Global Anesthesia Drugs Market By Type (General Anesthesia Drugs, Local Anesthesia Drugs), By Route of Administration (Inhalation, Intravenous, Others), By Application (General Surgeries, Cosmetic Surgeries, Plastic Surgery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117280

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

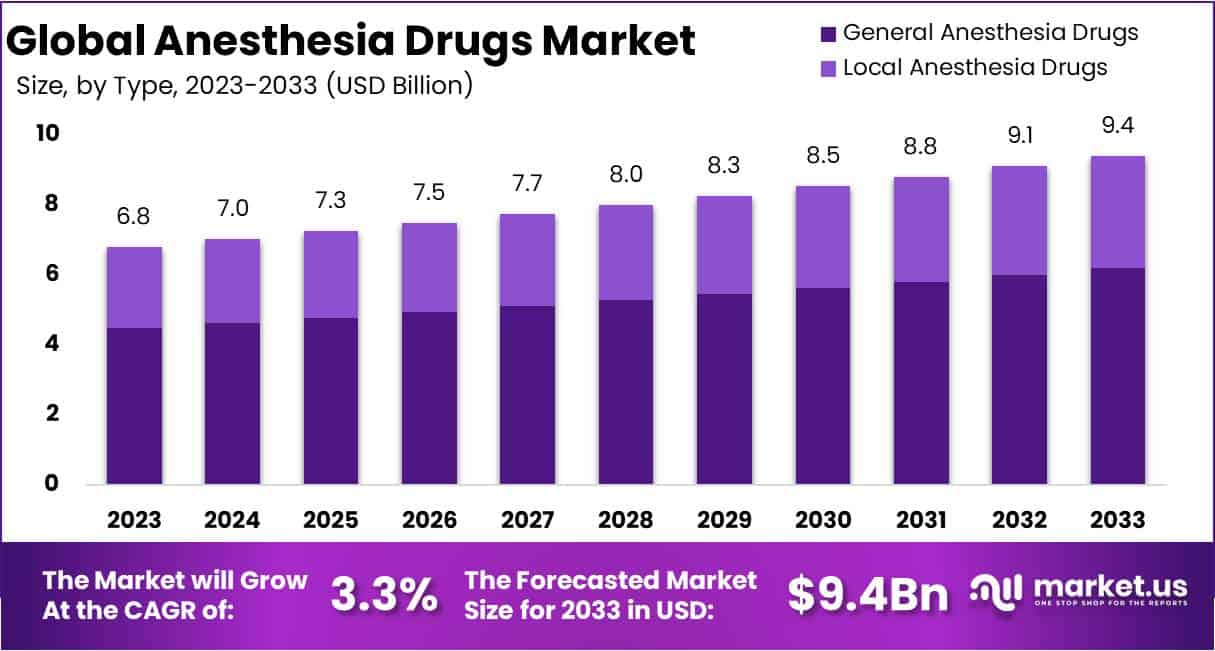

The Global Anesthesia Drugs Market size is expected to be worth around USD 9.4 Billion by 2033, from USD 6.8 Billion in 2023, growing at a CAGR of 3.3% during the forecast period from 2024 to 2033.

Anesthesia can be described as a state of temporary unconsciousness, loss of pain perception, memory loss, and muscle relaxation. These drugs are used to give a sense of calm to patients through muscle relaxation, which also causes amnesia. Anesthesia comprise of various varieties and forms like general anesthesia, regional anesthesia, epidural anesthesia, spinal anesthesia and nerve block anesthesia. These diverse forms are given to patients depending upon the type of surgeries performed on patients. Some types of anesthesia numb certain types of body parts while some numb the brain, resulting in sleepiness during invasive surgeries.

The market for anesthesia is majorly driven by increased number of operations and new anesthetic medication approvals. In addition to this, the rise in findings from private and government organizations for development of pharmaceutical manufacturing segments, rising prevalence of chronic illnesses and increasing research and development activities related to anesthesia drug formulations further expands the global anesthesia drugs market dimensions.

- According to American Society of plastic surgeons, in 2020, 2.3 million cosmetic surgical treatments, 13.2 million cosmetic minimally invasive procedures and 6.8 million reconstructive procedures were performed.

- In February 2021, PainPass announced the first Cannabidiol, product line aimed for treating chronic pain and externally numbing muscles.

- According to World Health Organization, cardiovascular disease is the most common cause of death in 2022, across the globe.

Key Takeaways

- Based on type, a laudable market revenue share of 65.9% is withheld by general anesthesia drugs segment, dominating the market in the year 2023.

- Based on route of administration, intravenous drug segment captured a remarkable market revenue share of 56.4%.

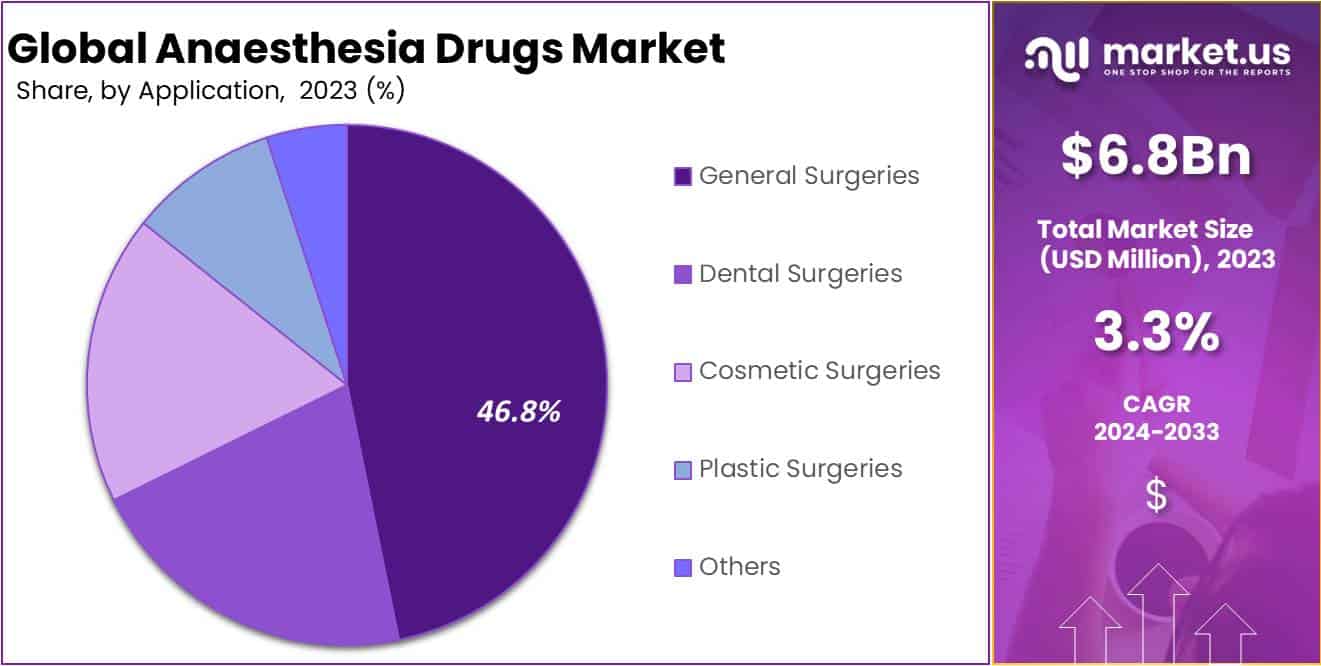

- Based on application, general surgeries segment overshadowed the market capturing a hefty market share of 46.8%.

- Rising pervasiveness of chronic illnesses coupled with advancements in anesthetic drug delivery systems fueled the anesthesia drugs market in recent years.

- High cost of procedures combined with lack of anesthesia physicians is likely to impede the market for anesthesia drugs.

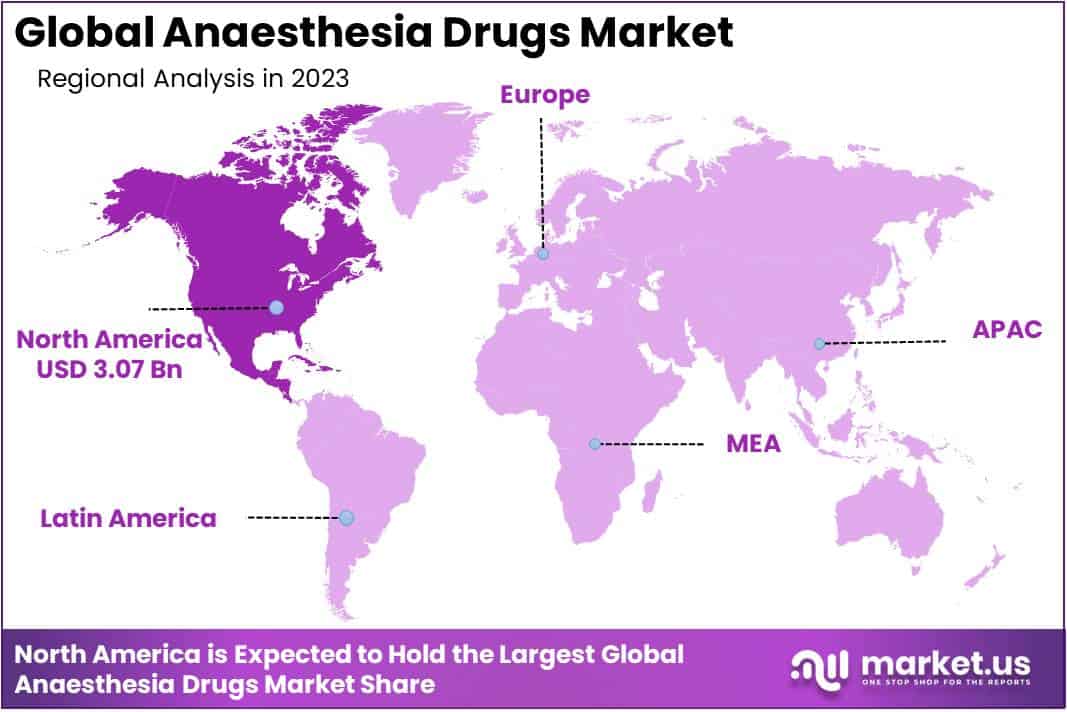

- North America underscores the dominance in global anesthesia market in 2023 with market share of 45.2%.

Type Analysis

General Anesthesia drug segment dominates the market

Based on type, the global anesthesia drugs market is majorly classified into general anesthesia drugs and local anesthesia drugs segment. Amongst these, general anesthesia drugs segment leads the global anesthesia drugs market capturing a laudable market revenue share of 65.9% in the year 2023.

The dominance of the segment owes to the increasing number of surgeries across the globe demanding anesthesia treatments. This aids the healthcare professionals to create individualized anesthetic plans that balance patients’ history with expected surgical plan, increasing safety of patients. On the other hand, local anesthesia drugs is anticipated to witness fastest growing CAGR owing to safety aspect as compared to general anesthetic drugs by virtue of fewer systemic side effects.

Route of Administration Analysis

Intravenous drug segment captivated a prominent market portion

Based on route of administration, the market for anesthesia drugs is bifurcated into inhalation, intravenous and other segments. Intravenous drug segment dominated the global anesthesia drugs market capturing a remarkable market share of 56.4% in the year 2023. The segment being predominate is highly ascribed to its more precise dose delivery into the patients at the time of surgeries.

In addition intravenous route of administration is a better form of injecting anesthesia drugs as it promises patients’ safety combined with lower rates of vomiting, postoperative nausea, urinary retention, and malignant hyperthermia (a rare but serious side effect of general anesthesia), reduced risk of blood clots, and pulmonary emboli (blood clots that move to lungs). Thus, these factors makes intravenous route of administration more preferred by healthcare professionals, thereby fueling the market growth.

Application Analysis

General surgery segment boosted in recent times

Based on application, the anesthesia drugs market is fractionated into general surgeries, dental surgeries, cosmetic surgeries, plastic surgery and other segments. General surgery segment dominates the market in 2023, grabbing a substantial revenue share of 46.8% during to excessive use of anesthesia drugs in general surgeries. In addition to its more usage during surgeries, the market is robustly propelled by rising geriatric population more prone to chronic diseases as well as technological advancements in anesthetic drugs.

- According to American Society of Plastic Surgeons, in 2019, around 1.8 million cosmetic surgeries were operated in United States and around 16.3 million cosmetic minimally invasive procedures were performed.

Key Market Segments

By Type

- General Anesthesia Drugs

- Local Anesthesia Drugs

By Route of Administration

- Inhalation

- Intravenous

- Others

By Application

- General surgeries

- Dental surgeries

- Cosmetic surgeries

- Plastic surgery

- Other

Market Drivers

Increasing geriatric population

The rising population comprising large pool of elderly people is the primary factor leading to the market growth. Elderly population over the age 60 and above are more susceptible to chronic illness such as diabetes, cancer, orthopedic issues, respiratory diseases, etc. necessitating surgical procedures for appropriate treatment. These surgical procedure incorporates anesthesia drugs to minimize pain sensation towards the patients. Thus, the growing frequency of elderly population across the globe is the main force behind the anesthetic agents market growth.

- According to World Health organization, in October 2021, 1 in every 6 people on the planet is expected to be 60 or older by 2030.

- According to Interactive Cardiovascular and Thoracic Surgery, in April 2022, around 227,442 people over the age of 70 have been operated through cardiovascular surgeries.

Rising pervasiveness of chronic illnesses

Another major factor pushing the market towards hefty growth involves rising prevalence of chronic illnesses such as cardiovascular illnesses, cancer, diabetes and osteoarthritis, etc. a steady demand for anesthetic drugs is created as these chronic illnesses surgical interventions for diagnosis, treatment or management, incorporating anesthesia. Thus, the global anesthesia drugs market is robustly driven by rising number of chronic cases.

- According to World Health Organization, in 2022, cardiovascular disease is the leading cause of mortality across the globe.

Market Restraints

High cost of procedure and lack of anesthetic professionals often hamper the market

The global anesthesia market witnesses sluggish growth due to the absence of healthcare services in low income countries and distant locations. This impacts the demand for anesthetic drugs as a gap gets created by virtue of inaccessibility towards essential medical services. The market further experiences hindrance due to the dearth of anesthetic physicians and certified anesthetic nurses per capita population. In addition to this, expensive nature of procedure and branded medicines often deter patients from seeking necessary medical intervention, which is further likely to roadblock the growth for anesthesia drugs market during the forecast period.

Market Opportunities

Anesthesia drugs market witnesses lucrative growth

The global anesthesia drugs market is showcasing hefty growth opportunities due to the development of nations’ healthcare infrastructure. Previously, due to high cost in both developing and developed nations there was underutilization of public health services. However, the problem is now resolved due to a greater emphasis on strengthening the healthcare infrastructures in diverse nations.

This escalates peoples’ access towards healthcare services, rising the number of surgical procedures globally. In addition to this, the rising recognition regarding the benefits of timely surgical interventions have also led to more surgeries being performed worldwide, which in turn, rises the demand for anesthetic drugs.

Moreover, the adoption of ambulatory anesthesia is anticipated to present significant opportunity in the future ahead, allowing patient to have a quick witted recovery from the effects of anesthesia drugs and hence hospital stays are shortened. In addition to this, the market boosts with rising number of approvals for anesthesia drugs.

- For instance, Food & Drug Administration (US) approved Propofol injectable anesthetic emulsion in September 2020, which is a combination of general anesthesia and sedative medicines employed prior to a surgical procedure.

Latest Trends

Several advancements are scaled in the area of Anesthesia Drugs resulting into market expansion. Some of these advances include:

Ultrasound Guided Regional Anesthesia

A revolution has brought by ultrasound technology in administering regional anesthesia, such as nerve blocks. The accuracy of the procedure enhanced as anesthesiologists can now visualize nerves and surrounding structures in real time, thereby minimizing risk of complications, particularly in orthopedic and obstetric procedures.

Target Controlled Infusion (TCI)

Accurate administration of intravenous anesthesia is done by TCI technology by calculating dosage of drug on the basis of patient-specific factors such as weight, age and medical conditions. Thus, a constant drug concentration is ensured in patients’ blood, leading to a smoother anesthesia induction and minimize side effects.

Closed Loop Anesthesia Systems

The technology employ artificial intelligence algorithms to monitor patient’s parameter and adjust anesthesia delivery automatically. Thus, drug dosage is optimized, maintaining a stable vital signs, thereby reducing risk of complications.

Impact of Macroeconomic factors

The market for Anesthesia Drugs is highly influenced by population demographics highlighting size and age distribution of geriatric population. The region faces greater medication demand with high elderly population demanding advanced anesthesia drugs, resulting it in growth of the market.

Pandemic or disease outbreaks can also impact the market, as more children are affected with infectious diseases so more is the demand for related medications. However, the changes in currency exchange rates can have a vital effect on cost import and export of pharmaceutical drugs, impacting the pricing and availability of anesthesia drugs in diverse market areas.

Regional Analysis

North America proves to be highly advanced region in Anesthesia Drugs market

A current dominance is showcased by North America in the global anesthesia drugs market capturing a measurable market share of 45.2% in the year 2023. Major market players in United States are speeding up the process of anesthesia drug formulation as there witnessed a severe shortage of these drugs such as midazolam, propofol and neuromuscular blocking agents at the time of COVID 19 pandemic.

In addition to the speedy development of drugs, the market further grows with increasing number of surgeries and rising elderly population in the region. The launch of new drug products by major pharmaceutical firms proves to be a significant accelerator for the market growth.

- According to American Society of Plastic Surgeons (ASPS), around 768,000 total cosmetic surgeries were performed in people aged 10-29 years and 6.1 million total cosmetic procedures were performed among the age group of 40-54 years old.

- In May 2020, Hikma Pharmaceutical introduced a new product “Propofol Injectable Emulsion”, in the United States.

- In December 2021, Hikma Pharmaceuticals Plc, launched Bupivacaine HCI injection USP through its United States affiliate Hikma Pharmaceuticals USA Inc., in 0.25%, 0.5%, and 0.75% in 10 mililiter and 30 mililiter doses.

Asia-Pacific entitles fastest growth

On the other hand, fastest market growth in global anesthesia drugs market is underscored by Asia-Pacific region. This lucrative growth is a reflection of rising therapeutic and technical advancement in anesthetic field in countries like India and China. in addition to this, sedentary lifestyles among population has led to greater number surgical operations, necessitating the demand for anesthesia drugs in the region.

- According to World Journal of Surgery, in September 2021, approximately 5,000 operation per 100,000 people, i.e., a total of 3,646 operations have been anticipated to meet the surgical demands of population in India.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major companies are focusing on growth strategies such as product developments, new product approvals, and mergers & acquisitions to enhance their share of the worldwide Anesthesia Drugs market. Approvals by regulatory authorities play a pivotal role in extending the medication use by the patients under surgical interventions.

Market Key Players

- Abbott Laboratories

- AstraZeneca Plc.

- Baxter International Inc.

- Claris Lifesciences, ltd

- Eisai Co, ltd.

- Glenmark Pharmaceuticals Ltd

- Hospira Inc.

- Mylan NV.

- Pfizer Inc.

- Slayback Pharma Inc.

- Teva Pharmaceuticals, Inc.

Recent Developments

- In June 2023: United States Food & Drug Administration approved Milla Pharmaceuticals’ generic variant of Precedex, dexmedetomidine hydrochloride injection 4mcg/mL in 50 mL and 100 mL.

- In June 2023: Midazolam Injection Pouches are introduced by Hikma Pharmaceuticals Plc. The injection pouches contains 0.9% Sodium Chloride (NaCl) in 50 mg/50 ml 100mg/100ml dosages. The medication is for constant intravenous infusion for sedation of ventilated and oxygen deprived adults, pediatric, and infants as part of anesthesia or at the time of therapy in a critical care environment in US.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Billion Forecast Revenue (2033) USD 9.4 Billion CAGR (2024-2033) 3.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Macroeconomic factors Impact, Competitive Landscape, Recent Developments Segments Covered By Type (General Anesthesia Drugs, Local Anesthesia Drugs), By Route of Administration (Inhalation, Intravenous, Others), By Application (General Surgeries, Cosmetic Surgeries, Plastic Surgery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherland, Rest of Europe; APAC – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA. Competitive Landscape Abbott Laboratories, AstraZeneca Plc., Baxter International Inc., Claris Lifesciences, ltd, Eisai Co, ltd., Glenmark Pharmaceuticals Ltd, Hospira Inc., Mylan NV., Pfizer Inc., Slayback Pharma Inc., Teva Pharmaceuticals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories

- AstraZeneca Plc.

- Baxter International Inc.

- Claris Lifesciences, ltd

- Eisai Co, ltd.

- Glenmark Pharmaceuticals Ltd

- Hospira Inc.

- Mylan NV.

- Pfizer Inc.

- Slayback Pharma Inc.

- Teva Pharmaceuticals, Inc.