Global Airborne Wind Energy Market By Technology(Larger Turbines (above 3 MW), Smaller Turbines (Less than 3 MW)), By Application(Offshore, Onshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 115311

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

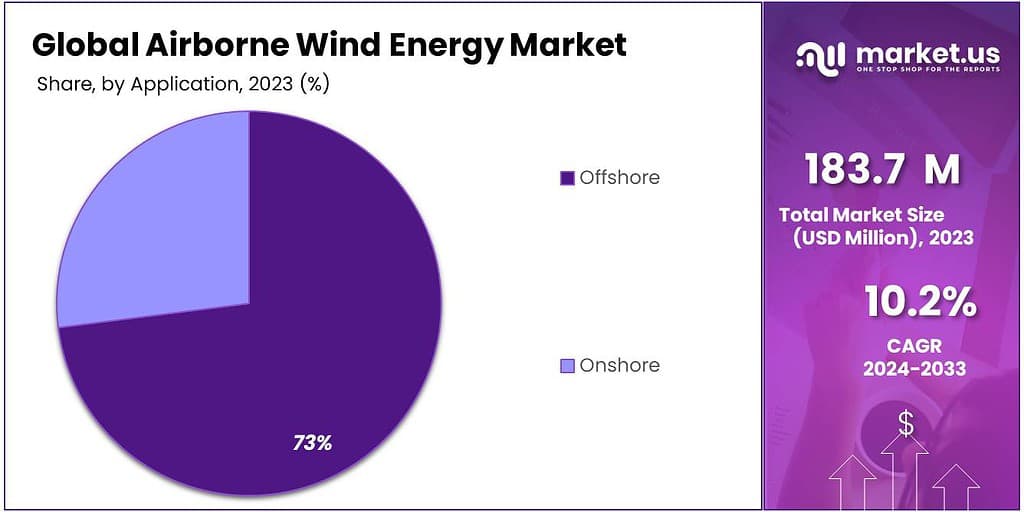

The Airborne wind energy market size is expected to be worth around USD 485.2 Mn by 2033, from USD 183.7 MN in 2023, growing at a CAGR of 10.2% during the forecast period from 2023 to 2033.

The airborne wind energy (AWE) market pertains to the development, manufacturing, and deployment of airborne wind energy systems (AWES). These innovative systems harness wind energy at altitudes higher than traditional wind turbines, where wind speeds are generally stronger and more consistent.

Unlike conventional wind turbines, which rely on fixed structures extending from the ground, airborne wind energy systems utilize kites, balloons, gliders, or drones equipped with wind turbines or tethered to ground-based generators. These devices are designed to capture kinetic energy from the wind at higher altitudes and convert it into electrical power through mechanisms that either operate airborne generators or transmit the mechanical power to a ground-based generator through tethers.

The concept behind AWE is to access the untapped potential of high-altitude winds in a cost-effective and environmentally friendly manner, potentially transforming the renewable energy landscape. The market for airborne wind energy is driven by the need for sustainable and efficient energy solutions, technological innovations, and increasing interest in harnessing alternative renewable energy sources.

It encompasses various aspects including research and development (R&D), system design and optimization, manufacturing of AWES components, installation and operation of systems, and ongoing maintenance and service.

As the AWE industry progresses, it is expected to offer solutions that are not only less intrusive visually and physically than traditional wind farms but also capable of generating power in regions where conventional wind turbines are not feasible due to space constraints or environmental concerns.

The growth of the airborne wind energy market can be attributed to the increasing demand for renewable energy sources, advancements in materials and aerodynamics, and the potential for lower installation and operating costs compared to traditional wind power generation methods.

Key Takeaways

- Market Projection: The Airborne Wind Energy market is set to reach USD 485.2 Million by 2033, growing at a 10.2% CAGR from 2023.

- Dominant Technology: Larger Turbines (above 3 MW) held over 56.35% market share in 2023, emphasizing power output and efficiency.

- Application Leadership: Offshore applications captured a substantial 73.3% market share in 2023, driven by strong and consistent winds.

- Technological Advancements: Advances in materials and aerodynamics are reducing the Levelized Cost of Energy (LCOE) and enhancing airborne wind energy competitiveness.

- Offshore Market Boost: Airborne wind energy provides a potential solution for challenges faced by offshore wind farms, driving investment and innovation.

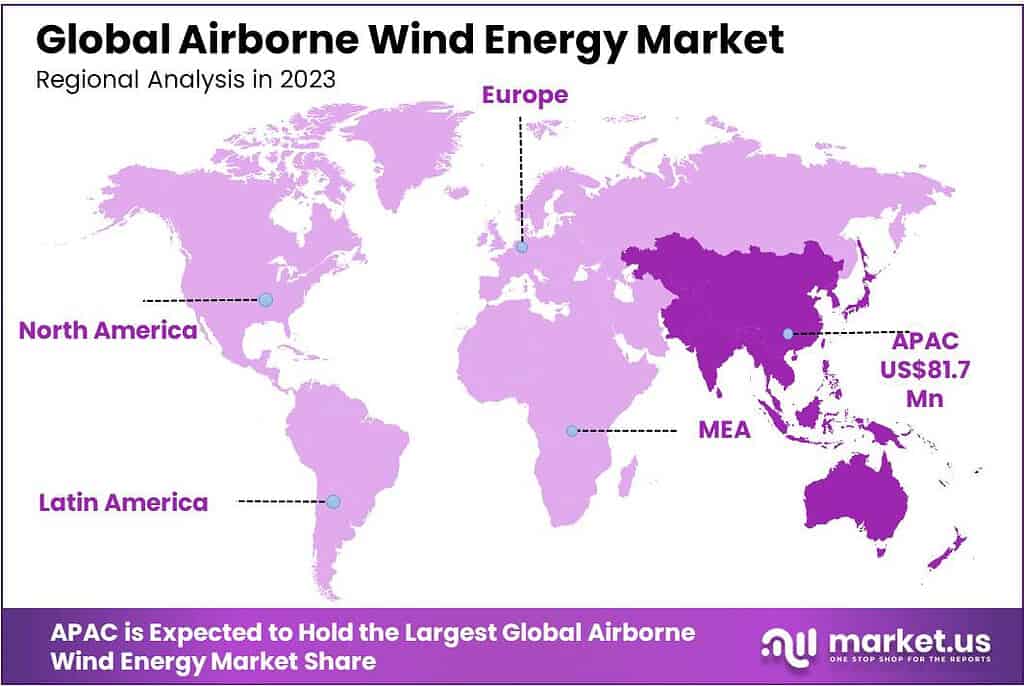

- Regional Dominance: Asia-Pacific dominated with over 44.5% market share in 2023, driven by technological adoption, sustainability focus, and R&D efforts.

- AWE systems have the potential to generate electricity at a lower cost compared to traditional wind turbines, with estimates suggesting cost reductions of up to 50%

- AWE systems can operate at altitudes ranging from 200 to 600 meters, where wind speeds are typically higher and more consistent than at ground level.

- Airborne Wind Energy (AWE) research and development. While I don’t have specific information about a €100 million funding allocation for 2023

By Technology

In 2023, Larger Turbines (above 3 MW) held a dominant market position, capturing more than a 56.35% share. These turbines are designed to generate significant amounts of electricity, making them suitable for large-scale energy generation projects. The dominance of larger turbines can be attributed to their higher power output and efficiency, which makes them ideal for capturing wind energy in areas with strong and consistent wind resources.

Larger turbines benefit from economies of scale, resulting in lower overall costs per unit of electricity generated compared to smaller turbines. This cost advantage makes them more attractive for developers and investors looking to maximize the return on investment in airborne wind energy projects. As a result, larger turbines are often deployed in utility-scale wind farms and large commercial installations, driving their market dominance.

Despite the dominance of larger turbines, there is still a growing market for Smaller Turbines (Less than 3 MW). These turbines are more versatile and can be deployed in a wider range of locations, including remote or off-grid sites. They are also easier to transport and install, making them suitable for decentralized energy generation and distributed energy projects. As a result, smaller turbines appeal to a different segment of the market, including smaller communities, rural areas, and developing regions where access to traditional grid infrastructure may be limited.

The airborne wind energy market is characterized by a diverse range of turbine technologies catering to different applications and market segments. While Larger Turbines dominate the market for utility-scale projects, Smaller Turbines offer flexibility and scalability for decentralized and distributed energy solutions. As technology continues to evolve and innovation drives efficiency improvements, both segments are expected to play significant roles in the transition to renewable energy and the expansion of the airborne wind energy market.

By Application

In 2023, Offshore held a dominant market position, capturing more than a 73.3% share. Offshore applications involve placing wind energy systems in bodies of water, typically oceans or seas. This dominance can be attributed to several factors, including the abundance of strong and consistent winds offshore, which can result in higher energy generation compared to onshore locations.

Additionally, offshore wind farms often face fewer land use constraints and benefit from larger available areas for development, allowing for the deployment of larger and more efficient wind turbines. Offshore wind energy projects offer several advantages, including proximity to densely populated coastal areas, where electricity demand is typically higher.

This geographical proximity reduces transmission losses and costs associated with delivering electricity to end-users, making offshore wind farms attractive for meeting urban energy needs. Additionally, offshore wind energy projects have the potential to stimulate local economies through job creation, infrastructure development, and investment in port facilities and supply chains.

While Offshore applications currently dominate the airborne wind energy market, there is growing interest and investment in Onshore projects. Onshore wind energy systems are located on land, typically in rural or agricultural areas.

These projects benefit from lower installation and operational costs compared to offshore projects, as they do not require expensive offshore infrastructure such as foundations and subsea cables. Onshore wind farms can often leverage existing grid infrastructure, reducing connection costs and project timelines.

Additionally, Onshore wind energy projects have the potential to provide economic benefits to rural communities through land lease payments, tax revenue, and job creation. As a result, Onshore applications are gaining traction in regions with favorable wind resources and supportive regulatory frameworks, contributing to the overall growth and diversification of the airborne wind energy market.

Key Market Segments

By Technology

- Larger Turbines (above 3 MW)

- Smaller Turbines (Less than 3 MW)

By Application

- Offshore

- Onshore

Drivers

One key driver is the increasing global demand for renewable energy sources to reduce carbon emissions and combat climate change. Airborne wind energy offers a promising alternative to traditional wind energy systems by harnessing wind power at higher altitudes where wind speeds are stronger and more consistent.

As countries and regions set ambitious targets for transitioning to renewable energy, airborne wind energy technologies are gaining attention for their potential to contribute to clean energy generation on a large scale. Technological advancements and innovations are driving improvements in airborne wind energy systems, making them more efficient, reliable, and cost-effective.

Advances in materials, aerodynamics, and control systems are enabling the development of lighter, more durable airborne wind energy devices capable of capturing wind energy more efficiently. These technological innovations are lowering the levelized cost of energy (LCOE) associated with airborne wind energy, making it increasingly competitive with conventional energy sources.

The expanding offshore wind energy market is driving investment and innovation in airborne wind energy technologies. Offshore wind farms face challenges related to installation, maintenance, and grid connection, particularly in deep-water locations. Airborne wind energy systems offer a potential solution to these challenges by operating at higher altitudes, where winds are stronger and more consistent, and where the installation of traditional offshore wind turbines may be impractical or cost-prohibitive.

The growing interest from governments, investors, and energy companies in the potential of airborne wind energy is driving research, development, and commercialization efforts. Governments are implementing supportive policies, incentives, and funding initiatives to accelerate the deployment of airborne wind energy technologies and foster innovation in the sector. Investors are increasingly recognizing the market potential of airborne wind energy and are providing funding to startups and companies developing innovative airborne wind energy solutions.

Restraints

One big problem is that it’s tough to scale up airborne wind energy systems to work on a large scale. While they seem promising, many of these systems are still in the early stages of development and have issues with things like reliability and efficiency. Making them big enough to produce lots of electricity for a long time is a big challenge that needs to be solved for them to become more popular.

Also, there are a lot of rules and permits needed to put airborne wind energy systems in place, especially offshore. Projects out at sea have to meet strict rules and do environmental studies, which can take a long time and cost a lot of money. Plus, people worry about things like air traffic safety and how it might affect animals and the environment. Getting approval for these projects can be tough and might make some people hesitate to invest in them.

It’s expensive and risky to develop and deploy airborne wind energy technology. It takes a lot of money to do research, build prototypes, and test them out, and there’s no guarantee that it’ll pay off in the end. Plus, getting funding for these projects is hard because they’re still new and not everyone is sure they’ll work.

And with other renewable energy options like regular wind turbines and solar panels already well-established, airborne wind energy systems have to compete with them on cost and how well they work. In short, there are a lot of challenges holding back the airborne wind energy market, like technical issues, strict regulations, high costs, and tough competition. Overcoming these challenges will take effort from everyone involved, including companies, government officials, and researchers, to make airborne wind energy a reliable and widely used source of renewable energy.

Opportunities

One major opportunity lies in the potential for airborne wind energy systems to access high-altitude winds that are stronger and more consistent than those at ground level. By harnessing these powerful winds, airborne wind energy systems can generate electricity more efficiently and reliably, offering a significant advantage over traditional wind turbines.

This opens up opportunities for deploying airborne wind energy systems in locations where conventional wind energy technologies may not be feasible or cost-effective, such as mountainous regions or remote areas with limited infrastructure. Advancements in technology and innovation are creating new opportunities for improving the performance and capabilities of airborne wind energy systems.

Research and development efforts are focused on developing lighter, more durable materials, optimizing aerodynamic designs, and enhancing control systems to increase the efficiency and reliability of airborne wind energy systems. These technological advancements are driving down costs and improving the overall competitiveness of airborne wind energy, making it an attractive option for meeting growing energy demand around the world.

The expanding offshore wind energy market presents significant opportunities for airborne wind energy systems. Offshore wind farms face challenges related to installation, maintenance, and grid connection, particularly in deep-water locations where traditional offshore wind turbines may be difficult to deploy.

Airborne wind energy systems offer a flexible and cost-effective alternative for harnessing wind energy offshore, with the potential to overcome many of the challenges associated with traditional offshore wind technologies. The increasing focus on renewable energy and sustainability by governments, corporations, and consumers is creating a favorable market environment for airborne wind energy. Policymakers are implementing supportive regulations and incentives to promote the development and deployment of renewable energy technologies, including airborne wind energy.

Corporations are increasingly seeking to reduce their carbon footprint and achieve sustainability goals, driving demand for clean and renewable energy sources like airborne wind energy. As awareness of the benefits of airborne wind energy grows, opportunities for market expansion and investment are expected to increase, driving further growth and innovation in the airborne wind energy sector.

Challenges

One major challenge is the technical complexity and uncertainty surrounding airborne wind energy systems. Unlike traditional wind turbines, airborne wind energy systems operate at higher altitudes and rely on aerodynamic principles and advanced control systems to capture wind energy. Developing and optimizing these systems requires extensive research, testing, and validation, which can be time-consuming and costly.

Additionally, there are uncertainties regarding the performance, reliability, and scalability of airborne wind energy technologies, which can pose risks for investors and developers. Moreover, regulatory and policy challenges present barriers to the deployment of airborne wind energy systems.

Existing regulations and standards may not adequately address the unique characteristics and operating conditions of airborne wind energy technologies, leading to uncertainty and delays in project approval and implementation. Additionally, airspace management and aviation safety considerations must be addressed to ensure the safe operation of airborne wind energy systems, particularly in airspace shared with manned aircraft and other aerial activities.

Market and economic challenges pose obstacles to the widespread adoption of airborne wind energy. The high upfront costs associated with developing and deploying airborne wind energy systems can be prohibitive for investors and developers, particularly in the absence of established revenue streams and market certainty.

Additionally, competition from other renewable energy technologies, such as conventional wind turbines and solar photovoltaic systems, can limit the market potential of airborne wind energy and hinder its commercial viability. Additionally, logistical and operational challenges, such as transportation, installation, and maintenance, can impact the feasibility and cost-effectiveness of airborne wind energy projects. Deploying airborne wind energy systems in remote or offshore locations may require specialized infrastructure and equipment, increasing project complexity and expenses.

Moreover, ongoing maintenance and repair of airborne wind energy systems, particularly those operating in harsh environmental conditions, can present operational challenges and add to the overall lifecycle costs of these systems. Addressing these challenges will require collaborative efforts from industry stakeholders, policymakers, and researchers to overcome technical, regulatory, economic, and operational barriers and unlock the full potential of airborne wind energy as a clean and sustainable energy solution.

Regional Analysis

In 2023, the Asia-Pacific region held a dominant position in the airborne wind energy (AWE) market, securing more than a 44.5% share. The market value for airborne wind energy in North America was estimated at USD 81.7 billion in 2023, with expectations for substantial growth in the coming years.

This regional dominance is attributed to several critical factors, including the adoption of advanced technological practices, a keen focus on sustainable and renewable energy sources, and vigorous research and development efforts. Specifically, the United States and Canada have been pioneers in the adoption of AWE technologies, motivated by the necessity to harness efficient renewable energy solutions and mitigate the reliance on conventional energy sources, while also addressing environmental concerns.

The regional analysis of the airborne wind energy (AWE) market reveals a varied landscape influenced by regional policies, technological readiness, investment climates, and the availability of natural wind resources.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

The airborne wind energy (AWE) market is characterized by the presence of several key players who are pioneering the development and deployment of AWE technologies. These entities are crucial in driving innovation, securing investments, and shaping the regulatory landscape for the burgeoning industry. Here is an analysis of key players in the AWE market, highlighting their contributions and strategic positions

Market Key Players

- Vestas Wind Systems A/S

- Nordex SE

- Enercon GmbH

- GE Power

- Siemens AG

- Senvion S.A.

- Goldwind

- United Power Inc

- Envision Energy

- Suzlon Energy Ltd.

Recent Developments

February 2023, IBL Energy Holdings (IBL) and SkySails Power GmbH partnered to execute their first project using high-altitude wind energy as a green power alternative for diesel generators. The initiative demonstrates the technology’s commercial potential for market entry in East Africa and the Indian Ocean region. This will also help in turning Mauritius more independent from fossil energies.

December 2022,Marcus Family Campus installed Wind Turbine. The GreeNegev student community, in collaboration with Flower Turbines and donor Mr. Daniel Farb, took the initiative. The turbine will be used to charge electrical appliances within the campus. It will cater to 20% of the electricity needed by the campus. At an estimated cost of 0.55 million USD, the project will replace more polluting fuels once completed.

October 2022, India’s Chennai Railway Division installed and commissioned three prototype unit flower turbines, combining wind and solar power generators of 1.5 KW each. These are equipped with a remote monitoring system for real-time monitoring of wind speed and power generation. These also will produce low noise. Such initiatives are taken to increase the use of green energy.

Report Scope

Report Features Description Market Value (2023) USD 183.7 Mn Forecast Revenue (2033) USD 485.2 Mn CAGR (2024-2033) 10.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology(Larger Turbines (above 3 MW), Smaller Turbines (Less than 3 MW)), By Application(Offshore, Onshore) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Vestas Wind Systems A/S, Nordex SE, Enercon GmbH, GE Power, Siemens AG, Senvion S.A., Goldwind, United Power Inc, Envision Energy, Suzlon Energy Ltd. Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Airborne wind energy market?Airborne wind energy market size is expected to be worth around USD 485.2 Million by 2033, from USD 183.7 MN in 2023

What CAGR is projected for the Airborne Wind Energy Market?The Airborne Wind Energy Market is expected to grow at 10.2% CAGR (2023-2032).Name the major industry players in the Airborne Wind Energy Market?Vestas Wind Systems A/S, Nordex SE, Enercon GmbH, GE Power, Siemens AG, Senvion S.A., Goldwind, United Power Inc, Envision Energy, Suzlon Energy Ltd.

Airborne Wind Energy MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Airborne Wind Energy MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vestas Wind Systems A/S

- Nordex SE

- Enercon GmbH

- GE Power

- Siemens AG

- Senvion S.A.

- Goldwind

- United Power Inc

- Envision Energy

- Suzlon Energy Ltd.