Global Air Suspension Market Size, Share, Growth Analysis By Technology (Electronic Controlled, Non-Electronic Controlled), By Component (Air Spring, Tank, Solenoid Valve, Shock Absorber, Air Compressor, Electronic Control Unit (ECU), Height & Pressure Sensor, Others), By Vehicle Type (Light Commercial Vehicle (LCV), Trucks, Bus), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169587

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

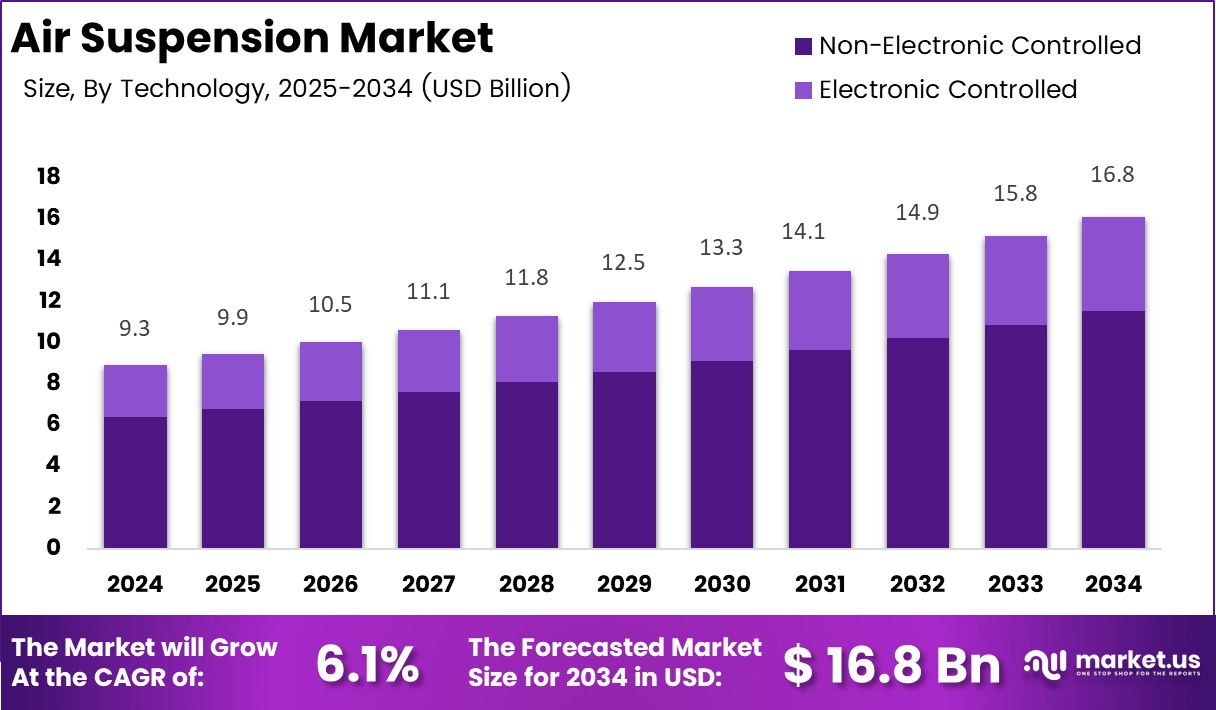

The Global Air Suspension Market size is expected to be worth around USD 16.8 billion by 2034, from USD 9.3 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Air Suspension Market represents a critical shift toward advanced ride-control systems that enhance comfort, stability, and load management across commercial vehicles, passenger cars, and rail applications. The market continues expanding as OEMs prioritize efficiency improvements, lightweight chassis integration, and reduced vibration, supporting long-term adoption across global transportation ecosystems.

Demand rises steadily as fleet owners embrace systems that improve vehicle handling and extend operational life. Moreover, rising urban freight movement accelerates the need for adaptive suspension solutions, especially in heavy-duty fleets seeking lower maintenance costs and improved uptime. This transition strengthens market positioning as logistics networks modernize.

Growth accelerates as governments invest in safer and more energy-efficient transportation. Regulatory pressure promoting reduced emissions encourages manufacturers to adopt lightweight materials and electronically controlled suspension modules. Additionally, infrastructure programs stimulate vehicle upgrades, pushing fleets toward smarter suspension systems with improved load-leveling capabilities.

Opportunities emerge as digital technologies enter the Air Suspension Market. Predictive diagnostics, enhanced telematics, and real-time monitoring create value for operators looking to reduce downtime and optimize vehicle health. These capabilities support better lifecycle management, further encouraging adoption across both on-road and off-road vehicle categories.

Furthermore, innovation in material science drives new designs that reduce weight while maintaining durability. This enables manufacturers to improve fuel efficiency and support the shift toward electric vehicle platforms requiring optimized ride-height and stability management. The evolution of adaptive and semi-active systems reinforces the market’s steady momentum.

In addition, the industry benefits from continuous advancements in rail suspension technologies. According to product specifications, air spring assemblies engineered for railway applications now offer capacities of 180 KN, 160 KN, 140 KN, and 120 KN, supporting both tare and full-load conditions. These capabilities enhance passenger comfort and system reliability across rail fleets.

Moreover, technological integration expands adoption in trailer applications. According to engineering updates, air suspension systems incorporated into Hindalco’s new aluminum trailer enable extended hub greasing intervals of up to 4 lakh kilometers or 4 years, highlighting significant maintenance savings. These improvements underscore strong market traction driven by performance, efficiency, and lifecycle benefit

Key Takeaways

- The Global Air Suspension Market reached USD 9.3 billion in 2024 and is expected to hit USD 16.8 billion by 2034, reflecting a strong growth outlook.

- The market grows at a steady 6.1% CAGR from 2025 to 2034, driven mainly by premium and commercial vehicle adoption.

- The Technology segment is led by Electronic Controlled systems with a dominant 68.6% share in 2024.

- Air Spring remains the leading Component segment with a notable 23.4% market contribution in 2024.

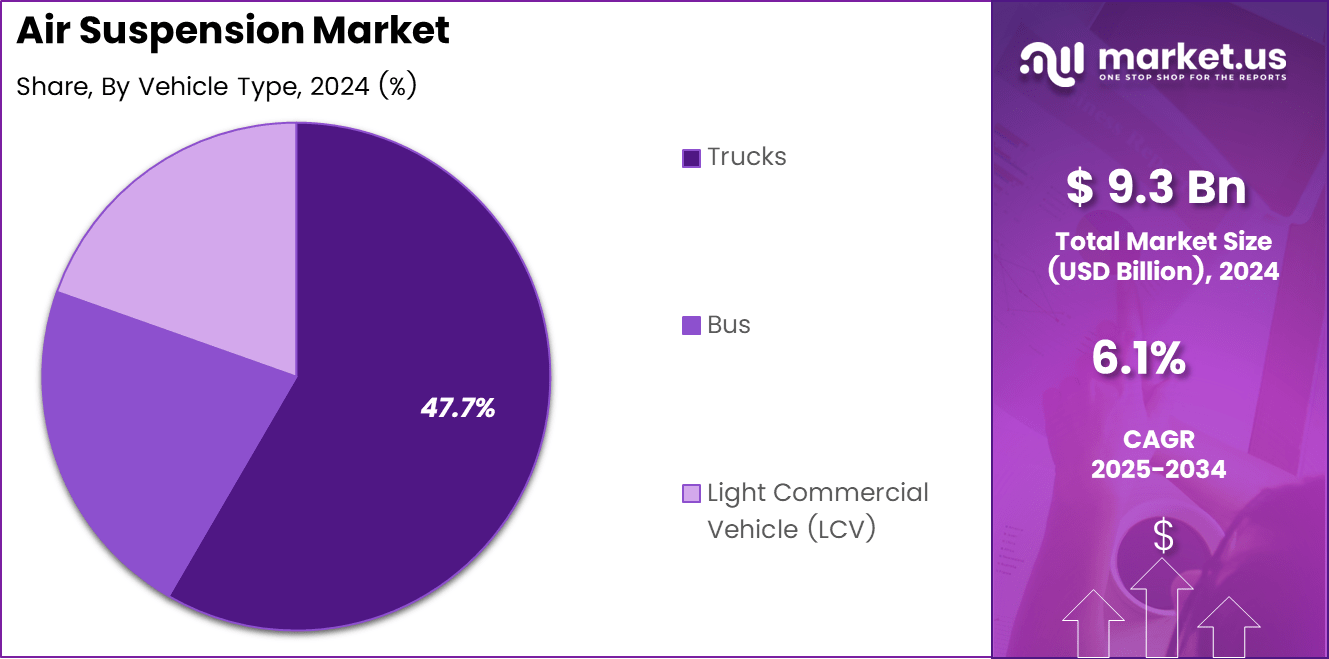

- Trucks represent the largest Vehicle Type segment, accounting for a substantial 47.7% share in 2024.

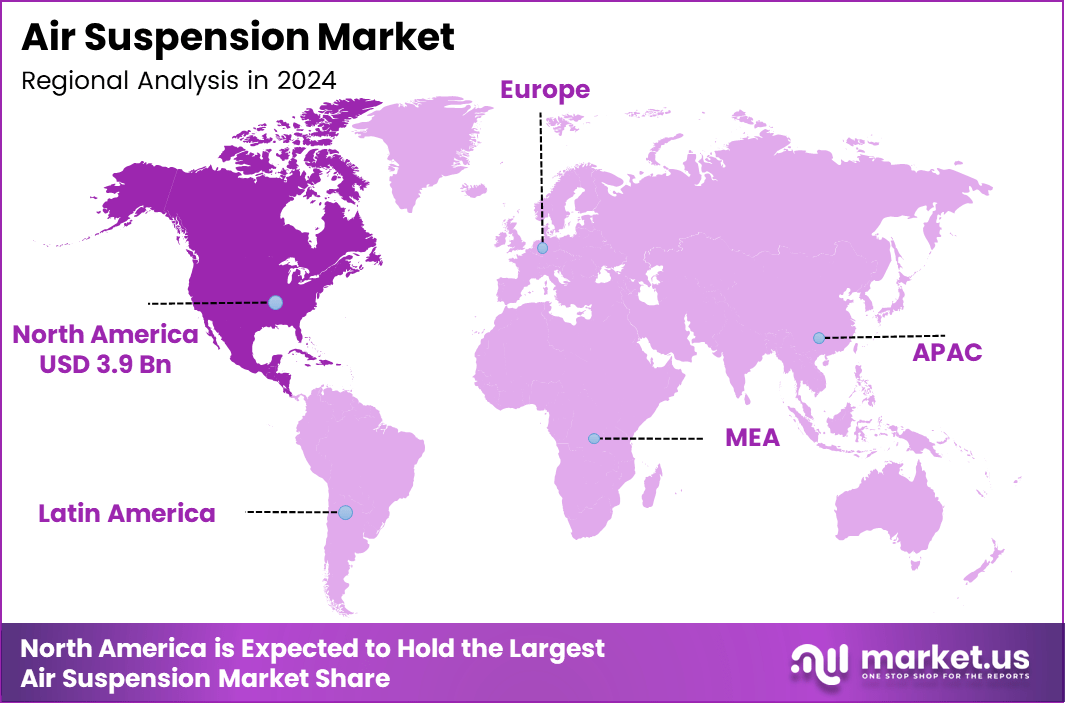

- North America leads the global market with a strong 42.8% share valued at USD 3.9 billion.

- Asia Pacific emerges as the fastest-growing region, driven by rising electric bus adoption and logistics expansion.

- Europe maintains a stable demand with the continued adoption of lightweight, efficiency-driven suspension technologies.

Technology Analysis

Electronic control dominates with 68.6% due to its precision, adaptive handling, and improved ride stability.

In 2024, Electronic Controlled held a dominant market position in the By Technology Analysis segment of the Air Suspension Market, with a 68.6% share. This segment grows strongly as OEMs adopt electronically managed systems that enhance ride comfort and reduce vehicle vibrations. Furthermore, increased demand for premium commercial mobility supports advanced suspension technologies.

Non-electronic controlled systems expand steadily as manufacturers target cost-sensitive fleets. These systems remain relevant because of their mechanical simplicity, reduced maintenance layers, and wider compatibility with older vehicle platforms. Additionally, the rising production of medium-duty vehicles in emerging economies continues to sustain the installation of conventional air suspension mechanisms.

Component Analysis

Air Spring dominates with 23.4% due to its essential function in maintaining vehicle height and supporting dynamic loads.

In 2024, Air Spring held a dominant market position in the By Component Analysis segment of the Air Suspension Market, with a 23.4% share. This component rises in adoption as fleets prioritize better load distribution, improved comfort, and reduced structural stress during long-haul operations across varying road conditions.

Tank components register consistent adoption as they store compressed air, critical for smooth suspension movement. They support optimized pressure management and stable vehicle posture. Their relevance increases further as commercial vehicles integrate multi-air-circuit systems for improved ride-level customization and overall durability.

Solenoid Valve usage grows as vehicles incorporate precision air-flow control. These valves regulate actuation speed and pressure, enabling responsive suspension adjustments. Their integration intensifies with the rising demand for electronically managed chassis systems and optimized on-road stability across commercial fleets.

Shock Absorber components strengthen market presence as they complement air springs by controlling rebound and damping. Their importance grows with the expansion of heavy-duty trucks and buses, where shock loads are higher. Improved shock absorber technology enables better comfort and extended component lifespan.

Air Compressor adoption increases as they power the entire suspension mechanism. Fleets prefer efficient compressors to reduce energy consumption and maintain consistent air pressure. Their role becomes crucial in vehicles requiring frequent height adjustments during loading and unloading cycles.

Electronic Control Unit (ECU) demand surges as smart suspensions expand. ECUs manage air pressure, adjust damping, and maintain stability in real time. Their integration grows with connected vehicle architectures and predictive load-sensing capabilities.

Height & Pressure Sensor installations rise as fleets emphasize safety and optimized vehicle posture. These sensors ensure accurate feedback for dynamic adjustments, reducing wear on tires and chassis components. Their adoption increases in multi-axle trucks and buses operating under varying loads.

Other components, such as fittings, tubing, and mounts, continue to support system reliability. They expand gradually as aftermarket maintenance cycles increase globally. Their role stays vital in ensuring efficient air distribution and long-term suspension performance.

Vehicle Type Analysis

Trucks dominate with 47.7% due to high load movement and demand for stability under varying cargo volumes.

In 2024, Trucks held a dominant market position in the By Vehicle Type Analysis segment of the Air Suspension Market, with a 47.7% share. The segment expands rapidly because heavy-duty logistics require better load cushioning, reduced cargo damage, and enhanced fuel efficiency made possible through advanced air suspension setups.

Light Commercial Vehicles grow steadily as manufacturers integrate air suspension for improved ride quality, better maneuverability, and comfort during urban transport. Increasing e-commerce logistics and last-mile operations continue to push adoption among LCV fleets seeking stable and smoother mobility performance.

Bus applications rise consistently as transit operators prioritize passenger comfort and safety. Air suspension enhances ride experience, accessibility, and chassis stability, especially in long-distance and city bus fleets. Additionally, growing investments in public transport modernization support wider integration across electric and low-floor buses.

Key Market Segments

By Technology

- Electronic Controlled

- Non-Electronic Controlled

By Component

- Air Spring

- Tank

- Solenoid Valve

- Shock Absorber

- Air Compressor

- Electronic Control Unit (ECU)

- Height & Pressure Sensor

- Others

By Vehicle Type

- Light Commercial Vehicle (LCV)

- Trucks

- Bus

Drivers

Rising Deployment of Electronically Controlled Air Suspension Drives Market Growth

The rising deployment of electronically controlled air suspension systems strengthens the market as automakers focus on improving stability and vehicle dynamics across premium and commercial fleets. This shift creates a strong preference for smarter load-adaptive systems that improve control during braking, cornering, and high-speed operations. The adoption trend expands with growing fleet modernization programs.

Increasing OEM integration of lightweight composite air springs further drives market growth by supporting better energy efficiency and reduced CO₂ emissions. Lightweight materials help manufacturers meet regulatory emission targets while maintaining durability. This transition supports electric and hybrid vehicle platforms where weight optimization remains a priority for improving battery range.

Expanding demand for advanced ride-comfort systems in electric buses and long-haul trucks enhances market potential. Fleet operators prefer smooth, vibration-free travel experiences to reduce driver fatigue and improve passenger comfort. Electrification pushes manufacturers to use air suspension to manage heavier battery loads and ensure stable vehicle dynamics across varied terrains.

Government-backed road safety programs accelerate the adoption of stability-enhancing suspension technologies. Regulatory bodies promote safer commercial mobility by encouraging features that reduce rollover risks and improve braking efficiency. As countries implement stricter road-safety requirements, air suspension becomes a preferred solution for compliance and operational safety improvements.

Restraints

High Maintenance Complexity Associated with Compressor Units Restrains Market Growth

High maintenance complexity associated with compressor units and electronically controlled valves acts as a major restraint. These components require periodic servicing and advanced diagnostic tools, adding downtime and operational costs for fleet operators. Such complexity limits rapid adoption among price-sensitive vehicle categories.

Limited aftermarket expertise for calibration of height sensors and ECU-based leveling systems further restricts market expansion. Incorrect calibration affects ride height, comfort, and load stability, leading operators to rely heavily on OEM-authorized service centers. This situation increases service bottlenecks in developing regions with fewer trained technicians.

Cost barriers also slow the shift from traditional steel-spring suspensions to advanced air systems. Fleets operating on tight margins find it challenging to justify higher upfront investment despite long-term performance benefits. This creates a slower adoption curve, especially in small logistics fleets and regional transport operators across emerging markets.

Growth Factors

Integration of AI-Driven Predictive Diagnostics Creates Growth Opportunities

Integration of AI-driven predictive diagnostics creates strong opportunities for proactive suspension health monitoring. These systems analyze compressor load, air leakage, and sensor accuracy to prevent unexpected breakdowns. Fleets benefit from reduced maintenance costs and better asset utilization, encouraging adoption of intelligent suspension solutions.

Increasing use of modular suspension platforms in autonomous delivery vehicles and robo-shuttles expands new revenue streams. Modular designs enable faster assembly, easier scalability, and flexible configuration for varied payload requirements. As last-mile automation grows, manufacturers expect higher demand for compact, lightweight air suspension units.

The development of electric and autonomous mobility ecosystems supports the broader commercialization of advanced suspension technologies. These platforms depend on precise ride-height control, stability management, and passenger comfort, creating favorable conditions for air suspension integration.

Emerging Trends

Adoption of Cloud-Connected Suspension Analytics Shapes Market Trends

Adoption of cloud-connected suspension analytics emerges as a major trend as fleets seek real-time performance optimization. Cloud dashboards monitor air pressure, sensor health, and leveling response, enabling data-driven decision-making. This trend aligns with the rising use of connected fleet management platforms.

Rising shift toward adaptive air suspension in luxury EVs drives aerodynamic ride-height control trends. Automakers use lower modes to boost efficiency at highway speeds and raise modes for rough terrain. This enhances range, comfort, and performance, making adaptive air suspension a core feature in premium electric models.

Expansion of smart sensor ecosystems using LiDAR and inertial modules supports precision leveling. These sensors enable immediate response to road variations, improving stability and passenger comfort. Their integration reflects the movement toward highly automated chassis systems.

Movement toward sustainable air spring materials grows as manufacturers adopt circular manufacturing practices. Recyclable elastomers, renewable composites, and low-impact production processes gain attention, aligning the industry with global sustainability goals and future regulatory expectations.

Regional Analysis

North America Leads the Air Suspension Market with a 42.8% Share Valued at USD 3.9 Billion

North America held a dominant position in the Air Suspension Market, accounting for a strong 42.8% share and reaching a valuation of USD 3.9 billion. The region benefited from high adoption of electronically controlled suspension systems in premium vehicles and commercial fleets. Strong regulatory emphasis on vehicle safety and ride stability further strengthened market penetration, supported by expanding electrified truck and bus platforms across the US and Canada.

Europe Air Suspension Market Trends

Europe continued to experience steady demand driven by the presence of advanced automotive manufacturing hubs and strong focus on vehicle efficiency. Increasing replacement needs for air springs and shock absorbers in aging commercial fleets accelerated market expansion. Additionally, EU sustainability policies supported lightweight suspension technologies across long-haul trucks and luxury vehicles.

Asia Pacific Air Suspension Market Trends

Asia Pacific emerged as a fast-growing region supported by rising commercial vehicle production and demand for enhanced ride comfort in electric buses. Expanding logistics networks across China, India, and Southeast Asia stimulated the installation of modern suspension systems. Economic development, coupled with government-led fleet modernization programs, further encouraged the adoption of electronically controlled air suspension.

Middle East and Africa Air Suspension Market Trends

The Middle East and Africa saw gradual market expansion owing to increasing investments in heavy-duty trucks and long-distance passenger transport. Infrastructure development projects accelerated demand for advanced suspension systems to ensure improved stability and durability. Adoption also increased among luxury vehicle owners seeking smoother ride performance under harsh climatic and road conditions.

Latin America Air Suspension Market Trends

Latin America recorded steady growth supported by rising commercial fleet upgrades in Brazil, Mexico, and Argentina. The region’s focus on improving freight efficiency and passenger mobility encouraged OEMs to integrate air suspension technologies. Economic recovery and government-backed public transportation improvements further supported market penetration across urban bus fleets.

United States Air Suspension Market Trends

The US remained a key contributor within North America as fleet operators increasingly adopted electronically controlled air suspension for safety and load handling benefits. Growth was supported by rising electric truck production, demand for smooth long-haul transport, and regulatory emphasis on reducing vibration-related wear. Continuous infrastructure spending also enhanced adoption among commercial and passenger vehicles across the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Air Suspension Company Insights

ZF Friedrichshafen AG focuses on enhancing electronically controlled suspension technologies, enabling improved ride stability for long-haul trucks and luxury passenger vehicles. Its continued emphasis on integrated chassis-control systems supports market growth as OEMs shift toward intelligent mobility solutions.

Continental AG advances lightweight air spring modules and electronic leveling units designed to optimize energy efficiency and improve load-handling performance. Its strategic focus on smart suspension products aligns with increasing demand for fuel-saving components in electric and hybrid fleets.

ThyssenKrupp AG contributes to market expansion through its precision-engineered shock absorbers and air-spring technologies tailored for heavy-duty commercial vehicles. The company’s focus on durability and lifecycle performance strengthens its position among fleet operators seeking reduced maintenance downtime.

Cummins-Meritor Inc. leverages its driveline and axle expertise to integrate advanced air suspension assemblies that enhance vehicle stability and payload management. Its development of modular and weight-optimized systems supports OEM adoption across buses, trailers, and vocational trucks.

Beyond the top contributors, companies such as Mando Corporation, SAF-Holland SE, Hendrickson USA, Firestone Industrial Products, Vibracoustic SE, and BWI Group reinforce competitive momentum through product enhancements and expansions into emerging markets. Their combined efforts in improving air spring durability, increasing electronic control capability, and supporting electric vehicle platforms are projected to accelerate overall market development. Collectively, these manufacturers are shaping the transition toward safer, smoother, and more efficient suspension technologies worldwide.

Top Key Players in the Market

- ZF Friedrichshafen AG

- Continental AG

- ThyssenKrupp AG

- Cummins-Meritor Inc.

- Mando Corporation

- SAF-Holland SE

- Hendrickson USA, L.L.C.

- Firestone Industrial Products Company, LLC

- Vibracoustic SE

- BWI Group

Recent Developments

- In Jul 2024, SI Air Springs, a subsidiary of the USD 3 billion TVS Mobility Group, announced the acquisition of Roberto Nuti Group, a Bologna based multinational manufacturer of suspension systems for heavy vehicles in the aftermarket. The acquisition strengthens SI Air Springs’ global footprint and reinforces its leadership in air spring solutions for the automotive and rail sectors.

- In Jun 2024, Nidec announced that its China based subsidiary Nidec Motor (Dalian) Limited developed a new automotive air suspension motor. The development supports advances in ride comfort, vehicle stability, and next generation suspension technologies for modern automobiles.

Report Scope

Report Features Description Market Value (2024) USD 9.3 billion Forecast Revenue (2034) USD 16.8 billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Electronic Controlled, Non-Electronic Controlled), By Component (Air Spring, Tank, Solenoid Valve, Shock Absorber, Air Compressor, Electronic Control Unit (ECU), Height & Pressure Sensor, Others), By Vehicle Type (Light Commercial Vehicle (LCV), Trucks, Bus) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ZF Friedrichshafen AG, Continental AG, ThyssenKrupp AG, Cummins-Meritor Inc., Mando Corporation, SAF-Holland SE, Hendrickson USA, L.L.C., Firestone Industrial Products Company, LLC, Vibracoustic SE, BWI Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ZF Friedrichshafen AG

- Continental AG

- ThyssenKrupp AG

- Cummins-Meritor Inc.

- Mando Corporation

- SAF-Holland SE

- Hendrickson USA, L.L.C.

- Firestone Industrial Products Company, LLC

- Vibracoustic SE

- BWI Group