Global Aircraft Manufacturing Market Size, Share Analysis Report By Aircraft Type (Fixed-Wing Aircrafts, Rotary-Wing Aircrafts, Helicopters, Unmanned Aerial Vehicles (UAVs), Other Aircraft Types), By End-User (Commercial Aviation, Military and Defense, Government & Public Services, Other End-Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 25503

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

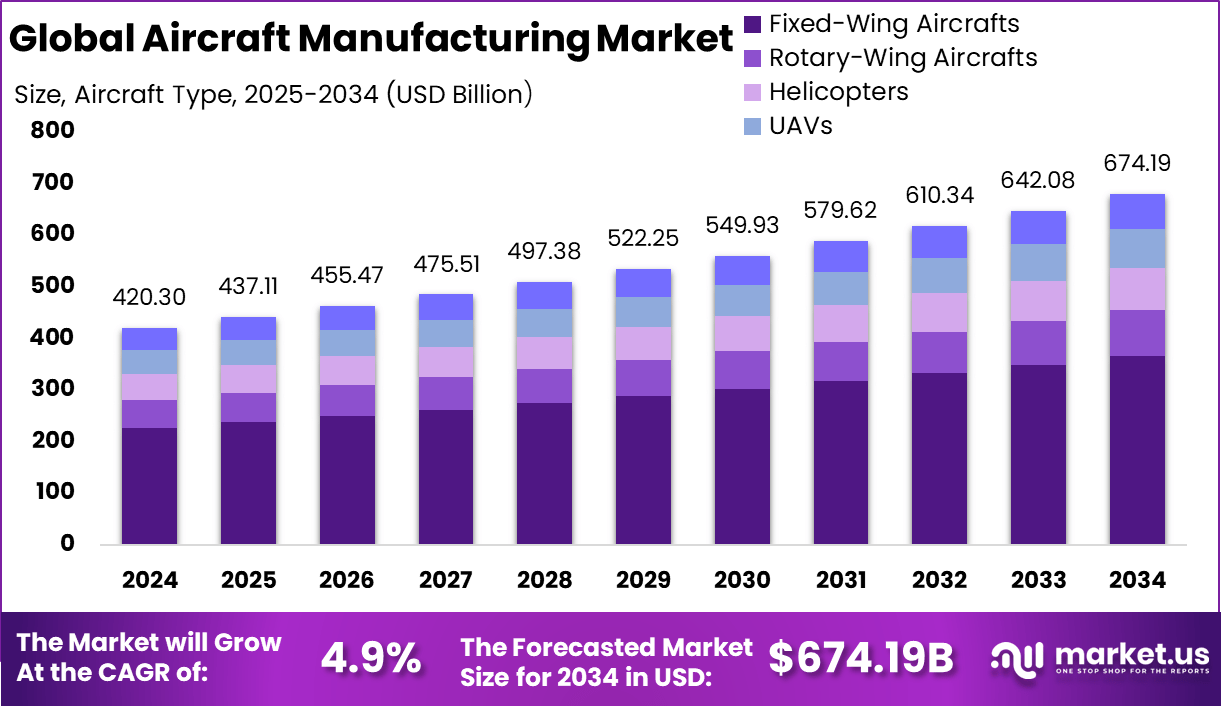

The Global Aircraft Manufacturing Market size is expected to be worth around USD 674.19 Billion By 2034, from USD 420.30 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.01% share, holding USD 159.7 Billion revenue.

The aircraft manufacturing market is experiencing significant transformation, driven by factors such as increasing global air travel demand, advancements in manufacturing technologies, and a heightened focus on sustainability. The market dynamics are influenced by the need for fleet modernization, the introduction of new aircraft models, and the expansion of low-cost carriers, particularly in emerging economies.

Key drivers propelling the growth of the aircraft manufacturing market include the surge in air passenger traffic, the need for fleet modernization, and the adoption of fuel-efficient and environmentally friendly aircraft. The expansion of low-cost carriers and the development of new regional aircraft further contribute to market growth. Technological advancements in materials and manufacturing processes are making aircraft lighter and more efficient, supporting global sustainability goals.

The demand for aircraft is primarily influenced by factors such as economic growth, urbanization, and the expansion of global trade. Emerging markets, particularly in Asia-Pacific, are witnessing a rapid increase in air travel, necessitating the acquisition of new aircraft to meet the growing passenger and cargo requirements.

The commercial aviation sector remains the dominant segment, with increasing investments in both narrow-body and wide-body aircraft to cater to diverse travel needs. The integration of advanced technologies is reshaping the aircraft manufacturing landscape. Digitalization, including the use of digital twins and simulation tools, facilitates real-time design validation and optimization.

Additive manufacturing, or 3D printing, allows for the production of complex components with reduced material waste. Moreover, automation and robotics enhance precision and efficiency in assembly processes, while artificial intelligence and machine learning contribute to predictive maintenance and supply chain optimization.

The adoption of advanced technologies in aircraft manufacturing is driven by the need to improve operational efficiency, reduce production costs, and meet stringent environmental regulations. Technologies such as automation and robotics minimize human error and increase production speed, while digital tools enhance design accuracy and reduce time-to-market.

Key Takeaways

- The market is projected to grow from USD 420.30 billion in 2024 to approximately USD 674.19 billion by 2034, registering a steady CAGR of 4.9%, driven by rising air travel demand, fleet modernization, and defense procurement programs.

- North America led the market in 2024, holding over 38.01% share with revenues of about USD 159.7 billion, supported by strong aerospace infrastructure, technological leadership, and consistent defense spending.

- Within North America, the U.S. market contributed approximately USD 147.59 billion in 2024, and is expected to grow at a CAGR of 4.35%, driven by both commercial and military aircraft demand.

- Canada’s market stood at USD 12.15 billion in 2024, with a higher projected CAGR of 5.9%, reflecting growing investments in regional aviation and aerospace manufacturing capabilities.

- By aircraft type, Fixed-Wing Aircraft dominated, accounting for 53.93% share, reflecting strong global demand for commercial jets, business aircraft, and military fighters.

- By application, Commercial Aviation led with 47.90% share, driven by increasing passenger traffic, low-cost carrier expansion, and the replacement of aging fleets with more fuel-efficient models.

US Market Size

The U.S. Aircraft Manufacturing Market was valued at USD 147.5 Billion in 2024 and is anticipated to reach approximately USD 224.7 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position in the aircraft manufacturing sector, capturing more than 38.01% of the global market share, equating to approximately USD 159.7 billion in revenue. This leadership is primarily attributed to the region’s robust aerospace infrastructure, significant defense budgets, and a well-established manufacturing base.

The United States, in particular, serves as a global hub for aircraft production, hosting major manufacturers and a comprehensive supply chain that supports both commercial and military aviation needs. The prominence of North America in the aircraft manufacturing market is further reinforced by its substantial investment in research and development, fostering innovation in aircraft design, materials, and propulsion systems.

Market Share By Region from 2019 to 2024 (%)

Region 2020 2021 2022 2023 2024 Europe 28.90% 28.98% 29.05% 29.13% 29.11% Asia-Pacific 19.67% 19.88% 20.10% 20.32% 20.54% Latin America 8.50% 8.30% 8.20% 8.11% 8.11% Middle East & Africa 4.26% 4.24% 4.21% 4.18% 4.14% The region’s commitment to technological advancements has led to the development of next-generation aircraft that offer improved fuel efficiency, reduced emissions, and enhanced performance. Additionally, the presence of a skilled workforce and supportive regulatory environment contributes to the region’s competitive edge in the global market.

Aircraft Type Analysis

In 2024, the Fixed-Wing Aircraft segment maintained a dominant position in the aircraft manufacturing market, capturing more than 58.7% of the total market share. This prominence can be attributed to the versatile applications of fixed-wing aircraft across commercial, military, and private sectors.

The sustained leadership of fixed-wing aircraft is further reinforced by their critical role in global air connectivity and defense strategies. Commercial airlines favor these aircraft for their ability to serve high-demand routes efficiently, while military forces rely on them for strategic mobility and surveillance missions.

Additionally, the ongoing advancements in aeronautical engineering continue to enhance the performance and operational capabilities of fixed-wing aircraft, ensuring their continued dominance in the market. The increasing adoption of advanced technologies is significantly influencing the aircraft manufacturing landscape.

Innovations such as digital design tools, additive manufacturing, and advanced materials are being integrated into the production of fixed-wing aircraft. These technologies contribute to improved fuel efficiency, reduced emissions, and enhanced safety features, aligning with the industry’s focus on sustainability and performance optimization.

Market Share By Aircraft Type Analysis from 2019 to 2024 (%)

Aircraft Type 2020 2021 2022 2023 2024 Fixed-Wing Aircrafts 53.40% 53.53% 53.66% 53.80% 53.93% Rotary-Wing Aircrafts 16.96% 16.87% 16.78% 16.69% 16.60% Helicopters 9.56% 9.43% 9.30% 9.18% 9.05% Unmanned Aerial Vehicles (UA) 14.64% 14.78% 14.91% 15.04% 15.18% Other Aircraft Types 5.43% 5.39% 5.34% 5.29% 5.24% End-User Insights

In 2024, the Commercial Aviation segment maintained a dominant position in the aircraft manufacturing market, capturing more than 47.90% of the total market share. This leadership is primarily attributed to the sustained growth in global air travel demand, driven by factors such as increasing disposable incomes, expanding tourism, and the globalization of business activities.

The commercial aviation sector encompasses a broad spectrum of aircraft, including narrow-body and wide-body airliners, which are integral to both short-haul and long-haul travel routes. The prominence of the Commercial Aviation segment is further reinforced by the strategic initiatives undertaken by airlines to modernize their fleets.

Airlines are increasingly investing in new-generation aircraft that offer improved fuel efficiency, reduced emissions, and enhanced passenger comfort. This shift is in response to stringent environmental regulations and the growing consumer preference for sustainable travel options. The competitive landscape in commercial aviation has driven innovation, with manufacturers developing advanced technologies to meet market demands.

Market Share By End-User Insights from 2019 to 2024 (%)

End-User 2020 2021 2022 2023 2024 Commercial Aviation 47.23% 47.39% 47.56% 47.73% 47.90% Military and Defense 24.63% 24.84% 25.05% 25.26% 25.47% Government & Public Services 16.32% 16.15% 15.98% 15.81% 15.65% Other End-Users 11.83% 11.62% 11.41% 11.20% 10.98% The expansion of low-cost carriers has also played a significant role in the growth of the Commercial Aviation segment. These carriers have democratized air travel by offering affordable options to a broader demographic, thereby increasing the overall volume of air traffic. Moreover, the rise of digital platforms has facilitated easier access to flight bookings, further contributing to the surge in air travel demand.

Key Market Segments

Aircraft Type

- Fixed-Wing Aircrafts

- Rotary-Wing Aircrafts

- Helicopters

- Unmanned Aerial Vehicles (UAVs)

- Other Aircraft Types

End-User

- Commercial Aviation

- Military and Defense

- Government & Public Services

- Other End-Users

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Integration of Sustainable Materials

The aircraft manufacturing industry is witnessing a growing trend toward the use of sustainable and lightweight materials, driven by the need to reduce carbon emissions and improve fuel efficiency. Advanced composites, bio-based polymers, and recycled alloys are being increasingly incorporated into airframe structures and components.

This trend is supported by stricter environmental regulations and the rising consumer preference for greener travel alternatives. The adoption of these materials is reshaping supply chains and encouraging innovation in manufacturing processes.

Driver

Rising Air Passenger Traffic

One of the key drivers of growth in the aircraft manufacturing sector is the continuous rise in global air passenger traffic. The expansion of middle-class populations, coupled with the increasing affordability of air travel, has led to higher demand for commercial aircraft.

Airlines are compelled to expand and modernize their fleets to cater to this surge while also ensuring operational efficiency. This sustained demand for new aircraft stimulates production, spurs technological advancements, and creates opportunities across the value chain.

Restraint

Supply Chain Disruptions

Supply chain disruptions remain a significant restraint for the industry, particularly due to geopolitical tensions, global trade uncertainties, and the lingering effects of pandemic-related shutdowns. These disruptions have caused delays in component deliveries and escalated production costs, directly affecting manufacturing timelines. Manufacturers are forced to navigate complex logistics and invest in alternative sourcing strategies, which may not always fully mitigate the risks or maintain optimal cost-efficiency.

Market Opportunity

Growth of Electric and Hybrid Aircraft

An emerging opportunity lies in the development of electric and hybrid-electric aircraft aimed at reducing dependency on fossil fuels. Governments and private investors are increasingly supporting projects that explore sustainable propulsion technologies.

This segment is still in its early stages but holds the potential to transform the industry by creating new product lines and business models. Manufacturers that invest early in these technologies are expected to gain a competitive edge as regulations tighten and customer demand for eco-friendly travel grows.

Market Challenge

Certification and Regulatory Complexity

One of the prominent challenges faced by manufacturers is the complex and time-consuming certification processes mandated by aviation authorities. As aircraft designs evolve to include novel technologies, the regulatory frameworks often lag, creating bottlenecks.

Complying with stringent safety and performance standards can delay market entry and inflate development costs. Overcoming these hurdles requires close collaboration with regulators, substantial investments in testing, and proactive risk management strategies.

Key Player Analysis

The aircraft manufacturing sector is led by several globally recognized companies that shape the strategic and technological landscape of the industry. Airbus SE and The Boeing Company represent two of the most influential players, known for their wide-body and narrow-body commercial aircraft.

Lockheed Martin Corp., Northrop Grumman Corp., and BAE Systems plc dominate the defense aircraft segment. These companies specialize in advanced combat aircraft, surveillance drones, and next-generation stealth technologies. Their core strengths lie in developing military-grade aviation platforms, supported by long-standing government contracts.

Textron Inc., Bombardier Inc., Dassault Aviation SA, Embraer S.A., Mitsubishi Corporation, and AeroVironment, Inc. represent a diverse mix of regional jet, business jet, and unmanned aircraft manufacturers. Their strength lies in niche applications, including executive travel, short-haul routes, and tactical UAVs. These companies serve as innovation hubs for lightweight composite materials, electric propulsion systems, and modular aircraft design.

Top Key Players

- Airbus SE

- Lockheed Martin Corp.

- The Boeing Company

- Northrop Grumman Corp.

- BAE Systems plc

- Textron Inc.

- Bombardier Inc.

- Dassault Aviation SA

- Embraer S.A.

- Mitsubishi Corporation

- AeroVironment, Inc.

- Others

Recent Developments

- In January 2025, Novaria, a specialty aerospace components manufacturer, acquired Bandy Manufacturing, known for tight-tolerance aerospace hinges and pins. Bandy’s operations will remain in California, ensuring continuity and expertise in precision aerospace hardware.

- In November 2024, AeroVironment revealed a $4.1 billion all-stock acquisition of BlueHalo, a leader in counter-UAS, electronic warfare, and space systems. This deal positions AeroVironment as a major force in next-generation autonomous and AI-driven defense aircraft, expanding its unmanned aircraft systems (UAS) portfolio.

Report Scope

Report Features Description Market Value (2024) USD 420.3 Bn Forecast Revenue (2034) USD 674.19 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Aircraft Type (Fixed-Wing Aircrafts, Rotary-Wing Aircrafts, Helicopters, Unmanned Aerial Vehicles (UAVs), Other Aircraft Types), By End-User (Commercial Aviation, Military and Defense, Government & Public Services, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus SE, Lockheed Martin Corp., The Boeing Company, Northrop Grumman Corp., BAE Systems plc, Textron Inc., Bombardier Inc., Dassault Aviation SA, Embraer S.A., Mitsubishi Corporation, AeroVironment, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aircraft Manufacturing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Aircraft Manufacturing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbus SE

- Lockheed Martin Corp.

- The Boeing Company

- Northrop Grumman Corp.

- BAE Systems plc

- Textron Inc.

- Bombardier Inc.

- Dassault Aviation SA

- Embraer S.A.

- Mitsubishi Corporation

- AeroVironment, Inc.

- Others