Global AI Workload Management Market Size, Industry Analysis Report By Component (Software, Services (Integration & Deployment, Training & Consulting, Managed Services)), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Technology (Machine Learning, Deep Learning, Natural Language Processing, Others), By End-user (BFSI, Healthcare, Retail and E-commerce, Telecommunications, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155854

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Regional Insights

- Key Benefits and Influencing Factors

- Top Growth Factors

- Key Trends and Innovations

- By Component: Software (70.3%)

- By Deployment: Cloud (60.4%)

- By Organization Size: Large Enterprises (65.7%)

- By Technology: Deep Learning (61.4%)

- By End-User: BFSI (25.1%)

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

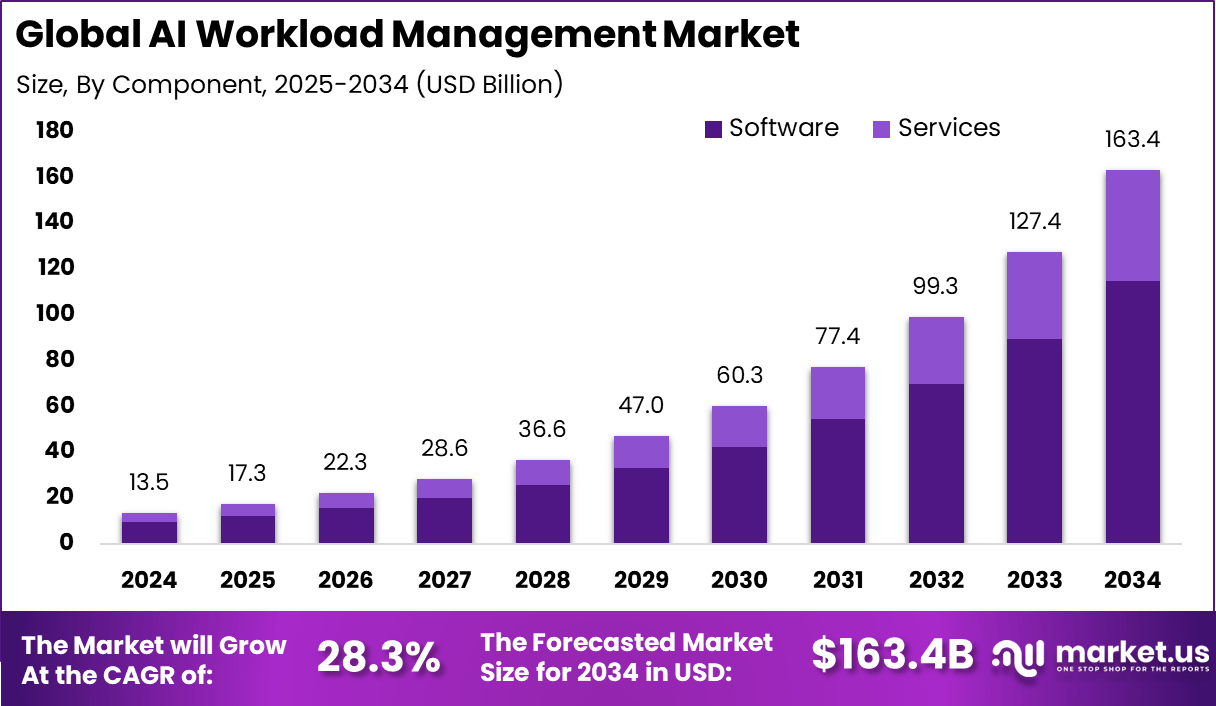

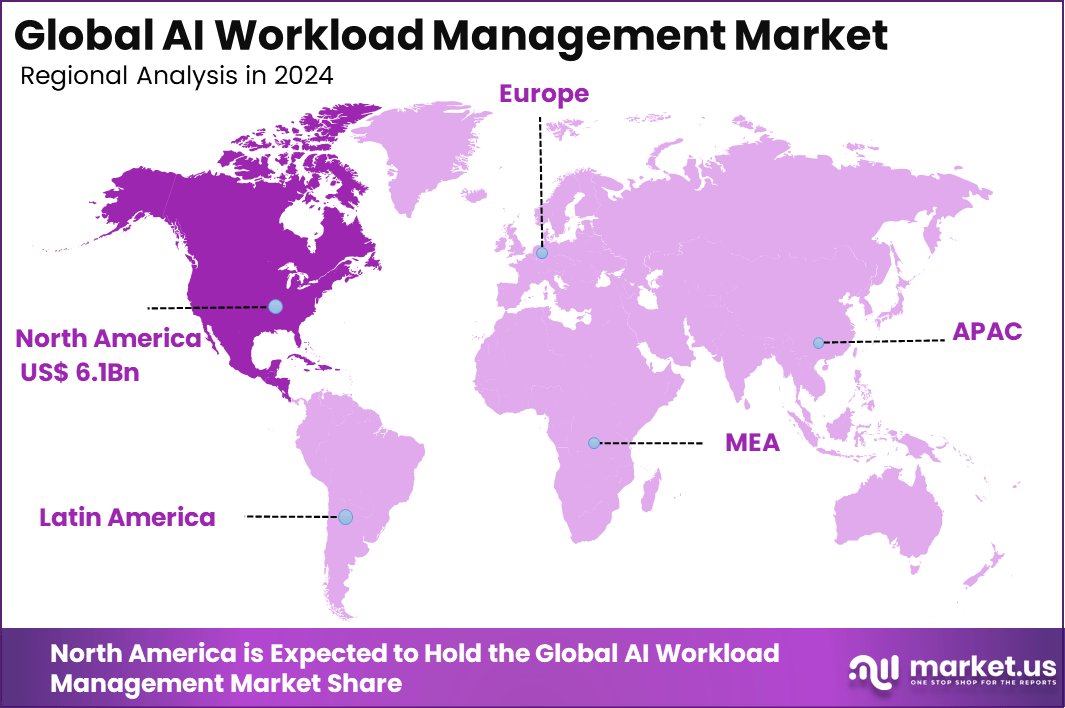

The Global AI Workload Management Market size is expected to be worth around USD 163.4 Billion By 2034, from USD 13.5 billion in 2024, growing at a CAGR of 28.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 45.7% share, holding USD 6.1 Billion revenue.

The AI workload management market refers to systems and tools designed to orchestrate and optimize the distribution of AI tasks, including training and inference, across computing infrastructure. These systems aim to ensure efficient use of resources, reduce latency, and maintain operational consistency in hybrid or multi‑cloud environments.

Top driving factors fueling growth in this market include the explosive rise of AI applications which demand significant computing power and cost-effective resource utilization. The economic necessity to optimize hardware use and reduce operational expenditures is paramount. Additionally, organizations are increasingly adopting hybrid and multi-cloud strategies that require intelligent workload management to distribute AI workloads seamlessly across different environments.

According to Telehouse, enterprises are increasingly dedicating a substantial share of their infrastructure to AI workloads. Between 16% and 20% of overall workloads are already AI-related, with another significant group allocating 21% to 30%. Larger companies with 5,000 or more employees report that on average 31% of their total workloads are devoted to AI, compared with 23% among smaller firms employing between 100 and 999 people.

Industry-level patterns further highlight the spread of AI integration. Companies in technology and healthcare/life sciences lead with about 30% of their workloads dedicated to AI. Close behind are financial and insurance services and manufacturing, each reporting a median of 25%. By contrast, sectors such as media, entertainment, and telecoms allocate a lower median of 20%, reflecting differences in digital maturity and operational needs.

AI workload management has gained traction due to the rise of complex AI models and growing demand for automation in enterprise IT operations. Investment opportunities in this market are substantial, as there is a need to innovate AI workload management tools that support both emerging AI models and complex IT environments.

Developing scalable, flexible systems that work across on-premises and cloud settings represents a lucrative area. Moreover, the integration of advanced AI and machine learning techniques into workload management software creates opportunities for new entrants and established vendors to differentiate through intelligent automation and predictive analytics.

Key Insight Summary

- Software held 70.3% share, as enterprises rely on intelligent platforms to handle complex AI workloads efficiently.

- Cloud deployment accounted for 60.4% share, supported by scalability, flexibility, and lower infrastructure costs.

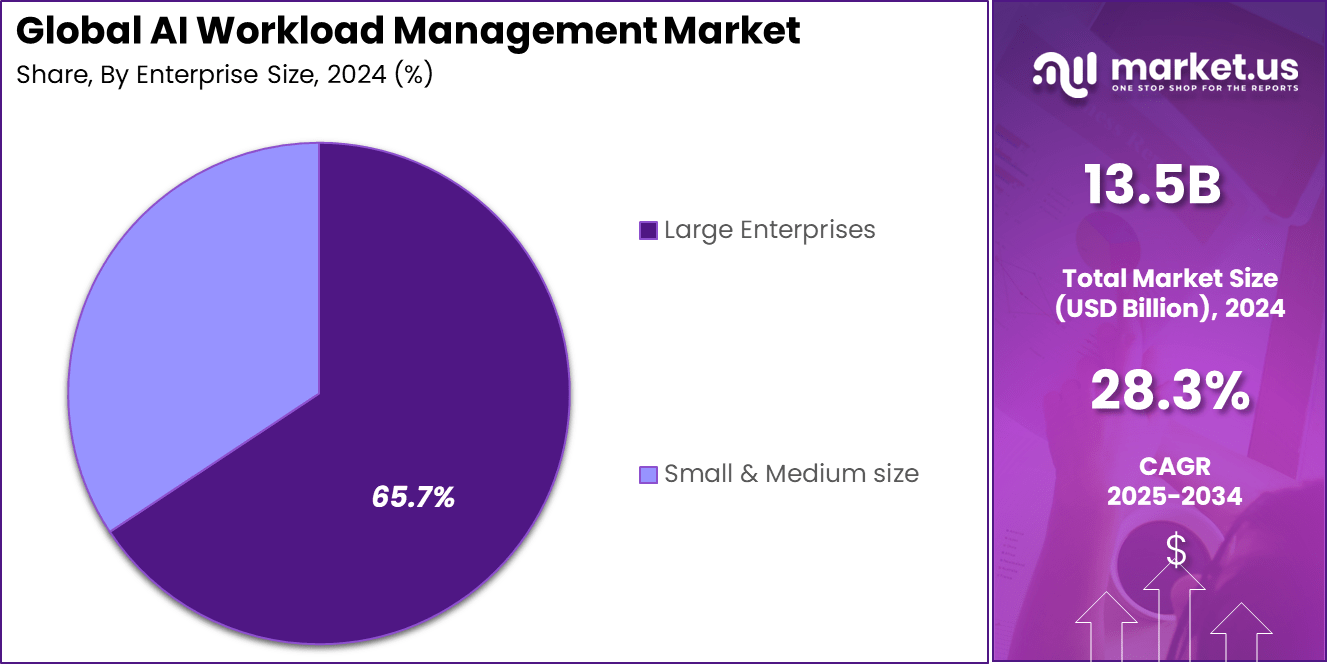

- Large enterprises captured 65.7% share, driven by higher investments in AI adoption and workload optimization.

- Deep learning technologies represented 61.4% share, reflecting their central role in training and managing high-volume data models.

- BFSI held 25.1% share among end-users, as banks and financial institutions increasingly use AI for fraud detection, risk management, and customer analytics.

Regional Insights

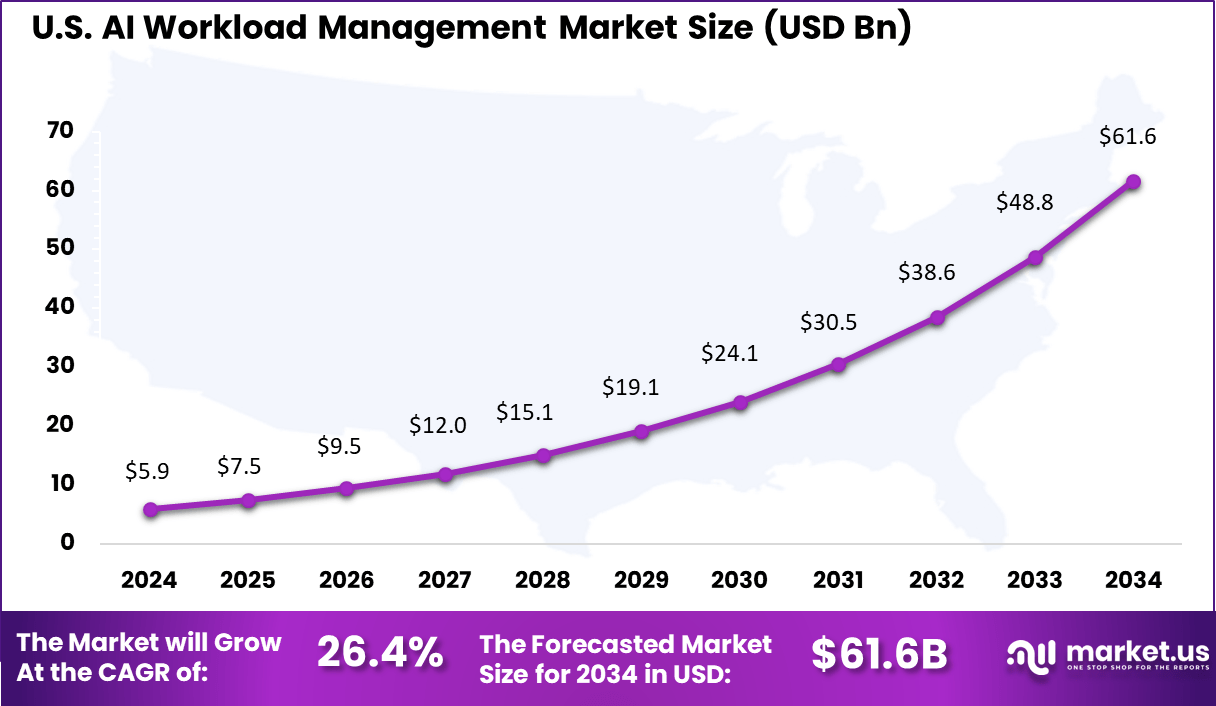

The U.S. AI Workload Management Market was valued at USD 5.9 Billion in 2024 and is anticipated to reach approximately USD 61.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 26.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 45.7% share, accounting for approximately USD 6.1 billion in revenue within the AI Workload Management Market. This leadership is closely tied to the region’s early adoption of AI infrastructure, widespread availability of GPU clusters, and the presence of robust cloud service providers.

Additionally, the strategic push by enterprises toward hybrid AI deployment models has required advanced workload orchestration tools to optimize performance and reduce latency. As organizations increasingly manage large-scale generative AI and machine learning models, intelligent workload distribution has become a critical capability.

The dominance of North America is also driven by regulatory clarity and institutional investments in AI governance frameworks. Countries like the United States have introduced compliance standards around model transparency and data traceability, requiring workload management systems to support granular monitoring and audit capabilities.

Moreover, demand from sectors such as healthcare, defense, and finance has remained high due to the complexity of AI tasks requiring efficient resource scheduling and task automation. These sectors continuously seek solutions that ensure high availability and reliability of AI pipelines, further fueling the need for sophisticated workload management tools.

Key Benefits and Influencing Factors

From a business perspective, the benefits of AI workload management are clear. Companies gain improved operational efficiency by automating task allocation and balancing computing resources according to demand fluctuations. This leads to reduced latency, better utilization of hardware, and cost savings by avoiding overprovisioning. Enhanced workload visibility allows for proactive management, enabling timely adjustments to workload priorities and preventing bottlenecks.

The regulatory environment around AI workload management mirrors the broader AI governance landscape, with emphasis on compliance, transparency, and risk mitigation. Organizations must navigate evolving regulations on AI ethics, data privacy, and system accountability. Frameworks like the EU AI Act, and standards from ISO and NIST offer guidance for responsible AI implementation including workload management.

Top impacting factors shaping the AI workload management market include rapid advancements in AI technologies and models that increase computational complexity, growing adoption of multi-cloud and hybrid IT strategies, and economic pressures to optimize IT expenditures. Cybersecurity concerns around cloud and AI environments also influence startups and enterprises to seek more secure and compliant management solutions.

Top Growth Factors

Growth Factor Description Growing Need for Automation Enterprises seek to optimize workload allocation and improve IT operations AI & ML Advancements Real-time analytics and intelligent task distribution capabilities Multi-cloud & Hybrid Environments Increased complexity in workload management across diverse infrastructures Increasing Data Volume Heavy data growth requires scalable & adaptive workload management Demand for Real-Time Processing Industries require prompt decisions and fast processing Key Trends and Innovations

Trend/Innovation Description AI-Powered Workload Automation Dynamic, automated resource allocation with minimal human input Predictive Analytics & Planning Anticipation of workload spikes and optimization of resources DevOps Integration Embedding workload management into CI/CD and software development workflows Real-Time Monitoring & Alerts Using AI to detect anomalies and prevent system failures Hybrid & Multi-cloud Orchestration Managing workloads across on-premises and cloud seamlessly By Component: Software (70.3%)

In 2024, Software is the driving force in the AI Workload Management market, capturing a dominant 70.3% share. This strong position arises because software solutions are essential for orchestrating complex AI workloads, managing computational resources, and automating tasks across diverse AI frameworks. These software platforms enable businesses to achieve operational efficiency by optimizing resource allocation, reducing processing times, and improving scalability.

With AI applications becoming increasingly complex and resource-intensive, the demand for sophisticated workload management software is surging. These solutions provide vital functionalities such as job scheduling, resource monitoring, and cloud integration, offering seamless management of AI pipelines across industries.

By Deployment: Cloud (60.4%)

In 2024, Cloud deployment holds 60.4% of the market, reflecting the widespread adoption of cloud infrastructure for AI workload execution and management. The cloud environment provides scalable and flexible compute resources that cater to the dynamic needs of AI workloads.

It also facilitates collaboration across distributed teams and supports hybrid infrastructure strategies that combine on-premises and cloud resources. The scalability, cost-effectiveness, and accessibility of cloud platforms make them highly attractive for enterprises that need to manage large-scale AI projects. Cloud-based workload management also enhances agility, enabling faster experimentation and deployment cycles.

By Organization Size: Large Enterprises (65.7%)

In 2024, Large enterprises dominate the market with a 65.7% share, driven by their significant investments in AI for various business functions. These organizations require advanced workload management solutions to handle extensive AI deployments, manage data complexity, and maintain regulatory compliance.

Large enterprises benefit from scalable platforms that streamline AI operations and optimize infrastructure utilization. The size and complexity of AI initiatives in such enterprises demand robust and flexible management tools. These solutions help large firms efficiently orchestrate AI workloads, reduce operational overhead, and accelerate innovation.

By Technology: Deep Learning (61.4%)

In 2024, Deep learning accounts for 61.4% of the market by technology, due to its resource-intensive nature and the growing adoption of neural network models. Managing deep learning workloads requires specialized tools that optimize GPU usage, schedule training jobs, and automate hyperparameter tuning.

Effective workload management ensures reduced training times and increased productivity. As deep learning applications expand into areas such as image and speech recognition, autonomous systems, and natural language processing, the market for corresponding workload management solutions continues to grow proportionally.

By End-User: BFSI (25.1%)

In 2024, the BFSI sector occupies 25.1% of the AI workload management market, reflecting its increasing dependence on AI-driven insights for risk assessment, fraud detection, customer personalization, and regulatory reporting. AI workload management allows BFSI firms to securely and efficiently process large volumes of financial data while adhering to stringent operational standards.

Efficiency in managing AI workloads is critical for BFSI to deliver robust and compliant services. The sector’s ongoing digital transformation and focus on automation continue to fuel demand for advanced AI workload management solutions.

Key Market Segments

By Component

- Software

- Services

- Integration & Deployment

- Training & Consulting

- Managed Services

By Deployment

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Technology

- Machine learning

- Deep learning

- Natural language processing

- Others

By End-user

- BFSI

- Healthcare

- Retail and e-commerce

- Telecommunications

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

The Growing Demand for Data and Advanced AI Technology

A primary driver accelerating AI workload management adoption is the surge in data availability combined with advances in AI technology. Organizations generate and collect unprecedented volumes of data daily, requiring sophisticated AI solutions that can process and analyze this information efficiently.

The sheer scale and complexity of data necessitate powerful AI workload management strategies to organize, allocate, and optimize computing resources. High-performance AI systems rely on a mix of data, robust algorithms, and specialized hardware like GPUs and TPUs to deliver results swiftly.

Companies’ ability to orchestrate these components internally or through external AI ecosystems is vital for harnessing AI’s full potential. The availability and integration of advanced AI models, along with the increasing AI skills and coordination capabilities within firms, play a crucial role in driving AI workload deployments and reaping competitive advantage.

Restraint

Resource Intensity and Infrastructure Complexity

One of the main restraints hindering AI workload management is the significant resource intensity and complexity associated with AI infrastructure. AI workloads demand massive processing power, memory, and storage, often requiring costly specialized hardware, sophisticated networking, and well-architected data pipelines.

The complexity involved in deploying, scaling, and orchestrating these AI workloads across distributed environments can pose major operational challenges. Additionally, AI workloads typically show unpredictable patterns with peaks and lulls in demand, complicating resource allocation.

Efficiently managing these fluctuations without under- or over-provisioning resources adds to both technical and financial strain. Organizations lacking the expertise or capital to build resilient infrastructure find it difficult to maintain consistent AI performance and operational agility.

Opportunity

Enhanced Automation and Productivity Gains

AI workload management presents a clear opportunity to unlock significant automation and productivity improvements across industries. By intelligently allocating tasks based on employee skills, capacity, and deadlines, AI workload platforms reduce bottlenecks and balance work more effectively.

Automation of repetitive tasks and real-time monitoring enable human workers to focus on higher-value activities, boosting overall productivity and job satisfaction. Moreover, predictive analytics integrated into AI workload management systems allow organizations to anticipate workload surges and adapt proactively.

This preparedness improves operational resilience and service quality, enabling industries like customer service, manufacturing, and IT to benefit from greater efficiency. The opportunity to scale AI workloads seamlessly with business growth while controlling costs makes workload management a strategic lever for future-ready enterprises.

Challenge

Data Governance, Security, and Compliance Complexities

A key challenge in AI workload management lies in navigating stringent data governance, security, and compliance requirements. AI workloads rely heavily on vast datasets, often including sensitive or regulated information.

Ensuring data privacy and legal compliance while maintaining data accessibility for AI processes demands robust governance frameworks and strong cybersecurity measures. This adds complexity to workload management systems, which must integrate controls to monitor and enforce policies without hindering AI performance.

Organizations face risks such as data breaches, regulatory fines, or loss of customer trust if governance failures occur. Balancing the need for innovation in AI workloads with maintaining data integrity and ethical standards therefore remains a critical challenge requiring ongoing attention.

Competitive Analysis

The AI Workload Management Market is characterized by the presence of global technology leaders that shape its competitive landscape. Amazon Web Services, Google, Microsoft, and Oracle are among the most influential companies, offering cloud-based workload management solutions that help enterprises optimize performance and reduce costs.

Traditional IT giants also maintain strong positions through enterprise-focused platforms and hybrid solutions. IBM and Hewlett Packard Enterprise are recognized for their legacy in enterprise computing and their transition toward AI-driven workload management. Dell Technologies and Juniper Networks support scalable architectures and networking capabilities that align with AI adoption.

Specialized companies are emerging as key challengers with their data-first strategies. Equinix, Snowflake, Salesforce, and Teradata offer platforms that improve workload efficiency, data integration, and AI-driven decision-making. Their strengths lie in enhancing scalability, supporting multi-cloud environments, and enabling advanced analytics.

Top Key Players in the Market

- Amazon Web Services Inc.

- Dell Technologies Inc.

- Equinix Inc.

- Google LLC

- Hewlett Packard Enterprise Co.

- Intel Corp.

- IBM Corporation

- Juniper Networks Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corp

- Salesforce Inc.

- Schneider Electric Services

- Snowflake Inc.

- Teradata Corp.

- Others

Recent Developments

- By May 2025, Dell announced new managed services supporting end-to-end AI infrastructure management, including automated lifecycle operations and hybrid cloud orchestration. The availability of this managed service portfolio drastically reduces the operational burden on customers, allowing them to speed AI deployment and scale.

- In 2024, AWS reinvent showcased optimizations for AI workloads via Amazon Bedrock and integration with AI monitoring tools like New Relic, enhancing performance and resource use. AWS offers extensive AI infrastructure including SageMaker for machine learning model development and GPU-powered instances (P3, P4) for deep learning training.

- In 2024, HPE unveiled a portfolio of co-developed AI workload management solutions with NVIDIA, branded as NVIDIA AI Computing by HPE. Launched in June 2024, this includes the innovative HPE Private Cloud AI, featuring the OpsRamp AI copilot for workload efficiency and full lifecycle management.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services (Integration & Deployment, Training & Consulting, Managed Services)), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Technology (Machine Learning, Deep Learning, Natural Language Processing, Others), By End-user (BFSI, Healthcare, Retail and E-commerce, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services Inc., Dell Technologies Inc., Equinix Inc., Google LLC, Hewlett Packard Enterprise Co., Intel Corp., IBM Corporation, Juniper Networks Inc., Microsoft Corporation, NVIDIA Corporation, Oracle Corp, Salesforce Inc., Schneider Electric Services, Snowflake Inc., Teradata Corp., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Workload Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

AI Workload Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services Inc.

- Dell Technologies Inc.

- Equinix Inc.

- Google LLC

- Hewlett Packard Enterprise Co.

- Intel Corp.

- IBM Corporation

- Juniper Networks Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corp

- Salesforce Inc.

- Schneider Electric Services

- Snowflake Inc.

- Teradata Corp.

- Others