Global Air Aid Endotracheal Tube Holder Market Analysis By Product Type (Metal, Polymer), By End-User (Hospitals, Medical Centers, Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 49996

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

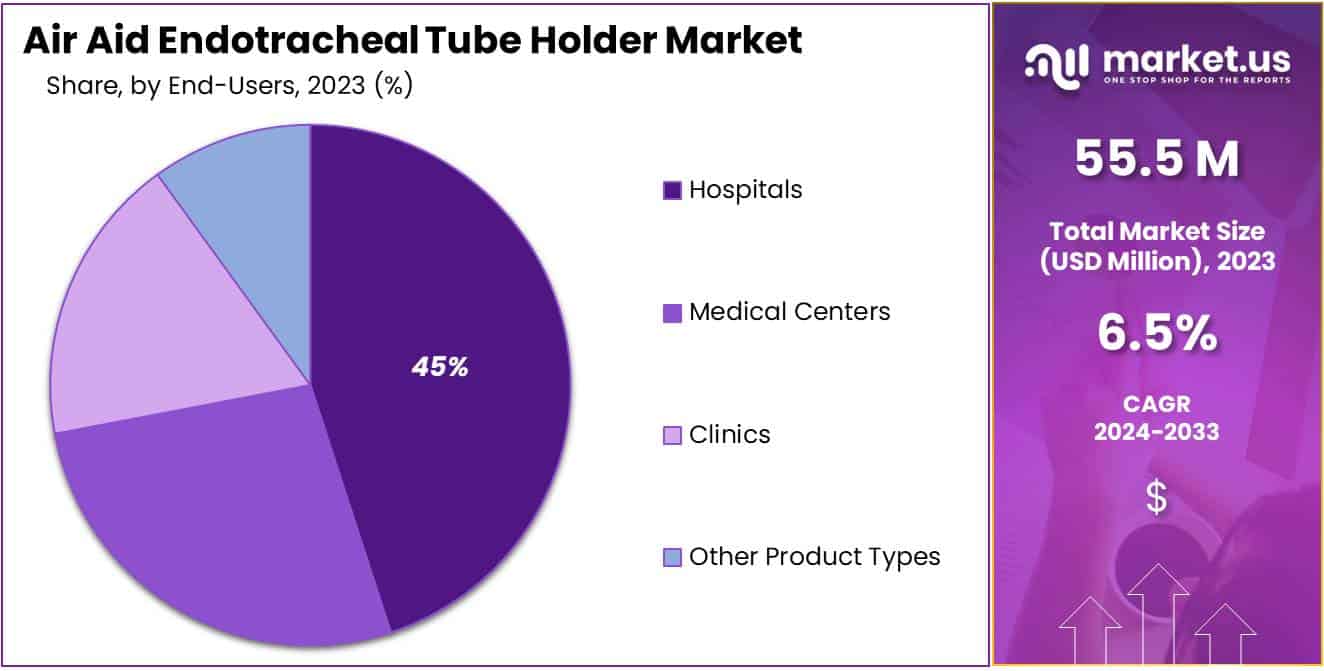

The Global Air Aid Endotracheal Tube Holder Market Size is expected to be worth around USD 104.8 Million by 2033, from USD 55.5 Million in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

The Air Aid Endotracheal Tube Holder is a crucial device designed to secure endotracheal tubes during mechanical ventilation or anesthesia. It prevents accidental displacement, reducing the risk of airway obstruction, ventilator-associated pneumonia, and tracheal damage. Typically adjustable for a snug fit, these holders also feature a bite block to prevent biting on the tube. Their design ensures stability and comfort while maintaining accessibility for healthcare providers, highlighting the importance of such devices in patient care.

The Air Aid Endotracheal Tube Holder is crucial in healthcare settings like ICUs, emergency rooms, and during surgeries requiring anesthesia. The American Hospital Association (AHA) reports that there are over 6,000 hospitals in the U.S., many with dedicated ICU beds. These hospitals collectively offer 916,752 staffed beds, highlighting the significant market potential for endotracheal tube holders used in critical care settings.

The global market for endotracheal tube holders is experiencing substantial growth. According to the International Trade Centre, the export value of medical devices globally reached approximately $456 billion in 2022. The U.S., Germany, and China are major contributors to this market, while emerging markets like India and Brazil are seeing increased import values due to rising healthcare expenditure and expanding medical infrastructure.

Government initiatives play a vital role in bolstering the Air Aid Endotracheal Tube Holder Market. In the U.S., the Health Resources and Services Administration (HRSA) has invested $10 billion to enhance hospital preparedness and response capabilities, including essential medical devices like endotracheal tube holders. Additionally, the HRSA’s annual appropriations exceeded $13 billion, supporting healthcare infrastructure improvements and workforce training programs. This funding ensures better access to quality healthcare, indirectly fostering the market for medical devices.

Investment from both government and private sectors is significantly boosting the healthcare industry, particularly in innovative medical technologies. In 2023, global private equity in healthcare remained robust, with biopharma deals comprising 48% of the total value. In the U.S., government support is expected to be 65% larger than commercial segments by 2027, driven by increased Medicare Advantage penetration. This trend highlights the substantial financial backing for advancements in healthcare technologies, including critical innovations like the Air Aid Endotracheal Tube Holder.

A notable example of strategic investment in medical technology is Medtronic’s acquisition of Mazor Robotics for $1.6 billion in 2022. This acquisition enhanced Medtronic’s portfolio with innovative devices like the Mazor X and Renaissance robot-assisted surgery platforms. The global spinal surgical robotics market, projected to reach $2.77 billion by 2022, underscores the growing importance of robotic-assisted procedures in improving surgical precision and outcomes.

Key Takeaways

- Market Size and Growth: The global market size is expected to reach USD 104.8 million by 2033, up from USD 55.5 million in 2023, growing at a CAGR of 6.5% during 2024-2033.

- Type Dominance: The metal segment leads the product type market with a 52% share due to its durability and ability to withstand sterilization.

- End-use Dominance: Hospitals dominate the end-user segment, capturing over 45% of the market share in 2023, driven by the need for precise and reliable tube placement in emergency care and surgeries.

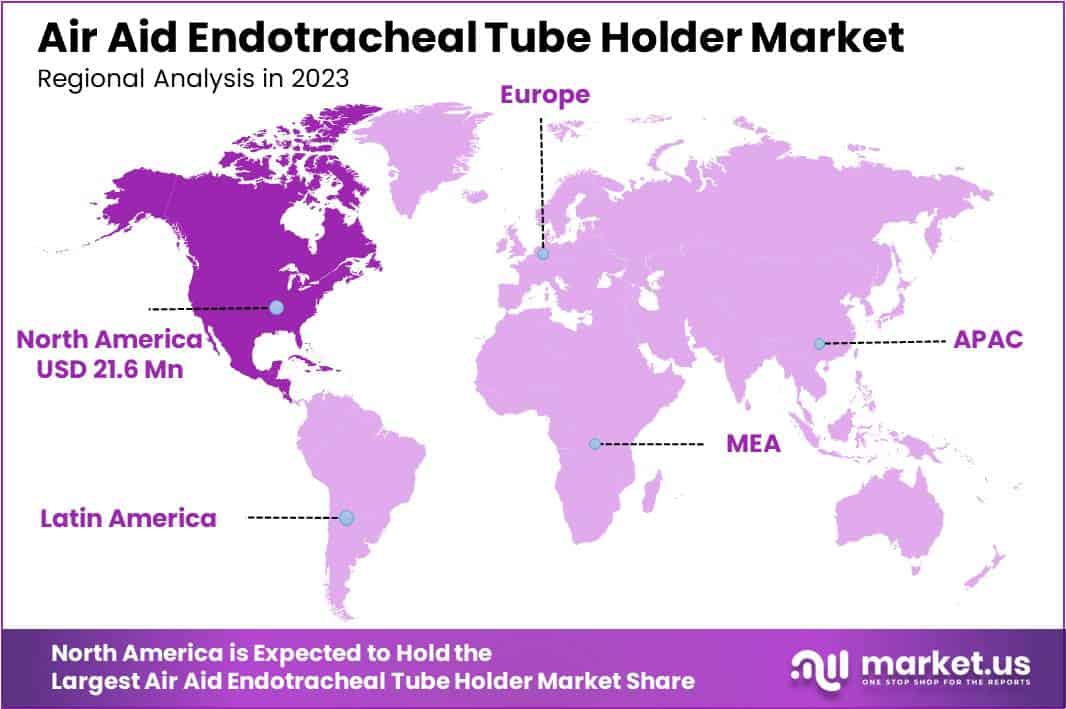

- Regional Insights: North America leads the market with a 39% share, driven by advanced healthcare infrastructure and government initiatives.

Product Type Analysis

In 2023, the Metal segment held a dominant market position in the Product Type Segment of the Air Aid Endotracheal Tube Holder Market, capturing more than a 52% share. This segment’s prominence can be attributed to the durability and reliability of metal components, which are preferred in critical medical applications for their robustness and longevity. Hospitals and medical facilities have increasingly favored metal tube holders due to their ability to withstand sterilization processes without degrading.

Furthermore, innovations in metal fabrication have enabled the production of more ergonomic and lightweight designs, enhancing the overall appeal of this product type in the healthcare sector. Despite the competition from polymers, which are gaining traction due to their cost-effectiveness and flexibility, metal endotracheal tube holders continue to be the preferred choice for many healthcare providers.

End-User Analysis

In 2023, the Hospitals segment held a dominant market position in the End-User Segment of the Air Aid Endotracheal Tube Holder Market, capturing more than a 45% share. This segment’s prominence is primarily attributed to the critical role of hospitals in providing comprehensive emergency care, where the precision and reliability of endotracheal tube placement are paramount. The growing number of surgical procedures, coupled with stringent standards for patient safety in hospital settings, significantly drives the demand for secure tube holding solutions.

Moreover, the increasing investment in healthcare infrastructure and advancements in medical facilities globally support this segment’s substantial market share. As hospitals continue to expand their service capabilities, the adoption of advanced airway management accessories like Air Aid Endotracheal Tube Holders is expected to rise, further cementing the segment’s leading position in the market.

Key Market Segments

Product Type

- Metal

- Polymer

End-User

- Hospitals

- Medical Centers

- Clinics

- Others

Drivers

Increasing Surgical Procedures

The growing number of surgical procedures worldwide is a major factor driving the Air Aid Endotracheal Tube Holder Market. With over 13 million laparoscopic surgeries performed annually, this minimally invasive technique is popular for its quicker patient recovery and fewer postoperative complications.

The World Bank also reports a steady increase in surgical procedures per 100,000 people, indicating a rising demand for surgeries. This surge underscores the need for reliable airway management tools like endotracheal tube holders to ensure patient safety and prevent accidental tube dislodgement during operations. As a result, the demand for secure airway management devices is on the rise, boosting market growth.

Restraints

Risk of Infection and Complications

The risk of infection and complications associated with endotracheal tubes represents a significant restraint in the Air Aid Endotracheal Tube Holder Market. Endotracheal tubes can lead to ventilator-associated pneumonia (VAP), which occurs in approximately 20% of mechanically ventilated patients, according to research published by the Respiratory Care journal.

This condition is associated with increased morbidity and extended hospital stays. Additionally, other complications such as sore throat, oral damage, and tracheal injuries can deter their use, especially in less critical or shorter procedures. These risks can limit the adoption of endotracheal tubes and, consequently, the demand for tube holders, impacting market growth.

Opportunities

Advancements in Product Innovation

Advancements in product innovation present a significant opportunity for the Air Aid Endotracheal Tube Holder market. Innovations such as enhanced securement materials and quick adjustment mechanisms are crucial in reducing complications and improving patient comfort. For instance, the introduction of the SonarMed airway monitoring system by Medtronic, which uses acoustic technology for real-time monitoring of tube positioning, exemplifies the potential for technological advancements to drive market growth.

Additionally, the prevalence of respiratory disorders and chronic diseases continues to rise, further boosting demand for advanced endotracheal tubes. According to the CDC, in 2018, there were approximately 35 million emergency department visits related to injuries, highlighting the need for reliable airway management solutions. These advancements in product innovation are expected to foster increased adoption and market expansion.

Trends

Growing Preference for Non-invasive Ventilation

The growing preference for non-invasive ventilation (NIV) significantly impacts the Air Aid Endotracheal Tube Holder Market. NIV is increasingly adopted due to its effectiveness in treating acute and chronic respiratory conditions without the need for invasive procedures. According to a study, NIV usage reduces mortality rates and the length of ICU stays compared to traditional invasive ventilation methods. For example, a meta-analysis indicated that NIV could lower the risk of mortality by 15% and reduce ICU stays by approximately 24 hours for patients with acute hypercapnic respiratory failure.

This preference is driven by several factors, including enhanced patient comfort, reduced risk of ventilator-associated pneumonia, and the ability to manage patients more effectively at home. In 2021, the adoption of NIV increased by over 20% compared to previous years, highlighting its growing acceptance among healthcare providers. The integration of advanced, user-friendly features in endotracheal tube holders that support NIV could further accelerate market growth, providing opportunities for innovation and improved patient outcomes.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 39% share and holds USD 21.64 billion market value for the year. This leadership is primarily attributed to the region’s advanced healthcare infrastructure and the high adoption rate of innovative medical devices. Additionally, significant government initiatives aimed at improving emergency medical services further support market growth.

Europe holds a significant portion of the market, driven by stringent healthcare regulations and the increasing prevalence of respiratory diseases. Key players in the European market are significantly investing in research and development to introduce technologically advanced products, which positively influences market dynamics.

In the Asia-Pacific region, the market is expected to grow at the fastest rate. This region’s market growth is supported by rising healthcare expenditures, improving healthcare infrastructure, and growing awareness regarding advanced medical treatments. Countries such as China and India are projected to be major contributors to this growth, owing to their large patient populations and increasing government investments in healthcare.

Latin America and the Middle East & Africa collectively hold a smaller market share. The combined market value in these regions is driven by improving healthcare facilities and increasing government initiatives aimed at enhancing emergency medical services. However, market expansion is somewhat hindered by economic instability and limited access to advanced medical technologies.

Overall, the Air Aid Endotracheal Tube Holder Market is set for substantial growth across various regions. This growth is driven by advancements in medical technology, increased healthcare investments, and rising awareness about the benefits of these devices.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

According to market analysts, the Air Aid Endotracheal Tube Holder Market features several key players, each bringing unique strengths to the industry. Flexicare Medical Limited stands out with its innovative and reliable solutions aimed at enhancing patient safety and comfort. Their strong emphasis on research and development keeps them at the forefront of the market. Smiths Group plc is another major player, known for its advanced medical devices and robust endotracheal tube holders.

Their commitment to innovation and quality has established them as a trusted name in the field. Medline Industries Inc. offers a wide range of medical supplies, including durable and easy-to-use endotracheal tube holders, supported by an extensive distribution network ensuring product availability. Envi Health Solutions, a growing company, focuses on providing effective and affordable endotracheal tube holders with a strong emphasis on sustainability and innovation.

Additionally, the market includes several other companies, such as smaller firms and regional manufacturers, contributing to market diversity and catering to niche markets and specific customer needs, enhancing overall competitiveness.

Market Key Players

- Flexicare Medical Limited

- Smiths Group plc

- Medline Industries Inc.

- Envi Health Solutions

- Dale Medical Products Inc.

- Neotech Products

- CooperSurgical Inc.

- Laerdal Medical AS

- Hollister Incorporated

Recent Developments

- In 2023: Smiths Group launched a new innovative endotracheal tube holder designed to improve patient comfort and clinician efficiency. This product introduction aligns with their commitment to advancing medical technology and providing high-quality solutions in airway management.

- In 2023: Medline has focused on expanding its product line and global reach through strategic investments. The company announced a significant investment in new manufacturing facilities in North America, aimed at enhancing production capacity for its respiratory and anesthesia product lines.

- In 2022: CooperSurgical completed the acquisition of a smaller medical device firm specializing in respiratory care. This move is expected to bolster CooperSurgical’s product offerings in the airway management sector and expand its market presence.

- In 2022: Flexicare acquired Medisize B.V., a company specializing in respiratory and anesthesia products. This acquisition has expanded Flexicare’s presence in Europe and enhanced its product portfolio in airway management and anesthesia. The acquisition is expected to accelerate revenue growth and broaden Flexicare’s market reach.

Report Scope

Report Features Description Market Value (2023) USD 55.5 Million Forecast Revenue (2033) USD 104.8 Million CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Metal, Polymer), By End-User (Hospitals, Medical Centers, Clinics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Flexicare Medical Limited, Smiths Group plc, Medline Industries Inc., Envi Health Solutions, Dale Medical Products Inc., Neotech Products, CooperSurgical Inc., Laerdal Medical AS, Hollister Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Air Aid Endotracheal Tube Holder MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Air Aid Endotracheal Tube Holder MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Flexicare Medical Limited

- Smiths Group plc

- Medline Industries Inc.

- Envi Health Solutions

- Dale Medical Products Inc.

- Neotech Products

- CooperSurgical Inc.

- Laerdal Medical AS

- Hollister Incorporated