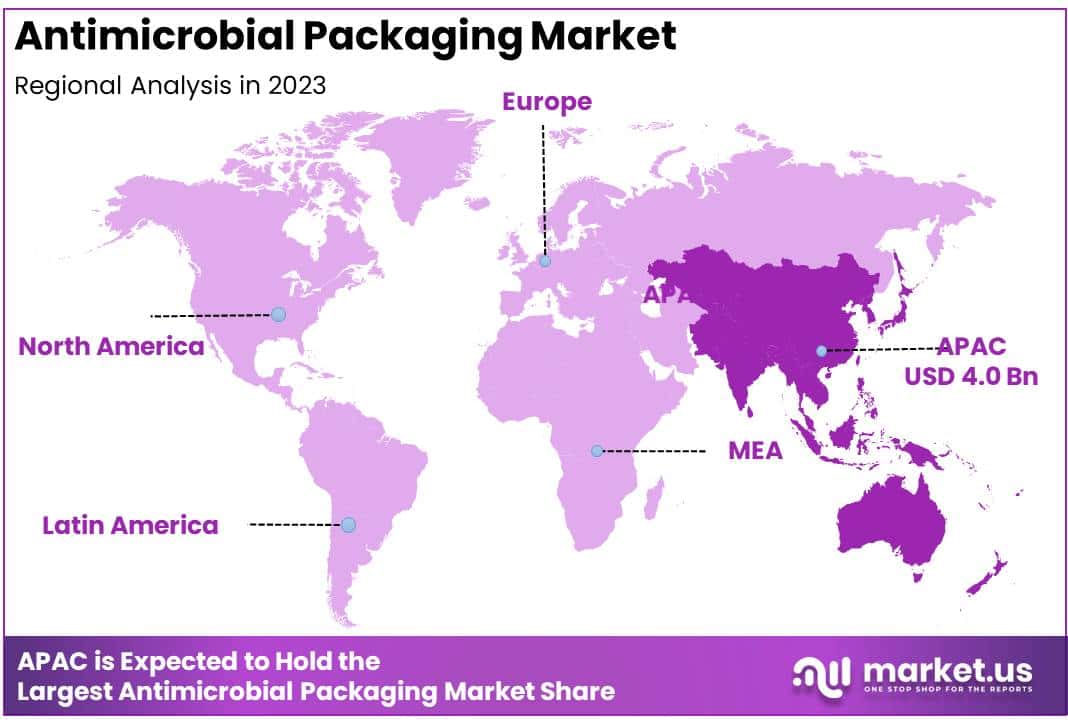

- Asia-Pacific leads the global market with a 38.2% share, propelled by robust demand in the food and beverage sector and rising urbanization across the region.

By Material Type Analysis

Plastic Dominates Antimicrobial Packaging Market by Material Type with 56.1% Share

In 2023, plastic held a dominant market position in the antimicrobial packaging market by material type, capturing more than a 56.1% share. Its widespread use is attributed to plastic’s versatility, durability, and cost-effectiveness, which make it highly suitable for various applications within the food, beverage, and healthcare sectors.

Plastic materials, especially polyethylene (PE) and polypropylene (PP), offer excellent barrier properties against moisture, oxygen, and microbial contamination, effectively extending product shelf life and reducing spoilage.

This capability has reinforced plastic’s stronghold in antimicrobial packaging, particularly in regions with high demand for packaged goods, such as Asia-Pacific and North America.

Biopolymers are emerging as a significant alternative within the market, driven by rising consumer and regulatory demand for sustainable and eco-friendly packaging. Although they represent a smaller share of the market, biopolymers are experiencing steady growth as manufacturers increasingly seek biodegradable options to meet environmental goals.

Paperboard, while traditionally used in packaging, holds a smaller share due to its comparatively limited durability and barrier properties; however, it remains an attractive choice in niche segments prioritizing sustainability.

Other material types, including metals and glass, contribute minimally but serve specialized applications where enhanced durability or specific antimicrobial properties are required. These materials are most commonly utilized in sectors requiring stringent packaging standards, such as pharmaceuticals and medical devices.

By Antimicrobial Agents Analysis

Organic Acids Dominate Antimicrobial Packaging Market by Antimicrobial Agents with 32.3% Share

In 2023, organic acids held a dominant market position in the antimicrobial packaging market by antimicrobial agent, capturing more than a 32.3% share. This substantial share can be attributed to organic acids’ effectiveness in inhibiting microbial growth, making them a popular choice in food and beverage packaging applications.

Compounds such as lactic acid and citric acid are widely used for their ability to extend shelf life and enhance food safety, particularly for perishable items. Their compatibility with various packaging materials, including plastics and biopolymers, further drives their prevalence in the market.

Enzymes are a growing segment, valued for their natural antimicrobial properties and potential in extending the freshness of packaged products. While enzymes currently capture a smaller market share, their application is expanding as consumer demand for natural preservatives increases.

Essential oils, known for their antimicrobial and aromatic properties, are increasingly used in niche markets focused on natural or organic packaging solutions, appealing to health-conscious consumers. Despite their smaller share, essential oils represent a growth area in the market.

Bacteriocins and other antimicrobial agents occupy niche segments, primarily utilized in specialized applications where specific microbial threats need to be addressed, such as in medical and pharmaceutical packaging. Although their overall market share remains limited, these agents are essential in sectors that demand high levels of microbial control and product safety.

By Packaging Type Analysis

Pouches Dominate Antimicrobial Packaging Market by Packaging Type with 43.5% Share

In 2023, pouches held a dominant market position in the antimicrobial packaging market by packaging type, capturing more than a 43.5% share. This leading position is driven by the rising demand for lightweight, flexible, and cost-effective packaging solutions that also offer strong antimicrobial properties to extend product shelf life.

Pouches are particularly popular in the food and beverage industry, where they provide an excellent barrier against contaminants, moisture, and oxygen, helping to preserve the freshness of products. Their adaptability for both solid and liquid contents further contributes to their widespread use.

Bags are another significant segment, valued for their versatility and cost-efficiency, particularly in bulk packaging applications. Although bags hold a smaller share than pouches, they remain popular in applications requiring antimicrobial protection at a lower cost.

Cartons are commonly used for packaging perishable items and have seen steady adoption due to their structural strength and ease of stacking, though their market share is limited compared to flexible formats like pouches and bags.

Trays and other packaging types fulfill specialized roles in the antimicrobial packaging market, particularly within sectors such as healthcare, where rigid packaging may be preferred to maintain sterility and product integrity. While they represent smaller segments, trays and similar formats are essential for applications requiring added protection and stability.

By Application Analysis

Food and Beverages Dominate Antimicrobial Packaging Market by Application with 43.1% Share

In 2023, food and beverages held a dominant market position in the antimicrobial packaging market by application, capturing more than a 43.1% share. This leadership is driven by the increasing need for packaging solutions that enhance food safety, extend shelf life, and reduce spoilage.

Rising consumer demand for fresh, minimally processed foods, particularly in regions like Asia-Pacific and North America, has spurred adoption of antimicrobial packaging within this sector.

The ability of antimicrobial packaging to inhibit bacterial growth helps manufacturers maintain product quality during storage and transportation, meeting stringent safety and quality standards.

The healthcare sector is another prominent application, where antimicrobial packaging is critical for safeguarding medical devices, pharmaceuticals, and other sterile products. Although healthcare represents a smaller share than food and beverages, it is a rapidly growing segment due to stringent regulatory requirements for sterility and contamination control.

Personal care applications are steadily expanding, driven by growing awareness of product safety and extended shelf life. While this segment holds a more modest market share, it is expected to grow as consumers prioritize hygiene and safety in personal care products.

Other applications, including industrial and household items, represent niche segments that require microbial protection, though their share is comparatively smaller. These applications are critical in environments where maintaining hygiene is essential, contributing to steady demand in the antimicrobial packaging market.

Key Market Segments

By Material Type

- Plastic

- Biopolymer

- Paperboard

- Other Material Types

By Antimicrobial Agents

- Organic Acids

- Enzymes

- Essential Oils

- Bacteriocins

- Other Antimicrobial Agents

By Packaging Type

- Bags

- Pouches

- Cartons

- Trays

- Other Packaging Types

By Application

- Food and Beverages

- Healthcare

- Personal Care

- Other Applications

Driver

Rising Consumer Awareness and Demand for Food Safety

The primary driver for the global antimicrobial packaging market in 2024 is the rising consumer awareness and demand for food safety. Consumers are increasingly vigilant about foodborne illnesses, contaminants, and preservatives in their food products. This shift in consumer behavior has spurred demand for packaging solutions that not only preserve food freshness but also actively reduce microbial growth.

As awareness of food safety issues continues to increase globally, consumers are more likely to opt for products that have antimicrobial packaging, particularly in regions where food recalls and contamination cases have been prominent.

This surge in awareness has led manufacturers and retailers to adopt antimicrobial packaging as a competitive advantage, using it to differentiate products in an increasingly safety-conscious market.

In tandem, regulatory bodies worldwide are implementing stringent food safety standards, compelling food manufacturers to explore innovative packaging solutions to maintain compliance.

Antimicrobial packaging helps meet these standards by extending shelf life and reducing the potential for bacterial contamination, an especially critical need as food supply chains become longer and more complex.

Additionally, antimicrobial packaging can decrease food wastage an area of focus for both businesses and governments aiming to address food security issues. With over one-third of food produced globally lost or wasted annually, antimicrobial packaging is emerging as a valuable tool to mitigate spoilage, align with sustainability goals, and meet consumer demands.

As a result, the ongoing emphasis on food safety, paired with stricter regulatory environments, is solidifying antimicrobial packaging as an essential component within the food and beverage sector, thereby driving significant growth in the global market.

Restraint

High Cost of Antimicrobial Packaging Materials

While the antimicrobial packaging market shows robust growth potential, the high cost of antimicrobial packaging materials is a significant restraint. Materials such as silver ions, organic acids, and enzymes, which are commonly used in antimicrobial packaging, are often costly to procure and integrate into packaging solutions.

The complex technology required for developing these materials further escalates production costs. As a result, companies that adopt antimicrobial packaging face higher expenses compared to conventional packaging solutions, which can be a barrier for widespread adoption, particularly among smaller manufacturers and startups with limited budgets. High costs may also be passed on to consumers, potentially leading to decreased demand in cost-sensitive markets.

This cost constraint is particularly impactful in emerging markets, where price sensitivity is higher, and consumers may be unwilling or unable to bear the premium price of antimicrobial packaging. Companies looking to enter these markets face the dual challenge of balancing quality with affordability, which can be difficult given the high production costs.

Additionally, the resources required to produce antimicrobial packaging solutions at scale can deter manufacturers who are aiming to keep operational costs low. While larger corporations may have the capacity to absorb or offset these costs, smaller players may find it challenging, which could restrict the overall market penetration of antimicrobial packaging.

As such, unless cost-effective alternatives become available, or companies achieve greater economies of scale, the high cost of antimicrobial materials will continue to act as a restraint, limiting market growth in certain segments.

Opportunity

Technological Advancements in Biodegradable Antimicrobial Packaging

Technological advancements in biodegradable antimicrobial packaging present a significant opportunity for the market. With increasing environmental concerns, there is a strong demand for sustainable packaging solutions that can address both food safety and environmental impact.

Traditional antimicrobial packaging, often composed of non-biodegradable materials, is being phased out in favor of eco-friendly alternatives.

The development of biodegradable antimicrobial packaging materials, such as those based on chitosan, cellulose, and essential oils, represents a breakthrough that can meet the dual needs of sustainability and microbial inhibition.

These materials not only help in reducing environmental impact but also extend the shelf life of perishable products, aligning with current consumer preferences for sustainable and healthy food products.

The opportunity for biodegradable antimicrobial packaging is further bolstered by government regulations and policies aimed at reducing plastic waste and promoting circular economies.

Many countries are implementing stricter regulations against single-use plastics, and this legislative push encourages companies to invest in research and development for sustainable packaging solutions.

Consequently, companies that leverage biodegradable materials in antimicrobial packaging stand to benefit from both regulatory incentives and consumer approval. Moreover, advancements in biodegradable antimicrobial technologies could lower production costs over time, making these products more accessible to a wider range of consumers and manufacturers.

This evolution in sustainable packaging technology provides an ideal growth opportunity for companies that can lead the market with innovative, eco-friendly solutions that address current regulatory and consumer demands.

Trends

Growing Adoption of Antimicrobial Packaging in Healthcare and Pharmaceutical Sectors

An emerging trend propelling the growth of the antimicrobial packaging market is its increasing adoption within the healthcare and pharmaceutical sectors. Traditionally dominated by food and beverage applications, antimicrobial packaging is now finding extensive use in medical and pharmaceutical products, where sterility and hygiene are paramount.

With heightened attention to infection control and hygiene standards, antimicrobial packaging solutions are being utilized to package medical devices, pharmaceutical products, and healthcare supplies.

These packages help reduce the risk of contamination and prolong the shelf life of sensitive materials, which is critical for both patient safety and regulatory compliance.In the wake of the COVID-19 pandemic, there has been a surge in demand for hygienic and safe packaging within the healthcare and pharmaceutical industries.

Packaging that minimizes microbial contamination is increasingly viewed as essential in this sector to prevent hospital-acquired infections (HAIs) and ensure the integrity of pharmaceutical products throughout their lifecycle.

This shift is reinforced by rising investments in healthcare infrastructure and advanced pharmaceutical supply chains in many regions. Additionally, the regulatory landscape for healthcare packaging is stringent, with antimicrobial solutions often seen as a proactive measure for meeting safety standards.

The increased use of antimicrobial packaging in these sectors not only expands its application base but also positions it as a critical component in the future of healthcare supply chains, enhancing market growth through diversified application areas.

Regional Analysis

Asia-Pacific Leads Antimicrobial Packaging Market with Largest Market Share of 38.2%

The antimicrobial packaging market exhibits strong regional variance, driven by differing levels of technological adoption, regulatory frameworks, and demand for food safety and shelf-life extension. The Asia-Pacific region dominates this landscape, holding a substantial 38.2% market share in 2023, equating to approximately USD 4.0 billion.

This market leadership is attributed to the rapid growth of food and beverage industries in countries such as China, Japan, and India, where rising disposable incomes and urbanization are fueling demand for advanced packaging solutions.

Additionally, heightened awareness of food safety and stringent regulations have accelerated the adoption of antimicrobial packaging across key Asian economies.

North America is also a prominent market, with significant investments in packaging innovation aimed at extending product shelf life and meeting stringent regulatory standards, particularly in the United States and Canada. The region’s robust healthcare and pharmaceutical sectors further support demand for antimicrobial packaging, particularly in medical applications where sterility is crucial.

In Europe, countries like Germany, the UK, and France are at the forefront of adopting sustainable and advanced packaging solutions. The region is characterized by a high level of environmental consciousness, which has encouraged the development of biodegradable antimicrobial packaging, aligning with the European Union’s sustainability goals. Consequently, Europe commands a substantial share, closely following North America.

The Middle East & Africa (MEA) and Latin America represent emerging markets with significant potential for future growth. In MEA, countries such as the UAE and Saudi Arabia are witnessing increased demand, driven by rising food imports and an expanding healthcare sector.

Similarly, Latin America, led by Brazil and Mexico, is experiencing growth due to an expanding retail sector and rising consumer demand for packaged food products with extended shelf lives.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the global antimicrobial packaging market in 2024 is marked by innovation, strategic partnerships, and a strong focus on sustainability, driven by key players such as Amcor plc, DuPont, Dunmore Europe GmbH, and Tetra Pak International S.A. Each of these companies plays a pivotal role in advancing antimicrobial solutions in packaging to meet rising demand for extended product shelf life, food safety, and reduced waste.

Amcor plc leads the market by combining its expertise in flexible and rigid packaging solutions with antimicrobial technology, addressing consumer demands for both convenience and safety. The company’s commitment to sustainable packaging aligns with its development of recyclable, antimicrobial products, capturing a significant share of the food and healthcare sectors.

DuPont, a long-standing leader in advanced materials, leverages its in-depth research and development capabilities to innovate in antimicrobial coatings. By integrating these solutions into flexible packaging, DuPont continues to serve diverse industries, reinforcing its reputation for reliability and safety.

Dunmore Europe GmbH focuses on antimicrobial films and coatings, capitalizing on its niche within Europe’s stringent regulatory landscape. The company’s collaborations with medical and food sector players have positioned it as a trusted partner, particularly in regions with high hygiene standards.

Meanwhile, Tetra Pak International S.A., a major player in liquid packaging solutions, is expanding into antimicrobial packaging to protect perishable products. Tetra Pak’s expertise in aseptic packaging gives it a competitive edge in developing antimicrobial solutions that prioritize both product quality and environmental considerations.

Other key players in this market continue to innovate, especially in natural antimicrobial agents, while smaller firms gain traction by offering specialized products tailored to local market needs. Together, these companies are driving the antimicrobial packaging market’s growth trajectory, fostering enhanced safety and sustainability in packaging worldwide.

Top Key Players in the Market

- Amcor plc

- DuPont

- Dunmore Europe GmbH

- Tetra Pak International S.A.

- Other Key Players

Recent Developments

- In 2023, Avient Corporation showcased new sustainable technologies at the Plastics Recycling Show Europe (PRSE) on May 10. This innovation broadens their packaging solutions, emphasizing sustainability within the industry.

- In 2023, DuPont announced on August 1 that it had finalized its acquisition of Spectrum Plastics Group, enhancing its footprint in the specialty medical devices market.

- In 2024, SEE, in collaboration with Ossid, launched a global initiative on April 4 to supply advanced tray overwrapping solutions to case-ready processors. This partnership is designed to enhance operational efficiency and promote sustainability in fresh protein production.

- In 2023, SK Chemicals of South Korea committed $98.4 million to acquire a chemical recycling plant from Shuye Environmental Technology in China. This facility, capable of processing 70,000 metric tons of material annually, uses cutting-edge depolymerization technology for recycling plastic waste.

- In 2023, Berry’s new CEO Kevin Kwilinski reported surpassing financial expectations, with significant gains in market share and robust capital investments leading to sustained profitability despite challenging market conditions. Berry has maintained a consistent trajectory of earnings growth and returned significant capital to its shareholders.

Report Scope

Report Features Description Market Value (2023) USD 10.5 Bn Forecast Revenue (2033) USD 21.4 Bn CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Material Type (Plastic, Biopolymer, Paperboard, Other Material Types), Antimicrobial Agents (Organic Acids, Enzymes, Essential Oils, Bacteriocins, Other Antimicrobial Agents), Packaging Type (Bags, Pouches, Cartons, Trays, Other Packaging Types), Application (Food and Beverages, Healthcare, Personal Care, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor plc, DuPont, Dunmore Europe GmbH, Tetra Pak International S.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antimicrobial Packaging MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Antimicrobial Packaging MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- DuPont

- Dunmore Europe GmbH

- Tetra Pak International S.A.

- Other Key Players