Global AI Video Market Size, Share, Growth Analysis By Device (Desktop Computers, Mobile Devices, Cloud-Based Platforms), By Users (B2B (Enterprise), B2C (Individuals)), By Offering Type (Creative Artificial Intelligence (AI) Video Generators, Video Enhancement AI, Video Editing AI, Video Analysis AI), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164518

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

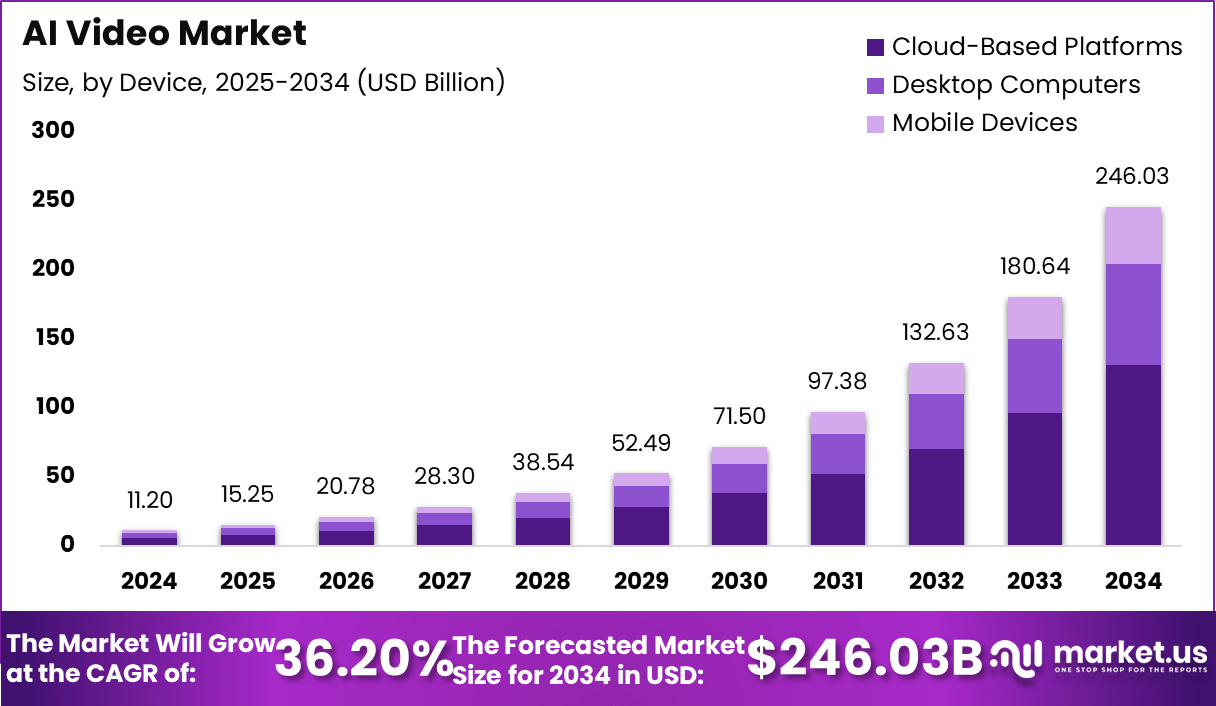

The global AI video market was valued at USD 11.2 billion in 2024 and is projected to reach USD 246.03 billion by 2034, expanding at a remarkable CAGR of 36.2%. This rapid growth is fueled by the increasing use of artificial intelligence across video production, editing, and distribution workflows. AI is transforming how videos are generated, personalized, and analyzed—enabling faster content creation, real-time scene enhancement, and automated video summarization.

Businesses are increasingly adopting AI-driven video tools for marketing, surveillance, education, and entertainment, as these solutions enhance efficiency, reduce production costs, and improve viewer engagement. The growing influence of generative AI models and advanced neural rendering technologies further accelerates this trend, enabling realistic visual effects and synthetic media creation with minimal human intervention.

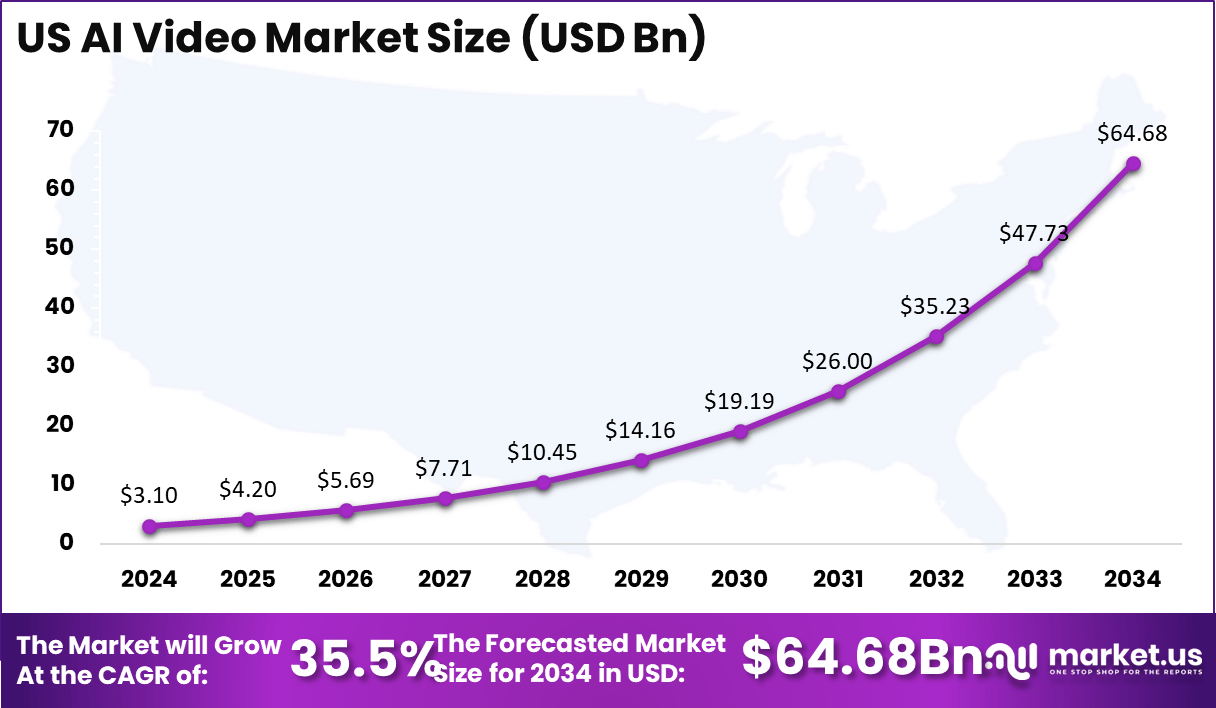

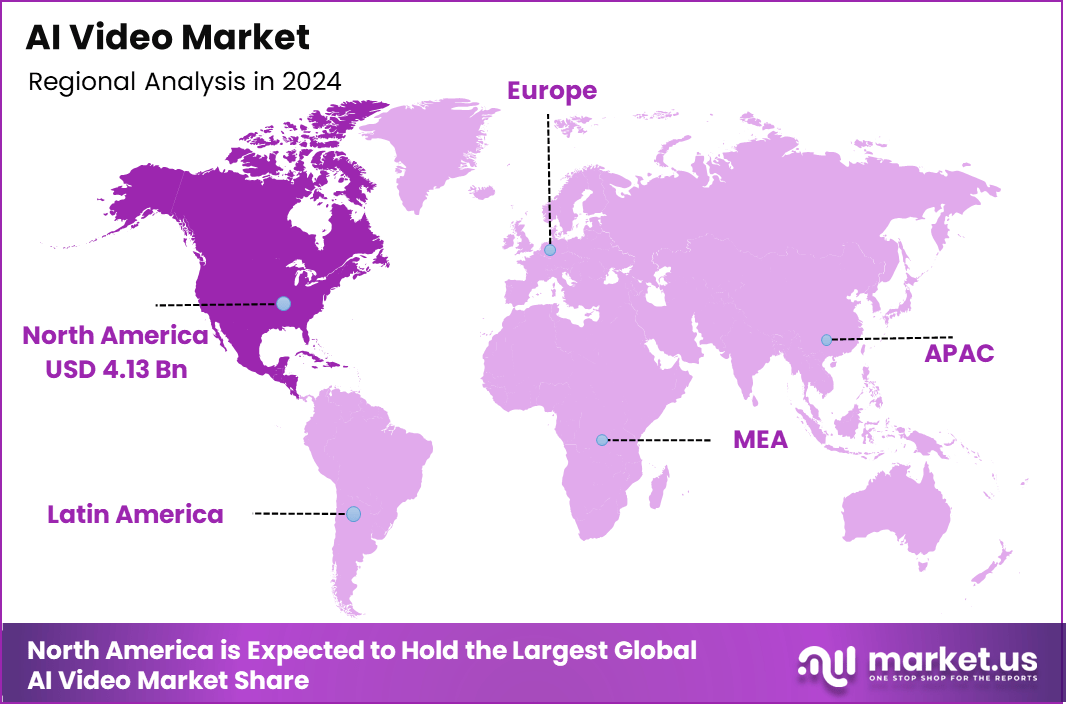

North America dominates the market with a 36.9% share, valued at USD 4.13 billion in 2024, owing to strong technological infrastructure and widespread use of AI-based media platforms. The US leads within the region, contributing USD 3.1 billion in 2024, and is anticipated to reach USD 64.68 billion by 2034, growing at a steady CAGR of 35.5%. Continuous investments in cloud-based video analytics, deep learning frameworks, and AI-powered creative tools are expected to position the US as a global hub for AI video innovation over the next decade.

The AI video market is revolutionizing how visual content is created, analyzed, and consumed across industries. Artificial intelligence has introduced automation, creativity, and personalization into the video production process, transforming traditional workflows into intelligent, data-driven systems.

AI-driven tools are now capable of generating scripts, editing footage, enhancing visuals, and even producing complete videos autonomously. These advancements are empowering businesses in media, entertainment, marketing, education, and surveillance to produce high-quality, customized content at scale while reducing production time and costs.

The growing integration of generative AI, computer vision, and machine learning technologies is enabling real-time scene understanding, emotion recognition, object tracking, and video summarization. This evolution is not limited to creative industries—corporates are adopting AI videos for training, communication, and customer engagement, while security sectors leverage intelligent video analytics for predictive surveillance.

The increasing adoption of cloud computing and edge AI further enhances video processing speed and scalability. As AI continues to evolve, the market is shifting from traditional video editing to fully automated storytelling, where algorithms understand context, tone, and intent. With continuous innovation and expanding use cases, AI video technology is expected to redefine global digital communication and content creation in the coming decade.

The AI video statistics market has seen explosive growth and record-breaking activity in 2025, with global market size estimates hitting $11.20 billion this year and projections expecting it to reach about $71.50 billion by 2030, growing at a robust 36.20% annual rate.

Major funding rounds have shaped the landscape, such as Synthesia raising $180 million in London, Runway securing $308 million in New York, and Hedra attracting a fresh $32 million in California; overall, AI video startups have raised more than $500 million in new funding since January, surpassing previous years. On the acquisitions and mergers front, the final quarter of 2024 and early 2025 were particularly dynamic, highlighted by Nvidia’s purchase of OctoAI for $250 million and Brev.dev for $300 million—moves aimed at bolstering generative AI cloud platforms.

Giant Cisco’s monumental $28 billion acquisition of Splunk in March brought advanced analytics to the forefront, while AMD invested $665 million to acquire Silo AI, expanding its portfolio in video-based AI technologies.

The sector’s pace is further marked by continuous product launches featuring interactive, real-time video capabilities and analytics tools, supporting a surge in personalized content creation and strategic partnerships in marketing, retail, and surveillance domains. With investors pushing the market’s boundaries and technology firms consolidating expertise through high-profile deals, the AI video statistics space is set for even more competitive expansion in the months ahead.

Key Takeaways

- The global AI video market is valued at USD 11.2 billion in 2024 and is projected to reach USD 246.03 billion by 2034, expanding at a CAGR of 36.2%.

- North America holds a dominant 36.9% market share, accounting for approximately USD 4.13 billion in 2024, supported by early adoption of AI-based media technologies.

- The US remains the largest contributor within North America, generating USD 3.1 billion in 2024 and expected to reach USD 64.68 billion by 2034, growing at a CAGR of 35.5%.

- By device, cloud-based platforms account for the largest share at 53.2%, driven by increasing demand for scalable and cost-efficient AI video solutions.

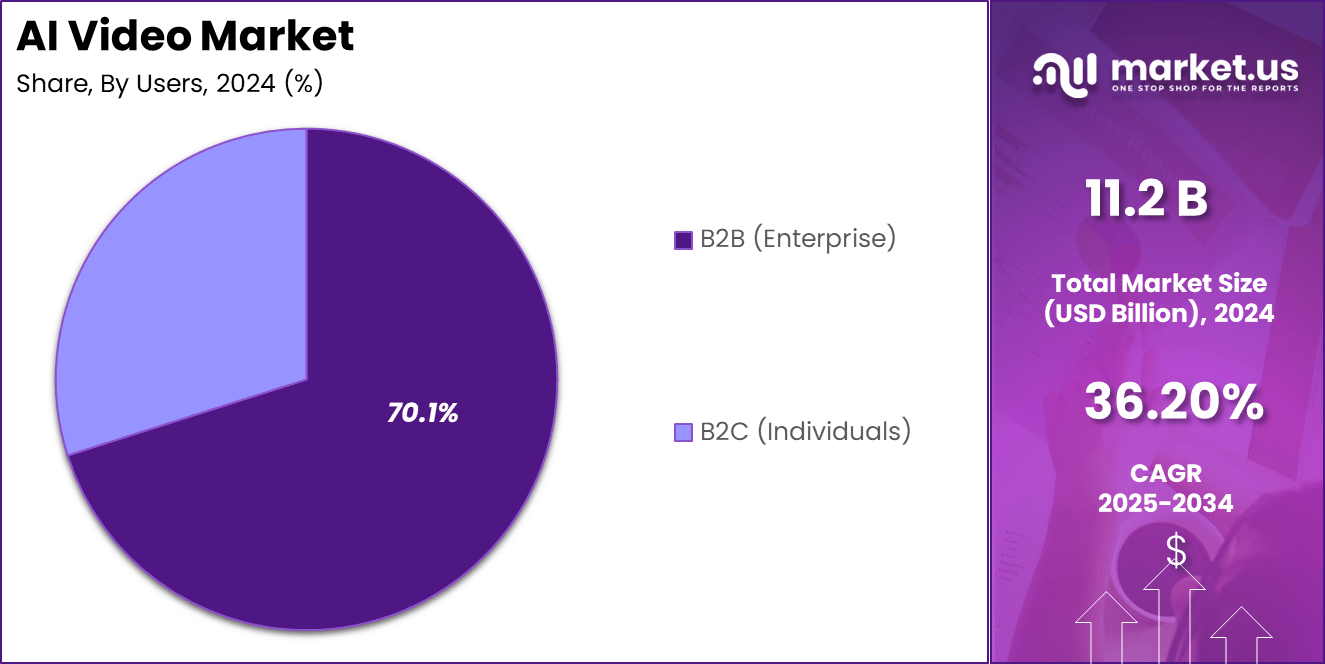

- By user type, the B2B (enterprise) segment dominates with 70.1%, reflecting widespread deployment of AI video tools for marketing, analytics, and corporate communications.

- By offering type, creative AI video generators lead the market with a 38.1% share, supported by the growing use of generative AI for automated video creation and personalized content delivery.

- Advancements in generative AI, machine learning, and natural language processing are expected to continue driving innovation and scalability across the global AI video ecosystem.

Role Of AI

Artificial intelligence plays a transformative role in reshaping the global video landscape by automating, enhancing, and personalizing every stage of the content lifecycle. AI technologies such as machine learning, deep learning, and natural language processing enable systems to analyze large volumes of visual data, detect patterns, and generate contextually relevant video content with minimal human input.

Through generative AI models, videos can now be created from text prompts, while advanced algorithms assist in real-time editing, color correction, and scene composition, significantly reducing production time and cost.

AI also enhances viewer engagement by enabling personalized recommendations, adaptive streaming quality, and intelligent content tagging. In marketing, AI-powered video analytics track viewer behavior and optimize campaigns based on audience insights. In surveillance and security, computer vision algorithms improve threat detection and automate monitoring processes.

Educational and corporate sectors benefit from AI-generated explainer videos and automated training modules, enhancing communication efficiency. As cloud computing and edge AI expand, real-time video processing and delivery have become more scalable and accessible. Ultimately, AI’s role extends beyond automation—it redefines creativity by merging human imagination with algorithmic precision, setting a new standard for how visual stories are produced, distributed, and experienced worldwide.

Industry Adoption

Artificial intelligence plays a transformative role in reshaping the global video landscape by automating, enhancing, and personalizing every stage of the content lifecycle. AI technologies such as machine learning, deep learning, and natural language processing enable systems to analyze large volumes of visual data, detect patterns, and generate contextually relevant video content with minimal human input. Through generative AI models, videos can now be created from text prompts, while advanced algorithms assist in real-time editing, color correction, and scene composition, significantly reducing production time and cost.

AI also enhances viewer engagement by enabling personalized recommendations, adaptive streaming quality, and intelligent content tagging. In marketing, AI-powered video analytics track viewer behavior and optimize campaigns based on audience insights. In surveillance and security, computer vision algorithms improve threat detection and automate monitoring processes.

Educational and corporate sectors benefit from AI-generated explainer videos and automated training modules, enhancing communication efficiency. As cloud computing and edge AI expand, real-time video processing and delivery have become more scalable and accessible. Ultimately, AI’s role extends beyond automation—it redefines creativity by merging human imagination with algorithmic precision, setting a new standard for how visual stories are produced, distributed, and experienced worldwide.

Analysts’ Viewpoint

Analysts view the AI video market as one of the most transformative segments in digital media and enterprise operations. They highlight that rapid improvements in generative AI, computer vision, and edge-AI processing are unlocking new capabilities in video creation, real‐time analytics, and personalised content delivery, which in turn drive broader adoption across sectors such as marketing, e-learning, and surveillance.

Analysts caution that despite strong growth projections, the market faces significant structural challenges. These include scalability of high-quality video generation, evolution of monetisation models, handling of regulatory and ethical issues (e.g., deep-fakes and content authenticity), and potential investment slowdowns for infrastructure and chipsets. Some reports note that infrastructure spending may taper, creating risk for companies without clear near-term ROI.

On the regional front, many analysts believe North America will maintain a dominant role due to mature AI ecosystems, while Asia-Pacific is expected to represent the fastest growth region owing to expanding digital infrastructure and large addressable user bases. Analysts emphasise that companies succeeding in the AI video space will combine technical innovation with industry-specific solutions, strong cloud and edge delivery, and attention to data governance.

US Market Size

The AI video market in the United States is experiencing rapid expansion, driven by strong adoption of artificial intelligence across content creation, marketing, and enterprise communication. Valued at USD 3.1 billion in 2024, the market is projected to reach approximately USD 64.68 billion by 2034, registering an impressive CAGR of 35.5%.

This growth is fueled by the increasing integration of AI in video editing, real-time analytics, and personalized video generation, enabling faster production cycles and enhanced user engagement. The proliferation of generative AI tools such as automated video synthesis, intelligent dubbing, and digital avatars has further transformed the country’s media and entertainment landscape.

Enterprises across sectors—including e-learning, retail, healthcare, and corporate communication—are increasingly leveraging AI video solutions to streamline content creation and training. The strong presence of leading technology companies, combined with significant investments in machine learning infrastructure and cloud computing, supports the US’s leadership position in this domain.

Additionally, demand for AI-driven marketing videos and real-time customer engagement content continues to grow as businesses seek innovative ways to reach audiences. With rising emphasis on automation, scalability, and creativity, the US AI video market is expected to remain a global benchmark for innovation and digital transformation in the coming decade.

By Device

The cloud-based platforms segment accounts for 53.2% of the AI video market, making it the leading category by device type. This dominance is driven by the increasing shift of video production, editing, and analytics to cloud environments that offer scalability, flexibility, and cost efficiency. Cloud-based AI video platforms allow users to access powerful computing resources and AI algorithms without the need for high-end local hardware.

This enables seamless video rendering, real-time collaboration, and large-scale content storage—all essential for enterprises and creators managing vast video libraries. The rise of remote work and digital media streaming has further accelerated the adoption of cloud-based tools for intelligent video generation and distribution.

Unlike desktop computers or mobile devices, cloud-based platforms support integration with advanced AI frameworks such as machine learning and generative AI models. These capabilities facilitate automated video synthesis, scene recognition, and personalized recommendations on a global scale.

Businesses across marketing, education, entertainment, and surveillance sectors increasingly rely on cloud infrastructure to streamline workflows and improve content delivery speeds. Continuous advancements in edge computing and cloud-native architectures are expected to enhance performance, reduce latency, and expand access to AI video services, solidifying the cloud-based platform’s leadership in the global market.

By Users

The B2B (enterprise) segment dominates the AI video market, accounting for 70.1% of the overall share. This strong presence reflects the growing use of AI-powered video solutions across enterprises for marketing, communication, training, and data-driven insights. Businesses are increasingly adopting AI video tools to automate content creation, enhance customer engagement, and optimize operations through intelligent video analytics.

Corporate sectors use AI-generated videos for personalized marketing campaigns, product demonstrations, and employee learning modules, reducing production costs and improving efficiency. Enterprises also integrate AI video systems with CRM and analytics platforms to gain actionable insights from viewer behavior and engagement metrics.

AI-driven automation is transforming industries such as retail, healthcare, finance, and education, where real-time video content supports better interaction and service delivery. The ability to scale video generation through cloud infrastructure and generative AI platforms has made AI video an essential component of digital transformation strategies.

Moreover, businesses are using AI to enhance internal communication through virtual meetings, explainer videos, and interactive presentations. Compared to the B2C segment, enterprises have greater resources and infrastructure to deploy AI tools effectively, resulting in higher adoption rates. As organizations continue prioritizing automation and personalization, the B2B segment is expected to remain the primary growth driver of the AI video market.

By Offering Type

The Creative Artificial Intelligence (AI) Video Generators segment leads the market with a 38.1% share, emerging as the most transformative offering in the AI video landscape. This segment’s growth is fueled by the increasing demand for automated content creation, where AI tools generate realistic, engaging, and contextually accurate videos from text prompts, images, or scripts.

These generators leverage advanced deep learning and generative AI models to produce customized visuals, voiceovers, and animations, significantly reducing production time and cost. Industries such as entertainment, advertising, and education are adopting creative AI video tools to streamline storytelling and deliver high-quality content at scale.

The surge in digital marketing and social media engagement has accelerated the use of AI video generators for personalized promotional videos and brand communication. Unlike traditional video editing or enhancement tools, creative AI generators can understand tone, language, and visual cues to craft human-like narratives and dynamic visuals.

Businesses use these platforms to produce explainer videos, training modules, and advertisements with minimal manual intervention. As generative AI continues to evolve, offering higher accuracy and realism, creative AI video generators are expected to redefine content creation workflows. Their growing adoption marks a fundamental shift from manual editing to intelligent, fully automated video production.

Key Market Segments

By Device

- Desktop Computers

- Mobile Devices

- Cloud-Based Platforms

By Users

- B2B (Enterprise)

- B2C (Individuals)

By Offering Type

- Creative Artificial Intelligence (AI) Video Generators

- Video Enhancement AI

- Video Editing AI

- Video Analysis AI

Regional Analysis

North America dominates the global AI video market, holding a 36.9% share with an estimated market size of USD 4.13 billion in 2024. The region’s leadership is driven by strong technological infrastructure, advanced cloud computing capabilities, and early adoption of artificial intelligence across industries.

The United States remains the key contributor, supported by major AI research centers, leading tech companies, and significant venture capital investments in generative and computer vision technologies. Enterprises across entertainment, marketing, and education sectors are increasingly integrating AI video tools for automated content creation, real-time analytics, and personalized user experiences.

The growing demand for AI-driven video editing, virtual avatars, and automated media production platforms continues to strengthen North America’s position in the market. The region also benefits from a mature regulatory environment and widespread access to high-speed internet and data centers that support large-scale AI model deployment.

Canada contributes notably through innovation in video analytics and AI-powered surveillance systems. With major players focusing on R&D and expanding cloud infrastructure, North America is expected to maintain its dominance throughout the forecast period. The strong alignment between government AI initiatives and private sector innovation is further reinforcing the region’s role as the global hub for AI video development and deployment.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The rapid growth of the AI video market is driven by the increasing consumption of video content across digital platforms, as businesses and consumers demand higher volumes of engaging visuals with shorter time-to-market.

Advanced machine learning, computer vision, and generative AI technologies are enabling automated video creation, editing, and personalization—thereby reducing production costs and enabling scale. The strong shift to cloud-based platforms provides the infrastructure to deliver AI video tools globally, enabling users to collaborate and access powerful processing without on-site hardware.

The dominance of enterprise (B2B) users means there is strong capital flow into AI video solutions for marketing, training, surveillance,ce, and corporate communication, underpinning demand from large organisations. The proliferation of mobile devices and social media channels further accelerates the need for sophisticated video production and distribution tools, supporting innovation and investments in this space.

Restraint Factors

High initial implementation costs and the need for advanced computing infrastructure remain significant barriers to adoption, especially among smaller firms without large budgets. Data privacy, copyright, and regulatory concerns over AI-generated content—such as synthetic video, deep-fakes, and misuse of likeness—pose legal and ethical risks that may slow deployment.

Quality and realism limitations of AI-generated videos can deter professional users who require top-tier production standards. Integration complexity of AI video solutions with existing video workflows and enterprise systems also hampers adoption. In some regions, limited digital infrastructure and slower cloud uptake reduce the addressable market size, constraining growth.

Growth Opportunities

The growth opportunity lies in expanding the use of creative AI video generators that automatically create videos from text, images, or raw footage, which opens new markets for SMEs, agencies, and individual creators. Many sectors—education, healthcare, retail, e-commerce, training, and corporate—are under-penetrated and offer potential for AI-video uptake, especially in personalised and interactive formats.

Emerging markets in the Asia-Pacific and other regions with rising internet penetration and digital video consumption offer geographical expansion opportunities. Partnerships between cloud providers, generative AI firms, and video producers can create platform-as-a-service models, reducing cost and increasing accessibility. Edge AI and mobile-optimized video processing can unlock real-time, low-latency applications in surveillance, live streaming, and immersive experiences, further widening use cases.

Challenging factors

The AI video market faces several significant challenges that could constrain its growth despite strong upside potential. One major challenge is regulatory and legal uncertainty related to content ownership, copyright, and synthetic-media liability. Without clear frameworks, enterprises and creators might hesitate to invest heavily in AI video platforms.

Another significant restraint stems from technology maturity and quality expectations. While generative video tools are advancing rapidly, many still struggle with nuanced artistic direction, realistic motion, and emotional storytelling—factors that matter in premium production contexts.

Operational and infrastructure issues also challenge deployment. AI video generation demands high compute resources and energy, particularly for high‐resolution outputs, which increases cost and carbon footprint and may reduce adoption among budget‐sensitive users.

Additionally, data privacy, security, and trust concerns can slow enterprise uptake. Using large volumes of content and personal data in video creation raises compliance burdens in sectors like healthcare and finance. Finally, integration with existing workflows and user skill gaps pose practical barriers—organisations often lack the in-house expertise to leverage creative AI video tools fully, and resistance to change can delay adoption.

Competitive Analysis

The competitive landscape of the AI video market is shaped by a mix of tech-giants, cloud providers, and niche creative-AI vendors, each with distinct capabilities and strategic positions.

Adobe leverages its long-standing dominance in creative software to push into AI video workflows: its “Media Intelligence” tools enable search and tagging of video clips using AI, and enhancements in Adobe Premiere Pro’s AI-assisted editing streamline content production. This gives Adobe a strong foothold among creative professionals and enterprises already embedded in its ecosystem.

Google LLC is advancing both generative and analytic video-AI: with its text-to-video model Veo (via Gemini and Google Vids) and its Video AI analytics in the cloud, Google combines deep research with broad deployment. This gives Google a strong vertical reach across enterprise and individual users.

Microsoft competes via its Azure and Bing platforms: it embeds generative video capabilities (powered by OpenAI’s model Sora) into Bing’s Video Creator, and offers enterprise video analytics via Azure Video Indexer. Microsoft’s cloud infrastructure strength allows strong enterprise traction and packaged offerings.

International Business Machines Corporation (IBM) positions itself around enterprise-grade generative AI and video solutions, focusing on data governance, workflow integration, and industry-specific use cases rather than point-consumer video generation.

NVIDIA Corporation underpins many of the video-AI capabilities via hardware and edge-AI innovation. Its GPUs, AI frameworks, and edge solutions accelerate generative video model performance—giving it an indirect but fundamental competitive advantage.

OpenAI’s Sora model represents a leading edge in text-to-video generation: it can generate realistic video from prompts and is being commercialised via ChatGPT and partner platforms. This gives OpenAI, strong creative-AI appeal, though it lacks the full enterprise ecosystem of the larger incumbents.

Midjourney and Muse.ai represent smaller, niche players focusing on creators, video editing, and collaborative workflows. Their agility allows faster iteration and steep competition in the creative segment.

Lumen5 is specialised in rapid, template-based video generation for marketing and social-media use-cases, often targeting SMEs rather than large enterprise workflows.

In summary, firms that combine strong generative-AI models (e.g., OpenAI, Google), deep enterprise/cloud infrastructure (e.g., Microsoft, IBM), and existing creative software ecosystems (e.g., Adobe) hold the strongest competitive positions. Growth will likely favour those able to offer end-to-end workflows—from ideation to creation to analytics—while ensuring integration, scalability, and data governance.

Top Key Players in the Market

- Adobe

- Designs.ai

- Google LLC

- International Business Machines Corporation

- Lumen5

- Microsoft

- Midjourney

- Muse.ai

- NVIDIA Corporation

- OpenAI

Major Developments

- July 30, 2025: Veo 3 from Google LLC was upgraded with a “Fast” version that enables 1080p video generation with integrated audio, and adds image-to-video support from August. It also introduces enterprise features such as SynthID watermarking to strengthen enterprise-readiness.

- September 4, 2025: ThinkAnalytics announced ThinkMetadataAI, an agentic AI solution to automate enriched metadata generation across large video catalogues—including multilingual support—aimed at improving personalization and monetization in streaming services.

- October 1, 2025: ByteDance revealed its AI-video generator Seedance, which rivals Western models in realism and cost-efficiency, raising increased attention around deep-fakes and global competitive dynamics in video AI.

Report Scope

Report Features Description Market Value (2024) USD 11.2 Billion Forecast Revenue (2034) USD 246.03 Billion CAGR(2025-2034) 36.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Device (Desktop Computers, Mobile Devices, Cloud-Based Platforms), By Users (B2B (Enterprise), B2C (Individuals)), By Offering Type (Creative Artificial Intelligence (AI) Video Generators, Video Enhancement AI, Video Editing AI, Video Analysis AI) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe, Designs.ai, Google LLC, International Business Machines Corporation, Lumen5, Microsoft, Midjourney, Muse.ai, NVIDIA Corporation, OpenAI Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Adobe

- Designs.ai

- Google LLC

- International Business Machines Corporation

- Lumen5

- Microsoft

- Midjourney

- Muse.ai

- NVIDIA Corporation

- OpenAI