Global Analytics as a Service Market By Enterprise Size (Large Enterprise and Small & Medium Enterprise (SME)), By Analytics Type (Predictive, Prescriptive, Diagnostic and Descriptive), By End-Use (BFSI, Retail, Government, IT & Telecom, Healthcare, Manufacturing, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 66813

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

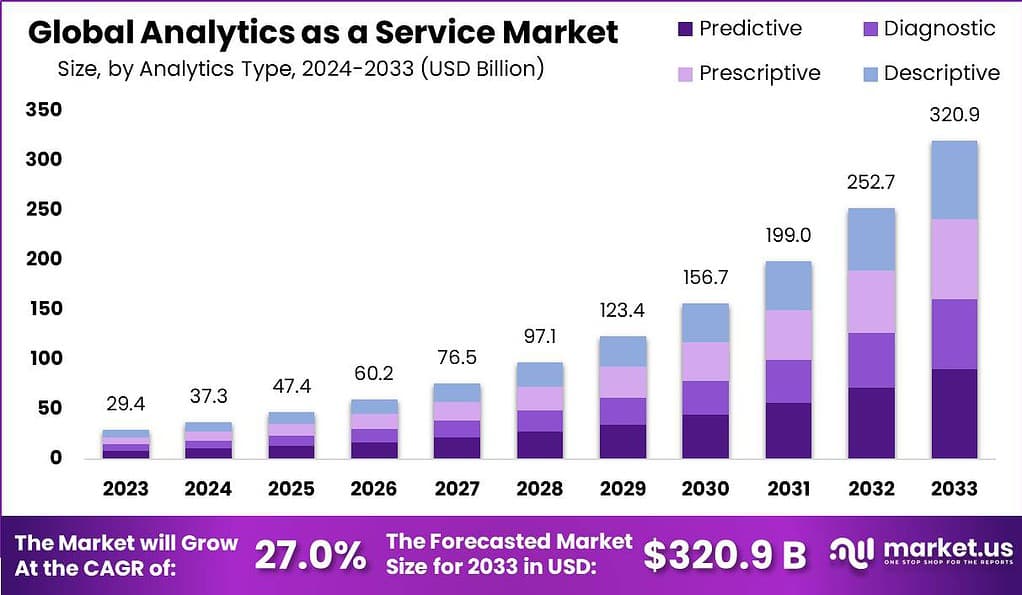

The Global Analytics as a Service Market size is expected to be worth around USD 320.9 Billion by 2033, from USD 29.4 Billion in 2023, growing at a CAGR of 27.0% during the forecast period from 2024 to 2033.

Analytics as a Service (AaaS) represents a modern business model where analytics capabilities, ranging from data management to advanced analysis, are provided over the cloud. This model allows organizations to access sophisticated analytical tools and insights without the need for substantial upfront investment in IT infrastructure or specialized personnel.

The Analytics as a Service (AaaS) Market is a rapidly expanding sector that offers cloud-based analytics solutions to businesses, enabling them to leverage big data and advanced analytics without the need for significant investment in physical IT infrastructure or specialized data analysis teams. This market is instrumental in providing scalable, flexible, and cost-efficient access to cutting-edge analytics, including predictive modeling, artificial intelligence (AI), and machine learning (ML), through a subscription-based model.

In the Analytics as a Service (AaaS) market, the dominance of top vendors such as Google, AWS, Microsoft, IBM, and Oracle underscores a significant concentration of market power, with these entities controlling an estimated 60-70% share.

This consolidation highlights the strategic importance placed on analytics within the broader digital transformation agendas of businesses globally. Google Cloud’s leadership position, commanding approximately 20% of the market share following a substantial investment exceeding $1 billion in data analytics capabilities in 2022, signifies a robust commitment to advancing cloud-based analytics solutions.

AWS and Microsoft Azure, each holding an estimated 15-18% market share, are intensifying the competition through the enhancement of machine learning-powered analytics services. This reflects a broader industry trend towards embedding AI and machine learning into analytics to provide deeper insights and more predictive capabilities to businesses.

IBM and Oracle, while currently holding single-digit market shares, are actively expanding their analytics offerings through strategic acquisitions and product innovations. This suggests a keen interest in capturing a larger slice of the AaaS market by broadening their technology stacks and solution portfolios.

Meanwhile, the emergence of smaller startups receiving venture capital funding in the range of $10M-$30M throughout 2022-2023 introduces a vibrant undercurrent of innovation and niche specialization. These entrants are pivotal in driving the market forward by filling gaps left by larger players and catering to specific industry needs or emerging analytics domains.

Key Takeaways

- Explosive Growth: The Analytics as a Service (AaaS) market is projected to witness remarkable growth, with an estimated value of USD 320.9 billion by 2033, reflecting a robust 27% compound annual growth rate (CAGR) from 2024 to 2033.

- Market Concentration: Top vendors like Google, AWS, Microsoft, IBM, and Oracle dominate the AaaS market, controlling approximately 60-70% share collectively. Google Cloud leads with a significant 20% market share, followed closely by AWS and Microsoft Azure.

- Innovation and Competition: Intensifying competition among major players is evident through substantial investments in enhancing machine learning-powered analytics services. Additionally, smaller startups contribute to innovation and niche specialization, driving market dynamics.

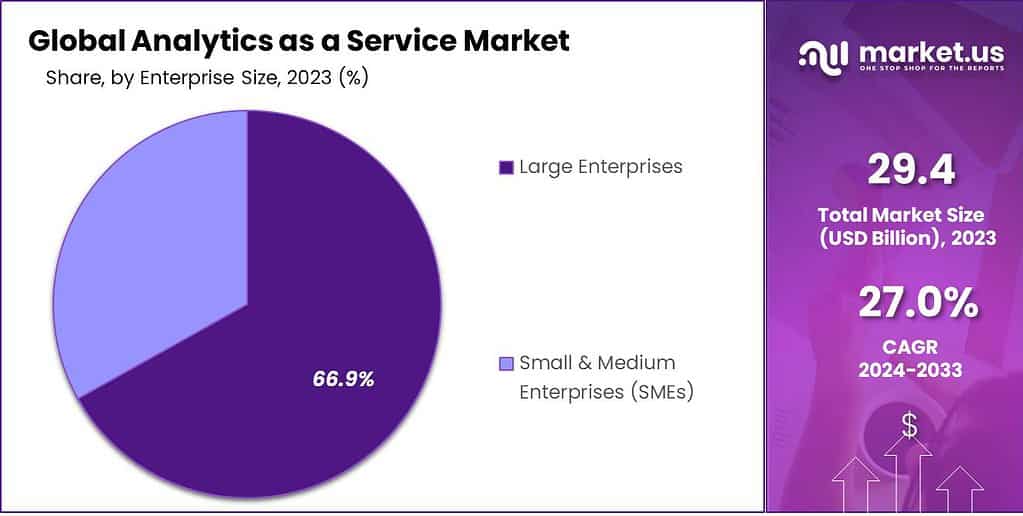

- Segment Analysis: Predictive analytics emerges as the dominant segment in the AaaS market, capturing over 28.3% share in 2023. Large enterprises lead in adoption, constituting more than 66.9% of the market, driven by their substantial resources and strategic imperatives.

- End-Use Applications: The BFSI sector holds a prominent position in the AaaS market, accounting for over 25.1% share in 2023. The critical need for comprehensive analytics to manage financial complexities and comply with regulations drives demand in this sector.

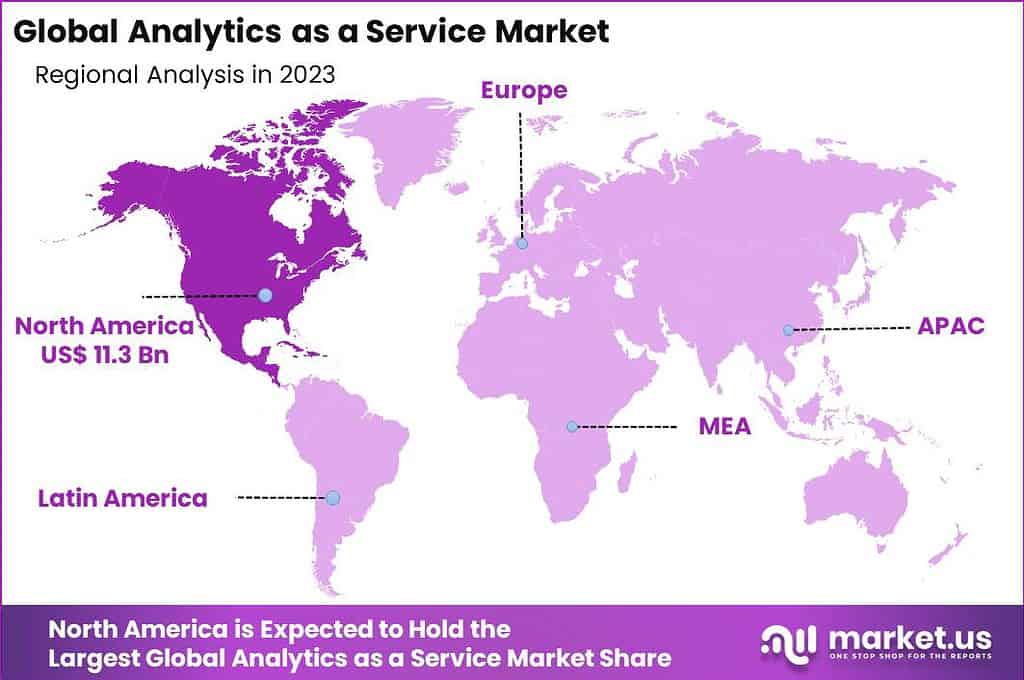

- Regional Insights: North America leads the global AaaS market, capturing over 38.5% share in 2023, attributed to its highly developed technological infrastructure, mature market for analytics solutions, and increasing adoption of advanced technologies.

Analytics Type Analysis

In 2023, the Predictive segment held a dominant market position in the Analytics as a Service (AaaS) market, capturing more than a 28.3% share. This prominence is largely due to the segment’s ability to offer forward-looking insights that empower businesses to anticipate market trends, customer behavior, and potential risks with remarkable accuracy.

Predictive analytics harnesses various statistical, modeling, data mining, and machine learning techniques to analyze current and historical facts to make predictions about future or otherwise unknown events. The driving force behind the predictive segment’s leadership is its critical role in enabling organizations to make informed decisions, optimize operations, and enhance their strategic planning processes.

In an era where data is proliferating at an unprecedented rate, the ability to sift through this vast amount of information and extract actionable insights is invaluable. Predictive analytics provides businesses with a competitive edge by identifying opportunities for growth and efficiency gains before they become apparent to competitors.

Moreover, the integration of advanced technologies such as AI and IoT with predictive analytics has expanded its applicability across various industries, including finance, healthcare, retail, and manufacturing. These sectors leverage predictive models to forecast demand, prevent equipment failures, improve patient outcomes, and personalize customer experiences, among other applications.

As organizations continue to recognize the strategic value of data-driven decision-making, the demand for predictive analytics services is expected to surge, further solidifying its market dominance. This trend is indicative of a broader shift towards more proactive and anticipatory business strategies, fueled by the power of predictive insights.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Analytics as a Service (AaaS) market, capturing more than a 66.9% share. This significant portion of the market can be attributed to the substantial resources large enterprises possess, which allow them to invest heavily in advanced analytics solutions to drive decision-making and strategic initiatives.

Large enterprises are often at the forefront of adopting innovative technologies due to their complex data needs and the strategic imperative to maintain competitive advantages in their respective industries. The dominance of large enterprises in the AaaS market is also a reflection of their extensive data ecosystems and the critical need to harness insights from this data to inform business strategies, optimize operations, and enhance customer experiences.

With the volume, velocity, and variety of data generated by large organizations, AaaS provides a scalable and efficient solution to manage and analyze data without the need for significant capital investment in on-premise infrastructure and specialized personnel. This approach not only helps in reducing operational costs but also enables large enterprises to focus on their core competencies while leveraging the expertise of AaaS providers for data analytics.

Furthermore, the adoption of AaaS by large enterprises is driven by the need to comply with regulatory requirements, manage risks effectively, and foster innovation. By leveraging AaaS, large organizations can access state-of-the-art analytical tools and technologies, including machine learning, artificial intelligence, and predictive analytics, facilitating informed decision-making and future-proofing their business models.

End-Use Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Analytics as a Service (AaaS) market, capturing more than a 25.1% share. This leading stance can be attributed to the BFSI sector’s critical need for comprehensive analytics to navigate the complexities of financial markets, manage risks effectively, and comply with increasingly stringent regulatory requirements.

Analytics services offer BFSI institutions the tools to make sense of vast data volumes, enabling them to uncover insights for better decision-making, fraud detection, customer segmentation, and personalized customer services. The demand for analytics in the BFSI sector is driven by the necessity to enhance operational efficiencies, improve customer experiences, and innovate financial products and services.

As the sector deals with highly sensitive personal and financial data, there is also a pressing need to employ predictive analytics for fraud prevention and to ensure data security. The adoption of advanced analytics helps financial institutions to gain a competitive edge by identifying market trends, optimizing investment strategies, and enhancing customer retention through tailored offerings.

Furthermore, the digital transformation initiatives across the BFSI sector have accelerated the integration of analytics as a core component of business strategies. This transformation is aimed at not only improving internal processes but also at redefining customer engagement models through data-driven insights. The ability of analytics to provide a 360-degree view of the customer and predict future behaviors with a high degree of accuracy makes it indispensable for the BFSI sector.

Key Market Segments

By Analytics Type

- Predictive

- Prescriptive

- Diagnostic

- Descriptive

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

By End-Use

- BFSI

- Retail

- Government

- IT & Telecom

- Healthcare

- Manufacturing

- Other End-Uses

Driver

Increasing Demand for Data-Driven Decision-Making

The escalating demand for data-driven decision-making across various sectors is a significant driver for the Analytics as a Service (AaaS) market. In today’s fast-paced business environment, organizations are increasingly relying on analytics to gain insights from large volumes of data to enhance operational efficiency, customer satisfaction, and competitive advantage.

The ability to quickly analyze and act on information is crucial for businesses aiming to adapt to market changes and anticipate future trends. As a result, the adoption of AaaS solutions is surging, providing companies with scalable, cost-effective access to advanced analytics capabilities without the need for substantial upfront investment in IT infrastructure or specialized personnel. This trend is expected to continue as more businesses recognize the value of leveraging data analytics to inform their strategic and operational decisions.

Restraint

Concerns Over Data Security and Privacy

One of the main restraints in the adoption of Analytics as a Service (AaaS) is the growing concern over data security and privacy. As AaaS involves processing and storing vast amounts of sensitive data on cloud platforms, businesses are apprehensive about the potential risks of data breaches and unauthorized access.

The complexity of ensuring data protection compliance, especially with regulations such as GDPR in Europe and various other local data protection laws, adds to the challenge. These concerns can deter organizations from embracing cloud-based analytics solutions, despite the benefits. To overcome this restraint, AaaS providers must demonstrate rigorous security measures, compliance with international data protection standards, and transparent data handling practices to reassure potential clients of the security and confidentiality of their data.

Opportunity

Integration of AI and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with Analytics as a Service (AaaS) presents a significant opportunity for market growth. AI and ML capabilities can enhance AaaS offerings by enabling more sophisticated data analysis, predictive analytics, and personalized insights at scale. This integration allows businesses to automate complex analytical processes, uncover deeper insights, predict future trends, and make more informed decisions faster than ever before.

As AI and ML technologies continue to evolve, their application in analytics services opens new avenues for innovation, offering businesses advanced tools to tackle complex challenges, optimize operations, and create personalized customer experiences. The opportunity for AaaS providers to incorporate AI and ML into their solutions is vast, promising to deliver enhanced value to customers and drive market expansion.

Challenge

Skill Gaps and Complexity of Integration

A significant challenge facing the Analytics as a Service (AaaS) market is the skill gap and complexity associated with integrating advanced analytics solutions into existing business systems. While AaaS offers the promise of accessible analytics, the reality is that effectively leveraging these services often requires specialized knowledge and skills. Many organizations lack the in-house expertise necessary to integrate and maximize the value of analytics services, leading to underutilization and inefficiency.

Furthermore, the complexity of integrating AaaS solutions with legacy systems and ensuring compatibility across diverse IT infrastructures can pose additional hurdles. This challenge necessitates a concerted effort from AaaS providers to offer more user-friendly, easily integrable solutions and to provide comprehensive support and training to help clients overcome these barriers and fully leverage the power of analytics.

Regional Analysis

In 2023, North America emerged as the leading regional market in the Analytics as a Service (AaaS) segment, capturing a dominant share of over 38.5%. The demand for Analytics as a Service in North America was valued at US$ 11.3 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region’s strong market position can be attributed to several factors. Firstly, North America has a highly developed technological infrastructure and a mature market for analytics solutions. The presence of major technology hubs and leading analytics service providers has contributed to the region’s dominance.

Additionally, the increasing adoption of advanced technologies such as big data analytics, artificial intelligence, and machine learning in various industries has fueled the demand for AaaS solutions in North America. Furthermore, the region’s focus on data-driven decision-making and the need for actionable insights to drive business growth have propelled the adoption of AaaS among enterprises.

The presence of a large number of established organizations across diverse sectors, including retail, healthcare, finance, and manufacturing, has further boosted the demand for AaaS in North America. As a result, the region is expected to maintain its dominant market position in the coming years, with sustained growth driven by ongoing digital transformation initiatives and the increasing importance of data analytics in driving business success.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Analytics as a Service (AaaS) market is characterized by the presence of several key players who are pivotal in shaping the industry’s dynamics and driving innovation. These entities not only lead in terms of market share but also in the development of cutting-edge analytics solutions that cater to a wide range of industries.

IBM Corporation, with its robust portfolio of cloud-based analytics solutions, continues to lead innovation, leveraging artificial intelligence and machine learning to offer advanced predictive analytics. Microsoft Corporation’s Azure Analytics services underscore the integration of analytics and cloud computing, enhancing scalability and accessibility for businesses of varying sizes.

Oracle Corporation, known for its comprehensive database management and analytics services, has emphasized the importance of real-time data analysis, catering to the demand for immediate insights. SAS Institute remains a pivotal figure, offering specialized analytics services that support industry-specific applications, thereby reinforcing its commitment to customization and precision.

Top Market Leaders

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAS Institute

- Amazon Web Services, Inc.

- Accenture plc

- SAP SE

- Hitachi, Ltd.

- MicroStrategy Incorporated

- Dell Inc.

- BAE Systems plc

- Cloudera, Inc.

- Other Key Players

Recent Developments

1. SAP SE:

- October 2023: Launched RISE with SAP, a cloud-based solution integrating data analytics and AI capabilities.

- August 2023: Partnered with Google Cloud to offer SAP solutions on Google Cloud Platform, with a focus on data analytics and AI.

- June 2023: Announced SAP Data Intelligence Cloud, a platform for unifying data management and analytics.

2. Hitachi, Ltd.:

- December 2023: Launched Lumada Data Catalog, a platform for discovering and managing data assets across hybrid cloud environments.

- September 2023: Partnered with Microsoft Azure to offer Hitachi’s Lumada analytics solutions on Azure.

- April 2023: Acquired GlobalLogic, a digital engineering company, boosting its IT consulting and data analytics capabilities.

Report Scope

Report Features Description Market Value (2023) US$ 29.4 Bn Forecast Revenue (2033) US$ 320.9 Bn CAGR (2024-2033) 27.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Enterprise Size (Large Enterprise and Small & Medium Enterprise (SME), By Analytics Type (Predictive, Prescriptive, Diagnostic and Descriptive), By End-Use (BFSI, Retail, Government, IT & Telecom, Healthcare, Manufacturing, and Other End-Uses) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute, Amazon Web Services Inc., Accenture plc, SAP SE, Hitachi, Ltd., MicroStrategy Incorporated, Dell Inc., BAE Systems plc, Cloudera Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Analytics as a Service (AaaS)?Analytics as a Service (AaaS) is a cloud-based service that provides businesses with analytics capabilities, such as data analysis, data visualization, and predictive modeling, without the need for on-premises infrastructure.

How big is Analytics as a Service Market?The Global Analytics as a Service Market size is expected to be worth around USD 320.9 Billion by 2033, from USD 29.4 Billion in 2023, growing at a CAGR of 27.0% during the forecast period from 2024 to 2033. The Global Analytics as a Service Market size is expected to be worth around USD 320.9 Billion by 2033, from USD 29.4 Billion in 2023, growing at a CAGR of 27.0% during the forecast period from 2024 to 2033.

Who are the prominent players operating in the analytics as a service (AaaS) market?Some of the prominent players operating in the Analytics as a Service (AaaS) market include IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute, Amazon Web Services Inc., Accenture plc, SAP SE, Hitachi Ltd., MicroStrategy Incorporated, Dell Inc., BAE Systems plc, Cloudera Inc., Other Key Players

Which are the driving factors of the analytics as a service (AaaS) market?The key driving factors of the Analytics as a Service (AaaS) market include the increasing volume of data generated by businesses, the growing adoption of cloud computing, the need for advanced analytics capabilities, and the demand for real-time analytics.

Which region will lead the global analytics as a service (AaaS) market?In 2023, North America emerged as the leading regional market in the Analytics as a Service (AaaS) segment, capturing a dominant share of over 38.5%.

Analytics as a Service MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Analytics as a Service MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAS Institute

- Amazon Web Services, Inc.

- Accenture plc

- SAP SE

- Hitachi, Ltd.

- MicroStrategy Incorporated

- Dell Inc.

- BAE Systems plc

- Cloudera, Inc.

- Other Key Players