Global AI Store Manager Tools Market Size, Share, Industry Analysis Report By Solution (AI Store Manager Software, Services), By Application (Inventory Management, POS systems, Employee Scheduling, Task Management, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-User (Supermarkets, Specialty Retail Stores, Grocery Stores, Retail Pharmacies, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165428

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Operational Impact And Benefits

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Solution Analysis

- Application Analysis

- Enterprise Size Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

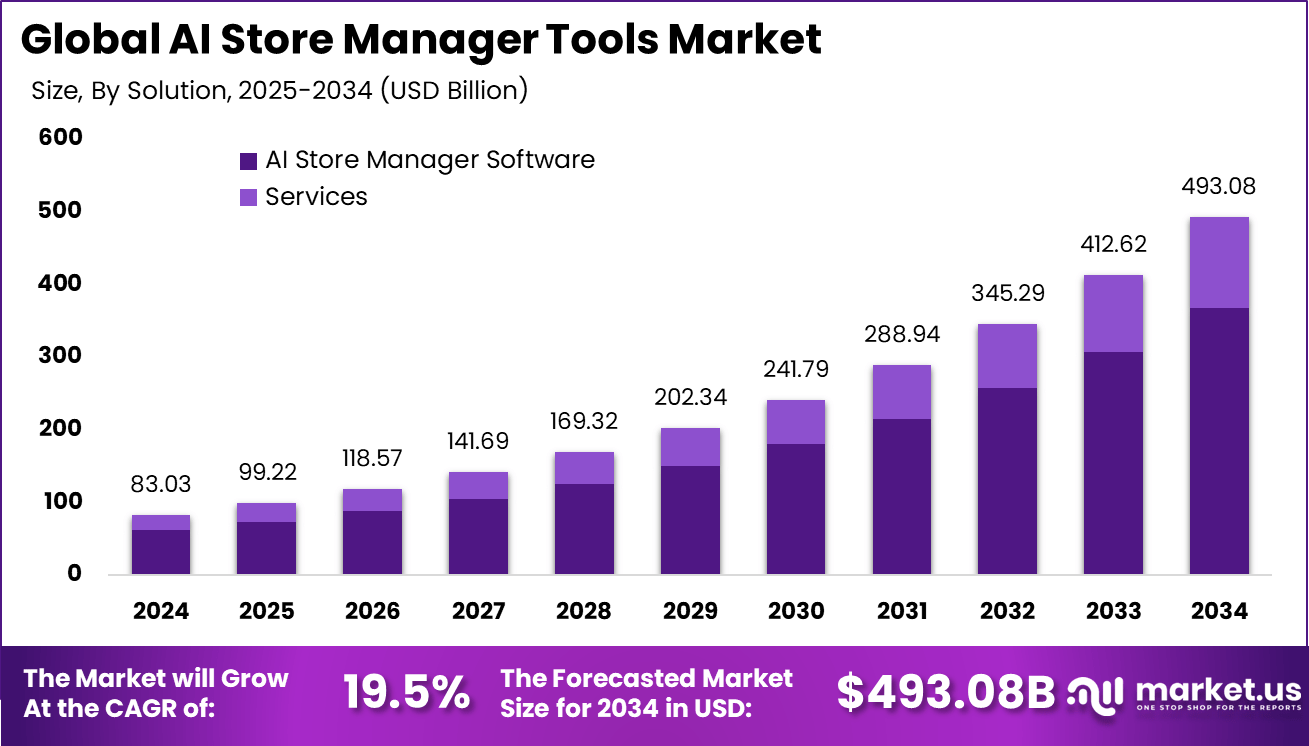

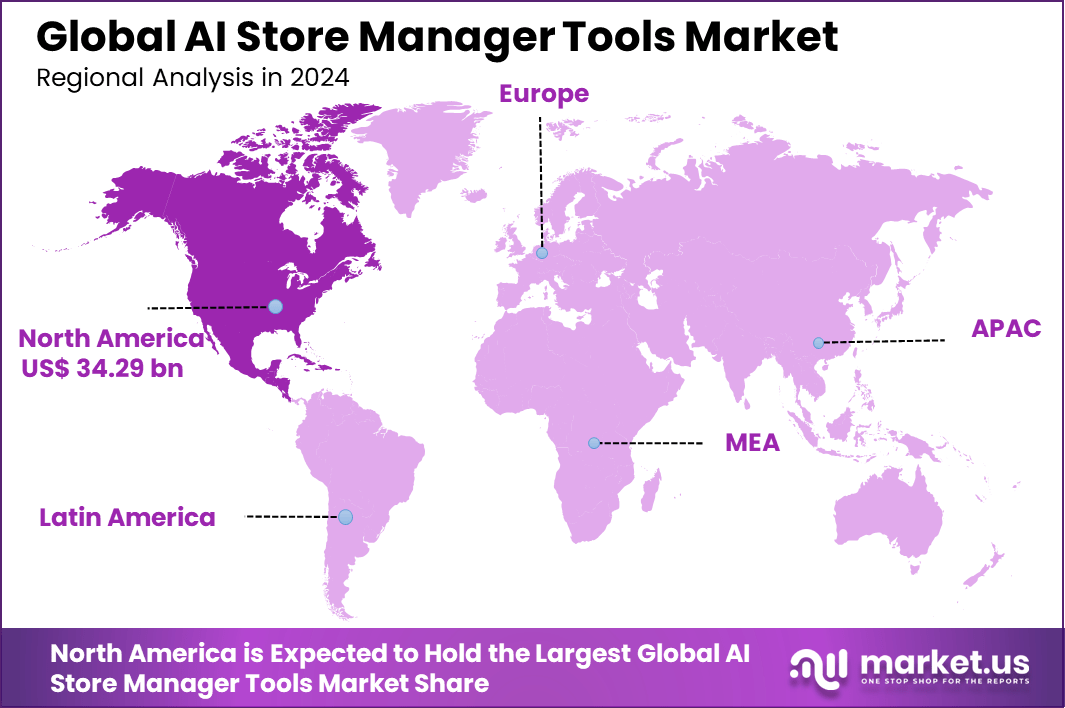

The Global AI Store Manager Tools Market size is expected to be worth around USD 493.08 billion by 2034, from USD 83.03 billion in 2024, growing at a CAGR of 19.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.3% share, holding USD 34.29 billion in revenue.

AI store manager tools are software solutions that automate and optimize various retail store operations. They help manage inventory, sales, customer interactions, employee scheduling, and reporting. These tools use AI technologies like predictive analytics and machine learning to forecast demand, reduce stock issues, and personalize customer engagement. By automating routine tasks, they free up staff to focus on improving the shopping experience and operational efficiency.

The main drivers supporting the adoption of AI store manager tools include rising labor costs, increasing complexity in inventory management, and the need to enhance customer experience. Retailers face challenges in balancing stock levels and operational efficiency, which AI can address by delivering real-time insights and automating replenishment.

The growth of omnichannel retailing and digital transformation strategies has pushed demand for integrated AI platforms that improve decision-making speed and accuracy. Additionally, the availability of cloud-based solutions reduces entry barriers for smaller retailers, broadening market adoption. The market for AI Store Manager Tools is driven by the growing need for enhanced operational efficiency in retail.

Retailers increasingly adopt AI-driven solutions to automate routine tasks like inventory management, demand forecasting, and customer behavior analysis. This helps reduce errors, optimize resources, and speed up decision-making, enabling stores to operate more smoothly and cost-effectively. Additionally, the rise of omnichannel retailing and digital transformation propels the demand for AI tools that integrate sales, inventory, and workforce management across channels, making them essential for modern retail operations.

For instance, in August 2025, Focal Systems began trials of AI-powered store shelf scanning cameras in select locations. The system offers real-time insights for shelf management, improving product availability and reducing waste, although some concerns about battery life and image resolution remain.

Key Takeaway

- The AI Store Manager Software segment dominated the market with a 74.5% share, driven by the rapid adoption of intelligent retail management platforms to enhance operational efficiency.

- Inventory Management emerged as the leading application, holding a 31.7% share, as AI-driven systems optimize stock levels, forecast demand, and reduce wastage.

- By enterprise size, Small and Medium Enterprises (SMEs) captured 60.4% of the market, reflecting growing accessibility of affordable, cloud-based AI retail tools.

- Among end-users, Supermarkets accounted for 30.6%, showcasing increased reliance on automation for shelf analytics, restocking, and customer engagement.

- North America led globally with a 41.3% share, supported by mature retail digitization and widespread integration of AI in store operations.

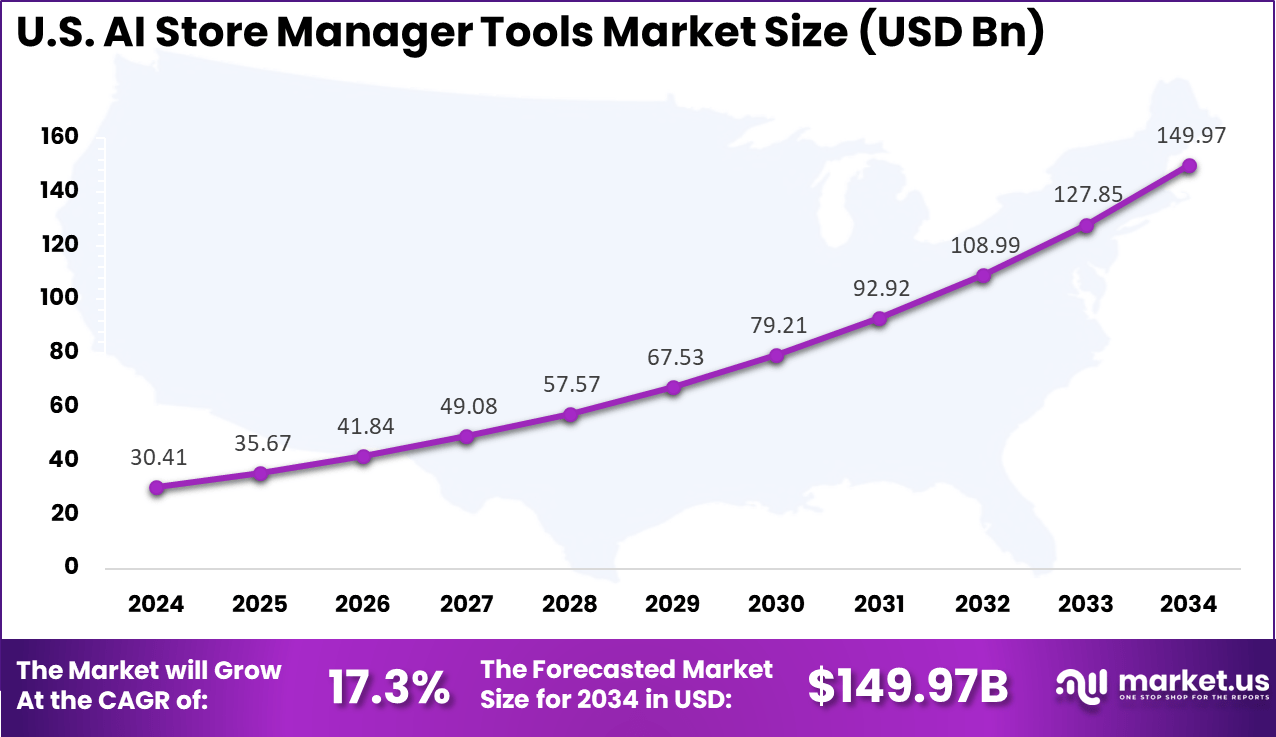

- The U.S. market was valued at USD 30.41 billion in 2024, expanding at a CAGR of 17.3%, underscoring strong investments in AI-powered retail transformation.

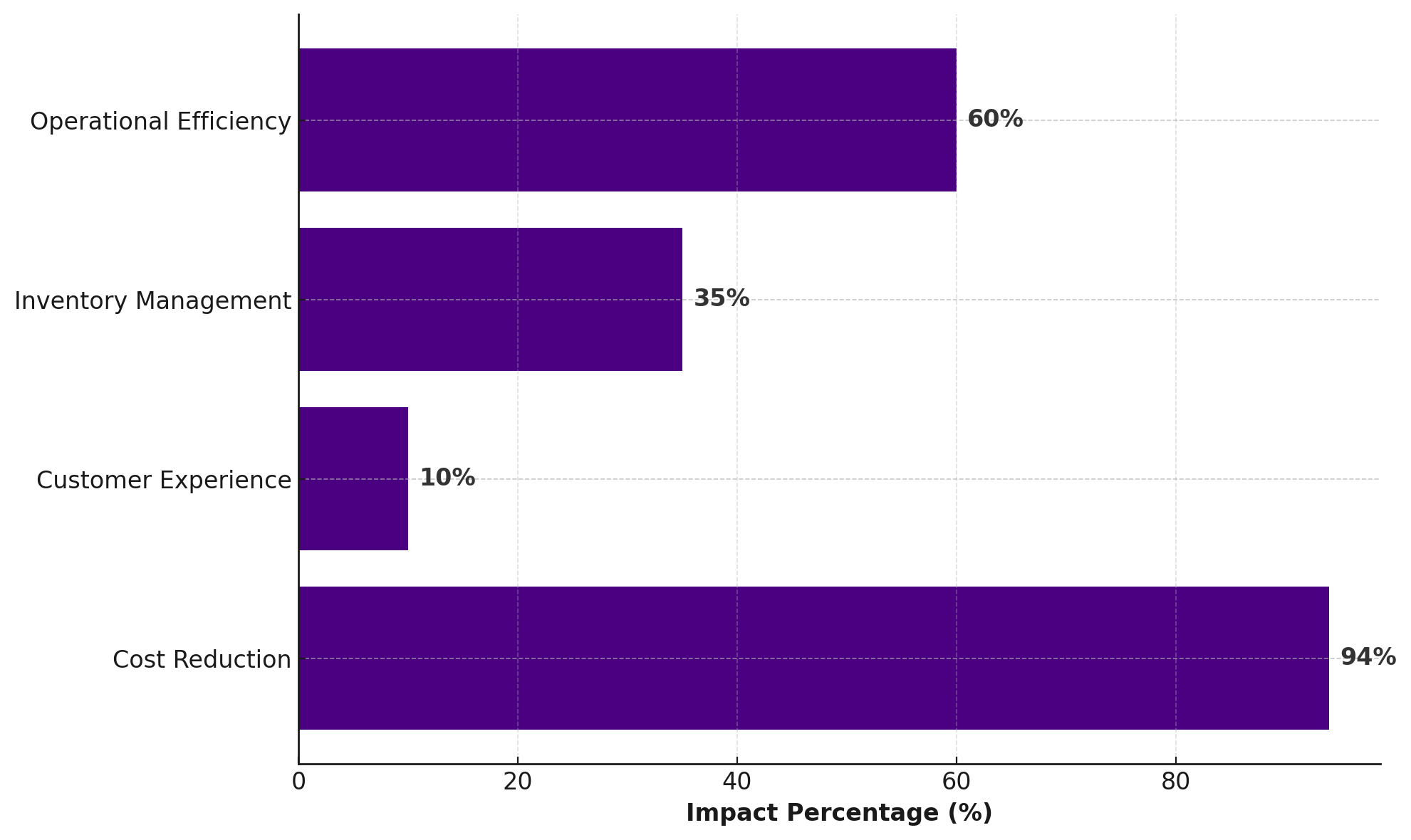

Operational Impact And Benefits

Role of Generative AI

Generative AI is transforming retail store management by automating routine tasks, such as employee scheduling, customer queries, and inventory checks. This automation frees employees to focus on more impactful activities like improving customer service and sales.

Around 69% of retailers report increased revenue, and 72% have seen cost reductions due to generative AI deployment, highlighting its role in driving store productivity and efficiency. The technology also supports managers with faster insights through automated analysis, allowing them to make better decisions without sifting through extensive data.

At the store level, generative AI acts as a workforce enhancer by providing real-time assistance through chatbots and computer vision tools that detect issues like product spoilage or shelf irregularities. This immediate, actionable intelligence helps maintain high operational standards and reduces losses.

AI’s ability to personalize customer interactions and optimize store layouts based on traffic and sales data leads to increased sales and improved shopper experience. Its accessibility means frontline workers can quickly adopt AI tools, driving productivity without major disruptions.

Investment and Business Benefits

The AI store manager tool space presents investment opportunities as the sector grows rapidly with technological advancements. Investors can explore software platforms offering scalable AI solutions for inventory, POS, and employee scheduling. There is also potential in service segments for expert system implementation and continuous support.

Emerging innovations like computer vision integration and AI-driven supply chain management represent attractive areas for future investment. Businesses using AI store manager tools see enhanced operational efficiency through automated reporting and task management.

Streamlining stock control reduces costs linked to excess or insufficient inventory. AI also supports better workforce planning, improving employee satisfaction by matching labor supply with demand dynamically. Real-time analytics empower retailers to make faster, evidence-based decisions, leading to improved sales and customer retention. Overall, AI tools enable retailers to be more agile and customer-focused

U.S. Market Size

The market for AI Store Manager Tools within the U.S. is growing tremendously and is currently valued at USD 30.41 billion, the market has a projected CAGR of 17.3%. This growth is driven by increasing demand for automation in retail operations, especially in inventory management and workforce optimization. Retailers are integrating AI tools to enhance real-time decision-making, boost customer experiences, and reduce operational costs.

Another significant factor contributing to this growth is the rise of e-commerce and digital retail channels that require advanced AI solutions for personalized shopping and supply chain efficiency. Investments in AI-powered analytics, predictive inventory control, and automation are helping retailers stay competitive in a rapidly evolving market. Government initiatives and technological advances further accelerate adoption.

For instance, in February 2025, Apple announced its largest-ever U.S. investment plan, pledging over $500 billion over four years. This includes building a new manufacturing facility in Texas to produce AI-supporting servers and expanding AI research and development domestically. Apple’s commitment boosts its AI infrastructure to support advanced AI store management solutions.

In 2024, North America held a dominant market position in the Global AI Store Manager Tools Market, capturing more than a 41.3% share, holding USD 34.29 billion in revenue. This leadership is driven by the region’s advanced retail infrastructure and rapid adoption of AI-powered solutions that automate store operations. Retailers in North America highly value AI tools for their ability to enhance inventory management, workforce scheduling, and sales performance through real-time analytics.

The U.S. market spearheads this dominance, supported by strong investments in digital transformation and cloud-based AI solutions. The prevalence of omnichannel retail strategies and a tech-savvy consumer base further accelerates AI adoption. These factors combined make North America the largest and most mature market for AI store management technologies.

For instance, in November 2025, Amazon Web Services (AWS) remains a leader in AI-driven store management despite growing competition. AWS launched a strong internal campaign to boost AI-related sales, focusing on generative AI tools for inventory, customer insights, and operational efficiency. This move reinforces AWS’s leading role in supporting AI applications in retail across North America.

Solution Analysis

In 2024, The AI Store Manager Software segment held a dominant market position, capturing a 74.5% share of the Global AI Store Manager Tools Market. This dominance is due to the software’s capability to provide real-time operational insights and predictive analytics, which help store managers optimize inventory, sales, and workforce activities effectively. Retailers rely heavily on these software tools for centralized control and smarter decision-making within store environments.

This strong preference for software solutions stems from their ability to offer scalable and adaptable management features that meet the needs of a variety of retail formats. The software’s role in driving efficiency and streamlining processes makes it the cornerstone of AI-powered store management across the industry.

For Instance, in June 2025, Walmart launched an AI-driven task management tool aimed at store associates to reduce time spent on shift planning. This technology helps managers focus more on critical errands by simplifying workflows and prioritizing tasks intelligently. The tool is currently piloted for various shifts and locations and is expected to ease store operations significantly.

Application Analysis

In 2024, the Inventory Management segment held a dominant market position, capturing a 31.7% share of the Global AI Store Manager Tools Market. This highlights the critical role AI tools play in optimizing stock levels, reducing waste, and improving product availability for retailers. AI enables precise demand forecasting and real-time tracking, helping stores maintain the right inventory balance and avoid stockouts or excess.

The increasing demand for efficient inventory oversight reflects the growing need for retailers to enhance customer satisfaction through better product availability and operational cost control. The application of AI in inventory management is seen as a practical investment in improving overall store performance.

For instance, in October 2025, Focal Systems introduced AI-powered shelf cameras that provide continuous real-time visibility of product availability on store shelves. Their system automates task management by prioritizing restocking and planogram compliance based on AI insights. This innovation directly addresses out-of-stock and inventory shrinkage challenges for retailers.

Enterprise Size Analysis

In 2024, The Small & Medium Enterprises (SMEs) segment held a dominant market position, capturing a 60.4% share of the Global AI Store Manager Tools Market. These businesses find AI solutions especially valuable because they offer scalable technologies suited to limited resources yet dynamic retail needs. SMEs use these tools to improve inventory accuracy, automate routine tasks, and enhance sales forecasting without extensive infrastructure investment.

The higher adoption rate among SMEs indicates their reliance on AI to level the playing field with larger competitors by boosting operational efficiency and customer experience. AI-driven tools empower these enterprises to manage growth challenges and customer demands with more precision.

For Instance, in November 2025, Brightpearl highlighted its AI-powered retail ERP system designed for SMEs, offering automation in sales forecasting and order fulfillment. This system is easy to integrate and designed specifically to enable smaller retailers to manage inventory, accounting, and multi-channel sales more effectively.

End-User Analysis

In 2024, the Supermarkets segment held a dominant market position, capturing a 30.6% share of the Global AI Store Manager Tools Market. This is due to supermarkets’ need to handle high inventory turnover, diverse product categories, and complex supply chains efficiently. AI tools provide supermarkets with advanced analytics for stocking, pricing, and customer engagement, enabling them to maintain optimal operations.

Supermarkets benefit greatly from AI-enabled real-time inventory monitoring and predictive forecasting, which can improve shelf availability and reduce waste. The segment’s sizable share highlights supermarkets as early adopters of AI store management solutions to meet their operational challenges.

For Instance, in July 2025, Instacart deployed AI-powered smart carts powered by Caper AI at Wegmans supermarkets. These cashierless carts use computer vision and sensors to scan items automatically, speeding up checkout and enhancing the customer shopping experience. Early pilot feedback showed strong customer satisfaction and operational improvements.

Emerging trends

One notable trend is the rise of AI-powered personalization, where generative AI creates customized shopping experiences by analyzing customer preferences and behavior. This trend is linked to a 68% adoption rate of AI for marketing content creation in retail, contributing to richer visual merchandising and better product appeal.

Retailers also focus on sustainability by using AI to optimize inventory and reduce waste, responding to growing consumer expectations for responsible business practices. Another emerging direction involves enhanced conversational AI and predictive analytics.

These tools streamline customer interactions and improve demand forecasting with about 15% higher operational efficiency reported by AI users in inventory and customer engagement processes. Automation extends deeply into supply chain and pricing decisions, allowing retailers to respond swiftly to market changes and customer needs, pushing the business toward more agile and data-driven models.

Growth Factors

Increasing labor costs and complexity in managing inventory are key reasons retailers turn to AI tools. By automating repetitive tasks, retailers save costs and improve efficiency while enhancing employee focus on customer-facing roles.

More than half of retailers report labor cost pressures as a leading driver for AI adoption, while advances in cloud and machine learning technologies enable these tools to deliver real-time operational insights. Personalization is another significant driver, with AI enabling retailers to tailor marketing and shopping experiences, which increases customer loyalty and sales.

Sustainable retail practices are supported by AI, balancing stock levels and cutting down on overstock, helping retailers meet environmental goals. Reports show retailers using AI tools have seen up to 10% better customer retention, demonstrating AI’s critical role in growing long-term customer relationships.

Key Market Segments

By Solution

- AI Store Manager Software

- Cloud-based

- On-Premises

- Services

- Design & Implementation

- Technology Consulting

- Support Services

By Application

- Inventory Management

- POS systems

- Employee Scheduling

- Task Management

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-User

- Supermarkets

- Specialty Retail Stores

- Grocery Stores

- Retail Pharmacies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Operational Efficiency Growth

The rising need for better operational efficiency is a key driver for AI Store Manager Tools. Retailers want to cut costs and use resources smartly. AI tools automate tasks like inventory tracking, demand forecasting, and customer behavior analysis. This lets stores reduce human error and speed up decision-making, improving overall performance.

Many retailers are shifting to omnichannel and digital strategies, which makes AI solutions even more important. These tools help manage inventory and sales both online and offline, giving managers real-time insights. As competition tightens, stores prioritize efficiency gains, boosting the demand for AI management solutions.

For instance, in September 2025, Amazon Web Services announced an enhanced AI-powered Seller Assistant that helps sellers automate inventory monitoring, optimize shipments, and analyze demand patterns. This tool reduces the need for manual oversight and streamlines store management tasks, supporting more efficient retail operations. Sellers benefit from AI that can anticipate needs and act proactively, allowing them to focus on growing their business.

Restraint

High Implementation Complexity

A major restraint for AI Store Manager Tools is the complexity involved in setting them up and integrating with existing systems. Many small and midsize retailers face difficulties because their current technology is often outdated or fragmented, making integration costly and slow.

Additionally, the initial expense of AI hardware, software, and staff training can be a barrier. This is especially true in developing regions where budgets are tight. These challenges limit the speed of adoption despite the clear benefits AI tools bring to store management.

For instance, in August 2025, Apple faced internal challenges in scaling its AI retail initiatives, including delays in major updates to its voice assistant Siri and leadership changes in its AI teams. Reports indicated struggles with integrating AI technologies seamlessly and retaining AI talent, highlighting the difficulties large companies face in implementing sophisticated AI store management at scale.

Opportunities

Personalized Customer Experiences

AI Store Manager Tools offer retailers the opportunity to deliver more personalized shopping experiences to their customers. By analyzing data such as past purchases and browsing habits, AI can tailor product recommendations and promotions to individual shoppers. This personalization helps stores better meet customer expectations and enhances satisfaction.

With more personalized service, stores can boost customer loyalty and encourage repeat visits. These AI-driven experiences also help retailers stand out in competitive markets by catering to unique consumer preferences. This ability to customize each shopper’s journey offers a promising path for sales growth and brand differentiation.

For instance, in June 2025, Google introduced a suite of AI-powered tools for retailers focused on enhancing personalized shopping. Google’s AI agents provide tailored product recommendations and virtual try-on experiences, helping retailers increase customer satisfaction and loyalty through customized interactions both online and in physical stores.

Challenges

Data Privacy Concerns

Data privacy remains a pressing challenge for AI Store Manager Tools in the retail sector. These tools gather and process large amounts of customer information, raising concerns about how safely this data is stored and used. Retailers worry about meeting increasing rules around data protection that vary across regions.

Customers themselves are becoming more cautious about sharing their personal data and demand transparency. Retailers must strengthen their security measures and clearly communicate data use policies to reassure shoppers. If privacy and regulatory issues are not handled well, retailers risk losing customer trust and slowing down AI tool adoption.

For instance, in October 2025, IBM released new AI agents integrated with Oracle Fusion Applications to improve efficiency in retail operations. Alongside these developments, the company emphasized the need for careful handling of data privacy and compliance protocols as AI adoption grows. This highlights the ongoing challenge retailers face in balancing AI benefits with regulatory and consumer data protection demands.

Key Players Analysis

The AI Store Manager Tools Market is driven by major technology platforms such as Amazon Web Services, Inc., Google LLC, IBM Corporation, and Microsoft Corporation. These companies provide cloud-based AI frameworks, machine learning models, and analytics services that enable retailers to deploy tools for store management, inventory optimization, customer flow analysis, and workforce scheduling. Their scalable architecture supports multichannel retail operations and real-time decision-making across store networks.

Retail-focused solutions providers including Caper AI, Focal Systems, Brightpearl, and GK Software SE specialize in AI-driven store operations. Their tools support smart checkout, shelf monitoring via computer vision, predictive restocking, and real-time staff allocation. Integration with POS systems, IoT sensors, and edge analytics enables store automation, shrink reduction, and improved customer experience flow, strengthening retailer competitiveness.

Supporting hardware and embedded tech firms such as Intel Corporation, NXP Semiconductors N.V., Infineon Technologies AG, Omron Corporation, and Pepperl+Fuchs SE, along with Kimonix, LEAFIO AI, Impact Analytics, Apple Inc., Oracle Corporation, Panasonic Corporation, and other key players, provide sensor modules, embedded AI chips, and store-edge computing tools that underpin in-store intelligence.

Top Key Players in the Market

- AI Store Manager

- Amazon Web Services, Inc.

- Apple Inc.

- Brightpearl

- Caper AI

- Focal Systems

- GK Software SE

- Google LLC

- IBM Corporation

- Impact Analytics

- Infineon Technologies AG

- Intel Corporation

- Kimonix

- LEAFIO AI

- Microsoft Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Oracle Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

- Others

Recent Developments

- In September 2025, Amazon Web Services introduced an advanced Seller Assistant with agentic AI capabilities. It actively helps sellers manage inventory, optimize shipments, analyze sales patterns, and even take authorized actions proactively. This tool aims to transform seller operations from reactive to strategic and collaborative modes, driving better inventory management and business decisions.

- In September 2025, GK Software SE showcased AI-driven retail innovations at NRF Europe 2025. Key highlights included AI-powered secure self-checkouts with computer vision to prevent fraud, hyper-personalized customer loyalty programs, real-time promotions, and AI-based price optimization to enhance sales and customer satisfaction.

Report Scope

Report Features Description Market Value (2024) USD 83.03 Bn Forecast Revenue (2034) USD 493.08 Bn CAGR(2025-2034) 19.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (AI Store Manager Software, Services), By Application (Inventory Management, POS systems, Employee Scheduling, Task Management, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-User (Supermarkets, Specialty Retail Stores, Grocery Stores, Retail Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AI Store Manager, Amazon Web Services, Inc., Apple Inc., Brightpearl, Caper AI, Focal Systems, GK Software SE, Google LLC, IBM Corporation, Impact Analytics, Infineon Technologies AG, Intel Corporation, Kimonix, LEAFIO AI, Microsoft Corporation, NXP Semiconductors N.V., Omron Corporation, Oracle Corporation, Panasonic Corporation, Pepperl+Fuchs SE, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Store Manager Tools MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI Store Manager Tools MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AI Store Manager

- Amazon Web Services, Inc.

- Apple Inc.

- Brightpearl

- Caper AI

- Focal Systems

- GK Software SE

- Google LLC

- IBM Corporation

- Impact Analytics

- Infineon Technologies AG

- Intel Corporation

- Kimonix

- LEAFIO AI

- Microsoft Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Oracle Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

- Others