Global Alternative Fuel Engine Market Size, Share, Growth Analysis By Fuel Type (Electricity, Biofuels, Hydrogen, Natural Gas, Ethanol), By Engine Type (Internal Combustion Engine, Electric Engine, Hybrid Engine, Fuel Cell Engine), By Application (Passenger Vehicles, Commercial Vehicles, Marine Applications, Aerospaces, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170479

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

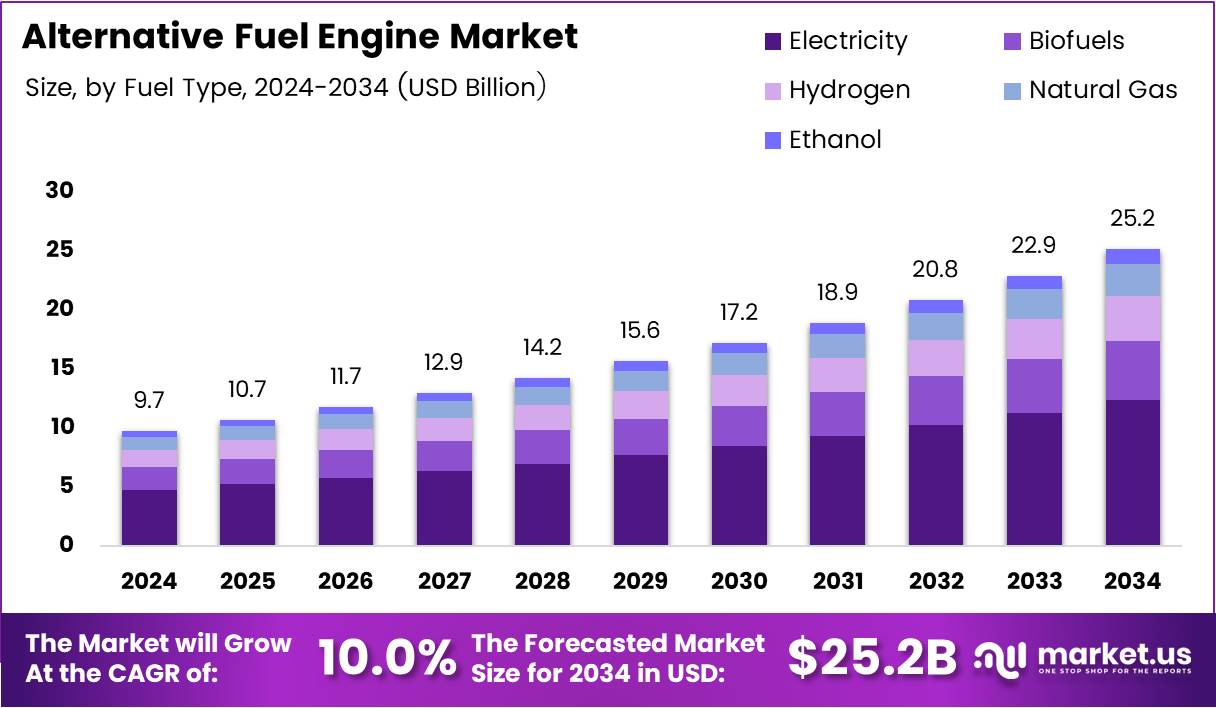

The Global Alternative Fuel Engine Market size is expected to be worth around US$ 25.2 Billion by 2034 from US$ 9.7 Billion in 2024, growing at a CAGR of 10.0% during the forecast period from 2025 to 2034. This market encompasses engines designed to operate on non-conventional fuel sources such as electricity, biofuels, hydrogen, natural gas, and ethanol. These powertrains serve as critical alternatives to traditional internal combustion engines, addressing environmental concerns and energy diversification needs.

The alternative fuel engine market represents a transformative shift in global transportation and industrial power generation. Manufacturers are developing advanced engine technologies that deliver comparable or superior performance while significantly reducing carbon emissions. Consequently, this sector has become integral to achieving climate targets and reducing dependence on petroleum-based fuels across multiple industries.

Growing environmental awareness is driving substantial investments in cleaner propulsion technologies worldwide. Governments across developed and emerging economies are implementing stricter emission standards and offering financial incentives for alternative fuel adoption. Furthermore, corporations are increasingly committing to carbon neutrality goals, creating sustained demand for low-emission engine solutions in commercial and passenger vehicle segments.

The market is experiencing robust expansion due to technological advancements improving fuel efficiency and engine durability. Innovation in hydrogen internal combustion engines, flex-fuel platforms, and hybrid powertrains is accelerating commercialization across diverse applications. Additionally, rising fossil fuel price volatility is prompting fleet operators to seek cost-stable alternative fuel options for long-term operational sustainability.

Infrastructure development remains a critical factor influencing market trajectory and adoption rates globally. Expansion of charging networks, hydrogen refueling stations, and biofuel distribution systems is gradually addressing accessibility barriers. Moreover, collaborative efforts between automotive manufacturers, energy providers, and policymakers are creating favorable ecosystems for alternative fuel engine deployment across passenger vehicles, commercial fleets, marine vessels, and aerospace applications.

According to EBSCO research data, California reported that 12 percent of its vehicles used alternative fuel sources in 2021, demonstrating significant regional adoption momentum. Meanwhile, according to UK Government statistics, the UK supplied 3,700 million litres equivalent of renewable fuel in 2023, comprising 7.5% of total road and non-road mobile machinery fuel, up from 6.8% in 2022. The verified renewable fuel achieved 82% average GHG savings equivalent to 7,972 kt CO2e versus fossil fuels, highlighting substantial environmental benefits driving market growth.

Key Takeaways

- The Global Alternative Fuel Engine Market is valued at US$ 9.7 Billion in 2024 and projected to reach US$ 25.2 Billion by 2034, growing at a CAGR of 10.0%.

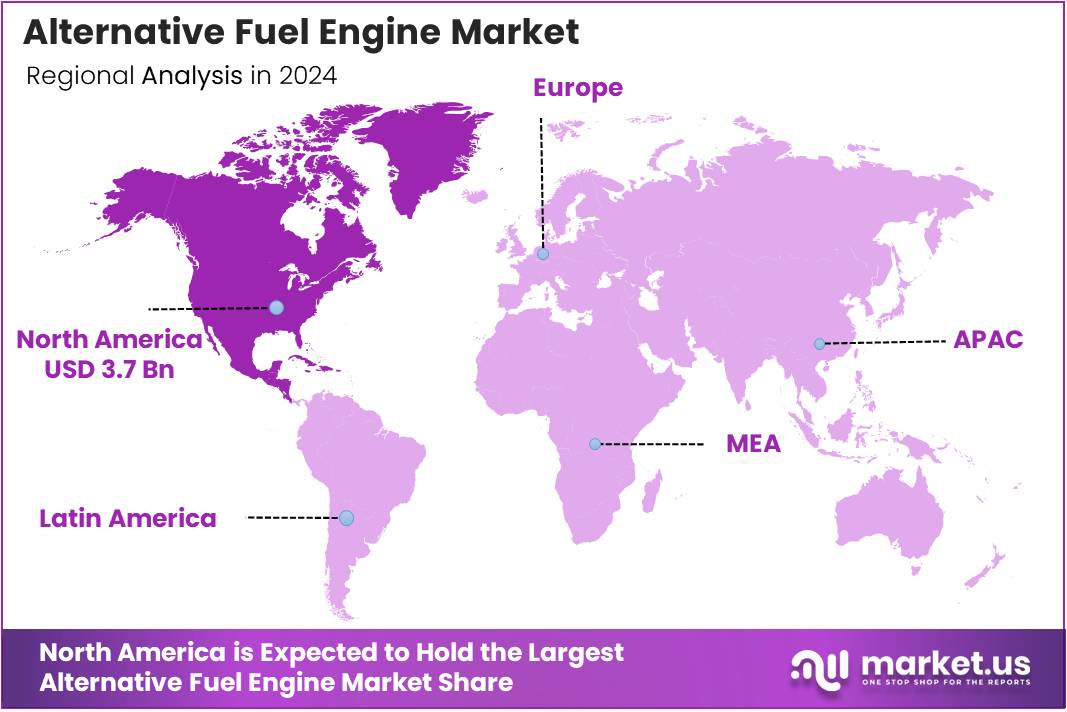

- North America dominates the market with a 38.9% share, valued at US$ 3.7 Billion in 2024.

- Electricity segment leads by fuel type with 39.1% market share in 2024.

- Internal Combustion Engine segment holds 44.9% share in the engine type category.

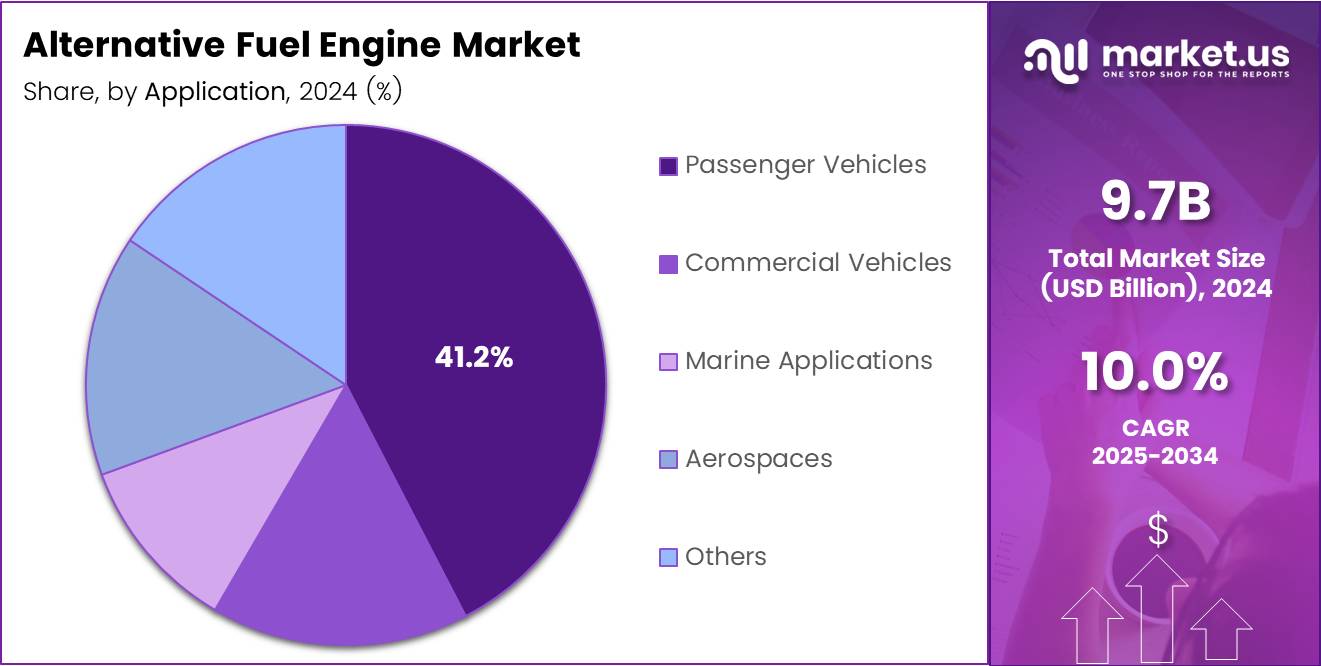

- Passenger Vehicles application accounts for 41.2% of total market demand in 2024.

Fuel Type Analysis

Electricity dominates with 39.1% due to extensive charging infrastructure development and government support for electrification initiatives.

In 2024, Electricity held a dominant market position in the By Fuel Type segment of Alternative Fuel Engine Market, with a 39.1% share. Electric powertrains offer zero tailpipe emissions and lower operational costs compared to conventional engines. Consequently, passenger vehicle manufacturers are rapidly expanding electric vehicle portfolios to meet regulatory requirements. Additionally, battery technology advancements are improving range capabilities and reducing charging times significantly.

Biofuels represent a growing segment driven by agricultural waste utilization and renewable feedstock availability. These fuels can be blended with conventional petroleum products or used in dedicated engines. Furthermore, biofuel engines provide compatibility with existing infrastructure while delivering substantial carbon reduction benefits. The aviation and marine sectors are particularly interested in sustainable biofuel solutions for decarbonization efforts.

Hydrogen is emerging as a promising fuel type for heavy-duty and long-haul applications globally. Fuel cell and internal combustion hydrogen engines offer extended range without battery weight limitations. Moreover, several manufacturers are investing in hydrogen engine platforms targeting commercial vehicle segments. Infrastructure development remains critical for widespread hydrogen adoption across transportation networks.

Natural Gas continues serving as a transitional fuel option for commercial and industrial applications. Compressed and liquefied natural gas engines provide cleaner combustion compared to diesel alternatives. Additionally, existing natural gas distribution networks facilitate easier adoption in specific regional markets. Fleet operators appreciate the cost advantages and reduced emissions profile of natural gas powertrains.

Ethanol-based engines offer flexibility through multi-fuel compatibility in internal combustion platforms. This fuel type benefits from established agricultural production systems in key markets. Furthermore, ethanol blends reduce petroleum dependence while supporting rural agricultural economies. Flex-fuel vehicles capable of running on various ethanol-gasoline blends continue gaining traction in specific regions.

Engine Type Analysis

Internal Combustion Engine dominates with 44.9% due to established manufacturing expertise and multi-fuel adaptation capabilities.

In 2024, Internal Combustion Engine held a dominant market position in the By Engine Type segment of Alternative Fuel Engine Market, with a 44.9% share. Modified ICE platforms can operate on hydrogen, biofuels, ethanol, and natural gas with relatively minor modifications. Consequently, manufacturers leverage existing production infrastructure to deliver alternative fuel compatibility cost-effectively. Additionally, ICE technology offers familiar performance characteristics and maintenance procedures for fleet operators.

Electric Engines are experiencing rapid growth driven by stringent emission regulations and declining battery costs. These powertrains eliminate combustion entirely, delivering instant torque and quiet operation. Furthermore, electric engines require minimal maintenance compared to mechanical alternatives, reducing total ownership costs. Urban transportation and short-range commercial applications are primary adoption segments for electric propulsion systems.

Hybrid Engines combine internal combustion and electric propulsion for optimized efficiency and flexibility. This configuration allows extended range while maintaining zero-emission capabilities in urban environments. Moreover, hybrid systems enable manufacturers to offer transitional solutions bridging conventional and fully electric platforms. Commercial vehicles particularly benefit from hybrid architecture in mixed-use driving conditions.

Fuel Cell Engines convert hydrogen directly into electricity through electrochemical processes with water as byproduct. These systems offer superior efficiency compared to combustion-based alternatives for certain applications. Additionally, fuel cell technology is advancing rapidly with decreasing costs and improving durability. Heavy-duty trucking and public transportation sectors are exploring fuel cell solutions for long-range zero-emission operations.

Application Analysis

Passenger Vehicles dominate with 41.2% due to large-scale consumer market and regulatory pressure for emission reductions.

In 2024, Passenger Vehicles held a dominant market position in the By Application segment of Alternative Fuel Engine Market, with a 41.2% share. Consumer demand for sustainable transportation options is driving automakers to expand alternative fuel offerings. Consequently, electric, hybrid, and flex-fuel passenger vehicles are becoming mainstream across global markets. Additionally, government incentives and tax benefits are accelerating consumer adoption of alternative fuel passenger cars.

Commercial Vehicles represent a significant growth segment as fleet operators seek operational cost reduction. Delivery vans, trucks, and buses are transitioning to electric, natural gas, and hydrogen powertrains. Furthermore, total cost of ownership analysis increasingly favors alternative fuel solutions for high-mileage commercial operations. Municipal governments are particularly active in deploying alternative fuel buses for public transportation systems.

Marine Applications are exploring alternative fuel engines to comply with international emission regulations. Biofuels, liquefied natural gas, and hydrogen are being tested for various vessel types. Moreover, the shipping industry faces increasing pressure to decarbonize operations across global trade routes. Alternative fuel engines offer viable pathways for maritime sector emission reduction without compromising cargo capacity.

Aerospace applications are investigating sustainable aviation fuels compatible with modified jet engines. While full electrification remains challenging for aviation, biofuel blends are already in commercial use. Additionally, hydrogen propulsion is being explored for regional aircraft and future long-range applications. The aviation sector requires substantial innovation to achieve carbon neutrality targets by mid-century.

Other applications include agricultural equipment, construction machinery, and stationary power generation systems. These segments benefit from alternative fuel engines offering operational flexibility and emission reductions. Furthermore, off-highway equipment manufacturers are developing multi-fuel platforms to meet diverse customer requirements. Decentralized power generation using alternative fuel engines is gaining attention for grid stabilization purposes.

Key Market Segments

By Fuel Type

- Electricity

- Biofuels

- Hydrogen

- Natural Gas

- Ethanol

By Engine Type

- Internal Combustion Engine

- Electric Engine

- Hybrid Engine

- Fuel Cell Engine

By Application

- Passenger Vehicles

- Commercial Vehicles

- Marine Applications

- Aerospaces

- Others

Drivers

Stringent Global Emission Regulations Accelerating Shift Away from Conventional ICE Platforms

Governments worldwide are implementing increasingly strict emission standards to combat climate change and air pollution. These regulations mandate significant reductions in carbon dioxide, nitrogen oxides, and particulate matter from vehicles. Consequently, manufacturers must transition toward alternative fuel engines to maintain market access in regulated jurisdictions. The regulatory pressure creates substantial demand for cleaner propulsion technologies across all vehicle categories.

Rising volatility in fossil fuel prices is driving demand for cost-stable alternative fuel solutions. Fleet operators face unpredictable operational expenses due to petroleum price fluctuations affecting profitability. Therefore, alternative fuels offering more stable pricing structures become economically attractive for long-term planning. Natural gas, electricity, and biofuels provide diversified energy sources reducing petroleum dependence risks.

Government incentives and subsidies are significantly supporting low-carbon engine adoption across transport sectors. Tax credits, purchase rebates, and infrastructure funding programs lower financial barriers for consumers and businesses. Additionally, preferential treatment such as access to restricted zones encourages alternative fuel vehicle adoption. These policy measures accelerate market development beyond what purely market-driven forces would achieve.

Growing corporate fleet commitments toward carbon neutrality and ESG compliance are driving procurement shifts. Major corporations are establishing ambitious emission reduction targets requiring alternative fuel vehicle deployment. Furthermore, environmental, social, and governance considerations influence investment decisions and corporate reputation management. This corporate commitment creates sustained demand for alternative fuel engines in commercial vehicle segments.

Restraints

Limited Refueling and Charging Infrastructure Restricting Large-Scale Deployment

Inadequate refueling and charging infrastructure remains a critical barrier to widespread alternative fuel engine adoption. Consumers and fleet operators require convenient, reliable access to fuel sources matching conventional gasoline availability. However, hydrogen stations, fast-charging networks, and biofuel distribution remain underdeveloped in most regions. Consequently, range anxiety and operational limitations discourage potential adopters from transitioning to alternative fuel vehicles.

The infrastructure gap is particularly pronounced in rural and developing regions with limited investment capacity. Urban areas benefit from concentrated infrastructure development, creating geographical adoption disparities. Moreover, the chicken-and-egg dilemma persists where infrastructure investors await vehicle adoption while buyers await infrastructure. Coordinated public-private investment strategies are essential to overcome this fundamental market restraint.

Higher upfront engine development and conversion costs compared to traditional ICE systems present significant challenges. Alternative fuel engines often require specialized components, materials, and manufacturing processes increasing production expenses. Therefore, vehicle prices remain elevated compared to conventional alternatives, limiting mass-market accessibility. Research and development investments necessary for performance optimization further burden manufacturer balance sheets.

The cost premium affects both manufacturers and end-users, slowing adoption rates across price-sensitive market segments. While total cost of ownership may favor alternative fuels long-term, initial purchase prices deter buyers. Additionally, financing mechanisms and residual value uncertainties complicate purchasing decisions for commercial fleet operators. Economies of scale will eventually reduce costs, but near-term financial barriers remain substantial restraints.

Growth Factors

Expanding Adoption of Hydrogen and Biofuel Engines in Heavy-Duty and Commercial Vehicles

Heavy-duty and commercial vehicle segments are increasingly adopting hydrogen and biofuel engines for emission reduction. These applications demand high power output and extended range difficult to achieve with battery-electric solutions. Consequently, hydrogen internal combustion and fuel cell engines offer viable zero-emission alternatives for trucking and logistics. Biofuel engines provide immediate compatibility with existing infrastructure while delivering substantial carbon savings.

Rapid urbanization is creating significant demand for low-emission public transport and municipal fleet solutions. Cities worldwide face air quality challenges requiring cleaner bus and utility vehicle options. Therefore, alternative fuel engines become essential for sustainable urban mobility systems and municipal operations. Population concentration in urban areas amplifies the environmental and health impacts of transportation emissions.

Technological advancements are substantially improving fuel efficiency and engine durability for alternative fuels. Engineering innovations address previous performance limitations and reliability concerns affecting early alternative fuel engines. Additionally, digital control systems optimize combustion processes and energy management across various operating conditions. These improvements make alternative fuel engines increasingly competitive with conventional powertrains in real-world applications.

Increasing use of alternative fuel engines extends beyond road transport into marine, rail, and off-highway applications. Industrial equipment manufacturers recognize the versatility of multi-fuel engine platforms for diverse operational environments. Furthermore, sectors facing emission regulations similar to automotive are exploring alternative fuel solutions proactively. This application diversification expands total addressable market size and drives technology development investments.

Emerging Trends

Rising Integration of Hybrid Powertrains with Alternative Fuel Internal Combustion Engines

Manufacturers are increasingly combining hybrid electric systems with alternative fuel internal combustion engines for optimal efficiency. This integration allows vehicles to leverage both combustion and electric propulsion advantages strategically. Consequently, hybrid configurations using natural gas, biofuels, or hydrogen provide flexibility and extended operational range. The trend represents intelligent technology convergence maximizing environmental benefits while maintaining practical utility.

Increasing OEM investments in hydrogen ICE and flex-fuel engine platforms demonstrate renewed confidence in combustion technology. Major manufacturers are developing next-generation internal combustion engines specifically optimized for hydrogen and multi-fuel operation. Moreover, these investments signal recognition that combustion engines retain relevance alongside electrification strategies. Hydrogen ICE technology particularly offers zero-emission solutions without complete powertrain redesign requirements.

Growing preference for renewable and synthetic fuels is extending internal combustion engine lifecycle viability. Drop-in replacement fuels allow existing engine infrastructure utilization while achieving carbon neutrality goals. Additionally, e-fuels and advanced biofuels enable emissions reduction without vehicle fleet replacement costs. This trend provides pragmatic pathways for emission reductions in hard-to-electrify transportation segments.

The shift toward modular engine designs supporting multi-fuel compatibility enhances market flexibility and resilience. Engineers are developing platforms capable of operating on various alternative fuels with minimal modifications. Furthermore, modular approaches reduce development costs and enable regional fuel availability adaptation. This design philosophy acknowledges that optimal fuel types vary across geographical markets and use cases.

Regional Analysis

North America Dominates the Alternative Fuel Engine Market with a Market Share of 38.9%, Valued at USD 3.7 Billion

North America leads the global alternative fuel engine market, capturing 38.9% share valued at USD 3.7 Billion in 2024. The region benefits from strong regulatory frameworks promoting emission reductions and substantial government incentives supporting adoption. Additionally, established automotive manufacturing infrastructure and advanced technology development capabilities drive innovation. Major manufacturers are investing heavily in electric, hydrogen, and flex-fuel engine platforms to meet evolving market demands.

Europe Alternative Fuel Engine Market Trends

Europe demonstrates aggressive alternative fuel adoption driven by stringent EU emission standards and climate commitments. The region leads in diesel-to-alternative conversions and hydrogen infrastructure development across transportation networks. Furthermore, European manufacturers are pioneering advanced biofuel and synthetic fuel engine technologies. Cross-border policy harmonization facilitates market development and technology deployment across member states.

Asia Pacific Alternative Fuel Engine Market Trends

Asia Pacific represents the fastest-growing regional market fueled by rapid urbanization and air quality concerns. China, Japan, and South Korea are making substantial investments in electric and hydrogen vehicle ecosystems. Moreover, government mandates and industrial policy support are accelerating alternative fuel engine manufacturing capacity. The region’s large vehicle production base provides economies of scale advantages for cost reduction.

Middle East and Africa Alternative Fuel Engine Market Trends

Middle East and Africa show emerging interest in alternative fuel engines despite traditional petroleum abundance. Natural gas vehicle adoption is significant in specific markets leveraging domestic resource availability. Additionally, renewable energy investments are creating opportunities for green hydrogen production and utilization. Urban centers are beginning to deploy alternative fuel public transportation to address pollution concerns.

Latin America Alternative Fuel Engine Market Trends

Latin America has established leadership in ethanol-based flex-fuel vehicle technology and biofuel production. Brazil particularly demonstrates mature alternative fuel markets with extensive consumer adoption and infrastructure. Furthermore, the region’s agricultural capacity positions it favorably for sustainable biofuel feedstock production. Regional manufacturers are expanding offerings to include electric and hybrid powertrains alongside traditional flex-fuel systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Alternative Fuel Engine Company Insights

The global Alternative Fuel Engine Market in 2024 features established automotive manufacturers leading technology development and commercialization efforts.

Ford Motor Company is advancing electric vehicle platforms and hydrogen fuel cell research to diversify its powertrain portfolio across commercial and passenger segments. The company’s strategic investments target both battery-electric and alternative fuel internal combustion technologies for market flexibility.

Mercedes-Benz Group AG is pursuing luxury segment electrification while maintaining research in hydrogen fuel cell and synthetic fuel engines. Their engineering excellence in powertrain development positions them as premium alternative fuel technology leaders. Additionally, the company’s commercial vehicle division is exploring multiple alternative fuel pathways for heavy-duty applications.

Volkswagen Group has committed substantial resources to electric vehicle transformation across its diverse brand portfolio globally. The company’s modular electric platforms enable economies of scale and rapid market deployment. Furthermore, Volkswagen is investigating synthetic fuels to extend internal combustion engine viability in specific applications.

Hyundai Motor Company is distinguished by comprehensive alternative fuel strategy encompassing battery-electric, hydrogen fuel cell, and hybrid technologies. Their leadership in fuel cell commercialization demonstrates commitment to multiple zero-emission pathways. Moreover, Hyundai’s investments in hydrogen production and infrastructure development support ecosystem growth.

Key Companies

- Ford Motor Company

- Mercedes-Benz Group AG

- Volkswagen Group

- Hyundai Motor Company

- BMW AG

- SAIC Motor Corporation

- Fiat Chrysler Automobiles

- Nissan Motor Co Ltd

- Renault-Nissan-Mitsubishi Alliance

- Volvo Group

Recent Developments

- March 2025: Cummins confirmed the successful completion of Project Brunel, delivering a 6.7-liter hydrogen internal combustion engine prototype for medium-duty trucks and buses, developed in collaboration with global technology partners.

- April 2025: Cummins officially launched its hydrogen-compatible turbocharger designed specifically for hydrogen internal combustion engines used in heavy-duty on-highway applications, marking a first-of-its-kind commercial component.

- March 2024: Nissan Motor Corporation initiated a bio-ethanol-fueled stationary power generation system trial, demonstrating the adaptability of alternative fuel engines beyond mobility into decentralized power generation.

- May 2024: Volvo Group publicly announced the development of hydrogen-powered combustion engines for heavy-duty trucks, targeting long-haul transport decarbonization while leveraging existing ICE platforms.

- October 2024: Hyundai Motor Group disclosed progress on scaling hydrogen internal combustion and fuel system technologies, aligning engine development with upcoming hydrogen infrastructure investments in Asia and Europe.

- January 2025: Multiple European transport authorities confirmed expanded real-world pilot testing of hydrogen ICE buses, validating operational feasibility and emissions performance under public transit conditions.

Report Scope

Report Features Description Market Value (2024) USD 9.7 Billion Forecast Revenue (2034) USD 25.2 Billion CAGR (2025-2034) 10.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Electricity, Biofuels, Hydrogen, Natural Gas, Ethanol), By Engine Type (Internal Combustion Engine, Electric Engine, Hybrid Engine, Fuel Cell Engine), By Application (Passenger Vehicles, Commercial Vehicles, Marine Applications, Aerospaces, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ford Motor Company, Mercedes-Benz Group AG, Volkswagen Group, Hyundai Motor Company, BMW AG, SAIC Motor Corporation, Fiat Chrysler Automobiles, Nissan Motor Co. Ltd., Renault–Nissan–Mitsubishi Alliance, Volvo Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alternative Fuel Engine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Alternative Fuel Engine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ford Motor Company

- Mercedes-Benz Group AG

- Volkswagen Group

- Hyundai Motor Company

- BMW AG

- SAIC Motor Corporation

- Fiat Chrysler Automobiles

- Nissan Motor Co Ltd

- Renault-Nissan-Mitsubishi Alliance

- Volvo Group