Global AI-Powered Smart Labeling Market Size, Share Analysis By Type (RFID Labels, EAS Labels, NFC Tags, Sensing Labels, Dynamic Display Labels, Others), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Predictive Analysis, Others), By Component (Batteries, Transceivers, Microprocessors, Memories, Other Components), By Application (Retail & Inventory Tracking, Perishable Goods, Electronics & IT Assets, Pallet Tracking, Equipment, Other Applications), By End-Use Industry (Logistics, Retail, FMCG, Healthcare, Automotive, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155670

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of AI in Smart Labeling

- US Market Size

- By Type Analysis

- By Technology Analysis

- By Component Analysis

- By Application Analysis

- By End-Use Industry

- Key Market Segments

- Key Trends & Innovations

- Top Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

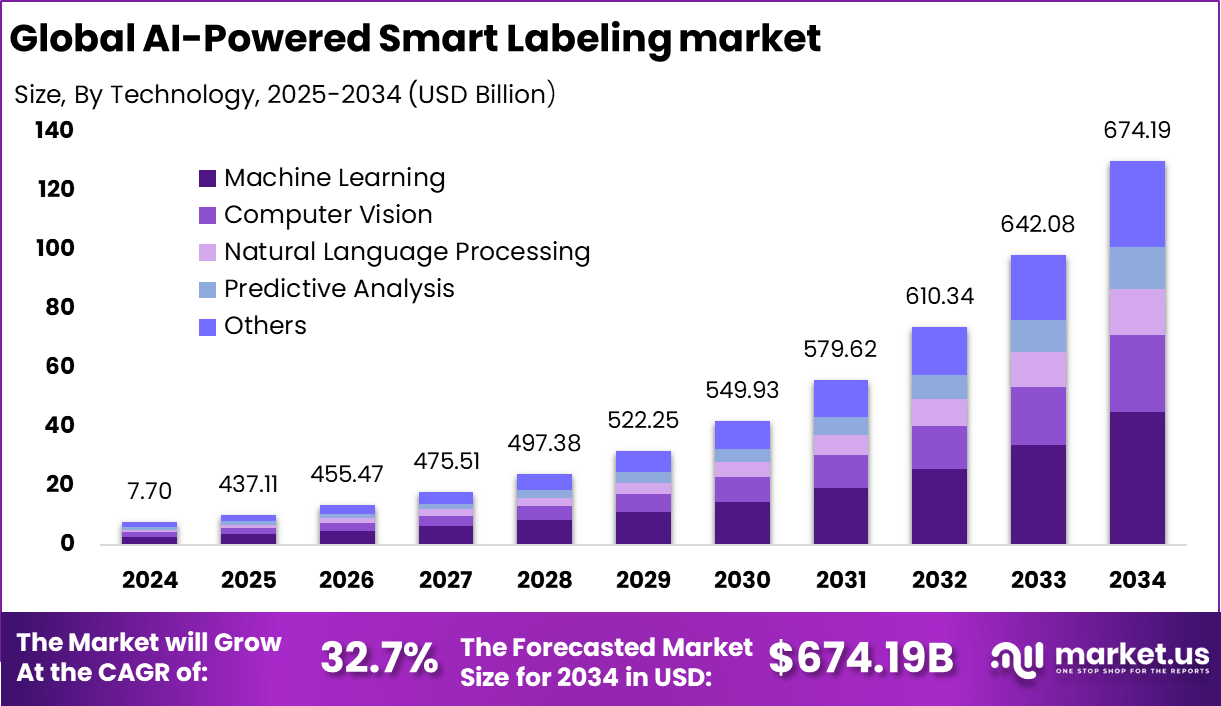

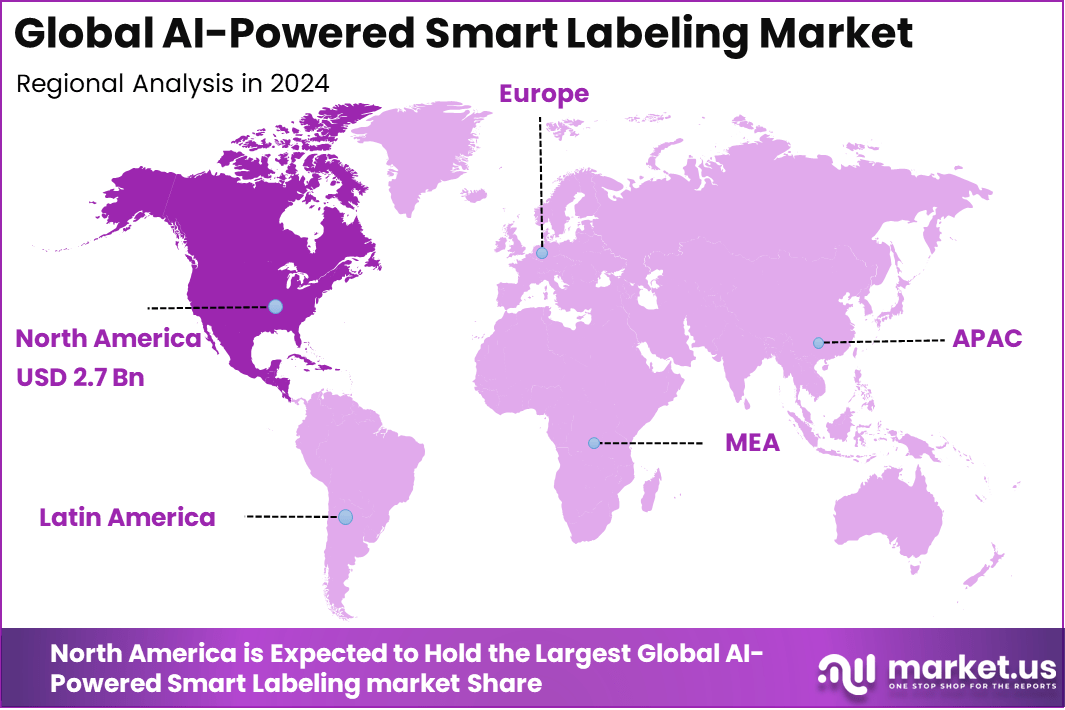

The Global AI-Powered Smart Labeling Market size is expected to be worth around USD 674.1 Billion By 2034, from USD 7.7 billion in 2024, growing at a CAGR of 32.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35.8% share, holding USD 2.7 Billion revenue.

The AI-Powered Smart Labeling market is experiencing rapid expansion due to the rising demand for automation in packaging, supply chain monitoring, and product authentication. Organizations are increasingly relying on intelligent labeling solutions to enhance traceability, improve inventory management, and ensure compliance with evolving regulations.

The growing need for real-time data insights and the ability to integrate labels with connected technologies such as IoT and machine learning has further accelerated adoption. Enhanced consumer expectations for transparency and sustainability are also driving greater investments in these advanced systems, strengthening their role in global industries.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 674.19 Bn CAGR(2025-2034) 32.7% Leading Segment By End-Use Industry – Logistics: 35.6% Leading Region Share North America [35.8% Market Share] Largest Country U.S. [USD 2.34 Bn Market Revenue], CAGR: 28.7% Demand for AI-powered smart labeling is increasing among businesses looking to automate compliance, enable real-time tracking, and gather rich product data without manual intervention. In sectors like healthcare and food, labels can monitor environmental conditions, automate recalls, and ensure products meet safety standards all the way to the end user.

Adoption of AI is advancing the industry by making smart labels self-optimizing. These labels can learn from previous data, adapt to new trends, and enable predictive maintenance or replenishment strategies. AI tools also automate label design, data gathering, translation, and regulatory monitoring, making global compliance and content management more accurate and less labor-intensive.

Key Insight Summary

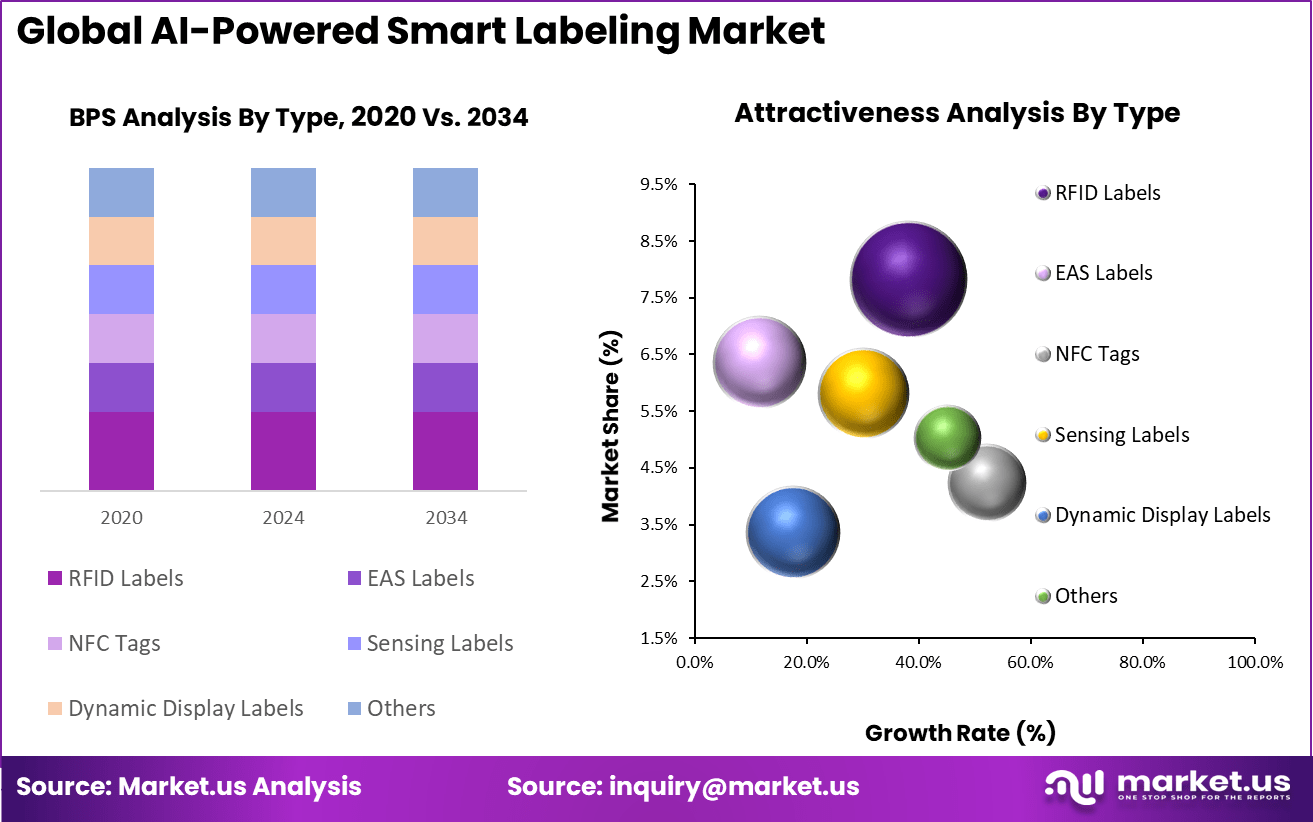

- By type, RFID labels accounted for 32.5% of the market, reflecting their strong role in real-time tracking and automated identification across supply chains.

- By technology, Machine Learning led with 34.6%, enabling intelligent labeling solutions that adapt to dynamic retail, logistics, and manufacturing environments.

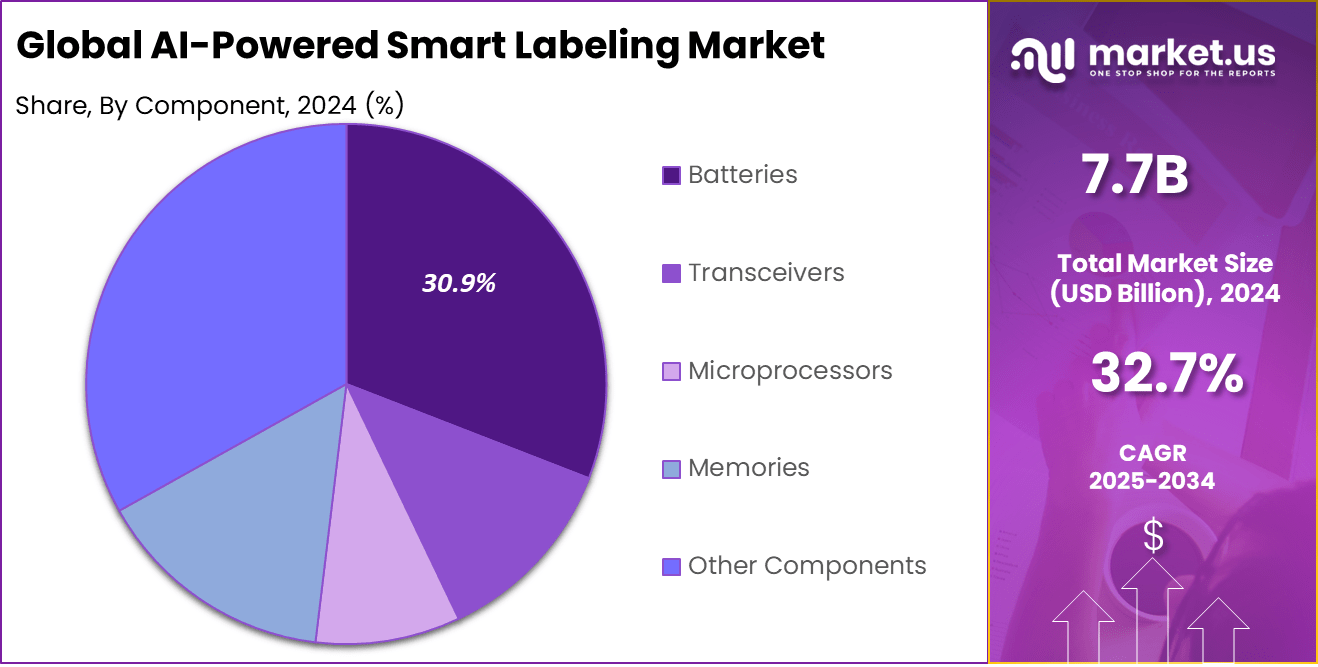

- By component, Batteries represented 30.9%, as energy efficiency and longer operational lifespans are critical for powering smart labeling systems.

- By application, Retail & Inventory Tracking held 28.8%, driven by demand for accurate product management, shrinkage reduction, and seamless checkout solutions.

- By end-use industry, Logistics dominated with 35.6%, as global distribution networks increasingly rely on AI-enhanced labeling for shipment tracking and operational efficiency.

- North America captured 35.8% of the market, reflecting advanced adoption of IoT, AI, and automated identification technologies.

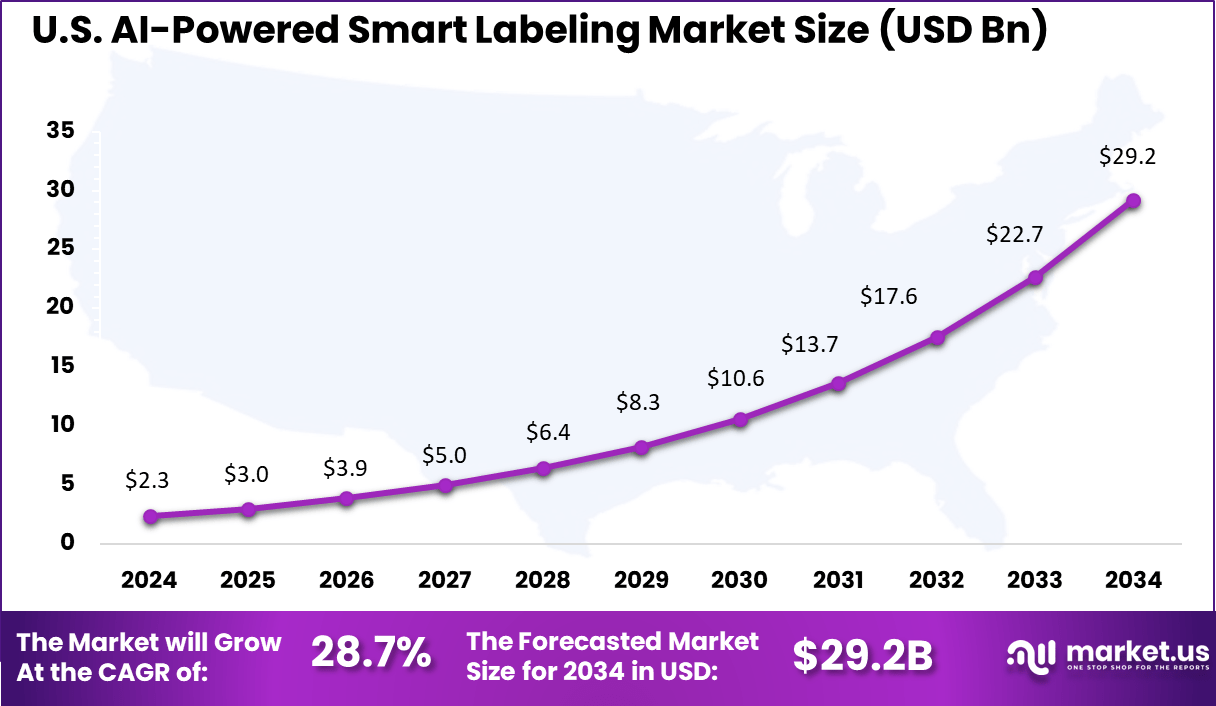

- The U.S. market reached USD 2.34 billion in 2024 and is expected to expand at a strong CAGR of 28.7%, supported by digital supply chain transformation and large-scale retail adoption.

Role of AI in Smart Labeling

AI Role/Function Description Data Pattern Recognition AI processes smart label data to extract trends in inventory, shipping, or consumption Predictive Analytics & Alerts Forecasts maintenance, freshness, demand, or issues before they happen Automated QC & Verification Computer vision/AI check label integrity, authenticity, and regulatory compliance Customization & Personalization AI creates dynamic, context-aware, or personalized content for consumer engagement Dynamic Supply Chain Optimization Proactively reroutes assets, flags bottlenecks, and optimizes logistics without human input Self-Optimizing Labeling Systems AI-adaptive labels can alter their behavior based on real-world feedback US Market Size

The U.S. AI-Powered Smart Labeling Market was valued at USD 2.3 Billion in 2024 and is anticipated to reach approximately USD 29.2 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 28.7% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 35.8% share and generating nearly USD 2.7 billion in revenue. The region’s leadership in the AI-powered smart labeling market is primarily the result of strong retail and logistics networks, where efficiency, transparency, and real-time tracking are considered essential.

Companies in the U.S. have been early adopters of AI-driven labeling technologies, leveraging machine learning and IoT-enabled systems to enhance supply chain visibility, reduce errors, and improve compliance with safety and regulatory standards. Consumer demand for product authenticity and detailed information has also fueled the adoption of smart labels across North America.

Retailers and manufacturers in sectors such as food, pharmaceuticals, and consumer electronics have embraced AI-powered labeling to provide traceability, ensure quality assurance, and meet rising expectations for sustainability. The widespread use of e-commerce in the U.S. and Canada further supports this trend, as smart labels play a critical role in logistics tracking, return management, and personalized customer engagement through interactive packaging.

By Type Analysis

In 2024, RFID Labels hold a leading position in the AI-Powered Smart Labeling Market with a market share of 32.5%. This technology is highly favored for its ability to enable fast, contactless tracking and identification of products in real-time.

RFID labels enhance visibility throughout the supply chain and inventory processes, driving efficiencies by reducing manual scanning errors and accelerating asset management. The integration of AI further optimizes RFID’s capability, facilitating predictive analytics and enhanced data-driven decision-making for businesses across industries.

The growing adoption of RFID in sectors such as retail, logistics, and manufacturing is propelled by its scalability and robustness, making it a foundational technology in smart labeling systems targeting operational excellence and cost reduction in 2024.

By Technology Analysis

In 2024, Machine Learning leads the technology category in the AI-Powered Smart Labeling Market with a share of 34.6%. Machine learning algorithms empower smart labels to interpret large volumes of collected data and identify patterns that enable predictive maintenance, demand forecasting, and anomaly detection.

This intelligent data processing transforms conventional labeling into dynamic systems that add value by anticipating needs and optimizing supply chain operations. Continued advancements in machine learning models and their integration into smart label systems are driving market growth, offering companies ever-improving accuracy and adaptability in their asset tracking and inventory monitoring efforts.

By Component Analysis

In 2024, the Batteries component segment contributes a notable 30.9% share to the AI-Powered Smart Labeling Market. Batteries serve as the critical power source for active smart labels that require consistent energy for wireless communication and sensor functionality.

Enhanced battery technology, featuring longer life cycles and compact size, supports the deployment of smart labels in increasingly demanding environments. Battery reliability is essential for maintaining uninterrupted data transmission and sensor operations, particularly in logistics and retail sectors where real-time tracking is mission-critical. This reliance ensures batteries remain a focal component in the smart labeling ecosystem throughout 2024.

By Application Analysis

In 2024, the Retail & Inventory Tracking application segment captures a market share of 28.8%, leading this area of the AI-Powered Smart Labeling Market. Retailers are adopting smart labeling solutions to improve stock accuracy, reduce shrinkage, and streamline the replenishment process.

AI-enabled labels enable comprehensive visibility into inventory flow, enhancing decision-making and customer satisfaction by ensuring product availability. The increasing shift towards omnichannel retail strategies and digital transformation accelerates the adoption of these technologies, making retail and inventory management vital application drivers in the smart labeling market landscape.

By End-Use Industry

In 2024, the Logistics industry stands as the foremost end-user segment for AI-Powered Smart Labeling Market with a substantial share of 35.6%. Logistics companies utilize smart labels to track shipments, monitor asset conditions, and optimize routing through real-time data.

The adoption of AI-powered smart labeling elevates operational efficiency by enabling predictive insights that reduce delays, loss, and shipment errors. Increased pressure on global supply chains for transparency, speed, and cost-efficiency fuels the logistics sector’s demand for intelligent labeling solutions. This trend makes logistics a key driver of smart labeling market growth as businesses strive for end-to-end visibility and control in 2024.

Key Market Segments

By Type

- RFID Labels

- EAS Labels

- NFC Tags

- Sensing Labels

- Dynamic Display Labels

- Others

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing

- Predictive Analysis

- Others

By Component

- Batteries

- Transceivers

- Microprocessors

- Memories

- Other Components

By Application

- Retail & Inventory Tracking

- Perishable Goods

- Electronics & IT Assets

- Pallet Tracking

- Equipment

- Other Applications

By End-Use Industry

- Logistics

- Retail

- FMCG

- Healthcare

- Automotive

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Trends & Innovations

Trend/Innovation Description Embedded Sensors (Temp/Gas/Humidity) Labels include advanced sensors for freshness, cold-chain, or theft detection Battery-Free & Printed Electronics NFC/BLE/RFID tags with no battery, printable smart circuits, recyclable substrates Blockchain-Linked Authenticity AI and DLT for end-to-end product traceability and anti-counterfeiting (food, pharma, luxury) Dynamic/Interactive Smart Labels Real-time info, AR experiences, consumer data capture via smartphone scanning Edge Intelligence & On-Label AI Localized, real-time analytics or feedback from the label itself (not just cloud-based AI) Top Growth Factors

Growth Factor Description Industry 4.0 & IoT Expansion Need for real-time tracking, asset management, and supply chain visibility Rise of Digital & Direct-to-Consumer E-commerce, omnichannel retail automation, and customer engagement Sustainability Pressures Demand for eco-friendly, recyclable, and digitally traceable packaging Regulatory & Traceability Mandates Compliance for pharma, food safety, and anti-counterfeiting drives adoption Data-Driven Decision Making Brands seek actionable insights from smart label analytics Driver Analysis

Growing Need for Inventory Management and Product Transparency

A key driver for AI-powered smart labeling adoption is the increasing demand for efficient inventory management and transparent product information. Industries want to know exactly where products are at any time, both to reduce losses and respond faster to changes in demand. Smart labels powered by AI make this possible by automatically tracking goods, updating inventories, and sending alerts about low stock or potential product issues.

For consumers, there is also a rising desire to access detailed information about product origin, safety, and authenticity. Smart labeling satisfies this need at the point of purchase or even at home, building trust and loyalty by ensuring accurate, easily accessible information. This is particularly important in sensitive sectors like healthcare and food, where accuracy and reliability can be critical.

Restraint Analysis

High Upfront Costs and System Integration Barriers

Despite their advantages, adopting AI-powered smart labeling is not always straightforward. The main restraints are high initial costs for hardware, software, and staff training, along with technical hurdles in connecting new systems to existing operations. Small and mid-sized businesses in particular may find these barriers hard to overcome.

Implementing smart labels also demands clean, organized data; poor data quality or incompatible software can lead to errors and inefficiencies. Many organizations struggle with finding IT expertise or managing large-scale deployments, sometimes slowing or limiting the benefits of smart labeling technology.

Opportunity Analysis

Sustainable Materials and Advanced Label Design

Sustainability is emerging as an important opportunity for the smart labeling market. Companies are beginning to roll out labels made from biodegradable or recycled materials, along with liner-free and compostable adhesives to reduce waste. These choices appeal to both regulators and consumers, who are increasingly prioritizing eco-friendly products and responsible packaging.

Meanwhile, advances in digital printing and sensor technology allow for highly customized labels that can update information dynamically or track product freshness. Businesses that develop flexible, sustainable, and innovative labels stand to gain a competitive advantage as both environmental and customization demands grow.

Challenge Analysis

Data Privacy, Compliance, and Workforce Adaptation

A major challenge for AI-powered smart labeling systems is ensuring data security, privacy, and compliance, especially given the increased data collection involved. Regulations around data use in packaging and inventory management are getting stricter, and any mishandling can harm reputation or result in fines. Companies must constantly review and update practices to match local and international laws.

In addition, workforce adaptation is needed. Employees must shift from manual labeling tasks to managing and reviewing automated, data-led processes – often requiring new training and a cultural change within organizations. Managing this transition smoothly, while keeping operations efficient and secure, will remain a top priority for companies moving forward.

Competitive Analysis

Zebra Technologies Corporation, Alien Technology, and Impinj, Inc. represent the technology-focused group that has been driving innovation in the AI-powered smart labeling space. These companies have advanced capabilities in RFID, data capture, and automation, enabling them to provide scalable and efficient labeling solutions. Their focus has been on improving accuracy, speed, and real-time data visibility for industries such as retail, logistics, and healthcare.

MPI Labels, Invengo Information Technology, and Murata Manufacturing have contributed by developing specialized labeling systems that address niche industry needs. These companies emphasize durability, cost-effectiveness, and compliance with global standards. Their offerings integrate seamlessly with smart supply chain operations, ensuring efficient product tracking and inventory management.

NXP Semiconductors, Avery Dennison, CCL Industries, Smartrac, Mühlbauer Group, and Checkpoint Systems form the group of diversified leaders with strong portfolios. They have established themselves with integrated solutions covering tags, sensors, chips, and enterprise platforms. Their strategies include building eco-friendly products, enhancing interoperability, and supporting large-scale deployments.

Top Key Players in the Market

- Zebra Technologies Corporation

- Alien Technology, LLC.

- Impinj, Inc.

- MPI Labels

- Invengo Information Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Avery Dennison Corporation

- CCL Industries Inc.

- Smartrac Technology GmbH

- Mühlbauer Group

- Checkpoint Systems, Inc

- Others

Recent Developments

Mergers and Acquisitions

- In March 2025, Elon Musk’s xAI acquired the social media platform X (formerly Twitter) for $33 billion. This move aims to combine xAI’s artificial intelligence capabilities with X’s global user base to improve labeling systems and content management at a large scale.

- Meta completed a $14 billion acquisition of Scale AI in June 2025. Scale AI is a well-known company in data labeling technology used in logistics, healthcare, and e-commerce.

- Salesforce made an $8 billion deal with Informatica in May 2025. This acquisition will help integrate smart labeling and data management across Salesforce’s cloud services.

Funding and Investment

- In the second quarter of 2024, global AI funding rose by 59% quarter-over-quarter, reaching $23.2 billion. Smart labeling startups received a significant portion of these investments.

- By the first quarter of 2025, AI funding had increased to $66.6 billion over more than 1,130 deals, with many focusing on smart labeling and related AI infrastructure.

- The average size of AI deals in 2024 rose to $23.5 million, a 28% increase from the previous year, driven partly by the growing adoption of smart labeling tools for supply chain management and error reduction.

New Product Launches and Technology Trends

- In 2025, smart labels that combine AI with Internet of Things (IoT) technologies like RFID and NFC gained greater adoption. These improved labels offer real-time updates, predictive analytics, and help automate processes in sectors such as healthcare, logistics, and retail.

- Companies including Avery Dennison, Zebra Technologies, and Identiv have increased efforts to develop smart labels with machine learning capabilities that adapt and learn over time.

- The food and beverage industry is adopting smart labels more widely to monitor freshness, provide origin traceability, and ensure regulatory compliance in 2024.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (RFID Labels, EAS Labels, NFC Tags, Sensing Labels, Dynamic Display Labels, Others), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Predictive Analysis, Others), By Component (Batteries, Transceivers, Microprocessors, Memories, Other Components), By Application (Retail & Inventory Tracking, Perishable Goods, Electronics & IT Assets, Pallet Tracking, Equipment, Other Applications), By End-Use Industry (Logistics, Retail, FMCG, Healthcare, Automotive, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zebra Technologies Corporation, Alien Technology, LLC., Impinj, Inc., MPI Labels, Invengo Information Technology Co., Ltd., Murata Manufacturing Co., Ltd., NXP Semiconductors, Avery Dennison Corporation, CCL Industries Inc., Smartrac Technology GmbH, Mühlbauer Group, Checkpoint Systems, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Smart Labeling MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Smart Labeling MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zebra Technologies Corporation

- Alien Technology, LLC.

- Impinj, Inc.

- MPI Labels

- Invengo Information Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Avery Dennison Corporation

- CCL Industries Inc.

- Smartrac Technology GmbH

- Mühlbauer Group

- Checkpoint Systems, Inc

- Others