Global AI Sports Betting Fraud Detection Market Size, Share and Analysis Report By Component (Solutions, Services), By Deployment Mode (On-Premises, Cloud-Based), By Technology (Machine Learning (ML), Artificial Intelligence (AI), Big Data Analytics, Natural Language Processing (NLP), Others), By Application (Online Betting Platforms, Mobile Betting Apps, Retail Betting Outlets), By End-User (Sportsbook Operators, Gaming Companies, Regulatory Bodies), By Sports Type (Football, Cricket, Basketball, Horse Racing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174927

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Deployment Mode Analysis

- Technology Analysis

- Application Analysis

- End-User Analysis

- Sports Type Analysis

- Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Investment and Business Benefits

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

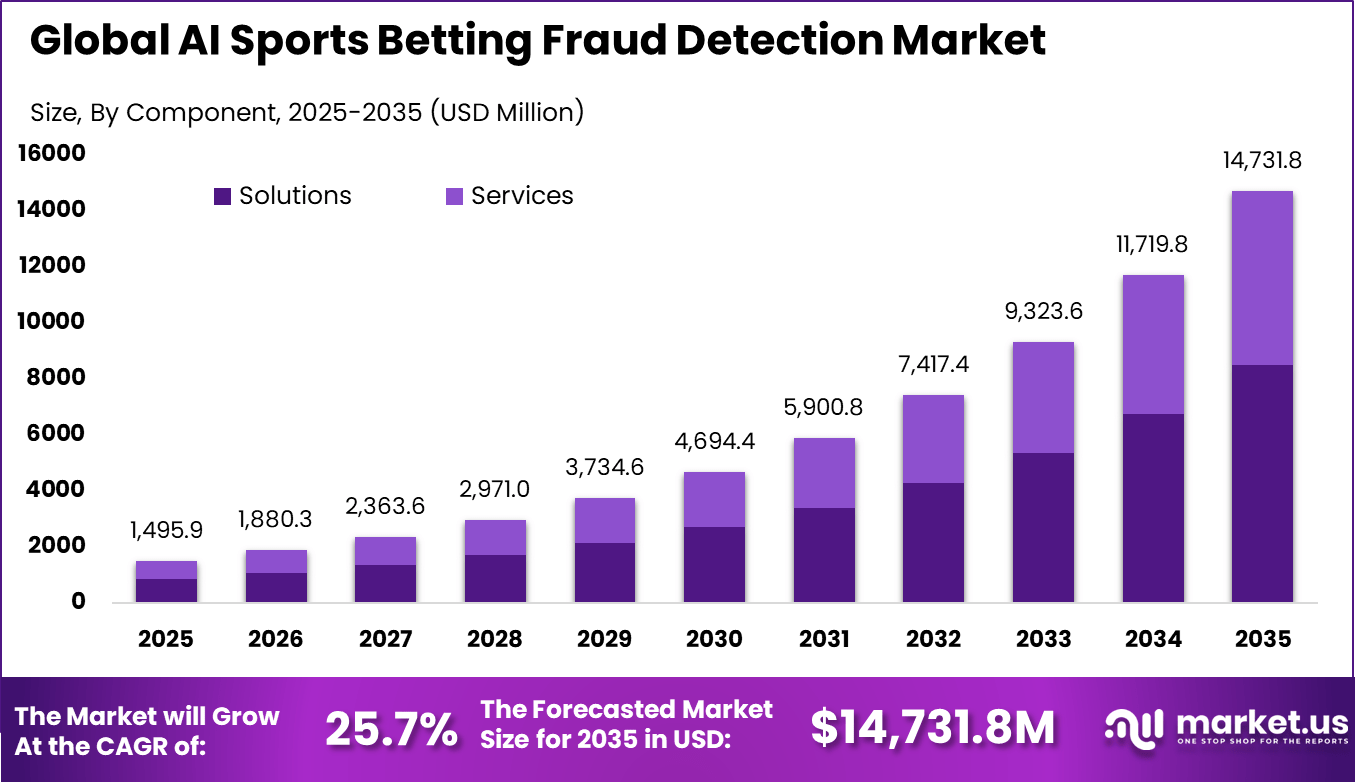

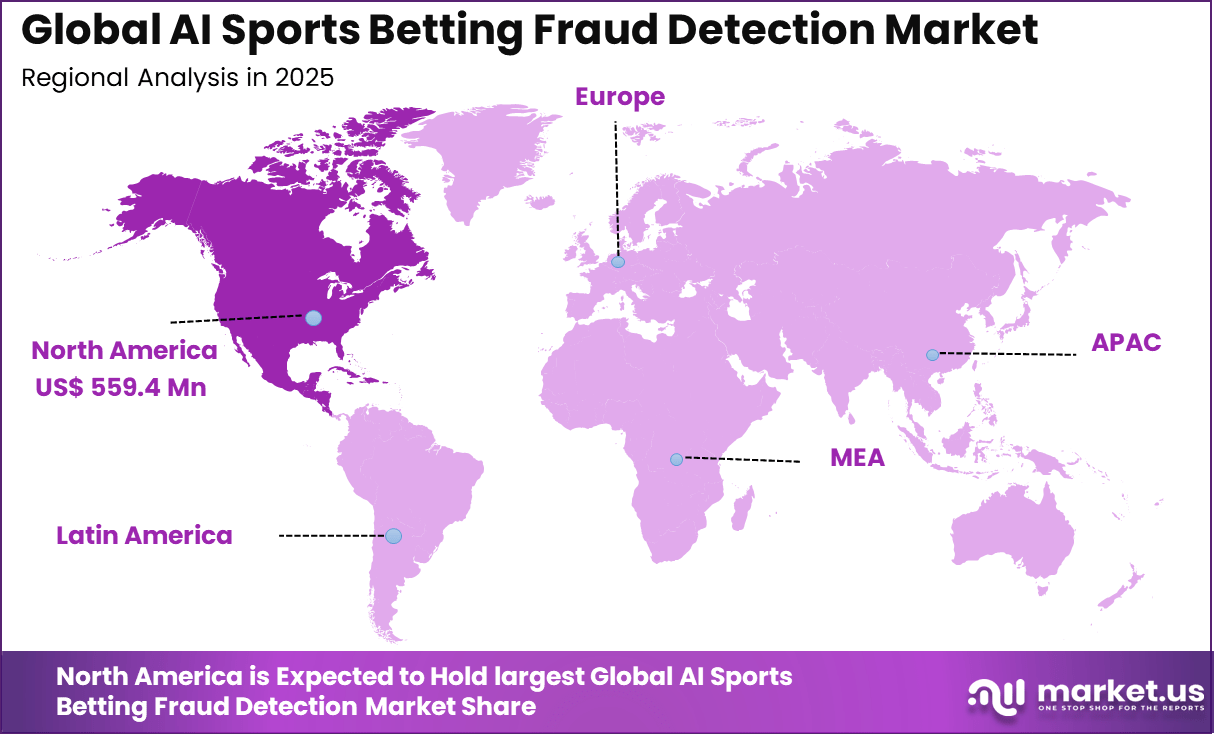

The Global AI Sports Betting Fraud Detection Market size is expected to be worth around USD 14,731.8 million by 2035, from USD 1,495.9 million in 2025, growing at a CAGR of 25.7% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 37.4% share, holding USD 559.4 million in revenue.

AI powered fraud detection in sports betting is expanding rapidly due to the need to analyze large volumes of real time data. Advanced algorithms are used to detect unusual betting patterns and potential match manipulation with greater speed and accuracy. This approach allows operators to respond quickly to emerging risks and protect market integrity. As betting activity continues to grow, reliance on AI driven monitoring systems is increasing.

In 2023, AI systems identified 73% of suspicious matches reported by Sportradar, which monitors more than 850,000 matches each year. This highlights the effectiveness of automated detection compared to manual methods. Continuous learning models improve detection accuracy as more data is processed. As a result, AI has become a core component of fraud prevention strategies in the sports betting industry.

The AI sports betting fraud detection market centers on software solutions that apply artificial intelligence to identify and prevent fraudulent activity across sports wagering platforms. These systems analyze betting behavior, transaction flows, account activity, and event related data to detect abnormal or suspicious patterns. The use of AI enables continuous monitoring of large scale, real time data streams with higher accuracy than manual methods. This approach improves early risk detection and operational response.

For instance, in November 2024, Genius Sports joined the International Betting Integrity Association (IBIA) as an associate member to share suspicious betting data, enhancing global anti-match-fixing efforts. The collaboration boosts transparency in betting patterns for better threat detection.

These solutions are widely used by online sportsbooks, betting exchanges, payment service providers, and regulatory authorities. AI based detection supports identification of risks such as match manipulation, bonus abuse, and coordinated betting behavior. Adoption of these systems helps maintain fair play and protects financial interests within betting ecosystems. As regulatory scrutiny increases, AI driven fraud detection is becoming a critical component of sports betting operations.

Key Takeaway

- In 2025, solutions dominated the AI sports betting fraud detection market with a 57.6% share, driven by demand for end to end fraud monitoring platforms.

- Cloud based deployment led adoption with an 84.8% share in 2025, supported by scalability and real time data processing needs.

- Machine learning technologies accounted for a 43.2% share in 2025, as operators relied on pattern recognition and anomaly detection models.

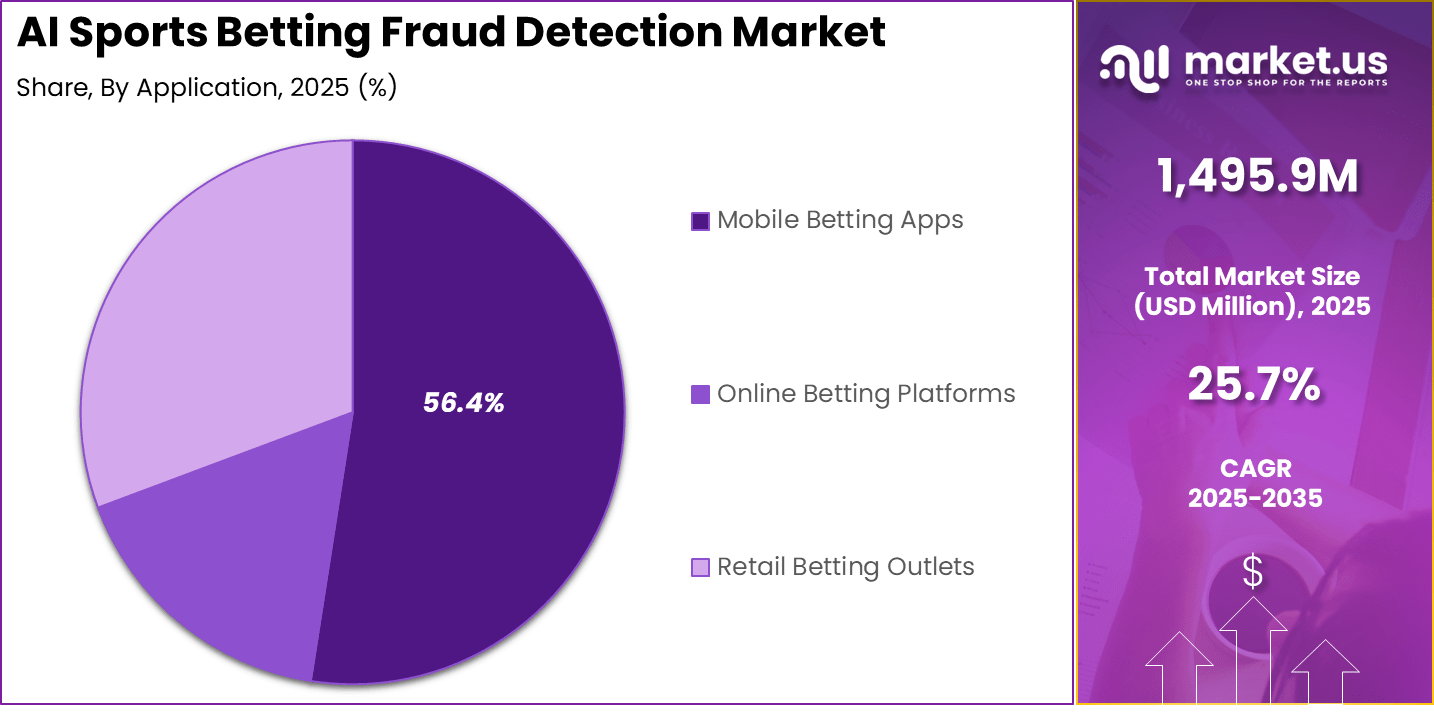

- Mobile betting apps captured a 56.4% share in 2025, reflecting the rapid shift toward smartphone based wagering.

- Sportsbook operators represented the largest end user group with a 75.1% share in 2025, due to direct exposure to fraud and compliance risks.

- Football dominated by sport type with a 51.4% share in 2025, supported by high betting volumes and global popularity.

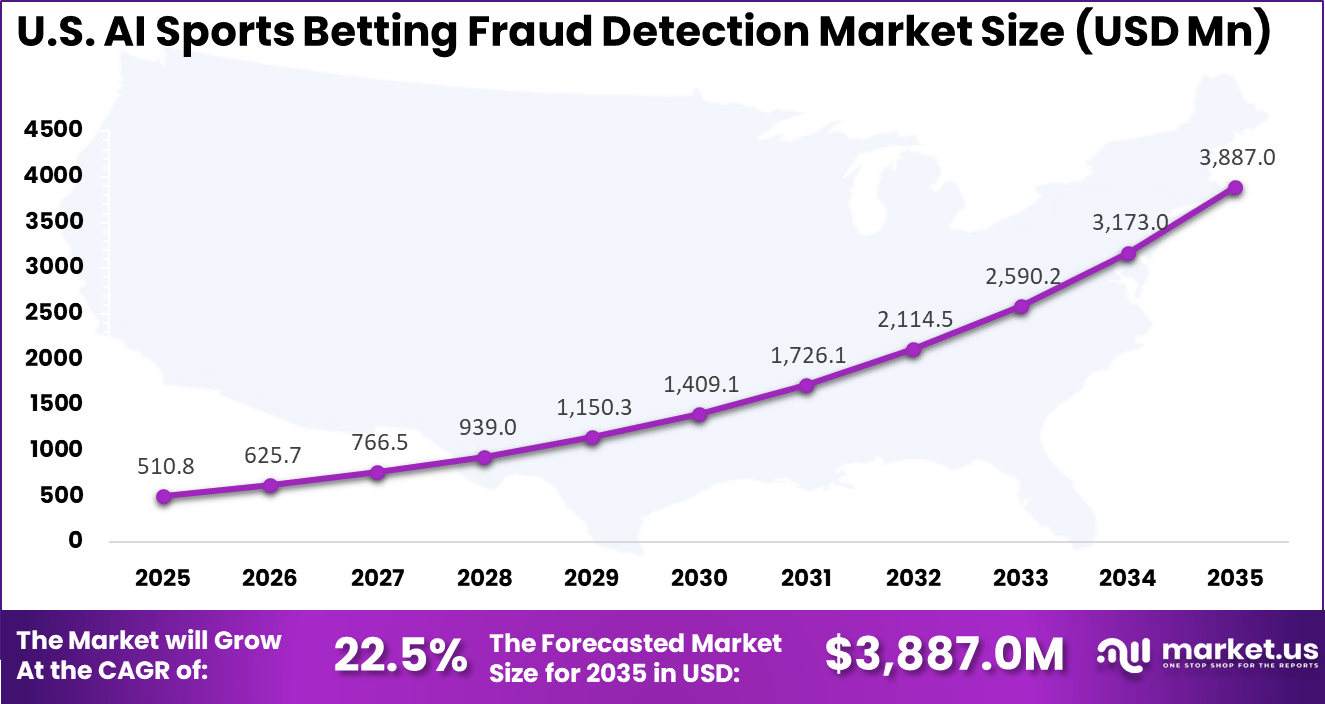

- The U.S. AI sports betting fraud detection market reached USD 510.8 million in 2025, expanding at a 22.5% CAGR.

- North America held a leading regional position with more than a 37.4% share in 2025, driven by regulated betting markets and advanced AI adoption.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Rapid expansion of online sports betting Higher exposure to digital fraud risks ~6.8% North America, Europe Short Term Growth of mobile betting platforms Real time fraud detection requirements ~6.1% Global Short Term Increasing regulatory scrutiny Mandatory integrity monitoring systems ~5.4% North America, Europe Mid Term Adoption of AI and machine learning Improved anomaly and pattern detection ~4.9% Global Mid Term Rising financial losses from fraud Protection of operator margins ~2.5% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline False positive alerts Disruption of legitimate betting activity ~4.6% Global Short Term Data privacy regulations Constraints on player data analysis ~3.9% Europe, North America Short Term Model accuracy limitations Evolving fraud techniques ~3.2% Global Mid Term Integration complexity Linking with legacy betting platforms ~2.6% Global Mid Term High competitive intensity Pricing pressure among vendors ~2.0% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High implementation cost Advanced AI infrastructure expenses ~5.2% Emerging Markets Short to Mid Term Limited skilled resources Shortage of AI fraud specialists ~4.1% Global Mid Term Platform dependency Reliance on third party betting data ~3.4% Global Mid Term Trust issues among operators Hesitation toward automated decisions ~2.7% Global Long Term Fragmented regulatory frameworks Different rules across regions ~2.1% Global Long Term Component Analysis

Solutions account for 57.6% of the AI sports betting fraud detection market, reflecting strong demand for end-to-end fraud prevention systems. These solutions integrate monitoring, detection, and alert mechanisms into a unified platform. Sports betting operators rely on such systems to identify suspicious betting behavior in real time.

AI-based solutions analyze large volumes of transaction data and betting patterns. This enables early detection of anomalies such as unusual stake sizes or coordinated betting activity. The ability to automate fraud identification reduces manual review efforts.

As betting volumes increase, scalable solution platforms become essential. Operators prioritize comprehensive tools that improve accuracy and response time. This keeps solutions as the dominant component in the market.

For Instance, in November 2025, Sportradar enhanced its Universal Fraud Detection System with new AI modules. Operators now use these software solutions to scan betting patterns in real time across thousands of events. The update spots hidden anomalies faster, helping teams cut fraud losses by linking data streams smoothly. This keeps solutions dominant as they deliver quick value without hardware overhauls.

Deployment Mode Analysis

Cloud-based deployment dominates the market with an 84.8% share, highlighting the need for scalable and flexible infrastructure. Cloud platforms support real-time data processing across multiple betting channels. This is critical for handling high transaction volumes during live events. Cloud-based systems allow sportsbook operators to deploy updates and security enhancements quickly.

Centralized data storage improves pattern recognition across regions and platforms. These advantages support rapid adoption. The preference for cloud deployment is also driven by cost efficiency and ease of integration. Operators can scale resources based on demand peaks. Cloud-based models remain the preferred deployment approach.

For instance, in October 2025, Stats Perform rolled out cloud integrity tools for betting platforms. The service monitors global odds and player data from any device, flagging risks instantly. Sportsbooks access dashboards to review alerts without local installs, scaling easily during big events. Cloud flexibility drives growth as it handles spikes in traffic seamlessly.

Technology Analysis

Machine learning holds a 43.2% share within the technology segment, reflecting its effectiveness in detecting complex fraud patterns. ML models continuously learn from historical and real-time data. This improves detection accuracy over time. Sports betting fraud often involves evolving tactics that are difficult to identify using static rules.

Machine learning adapts to these changes by identifying subtle correlations. This supports proactive fraud prevention. As data volumes expand, ML becomes increasingly valuable. Its ability to process large datasets strengthens system reliability. Machine learning remains central to fraud detection capabilities.

For Instance, in December 2025, Genius Sports integrated ML models into fraud alerts for partners. The tech learns from past bets to predict unusual activity, like matched fixes in football. Operators get precise warnings, reducing false positives. ML leads as it adapts to new tricks, making detection sharper over time.

Application Analysis

Mobile betting apps account for 56.4% of application demand, driven by the shift toward mobile-first wagering. Mobile platforms generate high transaction frequency and real-time betting activity. This increases exposure to fraudulent behavior. AI-driven fraud detection tools monitor mobile user behavior continuously.

Patterns such as rapid account switching or abnormal betting timing can be identified early. This enhances platform security and user trust. As mobile betting adoption continues to grow, fraud prevention becomes more critical. Operators prioritize mobile-focused detection tools. This sustains strong demand in this application segment.

For Instance, in September 2025, Mindway AI launched mobile-focused fraud scans via GameScanner. Apps now track user behavior on phones, spotting rapid bets or geo jumps early. Bettors stay safe while operators block bad actors fast. Mobile apps thrive with this as users bet on the go more.

End-User Analysis

Sportsbook operators represent 75.1% of end-user adoption, making them the primary users of fraud detection systems. Operators are responsible for ensuring fair play, regulatory compliance, and customer protection. AI tools support these responsibilities effectively. Fraud incidents can result in financial losses and reputational damage.

Advanced detection systems help mitigate these risks. Operators rely on AI to maintain platform integrity. As regulatory oversight increases, adoption among operators continues to rise. AI solutions support compliance and operational efficiency. This reinforces sportsbook operators’ dominant position.

For Instance, in January 2026, Altenar upgraded fraud suites for sportsbook clients. Operators deploy AI checks that watch live odds shifts and account links. This cuts manipulation risks in high-volume markets. Operators dominate as they need constant vigilance to protect revenue.

Sports Type Analysis

Football accounts for 51.4% of AI fraud detection deployment by sports type. The sport attracts high betting volumes across leagues and tournaments. This makes it a primary target for fraud monitoring. Football betting involves diverse markets and live betting options.

AI systems track these activities to identify suspicious patterns. Continuous monitoring helps reduce fraud exposure. The global popularity of football supports sustained demand for advanced fraud detection. Operators prioritize this sport due to high transaction values. Football remains a key focus area.

For Instance, in November 2025, Sportlogiq added football-specific ML for betting integrity. The tool analyzes match data and wagers to flag suspicious plays. Leagues and books use it to safeguard big games. Football pulls ahead with its huge betting volume and fix history.

Regional Analysis

North America holds a 37.4% share of the AI sports betting fraud detection market, supported by the expansion of regulated betting platforms. Strong digital infrastructure and widespread mobile adoption support AI implementation. Operators in the region focus on risk management and compliance.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity North America Regulated online sports betting markets 37.4% USD 559.5 Mn Advanced Europe Strong focus on match integrity 29.6% USD 442.6 Mn Advanced Asia Pacific Rapid growth of digital betting users 22.8% USD 341.1 Mn Developing to Advanced Latin America Expansion of legalized betting 6.1% USD 91.3 Mn Developing Middle East and Africa Early stage betting regulation 4.1% USD 61.4 Mn Early For instance, in September 2023, Stats Perform launched a performance integrity analysis service using Opta data and video analysis to flag suspicious activity and combat match-fixing, already employed by multiple football governing bodies for investigations, reinforcing North American leadership in sports betting integrity.

The United States contributes USD 510.8 million in market value, driven by rapid growth in online and mobile sports betting. Operators invest in AI solutions to protect revenue and ensure fair betting practices. Fraud prevention is a strategic priority.

A CAGR of 22.5% reflects strong growth momentum across the region. Rising betting activity and regulatory requirements support expansion. North America remains a key region for AI-based fraud detection solutions.

For instance, in July 2025, Sportradar launched Bettor Sense, an AI-driven responsible gambling tool by BettorView, to detect at-risk betting behavior early, supporting fraud prevention and market integrity amid record Q2 revenue growth. This innovation underscores proactive player protection in U.S. sports betting operations.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Sportsbook operators Very High ~75.1% Revenue protection and compliance Platform wide deployment Betting platform providers High ~18% Integrity and trust enhancement Embedded integration Regulatory bodies Moderate ~12% Fair play and market oversight Program based Payment processors Moderate ~8% Transaction fraud prevention Selective adoption Data analytics firms Low ~5% Value added services Opportunistic investment Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Machine learning models Behavioral and transactional analysis ~6.9% Growing Real time data streaming Instant anomaly detection ~5.8% Growing Cloud computing platforms Scalable fraud monitoring ~5.1% Mature AI driven risk scoring Automated fraud classification ~4.0% Developing API based integrations Seamless platform connectivity ~3.1% Developing Investment and Business Benefits

Investment opportunities in the AI sports betting fraud detection market exist in multi-platform monitoring solutions. Operators often manage web, mobile, and third-party betting channels. Unified detection systems improve oversight. Scalable architectures attract investor interest. Platform consolidation supports growth.

Another opportunity lies in integration with payment and identity verification systems. Combining fraud detection with transaction monitoring improves risk assessment. Cross-system visibility enhances prevention. Integrated solutions increase customer value. Ecosystem-driven platforms show expansion potential.

AI sports betting fraud detection systems improve operational efficiency by automating monitoring and analysis tasks. Reduced manual review lowers staffing requirements. Faster identification limits financial losses. Efficiency improvements support scalability. Operational resilience increases.

These systems also strengthen compliance and governance capabilities. Automated reporting supports regulatory audits. Transparent monitoring improves accountability. Strong controls enhance stakeholder confidence. Long-term business stability improves.

Driver Analysis

The AI sports betting fraud detection market is being driven by the increasing volume and sophistication of online sports wagering activity, which presents heightened risk of fraudulent behaviour. Traditional rule-based systems struggle to keep pace with complex schemes such as bonus abuse, account takeovers, collusive betting rings, and market manipulation.

AI-enabled detection platforms apply machine learning, pattern recognition, and real-time behavioural analysis to identify anomalies and suspicious patterns across vast streams of betting transactions with greater accuracy and speed than manual methods.

This proactive capability enhances operational integrity, protects revenue, and supports regulatory compliance, making AI-based fraud detection a critical investment for sportsbooks, operators, and payment partners focused on risk mitigation and trust.

Restraint Analysis

A significant restraint in the AI sports betting fraud detection market relates to data privacy and cross-jurisdictional regulatory complexity. Fraud detection models require access to sensitive customer data, transactional histories, and behavioural signals to generate reliable insights.

Ensuring that data collection and processing comply with diverse privacy regulations, licensing requirements, and responsible gaming standards can be technically and operationally challenging for operators. Fragmented regulatory environments across regions further complicate unified data policies, which can slow implementation of comprehensive AI detection systems and limit cross-market intelligence sharing.

Opportunity Analysis

Emerging opportunities in the AI sports betting fraud detection market are linked to the integration of advanced analytics, network-wide visibility, and collaborative risk ecosystems. AI platforms that combine real-time detection with predictive scoring and cross-operator intelligence can more effectively anticipate fraud attempts before they impact business outcomes.

There is also opportunity in embedding detection engines directly into customer engagement workflows, such as account opening, deposit activity, and live bet placement, to provide seamless protection without degrading user experience. Solutions that enable automated response actions, adaptive learning, and risk-based authentication can help operators strike a balance between security and convenience.

Challenge Analysis

A central challenge confronting this market involves balancing detection accuracy with user experience and false positive management. Overly sensitive models may trigger unnecessary alerts that disrupt legitimate customer activity, leading to account restrictions or friction in wagering experiences. Conversely, under-tuned systems may fail to flag sophisticated fraud patterns, exposing operators to financial loss and reputational damage.

Ensuring that AI models maintain precision while minimising false positives requires ongoing tuning, high-quality labelled training data, and collaboration between data scientists and domain experts to align detection logic with evolving threat behaviours.

Emerging Trends

Emerging trends within the AI sports betting fraud detection landscape include the adoption of graph-based machine learning models that map relationships across accounts, transactions, devices, and behavioural signals to uncover hidden fraud networks. Another trend is real-time streaming analytics that continuously ingests multi-source data to detect anomalies as they occur rather than in batch-oriented cycles.

Operators are also exploring federated learning approaches that allow models to improve using distributed data without compromising privacy or centralised storage, enabling broader learning while adhering to regulatory constraints.

Growth Factors

Growth in the AI sports betting fraud detection market is supported by the rapid expansion of mobile and online wagering platforms, growing global interest in sports betting, and heightened scrutiny from regulators and payment processors. Advanced AI models that learn from historical incidents and adapt to new threat vectors enhance resilience against evolving fraud tactics.

Expanding data sources, including behavioural biometrics, geolocation signals, and real-time bet analytics, strengthen the ability to distinguish between legitimate and deceptive activity. As operators prioritise risk control, customer protection, and regulatory compliance, investment in intelligent fraud detection systems continues to rise as a core component of competitive sports betting operations.

Key Market Segments

By Component

- Solutions

- Fraud Detection Platforms

- Risk Management Solutions

- Analytics & Reporting Tools

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Technology

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Big Data Analytics

- Natural Language Processing (NLP)

- Others

By Application

- Mobile Betting Apps

- Online Betting Platforms

- Retail Betting Outlets

By End-User

- Sportsbook Operators

- Gaming Companies

- Regulatory Bodies

By Sports Type

- Football

- Cricket

- Basketball

- Horse Racing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in November 2024, Mindway AI Integrated GameScanner technology with VBet in the Netherlands for proactive problem gambling detection using AI and neuroscience. The tool identifies early risk behaviors, supporting fraud prevention through responsible gaming compliance.

Top 5 key players

Company Core Fraud Detection Focus Key AI Capabilities Primary Customer Base Competitive Strength Sportradar Betting integrity and match fixing detection AI based anomaly detection, real time monitoring, pattern analysis Sportsbooks, sports federations, regulators Global leader with deep data coverage and strong regulatory trust Genius Sports Integrity monitoring and suspicious betting alerts Machine learning models for betting behavior analysis Sports leagues, betting operators Strong league partnerships and official data access Stats Perform Fraud risk analytics and betting behavior insights Predictive analytics, AI driven risk modeling Betting operators, media, sports bodies Advanced analytics expertise with large historical datasets Signify Group Betting corruption and integrity intelligence AI supported investigations, network behavior analysis Regulators, sports governing bodies Strong investigative and compliance focused positioning Mindway AI Player risk and fraud detection Behavioral AI, real time player profiling Online sportsbooks, casinos Specialized focus on player level risk and fraud prevention Top Key Players in the Market

- Sportradar

- Genius Sports

- Stats Perform

- Sportlogiq

- IDnow

- SAS Institute

- Signify Group

- TXODDS

- BettorView

- Right Angle

- Altenar

- Simplebet

- Mindway AI

- Metamako (Part of Nexus Group)

- BetConstruct

- SBTech

- Kambi

- OpenBet

- Betcris

- Betsson Group

- Others

Recent Developments

- In June 2025, Sportradar Secured exclusive betting data rights for the FIFA Club World Cup 2025, deploying its AI-powered Universal Fraud Detection System (UFDS) to monitor over 8,200 betting markets in real-time. This partnership underscores Sportradar’s leadership in preventing match-fixing through advanced surveillance and protecting tournament integrity.

- In January 2026, Stats Perform named FIFA’s first official betting data and live-streaming partner for the 2026 World Cup and other events like the 2027 Women’s World Cup. The AI-driven deal ensures secure data distribution and fraud monitoring across global betting platforms.

Report Scope

Report Features Description Market Value (2025) USD 1,495.9 Mn Forecast Revenue (2035) USD 14,731.8 Mn CAGR(2026-2035) 25.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (On-Premises, Cloud-Based), By Technology (Machine Learning (ML), Artificial Intelligence (AI), Big Data Analytics, Natural Language Processing (NLP), Others), By Application (Online Betting Platforms, Mobile Betting Apps, Retail Betting Outlets), By End-User (Sportsbook Operators, Gaming Companies, Regulatory Bodies), By Sports Type (Football, Cricket, Basketball, Horse Racing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sportradar, Genius Sports, Stats Perform, Sportlogiq, IDnow, SAS Institute, Signify Group, TXODDS, BettorView, Right Angle, Altenar, Simplebet, Mindway AI, Metamako (Part of Nexus Group), BetConstruct, SBTech, Kambi, OpenBet, Betcris, Betsson Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Sports Betting Fraud Detection MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI Sports Betting Fraud Detection MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sportradar

- Genius Sports

- Stats Perform

- Sportlogiq

- IDnow

- SAS Institute

- Signify Group

- TXODDS

- BettorView

- Right Angle

- Altenar

- Simplebet

- Mindway AI

- Metamako (Part of Nexus Group)

- BetConstruct

- SBTech

- Kambi

- OpenBet

- Betcris

- Betsson Group

- Others