Global Anti-Frizz Hair Care Market Size, Share, Growth Analysis By Product Type (Shampoos & Conditioners, Leave-In Creams, Serums & Oils, Hair Masks), By Hair Type (Curly & Wavy, Straight, Chemically Treated), By End User (Women, Unisex, Men), By Distribution Channel (E-Commerce, Salons & Professional Stores, Supermarkets & Hypermarkets, Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160204

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

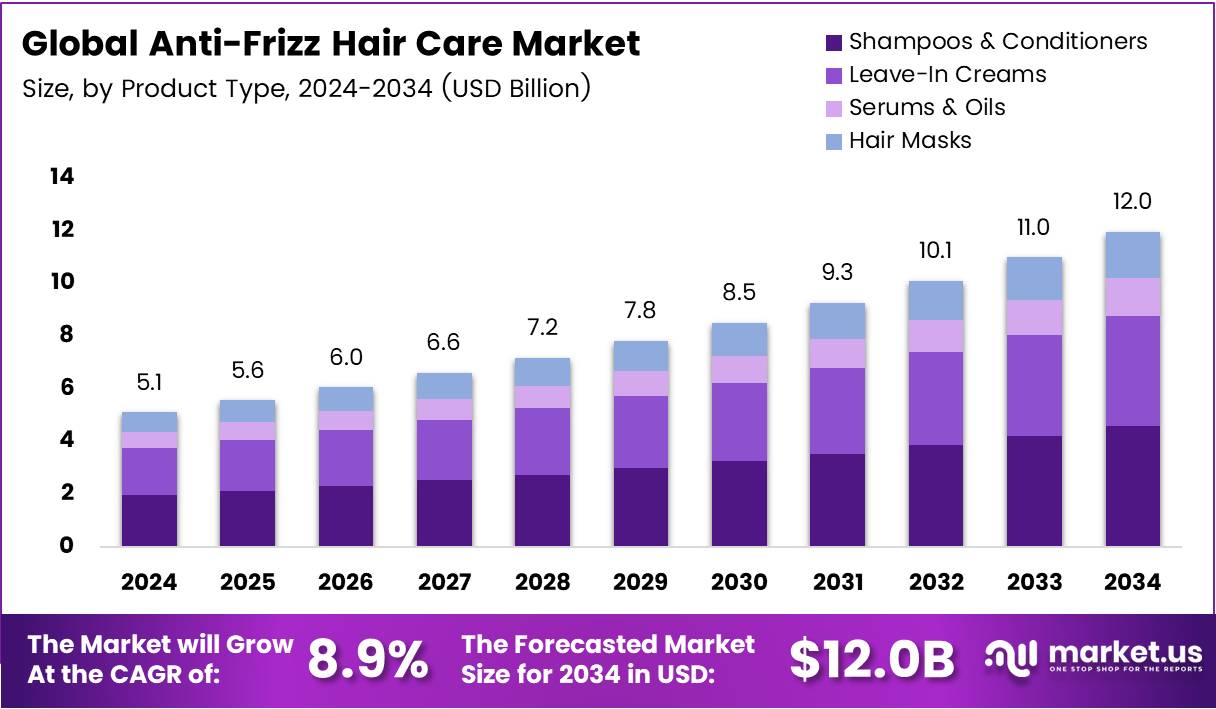

The Global Anti-Frizz Hair Care Market size is expected to be worth around USD 12.0 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The Anti-Frizz Hair Care Market represents a dynamic segment within the broader haircare industry, focusing on products that manage frizz, enhance smoothness, and improve texture. It includes shampoos, conditioners, serums, sprays, and treatments tailored for humidity control and damage repair. Consumers increasingly prefer advanced formulations with silicone alternatives and plant-derived actives.

The market has expanded significantly due to changing lifestyles, increased pollution exposure, and the growing use of heat styling tools. These factors contribute to frizz-related hair concerns, prompting brands to develop science-backed, multifunctional solutions. Additionally, the rising demand for sulfate-free, vegan, and paraben-free products reinforces the adoption of clean beauty formulations in this segment.

Moreover, growth opportunities emerge from innovation in ingredient technology and cross-category expansion into scalp care and hybrid beauty. Brands are also leveraging AI-driven hair diagnostics and personalized recommendations to enhance customer engagement. This data-driven approach supports tailored product offerings, fostering loyalty and premiumization trends across e-commerce and salon distribution channels.

Government initiatives promoting sustainable formulations and responsible labeling are shaping market dynamics. Regulatory bodies are emphasizing ingredient transparency and eco-friendly packaging, driving R&D investment in biodegradable polymers and green chemistry. Brands aligning with these regulations are gaining consumer trust and regulatory approval for international expansion.

The U.S. market offers strong potential, with high consumer awareness and preference for performance-based products. According to industry reports, 56% of U.S. female buyers cite “damaged hair that results in frizz” as a key concern—highlighting a runway for targeted SKUs. Additionally, 44% of 3,300 surveyed female consumers purchased frizz-control or smoothing products, while 59% opted for leave-in conditioners, showing strong product diversification.

Furthermore, 97% of consumers seek specific benefit statements—such as before-after visuals or clinical claims—on shampoos and conditioners, underscoring the value of evidence-based marketing. This shift toward proof-led messaging drives brand differentiation and conversion rates. As consumer sophistication rises, companies that blend scientific efficacy with sensory appeal will dominate the evolving anti-frizz hair care landscape.

Key Takeaways

- The Global Anti-Frizz Hair Care Market is projected to reach USD 12.0 Billion by 2034, up from USD 5.1 Billion in 2024, growing at a CAGR of 8.9% during 2025–2034.

- In 2024, Shampoos & Conditioners dominated the By Product Type segment with a 38.2% share, driven by their role in daily routines and affordability.

- Curly & Wavy Hair led the By Hair Type segment in 2024 with a 49.6% share, owing to higher frizz-prone characteristics and growing curl-acceptance trends.

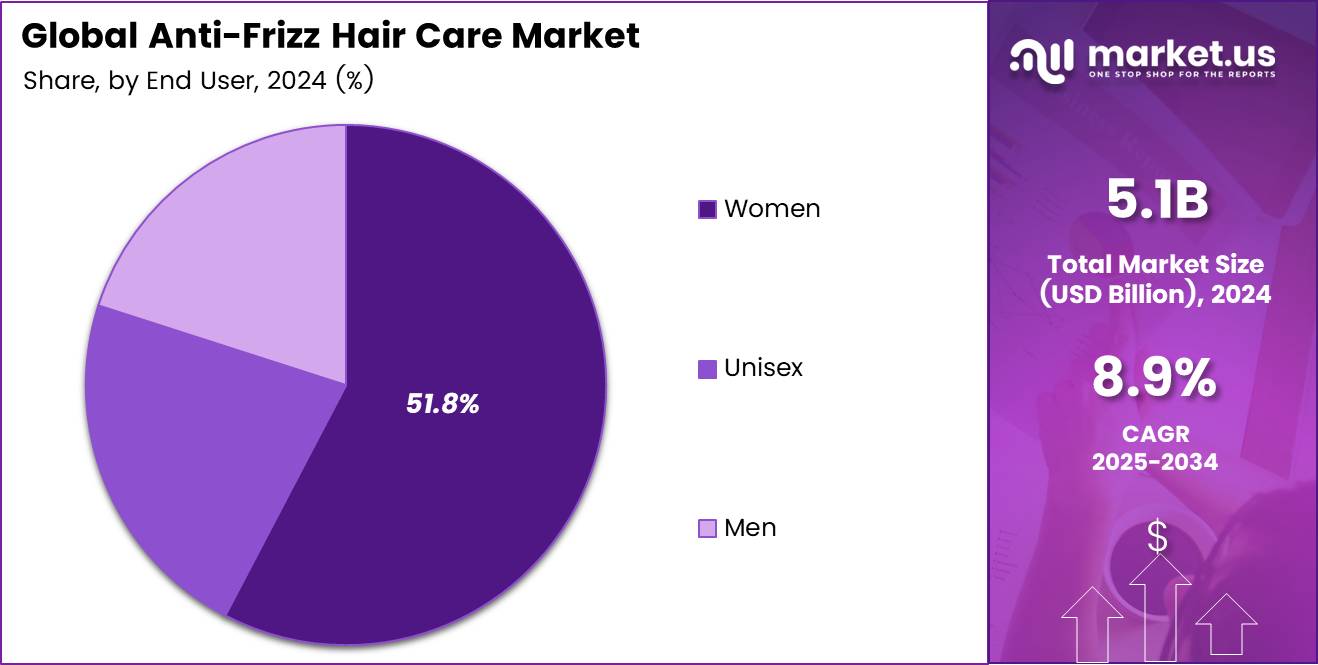

- The Women category captured a 51.8% share in 2024 under the By End User segment, reflecting strong demand for frizz-control due to styling and environmental exposure.

- E-Commerce emerged as the top Distribution Channel in 2024 with a 34.4% share, fueled by ease of price comparison, access to niche brands, and home delivery.

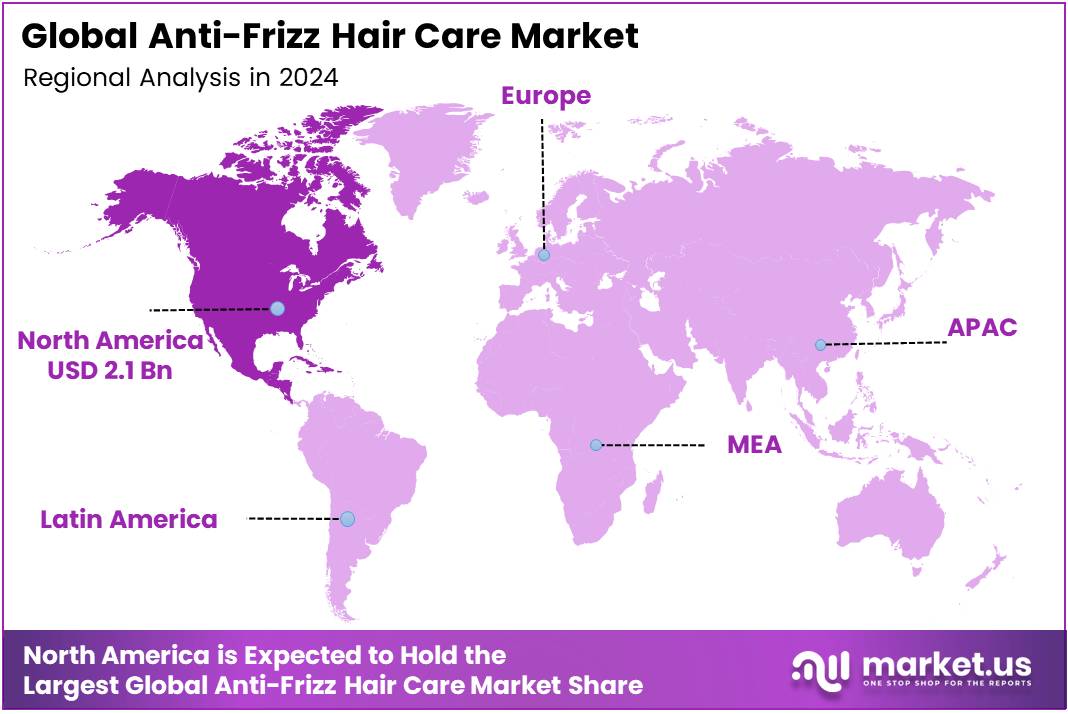

- North America dominated the global market with a 42.7% share and revenue of USD 2.1 Billion, supported by advanced formulations, ingredient transparency, and strong retail networks.

By Product Type Analysis

Shampoos & Conditioners dominate with 38.2% due to their widespread usage and daily applicability in managing frizz.

In 2024, Shampoos & Conditioners held a dominant market position in the By Product Type Analysis segment of the Anti-Frizz Hair Care Market, with a 38.2% share. These products are integral to daily hair care routines, offering gentle cleansing and hydration that reduce frizz effectively. Their affordability and availability across regions further drive growth.

Leave-In Creams continue to gain momentum as consumers seek convenient, long-lasting frizz control. They provide deep nourishment without rinsing, making them ideal for busy lifestyles. The growing preference for heat styling protection and smooth finish enhances their appeal among users with frizz-prone hair.

Serums & Oils represent a growing category owing to their concentrated formulations and ability to seal moisture. These products cater to premium buyers seeking glossy, smooth finishes. Their role in addressing humidity-induced frizz also fuels adoption across urban consumers.

Hair Masks are increasingly popular as weekly treatments designed to repair and hydrate. They deliver intensive nourishment, particularly for damaged or chemically treated hair. Consumers looking for salon-like care at home are significantly contributing to the expanding demand for these deep-conditioning products.

By Hair Type Analysis

Curly & Wavy Hair dominates with 49.6% due to its high susceptibility to frizz and greater product dependence.

In 2024, Curly & Wavy hair held a dominant market position in the By Hair Type Analysis segment of the Anti-Frizz Hair Care Market, with a 49.6% share. These hair types naturally experience more dryness and frizz, increasing demand for specialized smoothing and moisturizing formulations. Rising acceptance of natural curls boosts this segment’s growth.

Straight hair users also invest in anti-frizz products to maintain sleekness and shine, especially in humid climates. They prefer lightweight serums and conditioners that prevent flyaways without weighing hair down. Increased awareness about maintaining a polished look supports segmental demand.

Chemically Treated hair requires targeted anti-frizz care due to damage from coloring, perming, or straightening. These consumers rely on nourishing masks, oils, and sulfate-free shampoos to restore strength and smoothness. The rising number of salon treatments globally supports steady growth in this category.

By End User Analysis

Women dominate with 51.8% due to higher adoption of specialized hair care routines and product experimentation.

In 2024, Women held a dominant market position in the By End User Analysis segment of the Anti-Frizz Hair Care Market, with a 51.8% share. Their frequent use of styling tools and exposure to environmental stress drive demand for anti-frizz solutions that enhance manageability and softness.

Unisex products are witnessing rising traction as brands introduce gender-neutral formulations. These cater to households preferring shared usage and simplified purchasing. The segment benefits from minimalistic packaging and universal fragrances appealing to a broader audience.

Men are increasingly adopting anti-frizz products to maintain neat hairstyles and reduce dryness caused by grooming products. Growing awareness of personal grooming and hair texture care boosts market presence, supported by targeted marketing and product innovations for male consumers.

By Distribution Channel Analysis

E-Commerce dominates with 34.4% due to convenience, variety, and rising digital purchasing trends.

In 2024, E-Commerce held a dominant market position in the By Distribution Channel Analysis segment of the Anti-Frizz Hair Care Market, with a 34.4% share. Consumers increasingly prefer online platforms for price comparison, access to global brands, and doorstep delivery of niche formulations.

Salons & Professional Stores remain essential for premium product sales and expert recommendations. Professional-grade anti-frizz treatments available through salons build trust and drive brand loyalty among customers seeking personalized care solutions.

Supermarkets & Hypermarkets contribute substantially by offering wide assortments under one roof. These retail formats enable impulse purchases and discounts, attracting budget-conscious shoppers looking for daily-use hair care essentials.

Pharmacies appeal to consumers seeking dermatologist-recommended or sensitive formulations. Their association with reliability and safety supports sales, particularly for medicated or chemical-free options targeting frizz-prone hair.

Others channels, including specialty stores and direct selling, play a niche role by catering to loyal customers. They often offer exclusive or artisanal anti-frizz products, appealing to buyers preferring curated selections and personalized service.

Key Market Segments

By Product Type

- Shampoos & Conditioners

- Leave-In Creams

- Serums & Oils

- Hair Masks

By Hair Type

- Curly & Wavy

- Straight

- Chemically Treated

By End User

- Women

- Unisex

- Men

By Distribution Channel

- E-Commerce

- Salons & Professional Stores

- Supermarkets & Hypermarkets

- Pharmacies

- Others

Drivers

Rising Consumer Demand for Humidity-Resistant and Climate-Adaptive Hair Care Solutions Drives Market Growth

The anti-frizz hair care market is gaining strong momentum as consumers increasingly look for products that can withstand changing weather conditions. High humidity and extreme temperatures often cause frizz, leading to a greater need for climate-adaptive solutions. This demand is pushing brands to develop advanced formulations that maintain smoothness and shine, regardless of environmental factors.

Awareness of hair damage caused by frequent heat styling and exposure to pollutants is also fueling market growth. Consumers are shifting towards products that not only control frizz but also provide protection against damage from straighteners, blow dryers, and UV rays. This awareness encourages the use of nourishing ingredients that strengthen and repair hair.

In addition, the clean beauty movement has significantly influenced buying patterns. Shoppers are seeking sulfate-free, paraben-free, and silicone-free products that align with their preference for safe and sustainable beauty. As a result, many brands are reformulating their anti-frizz lines to include plant-based and gentle ingredients.

Moreover, personalized hair care is becoming a major driver, supported by AI and data-driven tools. Digital diagnostics allow brands to offer tailored solutions based on hair type, texture, and lifestyle. This trend enhances consumer trust and satisfaction, strengthening brand loyalty and supporting market expansion globally.

Restraints

Stringent Regulatory Approvals for New Active Ingredients and Formulations Restrict Market Expansion

One of the major challenges in the anti-frizz hair care market is the strict regulatory framework governing new ingredient approvals. Companies must undergo lengthy testing and compliance processes to introduce innovative active components. This slows down product launches and limits experimentation with novel formulations designed for specific climates or hair types.

Performance variability is another restraint affecting market growth. Anti-frizz solutions often work differently depending on hair texture, porosity, and local weather conditions. For example, what works for straight hair in humid regions may not deliver similar results for curly or coarse hair in dry areas. This inconsistency affects customer satisfaction and creates hesitation in repeat purchases.

Additionally, limited market penetration in rural and semi-urban areas poses a challenge. Many consumers in these regions have low awareness of specialized hair care needs, including frizz control. Coupled with weak distribution networks, this leads to restricted product availability and slower adoption rates.

Together, these factors constrain the overall growth potential of the anti-frizz hair care market. Addressing regulatory delays, improving formulation adaptability, and expanding distribution reach will be crucial for brands aiming to achieve wider market acceptance.

Growth Factors

Development of Hybrid Products Combining Frizz Control with UV and Pollution Protection Creates New Growth Avenues

The anti-frizz hair care market is witnessing exciting opportunities through the development of hybrid products. These solutions not only smooth hair but also offer added benefits such as UV protection and pollution defense. Consumers today prefer multifunctional products that save time and provide comprehensive hair care, making hybrids a key innovation area.

Collaborations with salons and e-commerce platforms are also opening new avenues for targeted launches. Salon partnerships help brands reach professional audiences, while online marketplaces allow for personalized promotions and customer engagement. This approach strengthens brand visibility and accelerates adoption across diverse customer groups.

The men’s grooming segment presents another growth area, as men increasingly seek effective hair solutions. Gender-neutral anti-frizz formulations cater to this demand, breaking stereotypes and appealing to a wider audience. Such inclusivity can help brands tap into an emerging and underexplored customer base.

Sustainability is also shaping opportunity pathways. Growing interest in eco-friendly packaging and plant-based silicone alternatives supports brand differentiation and aligns with global green initiatives. Companies embracing these practices can attract environmentally conscious consumers and reinforce their position as responsible market leaders.

Emerging Trends

Increasing Popularity of Leave-In Serums and Lightweight Anti-Frizz Sprays Shapes Market Trends

Consumer preferences are shifting toward lightweight and convenient products such as leave-in serums and anti-frizz sprays. These formulations are easy to apply, non-greasy, and effective in maintaining smooth hair throughout the day. The demand for such quick-fix solutions is rising, especially among busy urban consumers seeking hassle-free grooming.

Microencapsulation technology is another major trend influencing the market. This innovation enables the slow release of active ingredients, ensuring long-lasting frizz control and smoothness. Products incorporating this technology deliver extended performance, enhancing consumer satisfaction and value perception.

Social media continues to be a powerful force in shaping beauty trends. Influencers and hair care experts frequently share tutorials and product reviews that highlight frizz-free hairstyles. This digital exposure boosts awareness, encourages trial, and drives demand across global audiences.

Lastly, the rise of at-home hair smoothing treatments is transforming consumer behavior. With professional-grade results now achievable outside salons, more people are investing in DIY solutions. This trend supports product innovation and expands the market for advanced home-use anti-frizz kits.

Regional Analysis

North America Dominates the Anti-Frizz Hair Care Market with a Market Share of 42.7%, Valued at USD 2.1 Billion

North America leads the global Anti-Frizz Hair Care Market, capturing a dominant 42.7% share and generating revenue worth USD 2.1 Billion. The region benefits from strong consumer preference for premium hair care solutions targeting frizz caused by weather fluctuations. Additionally, rising ingredient transparency, advanced formulations, and widespread retail and e-commerce networks continue to fuel market growth across the U.S. and Canada.

Europe Anti-Frizz Hair Care Market Trends

Europe holds a significant position in the Anti-Frizz Hair Care Market, supported by its growing clean beauty movement and preference for sustainable products. Consumers across countries like Germany, France, and the U.K. actively invest in frizz-control products addressing humidity-related concerns. Furthermore, evolving EU regulations and eco-certifications drive brands to innovate safer, effective formulations, supporting stable regional revenue growth.

Asia Pacific Anti-Frizz Hair Care Market Trends

Asia Pacific shows robust expansion in the Anti-Frizz Hair Care Market, driven by rising disposable incomes and increasing adoption of professional hair treatments. Countries like China, Japan, and South Korea witness strong demand for anti-frizz shampoos and serums due to humid climates. Additionally, the rapid rise of e-commerce and influencer-led marketing strategies significantly boost awareness and accessibility across emerging markets.

Middle East and Africa Anti-Frizz Hair Care Market Trends

The Middle East and Africa region is gradually expanding in the Anti-Frizz Hair Care Market, with growing awareness of scalp and hair health. Hot and humid weather conditions create consistent demand for frizz-control products, particularly in Gulf nations. Moreover, the availability of premium brands in urban centers and mall-based retail stores contributes to the market’s steady progression.

Latin America Anti-Frizz Hair Care Market Trends

Latin America experiences consistent growth in the Anti-Frizz Hair Care Market, largely influenced by tropical climates and rising beauty awareness. Countries such as Brazil and Mexico lead regional demand, favoring salon-grade and smoothing formulations. The proliferation of online marketplaces and retail partnerships further supports greater accessibility and rising consumer spending on frizz-control products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Anti-Frizz Hair Care Company Insights

The global Anti-Frizz Hair Care Market in 2024 reflects robust competition driven by innovation, brand trust, and consumer-centric formulations. Key players are enhancing their product portfolios with science-backed ingredients and personalized solutions to meet rising consumer expectations for smooth, manageable hair.

L’Oréal S.A. continues to lead through its diversified product portfolio and strong R&D investments. The brand integrates advanced formulations like amino acids and hyaluronic acid in anti-frizz ranges, appealing to both premium and mass-market consumers. Its global distribution network and sustainability initiatives further enhance brand loyalty and market leadership.

Johnson & Johnson Services, Inc. focuses on dermatology-backed hair care, leveraging its expertise in gentle and clinically tested formulations. The company’s emphasis on consumer trust and effective solutions has strengthened its position among sensitive-scalp consumers seeking safe, science-based anti-frizz products. Its commitment to ingredient transparency resonates with health-conscious buyers.

NYKAA, a rising force in the beauty and personal care space, leverages its omnichannel presence and data-driven marketing to capture urban millennial consumers. Its in-house and partnered anti-frizz hair care lines are gaining traction in emerging markets, especially due to affordability, trend alignment, and strong influencer-based promotions.

Procter & Gamble remains a key innovator, emphasizing performance-driven anti-frizz solutions under its global hair care brands. Its focus on addressing humidity resistance, hair texture diversity, and long-lasting smoothness supports consistent consumer engagement. Additionally, P&G’s strong supply chain and digital campaigns enhance accessibility and awareness in multiple regions.

Top Key Players in the Market

- L’Oréal S.A.

- Johnson & Johnson Services, Inc.

- NYKAA

- Procter & Gamble

- Unilever

- AMOREPACIFIC US, INC.

- The Estée Lauder Companies Inc.

- Kanebo Cosmetics Inc.

- Himalaya Global Holdings Ltd

- Shiseido Company, Limited

Recent Developments

- In Jul 2024, D2C haircare brand Moxie Beauty successfully raised USD 2.1 million in funding, led by Fireside Ventures. This investment aims to accelerate product innovation, digital marketing, and strengthen the brand’s omnichannel presence across key urban markets.

- In Dec 2024, hair care brand Arata secured USD 4 million in Series A funding, led by Unilever Ventures. The raised capital will support R&D for clean formulations, expand retail footprints, and enhance e-commerce operations to capture growing demand in the premium natural haircare segment.

- In Jul 2025, L’Oréal signed a strategic deal to acquire the innovative hair care brand Color Wow. This acquisition is intended to broaden its professional product portfolio and leverage Color Wow’s expertise in frizz-control and color protection technologies.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 12.0 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Shampoos & Conditioners, Leave-In Creams, Serums & Oils, Hair Masks), By Hair Type (Curly & Wavy, Straight, Chemically Treated), By End User (Women, Unisex, Men), By Distribution Channel (E-Commerce, Salons & Professional Stores, Supermarkets & Hypermarkets, Pharmacies, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape L’Oréal S.A., Johnson & Johnson Services, Inc., NYKAA, Procter & Gamble, Unilever, AMOREPACIFIC US, INC., The Estée Lauder Companies Inc., Kanebo Cosmetics Inc., Himalaya Global Holdings Ltd, Shiseido Company, Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti-Frizz Hair Care MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Anti-Frizz Hair Care MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- L’Oréal S.A.

- Johnson & Johnson Services, Inc.

- NYKAA

- Procter & Gamble

- Unilever

- AMOREPACIFIC US, INC.

- The Estée Lauder Companies Inc.

- Kanebo Cosmetics Inc.

- Himalaya Global Holdings Ltd

- Shiseido Company, Limited