Global AI PC Market Size, Share, Trends Analysis By Product (Desktops and Notebooks, Workstations), By Operating System (Windows, macOS, Chrome), By Compute Type (GPU, 40-60 TOPS and Other), By Compute Architecture (X86, ARM), By Price (Below USD 1200, USD 1200 and Above), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 131356

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- APAC AI PC market Size

- Product Analysis

- Operating System Analysis

- Compute Type Analysis

- Compute Architecture Analysis

- Price Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

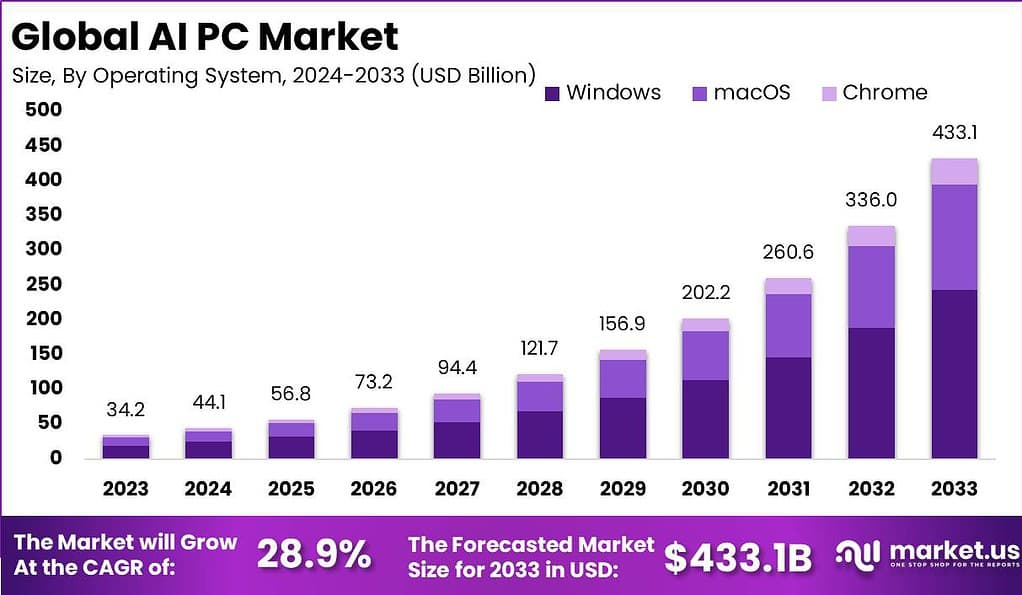

The Global AI PC Market size is expected to be worth around USD 433.1 Billion By 2033, from USD 34.2 Billion in 2023, growing at a CAGR of 28.9% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 36% share, holding USD 12.3 Billion revenue

An AI PC is a type of computer specifically equipped to handle artificial intelligence (AI) and machine learning (ML) tasks efficiently without relying on cloud processing. These computers incorporate a Neural Processing Unit (NPU), alongside traditional CPUs and GPUs, to accelerate AI-related operations. The NPU optimizes performance for tasks that involve AI, thereby enhancing the PC’s ability to perform AI tasks locally rather than in the cloud.

The AI PC market is expanding as these devices become integral to various professional and personal computing environments. Driven by increasing demands for higher computational power and efficiency in processing large volumes of data, the market is seeing significant growth. AI PCs cater to a range of applications from advanced gaming to professional AI research and development, contributing to their rising adoption.

The primary drivers of the AI PC market include the need for more powerful processing capabilities for AI and ML tasks, the growing popularity of AI-enhanced applications, and the enhancement of user experiences through faster and more efficient computing solutions. Additionally, the increasing use of AI applications in consumer electronics, business processes, and educational tools supports this growth.

Key Takeaways

- The Global AI PC Market is projected to reach an impressive USD 433.1 billion by 2033, growing from USD 34.2 billion in 2023. This surge represents a robust CAGR of 28.9% during the forecast period from 2024 to 2033.

- In 2023, the APAC region dominated the market, capturing more than 36% of the market share, with revenues reaching USD 12.3 billion. This dominance is attributed to the rapid adoption of AI technologies across various sectors in the region.

- The Desktops and Notebooks segment also held a leading position in 2023, commanding over 55% of the market. This growth reflects the increasing demand for powerful AI-driven devices in both personal and professional environments.

- In terms of operating systems, the Windows segment was the clear leader, capturing more than 56.1% of the AI PC market. This is largely due to Windows’ wide adoption and AI integration capabilities.

- The 40-60 TOPS NPU (Neural Processing Unit) segment held a dominant market share in 2023, reflecting the growing need for enhanced processing power in AI PCs.

- The X86 architecture was another significant player in the market, capturing a substantial share due to its performance and compatibility with AI workloads.

- Lastly, the USD 1200 and Above price segment was a key contributor to the market’s success in 2023, with premium AI PCs in high demand for both personal and professional use.

Analysts’ Viewpoint

Demand for AI PCs is fueled by industries that require high-performance computing such as video editing, 3D modeling, and software development. Consumers and professionals alike seek computers that can quickly and effectively manage AI-driven tasks like voice recognition, image processing, and autonomous operations.

The AI PC market presents numerous investment opportunities, particularly in the development of NPUs and AI-specific components, software for AI applications, and AI-integrated services. As technology evolves, investing in companies that innovate in AI hardware and AI optimization software appears particularly promising.

Recent advancements in AI PC technology include the development of more powerful NPUs, integration of AI capabilities directly onto chips, and enhancements in energy efficiency and processing power. These improvements enable AI PCs to handle more complex AI tasks locally, reducing reliance on cloud services and enhancing data security.

The regulatory landscape for AI PCs is increasingly focusing on issues such as data protection, AI ethics, and the responsible use of AI technology. Regulations are being developed to ensure that AI systems are secure, transparent, and fair, promoting trust and safety in AI applications across industries.

APAC AI PC market Size

In 2023, APAC held a dominant market position in the AI PC market, capturing more than a 36% share with revenues amounting to USD 12.3 billion. This significant market share can be attributed to several key factors that underscore the region’s pivotal role in the global AI PC landscape.

The rapid technological advancement, combined with high rates of adoption in both consumer and industrial sectors across the region, plays a crucial role in this dominance. APAC’s leadership in the market is further reinforced by the heavy investments in technology infrastructure and R&D by major economies such as China, South Korea, and Japan.

These countries have established themselves as global leaders in semiconductor and electronics manufacturing, contributing substantially to the development and innovation in AI-capable PCs. The presence of major technology firms that specialize in AI and machine learning technologies in these countries supports the widespread integration of advanced AI capabilities into PCs, making them more accessible to the regional market.

Moreover, the increasing demand for AI PCs in APAC is driven by the growing digitization of economies and the expansion of sectors such as e-commerce, automotive, and healthcare, which utilize AI technologies for better service delivery and operational efficiency. Government initiatives across the region to promote AI in manufacturing and technology sectors also incentivize companies to adopt AI-enhanced systems, further boosting the market growth.

Product Analysis

In 2023, the Desktops and Notebooks segment held a dominant market position in the AI PC market, capturing more than a 55% share. This segment’s leadership can be attributed to several key factors that resonate with both individual consumers and business clients. Primarily, the demand for high-performance computing solutions capable of supporting advanced AI applications and machine learning algorithms has significantly influenced market dynamics.

Desktops and notebooks are integral in providing the necessary hardware capabilities required for intensive data processing and AI tasks. These include graphics processing units (GPU) and high-speed processing units that are essential for running complex AI models. Additionally, the adaptability of desktops and notebooks to integrate with various AI software and peripherals has made them highly favorable in sectors such as healthcare, finance, and IT, where AI applications are rapidly expanding.

Moreover, the evolution of remote work and digital education platforms has spurred the demand for reliable and efficient computing devices, further cementing the leading position of desktops and notebooks in the market. As AI technologies continue to advance, these devices are increasingly preferred for their ability to offer enhanced interactive experiences and manage larger data volumes, which are crucial for AI-driven applications.

The sustained market preference for desktops and notebooks is also supported by their cost-effectiveness compared to more specialized AI hardware. While offering competitive performance, these devices provide a more accessible entry point for small businesses and individual users looking to leverage AI technology without the substantial initial investment required for higher-end workstations or dedicated AI systems. This accessibility has played a significant role in maintaining the segment’s market dominance.

Operating System Analysis

In 2023, the Windows segment held a dominant market position in the AI PC market, capturing more than a 56.1% share. This commanding presence is primarily due to Windows’ extensive compatibility with a wide array of AI software and hardware components.

As the most widely used operating system in corporate and consumer environments, Windows offers robust support for the integration of advanced AI capabilities. This includes compatibility with various machine learning frameworks and tools that are essential for developers and researchers focused on AI.

Windows operating systems are preferred for their flexibility in customization and scalability, which are crucial for AI applications that require significant computational resources. The availability of powerful administrative tools and widespread developer support also contributes to its dominance, enabling users to tailor their systems to specific AI tasks more efficiently than other operating systems.

Furthermore, Windows-based PCs often come equipped with advanced GPU options and optimized drivers that enhance the performance of AI-oriented applications, such as data modeling and deep learning algorithms. This integration of hardware acceleration capabilities has made Windows a go-to choice for AI professionals looking for reliable and effective computing solutions.

Additionally, the continuous updates and security features provided by Microsoft ensure that Windows systems remain at the forefront of technology, offering the latest in AI advancements and security measures. This commitment to innovation and security not only attracts enterprise clients but also reassures individual users, thereby maintaining the operating system’s lead in the AI PC market.

Compute Type Analysis

In 2023, the 40-60 TOPS NPU segment held a dominant market position in the AI PC market, capturing a significant share. This segment’s leadership stems from its optimal balance of power and efficiency, making it ideal for a wide range of AI applications that require both high performance and energy efficiency.

NPUs (Neural Processing Units) in this range are particularly favored in sectors where real-time data processing and decision-making are critical, such as in autonomous vehicles, healthcare diagnostics, and smart manufacturing. The 40-60 TOPS range of NPUs delivers exceptional computational speed, enabling devices to perform complex AI algorithms swiftly without the need for extensive power consumption.

This efficiency is vital for battery-operated devices or systems where energy consumption impacts operational costs and sustainability goals. As businesses and consumers increasingly prioritize eco-friendly technologies, the demand for these mid-range NPUs has grown.

Additionally, NPUs in this performance bracket are highly adaptable, capable of handling next-generation AI tasks while still being cost-effective compared to higher TOPS units. This cost-efficiency makes them accessible to a broader market, including small to medium-sized enterprises that are beginning to integrate AI into their operations but are sensitive to high capital expenditures.

Moreover, the 40-60 TOPS segment benefits from the development of specialized AI software optimized for this range, enhancing device capabilities and user experience. Software compatibility ensures that users can leverage the full potential of their hardware, making this NPU range a preferred choice for developers and end-users aiming for high-performance AI applications without the premium cost associated with the highest spec models.

Compute Architecture Analysis

In 2023, the X86 segment held a dominant market position in the AI PC market, capturing a substantial share. This prevalence is primarily due to the architecture’s long-standing integration within both personal and enterprise computing environments.

X86 processors are renowned for their robust performance capabilities and compatibility with a wide range of software, including complex AI and machine learning applications. This makes them a dependable choice for industries requiring heavy computational tasks.

The X86 architecture benefits significantly from the extensive support ecosystem of developers and third-party vendors who continually enhance its capabilities through software updates and tool optimizations. This support ensures that X86 systems remain versatile and capable of handling evolving AI workloads with improved efficiency and reliability.

Furthermore, the widespread use of X86 in server environments, which are crucial for training AI models, solidifies its position in the market. Moreover, X86 processors are often preferred for their advanced security features, which are vital for AI applications dealing with sensitive data.

The architecture’s ability to support sophisticated security protocols helps prevent data breaches, making it highly suitable for sectors such as finance, healthcare, and defense, where data integrity is paramount. Lastly, the continuous technological advancements in X86 architecture, such as the incorporation of AI-specific accelerators and custom co-processors, enable it to maintain a competitive edge.

These enhancements facilitate faster processing times and greater power efficiency, further driving the adoption of X86 in AI-driven applications. The blend of legacy compatibility, cutting-edge improvements, and broad industry acceptance explains why the X86 segment continues to lead in the AI PC market.

Price Analysis

In 2023, the USD 1200 and Above segment held a dominant market position in the AI PC market, capturing a significant share. This segment’s leadership can be largely attributed to the growing demand for high-performance PCs capable of handling advanced AI and machine learning tasks.

PCs priced above USD 1200 typically offer superior processors, enhanced GPU capabilities, and greater memory and storage options, which are essential for running sophisticated AI algorithms and large-scale data processing tasks. These high-end PCs cater to professional users, such as data scientists, AI researchers, and software developers, who require robust computing power to develop and deploy AI models efficiently.

The increased investment in AI development across various sectors, including healthcare, automotive, and finance, has spurred the demand for these premium machines. Organizations in these industries often opt for higher-priced PCs to gain a competitive edge through faster innovation and improved operational efficiency.

Furthermore, the USD 1200 and Above price segment benefits from the trend towards remote work and virtual collaboration, which has led to a higher demand for PCs with advanced specifications that can support video conferencing, complex project management, and real-time data analytics. These capabilities are less prevalent in lower-priced models, which typically target casual or standard office applications.

Moreover, manufacturers in this price range often bundle additional services and support with their PCs, such as enhanced security features, extended warranties, and dedicated customer service, adding value for enterprise users and justifying the higher price point. This comprehensive support is crucial for businesses that rely on their computing infrastructure’s continuous and reliable operation, further solidifying the appeal of the USD 1200 and Above segment in the AI PC market.

Key Market Segments

By Product

- Desktops and Notebooks

- Workstations

By Operating System

- Windows

- macOS

- Chrome

By Compute Type

- GPU

- NPU- <40 TOPs

- 40-60 TOPS

By Compute Architecture

- X86

- ARM

By Price

- Below USD 1200

- USD 1200 and Above

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Performance and Cost Efficiency

The AI PC market is seeing significant growth driven by the enhancement of performance and reduction of costs. As AI capabilities are integrated directly into PCs, they mitigate the need for constant cloud connectivity, which not only accelerates data processing but also lowers latency. This shift means AI tasks can run directly on the local device, enhancing user productivity.

This local processing eliminates the performance bottlenecks associated with data transmission to and from the cloud, leading to faster, more efficient computing experiences which are particularly advantageous for real-time applications. Moreover, by localizing data processing, PCs require less bandwidth and fewer cloud resources, which substantially lowers operational costs associated with cloud computing.

Restraint

High Initial Costs and Market Inertia

Despite the advantages, the market adoption of AI PCs is restrained by their high initial costs. The integration of advanced AI-specific components like Neural Processing Units (NPUs) raises the price of these systems. This cost barrier can deter budget-conscious consumers and small enterprises from immediate adoption.

Additionally, the market faces inertia as both individuals and organizations may be slow to transition from traditional PCs to AI-enhanced models, often due to a lack of immediate, visible return on investment or reluctance to depart from familiar technology systems without a compelling reason.

Opportunity

Broadening Application in Professional and Creative Fields

AI PCs present significant opportunities in professional and creative fields where enhanced computational capabilities can transform workflows. Industries such as digital content creation, gaming, and complex data analysis stand to benefit from AI-driven enhancements in processing speeds and capabilities.

For example, AI PCs can handle sophisticated tasks like 3D modeling, large-scale video edits, and real-time AI simulations more efficiently, paving the way for innovations in creative and engineering applications. This capability extends to the business sphere where AI PCs can streamline operations through automated tasks and predictive analytics.

Challenge

Need for Diverse Software Ecosystem

A major challenge in the AI PC market is the development of a robust, diverse software ecosystem that can fully leverage on-device AI capabilities. There’s a need for software that can harness the advanced capabilities of AI PCs, from basic operating systems enhancements to complex application-specific features.

The effectiveness of AI PCs depends significantly on the availability of applications that can utilize the advanced hardware effectively. Developing these applications requires time and significant resource investment from developers, which can delay the realization of AI PC benefits for end-users.

Growth Factors

Increasing Commercial Adoption

The commercial adoption of AI PCs is a critical growth factor in the market. As businesses recognize the efficiency and productivity gains offered by AI PCs, particularly in terms of enhanced performance and data security, their uptake in commercial settings is increasing.

This trend is supported by the growing need for powerful computing solutions that can handle extensive data analysis and machine learning tasks directly on devices, without compromising performance or security. The ability of AI PCs to operate independently of cloud services further enhances their attractiveness in sectors where data privacy is paramount.

Emerging Trends

AI Specialization and Premiumization

Emerging trends in the AI PC market include the specialization of hardware to accommodate specific AI tasks and the premiumization of devices. Manufacturers are increasingly focusing on embedding specialized AI hardware that can handle specific types of AI workloads more efficiently, such as machine learning model training or on-the-fly content generation.

Alongside this, there is a trend towards premiumization, where AI PCs are positioned as high-end products that offer superior performance and features compared to standard PCs. This trend is expected to drive up the average selling prices but also differentiate products in a crowded market.

Key Player Analysis

Intel’s AI PC market presence has been strengthened by the launch of its Intel Core Ultra processors in late 2023, marking a significant architectural shift. These chips feature Intel’s first on-chip neural processing unit (NPU), optimizing AI tasks and power efficiency. The 5th Gen Xeon processors also bring AI acceleration to the data center, enhancing performance across various workloads. Intel aims to dominate the AI PC market by integrating AI tools into more than 230 designs from leading laptop and PC manufacturers.

AMD continues to expand its AI PC portfolio with the launch of Ryzen PRO 8040 and 8000 Series processors in early 2024. These AI-optimized processors, powering desktops and laptops, have gained traction through partnerships with major OEMs like Lenovo and HP. Both companies have introduced new workstations and laptops that leverage AMD’s AI technology for superior performance and security features.

ASUS has positioned itself as a leader in the AI PC space with a strong focus on innovative products. The company continues to develop AI-integrated systems, offering solutions that support gaming, business, and creative applications. ASUS’s recent product lines, including its ROG series and ZenBook laptops, feature powerful AI tools designed to enhance user experience through intelligent cooling, performance optimization, and real-time system management.

Top Companies AI PC Market

- ASUSTeK Computer Inc. (China)

- Intel Corporation (US)

- Advanced Micro Devices, Inc. (US)

- NVIDIA Corporation (US)

- Apple Inc. (US)

- Dell Inc. (US)

- HP Development Company, L.P. (US)

- Lenovo (China)

- Acer Inc. (Taiwan)

- Microsoft (US)

- ASUSTeK Computer Inc. (Taiwan)

- Fujitsu (Japan)

- Huawei Technologies Co., Ltd. (China)

- Super Micro Computer, Inc. (US)

- Lambda, Inc. (US)

Recent Developments

- Intel Corporation (US): In January 2024, Intel launched its new “Lunar Lake” CPUs with powerful AI capabilities. These chips feature NPUs with 48 TOPS (trillions of operations per second), specifically designed to enhance AI workloads in AI PCs. The release of these chips is expected by Q3 2024, positioning Intel to lead in AI-enhanced laptops.

- Dell Technologies (US): Dell participated in CES 2024 with a focus on modular memory solutions aimed at improving the performance of AI PCs. The new technology, developed with Micron, is expected to make Dell laptops more efficient and AI-ready, improving their handling of AI workloads.

- In May 2024, Apple Inc. launched the SoC M4 chip for its iPad Pro, employing pioneering second-generation 3 nm technology. This chip enhances the iPad Pro’s thin design with a 10-core CPU and features the most rapid neural engine from Apple to date, capable of performing 38 trillion operations per second. This advancement underscores Apple’s commitment to integrating high-performance AI capabilities into its consumer devices.

Report Scope

Report Features Description Market Value (2023) USD 34.2 Bn Forecast Revenue (2033) USD 433.1 Bn CAGR (2024-2033) 28.9% Largest Market APAC Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Desktops and Notebooks, Workstations), By Operating System (Windows, macOS, Chrome), By Compute Type (GPU, 40-60 TOPS and Other), By Compute Architecture (X86, ARM), By Price (Below USD 1200, USD 1200 and Above) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ASUSTeK Computer Inc. (China), Intel Corporation (US), Advanced Micro Devices Inc. (US), NVIDIA Corporation (US), Apple Inc. (US), Dell Inc. (US), HP Development Company L.P. (US), Lenovo (China), Acer Inc. (Taiwan), Microsoft (US), ASUSTeK Computer Inc. (Taiwan), Fujitsu (Japan), Huawei Technologies Co. Ltd. (China), Super Micro Computer Inc. (US), Lambda Inc. (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ASUSTeK Computer Inc. (China)

- Intel Corporation (US)

- Advanced Micro Devices, Inc. (US)

- NVIDIA Corporation (US)

- Apple Inc. (US)

- Dell Inc. (US)

- HP Development Company, L.P. (US)

- Lenovo (China)

- Acer Inc. (Taiwan)

- Microsoft (US)

- ASUSTeK Computer Inc. (Taiwan)

- Fujitsu (Japan)

- Huawei Technologies Co., Ltd. (China)

- Super Micro Computer, Inc. (US)

- Lambda, Inc. (US)