Global AI Microwave Market Size, Share, Industry Analysis Report By Product Type (Convection, Grill, Solo), By Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Others), By Application (Household, Commercial), By Structure (Built-In, Countertop), By Sales Channel (Hypermarkets/ Supermarkets, Wholesalers/Distributors, Specialty Stores, Multibrand Stores, Online Retailers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162031

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

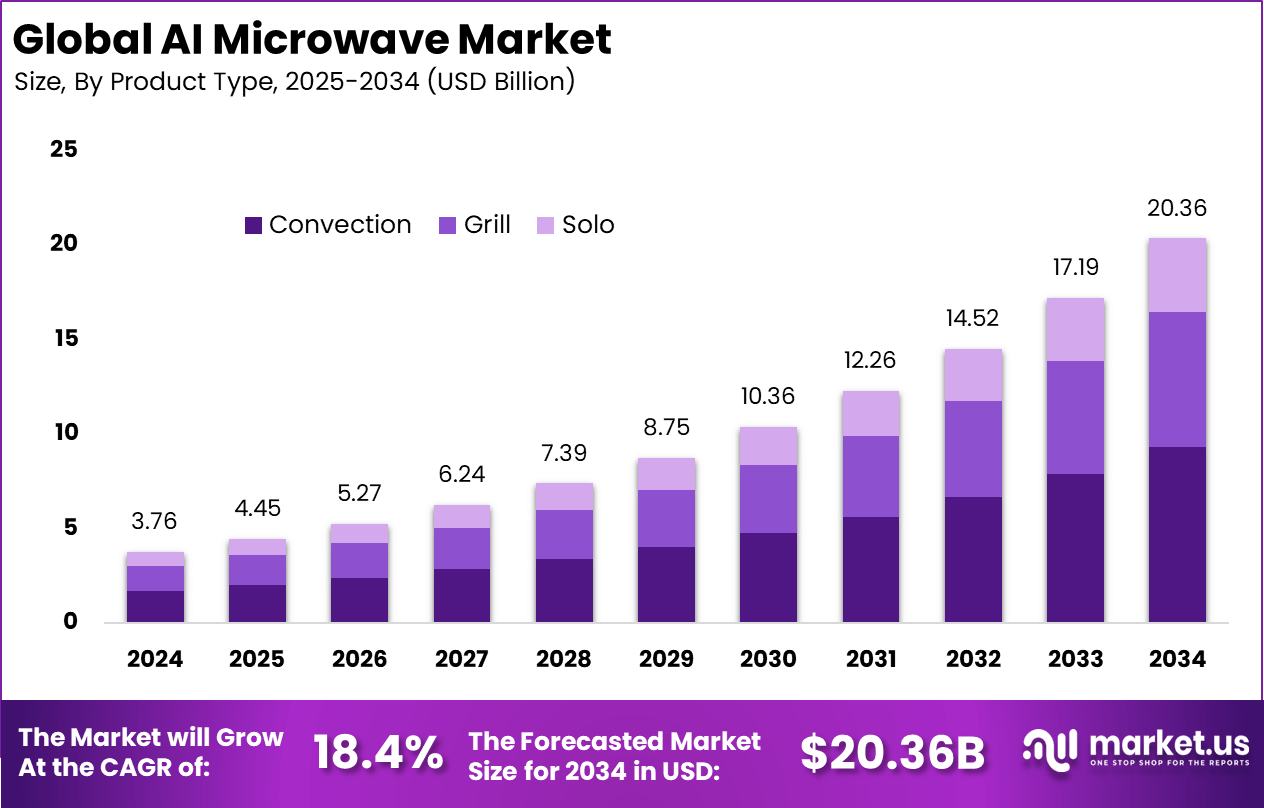

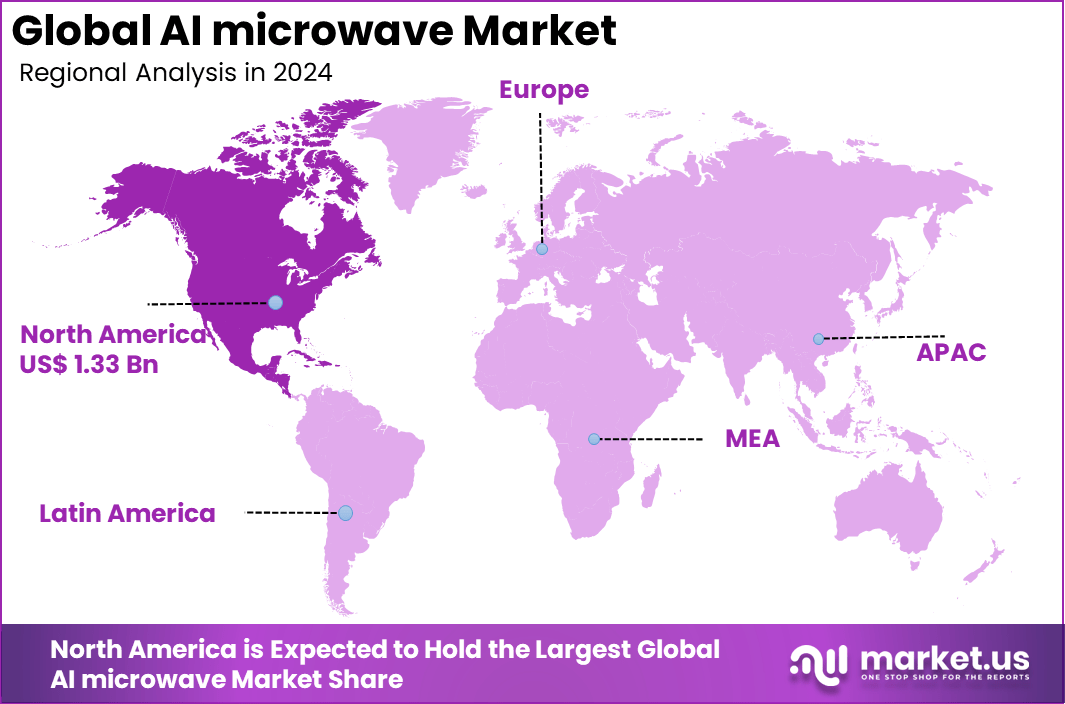

The Global AI microwave Market size is expected to be worth around USD 20.36 billion by 2034, from USD 3.76 billion in 2024, growing at a CAGR of 18.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.5% share, holding USD 1.33 billion in revenue.

The AI microwave market refers to kitchen appliances that integrate artificial intelligence to optimize cooking processes. These devices use sensors, pattern recognition, and adaptive learning to identify food types, adjust power levels, calculate cooking time, and provide voice or app-based control. Unlike conventional microwaves, AI-enabled models aim to deliver precision cooking with minimal user input.

Growth is driven by rising consumer demand for convenience, automation, and healthier cooking options. Busy households and working professionals are turning to smart kitchen appliances for efficiency. Advances in IoT integration and voice assistants have made it easier to control appliances remotely. Increasing awareness of food quality and nutrition has also encouraged adoption of AI-driven cooking guidance.

For instance, in September 2025, Midea showcased AI-driven kitchen innovations at IFA 2025, emphasizing energy efficiency improvements by 25% and a magnetron lifespan extended to 10 years thanks to AI-controlled heating systems. Midea’s commitment to sustainability and smart kitchen experience points to strong growth in AI microwave technology within its premium portfolio.

Key Insight Summary

- Convection models accounted for 45.8% of total AI microwave sales, making them the most preferred type in 2024.

- Natural Language Processing features made up 40.7%, showing strong demand for voice-enabled and smart control functions.

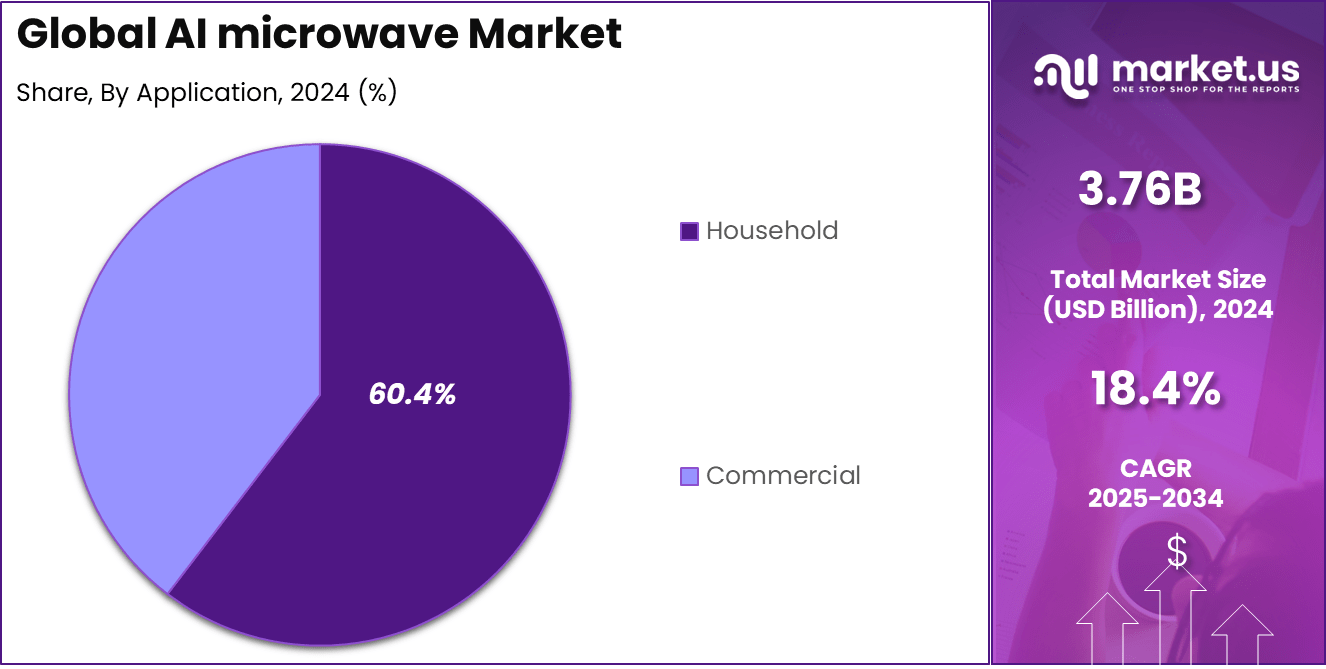

- Household users contributed 60.4% of overall adoption, confirming that residential kitchens are driving the market.

- Built-in AI microwave units secured 55.6%, reflecting growing interest in integrated and space-efficient appliances.

- Hypermarkets and supermarkets generated 42.6% of sales, indicating that large retail chains remain key purchase channels.

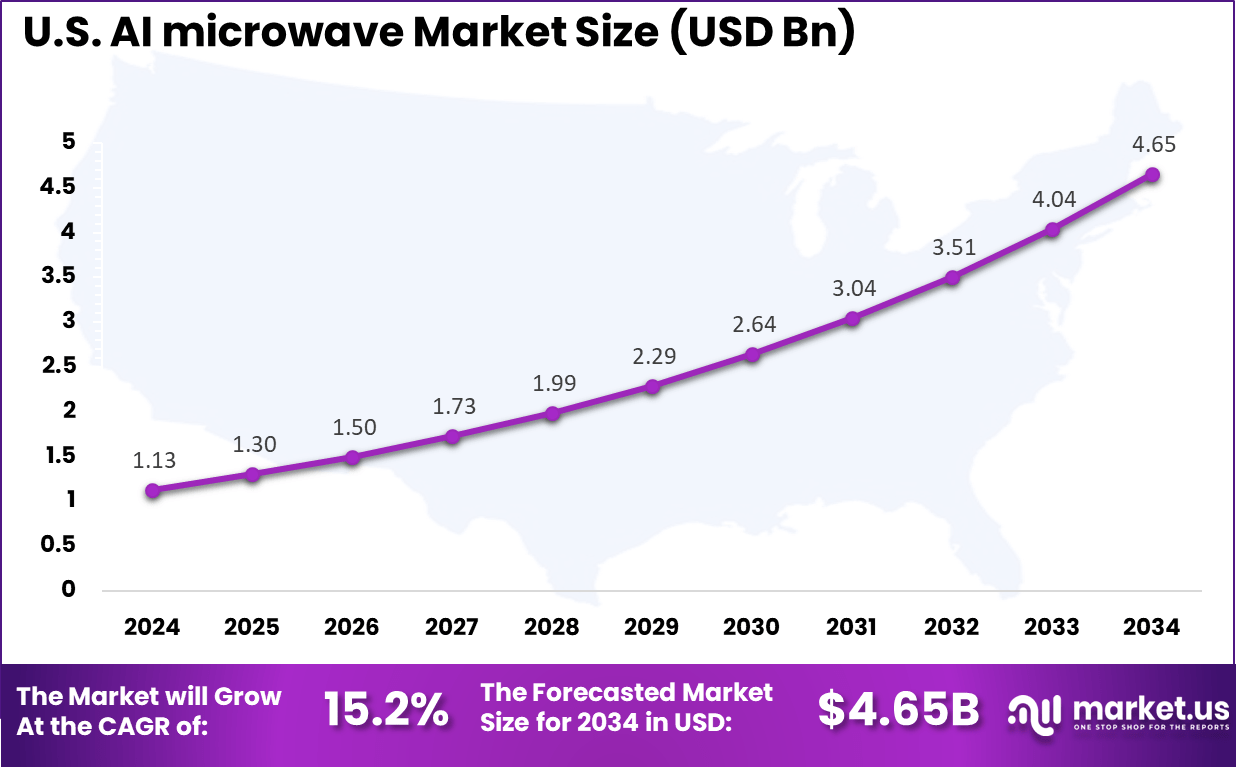

- The US market reached USD 1.13 Billion in 2024 with a solid 15.2% CAGR, supported by high smart home penetration.

- North America captured 35.5% of the global market, maintaining its lead in smart cooking appliance adoption.

Analyst Viewpoint

Demand for AI microwaves is rising because people want appliances that are easy to use and can be controlled remotely through smartphones or voice assistants. AI microwaves deliver consistent cooking by adjusting settings automatically based on food type and quantity. This suits those who want quick meals without manual effort. Especially in urban areas where incomes are higher, interest in connected kitchen gadgets is increasing.

Emerging trends focus on features like real-time food scanning and adaptive heating that boost cooking efficiency by more than 30%. Voice-guided cooking is also gaining popularity, with over 40% of new microwaves offering hands-free control and multi-language support. Hygiene improvements include special coatings that cut cleaning needs by about 90% and steam sanitizing functions that kill nearly all bacteria, especially in commercial settings.

Growth factors include rising consumer demand for convenience, with 70% of households preferring appliances that simplify food preparation. The rise of smart homes supports this trend, as over 75% of new homes have connected kitchen devices that integrate well with AI microwaves. Reduced technology costs and health awareness also drive growth, with 60% of buyers in 2025 choosing microwaves that help retain nutrients and promote healthier cooking.

U.S. AI Microwave Market Size

The market for AI microwave within the U.S. is growing tremendously and is currently valued at USD 1.13 billion, the market has a projected CAGR of 15.2%. The market is growing due to the increasing consumer demand for convenience and smart home integration, as busy households seek appliances that simplify cooking.

Advanced features like AI-powered cooking presets, voice control, and connectivity with smart home systems are making AI microwaves an essential part of modern kitchens. Furthermore, rising awareness of energy efficiency and healthier cooking methods contributes to growing adoption. Innovation by key manufacturers focusing on multifunctional, compact, and user-friendly designs further fuels the market expansion.

For instance, in February 2024, GE Appliances announced a software upgrade to its AI-driven “CookCam™ AI” platform, in which in-oven cameras analyse what food is placed inside and automatically recommend the best cooking mode. This move underscores the company’s U.S. leadership in integrating AI into cooking appliances and reflects how American appliance makers are shaping the AI-microwave and smart-kitchen space.

In 2024, North America held a dominant market position in the Global AI microwave Market, capturing more than a 35.5% share, holding USD 1.33 billion in revenue. This dominance is due to the region’s technological leadership, high disposable income, and rapid adoption of smart home appliances.

Consumers in North America increasingly favor interconnected devices, leveraging IoT and AI technologies for enhanced control and convenience. Additionally, regulatory emphasis on energy-efficient appliances encourages manufacturers to innovate eco-friendly AI microwaves. The robust infrastructure and presence of major kitchen appliance manufacturers further solidify North America’s leading market status.

For instance, in January 2025, Whirlpool Corporation announced at the Kitchen & Bath Industry Show (KBIS) 2025 that it would unveil next-generation smart kitchen appliances incorporating AI sensors and connected features, reinforcing its leadership in North America’s AI-enabled cooking appliance space. Included were items like smart ranges with “Air Cooking Technology” and remote control via the app.

Product Type Analysis

In 2024, The Convection segment held a dominant market position, capturing a 45.8% share of the Global AI microwave Market. This dominance is due to their ability to deliver uniform heating and energy-efficient cooking. These models use sensor-based automation that adjusts temperature and timing without manual input.

Consumers appreciate the balance between speed, convenience, and precision that convection systems bring to everyday cooking. Their ability to manage diverse cuisines also supports their growing popularity in both small and large households. The ongoing trend toward smart and healthier cooking continues to strengthen the position of convection models.

The users now prefer convection settings over traditional microwaves due to better flavor retention and texture consistency. As more homes integrate AI-enabled devices, convection systems combine performance with usability, allowing effortless synchronization with mobile apps and voice assistants for improved kitchen experiences.

For Instance, in March 2025, Panasonic launched its HomeCHEF Connect 4-in-1 Multi-oven in the US, which includes a convection microwave feature. This smart kitchen appliance combines microwave, air fry, convection bake, and broil functions in one device. It uses advanced inverter technology for even heating and better nutrition preservation.

Technology Analysis

In 2024, the Natural Language Processing (NLP) segment held a dominant market position, capturing a 40.7% share of the Global AI microwave Market. This dominance is due to a clear move toward intuitive, hands-free control. Consumers can now operate ovens by giving simple voice instructions, from cooking duration to recipe suggestions. This level of interaction improves convenience and reduces errors, especially for people new to smart kitchen technology.

The integration of NLP also supports accessibility by catering to users who benefit from guided control features. Manufacturers are integrating NLP with adaptive learning models, enabling microwaves to understand individual cooking patterns over time. The ability to respond naturally to spoken commands mirrors the way people already engage with virtual assistants, making smart kitchens feel more personal.

For instance, in May 2021, Farberware launched the FM11VABK microwave oven running Linux on a Rockchip RK3308 processor, featuring Natural Language Processing (NLP) for voice control. This AI microwave supports up to 150 voice commands processed locally without needing an internet connection or mobile app, prioritizing user privacy and faster response times.

Application Analysis

In 2024, The Household segment held a dominant market position, capturing a 60.4% share of the Global AI microwave Market. This dominance is due to the users prioritizing simplified cooking and automation in their daily routines.

AI microwaves designed for domestic use help manage multiple meals without constant supervision. They can identify food types, detect moisture levels, and adjust accordingly for better taste and texture. Ease of integration with home assistants further boosts adoption among tech-aware families looking for dependable performance.

Smart home ecosystems continue to expand, and AI microwaves have become an integral part of that growth. Many homeowners prefer interconnected solutions that align with their lifestyle, allowing time savings without compromising quality. The household preference underscores an emotional connection where technology supports comfort, quick decision-making, and a greater sense of control in everyday cooking.

For Instance, in December 2024, LG announced its new Over-the-Range Microwave as part of its Signature range, designed specifically for household applications. This AI microwave features three built-in cameras that allow users to monitor their food without opening the door, preserving heat and cooking efficiency.

Structure Analysis

In 2024, The Built-In segment held a dominant market position, capturing a 55.6% share of the Global AI microwave Market. This dominance is due to the strong demand from households prioritizing both functionality and design. These models cater to modern, space-conscious kitchens where aesthetics and convenience intersect.

Their discreet installation supports seamless coordination with cabinetry and other appliances, appealing to new homeowners and apartment dwellers alike. The built-in format also enhances safety by reducing clutter and ensuring stable placement. This preference reveals how consumers increasingly view appliances as part of home design rather than standalone devices.

Built-in AI microwaves blend style with performance through integrated sensors and multi-function settings. They deliver efficient results while maintaining visual harmony within the kitchen space, reinforcing the trend toward modern living environments that combine automation with personalized design choices.

For Instance, in January 2020, GE Appliances introduced an AI-powered Kitchen Hub incorporating a built-in microwave with computer vision technology that helps in recipe selection, ingredient detection, and cooking adjustments to reduce food waste and improve meal planning.

Sales Channel Analysis

In 2024, The Hypermarkets/ Supermarkets segment held a dominant market position, capturing a 42.6% share of the Global AI microwave Market. This dominance is due to the most influential physical retail channels for AI microwaves.

Customers often prefer the opportunity to compare models, get live demonstrations, and understand AI feature sets firsthand. Promotions, discounts, and display setups in these stores play an essential role in converting interest into purchase decisions. Retail associates also help build consumer confidence in adopting advanced home technology.

At the same time, large-format retail spaces maintain strong relationships with brands, helping them showcase the usability and intelligence of modern microwaves. Their accessibility across urban and suburban regions gives them an edge over purely digital platforms. As consumers become more curious about AI features, this hands-on environment remains a crucial part of brand engagement and product education.

For Instance, in October 2025, Samsung rolled out its “Big Bespoke AI Festival” across supermarkets, hypermarkets, and other major retail channels in India, offering substantial discounts and perks on its Bespoke AI appliance range. The campaign included cashback of up to ₹50,000 and discounts of up to 47 % on microwaves, refrigerators, washing machines, and air-conditioners, with flexible financing and extended warranty offers also featured.

Key Market Segments

By Product Type

- Convection

- Grill

- Solo

By Technology

- Natural Language Processing (NLP)

- Machine Learning

- Computer Vision

- Others

By Application

- Household

- Commercial

By Structure

- Built-In

- Countertop

By Sales Channel

- Hypermarkets/ Supermarkets

- Wholesalers/Distributors

- Specialty Stores

- Multibrand Stores

- Online Retailers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Drivers

Enhanced Convenience and Cooking Precision

AI microwave ovens are rapidly gaining popularity due to their smart cooking capabilities that bring ease and accuracy into everyday meal preparation. These appliances use artificial intelligence to automatically detect food type and weight and then adjust cooking time and power levels accordingly.

This feature removes the guesswork, ensuring that meals are cooked evenly and thoroughly without the need for user intervention, which is particularly attractive for busy households and anyone unfamiliar with cooking timings.

Moreover, AI microwaves often integrate with voice assistants and mobile applications, allowing users to operate them remotely or hands-free. This connectivity adds an extra layer of convenience, making cooking less of a chore and more of a seamless part of daily life. Over time, these microwaves can learn individual cooking preferences, enhancing user experience and encouraging wider adoption in smart homes.

For instance, in January 2025, LG unveiled its Signature microwave featuring a built-in 27-inch touchscreen display that provides a live interior view and guided recipes. This innovation underscores enhanced convenience and cooking precision as users can visually monitor their dish and select custom cooking modes with ease.

Restraint

High Cost Limits Accessibility

Despite the benefits, AI microwaves come with a higher price tag compared to traditional models, which can be a significant barrier for many consumers. The advanced technology, sensors, and connectivity features require costly components, driving up the retail price. This higher cost particularly limits accessibility in price-sensitive markets where consumers prioritize budget-friendly kitchen appliances.

Additionally, the premium cost slows adoption in emerging markets and among lower-income households. Without more affordable options, the market growth may remain restricted to more affluent consumer segments, potentially limiting the widespread penetration of AI microwaves despite the growing interest in smart kitchen technology.

Opportunities

Growing Demand for Smart Kitchen Integration

The future of kitchen appliances is increasingly connected and also benefits from the trend toward smart home ecosystems. Consumers increasingly seek devices that can communicate with each other and be controlled through a centralized interface, such as smartphone apps or virtual assistants like Alexa and Google Assistant.

AI microwaves that integrate with other smart kitchen appliances and meal planning systems enhance convenience by allowing coordinated cooking tasks and recipe suggestions. This increases not only operational efficiency but also consumer satisfaction, opening up expansive growth opportunities in both residential and commercial sectors as smart homes become mainstream.

For instance, in June 2025, Samsung’s microwaves featuring Wi-Fi connectivity and AI-driven cooking algorithms propelled the brand to the top of the European microwave market, enabling seamless smart-kitchen integration and automated recipe execution.

Challenges

Data Privacy and Security Concerns

Security and privacy concerns represent significant challenges for AI microwave adoption. These devices collect and transmit data about user habits and preferences to function optimally. Consumers wary of potential hacking incidents or misuse of personal data may hesitate to purchase connected appliances.

Manufacturers must therefore invest heavily in secure technology and transparent privacy policies to earn consumer trust. Failure to demonstrate strong cybersecurity measures could slow down market growth, especially in regions where digital privacy regulations are becoming stricter and consumers are more privacy-conscious.

For instance, in June 2025, the Information Commissioner’s Office (UK) issued guidance stating that smart devices (including models like air-fryers and kitchen appliances with connectivity) must handle personal data responsibly, make data practices transparent, and allow deletion of collected information, in response to consumer fears that connected appliances may “listen in” or track household behaviours.

Key Players Analysis

The AI Microwave Market is led by major home appliance manufacturers such as SAMSUNG, LG Electronics, Whirlpool, and GE Appliances. These companies are integrating artificial intelligence into microwave systems to enable automated cooking settings, voice control, food recognition, and personalized presets. Their strong global distribution networks and smart home ecosystems help drive adoption across residential and commercial kitchens.

Key contributors such as Midea, Sharp, and TOSHIBA CORPORATION focus on AI-enabled cooking assistance, sensor-based heating, and app-connected control. Their innovations include moisture detection, automatic temperature adjustments, and integration with IoT platforms. These features enhance energy efficiency, cooking accuracy, and ease of use for diverse consumer segments.

Additional participants including Telefonaktiebolaget LM Ericsson and other major players are exploring connectivity infrastructure, AI interfaces, and cloud-based control systems for smart kitchen appliances. Their contributions support interoperability with voice assistants, smart hubs, and mobile applications. Collectively, these companies are advancing the shift toward intelligent, connected microwave solutions in both domestic and professional environments.

Top Key Players in the Market

- SAMSUNG

- GE Appliances

- LG Electronics

- Whirlpool

- Midea

- Sharp

- Telefonaktiebolaget LM Ericsson

- TOSHIBA CORPORATION

- Other Major Players

Recent Developments

- In June 2025, Samsung launched its 2025 Bespoke AI appliance range in India, expanding its AI Home ecosystem to refrigerators, washers, and air conditioners. Though not explicitly mentioning microwaves, Samsung’s focus is on AI-powered smart appliances with intuitive controls and energy efficiency, which signals likely advancements toward AI microwaves in their lineup.

- In January 2025, LG previewed an advanced smart microwave at CES 2025 featuring a touchscreen, Wi-Fi, AI culinary assistance, and cameras inside the microwave for real-time cooking monitoring. The product targets social media-savvy users and smart home integration through LG ThinQ and Matter protocols. It is expected to reach the market by 2026, showcasing LG’s cutting-edge AI microwave technology.

Report Scope

Report Features Description Market Value (2024) USD 3.76 Bn Forecast Revenue (2034) USD 20.36 Bn CAGR(2025-2034) 18.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Convection, Grill, Solo), By Technology (Natural Language Processing (NLP), Machine Learning, Computer Vision, Others), By Application (Household, Commercial), By Structure (Built-In, Countertop), By Sales Channel (Hypermarkets/ Supermarkets, Wholesalers/Distributors, Specialty Stores, Multibrand Stores, Online Retailers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAMSUNG, GE Appliances, LG Electronics, Whirlpool, Midea, Sharp, Telefonaktiebolaget LM Ericsson, TOSHIBA CORPORATION, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SAMSUNG

- GE Appliances

- LG Electronics

- Whirlpool

- Midea

- Sharp

- Telefonaktiebolaget LM Ericsson

- TOSHIBA CORPORATION

- Other Major Players