Global AI-Powered Multicloud Networking Market Size, Share and Analysis Report By Component Solution (Network Security, Network Orchestration, Network Monitoring and Visibility, Others), Services (Professional Services, Managed Services), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End Use (BFSI, IT & Telecommunications, Retail & Consumer Goods, Government, Manufacturing, Healthcare, Media & Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174582

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment

- By Enterprise Size

- By End Use

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

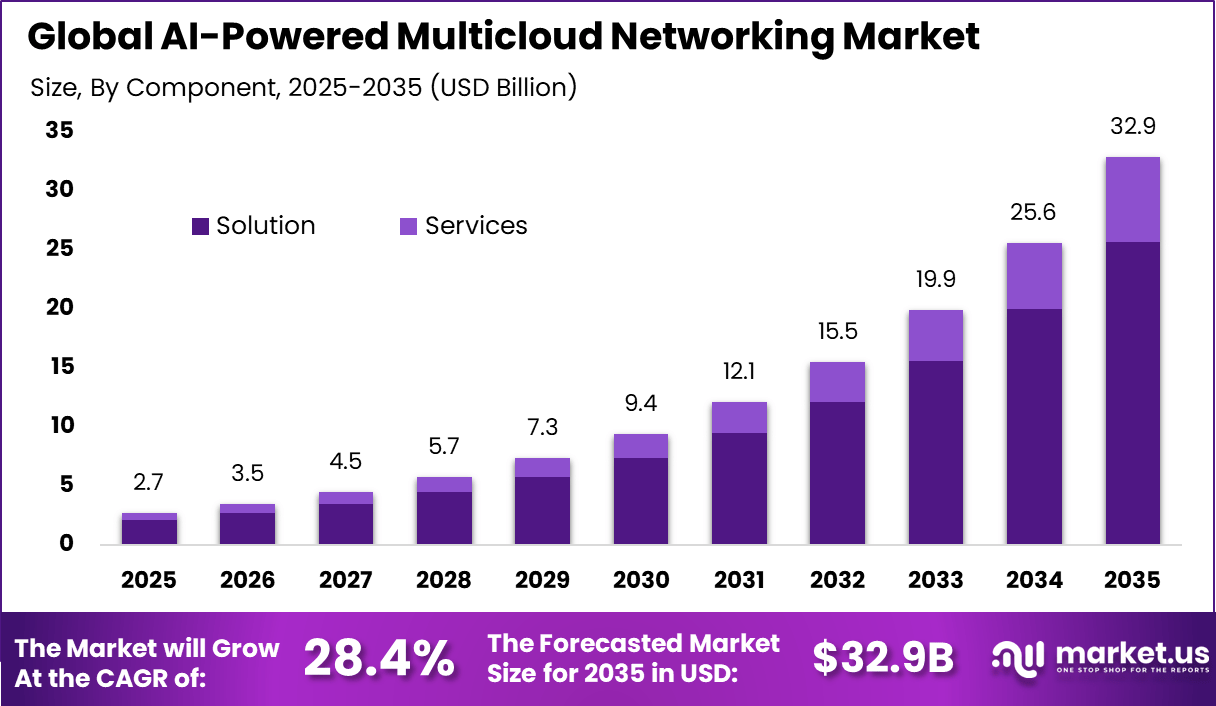

The Global AI-Powered Multicloud Networking Market size is expected to be worth around USD 32.9 Billion By 2035, from USD 2.7 billion in 2025, growing at a CAGR of 28.4% during the forecast period from 2026 to 2035.

The AI powered multicloud networking market refers to networking platforms that use artificial intelligence to manage, optimize, and secure connectivity across multiple cloud environments. These solutions support communication between public clouds, private clouds, and on-premise infrastructure. AI powered networking tools automate traffic routing, performance optimization, and fault detection across distributed environments.

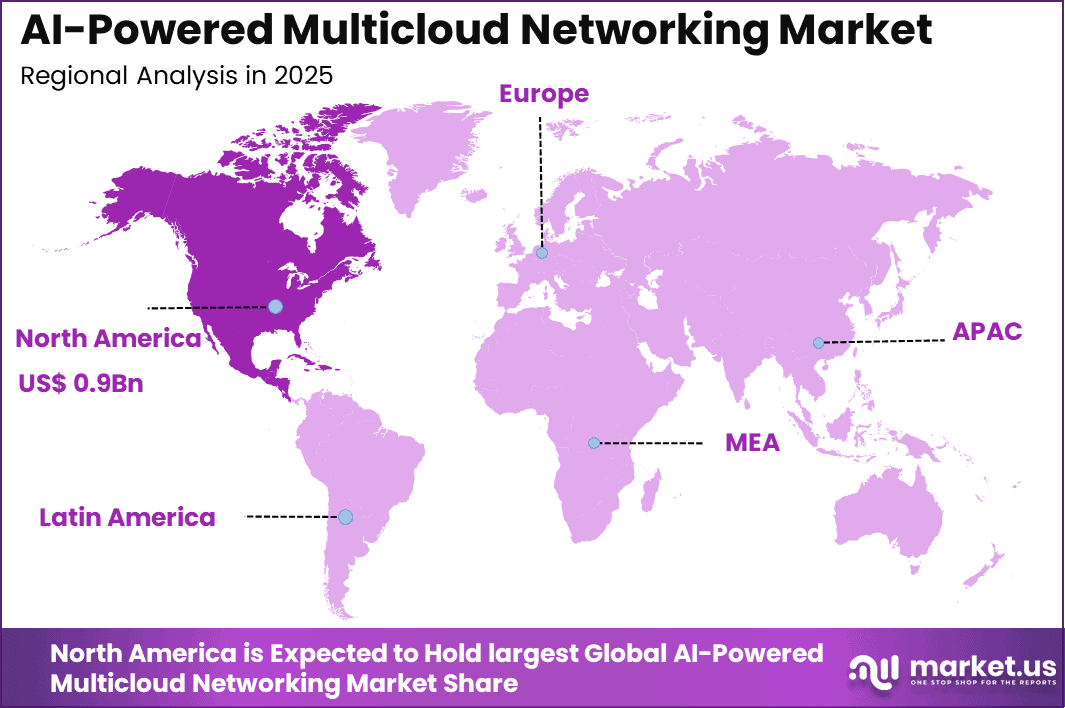

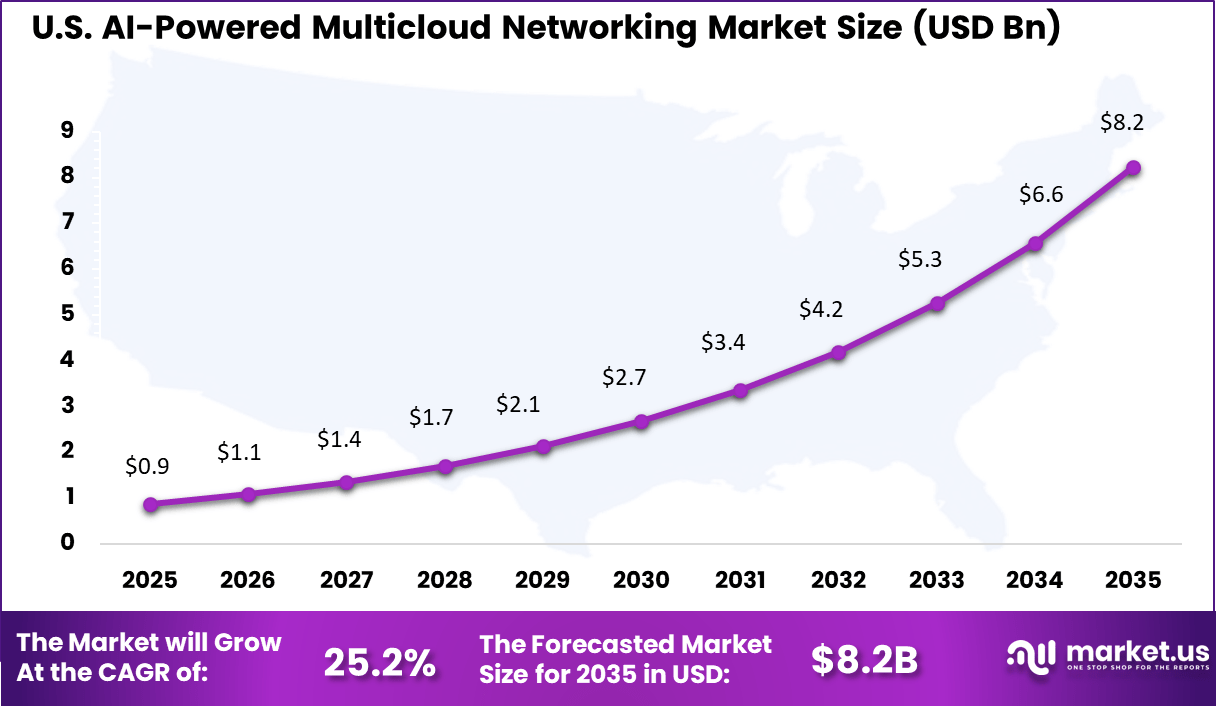

Metric Value Global Market Size USD 2.7 Bn Global CAGR 28.4% North America Share 36.8% North America Market Value USD 1.02 Bn U.S. Market Value USD 0.87 Bn U.S. CAGR 25.2% Adoption is seen across enterprises with complex cloud architectures. These platforms support consistent network performance and visibility. The market development has been influenced by growing multicloud adoption among enterprises. Organizations use multiple cloud providers to improve flexibility and reduce dependency risks. Managing connectivity across these environments introduces complexity. AI powered networking solutions address this challenge by providing centralized control and automation.

Top Market Takeaways

- Solutions led the AI powered multicloud networking market in 2025 with a 78.2% share, driven by demand for integrated and AI enabled network management platforms.

- Public cloud deployment accounted for 55.7%, reflecting preference for scalable and flexible networking across distributed environments.

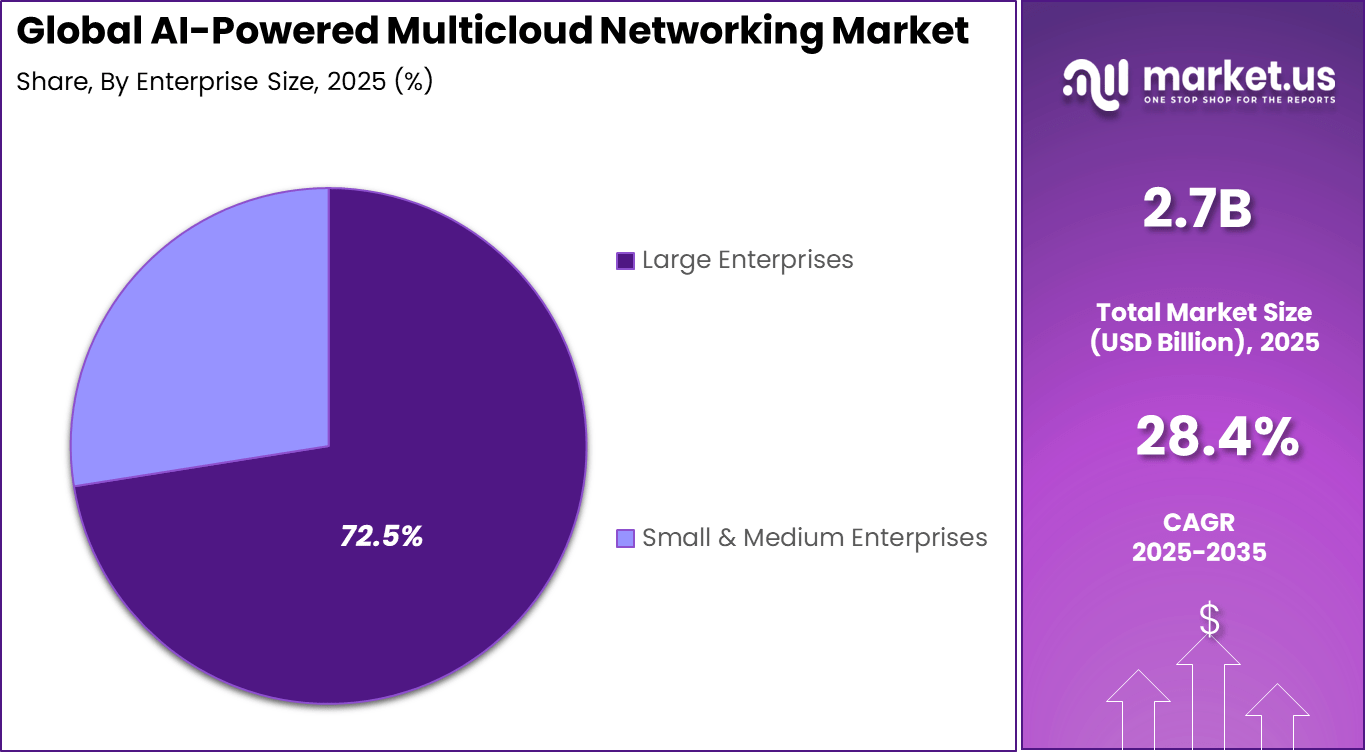

- Large enterprises dominated adoption with a 72.5% share due to complex hybrid and multicloud infrastructure needs.

- The BFSI sector captured 36.6%, supported by high requirements for security, reliability, and compliance.

- North America held a 36.8% regional share, supported by advanced cloud ecosystems and enterprise IT spending.

- The U.S. market reached USD 0.87 Billion in 2025, expanding at a 25.2% CAGR, driven by early AI adoption and multicloud networking demand.

Quick Market Facts

Adoption & Usage Patterns

- 86% of organizations use a multicloud strategy in 2025.

- 57% still run siloed applications, creating integration gaps.

- 66% of enterprises rank Generative AI as a top multicloud use case.

- By 2027, 70% of SD-WAN operations are expected to rely on Generative AI.

- 80% of AI workloads are planned for public cloud environments.

- 54% of organizations will retain AI workloads on premises, driving hybrid connectivity needs.

Efficiency & ROI Metrics

- AI driven network management enables up to 30% cloud cost savings.

- Advanced AI WAN solutions deliver up to 40% faster network performance.

- Total cost of ownership can drop by 40% versus customer managed WANs.

- Enterprises waste about 32% of cloud spend due to poor resource allocation.

Key Challenges Addressed

- 63% of organizations manually correlate data from five or more tools.

- AI driven rerouting can recover up to 84% of network outages automatically.

- 78% of cloud decision makers cite skills shortages as a major constraint.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of multicloud strategies Enterprises distributing workloads across clouds ~7.2% Global Short Term Rising network complexity Need for AI driven traffic optimization ~6.1% North America, Europe Short Term BFSI digital infrastructure expansion Secure and resilient cloud connectivity ~5.3% North America, Europe Mid Term Demand for low latency applications Real time analytics and transactions ~4.8% Global Mid Term Cloud cost optimization pressure Intelligent routing and usage efficiency ~3.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Security misconfigurations Exposure across multiple cloud environments ~5.4% Global Short Term Integration complexity Diverse cloud networking standards ~4.6% Global Short to Mid Term High deployment cost Advanced AI networking platforms ~3.9% Emerging Markets Mid Term Skills shortage Limited multicloud networking expertise ~3.2% Global Mid Term Vendor dependency Proprietary AI networking stacks ~2.5% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Licensing and infrastructure costs ~5.8% Emerging Markets Short to Mid Term Legacy network constraints Incompatibility with modern cloud fabrics ~4.5% Global Mid Term Data sovereignty issues Cross border traffic regulations ~3.7% Europe Mid Term Performance unpredictability Latency variation across clouds ~2.9% Global Long Term Limited SME adoption Budget and complexity barriers ~2.3% Emerging Markets Long Term By Component

Solutions account for 78.2%, highlighting their central role in AI-powered multicloud networking. These solutions provide unified visibility and control across multiple cloud environments. AI-driven orchestration improves traffic routing and network performance. Centralized management reduces operational complexity. Reliability and scalability remain essential requirements.

The dominance of solution-based components is driven by enterprise needs for integrated networking. Organizations prefer platforms that manage connectivity across providers. AI capabilities automate policy enforcement and optimization. Integrated solutions reduce manual intervention. This sustains strong adoption of solution offerings.

By Deployment

Public cloud deployment holds 55.7%, reflecting preference for flexible and scalable infrastructure. Public cloud environments support rapid provisioning of networking resources. AI-powered tools optimize connectivity across distributed workloads. Centralized control improves network efficiency. Accessibility supports broader adoption.

Adoption of public cloud deployment is driven by cloud-first strategies. Enterprises operate applications across multiple public clouds. AI networking tools adapt to dynamic traffic patterns. Cost efficiency improves with optimized routing. This keeps public cloud deployment widely adopted.

By Enterprise Size

Large enterprises represent 72.5%, making them the primary adopters of multicloud networking solutions. These organizations manage complex IT environments across regions. AI-powered networking supports consistent performance at scale. Centralized governance improves control and compliance. Scale increases the need for automation.

Adoption among large enterprises is driven by operational complexity. Multicloud strategies require intelligent traffic management. AI tools reduce configuration errors. Integration with enterprise systems improves coordination. This sustains strong enterprise-level demand.

By End Use

The BFSI sector accounts for 36.6%, making it a key end-use segment. Financial institutions operate across multiple cloud platforms. Secure and reliable connectivity is critical for transactions. AI-powered networking improves resilience and performance. Compliance and security remain priorities.

Growth in BFSI adoption is driven by digital banking expansion. Institutions require low-latency and high-availability networks. AI tools support real-time monitoring and optimization. Centralized networking reduces risk exposure. This sustains steady adoption in BFSI.

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity BFSI Secure multicloud transaction networks 36.6% Advanced IT and telecommunications Cross cloud service delivery 24.8% Advanced Retail and e commerce Omni channel application networking 18.7% Developing Healthcare Secure data exchange across clouds 11.2% Developing Government Resilient digital infrastructure 8.7% Developing By Region

North America accounts for 36.8%, supported by advanced cloud adoption. Enterprises in the region deploy multicloud architectures widely. AI networking tools support operational efficiency. Infrastructure maturity accelerates deployment. The region remains influential.

The United States reached USD 0.87 Billion with a CAGR of 25.2%, reflecting rapid growth. Expansion is driven by enterprise cloud strategies. Demand for intelligent networking continues to rise. AI adoption improves network management. Market momentum remains strong.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large enterprises Very High ~72.5% Performance and resilience Platform wide deployment BFSI institutions High ~36.6% Secure and compliant networking Long term contracts Cloud service providers High ~19% Differentiated networking services Capital intensive Telecom operators Moderate ~14% Cloud connectivity expansion Phased rollout SMEs Low to Moderate ~8% Cost sensitive cloud networking Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status AI traffic optimization Intelligent routing and load balancing ~7.1% Growing Software defined networking Centralized multicloud control ~6.0% Mature Network analytics engines Real time performance insights ~5.2% Growing Cloud native security Policy driven traffic protection ~4.1% Developing Automation and orchestration Zero touch network operations ~3.3% Developing Driver Analysis

The AI-powered multicloud networking market is being driven by the increasing complexity of hybrid and multicloud environments that demand intelligent, automated network management and optimisation. Organisations are adopting multicloud strategies to distribute workloads, improve resilience, and leverage best-of-breed cloud services. This dispersion, however, introduces challenges in connectivity, performance consistency, and policy enforcement across distributed networks.

AI-enabled multicloud networking tools address these needs by automating traffic routing, load balancing, anomaly detection, and performance forecasting, enabling real-time optimisation while reducing manual network administration. The result is improved operational efficiency, reduced downtime, and stronger alignment between networking performance and business objectives.

Restraint Analysis

A significant restraint in the AI-powered multicloud networking market stems from integration complexity and the specialised expertise required to deploy and manage these advanced systems. Organisations often operate heterogeneous network environments with legacy systems, proprietary cloud configurations, and varying security policies, complicating the seamless adoption of AI-driven networking solutions.

Aligning AI models with organisational policy frameworks, compliance standards, and operational practices requires extensive planning and testing, which can slow implementation and elevate total cost of ownership. Additionally, concerns about transparency and control over automated decision-making processes can limit trust among network administrators accustomed to manual governance.

Opportunity Analysis

Emerging opportunities in the AI-powered multicloud networking market are linked to growing demand for autonomous network operations and predictive analytics that pre-empt performance degradation and security threats. AI algorithms that learn from historical network behaviour can forecast congestion, identify latent faults, and recommend or enact corrective actions before users are impacted.

This proactive capability enhances service reliability and enables more efficient allocation of network resources across multicloud deployments. There is also opportunity in tailored solutions for industry-specific use cases where performance and regulatory compliance are critical, such as financial services, healthcare, and edge-intensive applications, driving differentiated value for specialised sectors.

Challenge Analysis

A central challenge confronting this market relates to ensuring AI-driven decisions remain interpretable, secure, and aligned with organisational governance. Automated network actions influenced by machine learning models must be transparent and justifiable to administrators and compliance stakeholders to maintain trust and accountability.

In multicloud environments that span public, private, and edge infrastructures, preserving secure data flows and consistent policy enforcement adds further complexity to model design and operational procedures. Balancing automation with human oversight, particularly for critical network events or regulatory audit requirements, remains a nuanced challenge as organisations scale AI-based networking capabilities.

Emerging Trends

Emerging trends in the AI-powered multicloud networking landscape include the adoption of intent-based networking principles that allow administrators to specify high-level outcomes while AI systems determine optimal configurations. There is also increased integration of real-time telemetry and predictive analytics that empower networks to self-adjust to changing traffic patterns, security postures, or application demands.

Another trend involves the consolidation of multicloud management platforms that unify visibility, policy control, and automated workflows across diverse cloud providers, reducing fragmentation and improving operational coherence.

Growth Factors

Growth in the AI-powered multicloud networking market is anchored in the continued expansion of cloud adoption, digital transformation initiatives, and the need for resilient and scalable network architectures. Organisations are increasingly reliant on multicloud infrastructures to support mission-critical applications, distributed workforces, and data-intensive operations that require consistent performance and low latency.

Advances in artificial intelligence, machine learning, and real-time analytics enhance the feasibility of automated network optimisation at scale. Demand for operational efficiencies, improved security postures, and reduced network administration overhead further strengthens investment in AI-driven multicloud networking solutions as strategic enablers of modern IT environments.

Key Market Segments

By Component

- Solution

- Network Security

- Network Orchestration

- Network Monitoring and Visibility

- Others

- Services

- Professional Services

- Managed Services

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End Use

- BFSI

- IT & Telecommunications

- Retail & Consumer Goods

- Government

- Manufacturing

- Healthcare

- Media & Entertainment

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Key players such as Alkira, Inc., Arrcus Inc., and Aviatrix, Inc. focus on software-centric multicloud connectivity. Their platforms simplify network design, traffic control, and visibility across multiple cloud environments. AI is used to automate routing decisions and policy enforcement. Cisco Systems, Inc. and VMware, Inc. strengthen the market through large enterprise adoption.

Equinix, Inc. supports the market through neutral interconnection and global data center infrastructure. This enables low-latency multicloud traffic exchange. F5, Inc. enhances application performance and security across distributed clouds. HCL Technologies Limited and Hewlett Packard Enterprise Development LP contribute through integration, managed services, and hybrid cloud solutions. IBM Corporation adds AI-driven network management capabilities.

Microsoft Corporation benefits from tight cloud integration and advanced AI tools that optimize multicloud networking. Netskope focuses on secure access and policy management across cloud platforms. Tata Communications Limited leverages its global backbone to support enterprise connectivity. Zenlayer expands reach through edge and cloud on-ramp services.

Top Key Players in the Market

- Alkira, Inc.

- Arrcus Inc.

- Aviatrix, Inc.

- Carahsoft Technology Corp.

- Cisco Systems, Inc.

- Equinix, Inc.

- F5, Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft Corporation

- Netskope

- Tata Communications Limited

- VMware, Inc.

- Zenlayer

- Others

Recent Developments

- September, 2025 – Equinix rolled out its Distributed AI Infrastructure at the AI Summit, featuring Fabric Intelligence for smarter automation in multicloud AI workloads. It’s set to launch fully in Q1 2026, making connections more responsive for distributed AI apps.

- November, 2025 – Cisco launched the Unified Edge platform, blending compute, networking, and AI to handle edge-based multicloud workloads seamlessly. This ties into their broader AI push with partners like Nvidia for distributed setups.

Report Scope

Report Features Description Market Value (2025) USD 2.7 Bn Forecast Revenue (2035) USD 32.9 Bn CAGR(2026-2035) 28.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component Solution (Network Security, Network Orchestration, Network Monitoring and Visibility, Others), Services (Professional Services, Managed Services), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End Use (BFSI, IT & Telecommunications, Retail & Consumer Goods, Government, Manufacturing, Healthcare, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alkira, Inc., Arrcus Inc., Aviatrix, Inc., Carahsoft Technology Corp., Cisco Systems, Inc., Equinix, Inc., F5, Inc., HCL Technologies Limited, Hewlett Packard Enterprise Development LP, IBM Corporation, Microsoft Corporation, Netskope, Tata Communications Limited, VMware, Inc., Zenlayer, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Multicloud Networking MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Multicloud Networking MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alkira, Inc.

- Arrcus Inc.

- Aviatrix, Inc.

- Carahsoft Technology Corp.

- Cisco Systems, Inc.

- Equinix, Inc.

- F5, Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft Corporation

- Netskope

- Tata Communications Limited

- VMware, Inc.

- Zenlayer

- Others