Global Amusement Parks Market By Rides (Mechanical Rides, Water Rides, Other Rides), By Age (19 to 35 years, Up to 18 years, 36 to 50 years, 51 to 65 years, More than 65 years), By Revenue Source (Ticket, Food and beverage, Merchandise, Hotels and Resorts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132263

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

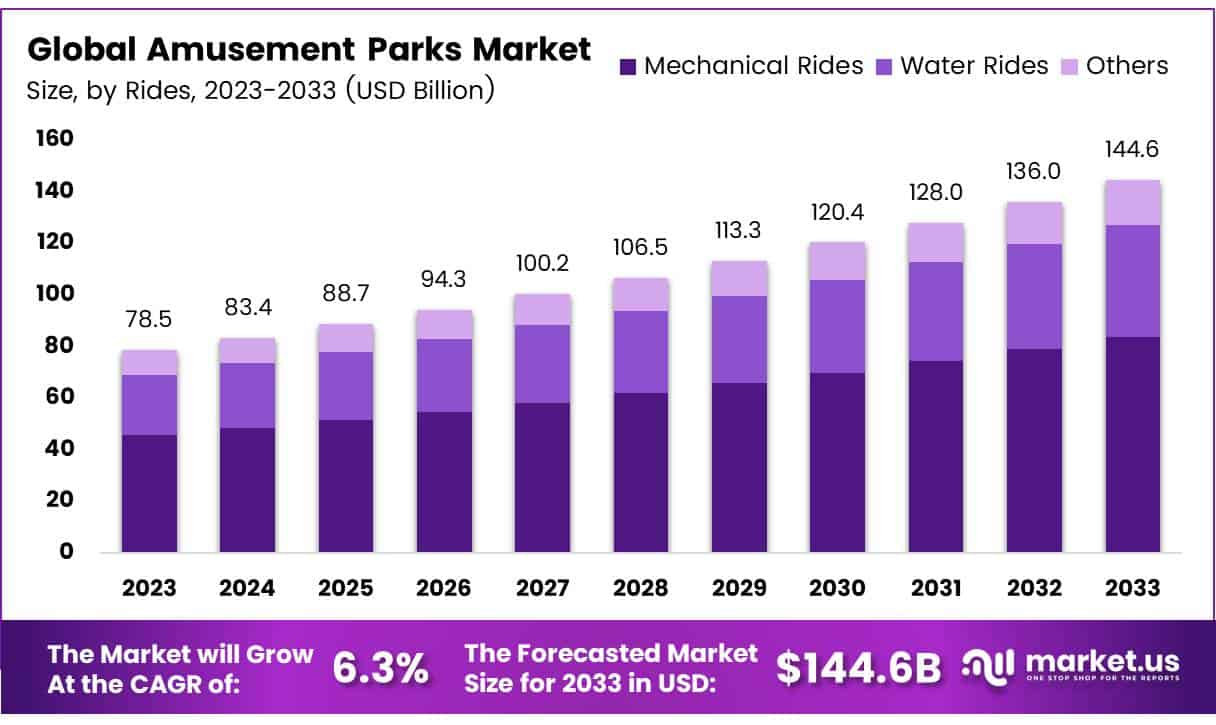

The Global Amusement Parks Market size is expected to be worth around USD 144.6 Billion by 2033, from USD 78.5 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Amusement parks are expansive entertainment complexes that feature a variety of attractions such as rides, games, and shows designed to cater to families and individuals seeking fun and excitement. These parks range from large, globally recognized destinations with high-tech thrill rides to smaller, regional parks with attractions themed around local culture or specific storytelling motifs.

The amusement parks market encompasses the global operations and business aspects of managing and operating amusement parks. This market segment includes not only the direct revenues generated from ticket sales, admissions, concessions, and merchandise but also the broader economic impact of these parks, including hotel stays, travel expenses, and other associated hospitality services.

The amusement parks sector has exhibited remarkable resilience and growth, particularly in the recovery phase following global economic disruptions. The resurgence in attendance to a level of 244.6 million guests in 2023, marking a 23.5 percent increase from the previous year, underscores the strong consumer demand and the sector’s ability to bounce back.

This rebound is primarily driven by the ongoing innovation within park attractions, including the integration of virtual reality and enhanced theme experiences, which continue to draw visitors and provide a competitive edge.

Governments worldwide recognize the economic benefits of amusement parks, leading to significant investments in this sector. For instance, Qatar’s planned $5.5 billion entertainment district highlights a strategic initiative to bolster tourism and diversify economic reliance away from traditional sectors.

Similarly, the substantial investment of $500 million by Silver Dollar City into expanding its facilities over the next decade reflects confidence in the market’s growth potential. Moreover, new ventures like the proposed $2 billion theme park in rural Oklahoma indicate both investor interest and government support in regional development.

Regulatory frameworks also play a crucial role in shaping the operations of amusement parks, focusing on safety standards, environmental compliance, and labor laws to ensure sustainable industry practices.

The data provided by various sources illustrates the vibrancy and potential of the amusement parks market. The significant increase in global theme park visitors as reported for 2023 not only highlights the sector’s recovery capabilities but also its expansion in attracting a broader audience.

Furthermore, the investments announced in new and existing parks signal a robust growth trajectory and confidence among stakeholders. These developments are likely to stimulate local economies, enhance employment opportunities, and drive advancements in related sectors such as hospitality and services.

Key Takeaways

- The Global Amusement Parks Market is projected to grow from USD 78.5 billion in 2023 to USD 144.6 billion by 2033, with a compound annual growth rate (CAGR) of 6.3%.

- Mechanical Rides dominate the Rides Analysis segment with an 84% market share in 2023, driven by technological advancements and strong consumer demand for thrilling rides.

- The 19 to 35 years age group is the largest demographic in the Amusement Parks Market, holding a 32% share, influenced by their disposable income and desire for diverse entertainment.

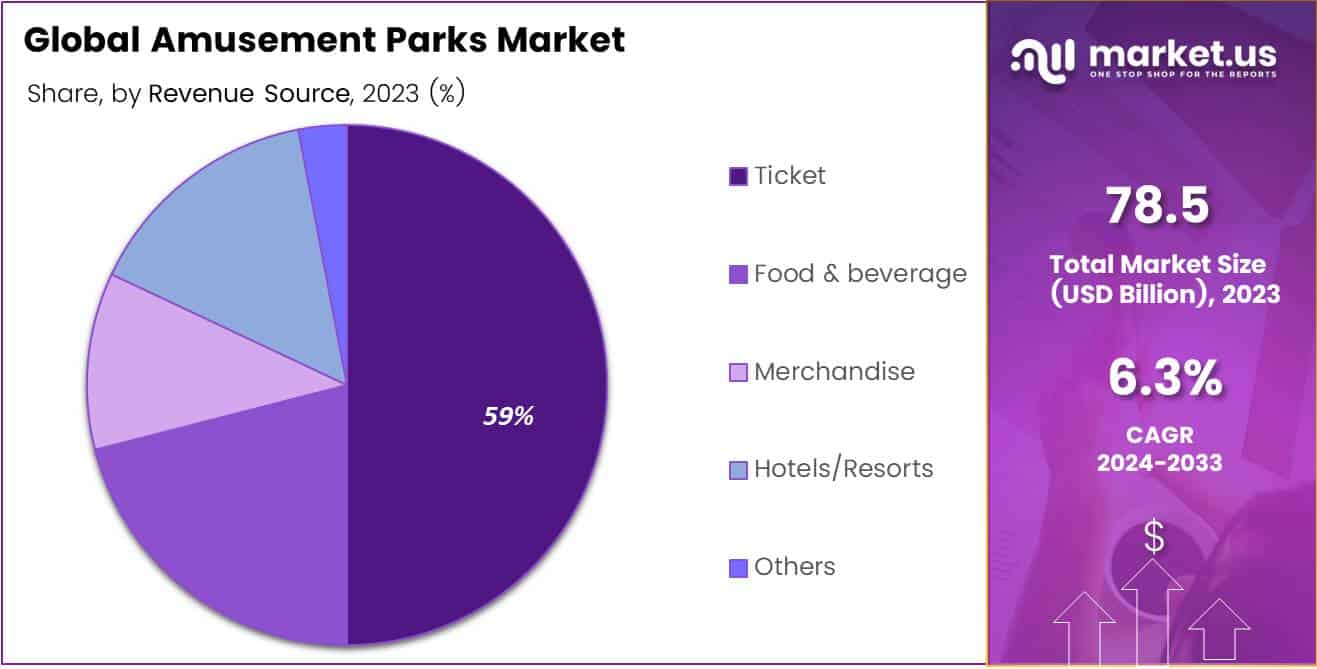

- Ticket sales are the most significant source of revenue, making up 59% of the market in 2023, highlighting their critical role in the financial sustainability of amusement parks.

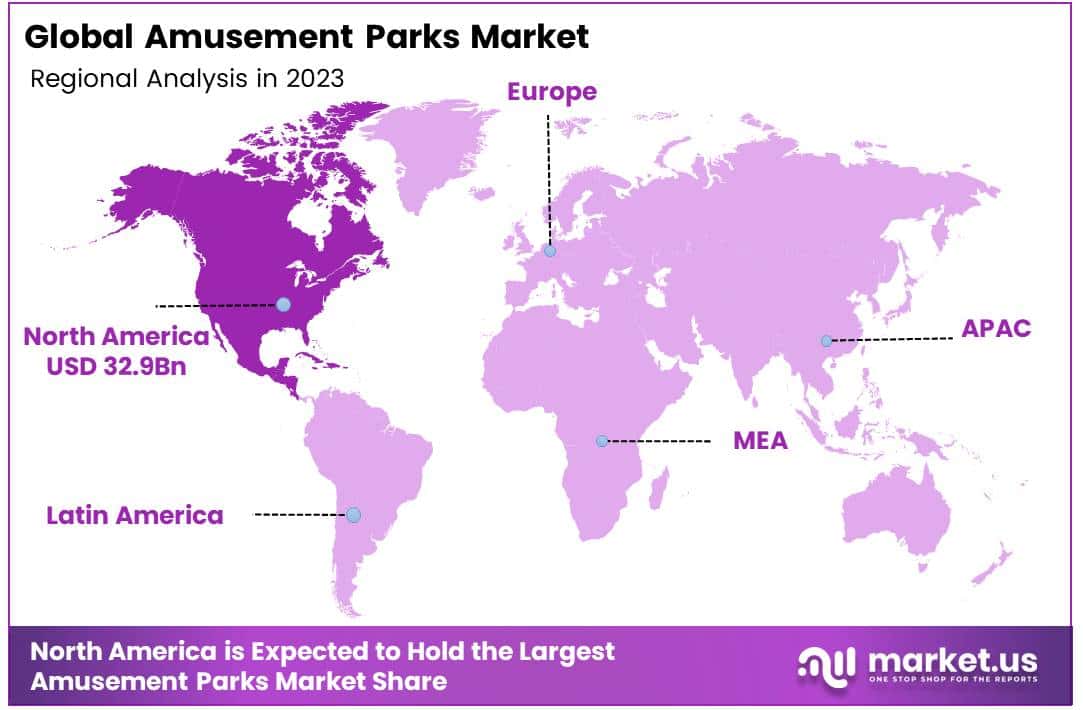

- North America leads the market with a 42% share, generating USD 32.97 billion in revenue, supported by high disposable income and continuous investment in theme park enhancements and digital integration.

- Key growth drivers include rising disposable incomes, particularly in rapidly developing regions, and urbanization, which supports the demand and creation of new amusement facilities in expanding cities.

Rides Analysis

Mechanical Rides Dominate Amusement Park Attractions with 84% Market Share

In 2023, Mechanical Rides held a dominant market position in the By Rides Analysis segment of the Amusement Parks Market, capturing an 84% share. This substantial market presence can be attributed to ongoing innovations in ride technology and heightened consumer demand for thrilling amusement experiences.

Mechanical rides, which include roller coasters, ferris wheels, and carousels, continue to be the centerpiece attractions that define the visitor experience at amusement parks globally.

In contrast, Water Rides, which provide a refreshing escape especially in warmer climates, accounted for a smaller portion of the market. These attractions, ranging from water slides to wave pools, cater to a broad demographic, yet their seasonal usage limits year-round revenue potential.

Other rides, encompassing a variety of entertainment forms such as interactive simulators and educational rides, occupy the remaining market share. These rides often incorporate advanced technology to enhance user engagement but have not yet reached the widespread popularity of their mechanical counterparts.

Collectively, the sustained popularity of mechanical rides underscores their pivotal role in driving visitor numbers and underlines the importance of continuous innovation within the segment to maintain consumer interest and market leadership.

Age Analysis

19 to 35 years segment Command 32% of Amusement Park Market Share in 2023

In 2023, the 19 to 35 years age group held a dominant market position in the By Age Analysis segment of the Amusement Parks Market, capturing a 32% share. This demographic’s engagement is primarily driven by their disposable income and preference for diverse entertainment options, contributing significantly to revenue streams.

The presence of thrill rides, interactive technology, and seasonal events are particularly appealing to this age cohort, supporting their high participation rate in the sector.

Conversely, the segments representing younger visitors, up to 18 years, along with older groups from 36 to 50 years, 51 to 65 years, and those over 65, collectively contribute to the remaining market share, each reflecting different degrees of market penetration and spending power.

These groups are influenced by varying factors such as family-oriented attractions, accessibility, and the provision of leisurely paced experiences. Amusement parks continue to evolve their offerings to cater to these diverse age groups, ensuring broad appeal across generational divides, thereby stabilizing market growth and expanding consumer base.

Revenue Source Analysis

Tickets Command 59% Share in Amusement Parks’ Revenue Stream for 2023

In 2023, Ticket sales held a dominant market position in the By Revenue Source Analysis segment of the Amusement Parks Market, commanding a 59% share. This substantial proportion underscores the central role ticketing revenue continues to play in the financial health of amusement parks. Revenue from ticket sales is pivotal, not only as the primary income stream but also as a baseline for ancillary sales across other segments.

The Food & Beverage segment also showcased robust performance, contributing significantly to the overall revenue, as park visitors often purchase meals and snacks as part of their visit. Similarly, Merchandise sales offered a lucrative revenue stream, leveraging branded products to enhance visitor engagement and loyalty.

Meanwhile, Hotels/Resorts provided a complementary boost to the market, capitalizing on multi-day stays from visitors seeking immersive experiences. The Others category, encompassing a range of minor revenue sources, further diversified the income portfolio of amusement parks, although to a lesser extent compared to primary sources.

Overall, while Tickets remain the cornerstone of revenue, other segments have shown healthy growth, indicating a dynamic market with multiple avenues for income generation.

Key Market Segments

By Rides

- Mechanical Rides

- Water Rides

- Other Rides

By Age

- 19 to 35 years

- Up to 18 years

- 36 to50 years

- 51 to 65 years

- More than 65 years

By Revenue Source

- Ticket

- Food & beverage

- Merchandise

- Hotels/Resorts

- Others

Drivers

Rising Disposable Income Boosts Amusement Park Spending

As a market analyst, it can be observed that the amusement parks market is currently experiencing significant growth, which can largely be attributed to a few key drivers. Firstly, rising disposable incomes have enabled more consumers to allocate funds towards leisure and entertainment activities, directly benefiting the amusement parks sector. This increased spending power is particularly evident in regions experiencing rapid economic growth, where middle-class populations are expanding.

Secondly, urbanization continues to be a strong factor, as growing urban centers both demand and support the establishment of new amusement facilities. As cities expand, so too do the opportunities for large-scale entertainment complexes to attract a dense population of potential visitors.

Lastly, technological advancements, such as the integration of virtual reality (VR) and augmented reality (AR), are revolutionizing visitor experiences in amusement parks. These technologies offer unique, immersive attractions that enhance the appeal of parks and can draw tech-savvy younger demographics. The synergy of these factors collaboratively propels the market forward, making the amusement parks industry a dynamic segment with robust growth prospects.

Restraints

High Initial Investment and Operating Costs

The amusement park market is characterized by high initial investments and operating expenses, which can be a significant barrier to entry for new players and a persistent challenge for existing operators. Building an amusement park demands substantial capital for land acquisition, construction, and the procurement of rides and attractions, which are crucial for drawing visitors but entail hefty upfront costs.

Furthermore, the ongoing maintenance of these facilities and rides, along with the need for constant renovation to maintain visitor interest, adds to the financial burden. The operational costs are further amplified by the need for trained personnel, safety measures, and marketing.

Another critical restraint is the seasonal nature of demand. Most amusement parks experience peak attendance during specific periods such as holidays and summer months, leading to significant fluctuations in revenue.

During off-peak times, parks often see a drastic drop in footfall, which can adversely affect profitability and strain cash flows, making it challenging to cover fixed costs and maintain profitability throughout the year. This seasonality requires effective management and strategic planning to mitigate revenue volatility and ensure financial stability.

Growth Factors

Growth Opportunities in the Amusement Parks Market: Enhanced Food and Beverage Offerings

As an analyst examining the amusement parks market, it is evident that significant growth opportunities lie in diversifying and upgrading food and beverage offerings. Modern consumers seek premium dining experiences that go beyond traditional park fare, indicating a shift towards more sophisticated and varied menu options.

By integrating gourmet food selections and themed dining experiences that cater to a broader range of dietary preferences and cultural tastes, amusement parks can enhance guest satisfaction and increase spending per visit. Additionally, the introduction of health-conscious and artisanal foods could attract a wider audience, promoting longer stays and more frequent visits.

Implementing these enhancements not only caters to evolving consumer demands but also positions parks as culinary destinations, potentially driving higher revenue and improving overall market competitiveness. This strategic focus on food and beverage innovation represents a proactive approach to meet and exceed guest expectations, securing a competitive edge in the dynamic amusement park industry.

Emerging Trends

Immersive Experiences Elevate Amusement Park Attractions

The amusement park market is witnessing a transformative shift towards immersive experiences, primarily driven by the integration of augmented reality (AR), virtual reality (VR), and mixed reality technologies. These advancements are revolutionizing visitor interactions within parks by enriching attractions with digitally enhanced realities that offer more engaging and personalized experiences.

Additionally, the sector is seeing a rise in themed accommodations, where hotels and resorts on park premises extend the thematic experience beyond the park itself, thus offering a holistic adventure that begins at check-in and continues throughout the visitor’s stay.

Mobile app integration is further optimizing the visitor experience with features like real-time navigation, queue management, and personalized suggestions, which streamline park exploration and minimize wait times. These trends collectively enhance visitor satisfaction and have substantial implications for market growth and customer loyalty in the amusement parks industry.

Regional Analysis

North America Leads with 42% Share and $32.97 Billion in Revenue

The global amusement parks market is a dynamic and varied landscape, reflecting diverse regional characteristics and growth trajectories.

North America stands as the dominating region, commanding 42% of the market share and generating revenue of USD 32.97 billion. This dominance can be attributed to the high per capita disposable income, coupled with a robust infrastructure supporting large-scale parks that are icons of entertainment and recreation. North America’s market is bolstered by ongoing investments in theme park expansions and the integration of digital technologies to enhance visitor experiences.

Regional Mentions:

Asia Pacific region is witnessing the fastest growth, driven by the rising middle class, increasing urbanization, and the growing popularity of cultural and entertainment tourism. The strategic development of amusement parks in countries like China, Japan, and India, focusing on localized themes and international partnerships, is propelling market expansion. Europe, while mature, continues to innovate through the rejuvenation of existing parks and the introduction of new, immersive experiences that leverage augmented and virtual reality.

The markets in Latin America and the Middle East & Africa, although smaller in comparison, show potential due to increasing tourism and leisure spending. Latin America benefits from its vibrant culture and favorable climate, which supports year-round operations, whereas the Middle East is transforming its luxury tourism sector by incorporating world-class amusement parks as part of broader economic diversification plans.

Overall, the global amusement parks market is poised for sustained growth, with North America leading in market share but Asia Pacific rapidly closing the gap through strategic developments and investments in the entertainment sector.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global amusement parks market witnessed dynamic contributions from major players, each showcasing distinct strategies for growth and customer engagement. Among these, Disney and Comcast have prominently enhanced their market presence through significant investments in digital integration and themed innovations, driving substantial visitor footfall.

Disney, a perennial leader, continues to leverage its iconic brand and extensive intellectual property to introduce immersive attractions and experiences that resonate globally. This strategy not only boosts attendance but also strengthens merchandise sales, thereby bolstering overall revenue streams.

Comcast, through its Universal Parks & Resorts division, aggressively expands by constructing new attractions and entering new markets, such as the announced theme park in Frisco, Texas, and the Universal Beijing Resort. Their focus on blockbuster franchises like Harry Potter and Jurassic World has effectively capitalized on cross-promotional opportunities between their entertainment productions and theme parks.

Meanwhile, Cedar Fair Entertainment Company and Merlin Entertainments focus on regional market penetration and diversifying their portfolio of attractions to cater to a broader demographic. Cedar Fair’s investment in year-round operations and lodging facilities aims to transform its parks into comprehensive resort destinations, while Merlin emphasizes interactive and family-oriented experiences, buoyed by the global appeal of its Legoland parks.

Emerging players like Fantawild Holdings Inc. and Chimelong Group Co., Ltd. are pivotal in Asia’s market growth, innovating with culturally distinct themes and leveraging local narratives to draw domestic and international visitors. Their growth underscores Asia’s increasing significance in the amusement parks landscape, propelled by rising middle-class affluence and urbanization.

Top Key Players in the Market

- Cedar Fair Entertainment Company

- Disney

- Chimelong Group Co., Ltd

- Ardent Leisure Group Limited.

- Fantawild Holdings Inc.

- IMG Worlds of Adventure

- Comcast

- Merlin Entertainments

- SeaWorld Parks & Entertainment, Inc.

- Warner Media, LLC.

Recent Developments

- In November 2023, Six Flags and Cedar Fair announced an $8 billion merger. This deal is set to create the largest theme park operator in North America, combining their resources to enhance visitor experiences across multiple locations.

- In February 2024, Disney revealed a massive $60 billion investment plan for its global theme parks. The company aims to expand and upgrade attractions, promising significant changes across its parks worldwide.

- In June 2024, Disney committed $17 billion to its Orlando theme parks over the next decade. This investment is expected to bring new attractions, entertainment options, and infrastructure improvements to one of its most popular destinations.

- In February 2024, Disney and Epic Games announced a strategic collaboration. They plan to co-develop video games and an entertainment ecosystem, with Disney also investing $1.5 billion to acquire an equity stake in Epic Games, strengthening their partnership in digital entertainment.

Report Scope

Report Features Description Market Value (2023) USD 78.5 Billion Forecast Revenue (2033) USD 144.6 Billion CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rides (Mechanical Rides, Water Rides, Other Rides), By Age (19 to 35 years, Up to 18 years, 36 to50 years, 51 to 65 years, More than 65 years), By Revenue Source (Ticket, Food & beverage, Merchandise, Hotels/Resorts, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cedar Fair Entertainment Company, Disney, Chimelong Group Co., Ltd, Ardent Leisure Group Limited., Fantawild Holdings Inc., IMG Worlds of Adventure, Comcast, Merlin Entertainments, SeaWorld Parks & Entertainment, Inc., Warner Media, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cedar Fair Entertainment Company

- Disney

- Chimelong Group Co., Ltd

- Ardent Leisure Group Limited.

- Fantawild Holdings Inc.

- IMG Worlds of Adventure

- Comcast

- Merlin Entertainments

- SeaWorld Parks & Entertainment, Inc.

- Warner Media, LLC.