Global Airborne Optronics Market By System Type (Imaging Systems, Non-Imaging Systems), By Technology (Multispectral, Hyperspectral), By Application (Military, Commercial, Civil, Other Applications), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs)),End-Use (OEM, Aftermarket), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2023

- Report ID: 74423

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

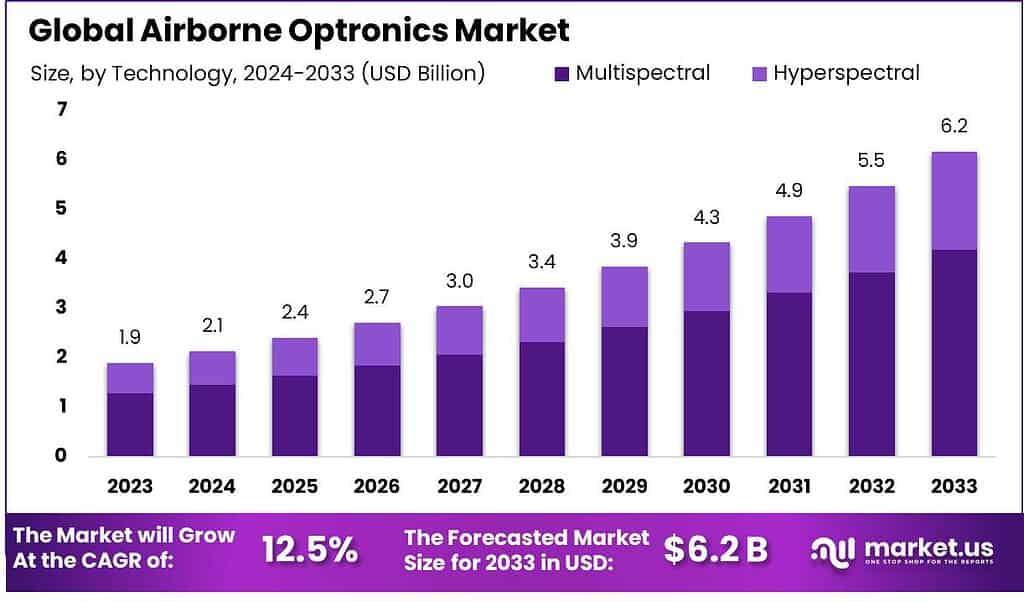

The Global Airborne Optronics Market is anticipated to be USD 6.2 billion by 2033. It is estimated to record a steady CAGR of 12.5% in the Forecast period 2024 to 2033. It is likely to total USD 1.9 billion in 2023.

Airborne Optronics refers to the systems and technologies used on aircraft and drones to capture images and video from the air. The key components of Airborne Optronics systems are cameras, sensors, and processors that allow an aircraft to see and record what is happening on the ground below.

The heart of an Airborne Optronics system is the camera and sensor payload. This includes high-resolution digital cameras capable of taking detailed still images. It also includes video cameras that can capture full motion video footage from the air. Infrared cameras are frequently used which can see heat signatures and help identify targets and activities even at night or in low visibility conditions. Other specialized sensors such as LIDAR or radar can also be equipped to gather additional data from the air.

Note: Actual Numbers Might Vary In Final Report

These camera and sensor systems are gyrostabilized to compensate for the movement and vibration of the aircraft. This allows them to stay pointed steadily at an area of interest on the ground while the aircraft is in motion. The cameras often have zoom lenses or telephoto capabilities so they can hone in on targets from high altitudes. Some Airborne Optronics systems even enable multiple sensors to be aimed independently and work in unison to capture different types of data simultaneously.

The images and video captured by Airborne Optronics are usually analyzed and enhanced using advanced processing systems on board the aircraft or back on the ground. This can include things like image stabilization, object recognition, target tracking, and 3D modeling. The goal is to take raw aerial footage and enhance it into valuable intelligence and reconnaissance data.

Airborne Optronics systems are extremely useful for military situations like surveillance, border control, and battlefield awareness. They are also valuable for public services like traffic monitoring, search and rescue, fighting wildfires, and responding to disasters. Police departments also use Airborne Optronics for tracking suspects and gathering evidence. The images and data collected from the air can give personnel on the ground unprecedented situational awareness and decision-making ability.

Key Takeaways

- Market Size and Growth: The Global Airborne Optronics Market is projected to reach USD 6.2 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 12.5% from 2024 to 2033. In 2023, it is estimated to be worth USD 1.9 billion.

- System Type Analysis: In 2023, Imaging Systems dominated the market with over 80% market share, while Non-Imaging Systems held a smaller share.

- Technology Insights: Multispectral technology led in 2023, with a 68% share, while Hyperspectral technology had a smaller share but offered more detailed data.

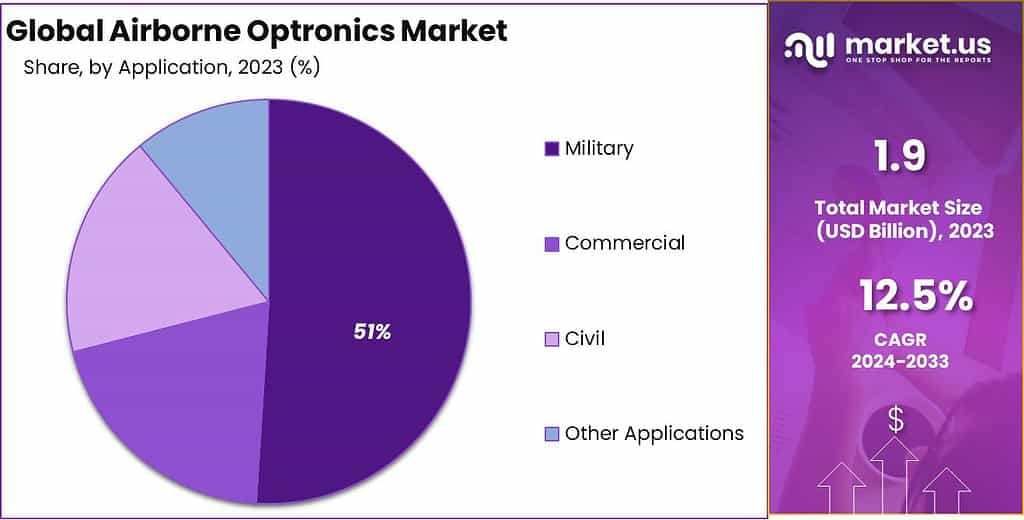

- Application Analysis: In 2023, the Military sector held the largest share at over 51%, followed by the Commercial and Civil sectors. Other Applications had a smaller market share.

- Platform Insights: Fixed-Wing Aircraft had the largest share in 2023, followed by Rotary-Wing Aircraft and Unmanned Aerial Vehicles (UAVs).

- End-Use Analysis: OEMs dominated the market in 2023 with over 65% market share, while the Aftermarket segment played a crucial role in maintaining and upgrading optronics systems.

- Driving Factors: Growth in the Airborne Optronics Market is driven by the increasing demand for surveillance and reconnaissance capabilities in the defense sector and technological advancements that enable lightweight and compact systems.

- Restraining Factors: High initial costs and cybersecurity concerns are significant challenges for the market.

- Growth Opportunities: Opportunities lie in the focus on natural products and sustainability, as well as the rise of autonomous vehicles and drones.

- Latest Trends: The market is witnessing increased demand for multi-spectral and hyperspectral imaging capabilities and the integration of Artificial Intelligence (AI) and machine learning into optronics systems.

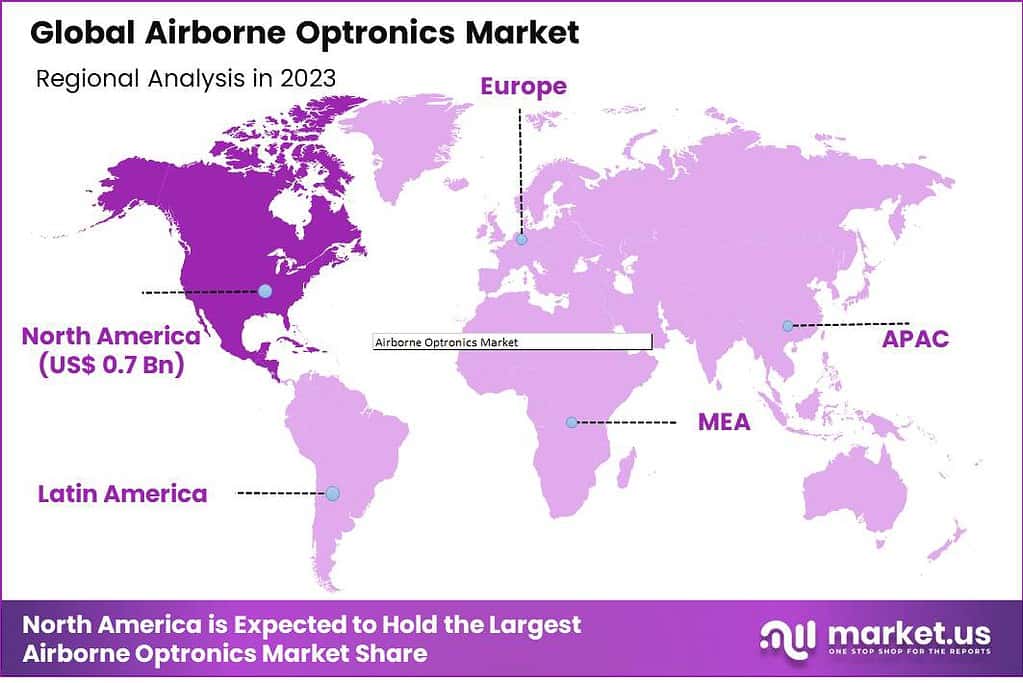

- Regional Analysis: North America dominated the market in 2023, followed by Europe, APAC, Latin America, and the Middle East & Africa, with specific factors contributing to growth in each region.

- Key Players: The report identifies major players in the market, including Northrop-Grumman Corporation, Thales SA, Flir Systems Inc., Safran, Elbit Systems Ltd., Lockheed Martin Corporation, Leonardo Spa, and others.

System Type Analysis

In 2023, Imaging Systems ruled the Airborne Optronics market, grabbing over 80% of the market share. These high-tech systems use cameras and fancy sensors to capture images and videos from aircraft. They’re like the eyes of the plane, helping it see and understand what’s going on. This dominance is because imaging systems are crucial for military, surveillance, and even in some civilian applications. They provide clear visuals, making it easier for pilots and operators to make informed decisions.

On the other hand, Non-Imaging Systems, while important, held a smaller share in 2023. These systems don’t focus on pictures but rather on gathering data through sensors and communication devices. They play a crucial role in information gathering and communication but had a smaller piece of the market pie compared to imaging systems.

Technology Insights

In 2023, Multispectral technology took the lead in the Airborne Optronics market, holding more than a 68% share. This advanced technology allows aircraft to see and analyze different colors and wavelengths of light, like a high-tech rainbow. It’s super important in applications like agriculture, where it helps monitor crop health and environmental changes.

Meanwhile, Hyperspectral technology, while significant, had a smaller share in 2023. It’s like the big brother of multispectral, offering even more detailed data by examining a wider range of light wavelengths. However, it’s used in more specialized fields like mineral exploration and environmental monitoring.

Application Analysis

In the year 2023, the Military sector was the big player in the Airborne Optronics market, holding over 51% of the market share. This means that a significant portion of airborne optronics technology was dedicated to military applications. Military use of airborne optronics includes surveillance, reconnaissance, and target acquisition, where clear and precise vision from aircraft is crucial for national security.

The Commercial sector also played a substantial role, although it had a smaller share compared to the Military. Commercial applications include using optronics for tasks like aerial photography, surveying, and monitoring of infrastructure.

The Civil sector, which covers activities such as search and rescue, firefighting, and law enforcement, contributed to the market as well, although it held a smaller portion compared to the Military and Commercial sectors.

Note: Actual Numbers Might Vary In Final Report

Lastly, there were Other Applications, which encompass various specialized uses like scientific research and environmental monitoring. These applications, while essential, held a relatively smaller market share in 2023.

Platform Insights

In the year 2023, Fixed-Wing Aircraft took the lead in the Airborne Optronics market, securing a dominant market position with more than a 40% share. These are the traditional airplanes with fixed wings, like commercial airliners and military fighter jets. Fixed-wing aircraft are essential users of airborne optronics technology for various purposes, including surveillance, navigation, and reconnaissance.

Rotary-Wing Aircraft, which includes helicopters and other aircraft with rotating blades, also played a significant role in the market. They rely on optronics for tasks like search and rescue, medical evacuation, and law enforcement operations.

Unmanned Aerial Vehicles (UAVs), often referred to as drones, were another key player in 2023. These autonomous flying machines use optronics extensively for applications such as aerial photography, monitoring, and even package delivery.

While Fixed-Wing Aircraft held the largest share, Rotary-Wing Aircraft and UAVs each had their unique roles in the airborne optronics market, catering to diverse needs in the aviation industry.

End-Use Analysis

In the year 2023, OEM (Original Equipment Manufacturers) claimed a dominant position in the Airborne Optronics market, commanding over 65% of the market share. This means that a significant portion of airborne optronics equipment was integrated directly into aircraft during their initial production.

The Aftermarket segment, while essential, held a smaller share compared to OEM. The Aftermarket involves the maintenance, repair, and upgrade of optronics systems in existing aircraft. This is crucial to ensure that the optronics equipment continues to function optimally throughout its lifespan.

OEMs were dominant players in the Airborne Optronics market in 2023, demonstrating the significance of integrating optronic technologies directly into new aircraft production. At the same time, Aftermarket segment played an essential part in maintaining and improving optronic systems over time. OEM (Original Equipment Manufacturer) sector held more than 65% market share indicating that many optronics systems were integrated during initial aircraft assembly production.

The Aftermarket segment, while important, held a smaller share in the market. Aftermarket services involve the maintenance, repair, and upgrading of optronics systems in existing aircraft after they have been in use. These services are crucial for ensuring that optronics equipment remains in top-notch condition over time.

In summary, the OEM sector dominated the market in 2023, signifying the importance of incorporating advanced optronics technology directly into aircraft during their manufacturing process. However, the Aftermarket segment also played a vital role in supporting and upgrading these systems to maintain their functionality and efficiency.

Driving Factors

The growth of the Airborne Optronics Market can be attributed to various key factors. Firstly, the escalating demand for surveillance and reconnaissance capabilities in the defense sector is driving the adoption of airborne optronics systems. These drones stand out as powerful tools, offering high-resolution imagery and real-time data, improving situational awareness.

Technological advancements have enabled the creation of lightweight and compact optronics systems, essential components of unmanned aerial vehicles (UAVs) and smaller aircraft. Thanks to this innovation, airborne optronics now serve a variety of civilian applications beyond military uses – agriculture, environmental monitoring and disaster management are just a few examples.

Restraining Factors

While the market holds immense potential, it is not devoid of challenges. One of the significant restraining factors is the high initial cost associated with the procurement and integration of advanced airborne optronics systems. This can deter budget-constrained defense agencies and organizations from investing in these solutions.

Furthermore, concerns related to cybersecurity and the vulnerability of optronics systems to cyberattacks are a growing issue. Ensuring the security of data transmitted by these systems is paramount, and any breach can have severe consequences.

Growth Opportunities

Despite the challenges, the Airborne Optronics Market presents promising growth opportunities. One of the most notable is the increasing focus on natural products and sustainability across various industries. Optronics systems play a crucial role in environmental monitoring and precision agriculture, aligning with the global trend toward sustainable practices. This opens doors for the market to expand its presence in these sectors.

Moreover, the rise of autonomous vehicles and drones presents a significant growth avenue. These platforms rely on optronics systems for navigation, obstacle detection, and surveillance, and as autonomous technologies advance, so do the opportunities for airborne optronics.

Latest Trends

In recent developments, the market has witnessed a surge in demand for multi-spectral and hyperspectral imaging capabilities. These advanced technologies enable better target detection and identification, making them invaluable in defense applications, agriculture, and mineral exploration.

Another noteworthy trend is the integration of Artificial Intelligence (AI) and machine learning algorithms into optronics systems. This enhances the system’s ability to process and analyze vast amounts of data in real-time, further improving its utility in a wide range of applications.

Key Market Segments

System Type

- Imaging Systems

- Non-Imaging Systems

Technology

- Multispectral

- Hyperspectral

Application

- Military

- Commercial

- Civil

- Other Applications

Platform

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aerial Vehicles (UAVs)

End-Use

- OEM

- Aftermarket

Regional Analysis

In 2023, North America commands a significant presence in the Airborne Optronics market, boasting a substantial revenue share of 36.7%. This region’s dominance can be attributed to several factors contributing to the growth of the airborne optronics sector. The demand for Airborne Optronics in North America was valued at USD 0.7 billion in 2023 and is anticipated to grow significantly in the forecast period

Firstly, North America benefits from a robust aerospace and defense industry. With major players in this sector headquartered in the region, there is a constant demand for cutting-edge optronic systems to enhance the capabilities of military aircraft and other airborne platforms.

North America has led the world in technological innovation and research and development activities, which has given birth to sophisticated optronic solutions and fuelled market growth as the region continues to invest in advanced optical systems for airborne applications.

Furthermore, the geopolitical landscape and security concerns have prompted increased defense spending in North America, leading to a higher procurement of airborne optronics equipment for surveillance, reconnaissance, and targeting purposes.

Europe is a significant player in the Airborne Optronics market, driven by its advanced technology adoption and military modernization efforts. APAC is experiencing substantial growth in the Airborne Optronics sector, driven by rising defense budgets, regional tensions, and a growing focus on military capabilities. Latin America is steadily embracing Airborne Optronics technology to enhance its defense and surveillance capabilities, contributing to the market’s expansion. The Middle East & Africa region is witnessing increased demand for Airborne Optronics systems, driven by security concerns and the need for advanced reconnaissance and surveillance equipment.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the context of the Airborne Optronics Market, a meticulous key player analysis unveils crucial insights into the competitive landscape of this industry. It illuminates the prominent companies that wield significant influence in shaping market dynamics.

This analysis identifies the major players who have established themselves as industry leaders through their innovative technology, extensive product portfolios, and a history of successful implementations. These key players are instrumental in driving advancements in airborne optronics solutions.

Their expertise and track record in delivering cutting-edge optical systems and sensors contribute to the overall growth and development of the market. As they continue to invest in research and development, these market leaders bolster the industry’s technological prowess, enhancing its global competitiveness.

Biggest Key Players

- Northrop- Grumman Corporation

- Thales SA

- Flir Systems Inc.

- Safran

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Leonardo Spa

- L3Harris Technologies Inc.

- Hensoldt AG

- Collins Aerospace

- Israel Aerospace Industries

- Rafael Advanced Defense Systems Ltd.

- Kappa Optronics GmbH

- Stark Aerospace Inc.

- Other Key Players

Recent Development

- In March 2021, Elbit Systems Ltd. secured a five-year contract worth USD 300 million to provide HermesTM 900 Unmanned Aircraft Systems.

- In February 2021, Northrop Grumman Corporation’s RQ-4D Phoenix Global Hawk enabled NATO Alliance Ground Surveillance (AGS) Force to achieve initial operating capability.

- In January 2021, Teledyne Technologies Incorporated acquired FLIR Systems, Inc. in a transaction valued at USD 8.0 billion.

- In January 2021, HENSOLDT and Fraunhofer IOSB entered into a cooperation agreement to develop robust lasers for laser-based countermeasures and reconnaissance.

Report Scope

Report Features Description Market Value (2023) US$ 1.9 Bn Forecast Revenue (2033) US$ 6.2 Bn CAGR (2023-2032) 12.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By System Type (Imaging Systems, Non-Imaging Systems), By Technology (Multispectral, Hyperspectral), By Application (Military, Commercial, Civil, Other Applications), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs)),End-Use (OEM, Aftermarket) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Northrop- Grumman Corporation, Thales SA, Flir Systems Inc., Safran, Elbit Systems Ltd., Lockheed Martin Corporation, Leonardo Spa, L3Harris Technologies Inc., Hensoldt AG, Collins Aerospace, Israel Aerospace Industries, Rafael Advanced Defense Systems Ltd., Kappa Optronics GmbH, Stark Aerospace Inc., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is airborne optronics?Airborne optronics, in the context of aviation and aerospace, refer to optical and electro-optical systems and technologies used on aircraft. These systems utilize light and electro-optical sensors to perform various functions such as surveillance, targeting, navigation, and reconnaissance. Airborne optronics play a critical role in enhancing situational awareness, improving targeting accuracy, and enabling visual data collection in both military and civilian aircraft.

How big is Airborne Optronics Market?The Global Airborne Optronics Market is anticipated to be USD 6.2 billion by 2033. It is estimated to record a steady CAGR of 12.5% in the Forecast period 2024 to 2033. It is likely to total USD 1.9 billion in 2023.

What factors are driving the growth of the airborne optronics market?The growth of the market can be attributed to increasing defense budgets, rising demand for unmanned aerial vehicles (UAVs), and the need for advanced surveillance and targeting systems.

Which regions are witnessing significant growth in the airborne optronics market?Regions with high military expenditures, such as North America and Europe, are experiencing substantial growth due to the demand for advanced optronic systems.

What are the anticipated trends in the airborne optronics market in the coming years?Anticipated trends include the integration of artificial intelligence (AI) for enhanced target recognition, miniaturization of optronic systems, and increased use of multi-sensor configurations.

-

-

- Northrop- Grumman Corporation

- Thales SA

- Flir Systems Inc.

- Safran

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Leonardo Spa

- L3Harris Technologies Inc.

- Hensoldt AG

- Collins Aerospace

- Israel Aerospace Industries

- Rafael Advanced Defense Systems Ltd.

- Kappa Optronics GmbH

- Stark Aerospace Inc.

- Other Key Players