Global AI Shoes Market Size, Share, Industry Analysis Report By Product Type (Smart Athletic Shoes (Running Shoes, Training & Gym Shoes, Basketball Shoes), Smart Casual & Lifestyle Shoes, Smart Safety & Industrial Shoes, Specialized Medical/Rehabilitation Shoes), By Technology (Sensor Technology, Machine Learning and Artificial Intelligence, Algorithms, Connectivity), By Sales Channel (Online Channel, Offline Channel), By End-User (Athletes & Fitness Enthusiasts, Tech-Savvy Consumers, Healthcare & Rehabilitation Patients, Industrial Workers, Elderly Population), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161693

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- AI Adoption by Industry

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- By Product Type

- By Technology

- By Sales Channel

- By End-User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

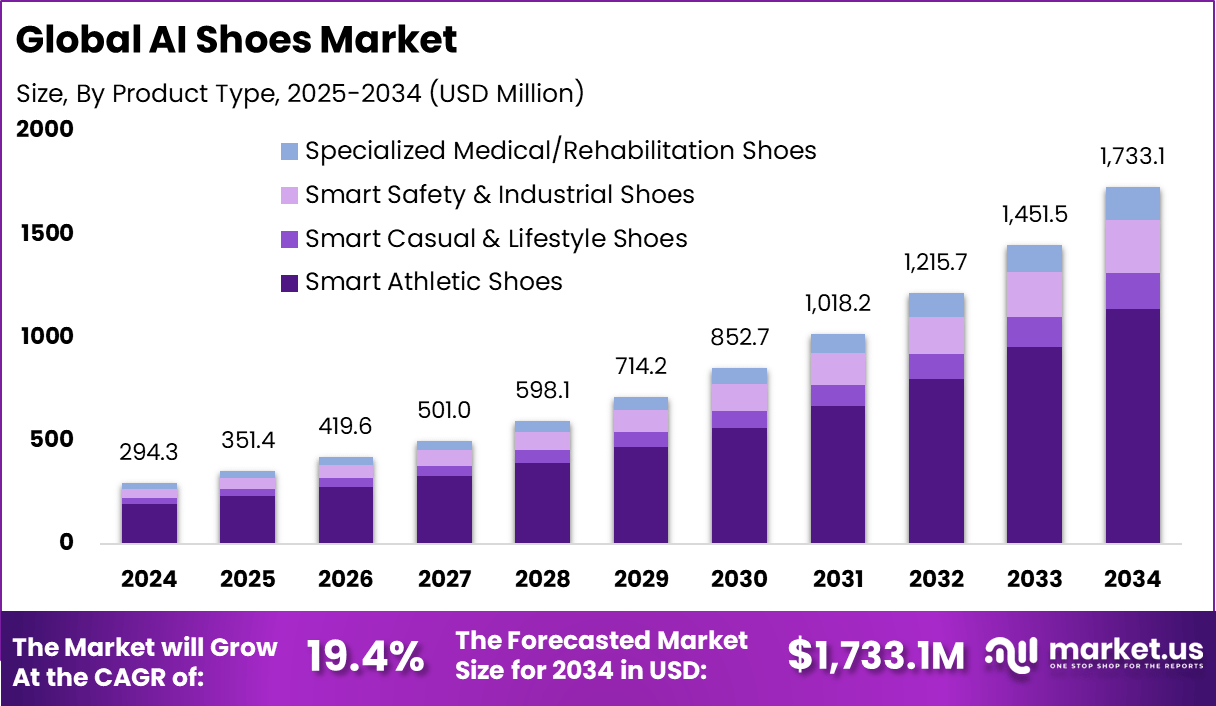

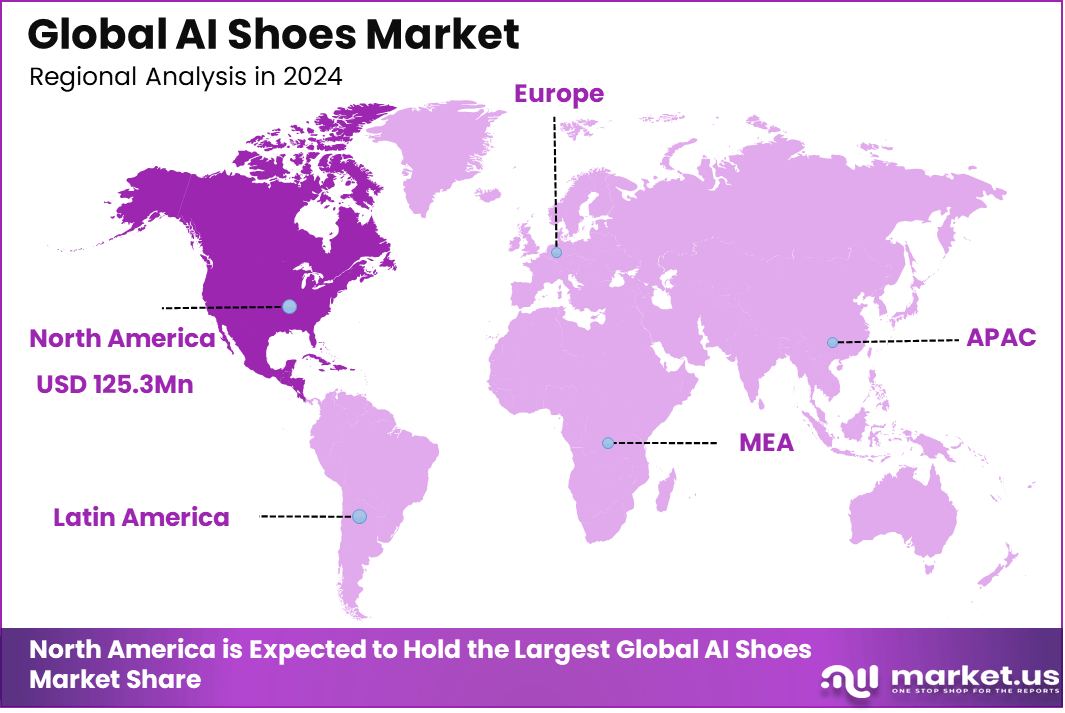

The Global AI Shoes Market generated USD 294.3 Million in 2024 and is predicted to register growth from USD 351.4 Million in 2025 to about USD 1,733.1 Million by 2034, recording a CAGR of 19.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.6% share, holding USD 125.3 Million revenue.

The AI shoes market involves footwear embedded with sensors, smart chips, pressure modules, motion trackers, and connectivity features that collect and process data through AI-based systems. These shoes are designed for fitness tracking, gait correction, posture monitoring, navigation assistance, rehabilitation feedback, and personalized athletic performance support. Some products connect to apps, while others operate through onboard processors.

Rising interest in personalized fitness tracking is one of the main growth drivers. Runners and athletes seek real-time feedback on stride, speed, foot pressure, and impact. Rehabilitation centers and physiotherapists use smart footwear to track recovery progress and correct movement patterns. Growth in smart textiles and wearable electronics has made it easier to integrate sensors into shoe soles and midsoles.

Demand is rising among athletes, health-conscious consumers, and individuals recovering from orthopedic conditions. The elderly population is showing interest in fall detection and movement support features. Fitness enthusiasts use AI-enabled shoes to measure step efficiency and calorie output without relying on wrist devices. Adoption is visible in North America, East Asia, and parts of Europe where smart wearables are widely accepted.

Advanced motion sensors, pressure-sensitive insoles, accelerometers, and AI-based gait analysis models are at the core of these products. Some designs use machine learning to study user movement over time and provide corrective guidance. Bluetooth connectivity links shoes with mobile apps for data storage and coaching insights. Augmented audio prompts are used for corrective feedback during walking or running.

Top Market Takeaways

- Smart athletic shoes hold about 65.7%, showing strong demand for AI-enabled footwear that supports training and performance tracking.

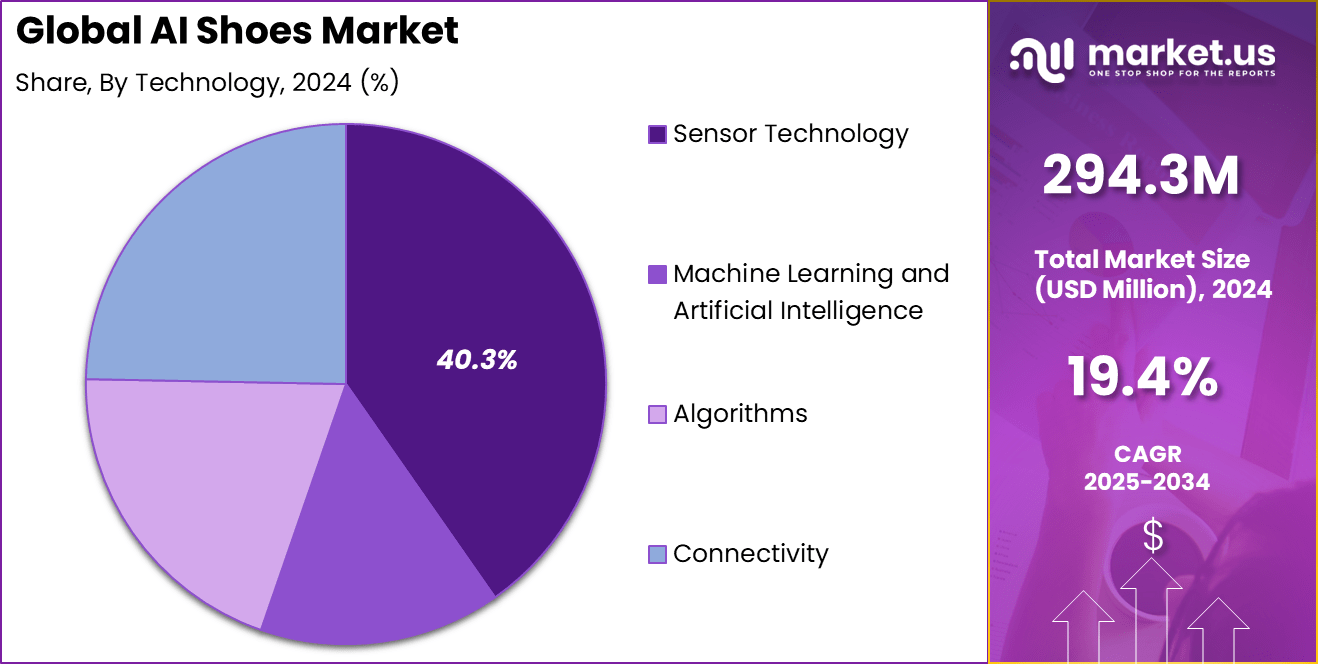

- Sensor technology accounts for nearly 40.3%, reflecting its role in gait analysis, motion tracking, and injury prevention.

- Online channels make up around 60.6%, driven by digital buying habits and access to customizable smart footwear.

- Athletes and fitness enthusiasts represent roughly 55.1%, highlighting performance, health insights, and training benefits as key adoption drivers.

- North America captures nearly 42.6%, backed by early tech adoption and strong consumer spending on fitness innovation.

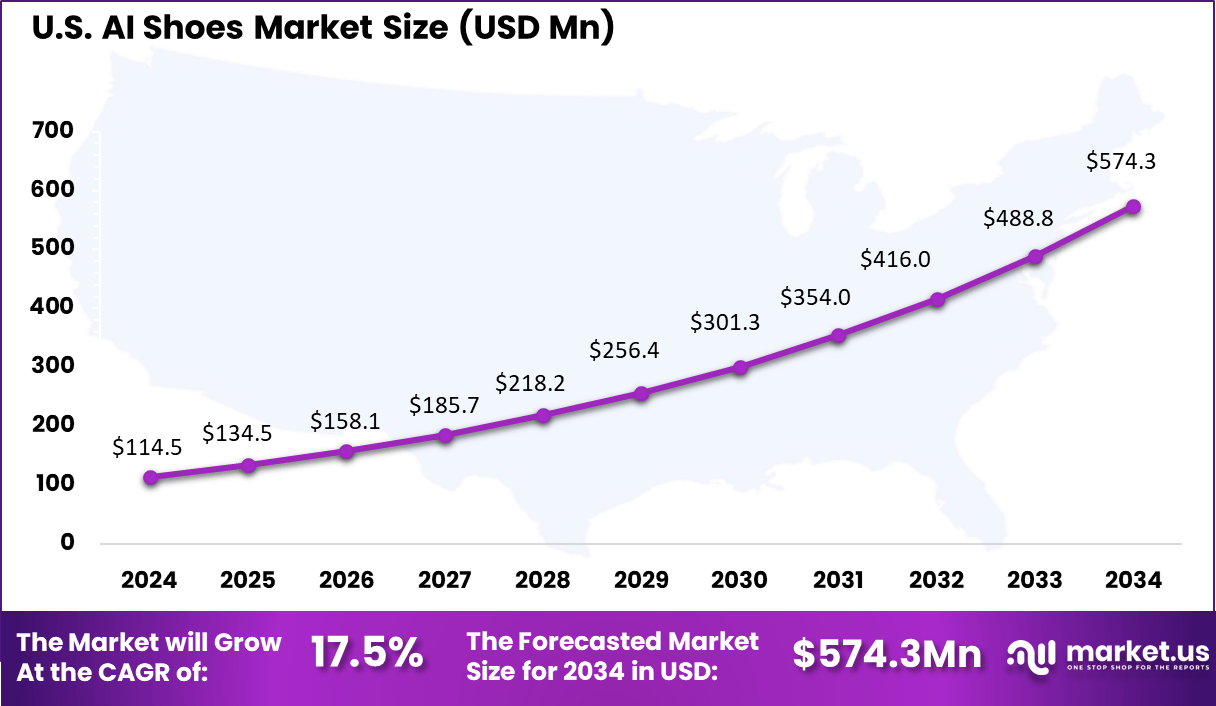

- The U.S. leads regional growth with rising interest in smart footwear for sports, wellness, and lifestyle use.

- Growth at about 17.5% CAGR reflects rising awareness of AI-driven training optimization and personalized performance insights.

AI Adoption by Industry

High-Adoption Sectors

- Technology: The sector leads with 88% of companies using generative AI, making information technology the highest adopter overall.

- Professional services, media, and telecom: Adoption is strong, with 80% in professional services and 79% in media and telecom.

- Financial services: About 65% of firms use generative AI, with projections indicating AI could add $1 billion in banking revenue by 2027.

- Consumer goods and retail: Adoption stands at 68%, driven by personalization and operational efficiencies.

- Industrial and automotive: Among India’s leading sectors, with automotive recording a 48% increase in machine learning adoption.

Low-Adoption Sectors

- Energy and materials: Currently the slowest adopters of generative AI, with uptake at 59%.

- Construction and agriculture: Tied for the lowest overall AI use at just 1.4%, showing significant untapped potential.

Common Reasons for AI Adoption

- Internal process automation: Identified by 36% of executives as the main driver of adoption.

- Data analysis and analytics: A core application of generative AI, supporting decision-making and predictive modeling.

- Marketing and sales: Widely used for content creation, lead generation, and personalized marketing strategies.

- Research and development (R&D): Around 44% of companies employ AI for R&D, particularly in information and communication sectors.

- ICT security: Adoption is high in electricity, gas, and water supply, where AI strengthens cybersecurity and operational resilience.

Role of Generative AI

Generative AI has become a key enabler in the AI shoes market by accelerating the design and customization processes. For example, generative design algorithms can produce hundreds of design variants within seconds, optimizing features such as fit, comfort, and durability based on biomechanical data and user feedback. This cuts design time dramatically and allows footwear brands to create highly personalized products that meet individual consumer needs with precision.

It is estimated that over 60% of new AI shoe designs now incorporate generative AI to enhance user experience and innovation. Moreover, generative AI helps brands in predictive analytics for demand forecasting, inventory management, and supply chain optimization, which improves operational efficiency and reduces waste by 30%.

Investment and Business Benefits

Investment opportunities in the AI shoes market are considerable, especially as brands capitalize on R&D to develop smarter, eco-friendlier materials and cutting-edge algorithms. Partnerships between footwear companies and tech firms accelerate innovation and enable market expansion. Emerging markets, particularly in Asia-Pacific, show growing consumer awareness and disposable income, opening new avenues for investments in production and distribution.

Business benefits include improved customer satisfaction through personalized offerings, increased operational efficiency via AI-driven inventory and supply chain management, and competitive advantage by embracing futuristic product features. Smart footwear helps reduce return rates by better matching customer needs and preferences, leading to cost savings. The use of AI in trend forecasting and design accelerates product development cycles, allowing businesses to respond faster to market changes and consumer tastes.

US Market Size

Within North America, the US is a central player in AI shoes, with sales exceeding 114 million units and a vigorous CAGR of 17.5%. The US market thrives due to the presence of early adopters, tech-savvy consumers, and the high prevalence of active lifestyles. Significant investments in wearable health technology further stimulate interest in AI-enhanced footwear.

US consumers increasingly look for products that provide measurable health benefits and integrate seamlessly with other smart devices. The competitive landscape in the US fosters rapid innovation and product releases tailored to both professional and casual fitness users, reinforcing the country’s dominant market position.

In 2024, North America leads the AI shoes market globally with 42.6% share. The region benefits from strong technological infrastructure, high disposable incomes, and growing consumer interest in fitness and smart wearables. AI footwear manufacturers in North America focus on innovation, integrating adaptive AI and sensor technology to meet the sophisticated demands of their consumers.

The increasing fitness culture, alongside wider adoption of smart devices, drives demand for AI shoes that blend comfort and intelligence. North America’s market growth is also supported by robust online retail channels and expanding sports technology ecosystems that help accelerate adoption.

By Product Type

In 2024, Smart athletic shoes dominate the AI shoes market, holding a significant 65.7% share. These shoes combine advanced design with AI technologies to enhance athletic performance by providing real-time data on factors like gait, posture, and foot pressure.

This functionality allows athletes to receive personalized feedback and adjust their movements to reduce injury risk and improve efficiency. Growing interest in fitness tracking and performance optimization is driving wide adoption of these smart shoes.

The integration of AI into athletic shoes has made them more than just footwear; they serve as wearable performance coaches. Many models now include adaptive cushioning and auto-tightening features, responding dynamically to the athlete’s activity. This product type appeals strongly to consumers who want to merge technology with physical training, supporting trends in health-conscious and data-driven fitness routines.

By Technology

In 2024, Sensor technology is the backbone of AI shoes, capturing 40.3% of the technology segment. These sensors collect precise data on motion, impact, and environmental conditions which AI algorithms then analyze to offer customized insights. Sensor advancements have improved accuracy, responsiveness, and battery life, making smart shoes increasingly reliable and user-friendly.

By providing continuous feedback, sensors help athletes and fitness enthusiasts monitor their form and progress closely, preventing injuries and enhancing training efficiency. The widespread use of wearable tech in health and fitness has made sensor technology the key enabler for AI footwear, highlighting its crucial role in the market’s growth.

By Sales Channel

In 2024, The online sales channel accounts for a strong 60.6% of sales for AI shoes. Consumers prefer online shopping for its convenience, wider product selection, and the ability to easily compare features and prices. AI-powered shoes benefit particularly from online channels due to digital marketing tools, virtual try-ons, and personalized recommendations that improve customer engagement.

E-commerce platforms also facilitate direct interaction between brands and customers through virtual fitting technologies and AI-driven customer service, enhancing trust and purchase confidence. This shift toward online purchasing is reshaping how AI shoes are marketed and sold, making a seamless digital experience essential for brands.

By End-User

In 2024, Athletes and fitness enthusiasts form the largest end-user base, taking up 55.1% of the market share. These users are drawn to AI shoes for their performance-enhancing features, including injury prevention, activity tracking, and real-time feedback tailored to individual needs. The demand comes from both professional athletes seeking an edge and fitness enthusiasts motivated to optimize their routines with data-driven guidance.

The rising trend toward health and wellness, along with increasing awareness about physical fitness, supports this segment’s growth. AI shoes offer users personalized insights and coaching, fostering greater engagement with physical activity and supporting higher endurance and better recovery practices.

Emerging Trends

One emerging trend is the integration of smart sensors in shoes that continuously track gait, posture, and other health-related metrics. These sensors enable AI systems to provide real-time feedback for injury prevention and performance optimization. Approximately 45% of new AI shoe models launched in 2025 now embed these sensor technologies, indicating a strong market shift toward health-focused smart footwear.

Another notable trend is the use of augmented reality for virtual try-ons and personalized shopping experiences, helping brands reduce return rates by up to 25%. Virtual platforms allow customers to see how shoes will fit and look without physical trials, increasing purchasing confidence. The combination of AR and AI-driven personalization is shaping the consumer journey from discovery to purchase, making shopping more convenient and engaging.

Growth Factors

Consumer demand for personalized fitness tracking and comfort is a significant growth driver. Around 70% of fitness-conscious consumers express willingness to pay a premium for AI-enabled footwear that offers personalized support and activity monitoring. This trend is pushing footwear companies to innovate with adaptive cushioning, customized fits, and AI-powered performance insights.

Technological advances in AI algorithms and miniaturized electronics also fuel growth by enabling smarter, more accurate data collection and analysis. The improvements in AI-driven material optimization help brands reduce production costs by an estimated 20%, making advanced footwear accessible to more consumers. Together, these factors create a cycle of innovation and adoption that propels the AI shoes market upward.

Key Market Segments

By Product Type

- Smart Athletic Shoes

- Running Shoes

- Training & Gym Shoes

- Basketball Shoes

- Smart Casual & Lifestyle Shoes

- Smart Safety & Industrial Shoes

- Specialized Medical/Rehabilitation Shoes

By Technology

- Sensor Technology

- Machine Learning and Artificial Intelligence

- Algorithms

- Connectivity

By Sales Channel

- Online Channel

- Offline Channel

By End-User

- Athletes & Fitness Enthusiasts

- Tech-Savvy Consumers

- Healthcare & Rehabilitation Patients

- Industrial Workers

- Elderly Population

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Personalized Fit and Enhanced Performance

AI shoes integrate advanced sensors and machine learning algorithms that collect detailed data about the wearer’s foot shape, gait, and movements. This allows manufacturers to create shoes tailored specifically to an individual’s needs, improving comfort and minimizing injury risk. Personalized fit and real-time performance feedback from these AI-enabled shoes are appealing to athletes and fitness enthusiasts seeking better performance and injury prevention.

As AI technology continues to advance, the ability to deliver highly customized footwear is a key growth driver for the AI shoe market. Moreover, these shoes can offer dynamic adjustments during use, such as adaptive lacing and posture correction, which enhance the user’s experience throughout various activities.

This personalization capability sets AI shoes apart from traditional footwear, opening new possibilities in both sports and casual segments. The growing demand for smart wearables that combine health tracking with footwear is driving widespread interest and market expansion.

Restraint

High Production Costs and Affordability

One major barrier to the widespread adoption of AI shoes is their high cost. The inclusion of sophisticated sensors, AI chips, and connectivity components significantly raises production expenses. These higher costs translate into elevated retail prices, making AI shoes less accessible for many consumers compared to conventional footwear. This price barrier restricts market penetration, especially among price-sensitive demographics and emerging markets.

Additionally, the technological complexity requires ongoing software updates and device compatibility considerations, which add to maintenance costs and may deter some potential buyers. The durability of AI components within shoes also raises concerns, as they must withstand rugged use without frequent malfunctions, affecting consumer confidence and limiting growth.

Opportunity

Growing Demand for Smart Footwear with Health Insights

The increasing global interest in health monitoring and smart wearable technology presents a substantial opportunity for AI shoes. These shoes can track metrics such as steps, running speed, calories burned, and gait patterns, providing valuable data for users to improve fitness and prevent injuries. Health-conscious consumers and athletes are particularly drawn to footwear that integrates AI-driven insights to optimize performance and safety.

Furthermore, AI-powered footwear paired with smartphones or health apps creates an ecosystem offering personalized coaching and long-term monitoring. Brands that develop these connected experiences can build stronger customer loyalty and expand into medical and therapeutic applications, including posture correction and gait rehabilitation. This convergence of footwear and digital health is set to accelerate market growth.

Challenge

Ethical and Privacy Concerns Around User Data

AI shoes collect and process a significant amount of personal data, including detailed movement patterns and biometric information. This raises substantial ethical and privacy concerns, especially regarding how data is stored, shared, and protected. Users may be hesitant to adopt AI shoes fully if they perceive risks around data security or feel uncomfortable with constant monitoring.

Moreover, the algorithms driving AI footwear must avoid biases that could lead to unfair or inaccurate recommendations for different user groups. Ensuring transparency and responsible use of AI is critical to building consumer trust. Compliance with data protection laws and regulations can also be complex and costly for manufacturers. Overcoming these challenges while maintaining innovation is vital for the sustainable growth of AI shoes in the marketplace.

Competitive Analysis

The AI Shoes Market is led by major global footwear brands such as Nike Inc., Adidas AG, Puma SE, and Under Armour Inc. These companies are incorporating AI-enabled features including smart insoles, performance tracking, gait analysis, and personalized coaching. Their focus on integrating sensors and companion mobile applications positions them at the forefront of smart sports and lifestyle footwear.

Sports and outdoor brands such as Asics Corp., Deckers Outdoor Corporation, Mizuno Corporation, Brooks Sports Inc., Salomon SAS, La Sportiva NA Inc., and Reebok International Ltd. contribute by integrating AI into performance running, hiking, and training shoes. These solutions provide real-time feedback on movement, posture, and impact, enhancing athletic performance and injury prevention.

Innovative and health-focused companies including Orpyx Medical Technologies Inc., Digitsole, Sensoria Health Inc., Wiivv Wearables Inc., Ajanta Shoe Private Limited, Shift Robotics, Lumo, Salted Venture, ShiftWear, Altra Torin IQ, Patagonia Inc., and other emerging players drive advancements in smart insoles, rehabilitation technology, and custom-fit designs. Their efforts expand AI footwear adoption across fitness, medical, and consumer wellness markets.

Top Key Players in the Market

- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Asics Corp.

- Deckers Outdoor Corporation

- Wolverine World Wide Inc.

- Reebok International Ltd.

- Mizuno Corporation

- Brooks Sports Inc.

- Salomon SAS

- Patagonia Inc.

- Vivobarefoot Limited

- Ajanta Shoe Private Limited

- Orpyx Medical Technologies Inc.

- Scott Sports SA

- La Sportiva NA Inc.

- Shift Robotics

- Digitsole

- Sensoria Health Inc.

- ShiftWear

- Wiivv Wearables Inc.

- Altra Torin IQ

- Salted Venture

- Lumo

- Others

Recent Developments

- October 2025, Ajanta Shoes introduced its first AI-powered smart shoe, Impakto Navigator, in October, featuring safety functions like SOS alerts, fall detection, and wellness tracking. The new product is part of the brand’s push into tech-enabled footwear targeted at young, tech-savvy audiences while emphasizing health and safety.

- September 2025, MySize Inc., a leader in AI-driven measurement solutions, acquired ShoeSize.Me in September, bolstering its portfolio with AI-powered footwear sizing technology. This move allows MySize to unify apparel and footwear sizing, leveraging ShoeSize.Me’s extensive data on over 92 million shopping experiences and 23 million shoe sizes across 19 international scales.

Report Scope

Report Features Description Market Value (2024) USD 294.3 Mn Forecast Revenue (2034) USD 1,733.1 Mn CAGR(2025-2034) 19.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Smart Athletic Shoes (Running Shoes, Training & Gym Shoes, Basketball Shoes), Smart Casual & Lifestyle Shoes, Smart Safety & Industrial Shoes, Specialized Medical/Rehabilitation Shoes), By Technology (Sensor Technology, Machine Learning and Artificial Intelligence, Algorithms, Connectivity), By Sales Channel (Online Channel, Offline Channel), By End-User (Athletes & Fitness Enthusiasts, Tech-Savvy Consumers, Healthcare & Rehabilitation Patients, Industrial Workers, Elderly Population) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nike Inc., Adidas AG, Puma SE, Under Armour Inc., Asics Corp., Deckers Outdoor Corporation, Wolverine World Wide Inc., Reebok International Ltd., Mizuno Corporation, Brooks Sports Inc., Salomon SAS, Patagonia Inc., Vivobarefoot Limited, Ajanta Shoe Private Limited, Orpyx Medical Technologies Inc., Scott Sports SA, La Sportiva NA Inc., Shift Robotics, Digitsole, Sensoria Health Inc., ShiftWear, Wiivv Wearables Inc., Altra Torin IQ, Salted Venture, Lumo, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Asics Corp.

- Deckers Outdoor Corporation

- Wolverine World Wide Inc.

- Reebok International Ltd.

- Mizuno Corporation

- Brooks Sports Inc.

- Salomon SAS

- Patagonia Inc.

- Vivobarefoot Limited

- Ajanta Shoe Private Limited

- Orpyx Medical Technologies Inc.

- Scott Sports SA

- La Sportiva NA Inc.

- Shift Robotics

- Digitsole

- Sensoria Health Inc.

- ShiftWear

- Wiivv Wearables Inc.

- Altra Torin IQ

- Salted Venture

- Lumo

- Others