Global Ammonium Sulfate Market By Form (Solid, Liquid), By Production Process (Caprolactam, Coke Oven Gas, Gypsum, Neutralization, Others), By Application (Fertilizers, Water Treatment, Pharmaceuticals, Food And Feed Additives, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 38253

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

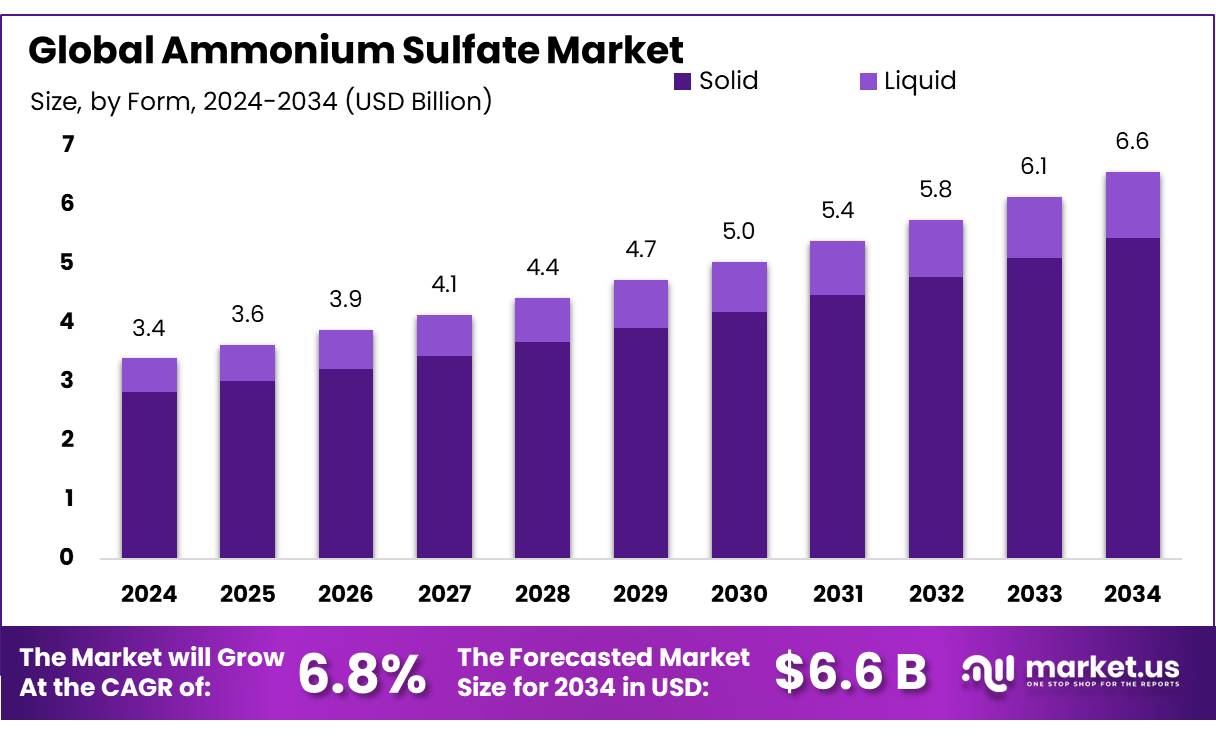

The Global Ammonium Sulfate Market size is expected to be worth around USD 6.6 billion by 2034, from USD 3.4 billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The global ammonium sulfate market plays a crucial role in agriculture, industrial applications, and the chemical sector, primarily due to its widespread use as a nitrogen-based fertilizer. Ammonium sulfate (𝑁𝐻4)4(NH4)2SO4 is an inorganic salt that enhances soil nitrogen and sulfur content, both of which are essential for plant growth. As global demand for high-yield crops continues to rise, the consumption of ammonium sulfate has increased significantly, making it one of the most commonly used fertilizers worldwide.

The ammonium sulfate is heavily influenced by its dominance in the fertilizer sector, accounting for nearly 70% of total consumption. The remaining demand stems from industries such as pharmaceuticals, textiles, and water treatment, where ammonium sulfate is used in chemical formulations. Leading production regions include China, the United States, and Europe, with China alone contributing over 35% of global output.

Several factors are driving the growth of the ammonium sulfate market, including rising global food demand and the need for increased agricultural productivity. The United Nations projects that the global population will reach 9.7 billion by 2050, requiring improved soil fertility and sustainable farming practices. Intensive farming has led to sulfur-deficient soils, making ammonium sulfate a crucial component in soil enrichment strategies to maintain crop health and yield.

Additionally, the compound is gaining traction in water treatment plants, where it helps control pH levels and reduces scaling in industrial operations. Ammonium sulfate is also used in pharmaceutical formulations, flame retardants, and food processing, further expanding its industrial applications. As industries seek reliable and cost-effective solutions for chemical processing, ammonium sulfate continues to be an essential component in multiple sectors.

Future growth opportunities in the ammonium sulfate market are linked to technological advancements and sustainable production processes. Manufacturers are investing in innovative methods to improve production efficiency while reducing emissions associated with ammonium sulfate synthesis. The development of enhanced fertilizers that combine ammonium sulfate with other essential nutrients is gaining traction, helping improve nutrient absorption in crops and increasing agricultural efficiency.

Key Takeaways

- Market Growth Projection: The Ammonium Sulfate Market is expected to witness significant growth, reaching around USD 6.6 billion by 2034 from USD 3.4 billion in 2024, exhibiting a projected CAGR of 6.8%.

- Solid ammonium sulfate held a dominant market position, capturing more than an 83.40% share.

- Caprolactam held a dominant market position, capturing more than a 43.30% share of the ammonium sulfate market by production process.

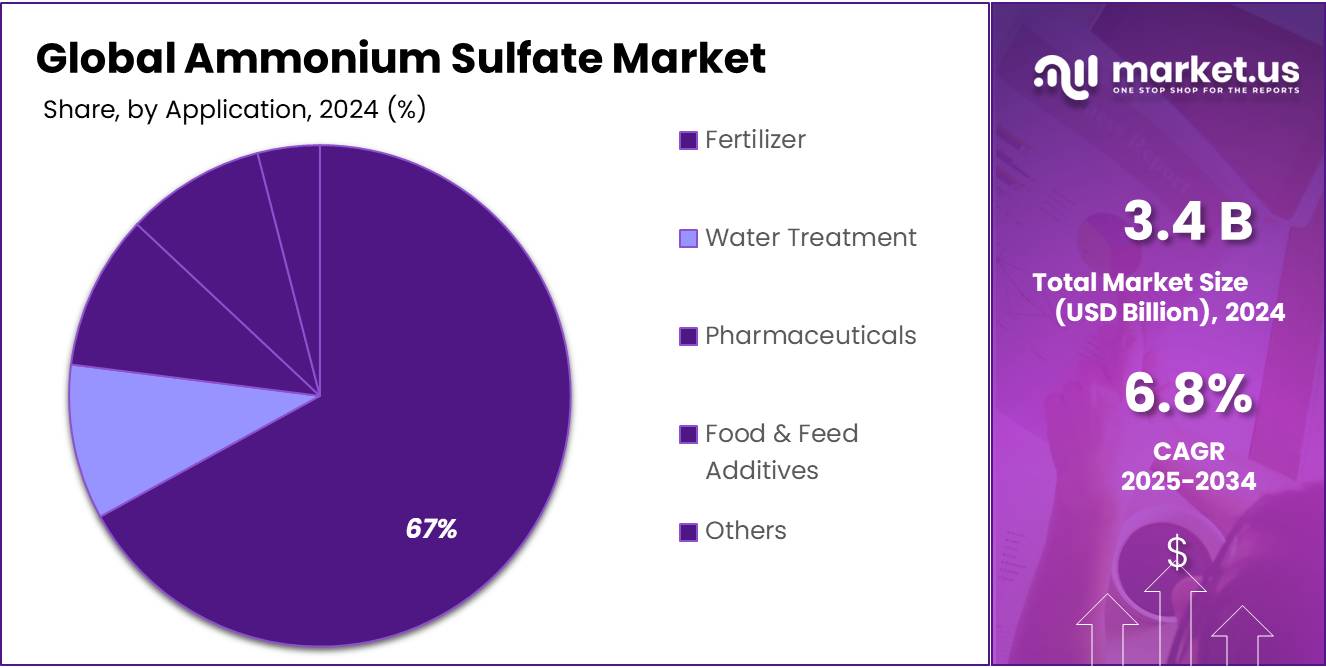

- Fertilizers held a dominant market position, capturing more than a 67.30% share of the ammonium sulfate market.

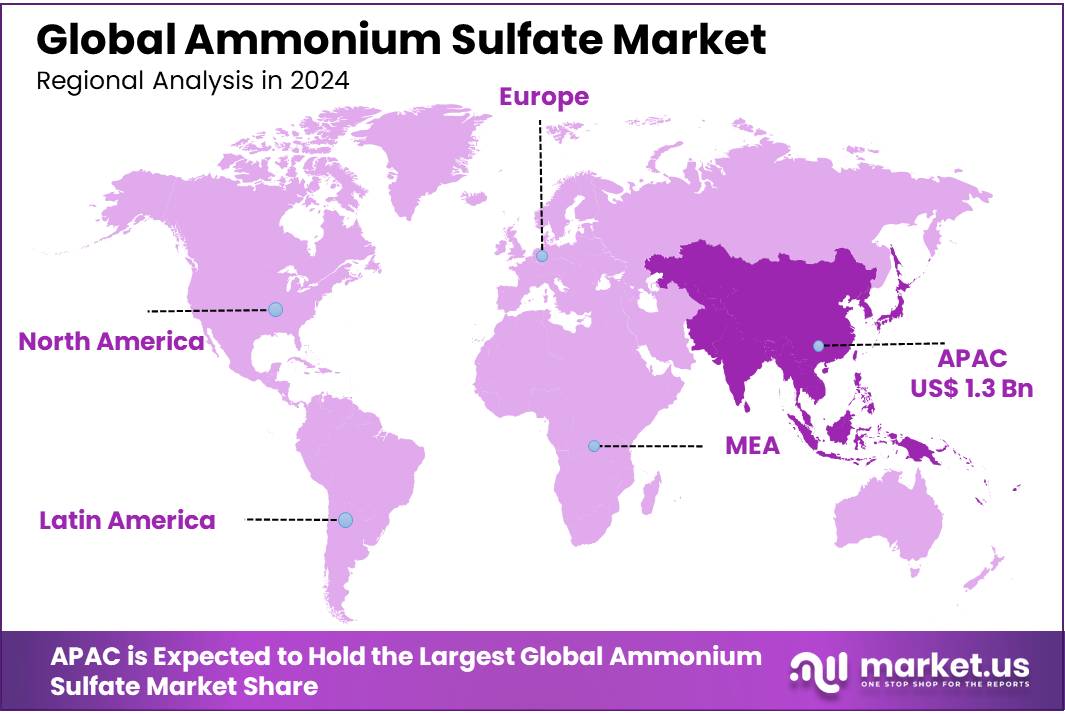

- Asia Pacific (APAC) region, which will capture a dominant share of 39.40%, equating to a market value of approximately $1.3 billion.

By Form Analysis

In 2024, Solid ammonium sulfate held a dominant market position, capturing more than an 83.40% share of the ammonium sulfate market. This segment’s dominance is primarily driven by its widespread use in agriculture as a nitrogen and sulfur-based fertilizer, which improves soil quality and promotes crop growth. Solid ammonium sulfate is preferred for its ease of handling, storage, and application, especially in large-scale farming operations. Its solid form also makes it highly effective in precise and controlled fertilizer distribution.

The liquid ammonium sulfate segment, while smaller in comparison, is gradually gaining traction due to its convenience in specific applications, such as fertigation systems and industrial processes. In 2024, the liquid form of ammonium sulfate is projected to capture a smaller market share, though it is expected to grow at a faster pace than the solid segment in the coming years. Liquid ammonium sulfate is favored in precision farming, where nutrients can be delivered directly to plants through irrigation systems.

By Production Process

In 2024, Caprolactam held a dominant market position, capturing more than a 43.30% share of the ammonium sulfate market by production process. This segment is primarily driven by the widespread use of caprolactam in the production of nylon, a key synthetic material. During the manufacturing of caprolactam, ammonium sulfate is produced as a byproduct, making it an integral part of the chemical industry.

The coke oven gas process, which is used to produce ammonium sulfate, also holds a notable share of the market. In 2024, this process is projected to account for around 25% of the total ammonium sulfate production. The coke oven gas process is primarily employed in the steel industry, where ammonium sulfate is produced as a byproduct of coke production. Although this process is not as widely used as caprolactam, it remains essential for certain industrial applications.

Gypsum and neutralization processes follow in importance, accounting for smaller portions of the market. In 2024, gypsum-based ammonium sulfate production is estimated to capture around 15% of the market, primarily used in agriculture. The neutralization process, which involves the reaction of sulfuric acid with ammonia, is expected to contribute about 10% of the ammonium sulfate market in 2024.

Application Analysis

In 2024, Fertilizers held a dominant market position, capturing more than a 67.30% share of the ammonium sulfate market. This is primarily due to the critical role ammonium sulfate plays as a nitrogen and sulfur fertilizer, which is vital for improving soil health and enhancing crop yields. Ammonium sulfate is widely used in agriculture for its high nutrient content, which supports the growth of plants by providing essential nitrogen and sulfur.

The Water Treatment segment, while smaller, is gaining traction, accounting for about 15% of the ammonium sulfate market in 2024. Ammonium sulfate is used in water treatment plants to remove impurities and improve the quality of drinking water. As urbanization increases and the need for clean water becomes more critical, this segment is expected to grow steadily.

Pharmaceuticals, Food & Feed Additives, and Other industrial applications together make up the remaining share of the market. In 2024, the Pharmaceuticals segment is expected to account for around 5% of the ammonium sulfate market. The compound is used in the production of certain medications and as a stabilizer in various formulations. The Food & Feed Additives segment is also expected to see modest growth, with ammonium sulfate being used as a nutritional supplement for livestock and in food processing.

Key Market Segments

By Form

- Solid

- Liquid

By Production Process

- Caprolactam

- Coke Oven Gas

- Gypsum

- Neutralization

- Others

By Application

- Fertilizers

- Water Treatment

- Pharmaceuticals

- Food & Feed Additives

- Other Applications

Drivers

Increasing Demand for Fertilizers to Support Global Agricultural Growth

As the global population continues to grow, there is an increasing need for efficient food production to meet the demands of billions of people. This has resulted in a higher need for nitrogen-rich fertilizers, where ammonium sulfate plays a crucial role. As one of the most widely used nitrogen fertilizers, ammonium sulfate provides both nitrogen and sulfur, essential nutrients for crops, helping to improve soil quality and enhance crop yields. The demand for ammonium sulfate, particularly in agriculture, is projected to continue increasing through 2024 and beyond.

In 2024, the agricultural sector accounts for over 67% of the global demand for ammonium sulfate, with the compound being essential in regions with large-scale farming activities, such as Asia-Pacific, North America, and Latin America. According to the Food and Agriculture Organization (FAO), global food production must increase by 60% by 2050 to feed the estimated 9.7 billion people on Earth. This growth in demand for food has driven the fertilizer market, as farmers seek solutions to boost crop productivity. In 2024, the global fertilizer market is estimated to reach approximately $230 billion, with nitrogen fertilizers like ammonium sulfate capturing a significant portion of that value.

The increased adoption of high-efficiency fertilizers in emerging markets is another factor contributing to the growth of the ammonium sulfate market. Developing regions, especially in Asia and Africa, have seen rapid agricultural growth, which, in turn, has spurred fertilizer demand. Countries like China and India, which are both key consumers of ammonium sulfate, have invested heavily in agricultural development and fertilizer use. In fact, China remains the largest consumer of ammonium sulfate, accounting for nearly 35% of the global market share in 2024. India, too, has witnessed a steady rise in fertilizer consumption, with ammonium sulfate being a key component in its agricultural practices.

Government initiatives also play an important role in driving demand for ammonium sulfate. Many governments are promoting the use of fertilizers to increase agricultural output and ensure food security. For example, India’s National Mission on Sustainable Agriculture (NMSA) aims to promote balanced fertilizer use, with ammonium sulfate being a critical component due to its dual nutrient benefit of nitrogen and sulfur. Similarly, in the United States, the government provides subsidies for fertilizer use, further supporting the agricultural sector. These initiatives not only help to boost crop production but also encourage farmers to adopt efficient, nutrient-rich fertilizers like ammonium sulfate.

Restraints

Environmental and Regulatory Challenges

Ammonium sulfate, while essential for crop production, is linked to various environmental challenges, including soil degradation, water pollution, and greenhouse gas emissions. The growing awareness about the environmental impact of chemical fertilizers has led to stricter regulations in many regions, which could limit the market’s growth potential.

Governments worldwide are introducing more stringent environmental regulations to reduce the environmental footprint of fertilizers. For example, in the European Union, the Fertilizer Regulation (EU 2019/1009) aims to promote sustainable practices by limiting the use of certain fertilizers that contribute to soil acidification and water contamination. This is particularly relevant to ammonium sulfate, which, when overused, can lead to harmful levels of nitrogen in the soil, resulting in nitrate leaching into groundwater and increasing the risk of eutrophication in water bodies.

In the United States, similar concerns are pushing for tighter controls. According to the U.S. Environmental Protection Agency (EPA), fertilizer runoff is one of the leading causes of water pollution in the country. The EPA has been working to improve water quality through the implementation of more sustainable farming practices. In response to this, many agricultural producers are moving toward more sustainable alternatives to ammonium sulfate, such as organic or bio-based fertilizers, which have a lower environmental impact. This trend is particularly evident in regions like California, where environmental regulations on water quality are more stringent.

Furthermore, many agricultural sectors in developing countries are also becoming more aware of the environmental consequences of excessive fertilizer use. Countries like India and Brazil, while still large consumers of ammonium sulfate, are beginning to promote the use of more sustainable agricultural practices, which could limit the demand for conventional fertilizers.

The Indian government has introduced initiatives aimed at reducing the overuse of chemical fertilizers, offering incentives for the adoption of organic farming and balanced fertilization practices. According to the Indian Ministry of Agriculture, the country plans to reduce its fertilizer consumption by 10% over the next decade as part of its efforts to promote sustainability.

Opportunities

Expansion of Sustainable Fertilizer Solutions

In recent years, the global agricultural sector has seen a notable shift toward sustainable farming. The Food and Agriculture Organization (FAO) estimates that by 2050, the world’s population will reach 9.7 billion, requiring a 60% increase in food production. To meet this demand, farmers need fertilizers that improve crop yields while minimizing their ecological footprint. Sustainable fertilizer solutions like ammonium sulfate are gaining attention because they provide the essential nitrogen and sulfur needed for crops, while also addressing environmental concerns like soil acidification and water contamination. As of 2024, sustainable fertilizers, including ammonium sulfate, represent a rapidly growing segment within the global fertilizer market, which is valued at over $230 billion.

Governments are playing a key role in driving this growth. For example, the European Union’s “Farm to Fork” strategy aims to reduce chemical fertilizer use by 20% by 2030, while promoting the use of organic and sustainable alternatives. This has encouraged companies to invest in cleaner and more sustainable production methods, such as using renewable hydrogen to produce “green ammonia,” a key ingredient in ammonium sulfate. The EU’s investment in sustainable agricultural practices is expected to create a growing market for ammonium sulfate produced with minimal environmental impact. Additionally, the U.S. Department of Agriculture (USDA) has also introduced initiatives to support sustainable farming practices, such as the Conservation Stewardship Program, which promotes the use of eco-friendly fertilizers and soil health improvement techniques.

In emerging markets, particularly in Asia-Pacific, there is a growing interest in sustainable fertilizers as farmers seek to improve yields while addressing the challenges posed by climate change. China, India, and other rapidly developing countries are increasingly adopting sustainable farming practices, supported by government subsidies for eco-friendly fertilizers. For instance, China’s 13th Five-Year Plan for Ecological Civilization emphasizes sustainable agricultural practices, which include the promotion of low-carbon, high-efficiency fertilizers like ammonium sulfate. As these regions continue to expand their agricultural sectors to feed their large populations, demand for sustainable fertilizers is expected to increase significantly.

Technological advancements are also creating opportunities for growth. The development of green ammonia production, using renewable energy sources such as wind and solar, has made ammonium sulfate more sustainable. Companies in the fertilizer sector, like Yara International and BASF, are investing in green ammonia projects that reduce carbon emissions and energy consumption in fertilizer production. By 2025, Yara plans to increase its green ammonia production by 20%, a move that will further bolster the sustainable ammonium sulfate market. The integration of such technologies is expected to provide a competitive edge for ammonium sulfate producers, making their products more attractive to environmentally-conscious consumers and regulatory bodies alike.

Challenges

Shift Toward Green and Sustainable Fertilizer Production

One of the main drivers of this trend is the rising awareness of the environmental impact of conventional fertilizer use, particularly nitrogen-based fertilizers like ammonium sulfate. The Food and Agriculture Organization (FAO) has highlighted that nitrogen fertilizers, when over-applied, can contribute to soil acidification, water pollution, and greenhouse gas emissions. In response to these concerns, many countries are setting ambitious sustainability targets for agriculture, with a strong emphasis on reducing the carbon footprint of fertilizer production. For example, the European Union’s “Farm to Fork” strategy, part of the European Green Deal, aims to reduce the use of chemical fertilizers by 20% by 2030 and promote the use of more sustainable alternatives.

To align with these environmental goals, producers of ammonium sulfate are increasingly focusing on “green ammonia” production, which is made using renewable energy sources, such as wind or solar power, instead of traditional fossil fuels. This green ammonia is then used to produce ammonium sulfate, providing a more sustainable fertilizer solution. In 2024, the use of green ammonia in fertilizer production is projected to grow by over 15% annually, as more companies invest in renewable energy technologies to reduce their carbon footprint. Companies like Yara International ASA and BASF SE have already made significant strides in adopting these cleaner production processes, positioning themselves as leaders in the sustainable fertilizer space.

Another factor fueling this trend is the growing demand for organic farming practices, which are more closely aligned with sustainable agriculture. According to the FAO, the global organic agriculture market was valued at over $120 billion in 2022, with organic farmland covering nearly 1.5% of total global agricultural land. As organic farming continues to expand, there is an increasing demand for fertilizers like ammonium sulfate that can provide nutrients in a more eco-friendly manner. For instance, in regions such as North America and Europe, where organic farming practices are on the rise, ammonium sulfate is being marketed as an environmentally safer alternative to synthetic fertilizers.

Additionally, as more agricultural producers adopt precision farming techniques, the application of fertilizers like ammonium sulfate has become more targeted and efficient. Precision farming uses data and technology to apply fertilizers in a way that maximizes crop yields while minimizing waste and environmental impact. This trend is expected to further boost the demand for ammonium sulfate, especially in regions like North America and parts of Asia, where high-tech farming solutions are becoming more widespread. According to the International Food Policy Research Institute (IFPRI), precision agriculture is expected to increase crop productivity by 20-30% over the next decade.

Regional Analysis

In 2024, the Ammonium Sulfate market is expected to be led by the Asia Pacific (APAC) region, which will capture a dominant share of 39.40%, equating to a market value of approximately $1.3 billion. APAC’s dominance is primarily driven by the robust agricultural sector, particularly in countries like China, India, and Southeast Asian nations, where the demand for fertilizers, including ammonium sulfate, continues to rise in response to growing food production needs.

Europe holds a significant share in the ammonium sulfate market, with a projected market share of around 25% in 2024. The region’s demand is fueled by both conventional farming practices and the rising adoption of sustainable agricultural techniques. The European Union’s commitment to reducing chemical fertilizer use aligns with the growing interest in eco-friendly fertilizers like ammonium sulfate. Additionally, the EU’s regulatory policies push for increased use of nutrient-efficient fertilizers, further supporting market growth.

North America is another key region for ammonium sulfate, accounting for approximately 18% of the market share in 2024. The United States, being one of the top producers of agricultural products, continues to be a significant market for ammonium sulfate, especially in large-scale farming operations. Latin America and the Middle East & Africa (MEA) are smaller but growing markets, driven by agricultural expansion in countries like Brazil, Argentina, and South Africa, where ammonium sulfate is increasingly used to enhance soil quality and crop yields.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The ammonium sulfate market is highly competitive, with several prominent players driving growth and innovation across various regions. BASF SE, one of the leading global chemical companies, holds a significant position in the ammonium sulfate market due to its vast portfolio of agricultural solutions and its focus on sustainable fertilizer production.

Lanxess AG, known for its chemical products, also plays a crucial role in the ammonium sulfate market, particularly in Europe, leveraging its strong capabilities in chemical manufacturing. Sumitomo Chemical Co., Ltd. is another key player, contributing to the market through its established presence in the fertilizer sector, especially in Asia-Pacific, where the demand for fertilizers is high.

In addition to these major players, companies like Honeywell International Inc., Evonik Industries AG, and Novus International, Inc. are increasingly focusing on the development of specialty chemicals, including ammonium sulfate, to support agriculture and industrial applications. These players are expanding their product offerings, with an emphasis on creating more sustainable and efficient solutions. AdvanSix Inc. and J.R. Simplot Company are also integral to the market, especially in North America, where they provide ammonium sulfate for both agricultural and industrial uses.

Other notable players such as Domo Chemicals, Arkema, Aarti Industries Ltd., and Gujarat State Fertilizers & Chemicals Limited (GSFC) have strengthened their positions in emerging markets like India, South America, and the Middle East, catering to the growing need for ammonium sulfate in agriculture.

UBE Corporation and GAC Chemical Corporation are making headway in the global market by focusing on innovative production processes and enhancing their distribution networks to meet the rising demand for high-quality fertilizers. These players, alongside other key contributors, are shaping the ammonium sulfate market by addressing regional needs and investing in sustainable solutions.

Key Market Players

- Lanxess Corporation

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Honeywell International Inc

- Evonik Industries AG

- Novus International, Inc.

- AdvanSix Inc.

- J.R. Simplot Company

- Domo Chemicals

- Arkema

- Aarti Industries Ltd

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- GAC Chemical Corporation

- UBE Corporation

- Other Key Players

Recent Developments

In 2024, BASF’s agricultural solutions segment, which includes ammonium sulfate, is projected to contribute significantly to the company’s overall revenue, with an expected market share of around 10-12%.

In 2024 Sumitomo Chemical Co., Ltd, is expected to maintain a strong presence in the ammonium sulfate market, contributing around 5-6% to its total agricultural chemicals sales.

In 2024, Honeywell is expected to contribute around 3-4% of the global ammonium sulfate market, primarily through its advanced chemical technologies.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 6.6 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid), By Production Process (Caprolactam, Coke Oven Gas, Gypsum, Neutralization, Others), By Application (Fertilizers, Water Treatment, Pharmaceuticals, Food And Feed Additives, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Lanxess AG, Sumitomo Chemical Co., Ltd., Honeywell International Inc, Evonik Industries AG, Novus International, Inc. , AdvanSix Inc., J.R. Simplot Company, Domo Chemicals, Arkema , Aarti Industries Ltd, Gujarat State Fertilizers & Chemicals Limited (GSFC), GAC Chemical Corporation, UBE Corporation, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lanxess Corporation

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Honeywell International Inc

- Evonik Industries AG

- Novus International, Inc.

- AdvanSix Inc.

- J.R. Simplot Company

- Domo Chemicals

- Arkema

- Aarti Industries Ltd

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- GAC Chemical Corporation

- UBE Corporation

- Other Key Players