Global Animation Toys Market Based on Type (Anime Gacha, Anime Doll, Anime Figure, Cartoon Plush Toys, Other Types), Based on the Product Price (Low, Medium, High), Based on Animation Titles (Pokemon, Hello Kitty, Gundam, Other Animation Titles), Based on Category (Recreational Toys, Learning Toys), Based on Age Group (0-2 Years, 2-8 Years, 8-14 Years , 14 Years and Above), Based on Character Traits (Cute, Cool, Angry, Other Character Traits), Based on Sales Channel (Online, Offline), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 105019

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Type Analysis

- Based on the Product Price Analysis

- Based on Animation Titles Analysis

- Based on Category Analysis

- Based on Age Group Analysis

- Based on Character Traits Analysis

- Based on Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Animation Toy Market is expected to be worth around USD 70.7 billion by 2033, up from USD 37.3 billion by 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

Animation toys are playthings inspired by characters, settings, and stories from animated films, television series, or other media. These toys often include action figures, dolls, playsets, and interactive gadgets replicating the animated universe’s elements, engaging children and collectors through imaginative play and fandom.

The Animation Toys Market encompasses the manufacture, distribution, and sale of toys based on animated content. This sector leverages the popularity of animation in global media, adapting iconic characters and scenes into tangible products that cater to a diverse audience ranging from young children to adult collectors.

The growth of the Animation Toys Market is fueled by the continuous production of animated series and movies that capture the imagination of a wide audience. As animation studios innovate with captivating storylines and characters, the demand for related toys sees a corresponding increase, sustaining market expansion.

Demand in the Animation Toys Market is driven by the broad appeal of animation across age groups and cultures, enhanced by marketing tie-ins with new and classic animated releases. The resurgence of nostalgic series reintroduces familiar characters to new generations, further boosting consumer interest and toy sales.

Opportunities in the Animation Toys Market include expansion into emerging markets where digital consumption of media is growing. Collaborations with animation studios for exclusive releases and leveraging technological advancements like augmented reality to create interactive toys can significantly enhance market presence and consumer engagement.

The Animation Toys Market is poised for transformative growth, driven by increasing global interest in animated films and series, coupled with advancements in digital technology. The rising popularity of low-budget animations, particularly from Japan, signals a significant shift in consumer preferences toward diverse and innovative content.

Notably, Mizuho Securities has recognized this potential, committing between ¥1.5 billion ($9.5 million) and ¥2.5 billion to a new investment fund aimed at supporting Japanese animated films. This initiative underscores the market’s potential for high returns on investment in culturally unique content.

Moreover, initiatives like the £840,000 Development Fund from Creative Wales demonstrate a growing commitment to nurturing animation projects within the UK. This fund supports innovative concepts such as dystopian series and supernatural comedies, highlighting the market’s evolution beyond traditional themes.

Additionally, the Little Journey app, developed with a £2m grant from the Lego Foundation, leverages animation to address real-world issues, such as easing children’s hospital experiences.

This not only broadens the application of animation but also enhances the market’s scope by integrating technology and social goods, potentially driving further expansion in related toy products.

Key Takeaways

- The Global Animation Toy Market is expected to be worth around USD 70.7 billion by 2033, up from USD 37.3 billion by 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

- In 2023, Anime Figures held a dominant market position in the Based on Type segment of the Animation Toys Market, with a 33.5% share.

- In 2023, Low held a dominant market position in Based on the Product Price segment of the Animation Toys Market, with a 46.3% share.

- In 2023, Gundam held a dominant market position in the Based on Animation Titles segment of the Animation Toys Market.

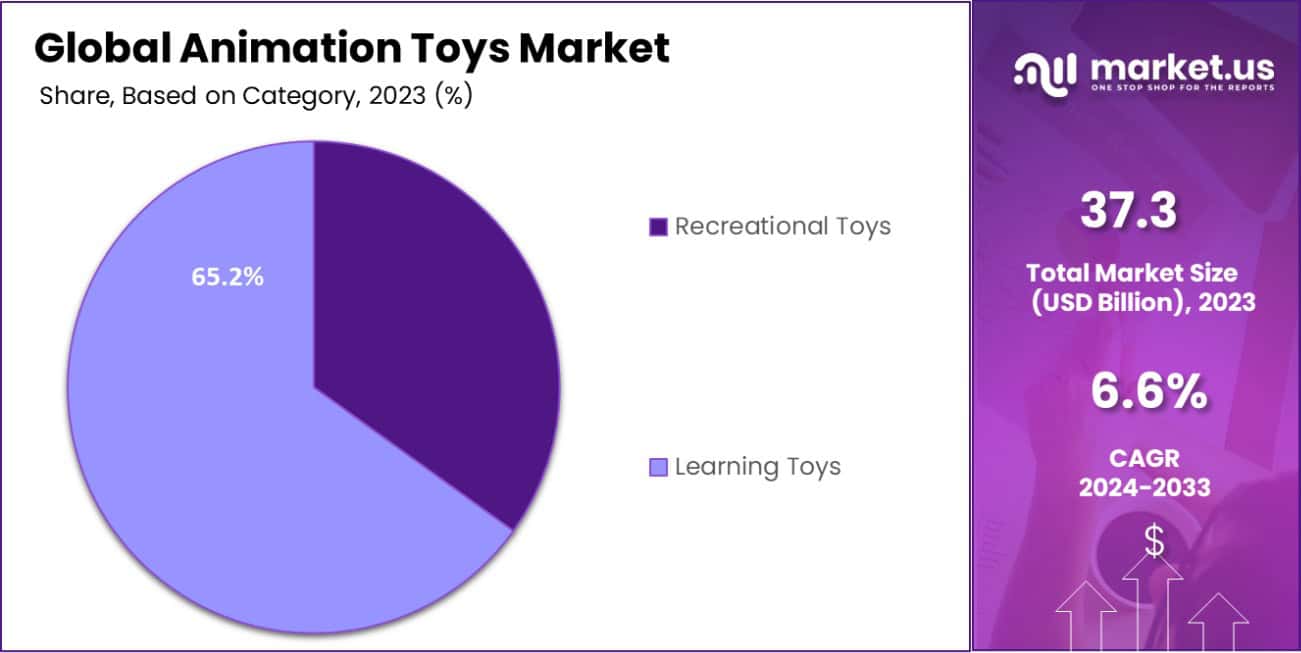

- In 2023, Learning Toys held a dominant market position in the Based on Category segment of the Animation Toys Market, with a 65.2% share.

- In 2023, 8-14 Years held a dominant market position in the Based on Age Group segment of Animation Toys Market.

- In 2023, Cute held a dominant market position in the Based on Character Traits segment of the Animation Toys Market.

- In 2023, Online held a dominant market position Based on the Sales Channel segment of the Animation Toys Market.

- Asia Pacific dominated a 31.3% market share in 2023 and held USD 11.6 Billion in revenue from the Animation Toys Market.

Based on Type Analysis

In 2023, Anime Figure held a dominant market position in the “Based on Type” segment of the Animation Toys Market, with a 33.5% share. This was followed by Anime Dolls at 26.2%, Cartoon Plush Toys at 22.3%, Anime Gacha at 10.4%, and Other Types comprising 7.6% of the market.

The preeminence of Anime Figures can be attributed to robust fan engagement and extensive merchandising opportunities tied to popular anime series. These figures, often detailed and collectible, cater to both aesthetic appreciation and the growing trend of “kidult” consumers—adults who indulge in high-quality toys and collectibles.

The rise in popularity of Anime Dolls underscores a diversifying market where personalization and craftsmanship appeal to a niche yet growing demographic. Meanwhile, Cartoon Plush Toys continues to captivate younger audiences, benefiting from their association with children’s television and digital media content.

The Anime Gacha segment, though smaller, reflects an emerging trend influenced by the blend of digital and physical play. Gacha toys, which offer a randomized selection in each purchase, capitalize on the element of surprise and the thrill of collecting rare items.

As market dynamics evolve, these segments illustrate significant intersections of cultural trends, technological advancements, and changing consumer preferences, highlighting areas ripe for further exploration and investment within the Animation Toys Market.

Based on the Product Price Analysis

In 2023, the Low pricing tier held a dominant market position in the “Based on Product Price” segment of the Animation Toys Market, commanding a 46.3% share. This was followed by the Medium and High pricing tiers, which accounted for 29.7% and 24.0% of the market, respectively.

The prominence of the Low pricing tier can be attributed to widespread accessibility and the mass-market appeal of affordably priced products, which are especially attractive in price-sensitive markets and among consumers with limited discretionary spending.

The Medium pricing tier represents a balance between quality and cost, appealing to middle-income consumers who are willing to invest in durable and moderately priced toys. This segment benefits from consumers seeking better materials and enhanced features that justify a higher price point compared to budget options.

Meanwhile, the High pricing tier, though smaller, caters to a niche audience that prioritizes premium qualities, such as exclusive designs, superior craftsmanship, and brand prestige. These high-end products often serve as collectibles or luxury gifts, reflecting the consumer’s willingness to invest in high-value items as part of a broader trend towards premiumization in consumer goods.

These price-based segments reveal distinct consumer behaviors and purchasing patterns within the Animation Toys Market, offering valuable insights for targeted marketing strategies and product development.

Based on Animation Titles Analysis

In 2023, Gundam held a dominant market position in the “Based on Animation Titles” segment of the Animation Toys Market. This series outperformed other popular titles, capturing a significant market share. Following Gundam, the market shares were distributed among Pokemon, Hello Kitty, and Other Animation Titles, each contributing variably to the sector’s dynamics.

Gundam’s leading position can be attributed to its enduring popularity and the continuous production of both television series and merchandise that appeal to a broad age range. The franchise’s ability to innovate within its product lines, including model kits and action figures, has effectively catered to both long-time fans and new enthusiasts. This strategy has not only sustained interest but has also expanded its consumer base globally.

Pokemon and Hello Kitty, while also strong contenders, attract different demographic segments. Pokemon appeals widely to children and gamers through its integration with digital gaming and collectible items, whereas Hello Kitty primarily targets younger demographics and the novelty gift market with its cute and iconic design.

The category of Other Animation Titles includes a diverse array of lesser-known or emerging animations, each contributing to the richness and variety of the market, catering to niche interests and regional preferences. This segmentation underscores the vibrancy and competitive nature of the Animation Toys Market.

Based on Category Analysis

In 2023, Learning Toys held a dominant market position in the “Based on Category” segment of the Animation Toys Market, commanding a substantial 65.2% share. Recreational Toys accounted for the remaining 34.8%.

The significant lead of Learning Toys can be largely attributed to the growing global emphasis on educational play, which combines skill development with entertainment. Parents and educators alike increasingly favor toys that promote cognitive, social, and emotional development, thus driving up the demand for products in this category.

Learning Toys, which often include interactive and STEM-based toys, have become integral in early childhood education. These toys are designed to enhance learning experiences through play, thereby supporting the development of problem-solving skills, creativity, and technological familiarity from a young age.

Recreational Toys, while holding a smaller market share, continue to play a crucial role in the industry, catering to traditional play patterns and leisure activities. These toys are fundamental in promoting physical activity and imaginative play, essential components of a balanced play diet.

The market dominance of Learning Toys reflects a broader trend toward educational products within the toy industry. This shift highlights the strategic importance of integrating educational value into product development to meet consumer expectations and drive market growth.

Based on Age Group Analysis

In 2023, the 8-14 Years age group held a dominant market position in the “Based on Age Group” segment of the Animation Toys Market. This demographic accounted for a substantial portion of the market, indicative of the central role that toys play in the lives of school-aged children.

The age segments of 0-2 Years, 2-8 Years, and 14 Years and Above also contributed to the market distribution, each catering to distinct developmental and entertainment needs.

The 8-14 Years segment’s prominence is driven by this age group’s increasing independence and decision-making capabilities regarding their interests and purchases. Toys targeting this demographic often involve more complex features and themes, including advanced building sets, collectibles, and technology-integrated products, which align with their developing skills and preferences.

The 2-8 Years segment, while slightly younger, focuses on educational and developmental toys that encourage learning through play. The youngest group, 0-2 Years, primarily requires toys that stimulate basic motor skills and sensory experiences. Conversely, the 14 Years and Above group often see a shift towards more sophisticated, often electronic or collectible items, reflecting a transition from play to hobby.

This segmentation underscores the varied and evolving interests across different age groups, highlighting the need for targeted product innovations and marketing strategies within the Animation Toys Market.

Based on Character Traits Analysis

In 2023, Cute held a dominant market position in the “Based on Character Traits” segment of the Animation Toys Market. This trait, which captured the largest share, outperformed other categories such as Cool, Angry, and Other Character Traits.

The appeal of Cute character toys is largely driven by their widespread acceptance across various demographic segments, from young children to adult collectors. These toys often feature endearing designs and are associated with themes of friendship and care, making them highly desirable in global markets.

The Cool category, with its edgier and more stylized depictions, appeals predominantly to older children and teenagers who prefer dynamic and heroic characters. Meanwhile, toys characterized as Angry often tie into narratives involving conflict and resolution, appealing to those interested in more intense and dramatic play.

Other Character Traits encompass a broad range of less common attributes, from whimsical to mysterious, catering to niche interests and diversified tastes within the toy market.

The strong performance of Cute character toys underscores a continuing trend towards toys that evoke a sense of warmth and comfort, serving not only as playthings but also as collectible and decorative items.

This trend highlights the importance of emotional connection in product design and consumer engagement within the Animation Toys Market.

Based on Sales Channel Analysis

In 2023, Online sales channels held a dominant market position in the “Based on Sales Channel” segment of the Animation Toys Market, significantly outpacing Offline channels. This shift is indicative of broader consumer behavior trends, where convenience, variety, and competitive pricing drive purchasing decisions.

The online segment’s superiority can be attributed to the seamless shopping experiences offered by e-commerce platforms, which include user-friendly interfaces, detailed product information, and customer reviews.

These platforms have effectively capitalized on the growing digitization of commerce and the increasing comfort of consumers with online transactions. Additionally, the ability to compare prices, along with the convenience of home delivery, has further solidified the appeal of online shopping.

Despite the surge in online sales, Offline channels remain vital, particularly for consumers who value the tactile experience of purchasing toys in physical stores. These venues are crucial for immediate product access and offer the advantage of personal customer service.

The continued dominance of online sales channels is expected to influence marketing strategies and distribution models in the Animation Toys Market. Retailers are increasingly integrating omnichannel approaches to blend the strengths of both online and offline sales, ensuring broad market reach and enhanced consumer satisfaction.

Key Market Segments

Based on Type

- Anime Gacha

- Anime Doll

- Anime Figure

- Cartoon Plush Toys

- Other Types

Based on the Product Price

- Low

- Medium

- High

Based on Animation Titles

- Pokemon

- Hello Kitty

- Gundam

- Other Animation Titles

Based on Category

- Recreational Toys

- Learning Toys

Based on Age Group

- 0-2 Years

- 2-8 Years

- 8-14 Years

- 14 Years and Above

Based on Character Traits

- Cute

- Cool

- Angry

- Other Character Traits

Based on Sales Channel

- Online

- Offline

Drivers

Drivers Influencing the Animation Toys Market

Several key factors are driving growth in the Animation Toys Market. Firstly, the increasing popularity of animated movies and television shows globally fuels demand for related merchandise, including toys. As franchises release new content, fans both young and old are eager to purchase figures, playsets, and other items featuring their favorite characters.

Secondly, advancements in technology are enabling toy manufacturers to create more interactive and engaging products, such as app-enabled devices and augmented reality experiences, which appeal to tech-savvy consumers.

Additionally, the rising middle class, particularly in developing countries, is expanding the consumer base ready to spend on discretionary items like toys.

Finally, social media and influencer marketing have become powerful tools for promoting animation toys, effectively increasing visibility and desire among potential buyers. These dynamics are collectively pushing the market towards sustained growth and diversification.

Restraint

Challenges in the Animation Toys Market

The Animation Toys Market faces several restraints that could hinder its growth. One significant challenge is the stringent safety regulations and standards that toys must meet, which can increase production costs and delay market entry for new products.

Additionally, the market is highly competitive, with numerous brands vying for consumer attention, making it difficult for newer or smaller companies to establish a foothold. Economic downturns and fluctuations also pose a risk, as they can reduce consumer spending on non-essential goods like toys.

Moreover, the shift towards digital entertainment options such as video games and online content can divert interest and spending away from traditional physical toys. Together, these factors create a challenging environment for companies operating within the Animation Toys Market, requiring strategic planning and innovation to overcome these barriers.

Opportunities

Opportunities in the Animation Toys Market

The Animation Toys Market presents several lucrative opportunities for growth and expansion. One key area is the integration of technology into toys, such as through interactive apps or augmented reality, which can attract a tech-savvy consumer base and differentiate products in a crowded market.

There is also potential for expanding into emerging markets where increasing disposable income and urbanization are driving consumer spending on toys. Additionally, partnerships with popular media franchises can provide a steady stream of new characters and stories to base toys on, keeping the product line fresh and appealing.

Licensing agreements with these franchises can lead to exclusive merchandise opportunities, tapping into dedicated fan bases eager for branded products. Furthermore, the trend towards eco-friendly and sustainable toys is growing, offering a chance to appeal to environmentally conscious consumers and gain a competitive edge.

Challenges

Challenges Facing the Animation Toys Market

The Animation Toys Market encounters several challenges that can impact its growth trajectory. One major issue is the high level of market saturation, with numerous companies competing for the same consumer base, which can limit the potential for new entrants and reduce profitability for established players.

Counterfeit products also pose a significant problem, as they can undermine brand reputation and consumer trust while diluting sales. Additionally, the fast pace of changing consumer preferences, particularly among children, requires companies to constantly innovate and quickly adapt their product offerings, which can be resource-intensive.

Economic fluctuations and the resulting uncertainty in consumer spending behavior further complicate market conditions. Addressing these challenges requires strategic planning, innovation, and effective brand management to maintain competitiveness in the dynamic Animation Toys Market.

Growth Factors

Growth Drivers for Animation Toys Market

The Animation Toys Market is poised for growth driven by several key factors. Increased global exposure to animated content through streaming platforms is significantly boosting demand for related toys as children and collectors seek tangible connections to their favorite characters.

Additionally, the rise in dual-income households globally has led to higher disposable incomes, allowing parents to spend more on toys. Collaborative ventures between toy manufacturers and animation studios have also become more common, leading to innovative products aligned with popular shows and movies.

Technological advancements have introduced interactive and educational elements to toys, making them more appealing. Moreover, seasonal marketing campaigns during holidays and movie releases often lead to spikes in toy sales. Together, these factors create a favorable environment for sustained growth in the Animation Toys Market.

Emerging Trends

Emerging Trends in Animation Toys Market

The Animation Toys Market is witnessing several emerging trends that are shaping its future. The incorporation of augmented reality (AR) and virtual reality (VR) technologies is becoming increasingly popular, offering immersive play experiences that blend the physical and digital worlds.

There is also a growing emphasis on sustainability within the industry, with manufacturers increasingly opting for eco-friendly materials and processes in response to consumer demand for environmentally responsible products. Additionally, the trend of personalization and customization allows consumers to tailor toys to their preferences, enhancing engagement.

Collaborative partnerships between toy brands and entertainment franchises continue to thrive, capitalizing on the cross-promotional potential of new film and TV releases. Finally, the rise of influencer marketing through social media platforms is significantly influencing consumer purchases, particularly among younger demographics.

These trends are vital for businesses aiming to stay competitive and innovative in a rapidly evolving market.

Regional Analysis

The Animation Toys Market exhibits diverse dynamics across various global regions, reflecting differing consumer behaviors and economic conditions. In 2023, Asia Pacific emerged as the dominating region, holding a substantial 31.3% market share, valued at USD 11.6 billion. This dominance is primarily due to the high popularity of anime and animated content in countries like Japan and South Korea, coupled with rising disposable incomes and urbanization in China and India.

North America also holds a significant position in the market, driven by consistent consumer demand and the presence of major entertainment conglomerates and toy manufacturers. Europe follows closely, with its market characterized by high consumer spending ability and a strong preference for licensed merchandise tied to European animations and Hollywood blockbusters.

Conversely, the Middle East & Africa, and Latin America show slower growth but offer potential due to increasing internet penetration and a growing young population. These regions are gradually embracing more Westernized entertainment, which could increase the demand for animation toys linked to popular media.

Overall, while Asia Pacific leads the market by a considerable margin, each region presents unique opportunities and challenges that influence the global distribution and sales strategies within the Animation Toys Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the landscape of the global Animation Toys Market was significantly shaped by the activities and offerings of key players such as AOSHIMA BUNKA KYOZAI Co., LTD., Arteza, and Mattel Inc. Each of these companies contributed uniquely to the market dynamics through their distinct strategies and product innovations.

AOSHIMA BUNKA KYOZAI Co., LTD., a renowned Japanese manufacturer, continued to leverage its expertise in highly detailed model kits and figures related to popular animations and automotive subjects.

The company’s commitment to quality and precision appeals particularly to hobbyists and collectors, driving its strong position in Asian markets and gaining traction globally among enthusiasts of niche animated series and cinematic universes.

Arteza, primarily known for its arts and crafts supplies, has made significant inroads into the animation toys market by offering creative toy sets that encourage artistic expression in children.

These products not only complement traditional play patterns but also resonate well with the growing consumer demand for educational and developmental toys. This strategic alignment with market trends has enabled Arteza to capture a unique segment of the market focused on creativity and learning.

Mattel Inc., as a dominant player with a broad portfolio, including iconic brands like Barbie and Hot Wheels, continued to innovate by integrating digital technology with physical toys. Their strategy focuses on interactive and augmented reality experiences, making their products more engaging for a technologically adept generation of kids.

Mattel’s strong distribution channels and brand recognition in North America and Europe provide a competitive edge, maintaining its leadership in these regions.

Overall, these companies exemplify the diverse approaches to capitalizing on the opportunities within the global Animation Toys Market, from niche market penetration to leveraging technology and broad-based brand strength.

Top Key Players in the Market

- AOSHIMA BUNKA KYOZAI Co.LTD.

- Arteza

- Mattel Inc.

- BANDAI NAMCO Holdings Inc.

- Dream International Limited

- GOOD SMILE COMPANY INC.

- Animation Toolkit LTD

- KOTOBUKIYA

- Kids Kits

- McFarlane Toys

- Spin Master

- TOMY

- Other Key Players

Recent Developments

- In June 2024, Netflix, in partnership with Skydance Animation, unveiled new details about “Spellbound” and “Pookoo” at a preview event. “Spellbound” features Ellian, whose spell-transformed parents become monsters, as shared by actor Nathan Lane.

- In February 2024, Blue Zoo Animation Studio signed a 5-year deal with Libertas Brands to expand the ‘Fugglers’ plush characters into an entertainment universe across digital platforms: online, on-screen, and in-game.

Report Scope

Report Features Description Market Value (2023) USD 37.3 Billion Forecast Revenue (2033) USD 70.7 Billion CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type (Anime Gacha, Anime Doll, Anime Figure, Cartoon Plush Toys, Other Types), Based on the Product Price (Low, Medium, High), Based on Animation Titles (Pokemon, Hello Kitty, Gundam, Other Animation Titles), Based on Category (Recreational Toys, Learning Toys), Based on Age Group (0-2 Years, 2-8 Years, 8-14 Years, 14 Years and Above), Based on Character Traits (Cute, Cool, Angry, Other Character Traits), Based on Sales Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AOSHIMA BUNKA KYOZAI Co.LTD., Arteza, Mattel Inc., BANDAI NAMCO Holdings Inc., Dream International Limited, GOOD SMILE COMPANY INC., Animation Toolkit LTD, KOTOBUKIYA, Kids Kits, McFarlane Toys, Spin Master, TOMY, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AOSHIMA BUNKA KYOZAI Co.LTD.

- Arteza

- Mattel Inc.

- BANDAI NAMCO Holdings Inc.

- Dream International Limited

- GOOD SMILE COMPANY INC.

- Animation Toolkit LTD

- KOTOBUKIYA

- Kids Kits

- McFarlane Toys

- Spin Master

- TOMY

- Other Key Players