Global AI-Powered Agri-Insurance Risk Modelling Market Size, Share, Industry Analysis Report By Component (Services, Software, Platforms), By Type(Probabilistic Risk Modelling, Parametric Risk Modelling, Deterministic Modelling, Deep Learning Forecast Models, Ensemble Modelling Solutions, Machine Learning-Based Simulation Models, Others), By Deployment Mode(Cloud-Based, On-Premise), By Application(Crop Insurance, Greenhouse Insurance, Aquaculture Insurance, Forestry Insurance, Livestock Insurance, Others), By Technology(Predictive Analytics, Machine Learning (ML), Artificial Intelligence (AI), Remote Sensing, Natural Language Processing (NLP), Geographic Information Systems (GIS), Others), By Farm Size(Small Farms, Medium Farms, Large Farms), By End-user (Agri-Tech Firms, Insurance Companies, Financial Institutions, Farmers & Producer Organizations, Government Agencies, Reinsurance Companies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157073

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- Emerging Trends

- Top Use cases

- By Component

- By Type

- By Deployment Mode

- By Application

- By Technology

- By Farm Size

- By End-User

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

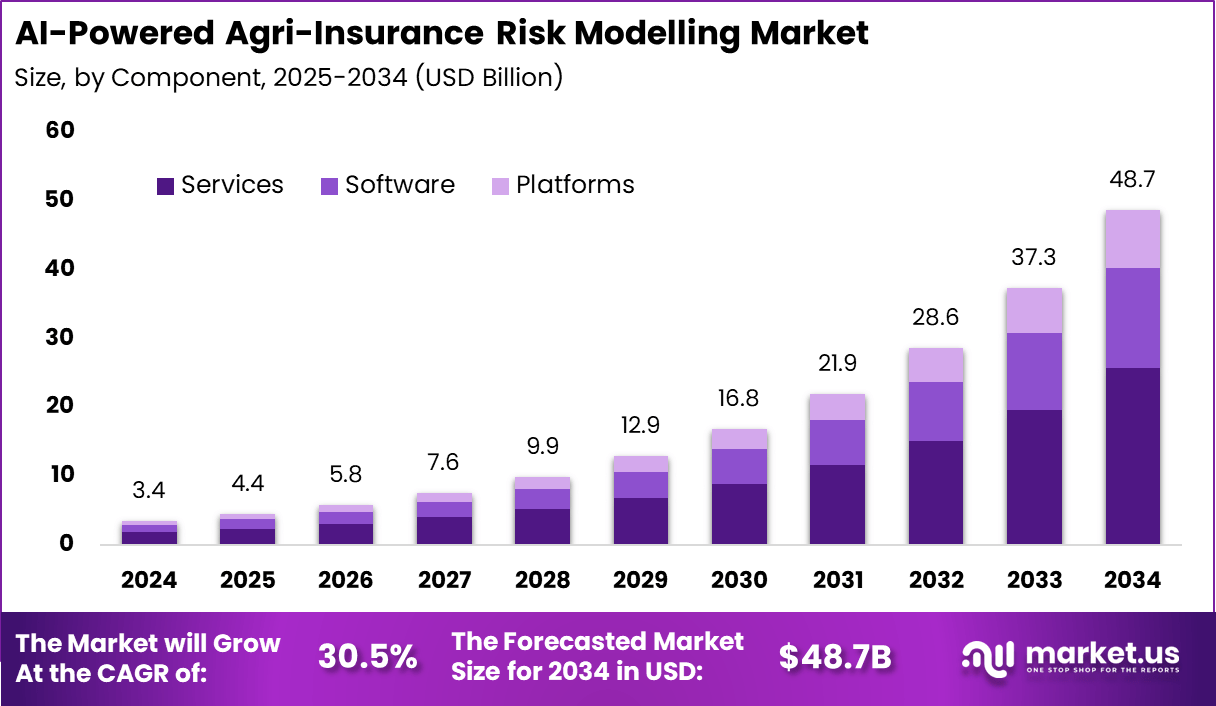

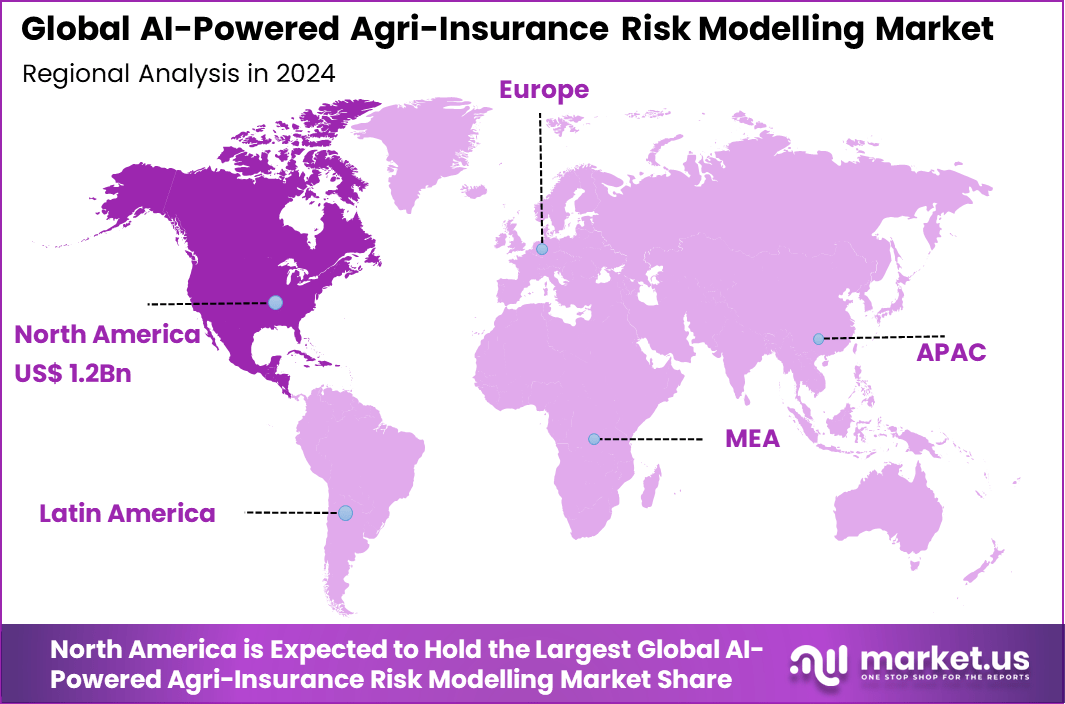

The Global AI-Powered Agri-Insurance Risk Modelling Market size is expected to be worth around USD 48.7 Billion By 2034, from USD 3.4 billion in 2024, growing at a CAGR of 30.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36.7% share, holding USD 1.2 Billion revenue.

The AI-Powered Agri-Insurance Risk Modelling market refers to analytics platforms and data services that quantify weather, biological, and operational risks in farming using machine learning, satellite and radar imagery, IoT telemetry, and probabilistic weather models. These systems are applied across underwriting, pricing, portfolio accumulation control, and automated claims, including index and parametric structures.

Top driving factors include climate volatility, public policy support for risk management, and the availability of high-resolution Earth observation data. The Common Agricultural Policy has embedded risk tools financing across Member States, with about EUR 4.6 billion of public expenditure earmarked for risk management instruments in the current plan cycle, signalling stable demand for actuarially sound, technology-enabled cover.

Key Insight Summary

- By component, Software led the market, accounting for 52.7% share.

- By type, Probabilistic Risk Modelling was the leading approach, holding 25.7% share.

- Cloud-based deployment dominated, contributing 58.8% share of the market.

- By application, Crop Insurance was the top area, securing 30.84% share.

- Predictive Analytics emerged as the leading technology, with 28.5% share.

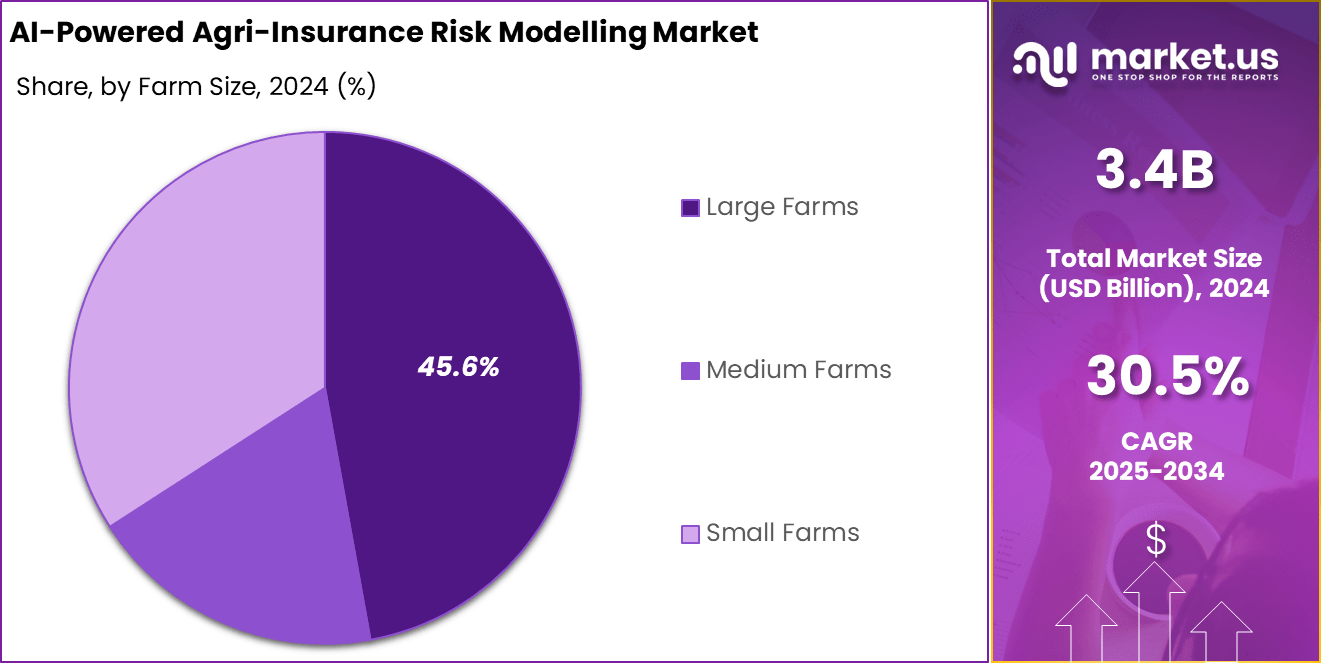

- By farm size, Large Farms were the main adopters, representing 45.6% share.

- Among end-users, Agri-Tech Firms held the leading position with 36.6% share.

US Market Size

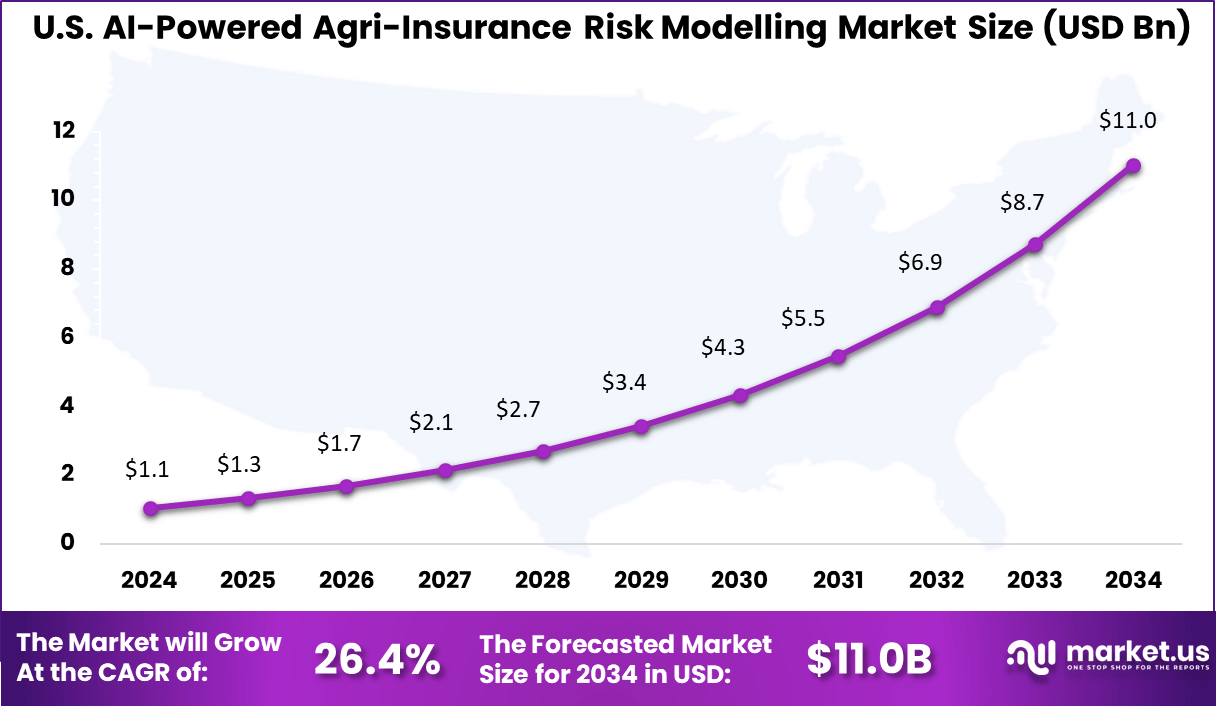

The U.S. AI-Powered Agri-Insurance Risk Modelling Market was valued at USD 1.1 Billion in 2024 and is anticipated to reach approximately USD 11.0 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 26.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 36.7% share and generating USD 11 billion in revenue in the AI-powered agri-insurance risk modelling sector. The region’s leadership can be attributed to its early adoption of advanced data analytics, machine learning, and satellite-based risk assessment tools.

Farmers and insurance providers in the United States and Canada have been quick to integrate AI models to manage climate risks, crop yield variability, and pest outbreaks, thereby reducing claim uncertainties and improving underwriting accuracy. The dominance of North America is further supported by strong policy frameworks and significant investments in digital agriculture.

Government-backed initiatives aimed at promoting precision farming and crop risk management have encouraged insurers to adopt AI-driven models. Additionally, high penetration of agri-tech startups and collaborations between insurance firms and technology providers have created a robust ecosystem that strengthens the adoption rate of AI tools in the insurance landscape.

Emerging Trends

Key Trend Description AI-driven Parametric Insurance Fast claim settlements triggered by weather events or predefined parameters, expanding in climate-vulnerable regions. Real-time Data Integration Use of satellite, IoT, and climate monitoring for more accurate and responsive coverage adjustment and policy pricing. Digital Policy Channels Mobile/web platforms reduce disputes and speed policy management in rural, remote farming areas. Blockchain Adoption Tamper-proof audit trails and claim histories increase trust and streamline verification processes. Public-Private Partnerships Governments and private insurers cooperate to broaden product scope and improve disaster resilience. Top Use cases

Use Cases Description Precision Risk Assessment AI analyzes vast climate, crop, and soil datasets for granular, context-driven underwriting. Automated Claims AI/IoT-enabled platforms process claims faster with image-based, sensor-backed field verification. Dynamic Pricing Policies adjust in real-time to changing environmental data for both efficiency and fairness. Weather Index Products Parametric schemes offer rapid, data-based payouts during flood, drought, or pest outbreaks. By Component

The software segment led the AI-powered agri-insurance risk modelling market in 2024 with a 52.7% share, highlighting the importance of advanced analytical platforms, data integration tools, and intelligent modelling suites for agricultural risk management. These platforms incorporate real-time data from satellites, IoT sensors, and climate analytics to drive precise risk assessment and policy pricing, providing insurers robust and automated risk models.

Continued innovations in software architecture have accelerated claims automation, fraud detection, and dynamic pricing, making it indispensable for both traditional insurers and agri-tech firms. The flexibility of these platforms integrates easily with policy delivery tools and other digital interfaces, enabling rapid adoption and greater market reach throughout rural and digitally connected regions.

By Type

Probabilistic risk modelling held a 25.7% share in the market, owing to its ability to generate nuanced risk scores using statistical simulation and scenario analysis. These models fuse historical data and environmental variables to forecast the likelihood of weather-related losses, enabling more accurate underwriting and premium adjustments.

The utility of probabilistic methodologies lies in their adaptability; insurers use them to design both traditional and parametric products that align with dynamic climate change patterns. This segment is particularly valued in regions exposed to variable weather conditions, supporting farmers and government-backed schemes in managing uncertainty.

By Deployment Mode

In terms of deployment mode, cloud-based platforms accounted for 58.8% of the market, driven by their scalability, cost-efficiency, and ease of implementation for insurers and agri-tech providers. Cloud solutions support large data processing volumes and remote model updates, enabling continuous improvement as new data becomes available.

Cloud-based deployments enable collaborative workflows and centralized monitoring, increasing transparency and enabling rapid service delivery in geographically dispersed farm areas. Providers often couple robust security, real-time access, and API-driven integrations with other farm management systems to support digital transformation in agriculture insurance.

By Application

Crop insurance was the dominant application, comprising 30.84% of the market, as climate variability and pest risks drive demand for precision coverage. AI-powered solutions in crop insurance use predictive analytics and remote sensing to streamline claims assessment and policy pricing, improving financial stability for farmers.

Advancements in yield forecasting, automated claim settlement, and integration with agronomic databases have accelerated adoption among insurers seeking to reduce loss ratios. The segment’s growth is further bolstered by public-private partnerships, regulatory support, and rising awareness about digital insurance products.

By Technology

Predictive analytics technology secured a 28.5% share in the market by enabling insurers to anticipate loss events and optimize risk portfolios. These models process multi-source data to identify patterns that inform underwriting, dynamic pricing, and claims management.

Its integration with machine learning and remote sensing expands risk evaluation capabilities, offering insurers actionable insights for proactive policy adjustments. The increasing sophistication of predictive algorithms is pushing industry standards and supporting the launch of new insurance products tailored to climate and pest risks.

By Farm Size

Large farms represented 45.6% market share, emphasizing their reliance on advanced risk modelling solutions to protect high-value crop investments and infrastructure. These enterprises possess the resources and data infrastructure to exploit the full capabilities of AI-driven analysis, optimizing policy selection and loss mitigation strategies.

As climate risk exposure on large farms increases, their adoption of multi-layered modelling tools supports greater risk transparency, operational resilience, and compliance with regulatory standards. Large farms are further motivated by tailored policies and dynamic coverage options facilitated by AI risk modelling.

By End-User

Agri-tech firms accounted for a 36.6% share of the market’s end-users, acting as primary innovation partners for insurers and growers. These companies use AI risk models to convert raw farm data into precise risk insights, bridging communication gaps between underwriters and agricultural stakeholders.

Their adoption is driven by the need to differentiate products and improve farmer satisfaction, leveraging AI-powered models for platform-based risk monitoring, policy customization, and digital insurance delivery. As agri-tech firms continue integrating these models into service offerings, they accelerate the modernization of insurance practices across emerging and established agricultural regions.

Key Market Segments

By Component

- Services

- Software

- Platforms

By Type

- Probabilistic Risk Modelling

- Parametric Risk Modelling

- Deterministic Modelling

- Deep Learning Forecast Models

- Ensemble Modelling Solutions

- Machine Learning-Based Simulation Models

- Others

By Deployment Mode

- Cloud-Based

- On-Premise

By Application

- Crop Insurance

- Greenhouse Insurance

- Aquaculture Insurance

- Forestry Insurance

- Livestock Insurance

- Others

By Technology

- Predictive Analytics

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Remote Sensing

- Natural Language Processing (NLP)

- Geographic Information Systems (GIS)

- Others

By Farm Size

- Small Farms

- Medium Farms

- Large Farms

By End-user

- Agri-Tech Firms

- Insurance Companies

- Financial Institutions

- Farmers & Producer Organizations

- Government Agencies

- Reinsurance Companies

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Integration of Real-Time Environmental Data

A major driver for AI-powered agri-insurance risk modelling is the growing use of real-time environmental data sourced from satellites, IoT sensors, and climate monitoring systems. This data allows insurers to understand and evaluate risks such as droughts, floods, pest infestations, and crop yield variations with much greater precision.

This precise risk evaluation enables insurers to price policies more accurately and automate claims processing, making insurance more responsive to changing farming conditions. As connectivity in rural areas improves, the demand for AI-driven solutions that leverage up-to-date environmental data is expected to grow strongly.

Restraint Analysis

Low Awareness and Adoption Barriers Among Farmers

A key restraint facing the market is limited awareness and understanding of AI-powered insurance products among many farmers, particularly in less developed regions. Many farmers are unfamiliar or unsure about the benefits and workings of these advanced technologies.

In addition to knowledge gaps, regulatory differences and complexities in insurance systems can slow adoption. This hesitance and uncertainty limit the scalability and reach of AI-based agri-insurance solutions until farmers become more educated and regulations become more supportive.

Opportunity Analysis

Growth of Parametric Insurance Solutions

An exciting opportunity lies in the increasing adoption of parametric insurance models powered by AI and advanced analytics. These models provide automatic payouts based on measurable triggers such as precipitation levels or wind speeds, reducing claim processing times significantly.

Parametric insurance offers greater transparency and quick access to funds for farmers after adverse weather events. With rising climate risks and expansions in mobile connectivity, this approach promises to make insurance more accessible and efficient, especially in flood- and drought-prone regions.

Challenge Analysis

Regulatory and Infrastructure Constraints

One of the market’s biggest challenges is the variation in regulatory frameworks across regions, which can restrict or slow down the deployment of innovative AI-driven insurance products. Different countries and states have varying rules that insurers must navigate carefully.

Additionally, many rural farming areas lack the digital infrastructure needed to support the continuous data collection and connectivity that AI models require. Without reliable internet and data systems, delivering accurate and timely AI-powered risk assessments becomes difficult, limiting market expansion.

Competitive Analysis

In the AI-powered agri-insurance risk modelling market, established reinsurers such as Swiss Re, Munich Re, and Allianz play a critical role. These companies leverage their global expertise in risk transfer to develop advanced AI-driven solutions tailored for agricultural needs. Their initiatives include digital ecosystems and AI-backed ventures that support farmers with predictive analytics, climate modelling, and insurance coverage optimization.

Alongside reinsurers, leading technology firms and insurers such as IBM, AXA XL, Generali, and Aon plc are shaping the competitive landscape. IBM’s agri-focused AI insurance solutions bring advanced data analytics and machine learning capabilities, while AXA XL and Generali are increasingly investing in AI-driven risk evaluation models. Aon plc is integrating data-driven platforms to improve underwriting efficiency.

Specialized agricultural technology providers add further depth to the market. Companies such as Bayer’s Climate Corp, Indigo Ag, Taranis, Descartes Labs, AgroGuard, AgRisk Analytics, and AgriShield deliver precision agriculture and risk modelling tools that enhance insurance offerings. Startups like Lemonade are also experimenting with AI-based agri-insurance models, while firms such as Blue River Technology and Syngenta apply AI in crop and field analysis.

Top Key Players in the Market

- IBM (Agri-focused Al Insurance Solutions)

- Swiss Re

- Generali

- Aon plc

- Bayer’s Climate Corp

- Indigo Ag

- AgroGuard

- AgRisk Analytics

- AgriShield

- Lemonade (Agri-Insurance Al)

- Munich Re

- AXA XL

- Allianz

- John Deere (Precision Agri-Insurance)

- Taranis

- Descartes Labs (Agri-Risk Al)

- Syngenta (Al Risk Modelling)

- Swiss Re’s Digital Ecosystem Partners

- Blue River Technology (Al for Agri-Risk)

- Munich Re’s Al Agri-Insurance Ventures

- Others

Recent Developments

- Generali entered a research partnership with MIT in early 2025 to advance AI solutions in risk modeling, smart underwriting, and claims assessment, investing heavily in AI-based automation and ethical AI frameworks.

- Aon plc launched the Aon Broker Copilot platform in mid-2025, leveraging AI, large language models, and predictive analytics to modernize commercial insurance placement and improve risk management workflows.

- Bayer’s Climate Corp is piloting a unique generative AI tool since early 2024 developed with Microsoft and Ernst & Young to provide expert agronomic advice and improve digital farming insights.

- Indigo Ag expanded its AI-driven platform for crop forecasting, soil mapping, and sustainability analytics, further reinforced by acquisitions and partnerships in 2025.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 48.7 Bn CAGR(2025-2034) 30.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Services, Software, Platforms), By Type(Probabilistic Risk Modelling, Parametric Risk Modelling, Deterministic Modelling, Deep Learning Forecast Models, Ensemble Modelling Solutions, Machine Learning-Based Simulation Models, Others), By Deployment Mode(Cloud-Based, On-Premise), By Application(Crop Insurance, Greenhouse Insurance, Aquaculture Insurance, Forestry Insurance, Livestock Insurance, Others), By Technology(Predictive Analytics, Machine Learning (ML), Artificial Intelligence (AI), Remote Sensing, Natural Language Processing (NLP), Geographic Information Systems (GIS), Others), By Farm Size(Small Farms, Medium Farms, Large Farms), By End-user (Agri-Tech Firms, Insurance Companies, Financial Institutions, Farmers & Producer Organizations, Government Agencies, Reinsurance Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM (Agri-focused AI Insurance Solutions), Swiss Re, Generali, Aon plc, Bayer’s Climate Corp, Indigo Ag, AgroGuard, AgRisk Analytics, AgriShield, Lemonade (Agri-Insurance AI), Munich Re, AXA XL, Allianz, John Deere (Precision Agri-Insurance), Taranis, Descartes Labs (Agri-Risk AI), Syngenta (AI Risk Modelling), Swiss Re’s Digital Ecosystem Partners, Blue River Technology (AI for Agri-Risk), Munich Re’s AI Agri-Insurance Ventures, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Agri-Insurance Risk Modelling MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Agri-Insurance Risk Modelling MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM (Agri-focused Al Insurance Solutions)

- Swiss Re

- Generali

- Aon plc

- Bayer's Climate Corp

- Indigo Ag

- AgroGuard

- AgRisk Analytics

- AgriShield

- Lemonade (Agri-Insurance Al)

- Munich Re

- AXA XL

- Allianz

- John Deere (Precision Agri-Insurance)

- Taranis

- Descartes Labs (Agri-Risk Al)

- Syngenta (Al Risk Modelling)

- Swiss Re's Digital Ecosystem Partners

- Blue River Technology (Al for Agri-Risk)

- Munich Re's Al Agri-Insurance Ventures

- Others