Global AI-Powered Fish Farming Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Application (Feeding Management, Monitoring, Tracking, and Behavior Analysis, Water Quality Management & Prediction, Disease Detection & Prevention, Harvesting Optimization & Sorting, Others), By Farm Type (Offshore & Inshore Cages, Recirculating Aquaculture Systems (RAS), Ponds & Open Inland Fisheries), By End-User (Large Commercial Aquaculture Corporations, Mid-sized Farms & Cooperatives, Research Institutions & Government Bodies), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167865

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Europe Market Size

- Component Analysis

- Application Analysis

- Farm Type Analysis

- End-User Analysis

- Investment and Business Benefits

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

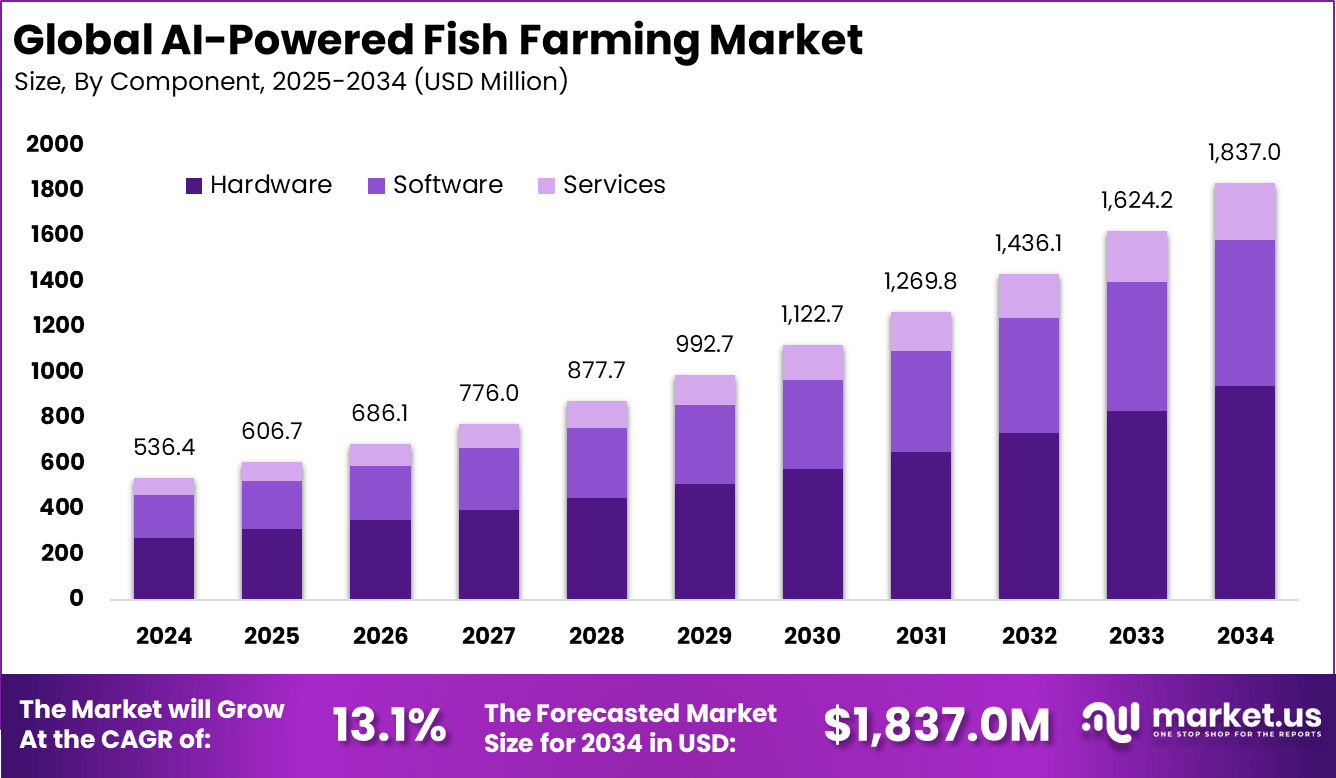

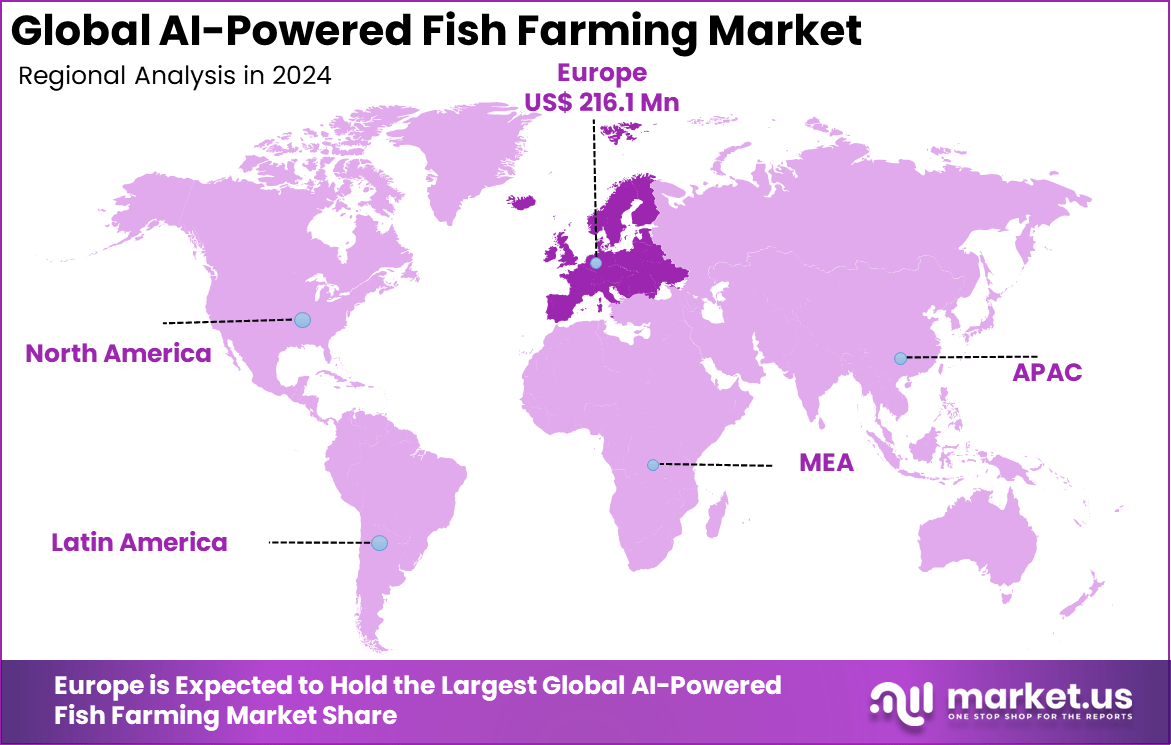

The Global AI-Powered Fish Farming Market size is expected to be worth around USD 1,837.0 million by 2034, from USD 536.4 million in 2024, growing at a CAGR of 13.1% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 40.3% share, holding USD 216.1 million in revenue.

The AI-powered fish farming market is mainly propelled by growing consumer demand for sustainable and healthy seafood. This demand encourages fish farmers to adopt intelligent technologies that improve efficiency and reduce environmental harm. Technological advances, such as machine learning and computer vision, enable enhanced feed management and early disease detection, which directly improve fish survival rates and productivity.

The main reasons driving AI adoption in fish farming include the need to reduce operational costs, enhance feed efficiency, and improve fish health management. Feed accounts for up to 70% of aquaculture costs, so minimizing waste has a direct impact on profitability. Rising global demand for seafood and environmental concerns are pushing producers to adopt more sustainable farming methods. Advances in sensor technology, machine learning, and cloud connectivity also make AI solutions more accessible and effective on farms.

Demand for AI-driven aquaculture solutions is growing as fish farmers seek better control over production variables. AI helps in optimizing feed schedules to reduce overfeeding-related pollution and improve feed conversion ratios. There is increasing interest from both small-scale farms and large commercial operations as they aim for higher yields with less environmental impact. Moreover, governments and regulatory bodies encouraging sustainability add further impetus to technology adoption.

For instance, in March 2025, Aquabyte showcased its AI-driven fish data collection and monitoring solutions at the AquaSur Tech event. Their system uses submersible cameras and machine learning to give producers critical data on biomass, lice counts, fish welfare, and behavior, helping improve farm profitability and fish health.

Key Takeaway

- In 2024, the hardware segment maintained the dominant position in the Global AI Powered Fish Farming Market by securing a 51.3% share.

- In 2024, the feeding management segment led its category and accounted for a 34.2% share within the Global AI Powered Fish Farming Market.

- In 2024, the offshore and inshore cages segment captured a leading 45.8% share, reinforcing its strong role in the Global AI Powered Fish Farming Market.

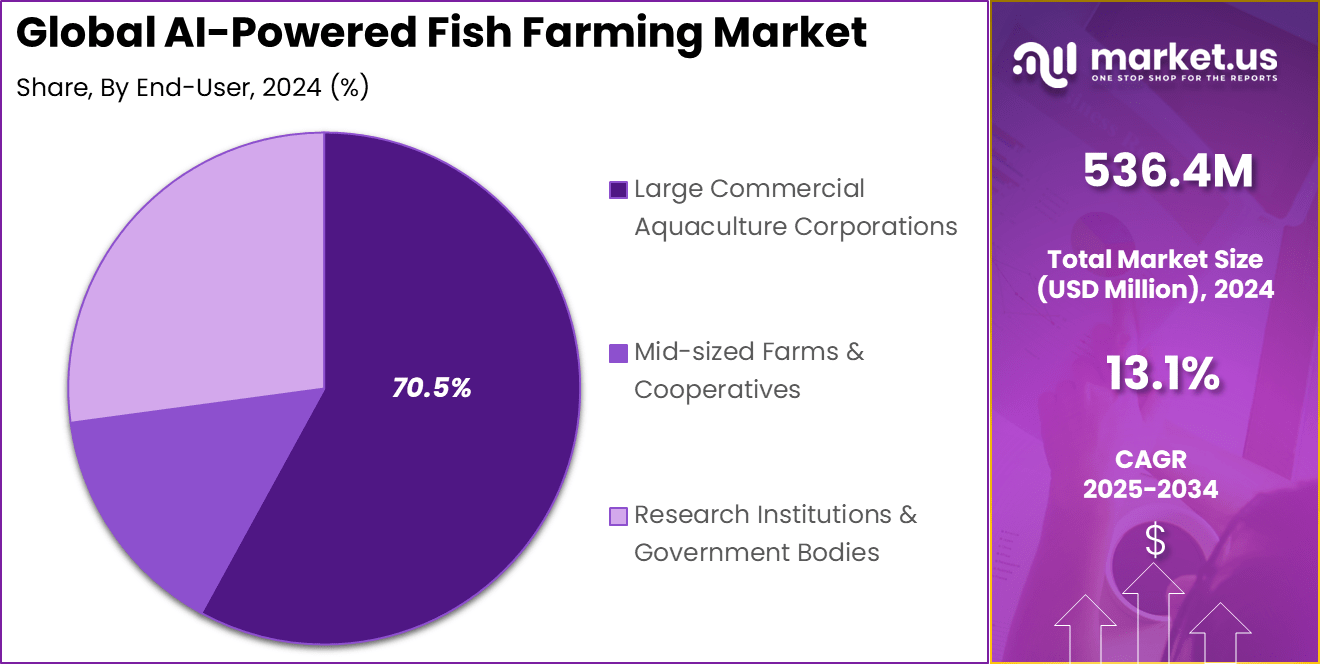

- In 2024, the large commercial aquaculture corporations segment held a decisive 70.5% share, establishing the highest contribution to the Global AI Powered Fish Farming Market.

- Germany’s AI Powered Fish Farming Market recorded a valuation of USD 28.9 Million in 2024, supported by a steady 9.4% CAGR.

- In 2024, Europe continued to dominate the Global AI Powered Fish Farming Market with a share of 40.3%, reflecting strong regional adoption and technological integration.

Role of Generative AI

Generative AI is changing how fish farmers keep track of fish health and predict diseases. It creates synthetic images and scenarios of fish under different conditions, which help train detection models even when real-world data is limited. This improves early spotting of sickness and fish growth estimates without disturbing them, leading to less loss and better care.

AI also pulls together data from sensors to give a clear picture of fish well-being and water quality, helping farmers act quickly to keep fish healthy. Another important role of generative AI is in automating feeding and general farm management. By analyzing water quality, fish movement, and other sensor inputs, these AI systems can suggest the best feeding times and amounts.

This reduces wasted feed and lowers costs while helping fish grow faster. The technology also supports virtual models of farms where farmers can test changes before actual implementation. This helps improve survival rates and efficiency without trial and error on real fish.

Europe Market Size

In 2024, Europe held a dominant market position in the Global AI-Powered Fish Farming Market, capturing more than a 40.3% share, holding USD 216.1 million in revenue. This dominance is driven by stringent environmental regulations, which push for sustainable and traceable aquaculture practices. The region’s strong focus on innovation, including AI, IoT, and automated feeding technologies, supports improved productivity and environmental stewardship in fish farming.

Furthermore, Europe’s established aquaculture infrastructure, government subsidies for sustainable protein production, and rising consumer demand for responsibly farmed seafood all contribute to market growth. Partnerships between technology firms and aquaculture operators help retrofit existing farms with smart systems, ensuring a competitive and scalable industry leadership in AI-powered aquaculture.

For instance, in September 2025, Cermaq Group AS advanced its sustainable aquaculture efforts by progressing construction on its flagship Chacao Canal Fish Farm in Chile, poised to become one of the largest and most modern salmon farms globally. The project incorporates advanced recirculating aquaculture systems expected to launch by early 2026, illustrating Cermaq’s leadership in AI-powered fish farming with a focus on innovation and sustainability.

Germany Market Outlook

The market for AI-Powered Fish Farming within Germany is growing tremendously and is currently valued at USD 28.9 million, the market has a projected CAGR of 9.4%. This growth is driven by increasing demand for sustainable aquaculture practices paired with advancements in technology like AI, IoT, and recirculating aquaculture systems (RAS).

German fish farms, especially in freshwater species like trout and carp, are adopting AI to optimize feeding, monitor fish health, and improve water quality management. Strong consumer demand for locally sourced, responsibly farmed fish also supports expansion. Additionally, government initiatives and private investments encouraging innovation in feed solutions, automated monitoring, and eco-friendly systems boost market momentum.

For instance, in January 2025, NeuroSYS Sp. z o. o. developed an AI-powered shrimp monitoring system utilizing computer vision to enable real-time welfare and growth assessments. Their AI solutions support sustainable aquaculture by ensuring optimal health and productivity of farmed shrimp, showcasing European innovation in aquaculture AI.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 51.3% share of the Global AI-Powered Fish Farming Market. These hardware solutions primarily include sensors, automated feeders, cameras, and IoT devices that collect data essential for analysis and decision-making.

The steady emphasis on modular, interoperable hardware helps fish farms update systems and enhance operations without overhauling their setups completely. This segment benefits from technological advances such as sensor networks and edge computing, which improve monitoring accuracy and operational efficiency.

Hardware investments focus heavily on robust, scalable devices that endure the challenging aquatic environments, while also enabling integration with software platforms for analytics and farm management. This blend of durable, adaptable hardware and AI-driven software supports optimized feeding, environmental monitoring, and fish health management, especially in larger commercial fish farms that rely on consistent and efficient resource use.

For Instance, In September 2025, Aquabyte introduced AI-powered feeding and decision support tools that use real-time weight, welfare, and behavior data collected through AI-enabled submersible cameras. These smart cameras capture more than 1 million fish images each day, allowing accurate biomass estimation and continuous welfare monitoring. The combined use of advanced hardware and AI enables fish farmers to manage feeding more efficiently while reducing handling stress on fish.

Application Analysis

In 2024, the Feeding Management segment held a dominant market position, capturing a 34.2% share of the Global AI-Powered Fish Farming Market. AI systems enhance feeding precision by using data from sensors and cameras to monitor fish behavior and hunger, allowing automated feeders to dispense the right quantity of feed at the right time. This reduces feed waste, a major cost driver, and minimizes environmental impact from excess nutrients in the water.

Effective feeding management also promotes better fish growth and health, improving overall yield quality. AI-driven feeding solutions, especially accessible for both large and smaller farms, help farmers optimize feed schedules and quantities, contributing to more sustainable and economically viable aquaculture operations.

For instance, in October 2025, ReelData AI secured $8 million in funding to advance its AI feeding optimization software, which automates feed delivery and biomass estimation for land-based aquaculture, helping reduce waste and improve feeding schedules. Their platform uses AI analytics to enhance feed efficiency and fish health outcomes.

Farm Type Analysis

In 2024, the Offshore & Inshore Cages segment held a dominant market position, capturing a 45.8% share of the Global AI-Powered Fish Farming Market. These cages benefit significantly from AI technologies that provide real-time monitoring of water quality, fish behavior, feeding, and environmental conditions through underwater sensors and machine vision.

Automated systems support remote management, reduce labor intensity, and enhance biosecurity by detecting early signs of disease or stress. This cage-based farming type is favored for its scalability and suitability for high-density stock in natural water bodies, which AI solutions help manage more effectively.

For Instance, in October 2025, Aquabyte’s technology automatically counts sea lice in offshore cages, enabling proactive pest management through AI-driven image analysis. This supports scalable cage farming with continuous environmental and fish behavior monitoring for disease prevention.

End-User Analysis

In 2024, The Large Commercial Aquaculture Corporations segment held a dominant market position, capturing a 70.5% share of the Global AI-Powered Fish Farming Market. This dominance is due to their capacity to invest in advanced AI technologies and integrate them at scale. These corporations focus on improving operational efficiency, feed conversion ratio, compliance with environmental regulations, and scalability.

AI-powered solutions provide them with valuable analytics for better decision-making, risk mitigation, and sustainability reporting. The adoption of AI in large operations supports sophisticated farm management platforms that combine feeding automation, water quality control, fish health monitoring, and supply chain traceability. This integration helps maintain consistent production standards and reduces wastage, supporting both profitability and environmental responsibility.

For Instance, in August 2024, Cermaq Group AS partnered with ReelData to deploy AI technology in its freshwater sites, enhancing feed delivery and biomass monitoring through the ReelAppetite system. This collaboration targets improving feed conversion rates and water quality control in large-scale commercial operations.

Investment and Business Benefits

Investment in AI-powered fish farming spans hardware like sensors and cameras, software platforms for data analytics, and autonomous feeding and monitoring systems. Opportunities exist in developing advanced AI algorithms for biomass estimation, disease prediction, and environmental impact control. Public and private funding increasingly target startups and scale-ups innovating in sustainable aquaculture solutions.

AI integration leads to higher operational efficiency with faster growth rates and better survival outcomes. Feed cost reductions and lower disease incidents improve profit margins. Data-driven decisions minimize environmental damage through optimized feeding and pollution management. Automation cuts labor expenses while increasing farm scalability. Overall, AI-powered fish farming offers stronger commercial resilience and sustainability.

Emerging trends

One clear trend is the growing use of AI paired with sensors and cameras underwater. This combination allows constant monitoring of fish and their environment so farmers get real-time updates. Many fish farms are using these smart systems to better understand feeding needs and detect diseases early. There is also an increase in using drones to oversee large fish farming areas from above, gathering data that AI analyzes to improve farm layouts and fish care.

Another trend is the use of predictive analytics driven by AI to plan harvesting and stocks better. Farms now rely on models that forecast fish growth and environmental changes to improve decision-making. Digital twins or virtual copies of farms are becoming more common, allowing farmers to simulate different scenarios without risking real fish. These trends focus on making fish farming more data-driven and efficient, with many farms reporting notable improvements in feed use and fish health.

Growth Factors

Rising demand for seafood worldwide encourages fish farmers to use smarter methods like AI to boost productivity while reducing environmental harm. AI helps better match feeding amounts to fish needs, cutting feed waste by 10-20% and enhancing growth rates. These gains help farmers make more money and reduce water pollution caused by excess feed and fish waste.

Another growth driver is the increasing focus on sustainability and reducing the carbon footprint of fish farms. AI enables ongoing water quality checks and quick detection of fish diseases, allowing preventive measures without heavy use of chemicals or antibiotics. Farms using AI have reported lower fish deaths and better overall environmental conditions. This growing need to balance production with eco-friendly practices pushes wider use of AI tools in fish farming.

Key Market Segments

By Component

- Hardware

- Underwater cameras & drones (ROVs)

- Water quality sensors

- Feeding systems

- Bioacoustic sensors

- Others

- Software

- Data Analytics Dashboards

- Predictive Modeling Software

- Computer Vision Analysis Tools

- Farm Management Suites

- Others

- Services

- Integration & Deployment Services

- Managed Services & Support

By Application

- Feeding Management

- Monitoring, Tracking, and Behavior Analysis

- Water Quality Management & Prediction

- Disease Detection & Prevention

- Harvesting Optimization & Sorting

- Others

By Farm Type

- Offshore & Inshore Cages

- Recirculating Aquaculture Systems (RAS)

- Ponds & Open Inland Fisheries

By End-User

- Large Commercial Aquaculture Corporations

- Mid-sized Farms & Cooperatives

- Research Institutions & Government Bodies

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Enhanced Operational Efficiency

AI-powered fish farming boosts operational efficiency by enabling precise control over feeding, health monitoring, and environmental conditions. Real-time data collected through sensors and computer vision helps farmers optimize feed usage, reducing waste and lowering costs. This precise monitoring also allows for early disease detection, cutting losses and improving overall yield consistency.

With AI integration, automation of routine tasks such as feeding and water quality checks becomes possible, reducing reliance on manual labor and enabling farms to scale more easily. These improvements help fish farms become more productive and cost-effective, making AI adoption a key growth driver in the sector.

For instance, in September 2025, Aquabyte launched new AI-powered tools named FEEDING and DECISION SUPPORT during Aqua Nor 2025. These tools help fish farmers by combining data on fish weight, welfare, behavior, and feeding into a single platform that simplifies decision-making. This innovation enhances operational efficiency by allowing more precise fish welfare monitoring and feeding guidance, reducing fish stress, and improving farm productivity.

Restraint

High Initial Investment and Technical Skills Gap

One significant barrier to wider AI-powered fish farming adoption is the high upfront cost of advanced AI systems, sensors, and IoT infrastructure. Many smaller and medium-sized farms struggle with budget constraints, making it challenging to invest in the necessary technology platforms.

Additionally, fish farmers often face a shortage of technical expertise required to implement and maintain AI solutions. Lack of skilled personnel to operate complex systems and analyze data limits the technology’s effective use. These factors together restrain market growth, especially in less developed regions.

For instance, in August 2023, NeuroSYS highlighted challenges in implementing AI due to technical skill gaps and the complexity of managing sophisticated AI systems in aquaculture. Despite AI’s benefits in disease detection and production optimization, smaller fish farms struggle with costly technology and a lack of trained staff to fully leverage the solutions, limiting broader adoption.

Opportunities

Growing Demand for Sustainable and Efficient Aquaculture

AI-powered technologies offer tremendous opportunities by enabling sustainable fish farming practices that meet increasing global seafood demand. By optimizing feed use and improving health management, AI helps minimize environmental impacts, reduce waste, and ensure compliance with stricter regulations on aquaculture sustainability.

Markets in Asia-Pacific, Latin America, and Europe show increasing adoption due to government incentives and rising consumer preference for eco-friendly seafood products. The convergence of AI with IoT and robotics opens new avenues for precision farming, boosting yield quality while promoting resource efficiency.

For instance, in August 2025, ReelData AI completed an $8 million Series A funding round to develop AI-driven autonomous operating systems for land-based aquaculture. This funding enables enhancements in scalability, operational efficiency, and sustainability, addressing growing demand for sustainable seafood production. ReelData’s technology directly tackles feed optimization and biomass monitoring, opening opportunities in both climate-resilient aquaculture and expanding global markets.

Challenges

Regulatory Complexity and Infrastructure Limitations

Navigating complex regulatory frameworks remains a major challenge for AI fish farming. Diverse rules across regions regarding aquaculture operations, data privacy, and technology use complicate market entry and scale-up efforts for technology providers and fish farmers alike.

Infrastructure limitations, especially in rural or remote fish farming areas, also hinder deployment. Limited connectivity and power supply issues restrict real-time data processing and remote management capabilities of AI systems. Overcoming these challenges requires coordinated policy efforts and investments in supporting infrastructure.

For instance, In July 2025, Cermaq Group AS completed a major acquisition to expand salmon farming in Canada and Norway. The move highlights ongoing challenges such as meeting different regulatory requirements and integrating operations across multiple regions, which continue to create hurdles for companies adopting advanced technologies and scaling in global fish farming markets.

Key Players Analysis

Aquabyte, Aquaconnect, and Bioplan lead the AI-powered fish farming market with advanced analytics platforms designed for stock monitoring, growth prediction, and automated feeding optimization. Their systems use computer vision, biomass estimation, and real-time environmental tracking to improve farm productivity. These companies help operators reduce feed waste, increase yield consistency, and improve overall fish health.

Cermaq Group, Deep Vision, GoSmart Farming, NeuroSYS, ReelData, SEAWATER Cubes, and Skretting strengthen the competitive landscape with specialized AI tools for behavior analysis, disease detection, and water-quality management. Their solutions support hatcheries and offshore farms with data-driven decision-making.

TidalX AI, xpertSea, and other participants expand the market with accessible, scalable AI solutions for small and mid-sized fish farms. Their tools offer mobile-friendly monitoring, automated counting, and yield forecasting. These companies prioritize ease of integration, lower operating costs, and actionable insights to support day-to-day farm management.

Top Key Players in the Market

- Aquabyte

- Aquaconnect

- Bioplan

- Cermaq Group AS

- Deep Vision AS

- GoSmart Farming

- NeuroSYS Sp. z o. o.

- ReelData

- SEAWATER Cubes GmbH

- Skretting by Nutreco N.V.

- TidalX AI Inc.

- xpertSea

- Others

Recent Developments

- In September 2025, Aquabyte continues expanding its global leadership with AI-driven fish farming tools. Their platform provides farmers with detailed data for biomass, growth estimation, welfare monitoring, and behavior analysis, using over a million images daily for accurate decision support. This helps farmers improve feed efficiency and fish health, reducing physical handling stress on fish.

- In August 2024, Cermaq is actively testing ReelData’s AI technology at two freshwater land-based salmon farms in Canada. The partnership focuses on optimizing feed delivery and improving water quality using ReelData’s AI-powered biomass camera and appetite monitoring system. This trial aims to refine production accuracy and sustainability in Cermaq’s operations.

Report Scope

Report Features Description Market Value (2024) USD 536.4 Bn Forecast Revenue (2034) USD 1,837 Bn CAGR(2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application (Feeding Management, Monitoring, Tracking, and Behavior Analysis, Water Quality Management & Prediction, Disease Detection & Prevention, Harvesting Optimization & Sorting, Others), By Farm Type (Offshore & Inshore Cages, Recirculating Aquaculture Systems (RAS), Ponds & Open Inland Fisheries), By End-User (Large Commercial Aquaculture Corporations, Mid-sized Farms & Cooperatives, Research Institutions & Government Bodies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aquabyte, Aquaconnect, Bioplan, Cermaq Group AS, Deep Vision AS, GoSmart Farming, NeuroSYS Sp. z o. o., ReelData, SEAWATER Cubes GmbH, Skretting by Nutreco N.V., TidalX AI Inc., xpertSea, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Fish Farming MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Fish Farming MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aquabyte

- Aquaconnect

- Bioplan

- Cermaq Group AS

- Deep Vision AS

- GoSmart Farming

- NeuroSYS Sp. z o. o.

- ReelData

- SEAWATER Cubes GmbH

- Skretting by Nutreco N.V.

- TidalX AI Inc.

- xpertSea

- Others