Global Ammonium Thiosulfate Market By Type (Ammonium Thiosulfate Solid, and Ammonium Thiosulfate Liquid), By Application (Fertilizers, Photographic Fixers, Metal Leaching, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 16264

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

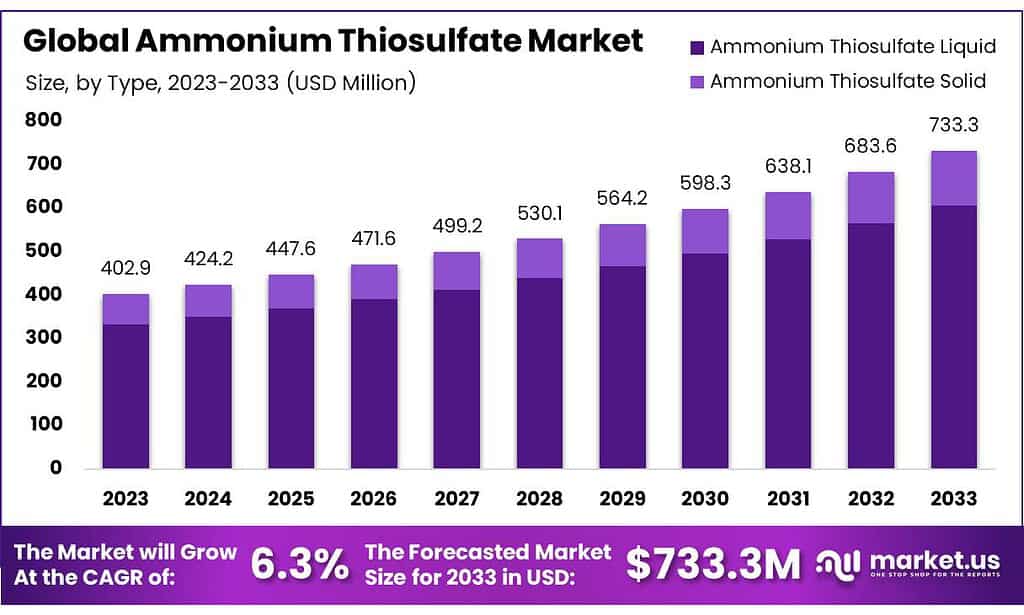

The Ammonium Thiosulfate Market size is expected to be worth around USD 733.3 Million by 2033, from USD 402.8 Million in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2033.

Ammonium Thiosulfate [NH₄]₂S₂O₃, furthermore, ammonium thiosulfate is relatively toxic and soluble in water. It is considered as best source of fertilizer owing to the presence of sulfur hydrogen, ammonia, and nitrogen. The compound is also used in the production of herbicides, insecticides, and fungicides, which are essential in the agricultural sector to control pests and diseases that affect crops.

In addition, it is used as the best alternative option to cyanide-based leaching. Moreover, ammonium thiosulfate is valued for its role in chemical research and development, serving as a fundamental reagent in inorganic chemistry laboratories worldwide. Its ability to react with various compounds and substances makes it best suited for manufacturing pharmaceutical dyes.

The global ammonium thiosulfate market is primarily driven by its extensive use in agriculture as a nitrogen and sulfur fertilizer, enhancing both crop yield and soil health. As a liquid fertilizer component, its demand is bolstered by the growing need for efficient and environmentally friendly agricultural practices.

Major producers are located in North America, Europe, and Asia-Pacific, with the U.S. and China playing significant roles in production and consumption. Market growth is supported by advancements in agricultural technology and an increasing focus on sustainable farming. However, volatility in raw material availability and geopolitical tensions continue to pose challenges to market stability.

- USDA has invested more than US$ 174 million through the Fertilizer Production Expansion Program (FPEP) to support 42 projects nationwide to boost domestic fertilizer production.

Key Takeaways

- The global ammonium thiosulfate market was valued at US$ 402.9 Million in 2023.

- The global ammonium thiosulfate market is projected to reach US$ 733.3 Million by 2033.

- Among other types, liquid accounted for the largest market share of 82.8%.

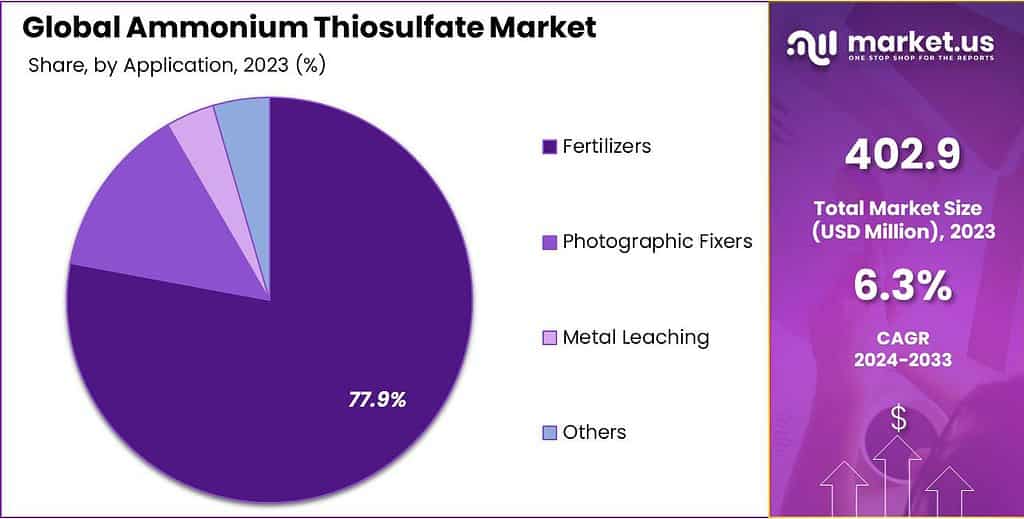

- Among applications, fertilizers accounted for the majority of the ammonium thiosulfate market share with 77.9%.

Raw Material Analysis

Liquid Form Of Ammonium Thiosulfate Held The Major Share Owing To Its Easier And More Precise Application

The ammonium thiosulfate market is segmented based on type into ammonium thiosulfate solid and ammonium thiosulfate liquid. Among these, the liquid type held the majority of revenue share in 2023, with a market share of 82.8%. Liquid ammonium thiosulfate is often favored for its convenience in application. It can be readily mixed with liquid fertilizers, making it easier for agricultural operators to apply directly to crops or soil.

Furthermore, liquid ammonium thiosulfate typically exhibits higher solubility compared to its solid counterpart. This enhanced solubility facilitates quicker absorption by plants, leading to more rapid results and improved efficiency in sulfur supplementation. The prevalence of liquid ammonium thiosulfate in the market underscores its favorable attributes and utility within the agricultural sector, positioning it as the preferred choice among stakeholders seeking efficient sulfur supplementation solutions. The liquid form allows for more uniform dispersion over the intended area, ensuring consistent coverage and effectiveness in addressing sulfur deficiencies in crops.

Application Analysis

Fertilizers Accounted for a Major Share in the Ammonium Thiosulfate Market

The market is segmented into fertilizers, photographic fixers, metal leaching, and others based on application. Among these applications, fertilizers accounted for the majority of the market share with 77.9%. The agricultural sector remains a basis of global economies, with a continuous demand for fertilizers to enhance crop yields and maintain soil fertility. As populations grow and arable land diminishes, the need for efficient agricultural practices intensifies, further driving the demand for fertilizers. Moreover, technological advancements in fertilizer production have facilitated the development of specialized formulations tailored to specific soil and crop requirements.

These innovative solutions offer improved nutrient absorption, reduced environmental impact, and enhanced crop productivity, thereby attracting significant interest and investment from agricultural stakeholders. The dominance of fertilizers in the market landscape underscores their indispensable role in modern agriculture, driven by technological innovation, regulatory support, and evolving consumer preferences toward sustainable farming practices.

Key Market Segments

By Type

- Ammonium Thiosulfate Solid

- Ammonium Thiosulfate Liquid

By Application

- Fertilizers

- Photographic Fixers

- Metal Leaching

- Others

Drivers

Continuous Growth of the Agriculture Industry Surge the Crop Production

Key attributes such as rising population, globalization, and the growing agriculture sector have enhanced the overall performance of the agriculture industry. The agriculture sector is booming across North America, Europe, Asia-Pacific, Middle East and other regions. The urgent need for agricultural fertilizer and consumer preferences for organic and nutritious food has increased the production rate of ammonium thiosulfate.

- For instance, according to a report, the Indian agricultural sector is predicted to increase to US$ 24 billion by 2025.

Ammonium thiosulfate is widely utilized as fertilizer and herbicide across the globe owing to its low toxicity and solubility properties. Thus, there has been a prominent upsurge in the demand for key intermediates such as ammonium thiosulfate, which serve as essential components in the synthesis of agricultural fertilizers.

Moreover, the key factors such as the adoption of advanced technology, and significant transformation with a rapid shift towards commercialization, modernization, and consolidation of small farms have raised the demand for the ammonium thiosulfate market. Government policies for supporting agricultural mechanization, rural development, and food security have driven growth in crop yields and livestock production. These factors together increase the overall demand for ammonium thiosulfate fertilizer during the forecast period; thus, enhancing the overall agriculture industry.

The global economy is growing at 2.9% annually which will lead to a significant reduction or a near elimination of absolute economic poverty in developing nations; thus, the demand for food across the world is expected to reach at a rapid pace. In addition, globalization and urbanization lead to changes in the lifestyle and dietary habits of consumers, and also urban lifestyles tend to be more fast-paced, leading to increased consumption of convenience foods and packaged products.

Furthermore, international trade affair of food products enables consumers to access a diverse variety of foods from different regions of the world. Increased trade has expanded the availability of certain food items and has exposed consumers to new cuisines and culinary trends. Thus, it has also increased the production of ammonium thiosulfate as fertilizer.

Restraints

Adverse Impact On Environment May Hinder the Growth

Ammonium thiosulfate is relatively low toxic and safe to use but a recent study shows that ammonium thiosulfate has an impact on the environment. Government imposition of strict norms and regulations on using ammonium thiosulfate is expected to hamper the market growth. European Union has imposed stricter regulations on using ammonium thiosulfate.

For instance, according to a report published by the US EPA, it states that there is a mandate reregistration eligibility decision (RED)on using ammonium thiosulfate. The high cost and availability of other substitutes to ammonium thiosulfate such as aluminum hydroxide, Phenylarsine Oxide (PAO), and others have affected the market growth.

Furthermore, ammonium thiosulfate, which is extensively used in sewage water systems, industrial wastewater, and the agriculture sector as pesticide residues, is expected to pose a great threat to aquatic organisms and human health. decomposition ammonium thiosulfate products, such as ammonia and sulfides, are harmful to aquatic life, and if it is released into water bodies in high concentrations aquatic ecosystems, include fish kills and habitat degradation.

Opportunity

Wide Range Of Applications Is Expected to Create Lucrative Opportunities

Ammonium thiosulfate is a versatile chemical intermediator in various end-use industries for industrial processes. In addition, the global dyes and pigments market is poised for expansion, driven by the escalating coloring needs across various industries, including construction, coatings, textiles, and printing inks.

Its properties of participating in redox reactions, forming complexes with metal ions and acting as a sulfur source make it a crucial component for the production of pharmaceuticals, dyes, and specialty chemicals. With diversified uses, new routes for chemical synthesis, and applications, key manufacturers of ammonium thiosulfate have expanded their market reach into diverse industrial sectors.

Ammonium thiosulfate also finds applications in materials science, including the production of advanced materials such as catalysts, polymers, and coatings. Its unique chemical properties of sulfur find diverse applications in the electronics and construction industry. For instance, sulfur is used for the formation of a thin film of cadmium sulfide in electronic applications.

Moreover, ammonium thiosulfate is widely used in biotechnological and pharmaceutical industries for reagent and additives processors. Its role in redox reactions and sulfur metabolism makes it relevant for applications such as enzyme production, fermentation, and drug synthesis.

Ammonium thiosulfate also finds its use in biopharmaceutical manufacturing, biocatalysis, and other bioprocesses as the biotechnology sector continues to grow. ammonium thiosulfate is also utilized in environmental remediation efforts to address pollution and contamination issues. Its ability to react with heavy metals, chlorinated compounds, and other pollutants makes it suitable for applications such as soil and groundwater remediation, wastewater treatment, and air pollution control.

Trends

Increasing Demand for Liquid Fertilizer Solutions

The global shift towards precision agriculture is significantly driving the demand for liquid fertilizers, including ammonium thiosulfate. Ammonium thiosulfate is primarily used as a source of nitrogen and sulfur, two essential nutrients required for healthy plant growth. Its liquid form allows for easier and more precise application, which is crucial in modern farming practices aiming for optimal crop yields and resource management.

The adoption of precision agriculture techniques, characterized by the use of technology and data analytics to enhance crop productivity and sustainability, has led to a higher demand for specialized agrochemicals such as ammonium thiosulfate. These techniques enable farmers to apply fertilizers more efficiently, minimizing waste and environmental impact while maximizing plant nutrition. Precision irrigation systems, GPS technology, and drones for aerial application are increasingly utilized to distribute liquid fertilizers such as ammonium thiosulfate, enhancing the nutrient uptake efficiency in plants.

Furthermore, the compatibility of ammonium thiosulfate with other agricultural chemicals makes it an attractive choice for agronomists and farmers. Ammonium thiosulfate can be mixed with various liquid fertilizers and pesticides, reducing the number of separate applications needed and thereby saving time and resources. This integration capability aligns with the ongoing trend towards streamlined and cost-effective farming operations, further bolstering the market growth of ammonium thiosulfate.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impact the Growth of the Ammonium Thiosulfate Market Due to

Ammonium thiosulfate (ATS) is a crucial component in the agriculture industry, primarily used as a nitrogen and sulfur fertilizer. Its market dynamics are influenced by factors including agricultural demand, raw material availability, and international trade policies, all of which have been subject to shifts due to recent geopolitical tensions.

The onset of the Russia-Ukraine conflict in early 2022 had immediate and profound effects on the global fertilizer market, including the segment for ammonium thiosulfate. Russia is one of the world’s largest producers of natural gas, a key input in the production of ammonia, which is subsequently used to produce ammonium thiosulfate.

The conflict led to significant disruptions in natural gas supply chains, causing a spike in global energy prices and increasing the costs of ammonia production. Moreover, Ukraine and Russia are both significant exporters of agricultural products. The conflict disrupted farming activities and exports from these regions, leading to global uncertainty in agricultural markets.

This uncertainty influenced the demand for fertilizers, as farmers around the world adjusted to changing price signals and supply chain disruptions. In response to the conflict, several Western countries imposed economic sanctions on Russia. These sanctions, coupled with voluntary divestments by companies avoiding business in the region, further strained the global supply of natural gas and ammonia.

The European Union’s dependency on Russian energy necessitated rapid adjustments, which included seeking alternative sources and increasing energy prices, indirectly affecting the cost structure of fertilizer production and distribution, including ammonium thiosulfate.

By 2023, the ammonium thiosulfate market began adapting to the new geopolitical landscape. Manufacturers and agricultural enterprises increased their reliance on strategic reserves of raw materials and diversified their sourcing to mitigate future supply risks. There was also a notable shift toward renewable energy sources within the industry, as companies sought to reduce dependency on volatile fossil fuel markets.

Furthermore, countries heavily reliant on imports for their agricultural needs, such as those in the Middle East and parts of Asia, began to re-evaluate their agricultural input supply chains. There was an increased interest in developing domestic capabilities for fertilizer production or forming new trade partnerships with less politically volatile regions.

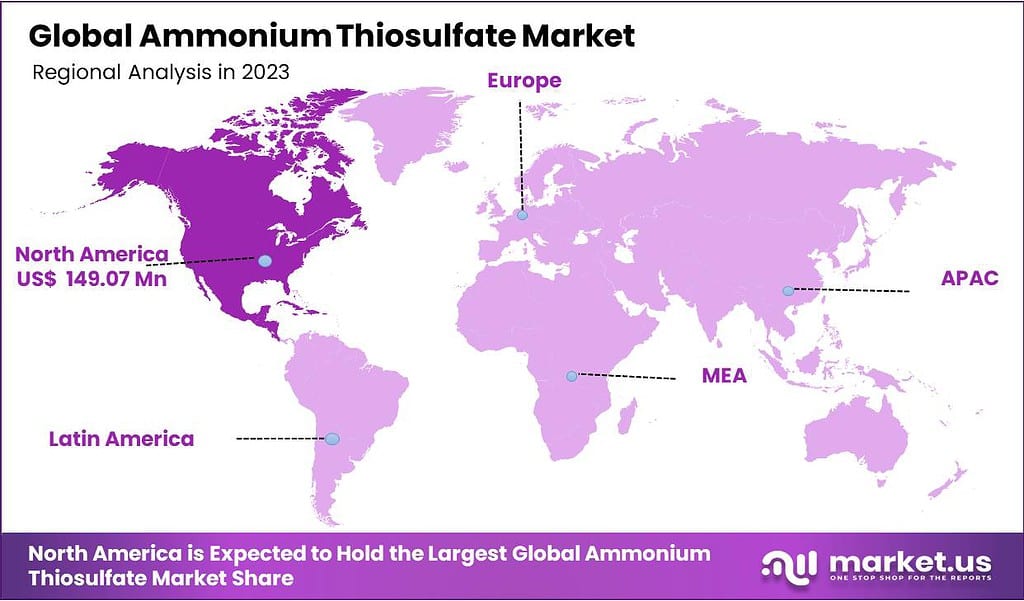

Regional Analysis

North America held the largest market share, with 37.0% in ammonium thiosulfate in 2023. Ammonium thiosulfate is primarily used as a nitrogen and sulfur fertilizer in agriculture. North America, especially the United States, has extensive agricultural activities that require high-quality fertilizers to enhance crop yield and quality.

The region’s significant demand for fertilizers correlates with a strong market for ammonium thiosulfate. There is a strong emphasis on research and development in North America, supported by collaborations between universities, research institutions, and the agricultural sector. These collaborations help in optimizing fertilizer formulations and enhancing the effectiveness of products such as ammonium thiosulfate.

North American farmers are known for their adoption of advanced and precise agricultural practices. The use of ammonium thiosulfate, particularly in liquid fertilizer applications, aligns with modern farming techniques that emphasize efficiency and environmental sustainability. This adoption is supported by robust agricultural infrastructure and technology, which facilitates the use of complex fertilizers.

These combined factors contribute significantly to North America’s leadership in the global ammonium thiosulfate market, reflecting the region’s capacity to integrate agricultural demand with advanced production and supportive policies. In regions such as North America and Europe, regulatory bodies have implemented strict guidelines on fertilizer usage.

These regulations encourage the adoption of environmentally friendly and efficient fertilizers such as ammonium thiosulfate. This is regarded as a more environmentally benign option compared to traditional sulfur-bearing fertilizers due to its higher efficiency and lower volatility. As precision agriculture continues to expand and environmental sustainability becomes even more crucial, the role of ammonium thiosulfate is expected to become more prominent, making it a key player in the future of agriculture.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain the Dominance of Industry Leaders

Market leaders invest in research and development to enhance the efficacy and versatility of ammonium thiosulfate formulations. This could involve developing products with improved nutrient uptake efficiency or customizing formulations for specific soil types and crop varieties. Collaborating with local manufacturers or agricultural cooperatives allows industry leaders to access new markets and distribution channels.

Joint ventures can also facilitate technology transfer and knowledge sharing, leading to mutual benefits for all parties involved. Acquiring upstream suppliers or downstream distributors can enhance the vertical integration of market leaders. By controlling the entire value chain, companies can streamline operations, reduce costs, and ensure a consistent supply of raw materials.

Market Key Players:

Industry leaders in the ammonium thiosulfate market are leveraging various strategies, including innovation, strategic partnerships, mergers and acquisitions, and geographical expansion, to expand their product portfolios and maintain their dominance. By continuously adapting to evolving market dynamics and customer preferences, these companies remain at the forefront of the global fertilizer industry.

The following are some of the major players in the industry

- Koch Industries, Inc. (Koch Fertilizer, LLC)

- Nutrien (Agrium)

- Tessenderlo

- Martin Midstream Partner

- Hydrite Chemical

- TIB Chemicals AG

- TerraLink

- PCI Nitrogen

- Kugler Company

- Plant Food Company, Inc.

- Poole Chemical Company, Inc.

- Mears Fertilizer Inc.

- Shakti Chemical

- Juan Messina S.A

- Haimen Wuyang Chemical Industry Co., Ltd

- Other Key Players

Recent Development

- In May 2022, Nutrien Ltd. revealed plans to assess Geismar, LA as the potential location for constructing the world’s largest clean ammonia facility. Leveraging its proficiency in low-carbon ammonia production, the company aims to utilize innovative technology to achieve a minimum of 90 percent reduction in CO2 emissions.

- In May 2021, Hydrite is delighted to announce a significant expansion of its ammonium thiosulfate production line at its Terre Haute, plant. The approval from Hydrite’s Board of Directors to invest in the installation of an additional sulfur burner and a new thiosulfate production line is a testament to the company’s commitment to meeting the growing demand for its products.

Report Scope

Report Features Description Market Value (2023) US$ 402.9 Mn Forecast Revenue (2033) US$ 733.3 Mn CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Ammonium Thiosulfate Solid, and Ammonium Thiosulfate Liquid), By Application (Fertilizers, Photographic Fixers, Metal Leaching, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Koch Industries, Inc. (Koch Fertilizer, LLC), Nutrien (Agrium), Tessenderlo, Martin Midstream Partner, Hydrite Chemical, TIB Chemicals AG, TerraLink, PCI Nitrogen, Kugler Company, Plant Food Company, Inc., Poole Chemical Company, Inc., Mears Fertilizer Inc., Shakti Chemical, Juan Messina S.A, Haimen Wuyang Chemical Industry Co., Ltd, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Ammonium Thiosulfate Market?Ammonium Thiosulfate Market size is expected to be worth around USD 733.3 Million by 2033, from USD 402.8 Million in 2023

What is the projected CAGR at which the Ammonium Thiosulfate Market is expected to grow at?The Ammonium Thiosulfate Market is expected to grow at a CAGR of 6.3% (2022-2032).Name the major industry players in the Ammonium Thiosulfate Market?Koch Industries, Inc. (Koch Fertilizer, LLC), Nutrien (Agrium), Tessenderlo, Martin Midstream Partner, Hydrite Chemical, TIB Chemicals AG, TerraLink, PCI Nitrogen, Kugler Company, Plant Food Company, Inc., Poole Chemical Company, Inc., Mears Fertilizer Inc., Shakti Chemical, Juan Messina S.A, Haimen Wuyang Chemical Industry Co., Ltd, and Other Key Players

Ammonium Thiosulfate MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Ammonium Thiosulfate MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Koch Industries, Inc. (Koch Fertilizer, LLC)

- Nutrien (Agrium)

- Tessenderlo

- Martin Midstream Partner

- Hydrite Chemical

- TIB Chemicals AG

- TerraLink

- PCI Nitrogen

- Kugler Company

- Plant Food Company, Inc.

- Poole Chemical Company, Inc.

- Mears Fertilizer Inc.

- Shakti Chemical

- Juan Messina S.A

- Haimen Wuyang Chemical Industry Co., Ltd

- Other Key Players