Global Antifouling Coating Market By Type (Copper-based, Self-polishing Copolymer, Hybrid, Biocides, and Others Types), By Application Type (Shipping Vessels, Drilling Rigs and Production Platforms, Fishing Boats, Yachts and other Boats, and Others Application), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 13610

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

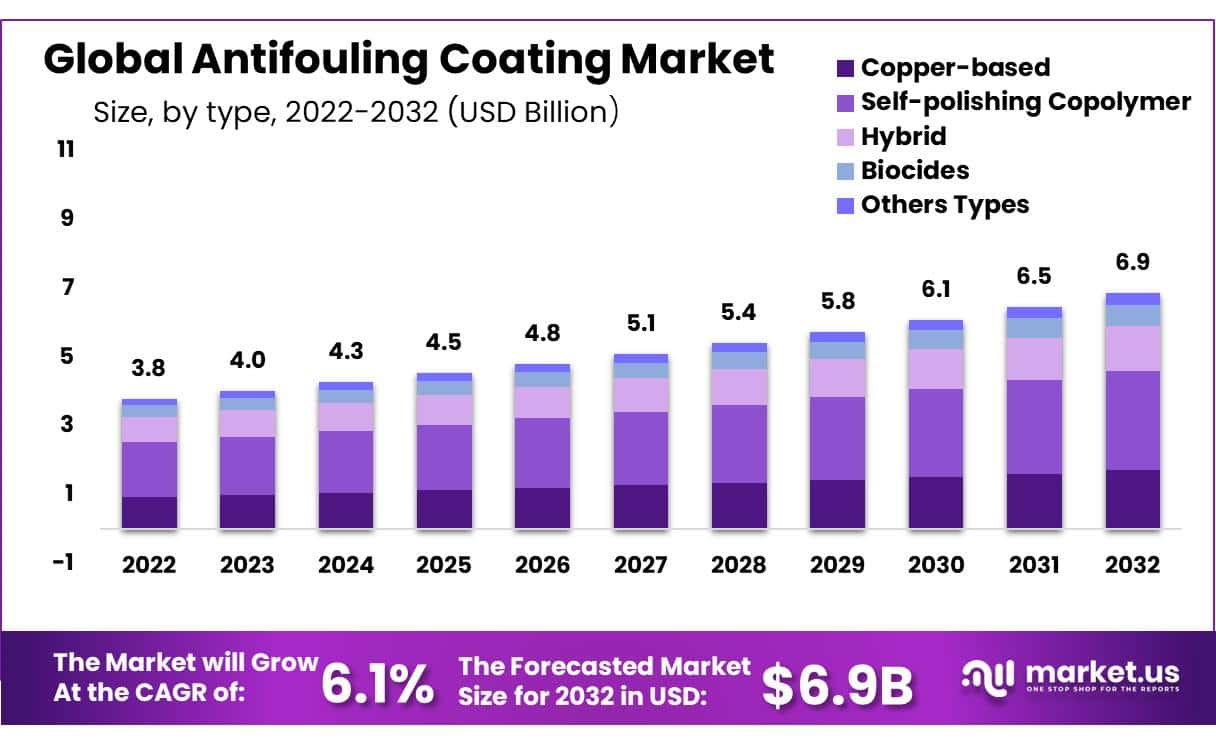

In 2022, the Global Antifouling Coating Market was valued at USD 3.8 Billion, and is expected to reach USD 6.9 Billion in 2032 from 2023 to 2032, this market is estimated to register a CAGR of 6.1%.

Antifouling coatings are specialized to the ship’s hull to slow the marine growth in the underwater area, affecting the vessel’s performance and durability. The hull coating can serve as a barrier against hull corrosion, which weakens and damages the metal and prevents marine growth. Additionally, it enhances the water flow under the hull of a fishing boat or a high-performance racing yacht.

The production of antifouling coating involves the production of components that resist the growth of organisms that cause the decay of the marine environment. Its application has a significant impact on the overall operational costs of vessels and maritime industries, as well as on the overall operating costs of industries.

Nowadays, antifouling coatings are made with special chemicals that stop barnacles, algae, and other marine creatures from growing. These chemicals include organotin, copper, and other types of biocide. Most commercial ships use an antifouling coating with synthetic chemicals that can harm the environment.

With the ban on these chemicals, people started looking for ways to use antifouling chemicals that are biologically inspired. This could lead to the development of natural or biomimetic anti-foaming surface coatings.

Key Factors

- In 2022, the Global Antifouling Coating Market was valued at US$ 3.8 Billion, and from 2023 to 2032, this market is estimated to register a CAGR of 6.1%.

- In 2022, self-polishing accounted for a market share of 42%.

- According to the United Nations Conference on Trade and Development (UNCTAD) statistics, there were 102,899 ships worldwide in 2022, an increase of 1.5%. Most were Bulk Carriers, Oil Tankers, and Cargo Ships, making up 20% of the total. With more ships, there is more need for corrosion-resistant hull coatings that stick well.

- According to the UNCTAD data, the majority of the fleets were owned by Asian people (50%), followed by Americans (20%) and Europeans (18%).

- According to a report by the United Nations Convention on the Rights of Persons with Disabilities (UNCTAD), the world’s fleet comprises 53% of its total tonnage, with Greece holding 18% of that market share, followed by China at 13%, Japan at 11%, and Singapore at 6%, and the Hong Kong SAR at 5%.

Actual Numbers Might Vary in the final report

Market Scope

Type Analysis

There is a rise in demand for the self-polishing segment because of its significant use in ships and underwater facilities.

The antifouling coating market is segmented based on metal type into copper-based, self-polishing copolymer, hybrid, biocides, and other types. Among these, self-polishing held the majority of revenue share. In 2022, self-polishing accounted for a market share of 42%. Marine biofouling can cause significant damage to ships and underwater facilities.

The best way to protect against this type of damage is to use anti-fouling self-polish coatings because self-polishing coatings are made up of a copolymer that releases biocide at a constant rate over the life of the coating because of chemical reactions between the coating and the seawater, which does not harm ship and underwater facility. This has been a contributing factor to the increasing market demand for this type of coating.

Application Analysis

Increased demand for shipping vessels segment due to rising demand in the marine sector.

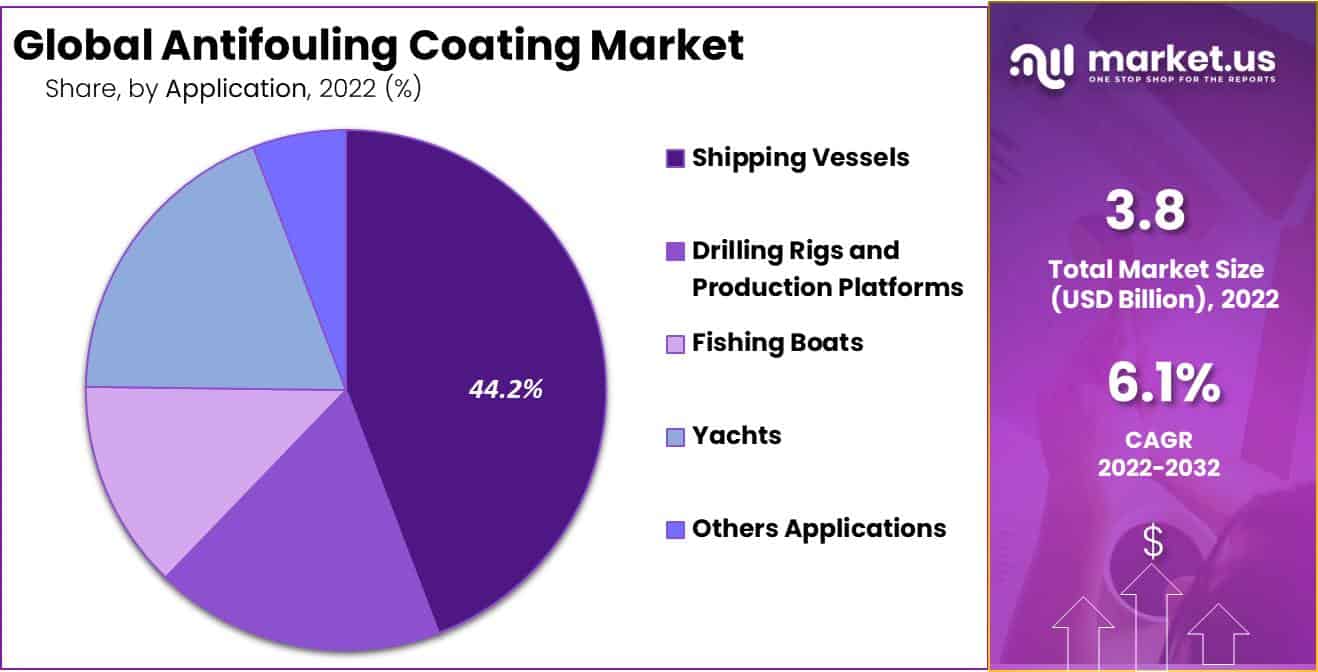

By applications, the market is segmented into shipping vessels, drilling rigs and production platforms, fishing boats, yachts and other boats, and other applications. Among these types, shipping vessels accounted for the majority of the market share.

In 2022, shipping vessels held 44.2% of the global market because copper antifouling coatings are highly effective and have long been used in the marine sector. Copper coatings release copper ions into water, which are toxic to most marine organisms and prevent them from attaching to and proliferating on the ship’s hull. Copper-based coatings have a long-lasting service life and provide superior anti-fouling properties.

Key Market Segments

By Type

- Copper-based

- Self-polishing Copolymer

- Hybrid

- Biocides

- Other Types

By Application Type

- Shipping Vessels

- Drilling Rigs and Production Platforms

- Fishing Boats

- Yachts and Other Boats

- Others Application

Drivers

The increased demand from the ship and oil industry drives the global antifouling coating market.

As a result of globalization, the necessity to import and ship goods has risen drastically. Antifouling coatings have become a critical business in this regard. Shipyards around the world are responsible for ship design and construction. Asian countries such as Japan, South Korea, and China account for most of the world’s ship production.

However, there are also large shipyards across many other regions. A shipyard is a specialized workplace where the main focus of the shipbuilding industry is to design and customize vessels. As more countries open their doors to international trade, there will be a rise in demand for products made by the antifoaming coating industry.

It is increased that the use of compact integrated systems in deep-sea offshore reserves during bad weather conditions will lead to an increase in the demand for Floating production storage and offloading (FPSO) vessels in the upstream petroleum and gas sector, thus stimulating the market. Furthermore, the development of alternative energy sources, such as Tight Oil and U.S. Shale Gas, contributes to the growth of the coating market.

Restraints

The Fluctuation of the Prices of Essential Raw Materials Used In Manufacturing Processes.

The primary resistance to the industry’s development is the high cost of raw materials. The availability of raw materials directly affects the raw material price. This is one of the reasons why the market growth is hindered. With the fall in the supply of materials, the production rate will decrease; as a decrease in production occurs, there is less supply of goods, leading to market growth.

In addition, the rise in demand for antifouling coatings from various industries and the shipbuilding industry is also a large obstacle to the development of the industry. Hence, the market growth is restrained by these factors.

Opportunity

Environmentally friendly antifouling coatings.

In recent years, many major companies have released new antifouling coatings. The most significant launch in the market has been the introduction of Copper-free Antifouling Coatings, which are safer and more efficient for the marine industry. Additionally, Akzo Nobel has released a new coating, Interslek 1100SR.

This coating uses advanced silicone technology and offers long-term protection against bio-fouling. It is also more environmentally friendly than existing coatings. Many companies that use metal antifouling coatings have begun manufacturing products with a reduced leach rate. These are the key factors that encourage market growth, and eco-friendly coating is a great opportunity for growth in this market.

Trends

Increased Demand for Hull Coating

Hull coatings are used to protect underwater parts of ships and yachts from the growth of organisms and microbes. These coatings improve the appearance and durability of the hull, as well as their ability to clean itself and resist graffiti.

As per the United Nations Conference on Trade and Development Data, the global fleet totaled 102,899 vessels in 2022, an increase of 1.5% compared to the last year. Bulk carriers (20%), cargo ships (20%), and oil tankers (19%) accounted for the majority of this total.

As the global fleet expands, there will be a greater need for corrosion-resistant hull coatings that can withstand wear and tear. These global trends have led to a boom in the shipbuilding industry, which is likely to raise the demand for antifouling hull coatings over the upcoming years.

Geopolitical Analysis

- Regulation– the International Maritime Organization (IMO) has regulations in place to reduce the environmental impact of antimicrobial and biocide coatings. At the same time, the EU (European Union) has banned the use of some bio-based antimicrobial coatings and is encouraging the development of environmentally friendly antimicrobial technologies

- Government funding, international cooperation, and intellectual property (IP) rights influence research and development- The research and development of anti-fouling coatings. For instance, governments can fund research and development of eco-friendly antifouling coatings. International cooperation can help develop new technologies and transfer knowledge.

- Economic growth- Antifouling coating industries are driven by economic growth. As the market expands, companies have the opportunity to invest in R&D for new and innovative anti-fouling technologies. These technologies can lead to more effective and eco-friendly antifouling solutions.

Regional Analysis

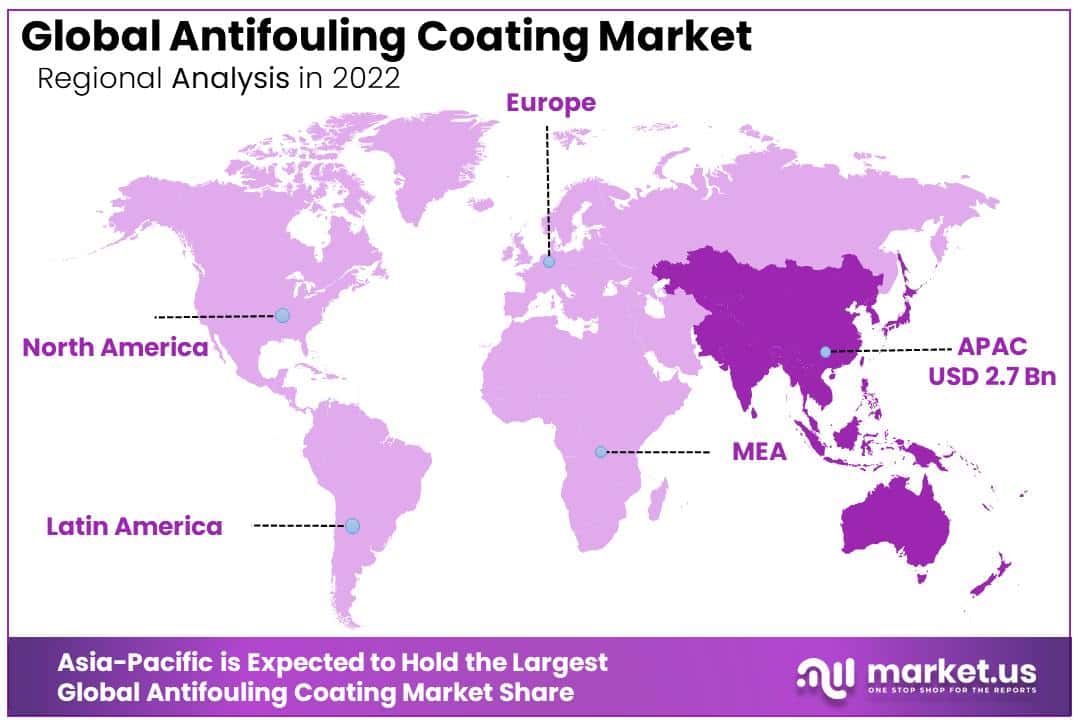

Asia-Pacific Region Accounted Significant Share of the Global Antifouling Coating Market

In 2022, Asia Pacific accounted for the largest proportion of the total revenue, with a maximum share of over 72.2%. Asia-Pacific accounted for the largest share of the global market. Asia is the world’s largest shipbuilding and ship-repair market, covering a wide range of vessel types, from ferries and small boats to fishing boats, towboats, and tugboats, to oil-industry vessels, cargo vessels, passenger vessels, bulk carriers, and container ships.

In Asia-Pacific, the major shipyards are located in China, Japan, and South Korea, while there are also large shipyards in other countries of the region. The APAC region was projected to account for approximately half of the world’s shipbuilding capacity in 2022, according to the United Nations Conference on Trade and Development statistics, with an estimated 51,988 ships owned by the region out of 102,988 in total. Hence, this region held the maximum market share.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Industry Leaders Stay Ahead Of the Competition by Investing a Lot of Time and Energy into Expanding Their Product Portfolio through Various Strategies.

Key players in the sector are focusing more on product innovation. Competition among the players is leading to the development of anti-foaming coatings.

Some regional manufacturers have created a coating that offers the best protection of the hull and optimizes the performance of the vessel as per the International Maritime Organization (IMO) energy efficiency standards.

Market Key Players

Leading market companies are generating considerable investments in R&D to expand their product portfolio, which contributes to the growth of the Antifouling Coatings market.

Additionally, market participants are taking various strategic steps to expand their presence in the market, such as launching new products, entering into contractual mergers and agreements, increasing investments, acquiring businesses, and collaborating with other organizations.

In order to remain competitive and successful in a rapidly expanding market, the anti-fouling coating industry must provide cost-effective solutions.

- Akzo Nobel N.V.

- Jotun

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Hempel A/S

- Nippon Paint Marine Coatings Co., Ltd.

- BASF SE

- Boero

- Chugoku Marine Paints, Ltd.

- Kansai Paint Co., Ltd.

- Nautix

- Nouryon

- Silicone Solutions

- Aquarius Marine Coatings Ltd

- Other Key Players

Recent Development

- In December 2022, I-Tech AB and LANXESS, the creators of the Selektope anti-fouling biotechnology, announced that they have successfully tested Selektope-based coating formulations for the maritime industry, which contain Selektope as well as the SEA NINE group of biocides. This means that manufacturers can now use these coating formulations to test out new combinations of existing biocides without any extra research and development.

- In November 2022, Akzo Nobel NV announced the introduction of a new B-Free (Biocide-Free) Fouling Control Range from Akzo Nobel’s yacht coatings business. This range enables boaters to keep their ship or boat’s hull clean and smooth when applied. The new product line benefits the marine ecosystem, as it does not contain any biocide. The smooth surface improves the efficiency of hulls, resulting in a lower carbon footprint.

Report Scope

Report Features Description Market Value (2022) US$ 3.8 Bn Forecast Revenue (2032) US$ 6.9 Bn CAGR (2023-2032) 6.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Copper-based, Self-polishing Copolymer, Hybrid, Biocides, and Others Types), By Application Type (Shipping Vessels, Drilling Rigs and Production Platforms, Fishing Boats, Yachts and other Boats, and Others Applications). Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Akzo Nobel N.V., Jotun, PPG Industries, Inc., The Sherwin-Williams Company, Hempel A/S, Nippon Paint Marine Coatings Co., Ltd., BASF SE, Boero, Chugoku Marine Paints, Ltd., Kansai Paint Co., Ltd., Nautix, Nouryon, Silicone Solutions, Aquarius Marine Coatings Ltd, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is antifouling coating market?Antifouling coating is a specialized type of paint or coating applied to the hulls of ships, boats, and marine structures to prevent the attachment and growth of marine organisms, such as barnacles and algae.

Why is antifouling coating market important?Antifouling coatings help maintain the performance and efficiency of marine vessels by reducing drag, fuel consumption, and maintenance costs. They also prolong the lifespan of marine structures by preventing damage caused by fouling organisms.

How does antifouling coating market work?Antifouling coatings release biocides or inhibit the adhesion of marine organisms, making the surface unattractive for fouling. Biocides are toxic to fouling organisms, preventing them from attaching to the coated surface.

-

-

- Akzo Nobel N.V.

- Jotun

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Hempel A/S

- Nippon Paint Marine Coatings Co., Ltd.

- BASF SE

- Boero

- Chugoku Marine Paints, Ltd.

- Kansai Paint Co., Ltd.

- Nautix

- Nouryon

- Silicone Solutions

- Aquarius Marine Coatings Ltd

- Other Key Players