Global AI-powered Audio Enhancer Market Size, Share and Analysis Report By Component (Software, Hardware, Services), By Application (Music and Entertainment, Gaming, Podcasting, Broadcasting, Telecommunications, Others), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (Media and Entertainment, Gaming, Telecommunications, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174388

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Performance and Capability Insights

- Leading AI Audio Enhancement Tools

- U.S. Market Size

- Component Analysis

- Application Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- End-User Analysis

- Key Market Segments

- Key Regions and Countries

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

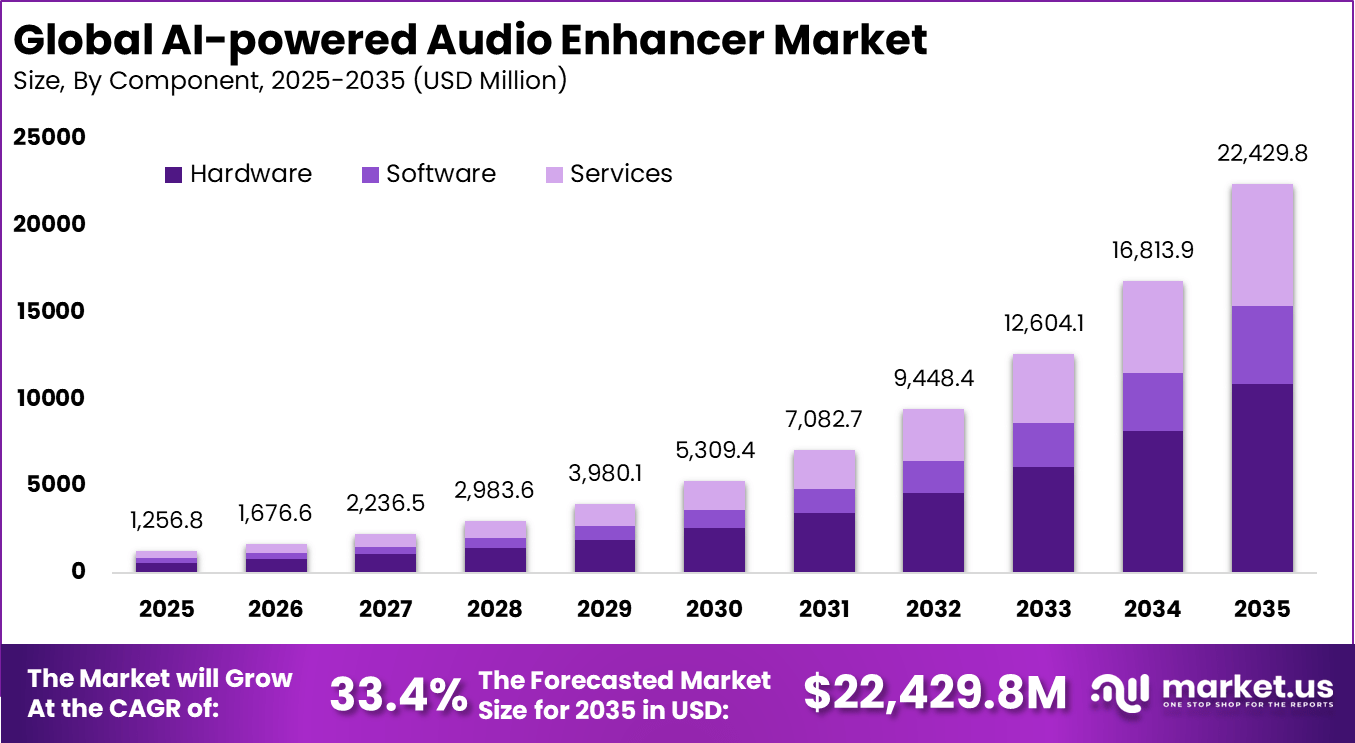

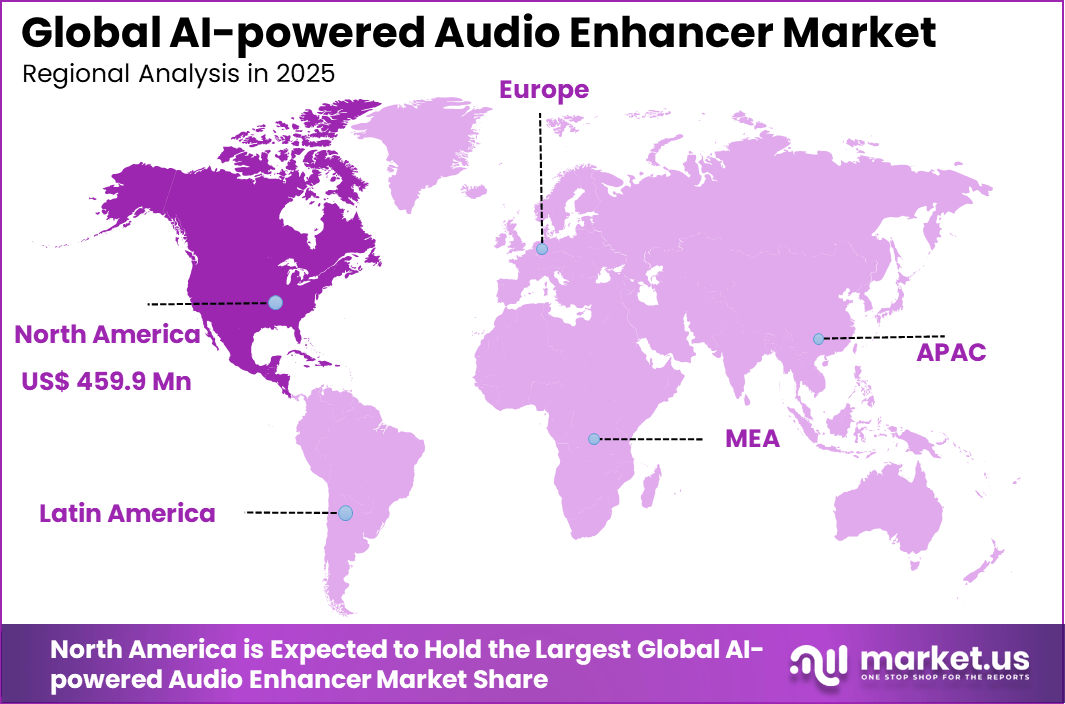

The Global AI-powered Audio Enhancer Market size is expected to be worth around USD 22,429.8 million by 2035, from USD 1,256.8 million in 2025, growing at a CAGR of 33.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 36.6% share, holding USD 459.9 million in revenue.

The AI powered audio enhancer market refers to software and tools that use artificial intelligence to improve audio quality by reducing noise, enhancing clarity, and optimizing sound levels. These solutions are used across media production, streaming, telecommunications, gaming, education, and enterprise communication systems. AI audio enhancers process voice and sound signals in real time or post-production environments.

One major driving factor of the AI powered audio enhancer market is the growth of digital content creation. Podcasts, video streaming, online education, and social media content require clear and professional sound quality. AI audio enhancers help creators improve output without advanced audio engineering skills. This accessibility supports wider adoption.

The market for AI-powered Audio Enhancers is driven by rising demand for clear audio in remote work, content creation, and online entertainment. People need tools to cut noise from calls, podcasts, and videos in everyday noisy settings like homes or streets. Tech advances in machine learning make these fixes fast and natural, pulling in users from gaming to teleconferencing. This push comes with more smart devices and 5G for real-time processing, helping creators and businesses deliver pro sound without hassle.

For instance, in September 2025, Apple Inc. rolled out new Apple Intelligence features, including AI-enhanced Live Translation on AirPods with real-time audio processing and noise cancellation. This advances on-device audio enhancement for calls and FaceTime, maintaining privacy while delivering natural multilingual experiences.

Key Takeaway

- In 2025, the hardware segment led the market with a 48.6% share, showing continued reliance on dedicated audio processing equipment to deliver real time enhancement and low latency performance.

- The music and entertainment segment captured a 38.4% share, reflecting strong demand for high quality sound enhancement across music production, live events, and streaming content.

- On premises deployment remained dominant with a 60.2% share in 2025, indicating that control over audio pipelines, data security, and performance tuning remained critical for professional users.

- Large enterprises accounted for 72.5% of adoption, driven by higher budgets, complex production environments, and sustained investment in advanced audio technologies.

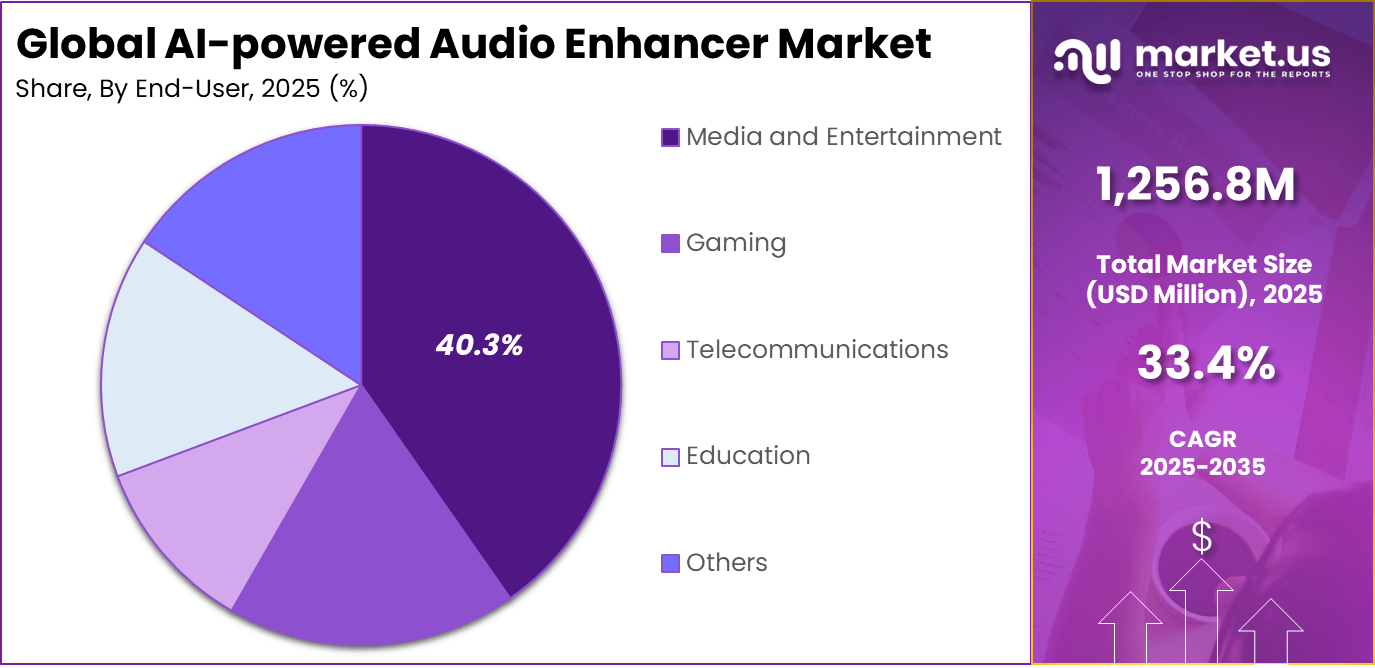

- The broader media and entertainment industry held a 40.3% share, supported by rising content volumes, immersive audio formats, and growing expectations for superior sound quality.

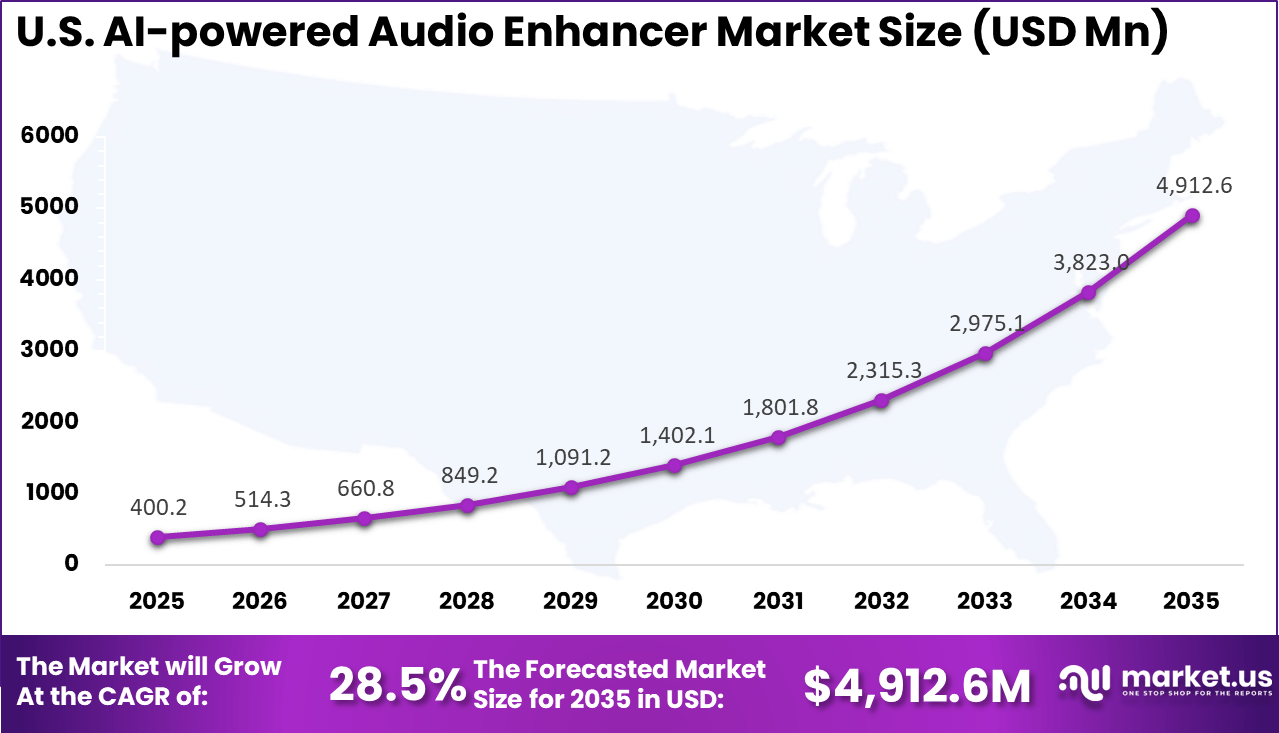

- The U.S. market reached USD 400.2 million in 2025, expanding at a strong 28.5% growth rate, supported by rapid adoption in professional audio production and digital media workflows.

- North America maintained regional leadership with more than 36.6% share in 2025, backed by advanced media infrastructure, early AI adoption, and strong presence of professional audio users.

Performance and Capability Insights

- Accuracy and audio quality improved markedly with AI driven enhancement, as leading models delivered up to 40% fewer detection errors and nearly 48% higher speech clarity compared with traditional digital signal processing approaches. This improvement supported cleaner vocals and reduced background artifacts.

- Real time performance reached professional standards, with modern AI audio enhancers achieving latency levels as low as 10 milliseconds. This made them suitable for live calls, broadcasting, and telecommunications without noticeable delay.

- Training scale and language coverage expanded significantly, as advanced models were trained on thousands of hours of speech data across nearly 100 languages. This broad exposure improved accent handling, noise robustness, and cross language performance.

- Service accessibility increased through flexible usage limits, as some platforms allowed enhancement of up to 4 hours of audio per day with file sizes reaching 1 GB. These tiers supported wide adoption among individual creators and small teams.

Leading AI Audio Enhancement Tools

- Adobe Enhance Speech gained popularity for its one click approach to studio quality voice cleanup, reducing the need for manual audio engineering.

- iZotope RX remained the professional standard for audio restoration, offering advanced tools for noise removal, separation, and complex sound repair.

- Descript combined transcription and audio enhancement, supporting workflows in 23 languages through integrated AI editing features.

- ElevenLabs stood out for highly natural AI voice generation, delivering human like pacing and intonation suitable for narration and media content.

- LALAL.AI specialized in stem separation and echo removal, enabling clean extraction of vocals and instruments from complex audio tracks.

U.S. Market Size

The market for AI-powered Audio Enhancer within the U.S. is growing tremendously and is currently valued at USD 400.2 million, the market has a projected CAGR of 28.5%. This surge comes from rising needs for clear sound in streaming, podcasts, and video calls, where users demand noise-free experiences.

Tech advances in machine learning enable real-time fixes like echo removal and voice boost, making tools faster and smarter. Smart devices and home setups integrate these features, while content creators push for pro-quality from mobiles. Remote work and entertainment fuel adoption as firms seek better communication.

For instance, in October 2025, Adobe launched new Firefly audio tools, including Generate Soundtrack and Generate Speech, powered by its commercially safe AI models for studio-quality soundtracks and crystal-clear voiceovers. This innovation streamlines creative workflows by enabling precise audio generation synced to video footage. Adobe’s advancements solidify U.S. leadership in AI-powered audio enhancement technologies.

In 2025, North America held a dominant market position in the Global AI-powered Audio Enhancer Market, capturing more than a 36.6% share, holding USD 459.9 million in revenue. This lead stems from top tech firms and strong R&D investments that spark fast innovation in machine learning for sound fixes.

High demand hits from streaming, podcasts, and remote work, where clear audio rules. Early uptake in media and smart devices, plus solid infrastructure, speeds rollout. U.S. hubs drive most gains with venture funds and pro adoption across apps.

For instance, in February 2025, NVIDIA enhanced its Broadcast app with upgraded AI noise removal and room echo cancellation, improving audio clarity for streaming and video calls. The technology ensures professional-quality sound by eliminating background interference in real-time. This development reinforces North America’s dominance in AI audio processing solutions.

Component Analysis

In 2025, The Hardware segment held a dominant market position, capturing a 48.6% share of the Global AI-powered Audio Enhancer Market. These components include chips and processors built for tasks like noise cancellation and voice clarity. They process sound right on the device, which works well for live settings and studios. Users like the speed and the lack no need for internet. This setup keeps things reliable when timing counts most.

Reliability draws users to hardware in tough spots like events or recordings. New chip tech makes units smaller yet stronger, handling more data faster. Teams value this for steady output during long sessions. It cuts worries about network glitches. As audio needs grow, hardware stays key for hands-on work. Pros pick it to tweak sounds their way, boosting daily tasks. This keeps the segment strong amid rising demands.

For Instance, in November 2025, NVIDIA pushed forward with Fugatto, its new AI model for audio tasks. This hardware-accelerated tool generates sound effects and music from text prompts. It runs on NVIDIA GPUs, aiding hardware setups in studios for fast processing. Creators use it to tweak voices and build tracks without extra gear.

Application Analysis

In 2025, the Music and Entertainment segment held a dominant market position, capturing a 38.4% share of the Global AI-powered Audio Enhancer Market. Artists and producers clean tracks, lift vocals, and build rich sound for streams and shows. Digital platforms push clear audio to keep listeners hooked. Home creators jump in too, using tools to match studio levels. This area thrives on content boom, where quality sets top work apart. Fans notice sharp sound, driving more use.

Podcasts and videos lean on these enhancers for fast fixes. They turn rough clips into polished ones, saving hours. Growth comes from more people making media daily. Tools help balance mixes and cut flaws quickly. This fits the shift to on-demand listening. As platforms grow, so does the need for pro sound from anyone. Entertainment keeps pulling ahead with easy access tech.

For instance, in October 2025, Adobe launched Generate Soundtrack and Generate Speech at MAX 2025. These Firefly tools create licensed music tracks and clear voice-overs synced to video. They fit music production by extending audio seamlessly. Entertainment creators save time on edits with pro results.

Deployment Mode Analysis

In 2025, The On-Premises segment held a dominant market position, capturing a 60.2% share of the Global AI-powered Audio Enhancer Market. Firms in sensitive fields like media run these locally to dodge cloud risks such as latency or breaches. Servers process audio on site, suiting heavy workflows without internet reliance. Privacy rules make this a must for many operations. It lets teams tweak settings for exact needs, ensuring smooth runs during peaks. This mode fits outfits prioritizing security over flexibility.

Security and performance needs lock in on-premises dominance here. Local setups avoid outages that plague remote work, vital for live broadcasts or edits. Enterprises scale them across rooms without extra fees. Maintenance stays in-house, cutting long-term costs. As data volumes rise, this choice handles loads better than shared systems. Users find it reliable for daily tasks, building trust in consistent output. Growth here ties to rising concerns over shared cloud vulnerabilities in pro audio.

For Instance, in March 2025, Krisp Technologies, Inc. (Microsoft). Krisp joined Microsoft’s AI Hub with on-device noise cancellation. It cleans audio locally on Windows, no cloud needed. Teams run it for clear calls in meetings. Privacy-focused setup aids secure on-premises use across apps.

Enterprise Size Analysis

In 2025, The Large Enterprises segment held a dominant market position, capturing a 72.5% share of the Global AI-powered Audio Enhancer Market. They deploy in broadcasting and production, handling massive audio flows daily. Budgets allow full integration with custom features for complex tasks. Remote teams stay aligned with high standards company-wide. These firms lead adoption because scale demands robust tools that perform under pressure. Investments here pay off in streamlined workflows and better output quality.

Big players gain tailored solutions that evolve with needs. They train systems on internal data for precise results across departments. As work spreads globally, audio consistency matters more, pushing heavy use. Resources fuel R&D tie-ins, keeping them ahead. Staff report time savings from automated fixes, freeing focus for creative work. This segment’s strength comes from its ability to absorb tech fully, driving market reliance on enterprise-level demand and deployment.

For Instance, in December 2025, Google LLC. Google upgraded Gemini 2.5 Flash for native audio in enterprise tools. It handles complex voice tasks accurately at 90% compliance. Large firms use it in AI Studio for smooth workflows. On-device processing suits high-volume ops.

End-User Analysis

In 2025, The Media and Entertainment segment held a dominant market position, capturing a 40.3% share of the Global AI-powered Audio Enhancer Market. Studios refine sound to grip audiences, fixing issues in post-production quickly. Broadcasters ensure live feeds stay clear amid chaos. High content volume needs efficient tools that scale.

Viewers notice sharp audio, boosting retention. This group drives growth through constant output demands in a visual world where sound seals impact. Live streaming and events pull heavily on these tools for instant polish. Creators fix mic glitches or crowd noise on the fly, keeping quality high.

Post-work enhances dubs and effects seamlessly. Push for immersive experiences as VR audio fits perfectly. Teams value speed that matches tight deadlines. End-user strength here stems from a direct link to viewer satisfaction, making enhancers core to modern media pipelines and success.

For Instance, in January 2026, Dolby Laboratories, Inc. teamed with MediaTek for Atmos FlexConnect in soundbars. It pairs bars with wireless speakers for immersive home audio. Media users get cinema-like sound easily. Entertainment expands with flexible setups for shows.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Application

- Music and Entertainment

- Gaming

- Podcasting

- Broadcasting

- Telecommunications

- Others

By Deployment Mode

- On-Premises

- Cloud

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- Media and Entertainment

- Gaming

- Telecommunications

- Education

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growth in the AI-powered audio enhancer market has been propelled by the rising demand for superior audio quality across a wide range of applications including professional media production, virtual communication, music mastering, and content creation.

Recent industry insights identify that advancements in artificial intelligence and machine learning algorithms have significantly improved real-time processing, noise reduction, and speech clarity, meeting the needs of both consumer and professional segments seeking enhanced sound experiences.

The increasing adoption of smart devices and growth in online audio and video content consumption further reinforce demand for solutions capable of delivering high-fidelity audio with minimal effort. These dynamics position AI audio enhancement technologies as essential enablers of quality-centric audio workflows in modern digital environments.

Restraint Analysis

A key restraint affecting the AI-powered audio enhancer market is the complexity and resource intensity of advanced AI models, which can demand substantial computational power and technical expertise for effective deployment. High-end audio processing may require significant processing resources, potentially limiting adoption on lower-end or resource-constrained devices.

Additionally, the market faces challenges associated with inconsistent regulatory frameworks and the need to address potential ethical concerns regarding data use and model bias, particularly where voice and personal audio data are involved. These factors can impede smooth integration and slow adoption in certain segments of the market that require robust performance and compliance assurance.

Opportunity Analysis

Opportunities in the AI-powered audio enhancer market are emerging from integration with immersive technologies and personalised audio experiences. There is an observable trend toward AI-driven spatial audio and adaptive sound profiles that tailor audio output to individual preferences and specific listening environments.

This trend supports expansion into virtual reality, augmented reality, and next-generation entertainment platforms where immersive sound is critical. Moreover, advanced audio restoration and forensic enhancement present new applications beyond conventional use cases, enabling adoption in areas such as archival audio recovery, security analytics, and accessibility tools for assistive technologies.

Challenge Analysis

A central challenge confronting the AI-powered audio enhancer market is maintaining a balance between deep automation and the preservation of natural, authentic sound quality. While sophisticated AI techniques deliver powerful noise suppression and enhancement, there is a risk that over-processing can result in artificial or undesirable audio artefacts that compromise user experience.

Ensuring models produce enhancements that align with listener expectations across diverse audio scenarios remains a complex technical undertaking. Continuous refinement of algorithms and rigorous testing with diverse audio profiles are required to optimise performance without degrading the intrinsic quality of original audio content.

Emerging Trends

Emerging trends within the AI-powered audio enhancer landscape include the rise of personalised and context-aware audio processing that adapts to individual preferences and real-time environmental conditions. AI is increasingly being used to power spatial audio and immersive soundscapes for applications in live entertainment, gaming, and virtual reality. .

Advanced audio restoration and separation algorithms are enabling novel functions such as recovery of degraded recordings and isolation of vocal or instrumental elements. Edge AI adoption is also gaining momentum, enabling high-quality audio enhancement on devices without reliance on continuous cloud connectivity, which enhances privacy and reduces latency.

Growth Factors

Growth in the AI-powered audio enhancer market is catalysed by the burgeoning creator economy and the widespread use of digital audio content across platforms. Creator communities demand accessible tools that can deliver professional-grade sound quality for podcasts, streaming, online tutorials, and entertainment content.

Ongoing advancements in AI and deep learning continue to enhance the accuracy, efficiency, and capabilities of audio enhancement technologies. In addition, the proliferation of connected smart devices with integrated audio capabilities expands the potential user base, enabling broader adoption in consumer electronics, professional audio software, and enterprise communication systems.

Key Players Analysis

One of the leading players in October 2025, Adobe Systems Inc., unveiled groundbreaking AI audio tools at Adobe MAX, including Generate Soundtrack and Generate Speech powered by the commercially safe Firefly Audio Model. These features create royalty-free, studio-quality music tracks and natural voiceovers that sync perfectly with video footage. Creators can fine-tune emotion and pacing for podcasts and videos, making professional audio production accessible without expensive studios.

Top Key Players in the Market

- Adobe Systems Inc.

- NVIDIA Corporation

- Google LLC

- Apple Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- IBM Corporation

- Bose Corporation

- Dolby Laboratories, Inc.

- Sony Corporation

- Sennheiser Electronic GmbH & Co. KG

- Shure Incorporated

- Harman International Industries, Inc.

- Auphonic

- iZotope, Inc.

- Waves Audio Ltd.

- LANDR Audio Inc.

- Accusonus Inc.

- Descript Inc.

- Krisp Technologies, Inc.

- Others

Recent Developments

- In January 2026, NVIDIA Corporation released open Nemotron Speech models for real-time speech recognition and audio processing, optimized for low-latency applications. These models support agentic AI workflows in content creation and enterprise tools, building on RTX hardware advancements from CES 2025. This move accelerates AI audio enhancement adoption across developers and creators.

- In June 2025, Google LLC introduced Gemini 2.5 with native audio dialog and controllable text-to-speech capabilities, enabling multi-speaker generation and precise voice customization. Integrated into NotebookLM and Project Astra, it powers immersive audio for podcasts and real-time conversations, showcasing its multimodal AI audio innovation.

Report Scope

Report Features Description Market Value (2025) USD 1,256.8 Mn Forecast Revenue (2035) USD 22,429 Mn CAGR(2025-2034) 33.4% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Application (Music and Entertainment, Gaming, Podcasting, Broadcasting, Telecommunications, Others), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (Media and Entertainment, Gaming, Telecommunications, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Systems Inc., NVIDIA Corporation, Google LLC, Apple Inc., Microsoft Corporation, Amazon Web Services, Inc., IBM Corporation, Bose Corporation, Dolby Laboratories, Inc., Sony Corporation, Sennheiser Electronic GmbH & Co. KG, Shure Incorporated, Harman International Industries, Inc., Auphonic, iZotope, Inc., Waves Audio Ltd., LANDR Audio Inc., Accusonus Inc., Descript Inc., Krisp Technologies, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-powered Audio Enhancer MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-powered Audio Enhancer MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Systems Inc.

- NVIDIA Corporation

- Google LLC

- Apple Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- IBM Corporation

- Bose Corporation

- Dolby Laboratories, Inc.

- Sony Corporation

- Sennheiser Electronic GmbH & Co. KG

- Shure Incorporated

- Harman International Industries, Inc.

- Auphonic

- iZotope, Inc.

- Waves Audio Ltd.

- LANDR Audio Inc.

- Accusonus Inc.

- Descript Inc.

- Krisp Technologies, Inc.

- Others