Global Analytical Instrumentation Market By Product (Instruments, Services, and Software), By Technology (Polymerase Chain Reaction, Spectroscopy, Other Technologies), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 100738

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

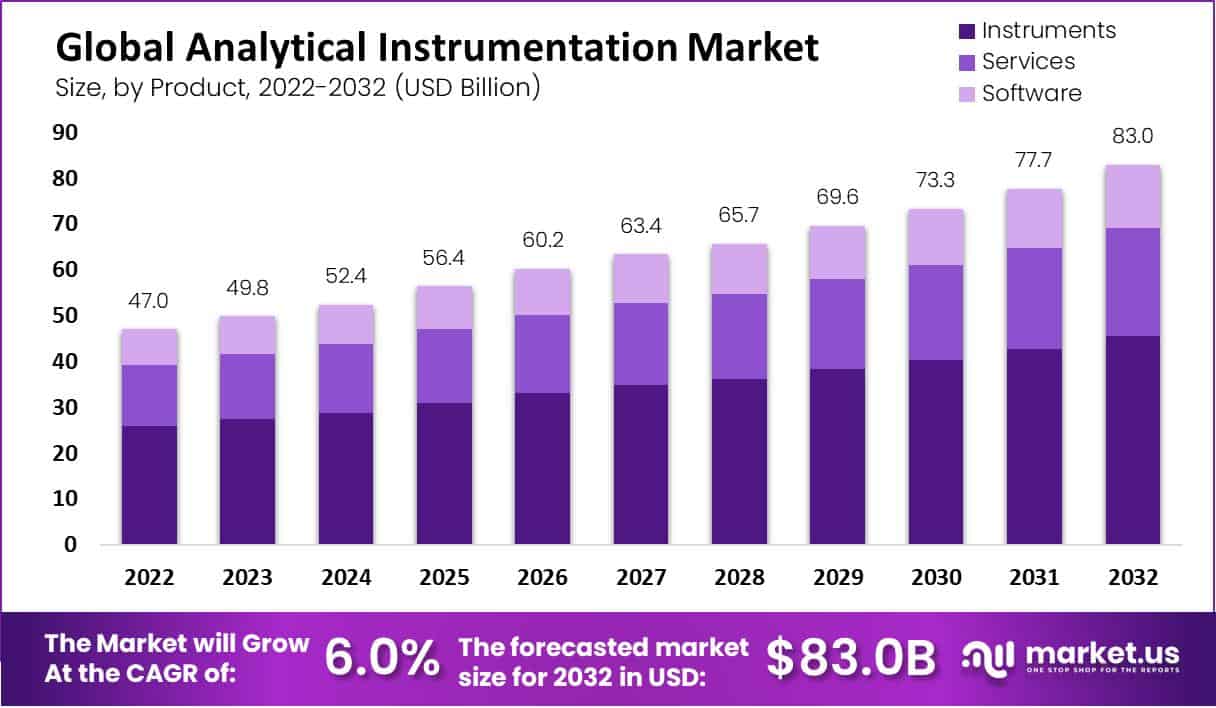

Global Analytical Instrumentation Market size is expected to be worth around USD 83.0 Billion by 2032 from USD 49.8 Billion in 2023, growing at a CAGR of 6.0% during the forecast period from 2024 to 2032.

Analytical instrumentation plays an integral role in modern scientific research as well as industrial processes. Advanced equipment and techniques are employed to evaluate the chemical, physical, and biological characteristics of substances.

This enables researchers to identify components within a sample, define its structure and properties, and monitor its behavior and interactions. Analytical instrumentation is essential in many fields, such as pharmaceuticals, food and beverage, environmental monitoring, and material science. It helps guarantee product safety and quality while developing new materials and technologies with a greater depth of understanding.

Key Takeaways

- Market Size: Analytical Instrumentation Market size is expected to be worth around USD 83.0 Billion by 2032 from USD 49.8 Billion in 2023.

- Market Growth: The market growing at a CAGR of 6.0% during the forecast period from 2024 to 2032.

- Product Analysis: The instruments segment is expected to have the most significant growth, with a projected CAGR of 7.2%.

- Technology Analysis: The polymerase chain reaction technology held the largest market share of 23.9% in the global analytical instrumentation market in 2022.

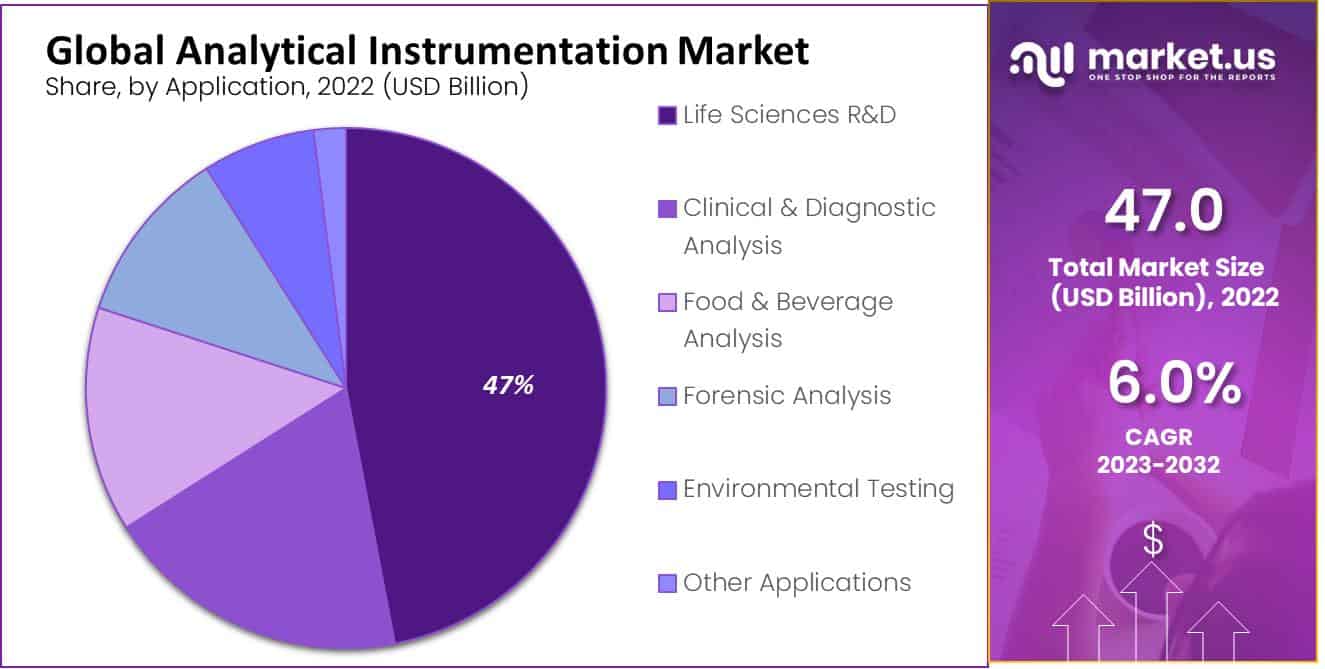

- Application Analysis: the life sciences research & development segment held the largest market share of 47% in the global analytical instrumentation market in 2022.

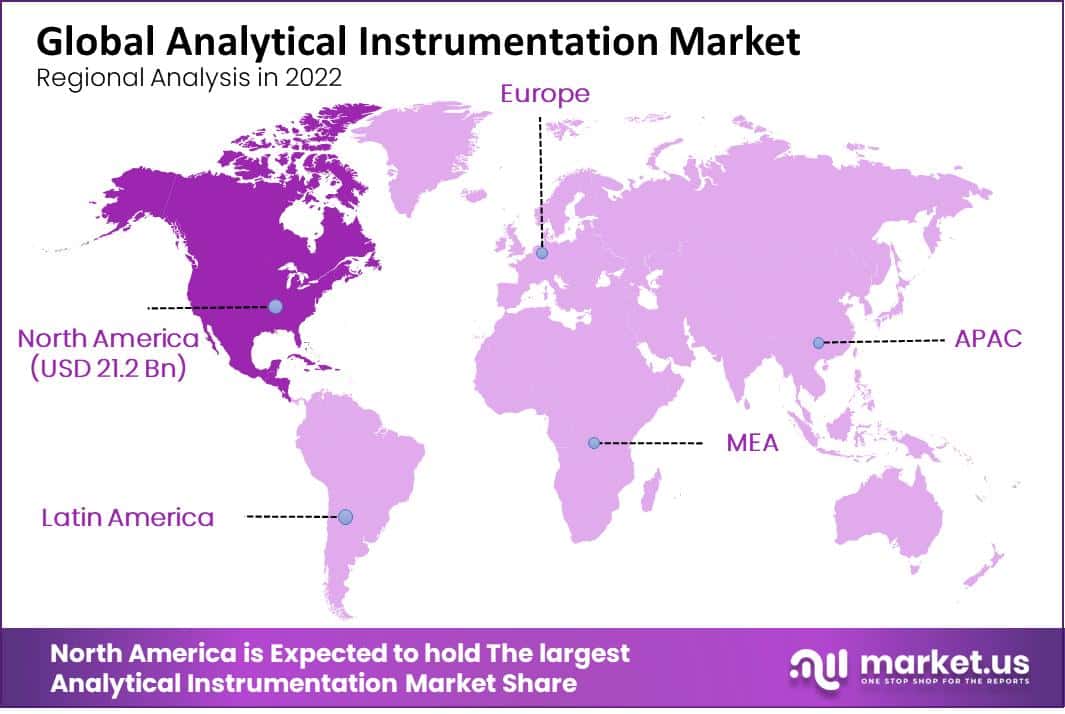

- Regional Analysis: North America holds the largest market share of 45% of the total revenue in 2022 and is anticipated to be the most dominant region.

- Pharmaceutical and Biotechnology Demand: The pharmaceutical and biotechnology sectors are major drivers of the market, requiring advanced analytical tools for drug development, quality control, and regulatory compliance.

- Environmental Testing: Growing environmental concerns and regulatory requirements are boosting the demand for analytical instruments used in monitoring air, water, and soil quality, as well as detecting pollutants and contaminants.

- Healthcare Applications: Analytical instruments are increasingly used in clinical diagnostics and research, contributing to advancements in personalized medicine, genomics, and proteomics.

- Future Prospects: The market is anticipated to grow further with the integration of artificial intelligence and automation in analytical instruments, enhancing their efficiency, accuracy, and ease of use, thereby broadening their applications across various sectors.

By Product Analysis

The Instruments Segment is Dominant

Based on product, the market for analytical instrumentation is segmented into instruments, services, and software. Among these products, the instruments segment is the most lucrative in the global analytical instrumentation market with a projected CAGR of 7.2% in the forecasted period. The total revenue share of the instruments segment is 55% in 2022. The instruments used in analytical instrumentation are distinct and specialized which is designed to perform a specific function in the analysis of substances.

Chromatographs, spectrometers, and mass spectrometers are some instruments mainly used to divide and identify components in a sample, examine its properties, and measure its composition. However, the software segment is expected to register the highest CAGR of 7.5% during the forecast period. Software is widely used for data analysis and interpretation of outcomes in analytical practices in several areas such as hypothetical research and medical diagnosis.

By Technology Analysis

Polymerase Chain Reaction (PCR) Technology is Dominant

Based on technology, the market is classified into a polymerase chain reaction, spectroscopy, microscopy, chromatography, flow cytometry, sequencing, microarray, and other technologies. The polymerase chain reaction technology held the largest market share of 23.9% in the global analytical instrumentation market in 2022 and is forecasted to be the most lucrative segment with a projected CAGR of 7.4% in the projected period. The technology delivers various advantages such as fast amplification, the necessity of a less quantity of sample, and utility for the exposure of various diseases.

It allows a higher level of amplification of specific orders and more delicate detection in less time as compared to other traditional methods making the procedure significantly useful for basic and industrial purposes. The sequencing segment is expected to register a higher CAGR of 7.6% over the forecast period due to its growing usage to evaluate the sequence of nucleotides in small targeted overall genomes or genomic regions.

By Application Analysis

The Life Sciences R&D Segment is Dominant

Based on application, the market is segmented into life sciences R&D, clinical & diagnostic analysis, food & beverage analysis, forensic analysis, environmental testing, and other applications. From these applications, the life sciences research & development segment held the largest market share of 47% in the global analytical instrumentation market in 2022, with a projected CAGR of 6.9% during the estimated period.

The rising occurrence of chronic diseases is contributing to the increase in R&D activities through several life sciences industries to develop and produce novel biologics such as spectroscopy and UV-Vis spectroscopy used in the classification of antibodies. The clinical & diagnostic analysis segment is expected to grow at the highest CAGR of 7.3% during the forecast period. The growing cases of cancer and chronic diseases have resulted in huge demand for diagnostic tests and also increase the requirement for analytical instrumentation products such as flow cytometers for clinical testing.

Key Market Segments

By Product

- Instruments

- Services

- Software

By Technology

- Polymerase Chain Reaction

- Spectroscopy

- Microscopy

- Chromatography

- Flow Cytometry

- Sequencing

- Microarray

- Other Technologies

By Application

- Life Sciences R&D

- Clinical & Diagnostic Analysis

- Food & Beverage Analysis

- Forensic Analysis

- Environmental Testing

- Other Applications

Driving Factors

Rising Demand for Analytical Instruments in the Pharmaceutical and Biotechnology Industries

The analytical instrumentation market has been growing rapidly in past years and is driven by various key factors. The rising demand for analytical instruments in the pharmaceutical and biotechnology industries are major drivers where they are used to develop new drugs and therapies. The growth of the food and beverage industry drives the market where analytical instruments are used to ensure food safety and quality.

Furthermore, the rise of environmental regulations and concerns about pollution have been responsible for an increased need for analytical instrumentation in the environmental monitoring and testing sector. Also, technological advancements such as the development of portable and handheld instruments are driving growth in the analytical instrumentation market as they offer greater convenience and flexibility to users.

Latest Trends

Increasing Demand for Personalized Treatments

The analytical instrumentation market is experiencing several key trends that are revolutionizing the industry and stimulating innovation. One trend in medicine and healthcare is the increasing demand for personalized treatments which has propelled the development of advanced analytical technologies in drug discovery, diagnostics, and monitoring. Another trend is the increasing function of automation and artificial intelligence in analytical instruments and software which improve efficiency and accuracy while excluding human intervention.

Also, the move towards greener and more sustainable practices has driven the development of new analytical instruments and methods for environmental monitoring and analysis. Furthermore, the increasing adoption of data analytics and the Internet of Things (IoT) provides better opportunities for analytical instruments to offer real-time monitoring and analysis of various processes from manufacturing to environmental controlling.

Restraining Factors

High Cost and Need of Expertise

Though the analytical instrumentation market is on the rise, several challenges could hinder its expansion. One major barrier is the high cost of instruments which may prove prohibitive for smaller businesses and laboratories with limited budgets. Furthermore, some analytical instruments can be complex to operate and maintain, necessitating specialized training and expertise.

Another potential constraint is the regulatory environment; changes in the regulations or standards for these instruments could impact demand for certain types of analytical instrumentation. Competition in the market can be fierce as many companies offer similar products leading to price wars and pressure on profit margins.

Growth Opportunity

Rising Demand for Analytical Instruments in Emerging Markets

The analytical instrumentation market presents numerous prospects for growth and innovation. One major opportunity lies in the rising demand for analytical instruments in emerging markets, particularly Asia-Pacific and Latin America, where rapid industrialization and urbanization are fueling the demand for new technologies and solutions.

Furthermore, the development of new analytical technologies and applications such as nanotechnology and proteomics, presents companies with new chances to enter the market and create innovative products. The explosion of big data analytics and the need for real-time monitoring and analysis are driving demand for advanced analytical instruments and software. Also, the growing emphasis on sustainability and environmental protection is creating new applications for analytical instrumentation in areas such as air/water quality monitoring and renewable energy development.

Regional Analysis

North America is Dominant Region in the Global Analytical Instrumentation Market

North America holds the largest market share of 45% of the total revenue in 2022 and is anticipated to be the most dominant region in the global analytical instrumentation market with a projected CAGR of 7.2% during the forecast period. The regional market for analytical instrumentation is driven by the existence of various leading organizations and a huge demand from the pharmaceutical and biotechnology industries.

Whereas, the Asia-Pacific accounts for the fastest growth in the global analytical instrumentation market with a projected CAGR of 7.6% during the forecast period. As the region showcases rapid industrialization & urbanization, the increasing demand for new technologies and solutions in industries such as healthcare, food and beverage, and environmental monitoring are contributing to market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are employing various strategic tactics to expand their businesses into global markets. Companies are investing heavily in research and development to release more in-depth product portfolios that meet the increasing demand for analytical instruments. To boost global revenues, analytical instrumentation market companies are employing merger and acquisition tactics.

Furthermore, they’re expanding their operations by offering several facilities like customized and personalized products, operating in niche segments, and adopting technological change catering to different customer requirements.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Waters Corp.

- Shimadzu Corp.

- Danaher

- Agilent Technologies, Inc.

- Bruker Corp.

- PerkinElmer, Inc.

- Mettler Toledo

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Eppendorf SE

- Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc.

- Other Key Players

Recent Developments

- Thermo Fisher Scientific, Inc. (June 2024): Thermo Fisher Scientific, Inc. acquired BioAnalytica Inc., a leading provider of advanced analytical instruments, to enhance their portfolio in chromatography and mass spectrometry, thereby strengthening their position in the analytical instrumentation market and expanding their customer base.

- Waters Corp. (May 2024): Waters Corp. launched the ACQUITY PREMIER UPLC System, an advanced ultra-performance liquid chromatography system designed to deliver unparalleled separation capabilities and increased sensitivity, offering researchers improved analytical performance for complex sample analysis.

- Shimadzu Corp. (April 2024): Shimadzu Corp. introduced the Nexera XS Inert UHPLC System, featuring innovative inert flow path technology to prevent sample adsorption and degradation, ensuring accurate and reliable analysis for sensitive compounds in pharmaceutical and environmental testing.

- Danaher (March 2024): Danaher acquired LabTech Instruments, a prominent manufacturer of laboratory automation solutions, to integrate their advanced automation technologies into Danaher’s analytical instruments, enhancing productivity and efficiency in laboratories worldwide.

- Agilent Technologies, Inc. (July 2024): Agilent Technologies, Inc. unveiled the 8900 Triple Quadrupole ICP-MS, a next-generation inductively coupled plasma mass spectrometer offering unmatched sensitivity and precision for trace element analysis in environmental, food, and pharmaceutical applications.

- Bruker Corp. (February 2024): Bruker Corp. acquired NanoTech Solutions, a specialist in nanomaterial characterization instruments, to expand their capabilities in nanoscale analysis and strengthen their position in the analytical instrumentation market focused on materials science and nanotechnology.

Report Scope

Report Features Description Market Value (2022) USD 47.0 Billion Forecast Revenue (2032) USD 83.0 Billion CAGR (2023-2032) 6.0% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments, Services, and Software), By Technology (Polymerase Chain Reaction, Spectroscopy, Microscopy, Chromatography, Flow Cytometry, Sequencing, Microarray, Other Technologies), By Application (Life Sciences R&D, Clinical & Diagnostic Analysis, Food & Beverage Analysis, Forensic Analysis, Environmental Testing, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Waters Corp., Shimadzu Corp., Danaher, Agilent Technologies, Inc., Bruker Corp., PerkinElmer, Inc., Mettler Toledo, Zeiss Group, Bio-Rad Laboratories, Inc., Illumina, Inc., Eppendorf SEF., Hoffmann-La Roche AG, Sartorius AG, Avantor, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Analytical Instrumentation MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Analytical Instrumentation MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Waters Corp.

- Shimadzu Corp.

- Danaher

- Agilent Technologies, Inc.

- Bruker Corp.

- PerkinElmer, Inc.

- Mettler Toledo

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Eppendorf SE

- Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc.

- Other Key Players