Global Anti-Slip Paper Market Size, Share, And Business Benefits By Product Type (Coated Anti-Slip Paper, Uncoated Anti-Slip Paper), By Application (Food and Beverage, Pharmaceuticals, Electronics, Automotive, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Stores, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151226

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

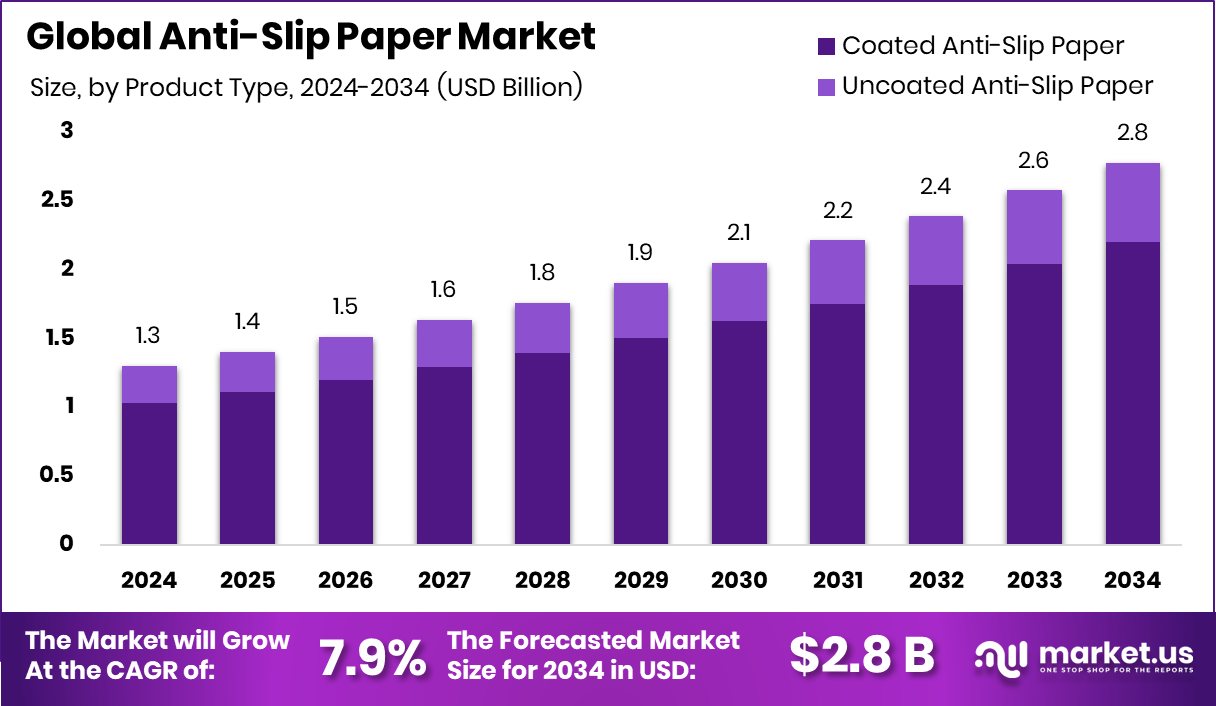

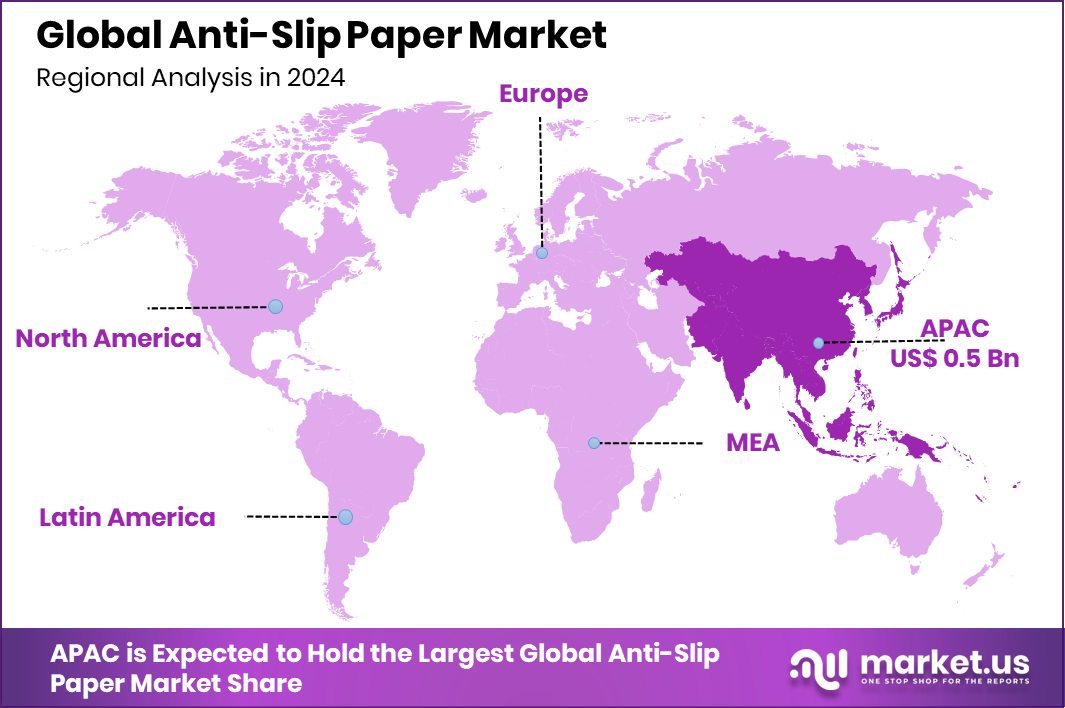

Global Anti-Slip Paper Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.3 billion in 2024, and grow at a CAGR of 7.9% from 2025 to 2034. With a 43.9% share, Asia-Pacific leads in the Anti-Slip Paper Market at USD 0.5 Bn.

Anti-slip paper is a specially coated or textured paper material designed to prevent products from slipping and sliding during transportation or storage. It is often placed between layers of goods on pallets or within packaging to stabilize items and reduce movement. By increasing friction between surfaces, anti-slip paper helps protect items from damage, especially during shipping over long distances.

The anti-slip paper market refers to the industry involved in the production, distribution, and use of anti-slip paper across various sectors. This market includes manufacturers, packaging companies, and end-users who rely on this paper for the safe transport and handling of goods. The market continues to grow as businesses aim to enhance safety, reduce waste, and optimize packaging efficiency.

The growing demand for efficient and safe transportation of goods is a major driver for the anti-slip paper market. As global trade expands, manufacturers are prioritizing damage-free shipping, which fuels the use of anti-slip solutions. Moreover, the rise in e-commerce and direct-to-consumer shipping has pushed logistics companies to adopt materials that minimize product loss.

There is increasing demand for sustainable and cost-effective packaging alternatives, pushing companies to shift from plastic-based stabilizers to recyclable anti-slip paper. Businesses are also becoming more aware of safety regulations in transport, boosting the use of such materials to comply with handling standards.

Key Takeaways

- Global Anti-Slip Paper Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.3 billion in 2024, and grow at a CAGR of 7.9% from 2025 to 2034.

- Coated anti-slip paper dominates the market, accounting for 79.2% due to its high effectiveness.

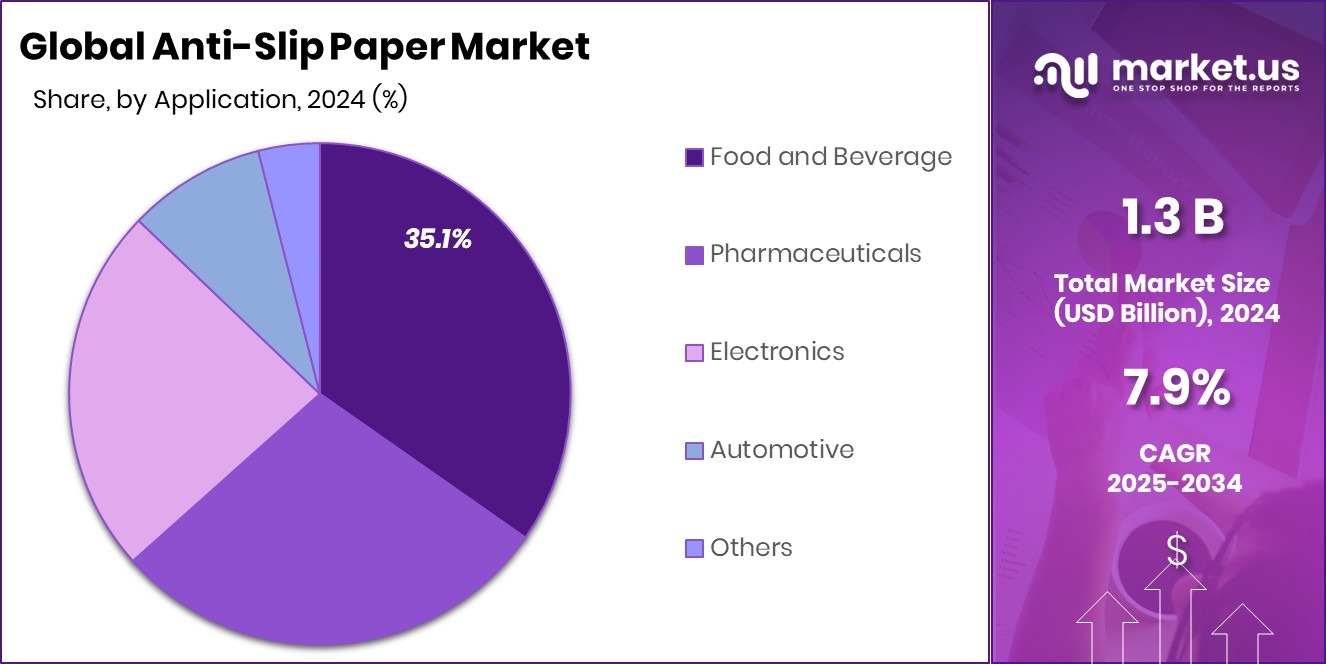

- The food and beverage industry leads demand at 35.1%, ensuring safer transport of packaged goods.

- Supermarkets and hypermarkets hold a 38.3% share, using anti-slip paper for shelf and pallet stability.

- Asia-Pacific held a strong 43.9% share in the Anti-Slip Paper Market.

By Product Type Analysis

Coated anti-slip paper dominates the market, holding 79.2% product share globally.

In 2024, Coated Anti-Slip Paper held a dominant market position in the By Product Type segment of the Anti-Slip Paper Market, with a 79.2% share. This significant market share reflects the high preference for coated variants due to their superior grip, durability, and moisture-resistant properties.

Coated anti-slip paper is widely used across various industries, particularly in logistics and packaging, where maintaining load stability during transportation is critical. Its ability to offer consistent friction across different surfaces makes it a preferred choice over other alternatives. The coated layer enhances performance by providing a reliable non-slip surface, reducing product shifting and damage during transit.

This dominance also indicates strong customer trust in the reliability and quality of coated solutions. Companies seeking to meet both safety and efficiency goals in material handling often opt for this type due to its effectiveness under diverse conditions.

The 79.2% share held by coated anti-slip paper in 2024 showcases its central role in the market, reflecting both widespread application and consistent demand. As businesses continue to prioritize protective packaging solutions, the coated variant remains the cornerstone of the Anti-Slip Paper Market within the product type segment.

By Application Analysis

The food and beverage sector leads application use, accounting for 35.1% market share.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Anti-Slip Paper Market, with a 35.1% share. This strong market presence is driven by the critical need for stability and safety in the transportation and storage of packaged food and beverage products. The sector demands high levels of hygiene and damage prevention, making anti-slip paper an essential material in palletizing and internal handling processes.

Food and beverage items are often sensitive to movement and impact, and the use of anti-slip paper helps ensure these products remain secure during transit, reducing spoilage and packaging damage. The 35.1% market share indicates widespread adoption of anti-slip paper across food processing, distribution, and retail supply chains. Its use not only contributes to product safety but also supports compliance with industry standards related to packaging integrity.

The growing volume of food and beverage shipments, along with heightened attention to delivery efficiency and product preservation, has reinforced the segment’s reliance on such stabilizing materials. The leading position of this application segment highlights the consistent and practical role anti-slip paper plays in safeguarding high-value, high-volume consumer goods within this industry.

By Distribution Channel Analysis

Supermarkets and hypermarkets represent 38.3% of anti-slip paper distribution channels.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Anti-Slip Paper Market, with a 38.3% share. This leadership reflects the significant volume of goods handled and the constant need for secure product stacking and transportation within large-scale retail environments. Supermarkets and hypermarkets manage high inventory turnover and bulk movement of packaged goods, making load stability a critical requirement in their supply chains.

Anti-slip paper plays a key role in ensuring that pallets remain stable during internal transfers and shelf restocking, reducing the risk of product damage or accidents. The 38.3% share indicates the strong dependence of this retail format on reliable handling solutions to maintain operational efficiency and safety. These retail outlets often require standardized packaging solutions, and the consistent performance of anti-slip paper supports their logistics needs effectively.

The dominance of this channel also suggests frequent and large-scale purchases of anti-slip paper, as retailers aim to optimize the flow of goods from distribution centers to store floors. As supermarkets and hypermarkets continue to prioritize streamlined operations and product safety, anti-slip paper remains a preferred and practical choice in their distribution and handling processes.

Key Market Segments

By Product Type

- Coated Anti-Slip Paper

- Uncoated Anti-Slip Paper

By Application

- Food and Beverage

- Pharmaceuticals

- Electronics

- Automotive

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Stores

- Specialty Stores

- Others

Driving Factors

Growing Focus on Safe Goods Transportation

One of the main driving factors of the Anti-Slip Paper Market is the rising demand for safe and secure transportation of goods. Businesses today are moving more products across cities, countries, and even continents. During shipping, products can easily shift, fall, or get damaged if they are not packed properly. Anti-slip paper helps solve this problem by keeping items steady and in place.

This is especially important for industries that deal with fragile or heavy items, such as food, beverages, or electronics. By using anti-slip paper, companies can avoid losses from damaged goods and improve delivery quality. As the need for safe handling grows, more businesses are choosing anti-slip paper to protect their products during transit.

Restraining Factors

High Material Costs Limit Wider Market Use

A major restraining factor for the Anti-Slip Paper Market is the high cost of raw materials used in its production. Coated and high-quality anti-slip paper often requires special treatments and durable materials, which can increase production costs. For small businesses or price-sensitive sectors, these added expenses may make anti-slip paper less attractive compared to cheaper alternatives like plastic films or simple cardboard sheets.

This cost challenge can slow down wider adoption, especially in markets where packaging budgets are tight. While the benefits of anti-slip paper are clear, the upfront costs can discourage companies from switching, particularly when they are trying to reduce expenses. As a result, price remains a key barrier to market growth.

Growth Opportunity

Rising Demand for Eco-Friendly Packaging Solutions

A key growth opportunity for the Anti-Slip Paper Market lies in the increasing demand for eco-friendly and sustainable packaging options. As more companies and consumers become aware of environmental issues, there is a strong shift away from plastic-based materials toward recyclable and biodegradable alternatives. Anti-slip paper, being paper-based and often recyclable, fits well with this trend.

Businesses are now looking for ways to reduce their carbon footprint and meet sustainability goals, and using anti-slip paper helps them do both. This change is especially strong in industries like food, retail, and logistics, where packaging waste is a major concern.

Latest Trends

Use of Recycled Materials in Paper Production

One of the latest trends in the Anti-Slip Paper Market is the increasing use of recycled materials in the production process. Companies are becoming more aware of the need to reduce waste and support sustainable practices. As a result, many manufacturers are now using recycled paper and eco-friendly coatings to make anti-slip sheets.

This not only helps the environment but also appeals to businesses looking to improve their green image. Using recycled materials also lowers the demand for fresh raw resources, making the entire supply chain more efficient. This trend is gaining popularity because it supports both cost-saving and environmental goals, creating a win-win situation for producers and end users alike.

Regional Analysis

In Asia-Pacific, the Anti-Slip Paper Market reached USD 0.5 Bn in 2024.

In 2024, the Anti-Slip Paper Market showed varied performance across key regions, including North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Among these, Asia-Pacific emerged as the dominating region, holding a leading 43.9% market share, valued at approximately USD 0.5 billion. This dominance is supported by the region’s strong manufacturing base, growing logistics sector, and rising demand for safe packaging solutions in countries like China, Japan, and India.

The growth in e-commerce and retail distribution further boosts the need for anti-slip packaging materials in this region. While North America and Europe continue to represent stable markets due to established logistics and regulatory standards, their growth remains moderate compared to Asia-Pacific. The Middle East & Africa and Latin America show emerging potential, particularly in food exports and consumer goods, though their market shares remain comparatively lower.

However, Asia-Pacific’s strong industrial output and continuous investments in packaging safety solidify its leading role in the global anti-slip paper landscape. As companies across the region focus more on sustainable and efficient transportation, the demand for anti-slip paper is expected to maintain a positive trajectory, making Asia-Pacific the most influential region in shaping market trends and volume.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Smurfit Kappa Group, Mondi Group, and International Paper Company remained key players shaping the competitive landscape of the global Anti-Slip Paper Market. These companies maintained strong positions due to their extensive product portfolios, established supply networks, and continued focus on sustainable packaging solutions.

Smurfit Kappa Group demonstrated consistent performance by leveraging its integrated production systems and innovation in fiber-based materials. Its focus on providing eco-friendly and customizable anti-slip paper solutions helped meet growing customer demand across the logistics and retail sectors. With a strong presence in both European and emerging markets, the company continues to reinforce its leadership in the packaging space.

Mondi Group showed resilience through its commitment to sustainable manufacturing and innovation in paper technology. By offering high-performance anti-slip paper with recyclable and biodegradable options, Mondi capitalized on the shift toward eco-conscious packaging. Its global reach and operational flexibility supported strong customer relationships and consistent delivery across sectors.

International Paper Company maintained its competitive edge with scale and product quality. The company’s focus on customer-specific solutions and operational efficiency allowed it to cater to diverse industries with precision. Its continued investment in product development and supply chain reliability positioned it as a trusted partner in key markets.

Top Key Players in the Market

- Smurfit Kappa Group

- Mondi Group

- International Paper Company

- DS Smith Plc

- Georgia-Pacific LLC

- Nippon Paper Industries Co., Ltd.

- Packaging Corporation of America

Recent Developments

- In April 2025, Mondi completed its acquisition of Schumacher Packaging’s Western Europe assets, adding seven corrugated converting plants and solid board mills. This boosted capacity by over 1 billion m² and enhanced the company’s ability to integrate fiber solutions—including anti-slip grades—into large-scale packaging operations .

- In January 2025, International Paper finalized its all-share acquisition of DS Smith, a major packaging firm based in London, for approximately $7.2 billion. This move establishes International Paper as a global leader in sustainable packaging, with greater scale in Europe and North America.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Coated Anti-Slip Paper, Uncoated Anti-Slip Paper), By Application (Food and Beverage, Pharmaceuticals, Electronics, Automotive, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Smurfit Kappa Group, Mondi Group, International Paper Company, DS Smith Plc, Georgia-Pacific LLC, Nippon Paper Industries Co., Ltd., Packaging Corporation of America Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Smurfit Kappa Group

- Mondi Group

- International Paper Company

- DS Smith Plc

- Georgia-Pacific LLC

- Nippon Paper Industries Co., Ltd.

- Packaging Corporation of America