Global AI Smart Glasses Market Size and Forecast Industry Analysis Report By Type (Voice Interaction, and Visual Interaction), By Application (Industrial, Medical, Consumer electronic, and Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159078

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business Benefits

- Role of Generative AI

- US Market Size

- By Type Analysis

- By Application

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

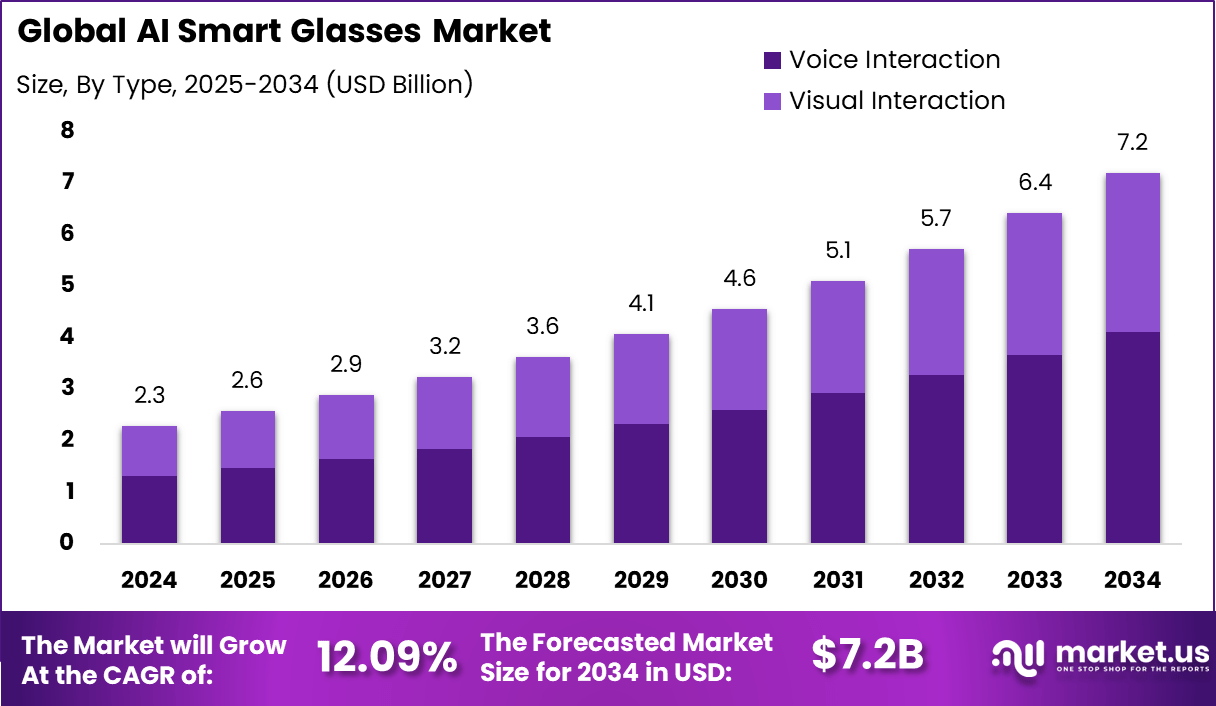

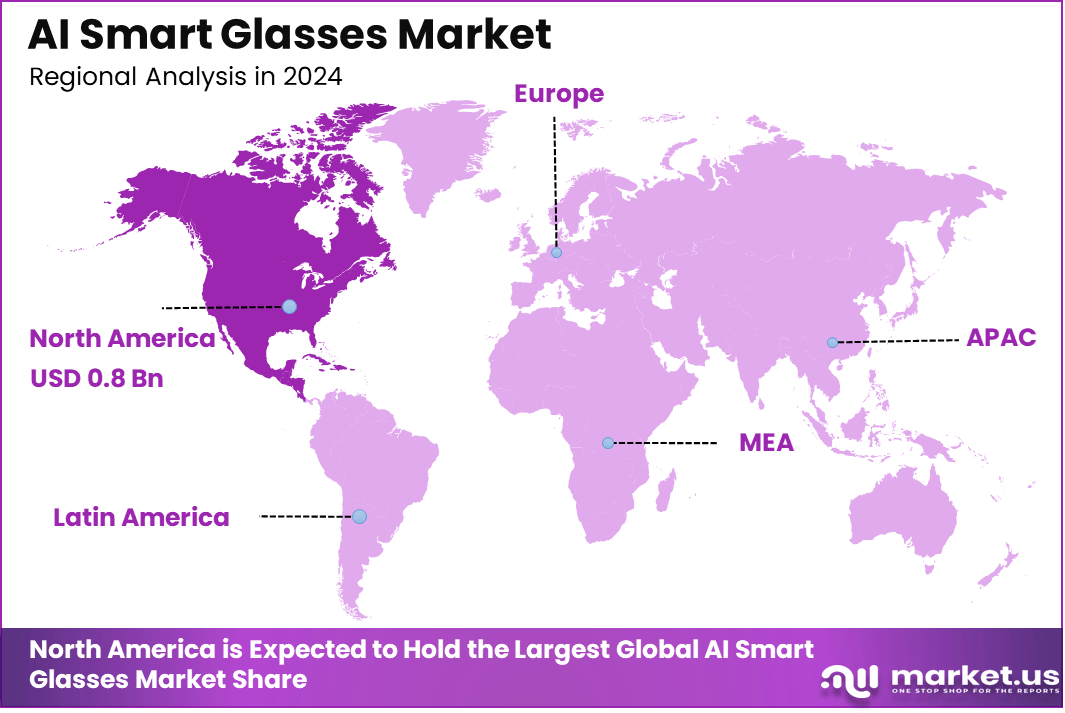

The Global AI Smart Glasses Market size is expected to be worth around USD 7.2 Billion By 2034, from USD 2.3 billion in 2024, growing at a CAGR of 12.09% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 37.5% share, holding USD 0.8 Billion revenue.

The AI Smart Glasses Market refers to wearable eyewear devices integrated with artificial intelligence to provide augmented vision, real-time information, and interactive experiences. These glasses combine sensors, cameras, voice recognition, and display technologies with AI-driven software to enable features such as object recognition, language translation, navigation, and hands-free communication.

The market is driven by the growing adoption of wearable technology and rising demand for augmented reality solutions in both consumer and enterprise applications. Increasing reliance on hands-free devices for productivity and safety is accelerating adoption. Growth in e-commerce, logistics, and field services is fueling demand for AI smart glasses to improve efficiency. Rising consumer interest in connected wearables for fitness, entertainment, and lifestyle enhancement also contributes to market growth.

By the end of 2024, global 5G connections did reach 2.25 billion, marking a substantial leap in adoption. This rapid growth in 5G has been crucial in enabling real-time data processing capabilities, which are essential for advanced applications such as AI-powered smart glasses. The high-speed, low-latency 5G networks allow AI smart glasses to process and transmit data in real-time, supporting functionalities like object recognition, facial recognition, and immersive augmented reality experiences.

According to The Indian Express, AI smart glasses made up 78% of global shipments in H1 2025, a sharp increase from 46% in H1 2024 and 66% in H2 2024, largely driven by the success of Ray-Ban Meta AI Glasses. The global smart glasses market is divided into two main segments: AI smart glasses and audio smart glasses. While the AI segment recorded over 250% year-on-year growth in H1 2025, shipments of audio smart glasses declined, reflecting a clear market shift toward AI-powered models.

Key Insight Summary

- By type, the Voice Interaction segment dominated with 57.2% share, highlighting strong demand for hands-free, AI-powered features.

- By application, the Consumer Electronics segment held the largest share at 39.1% in 2024, driven by lifestyle and personal tech integration.

- Regionally, North America captured 37.5% share, reflecting early adoption and strong wearable tech ecosystems.

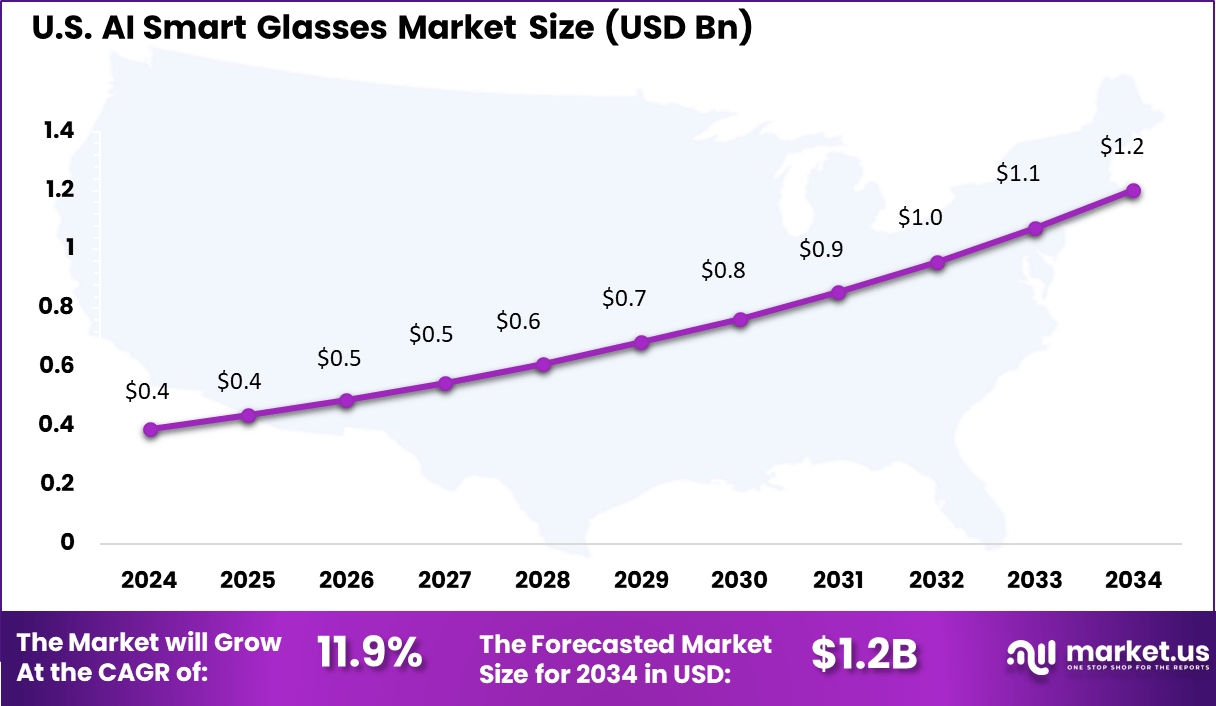

- The U.S. market was valued at USD 0.39 Billion in 2024, expanding at a solid CAGR of 11.9%, underscoring its leadership in AI-enabled wearables.

Analysts’ Viewpoint

Demand is strong in enterprise applications, particularly in logistics and warehousing, where AI smart glasses assist workers with inventory management and real-time task instructions. Healthcare professionals are adopting these devices for remote consultations, surgery assistance, and medical training. In the consumer segment, demand is driven by lifestyle, fitness, and immersive entertainment experiences.

The market is witnessing rapid integration of artificial intelligence with augmented reality and computer vision. Natural language processing is enabling voice-controlled interaction, while real-time translation tools are gaining adoption in global travel and communication. Edge AI and 5G connectivity are enhancing the responsiveness of smart glasses by processing data closer to the source.

Organizations adopt AI smart glasses to improve workforce productivity, reduce errors, and enhance training efficiency. For enterprises, adoption supports real-time collaboration, hands-free information access, and cost savings in operations. Healthcare institutions adopt these solutions to deliver better patient care and enable telemedicine.

Investment and Business Benefits

Investment opportunities exist in AR-enabled AI glasses, healthcare-focused smart eyewear, and consumer lifestyle products. Startups developing lightweight, affordable, and specialized smart glasses are attracting venture capital. Partnerships between technology firms, telecom providers, and enterprises are opening opportunities for growth.

Expansion in emerging markets, where demand for wearable technology is rising, presents further investment potential. AI-driven applications such as real-time translation, personal assistance, and immersive gaming represent additional growth avenues.

Businesses benefit from AI smart glasses by achieving higher operational efficiency, improved worker safety, and enhanced customer experiences. For logistics companies, adoption reduces training time and increases task accuracy. Healthcare providers gain access to real-time data and collaboration tools during patient care. Retailers and consumer brands benefit from immersive shopping and marketing experiences.

Role of Generative AI

Generative AI is playing a transformative role in smart glasses by enabling interactive, context-aware experiences without relying on keyboards or traditional input devices. The integration of lightweight generative AI models directly on smart glasses hardware allows for real-time assistance such as translations, object recognition, and environment-aware prompts.

This offers hands-free access to apps and services that adapt to the user’s surroundings seen through the glasses lens. This reflects an industry movement toward on-device AI to reduce latency and power consumption while improving user interaction with spatial computing capabilities. Such advancements position smart glasses to deliver personalized, intelligent augmented reality experiences that go beyond simple notifications or static overlays.

US Market Size

The U.S. AI Smart Glasses Market was valued at USD 0.4 Billion in 2024 and is anticipated to reach approximately USD 1.2 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 11.9% during the forecast period from 2025 to 2034.

In 2024, more than 36% of U.S. enterprises adopted smart glasses as part of their operational workflows. This shift highlights how wearable technology is moving beyond experimental use into mainstream business functions. The integration was supported not only by private sector initiatives but also by government policies that encouraged digital transformation and workplace innovation

In 2024, North America held a dominant market position, capturing more than 37.5% share and generating USD 0.8 billion in revenue in the AI smart glasses market. The region’s leadership is fueled by strong consumer adoption of wearable technologies, combined with the presence of major technology innovators who are actively investing in AR, AI, and mixed-reality solutions.

The United States, in particular, has seen early adoption of AI smart glasses in industries such as healthcare, logistics, defense, and retail, where real-time data visualization and hands-free operations bring clear efficiency gains. This broad application base has firmly positioned North America as the largest contributor to market growth.

The dominance of North America is also supported by its advanced digital ecosystem, which integrates AI-powered wearables with cloud platforms, 5G connectivity, and enterprise applications. Companies across the region are exploring smart glasses for workforce training, field services, and remote collaboration, aligning with the broader digital transformation agenda.

By Type Analysis

In 2024, the voice interaction segment accounted for 57.2% of the AI smart glasses market. Voice-enabled features have become popular because they allow users to operate the glasses hands-free, making them practical for daily functions such as navigation, calls, or online searches. This ease of use has made voice control the preferred mode for both consumer and professional users who value quick responses without manual effort.

In addition, advances in natural language processing have made voice commands more accurate and intuitive. This has encouraged integration into AI smart glasses for seamless interaction with other connected devices. As AI assistants become more conversational, voice-based smart glasses are gaining stronger acceptance among a wide base of users.

By Application

In 2024, Consumer electronics held 39.1% share in 2024. This segment benefits from strong demand for wearable devices that combine entertainment, fitness, and everyday utility in a lightweight design. Consumers are drawn to AI smart glasses for functions such as immersive media experiences, real-time translations, and access to smart home controls.

The rise of digitally active lifestyles has reinforced the need for multifunctional wearables. AI-enabled glasses are increasingly seen as an extension of smartphones, offering users a more natural and interactive way to access information and services without being tied to traditional screens.

Emerging Trends

The AI smart glasses market in 2025 is characterized by a blend of augmented reality and AI features that significantly enhance usability and adoption. Current models combine AI agents powered by multimodal large language models, AR overlays, voice assistants, and environmental sensing to offer seamless integration into daily activities.

Design improvements now make smart glasses resemble conventional eyewear, aiding broader social acceptance. Developer ecosystems are expanding, encouraging application innovation in areas like real-time translation, navigation, and fitness tracking.

The market is shifting steadily from industrial applications toward consumer use, evidenced by increasing adoption in sectors like retail, healthcare, and entertainment. Sales have tripled in recent periods, showing strong consumer interest.

Growth Factors

Several factors contribute to the growth of AI smart glasses, including advancements in 5G networks that enable real-time data processing, improving device responsiveness. The demand for hands-free operation in logistics, healthcare, and manufacturing drives enterprise adoption, while consumers seek immersive augmented reality for gaming, communication, and fitness.

Battery life improvements, smaller components, and enhanced user interfaces make these devices practical for daily use. Furthermore, strong government and private investments in wearable technology, along with supportive regulatory and innovation ecosystems, bolster market expansion. North America remains a leading region due to robust technological infrastructure and early adoption, supported by a 36.5% market share in 2024.

Key Market Segments

By Type

- Voice Interaction

- Visual Interaction

By Application

- Industrial

- Medical

- Consumer electronic

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

AI and 5G Integration Enhances Functionality

The growing integration of advanced AI capabilities with 5G connectivity is a key driver for the AI smart glasses market. AI enables features like real-time object recognition, facial recognition, and voice assistance, which improve user experience and functionality.

The high-speed and low-latency properties of 5G allow smart glasses to process and transmit data instantly, enabling seamless applications such as remote collaboration in healthcare, engineering, and education. For instance, professionals can guide others remotely through complex procedures, enhancing productivity and convenience.

Moreover, the miniaturization of sensors and AI chip improvements make devices lighter, more comfortable, and longer-lasting on battery power. This advancement supports sustained use in daily and professional activities. Products like Ray-Ban Meta AI Glasses demonstrate how AI-powered features combined with sleek design are attracting consumers, contributing to rapid market growth.

Restraint Analysis

High Production Costs Limit Accessibility

One significant restraint slowing the AI smart glasses market is the high cost of production. The complexity of integrating powerful AI processors, multiple sensors, cameras, and 5G modules into a compact, lightweight frame drives manufacturing expenses.

As a result, pricing remains out of reach for many potential consumers, limiting widespread adoption beyond early adopters and enterprise users. For example, despite advances in miniaturization, AI-powered smart glasses often cost several hundred dollars or more, posing affordability challenges for mass-market penetration.

Additionally, maintaining a balance between performance, design, and battery life is costly, further raising prices. The expensive components and specialized manufacturing processes slow down large-scale production and rollouts. This financial barrier makes it harder for new players to enter the market or for existing companies to offer competitive, budget-friendly models.

Opportunity Analysis

Expanding Use Cases in Healthcare and Enterprise

An important opportunity lies in the expanding use of AI smart glasses within healthcare, industrial, and enterprise sectors. These devices offer hands-free access to augmented reality overlays, real-time data, and remote assistance, which can improve productivity and safety on the job.

For instance, surgeons can access patient data and visual guides during operations, while warehouse workers benefit from navigation aids and inventory management tools. This sector focus provides a clear path for adoption given its practical benefits and willingness to invest in innovative technology.

Furthermore, as AI smart glasses become more affordable and user-friendly, new applications in training, remote collaboration, and immersive learning are emerging. These opportunities cater not only to professionals but also to education and enterprise training environments where hands-free information enhances efficiency.

Challenge Analysis

Privacy and Security Concerns

Privacy and security concerns pose a major challenge to the widespread adoption of AI smart glasses. Since these devices continuously collect and process sensitive visual and audio data, users and regulators worry about unauthorized surveillance and data misuse.

For instance, persistent camera use and AI-driven facial recognition raise issues about consent and how personal information is stored or shared. These fears slow public acceptance and invite strict regulation, complicating market growth.

Moreover, addressing these concerns requires companies to invest heavily in robust security protocols and transparent data management policies, adding to product development costs. Balancing innovation with compliance and user trust is a complex task. Until these privacy challenges are satisfactorily resolved, many potential customers remain cautious, which could restrict overall market momentum despite technological advances and expanding use cases.

Competitive Analysis

In the AI smart glasses market, Google, Microsoft, and Meta are leading players with strong ecosystems in augmented reality and AI-driven wearable technologies. Their products integrate advanced display systems, voice assistants, and cloud connectivity to enhance user experiences across enterprise and consumer applications.

Specialized firms such as Vuzix, Magic Leap, RealWear, and North strengthen the market with enterprise-focused solutions and niche consumer offerings. Their devices are widely used in industrial training, remote assistance, and immersive visualization. By focusing on lightweight designs, real-time data integration, and AI-enhanced features, these companies provide competitive alternatives that cater to specific market needs, particularly in business and field operations.

Other contributors including Epson, ODG, and Snap expand the ecosystem with innovative applications in imaging, social media, and entertainment. Their products target unique segments such as interactive consumer experiences and enterprise imaging solutions. Together with emerging players, these firms diversify the competitive landscape, ensuring steady advancements and broader adoption of AI smart glasses across industries.

Top Key Players in the Market

- Microsoft

- Vuzix

- North

- Magic Leap

- RealWear

- Epson

- ODG

- Snap

- Meta

- Others

Recent Developments

- May 2025, Google launched Android XR glasses featuring Gemini AI, their advanced multimodal AI system. These glasses are built on an open ecosystem with partners like Xreal, blending AI with seamless design for professional and daily use. Google positions these glasses as a next step beyond smartphones, emphasizing usability and privacy.

- Meta announced new AI-powered Ray-Ban smart glasses with high-resolution displays and a neural band, set for consumer launch later in 2025. These smart glasses offer features like voice assistance, live translation, messaging integration, and high-quality audio, targeted at mainstream wearable users.

- July 2025, Microsoft filed patents revealing design and AI integration plans for CoPilot AR smart glasses. The patents hint at a Windows-based spatial computing device with AI-assisted environment interaction, emphasizing accessibility and real-time spatial data processing.

- November 2024, RealWear acquired smart glasses innovator Almer. This strategic acquisition aims to accelerate the adoption of industrial wearable technology, strengthening RealWear’s position in AI-powered smart glasses for enterprise use.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 8.8 Bn CAGR(2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Voice Interaction, and Visual Interaction), By Application (Industrial, Medical, Consumer electronic, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google, Microsoft, Vuzix, North, Magic Leap, RealWear, Epson, ODG, Snap, Meta and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft

- Vuzix

- North

- Magic Leap

- RealWear

- Epson

- ODG

- Snap

- Meta

- Others