Global AI Soundbar Market Size, Share, Industry Analysis Report By Product type (2 channel soundbars, 3 channel soundbars, 5 channel soundbars, 7 channel soundbars), By Connectivity (Bluetooth, Auxiliary, Wi-Fi, Others (HDMI, optical, USB, NFC, etc.), By Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Others), By Installation Type (Wall mounted, Tabletop, Free standing), By Speaker Wattage (Up to 200 Watts, Between 200-800 Watts, Above 800 Watts), By Price Range (Low, Medium, High), By Size (Under 30 inches, 30-60 inches, Above 60 inches), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162138

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analyst Viewpoint

- U.S. AI Soundbar Market Size

- Product Type Analysis

- Connectivity Analysis

- Technology Analysis

- Installation Type Analysis

- Speaker Wattage Analysis

- Price Range Analysis

- Size Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Latest Trends

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

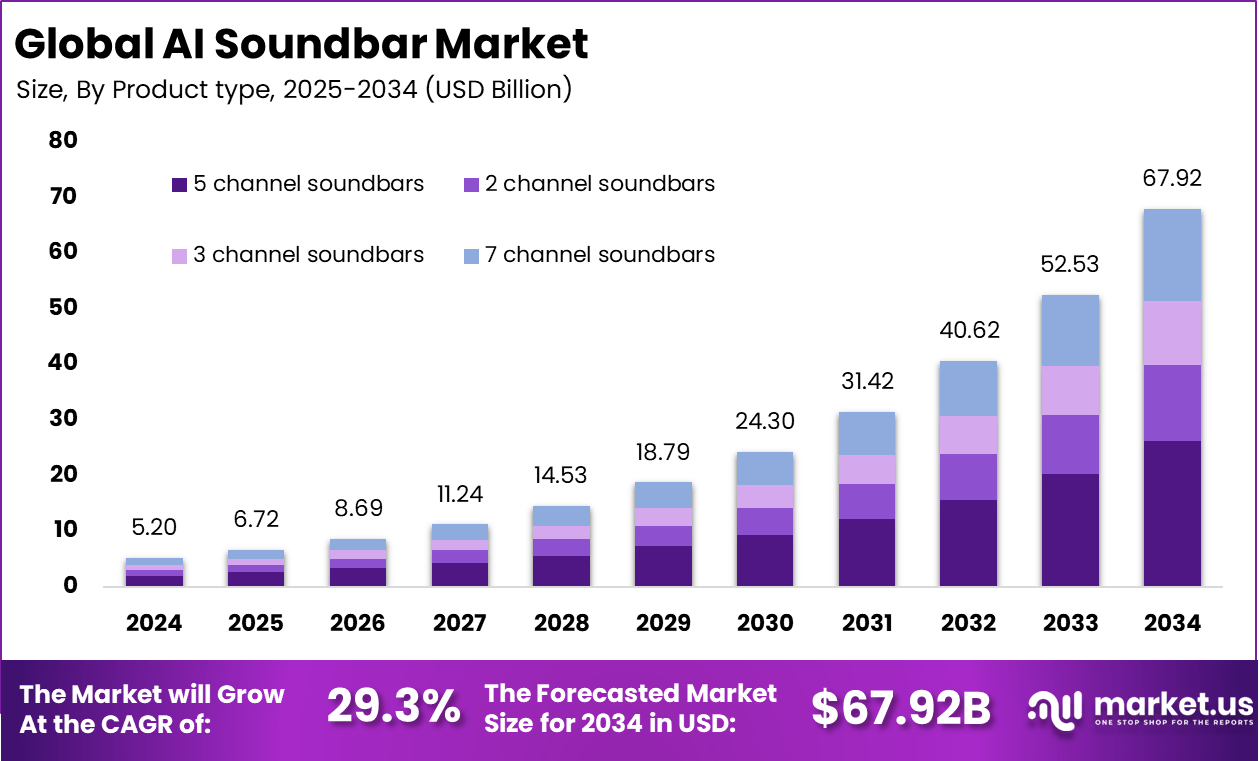

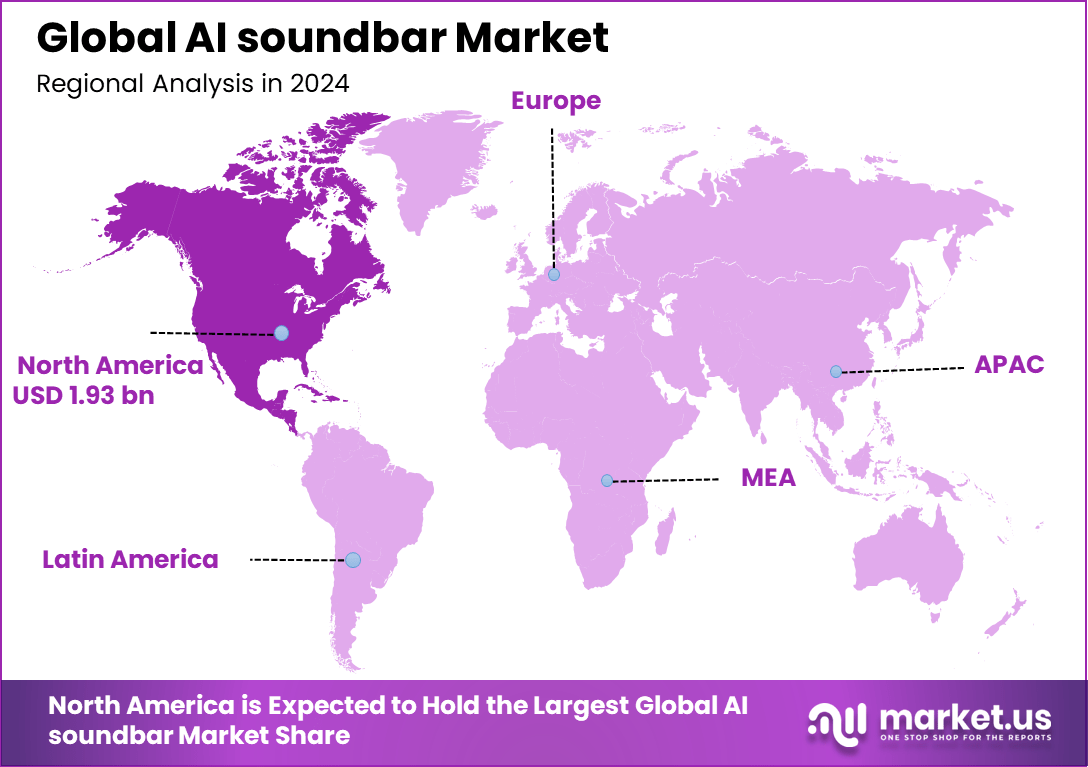

The Global AI soundbar Market size is expected to be worth around USD 67.92 billion by 2034, from USD 5.20 billion in 2024, growing at a CAGR of 29.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 1.93 billion in revenue.

The AI soundbar market is evolving rapidly as consumers increasingly seek high-quality, immersive audio experiences in their homes. These devices stand out by integrating artificial intelligence to optimize sound output based on room acoustics, content type, and user preferences. Unlike traditional soundbars, AI soundbars can dynamically adapt audio settings in real time, providing a superior and personalized listening experience.

Top driving factors for the AI soundbar market include the rising demand for better sound quality as viewers upgrade to 4K and 8K TVs. Streaming platforms’ emphasis on immersive audio content has amplified the need for sound systems that can deliver rich, multi-dimensional audio. Wireless connectivity features such as Wi-Fi and Bluetooth contribute to convenience by reducing cable clutter, while AI algorithms enhance sound clarity by automatically calibrating volumes and reducing background noise.

The significant growth in interest from mid-range and premium consumer segments. Wireless AI soundbars with multi-room capabilities and voice assistant integrations are among the most sought-after. Consumers increasingly prefer AI-enabled devices that link seamlessly with smart home ecosystems, allowing control via voice or mobile apps. Recent observations reveal that Over 70% of new soundbar users prioritize AI-powered sound optimization, mainly for clearer dialogue and dynamic sound adjustment.

For instance, in March 2025, LG Electronics highlighted its soundbars like the S95TR with Dolby Atmos and AI Sound Pro technology that intelligently adjusts sound profile according to content type. This includes crisp vocals for sports and immersive soundscapes for movies, tailored especially for LG TV users for seamless integration.

Key Takeaway

- The 5-channel soundbars segment led with 38.7%, indicating consumer preference for immersive, multi-channel audio setups.

- Bluetooth connectivity dominated with 42.7%, highlighting the demand for wireless and seamless device integration.

- Natural Language Processing (NLP) features held 40.6%, showing strong adoption of AI-enabled voice control systems.

- Wall-mounted models captured 46.6%, reflecting their popularity in modern home and commercial installations.

- Soundbars up to 200 Watts accounted for 47.7%, appealing to users seeking balanced performance and energy efficiency.

- Medium-sized soundbars represented 55.5%, suggesting widespread acceptance for mid-range audio solutions.

- Units designed for 30–60 inch displays secured 52.6%, aligning with the standard screen sizes in homes and offices.

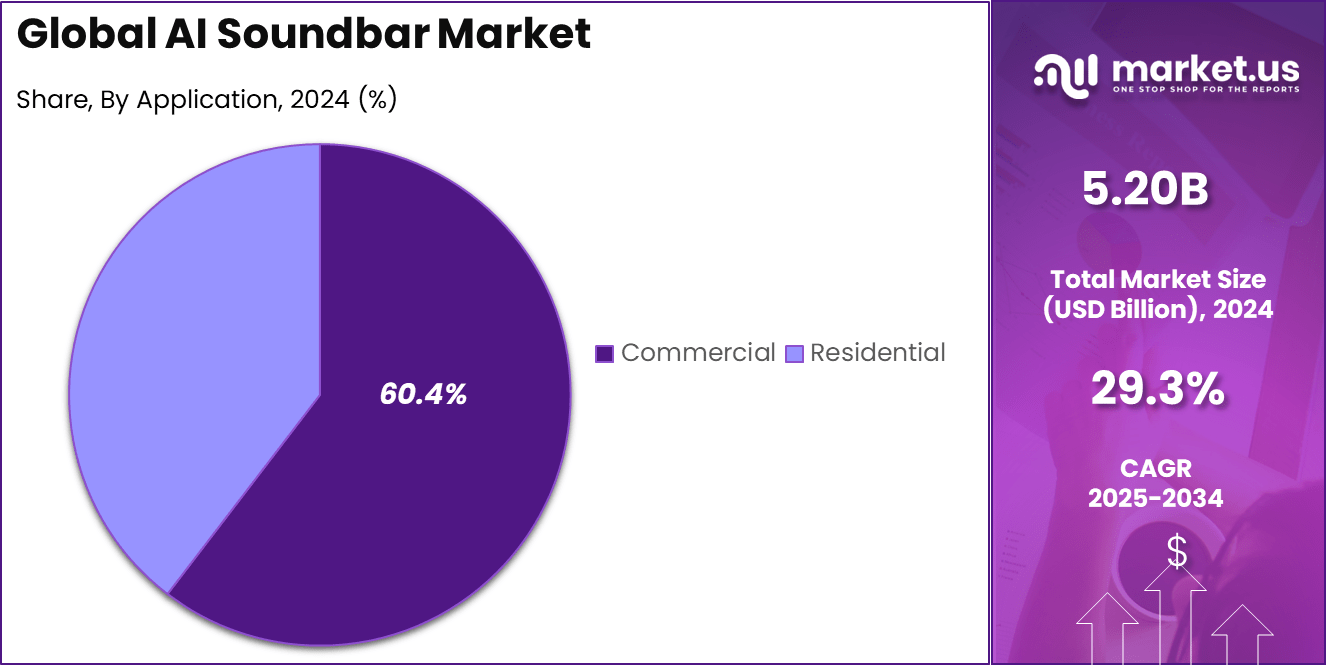

- Commercial applications led with 60.4%, driven by increasing use of AI sound systems in retail, hospitality, and corporate environments.

- Offline channels contributed 65.7% of sales, showing that customers still prefer in-store product testing and demonstrations.

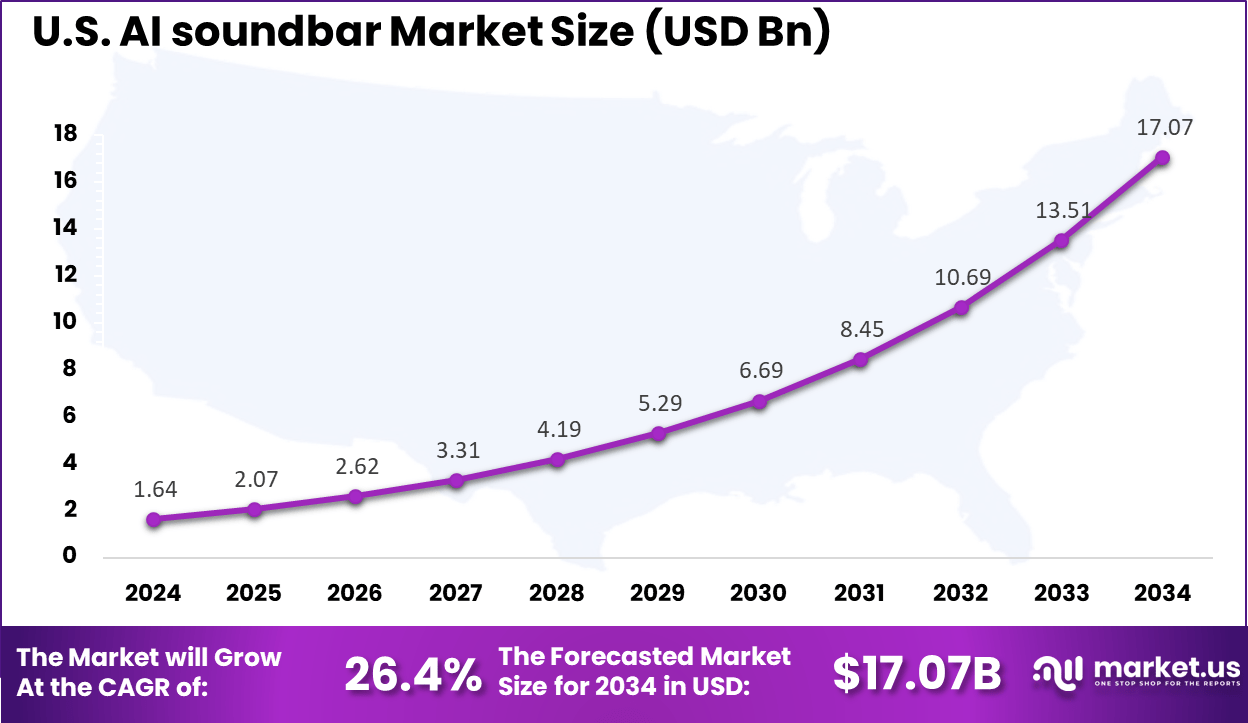

- The US market reached USD 1.64 Billion in 2024 with a strong 26.4% CAGR, supported by rising adoption of smart home audio technologies.

- North America dominated the global market with 37.2% share, driven by high consumer spending and integration of AI-based entertainment devices.

Analyst Viewpoint

Consumer demand for AI soundbars is growing rapidly as people seek immersive, connected entertainment experiences. Currently, over 45% of households in developed economies are smart homes, boosting the integration of connected audio devices. Technologies such as Dolby Atmos are popular for delivering rich surround sound, especially in smaller living spaces where traditional speaker systems are impractical.

Key technologies driving adoption include AI-based sound optimization, voice assistant integration, and spatial sound mapping. These soundbars learn user preferences and adjust audio settings according to room acoustics and content type. AI algorithms improve sound clarity by about 20% to 30%, balancing frequencies and reducing distortion.

The main reasons consumers choose AI soundbars are their premium sound quality combined with ease of use. AI soundbars replace complex multi-speaker setups by offering similar or better performance with simpler installation. Voice control through assistants like Google Assistant, Alexa, or Siri provides hands-free convenience, appealing especially to tech-savvy users.

U.S. AI Soundbar Market Size

The market for AI soundbars within the U.S. is growing tremendously and is currently valued at USD 1.64 billion, the market has a projected CAGR of 26.4%. The market is growing due to rising smart home adoption and the trend toward upgrading home entertainment systems. Consumers increasingly demand sound devices that integrate AI for a seamless, personalized audio experience.

Additionally, the proliferation of streaming platforms and voice assistant technology is fueling the need for smarter, high-fidelity audio solutions. With continuous innovation and consumer interest in immersive sound, the U.S. market remains highly dynamic and fast-growing.

For instance, in May 2025, Sonos, a prominent U.S.-based company, introduced an AI-powered speech clarity update for its premium Dolby Atmos Sonos Arc Ultra soundbar. Developed in collaboration with the Royal National Institute for Deaf People (RNID), this software enhancement allows users to customize dialogue clarity across four levels, from Low to Max, catering to diverse listening needs, including those with hearing loss.

In 2024, North America held a dominant market position in the Global AI soundbar Market, capturing more than a 37.2% share, holding USD 1.93 billion in revenue. This dominance is due to the high smart TV penetration and a culture that prioritizes home entertainment quality. Strong retail infrastructure and diverse distribution channels make technology easily accessible to consumers across the region.

Advanced features like Dolby Atmos and AI-enhanced sound optimize the audio experience, reinforcing consumer preference for sophisticated soundbars. The region’s purchasing power and tech-savvy population continue to fuel market leadership, making North America a key hub for AI soundbar innovation and sales.

For instance, in September 2024, Bose, a leading U.S.-headquartered company, reinforced North America’s dominance in the AI soundbar market by launching its new AI-embued Dolby Atmos Smart Soundbar. Priced at $499, this model serves as a more accessible option beneath the premium Smart Soundbar Ultra.

Product Type Analysis

In 2024, The 5 channel soundbars segment held a dominant market position, capturing a 38.7% share of the Global AI soundbar Market. This dominance is due to its ability to deliver immersive audio experiences with multi-speaker setups, which enrich surround sound quality.

Consumers often prefer this type for home theaters and commercial use, where clear, distributed sound is essential. The balanced performance of 5 channel soundbars meets both aesthetic and functional demands, making them a popular choice in the market.

Additionally, the advanced features and compatibility with modern smart home devices are further driving growth. Their ability to support dynamic soundscapes enhances user engagement, making them a preferred choice among customers who want richer entertainment experiences without bulky setups.

For Instance, in September 2025, Bose launched its new 5 channel soundbar featuring immersive Dolby Atmos technology that delivers rich, clear audio with deep bass, elevating home theatre experiences while maintaining a sleek design.

Connectivity Analysis

In 2024, the Bluetooth segment held a dominant market position, capturing a 42.7% share of the Global AI soundbar Market. This dominance is due to their hassle-free wireless audio streaming. Its universal compatibility enables seamless connection with smartphones, tablets, and TVs without extra wiring, making it very attractive to consumers.

Bluetooth emphasizes convenience and mobility by allowing users to play content from various devices easily. Additionally, Bluetooth technology is continuously improving with better range, sound quality, and low latency, which supports enhanced listening experiences. The simplicity of pairing, paired with widespread device availability, keeps this segment at the forefront of AI soundbar connectivity options.

For instance, in August 2025, Samsung unveiled its 2025 Bluetooth-enabled soundbar range powered by an upgraded AI Sound Engine that dynamically adjusts audio based on content type and environment for optimized sound clarity.

Technology Analysis

In 2024, The Natural Language Processing (NLP) segment held a dominant market position, capturing a 40.6% share of the Global AI soundbar Market. This dominance is due to its improved voice command recognition and interaction. NLP allows users to control soundbar functions, access music, or integrate with smart home ecosystems using natural spoken phrases.

This hands-free interaction makes using audio devices easier and more intuitive, increasing customer satisfaction. Moreover, NLP technology adapts to user speech patterns and accents over time, improving accuracy and responsiveness. This personalized interaction layer adds value to AI soundbars and drives adoption among consumers looking for smarter, voice-activated home audio solutions.

For Instance, in May 2025, Sonos introduced an AI-driven Natural Language Processing (NLP) feature in its Arc Ultra soundbar, enhancing real-time speech clarity by isolating dialogue while preserving overall sound balance.

Installation Type Analysis

In 2024, The Wall mounted segment held a dominant market position, capturing a 46.6% share of the Global AI soundbar Market. This dominance is due to its space-saving and aesthetic appeal, fitting well with modern flat-screen TVs. Mounting soundbars on walls reduces clutter and supports optimal sound projection directly toward listeners.

This installation method complements contemporary home and commercial setups focused on clean and efficient audio design. This preference stems from the sleek, space-saving design that complements modern flat-panel TVs and home aesthetics.

Wall-mounted units reduce clutter and integrate well with home décor, providing both functional sound placement and a clean look. Increasing adoption of OLED and slim TVs boosts demand for wall-mounted setups in both residential and commercial environments.

For Instance, in October 2025, LG released its wall-mounted soundbar compatible with the LG QNED Synergy bracket, designed to seamlessly fit below LG TVs and provide immersive Dolby Atmos sound for wall installations.

Speaker Wattage Analysis

In 2024, The Up to 200 Watts segment held a dominant market position, capturing a 47.7% share of the Global AI soundbar Market. This wattage level offers a good balance of loudness and clarity suited for most living rooms and commercial spaces. It ensures an immersive sound experience without over-amplification, fitting various room sizes while controlling energy consumption.

Manufacturers are focusing on a broad consumer base seeking powerful yet efficient audio devices. Manufacturers target this wattage range for optimum balance between sound quality and cost-effectiveness. Users benefit from reliable volume and clarity, enhancing their overall audio experience without investing in more complex or expensive sound systems.

For Instance, in July 2025, Yamaha launched soundbars with up to 200 Watts wattage offering powerful audio performance, virtual surround capabilities, and Bluetooth connectivity suitable for a range of room sizes.

Price Range Analysis

In 2024, The Medium segment held a dominant market position, capturing a 55.5% share of the Global AI soundbar Market. This dominance is due to consumers looking for cost-effective products packed with advanced features. These soundbars appeal to buyers who want smart capabilities like AI integration and multiple connectivity options without a premium price tag.

Additionally, the increasing acceptance of smart audio devices by everyday users is growing the market. The balance of manageable cost and value-added technologies makes medium-priced units the most accessible and appealing option for a wide variety of customers.

For Instance, in August 2025, Harman International promoted its medium-priced soundbar models featuring voice assistant integration and adaptive sound equalization, appealing to consumers seeking mid-tier products with smart features.

Size Analysis

In 2024, The 30-60 inches segment held a dominant market position, capturing a 52.6% share of the Global AI soundbar Market. This size aligns well with common television dimensions. This size ensures adequate sound coverage for typical living room setups and commercial installations, delivering balanced audio performance and proper visual proportions.

The preference for this size reflects consumer priorities for devices that complement their TV size without being too bulky or small. It supports versatility in placement, maintaining aesthetic coherence while providing high-quality sound output.

For Instance, in January 2025, Philips introduced new 30-60 inch soundbars, including the B8500 model, designed to fit perfectly with Philips TVs and equipped with Dolby Atmos, HDMI 2.1, and Bluetooth 5.4 connectivity.

Application Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 60.4% share of the Global AI soundbar Market. Businesses such as hotels, retail stores, and conference venues adopt AI soundbars to deliver clear, immersive sound that enhances customer experience and communication.

The ability to integrate AI features for voice control and adaptive sound makes these soundbars useful in diverse professional settings. Commercial users value the functionality and ease of use of AI soundbars, which help improve ambience and provide efficient audio solutions. The demand in this segment is growing as companies invest more in technology to improve customer engagement and operational efficiency.

For Instance, in January 2025, Klipsch launched commercial-grade AI soundbars designed for business environments, offering advanced audio processing and robust build quality to enhance sound experiences in professional settings.

Distribution Channel Analysis

In 2024, The Offline segment held a dominant market position, capturing a 65.7% share of the Global AI soundbar Market. This dominance is due to many consumers preferring to physically experience the sound quality before purchasing. In-store shopping allows buyers to test products, receive expert advice, and access installation and after-sales services conveniently.

Despite the growth of online shopping, the need for hands-on experience with audio devices and confidence in purchase decisions keeps offline retail important. This channel remains critical for building consumer trust and facilitating immediate product availability.

For Instance, in September 2025, Panasonic emphasized offline sales channels for its AI soundbars in retail stores, including supermarkets and electronics outlets, combining in-store promotions with expert customer support to drive adoption.

Key Market Segments

By Product Type

- 2 channel soundbars

- 3 channel soundbars

- 5 channel soundbars

- 7 channel soundbars

By Connectivity

- Bluetooth

- Auxiliary

- Wi-Fi

- Others (HDMI, optical, USB, NFC, etc.)

By Technology

- Natural Language Processing (NLP)

- Machine Learning

- Computer Vision

- Others

By Installation Type

- Wall mounted

- Tabletop

- Free standing

By Speaker Wattage

- Up to 200 Watts

- Between 200-800 Watts

- Above 800 Watts

By Price Range

- Low

- Medium

- High

By Size

- Under 30 inches

- 30-60 inches

- Above 60 inches

By Application

- Residential

- Commercial

- Hospitality (hotels, restaurants)

- Retail stores

- Offices/conference rooms

- Educational institutions

- Entertainment venues (cinemas, theaters)

- Others

By Distribution Channel

- Online

- E-commerce

- Company websites

- Offline

- Hypermarkets/supermarkets

- Specialty stores

- Brand outlets

- Other retail stores (e.g., department stores, local electronics shops)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Enhanced Audio Experience Through AI

AI technology in soundbars enhances the audio experience by automatically tuning sound quality based on room acoustics and content type. This smart audio optimization brings a personalized listening experience without the need for manual adjustments, making it appealing to modern consumers who prefer convenience and high performance.

The evolving preference for immersive sound in home entertainment is a significant factor driving demand for AI-enabled soundbars. Furthermore, AI soundbars easily integrate with smart home ecosystems, supporting voice commands and wireless connectivity with other devices like TVs and smartphones.

This creates a seamless entertainment environment, aligning with the rising adoption of smart homes. The convenience and premium features offered by AI soundbars are vital drivers in the market, especially in regions with high technology penetration, such as North America and Europe.

For instance, in October 2025. Bose has launched AI-enabled soundbars that automatically adapt sound based on room acoustics, enhancing the overall audio experience. This development exemplifies how brands are leveraging AI to deliver superior, personalized sound quality, which is crucial for market growth.

Restraint

High Cost Limits Broader Adoption

AI soundbars, due to their advanced technologies like Dolby Atmos and AI-based sound calibration, are priced at a premium level. This higher cost impacts affordability and limits adoption, particularly in emerging and price-sensitive markets where consumers often choose lower-priced alternatives or rely on basic TV speakers. The premium pricing reduces the potential consumer base and slows market growth in these regions.

Additionally, economic uncertainties and shifts in consumer spending habits intensify this restraint, prompting buyers to prioritize essential purchases over luxury audio products. Despite growing demand for smarter audio devices, the price sensitivity prevalent among large sections of consumers restricts widespread penetration of AI soundbars.

For instance, in September 2025, Samsung announced a premium AI soundbar priced above $1,000 that received limited consumer interest. The high cost restricted wider adoption, illustrating how pricing remains a restraint in expanding the AI soundbar market beyond higher-income consumers.

Opportunities

Growing Demand for Eco-Friendly Soundbars

Consumers are increasingly conscious about the environmental impact of their purchases, presenting manufacturers with an opportunity to develop eco-friendly AI soundbars. Features like energy-efficient components, auto power-off modes, and the use of recycled or biodegradable materials cater to this sustainability trend. These attributes allow brands to differentiate themselves and attract eco-minded customers.

Beyond consumer preferences, tightening regulations on electronic waste and energy consumption encourage companies to introduce greener products. By promoting lower energy consumption and environmental responsibility, soundbar makers can strengthen brand loyalty and tap into a growing sustainability-driven market segment while enhancing their corporate social responsibility image.

For instance, in August 2025, LG introduced a line of eco-friendly AI soundbars with energy-efficient features and recycled materials, announced. This move reflects the opportunity for brands to target environmentally conscious customers and differentiate in a competitive market.

Challenges

Maintaining Sound Quality Over Wireless Connections

Wireless connectivity is indispensable for AI soundbars, enabling ease of use and integration with other smart devices. However, maintaining consistent high-quality sound over wireless connections is a technical challenge. Issues like signal interference, latency, and compression can degrade audio quality, which is critical for delivering a satisfying entertainment experience.

Moreover, wireless soundbars often struggle to reproduce the same richness and deep bass as traditional multi-speaker setups due to limitations in compact design and signal transmission. These challenges require continuous innovation to balance the convenience of wireless operation with uncompromising sound quality, which remains a hurdle in market expansion.

For instance, in September 2025, Sony faced issues maintaining consistent sound quality over wireless connections in their latest AI soundbars, revealed during product reviews. Signal interference and latency challenges highlight ongoing technical hurdles in delivering seamless wireless audio experiences.

Latest Trends

AI personalization in soundbars is now a standard feature, allowing devices to automatically adjust audio based on the type of content and the surrounding environment. This real-time tuning enhances clarity and balance, delivering a richer and more immersive listening experience.

Such smart soundbars can detect ambient noise and optimize sound output accordingly, improving user satisfaction without manual adjustments. This advancement is shaping the future of home audio by making soundbars more adaptive and user-friendly.

For instance, in August 2025, Samsung’s 2025 soundbars use an upgraded AI Sound Engine to deliver clearer dialogue, richer bass, and tailored sound profiles depending on whether you are watching movies, listening to music, or gaming. These devices also incorporate features like Active Voice Amplifier Pro to make speech sharp and distinct.

Key Players Analysis

The AI Soundbar Market is dominated by leading consumer electronics and audio brands such as Samsung Electronics, Sony, LG Electronics, and Bose. These companies integrate artificial intelligence into soundbars to enable adaptive sound calibration, voice assistant control, and immersive audio experiences. Their focus on smart home integration and multi-device connectivity drives global market adoption across both premium and mid-range segments.

Key players including Sonos, Harman International, Philips, Panasonic, Yamaha, and Denon emphasize high-fidelity sound reproduction combined with AI-based room optimization and automatic content recognition. Their products cater to home entertainment systems, offering dynamic tuning, spatial audio, and compatibility with virtual assistants such as Alexa and Google Assistant.

Additional manufacturers such as Bowers & Wilkins, Klipsch, Pioneer, Onkyo, TCL, Sharp, Vizio, Polk Audio, Xiaomi, Devialet, and other emerging players are expanding AI soundbar accessibility through innovative acoustic design and affordability. Their efforts in integrating machine learning for sound enhancement and personalized audio settings continue to elevate user experience across residential and commercial entertainment environments.

Top Key Players in the Market

- Bose

- Bowers and Wilkins

- Denon

- Devialet

- Harman International

- Klipsch

- LG Electronics

- Onkyo

- Panasonic

- Philips

- Pioneer

- Polk Audio

- Samsung Electronics

- Sharp

- Sonos

- Sony

- TCL

- Vizio

- Xiaomi

- Yamaha

- Others

Recent Developments

- In April 2025, Samsung Electronics launched its 2025 flagship soundbar lineup, including the Q-series and B-series models featuring enhanced AI-driven adaptive sound technologies. The new soundbars integrate innovative hardware and AI to deliver personalized, immersive audio in any space, along with slim, aesthetic designs. Samsung emphasized flexible usage scenarios and advanced bass performance in this lineup.

- In September 2024, Bose introduced its latest Smart Soundbar with AI Dialogue Mode, which uses machine learning to enhance speech clarity in real-time during movies and shows. It supports Dolby Atmos and Bose Personal Surround technology by pairing with Bose Ultra Open Earbuds to create a personal surround sound experience. The soundbar also offers voice assistant compatibility and multi-room integration.

Report Scope

Report Features Description Market Value (2024) USD 5.20 Bn Forecast Revenue (2034) USD 67.9 Bn CAGR(2025-2034) 29.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product type (2 channel soundbars, 3 channel soundbars, 5 channel soundbars, 7 channel soundbars), By Connectivity (Bluetooth, Auxiliary, Wi-Fi, Others (HDMI, optical, USB, NFC, etc.), By Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Others), By Installation Type (Wall mounted, Tabletop, Free standing), By Speaker Wattage (Up to 200 Watts, Between 200-800 Watts, Above 800 Watts), By Price Range (Low, Medium, High), By Size (Under 30 inches, 30-60 inches, Above 60 inches), By Application (Residential, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bose, Bowers and Wilkins, Denon, Devialet, Harman International, Klipsch, LG Electronics, Onkyo, Panasonic, Philips, Pioneer, Polk Audio, Samsung Electronics, Sharp, Sonos, Sony, TCL, Vizio, Xiaomi, Yamaha, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bose

- Bowers and Wilkins

- Denon

- Devialet

- Harman International

- Klipsch

- LG Electronics

- Onkyo

- Panasonic

- Philips

- Pioneer

- Polk Audio

- Samsung Electronics

- Sharp

- Sonos

- Sony

- TCL

- Vizio

- Xiaomi

- Yamaha

- Others