Global AI-powered Edge Networking Market Size, Share Analysis Report By Offering (Hardware, Software (Network Management Software, Network Security Software, Software-defined Networking, Services)), By Deployment (Cloud-based, On-Premise), By Technology (Generative AI, Machine Learning, Deep Learning, Natural Language Processing (NLP), Others), By Network Function (Network Optimization, Network Cybersecurity, Network Predictive Maintenance, Network Troubleshooting, Others), By End-Use Industry (Telecom Service Providers, Enterprises, Data Centers, Government, Other End-use industry), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139823

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

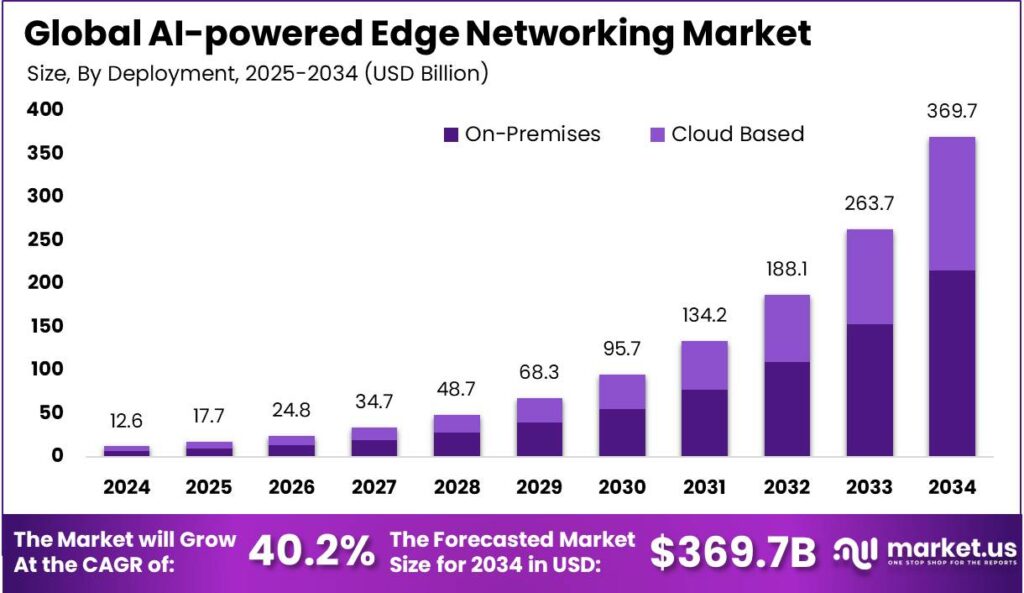

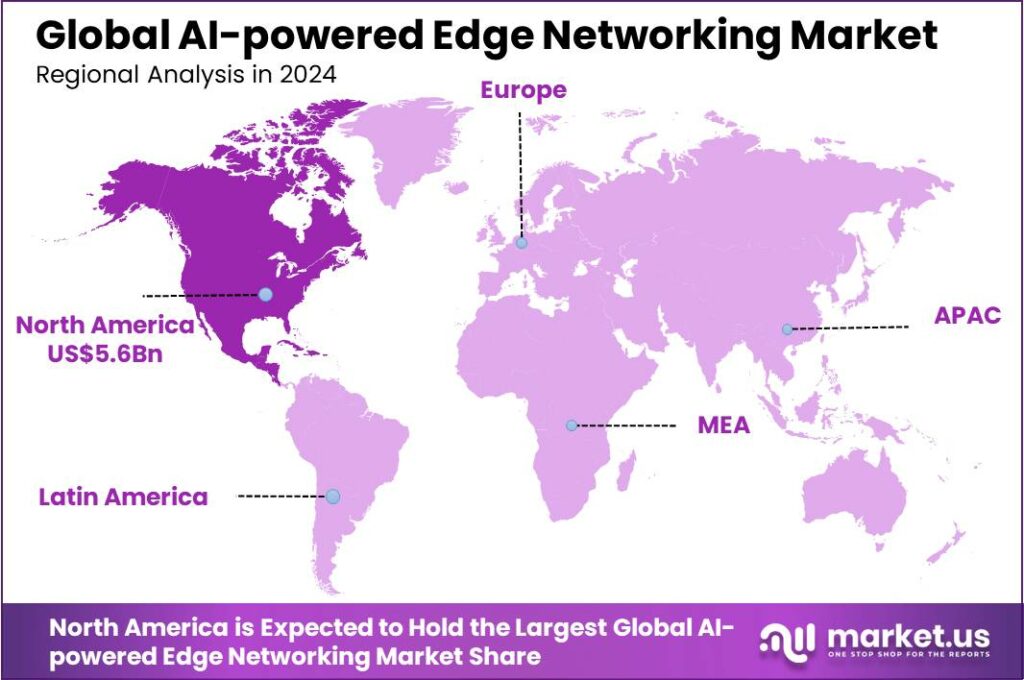

The Global AI-powered Edge Networking Market size is expected to be worth around USD 369.7 Billion By 2034, from USD 12.6 Billion in 2024, growing at a CAGR of 40.20% during the forecast period from 2025 to 2034. In 2024, North America dominated the AI-powered edge networking market with over 44.7% share, generating around $5.6 billion in revenue.

AI-powered Edge Networking Market has seen significant growth in recent years, driven by the increasing need for low-latency, high-speed data processing, and real-time decision-making. The market is expanding as industries such as manufacturing, healthcare, automotive, and smart cities implement AI and edge technologies to enhance operational efficiency.

The rise of AI-powered edge networking is fueled by several key factors. The proliferation of IoT devices has created a surge in data generation that requires localized processing to ensure efficiency and reduce latency. The rollout of 5G networks has further accelerated adoption by enabling faster data transmission, which is essential for edge-based applications.

According to the research conducted by Market.us, The global edge computing market is projected to reach USD 206 billion by 2032, up from USD 55 billion in 2024, reflecting a robust CAGR of 18.3% from 2023 to 2032. This growth is driven by the increasing demand for low-latency processing and decentralized data management.

Additionally, the mobile edge computing market is expected to expand significantly, with a projected market size of USD 12,534.7 million by 2033, growing at an impressive CAGR of 30.5% from 2024 to 2033. This growth is fueled by the rise in mobile data traffic and the need for real-time processing at the network edge.

Key Takeaways

- The Global AI-powered Edge Networking Market size is expected to reach USD 369.7 Billion by 2034, growing from USD 12.6 Billion in 2024, at a CAGR of 40.20% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment held a dominant market position, capturing more than 43.6% of the share in the AI-powered edge networking market.

- The On-Premise segment held a dominant position in 2024, capturing over 58.4% of the market share in the AI-powered edge networking sector.

- In 2024, the Generative AI segment held a leading market position, capturing more than 38.7% of the AI-powered edge networking market share.

- The Network Optimization segment also held a dominant position in 2024, accounting for more than 25.6% of the market share.

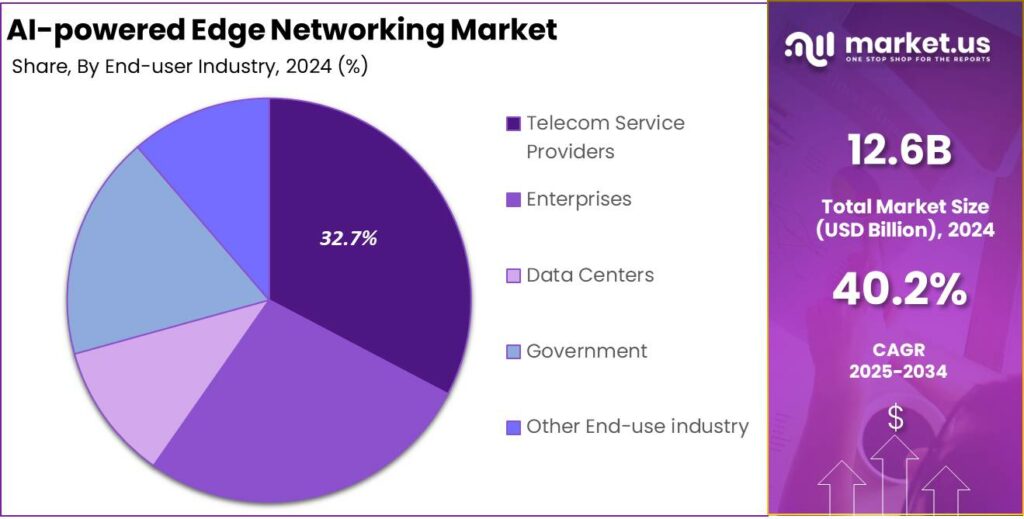

- The Telecom Service Providers segment captured over 32.7% of the market share in the AI-powered edge networking market in 2024.

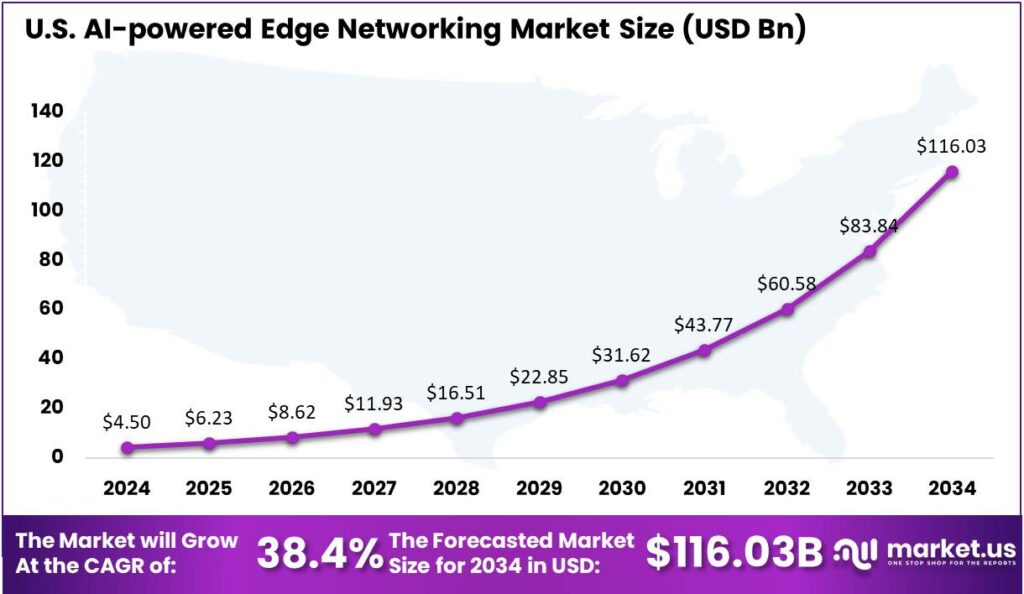

- In 2024, the U.S. market for AI-powered edge networking was valued at $4.50 billion, and it is experiencing rapid growth with a CAGR of 38.4%.

- In 2024, North America held a dominant market position in the AI-powered edge networking sector, capturing more than 44.7% of the market share and generating around $5.6 billion in revenue.

U.S. Market Growth Analysis

In 2024, the U.S. market for AI-powered edge networking was valued at $4.50 billion. This sector is experiencing rapid growth, with a compound annual growth rate (CAGR) of 38.4%. This impressive growth rate highlights the increasing reliance on edge computing technologies that integrate artificial intelligence to handle data processing closer to the source of data generation.

The growth of the AI-powered edge networking market is fueled by the rising need for faster processing and lower latency in network communications. With the increasing interconnection of devices in the Internet of Things (IoT) era, there’s a growing demand for advanced networking solutions that can handle large data volumes at the network edge, minimizing reliance on centralized servers.

The adoption of AI in edge networking enhances data management and security, essential for handling increased data traffic and IoT vulnerabilities. Companies are heavily investing in robust edge AI solutions to capitalize on data generated at the edge, boosting operational efficiency and creating new market opportunities.

In 2024, North America held a dominant market position in the AI-powered edge networking sector, capturing more than a 44.7% share. This region generated significant revenue, amounting to approximately $5.6 billion.

The concentration of major tech firms in the U.S. and Canada has been pivotal, with these companies investing heavily in R&D and quickly adopting new technologies, fueling demand for AI-powered edge networking solutions. This is further supported by the region’s strong infrastructure, which enables advanced networking and data processing needed for edge computing.

Furthermore, North America benefits from a strong regulatory framework and government initiatives that encourage innovation in the tech sector. Initiatives aimed at enhancing digital infrastructure, coupled with favorable policies around data privacy and security, have fostered a conducive environment for the growth of AI technologies at the network edge.

The widespread adoption of IoT devices in industries like automotive, healthcare, and manufacturing in North America drives the demand for advanced edge networking solutions. The need for real-time data processing and analytics makes North America a key market for AI-powered edge networking technologies.

Offering Analysis

In 2024, the Hardware segment held a dominant market position in the AI-powered edge networking market, capturing more than a 43.6% share. This segment primarily includes devices and equipment like routers, switches, servers, and edge devices that are essential for establishing and maintaining the infrastructure needed for edge computing.

The prominence of the Hardware segment can be attributed to the foundational role these components play in deploying edge networks. As businesses increasingly adopt IoT devices and integrate AI into their operations, the demand for robust hardware that can process and analyze data locally has surged, driving substantial investments into this segment.

The Software segment, although significant, follows the Hardware in market share. This includes network management software, network security software, and software-defined networking. These software solutions are crucial for optimizing the performance and security of edge networks.

The Hardware segment holds a larger share due to the significant investments required for the initial setup and ongoing maintenance of physical infrastructure. As infrastructure matures, the focus is expected to shift towards software solutions that improve functionality and efficiency.

Deployment Analysis

In 2024, the On-Premise segment held a dominant position in the AI-powered edge networking market, capturing more than a 58.4% share. This substantial market presence is attributed to several key factors that favor on-premise solutions over cloud-based alternatives.

Organizations opt for on-premise deployments to maintain tighter control over their critical data and network operations. The direct oversight of infrastructure allows businesses to enforce robust security measures, comply with stringent data protection regulations, and ensure that sensitive information remains within the physical confines of the company.

On-premise deployment in AI-powered edge networking is popular for its lower latency compared to cloud-based solutions. Industries like manufacturing, finance, and healthcare, where even a millisecond’s delay can have major consequences, benefit from the speed and immediacy that on-premise edge computing offers.

Moreover, the on-premise segment leads due to its advantage in customization and scalability according to specific organizational needs. Companies can tailor their edge computing infrastructure to fit precise operational requirements and scale up as necessary without the complexities and potential security concerns of involving third-party cloud providers.

Technology Analysis

In 2024, the Generative AI segment held a dominant market position in the AI-powered edge networking sector, capturing more than a 38.7% share. This segment thrives due to its ability to generate content and solutions from edge data, improving real-time data processing and decision-making efficiency.

Generative AI enables dynamic, adaptable network solutions by autonomously predicting and resolving anomalies, optimizing data flow in real-time. This is vital in sectors like remote monitoring and autonomous vehicles, where edge devices must operate independently.

The integration of Generative AI into edge networking strengthens security by predicting and neutralizing potential threats before they reach the core network. This preemptive measure is crucial in an era of widespread IoT devices, which has expanded the attack surface.

The rise of Generative AI in edge networking is driven by its ability to support seamless human-machine interactions, enhancing natural language processing for quicker, more intuitive responses. Ongoing advancements are expected to boost adoption and innovation, solidifying its leadership in the AI-powered edge networking market.

Network Function Analysis

In 2024, the Network Optimization segment held a dominant market position in the AI-powered edge networking market, capturing more than a 25.6% share. This leadership is primarily driven by the escalating demand for efficient data traffic management and reduced latency across various industries, which is critical for the performance of modern networks.

Network optimization technologies leverage AI to predict and analyze data flow, enabling real-time adjustments that improve efficiency and reliability. This is especially important in high-demand environments like streaming services, cloud computing, and large-scale IoT deployments, where optimal data routing and load balancing are essential.

Additionally, as networks grow in complexity, the ability of AI-powered Network Optimization to automatically detect and resolve inefficiencies without human intervention becomes increasingly important. This autonomous handling helps prevent bottlenecks and downtime, ensuring smoother operations and improved user experiences.

Network optimization offers economic benefits, including cost savings from reduced bandwidth usage and extended network lifespan. These financial advantages attract businesses seeking to maximize technology investments, ensuring the continued dominance of this segment in the AI-powered edge networking market.

End-Use Industry Analysis

In 2024, the Telecom Service Providers segment held a dominant position in the AI-powered edge networking market, capturing more than a 32.7% share. This segment’s leadership is primarily attributed to the growing demand for enhanced network management and real-time data processing capabilities among telecom operators.

As data traffic grows with more connected devices and 5G expansion, telecom providers are adopting AI-powered edge networking solutions. These solutions help manage network traffic, optimize bandwidth, and improve customer experience by reducing latency and enhancing connectivity.

Enterprises, forming another significant segment, leverage AI-powered edge networking to streamline operations and secure critical data across multiple locations. This segment benefits from edge networking by facilitating faster data processing and decision-making at the local level, reducing the need for data transmission to centralized cloud infrastructures.

The Data Centers segment leverages AI-powered edge networking to manage growing data demands, reducing latency and speeding up data analytics. This enhances real-time applications like IoT data processing and user authentication, enabling quicker insights and more responsive IT operations.

Key Market Segments

By Offering

- Hardware

- Software

- Network Management Software

- Network Security Software

- Software-defined Networking

- Services

By Deployment

- Cloud-based

- On-Premise

By Technology

- Generative AI

- Machine Learning

- Deep Learning

- Natural Language Processing (NLP)

- Others

By Network Function

- Network Optimization

- Network Cybersecurity

- Network Predictive Maintenance

- Network Troubleshooting

- Others

By End-Use Industry

- Telecom Service Providers

- Enterprises

- Data Centers

- Government

- Other End-use industry

Driver

Rising Demand for Real-Time Data Processing

In today’s fast-paced world, industries like healthcare, manufacturing, and autonomous vehicles require immediate data analysis. AI-powered edge networking brings computation closer to data sources, reducing delays and enhancing responsiveness.

In addition to the benefits of faster decision-making, edge AI also enhances data privacy and security. By processing sensitive information locally, it minimizes the need to transmit data over potentially vulnerable networks to central servers. This reduces the risk of data breaches and ensures that personal or confidential data remains protected, which is particularly important in applications like healthcare, finance, and smart cities.

Restraint

Security Concerns at the Edge

Deploying AI at the edge introduces significant security challenges. Decentralized data processing and storage expose devices to various risks, sometimes more severe than those in centralized cloud systems. Edge devices are vulnerable to physical tampering and cyberattacks, leading to potential data breaches.

Another critical point is the need for regular maintenance and software updates for edge devices. In remote industrial setups, where manual intervention can be limited, outdated or unpatched devices may become vulnerable to security threats. Ensuring that edge devices are regularly updated with the latest security patches and software improvements is crucial in preventing cyber-attacks and maintaining operational integrity.

Opportunity

Growth of Smart City Initiatives

The global push towards smart cities presents a significant opportunity for AI-powered edge networking. Integrating advanced technologies like AI into urban infrastructure enhances services such as traffic management, energy distribution, and public safety.

Edge AI enables real-time data analysis from numerous sensors and devices deployed across cities, leading to efficient resource utilization and improved citizen services. For instance, smart traffic lights can adjust in real-time based on traffic flow data processed locally, reducing congestion and emissions. As urban areas continue to adopt smart technologies, the demand for edge AI solutions is expected to rise.

Challenge

Balancing Performance and Resource Constraints

Implementing AI models at the edge involves balancing performance with limited computational resources. Edge devices often have constrained processing power, memory, and energy capacity, making it challenging to run complex AI algorithms.

Techniques like model quantization and pruning can reduce resource demands but may affect accuracy. Finding the right balance between model efficiency and performance is crucial. For example, deploying a speech recognition model on a smartphone requires optimization to ensure quick responses without draining the battery. Addressing these constraints is vital for the effective deployment of AI at the edge.

Emerging Trends

AI on the edge allows for faster decision-making by processing data in real time, reducing latency. This is critical for applications such as autonomous vehicles, industrial IoT, and smart cities, where delays could result in significant issues.

The rollout of 5G networks has enabled faster communication speeds and lower latency, which is crucial for AI-driven edge networking. With 5G, real-time data processing at the edge becomes even more feasible, enabling critical applications such as remote surgery or real-time video analytics.

Real-time video processing at the edge enables AI-powered surveillance systems to analyze video feeds for object recognition, face detection, and behavior analysis without relying on cloud servers. This is increasingly being used in smart cities and retail environments.

Business Benefits

- Faster Response Times: By processing data close to its source, decisions are made swiftly, enhancing efficiency.

- Enhanced Data Privacy: Keeping data on local devices reduces the risk of breaches, ensuring sensitive information remains secure.

- Reduced Bandwidth Use: Handling data locally means less need to send large amounts of information to distant servers, saving on transmission costs.

- Improved Reliability: Local processing allows devices to function independently, even if there’s no internet connection, ensuring continuous operation.

- Cost Savings: By minimizing data transfers and relying less on centralized cloud services, businesses can lower operational expenses.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The key players in AI-powered Edge Networking Market are leveraging AI to enhance decision-making, automate processes, and enable real-time analytics closer to the end-user.

NVIDIA Corporation is a dominant player in AI-powered edge networking, primarily known for its powerful graphics processing units (GPUs). The company’s GPUs are designed to handle the computational needs of AI workloads, making them ideal for edge computing. NVIDIA’s solutions are widely adopted in various industries, including automotive, healthcare, and smart cities.

Cisco Systems, Inc. has long been a leader in networking technologies and has been actively integrating AI into its edge networking solutions. Cisco’s AI-driven edge solutions offer businesses smarter network management, enhanced security, and improved performance. Their network devices and software are equipped with AI capabilities that can predict network issues, automate tasks, and optimize traffic.

Telefonaktiebolaget LM Ericsson is a key player in the telecom industry and is rapidly expanding its presence in AI-powered edge networking. Ericsson focuses on providing telecom operators with solutions that enable them to deploy AI-driven edge networks. Their innovations in 5G and edge computing are setting the stage for faster, more efficient delivery of AI services to end-users.

Top Key Players in the Market

- NVIDIA Corporation

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Hewlett Packard Enterprise Development LP

- Arista Networks, Inc.

- Juniper Networks, Inc.

- Ciena Corporation

- Extreme Networks

- Fujitsu

- Huawei Technologies Co., Ltd.

- Nokia

- Others

Top Opportunities Awaiting for Players

The AI-powered edge networking market is poised for significant expansion with opportunities present in this rapidly evolving sector.

- AI-Powered Network Operations (AIOps): With the integration of AI into network operations becoming standard practice, there’s a substantial opportunity for AI to enhance network monitoring, predictive maintenance, and automated troubleshooting. This trend necessitates a new skill set for network engineers who need to blend traditional networking knowledge with AI and machine learning concepts.

- Enhanced Security Measures: As the use of edge devices spreads, the importance of securing these devices becomes paramount. Emerging solutions like secure hardware enclaves, encrypted data transmissions, and AI-driven threat detection are vital for protecting sensitive data at the edge. This area offers growth opportunities for technology providers specializing in edge security.

- Edge Computing Integration with 5G Networks: The global rollout of 5G networks enhances the capabilities of edge computing, offering high bandwidth and ultra-low latency. This synergy supports innovative applications in sectors such as manufacturing, healthcare, and entertainment, and fosters opportunities for network solutions that can integrate these technologies effectively.

- Sustainable Edge Solutions: With a growing emphasis on sustainability, there is an increasing need for energy-efficient hardware and optimized resource utilization at the edge. Innovations in cooling systems, energy management, and the integration of renewable energy sources into edge computing infrastructures are creating opportunities for companies that can provide green technology solutions.

- Industry-specific Edge Applications: Edge computing is expanding into vertical-specific applications, providing tailored solutions for industries like healthcare, retail, and manufacturing. This diversification offers a broad spectrum of opportunities for service providers to develop specialized edge solutions that address the unique challenges and needs of different sectors.

Recent Developments

- In October 2024, Cisco Live 2024 showcased AI-driven innovations in networking, security, and observability. They also highlighted solutions like Nexus HyperFabric AI Clusters for simplifying AI networking and the expansion of Digital Experience Assurance capabilities in Cisco ThousandEyes.

- In October 2024, Juniper Networks launched Juniper Secure AI-Native Edge, integrating networking and security management under a unified cloud and AI engine.

- In December 2024, Verizon and NVIDIA have joined forces to supercharge AI workloads on 5G private networks with mobile edge compute. By integrating Verizon’s 5G and private MEC with NVIDIA AI Enterprise software and NIM microservices, they deliver real-time AI solutions for enterprises.

Report Scope

Report Features Description Market Value (2024) USD 12.6 Bn Forecast Revenue (2034) USD 369.7 Bn CAGR (2025-2034) 40.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software (Network Management Software, Network Security Software, Software-defined Networking, Services), By Deployment (Cloud-based, On-Premise), By Technology (Generative AI, Machine Learning, Deep Learning, Natural Language Processing (NLP), Others), By Network Function (Network Optimization, Network Cybersecurity, Network Predictive Maintenance, Network Troubleshooting, Others), By End-Use Industry (Telecom Service Providers, Enterprises, Data Centers, Government, Other End-use industry) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson , Hewlett Packard Enterprise Development LP, Arista Networks, Inc. , Juniper Networks, Inc., Ciena Corporation, Extreme Networks, Fujitsu, Huawei Technologies Co., Ltd., Nokia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-powered Edge Networking MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

AI-powered Edge Networking MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA Corporation

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Hewlett Packard Enterprise Development LP

- Arista Networks, Inc.

- Juniper Networks, Inc.

- Ciena Corporation

- Extreme Networks

- Fujitsu

- Huawei Technologies Co., Ltd.

- Nokia

- Others